1 Introduction

Currently, with the reduction of trade barriers, the competitiveness and value of the big companies are strong related to the creation of competitive advantages in global terms, either through innovation, quality or even leadership in costs - through gains achieved by the scale obtained from growth. Growth and development of new businesses, products, markets and services become thus an essential activity in the organizations as an element of sustainability on the long term.

With the effect of the competition, the saturation of markets, the maturity of the industries, the fast diffusion of new technologies and the strengthen of antitrust regulation, the challenge becomes the equilibrium between the growth of the actual attractive businesses and the development of new businesses, mainly aiming at the diversification of risks, and also opposing itself to the technological obsolescence and to regulation.

During the 50’s and 60’s, many North American companies had initiated an intense process of diversification, mainly unrelated, motivated by the availability of capital and the strong antitrust regulation, and reached its apex in the end of the 60’s and resulting in the sprouting of giant corporative conglomerates. In the 70’s, after a history of unsuccessful diversifications and divestments, research has been focused on the understanding of the new businesses characteristics, being the precursor, Rumelt’s (1974) pioneering study, which referred to the degree of relationship between the new businesses and the current businesses. Rumelt (1982) extended the universe of research of its original work, and studying diverse American companies between 1974 and 1982, demonstrated that the related diversification presented better results than the unrelated one, which was confirmed in diverse subsequent researches.

The high degree of failure of the diversifications has triggered the trend towards the return to the specialization in the beginning of the 90’s, as showed by the studies of Berger and Ofek (1995) and Liebeskind and Opler (1993). Confirming these findings, Hunger and Wheelen (1995) support that, as a generic rule it is recommendable, to minimize the risks, to prioritize the growth in the same business or industry until its attractiveness is depleted, however, taking into account that long term strategic factors can indicate a need of diversification.

From the studies of Rumelt and the high degree of failure of the unrelated diversifications, more focus has been given to the thematic of detailing of the organizational factors and the determinant success factors of the growth strategies and business diversification, with significant advance in this field coming from Burgelman (1984) researches in a company highly diversified and from Block and Mac Millan (1995), both on the organization ways to acquire knowledge in corporate venturing.

However, there was a lack of a prescriptive model dealing with the unrelated diversification – very important many times for reaching the strategic and long term goals- the one that could describe the best conditions necessary to adopt and optimize the results of these growth strategies. It was contemplated in the Roberts and Berry (1985) model, which provides the optimum situations for selecting the growth strategies, according to the degree of existing newness and familiarity with technologies and markets, and also depending on the selection factors, such as the level of available resources, the abilities and knowledge available in the technology and market dimensions, financial returns, involved risks, strategic fit, degree of diversification and corporate involvement of the parent company.

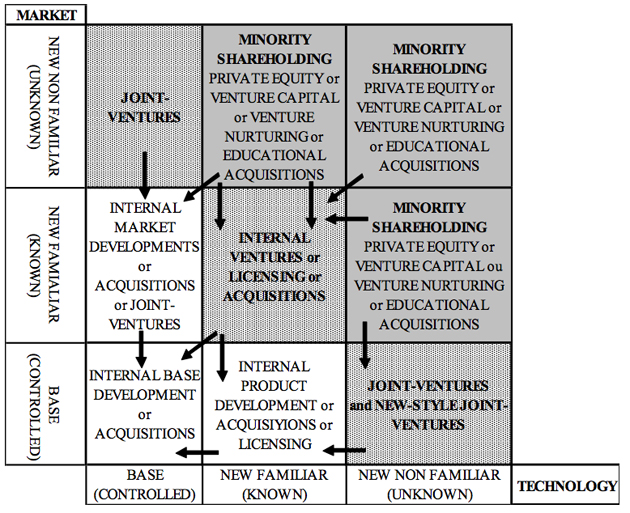

The authors based on the researches of Rumelt (1982) and Peters (1980), referring to the lower degree of involved risk in related diversification, and on the findings of Roberts (1980) related to the degree of involvement of the corporation with the new business, and formulated diverse hypotheses, which had been checked in a field research trying to identify the responsible factors for the success or failure of the ventures. It has deeply studied a highly diversified American company, analyzing the performance of 14 new businesses (6 internal developments, 6 acquisitions and 2 venture capital initiatives), generating a model called “familiarity matrix” (Figure 1). It must be noticed on the graphic that the arrows indicate the desired transition throughout the time as long as the familiarity degree increases.

Roberts and Berry (1985) suggested a matrix model for the selection of optimum modes of growth and entrance in new businesses, after a deep review of the research findings on the subject and the analysis of these 14 episodes of growth of a highly diversified technological company in the United States in the period of 1971 the 1977. They developed the characterization of the different alternatives of growth as well as in which situations each one of them better applies, proposing the selection of optimum strategic modes of growth and entrance in new businesses according to degree of innovation and familiarity with technologies and markets, thus considering the best indicated choices for the diversifications with different degrees of relationship, including Internal Development (Base, Product and Market), Acquisitions, Licensing, Internal Ventures, Joint-Ventures, Venture Capital and Educational acquisitions, each one better indicated considering the level of available resources, available competences and knowledge (technology and market), return and return period, involved risk, strategic adherence, desired degree of diversification and the headquarters management involvement.

Maula (2001, p.20) argues that the researches of Roberts (1980), and Roberts and Berry (1985) were concentrated in building a more systematic vision of the various alternatives used in the development of new businesses. Accordingly to Dussauge et al (1992, p.90-91), the advantage of the Roberts and Berry’s matrix is that it considers the position of the companies with respect to these technologies, in terms of its familiarity. The major contribution of this model resides in the possibility of choosing the entry strategy better indicated for the minimizing of the risks and the increase of the success probability, mainly in situations of diversification, in which the absence of familiarity with the new technology and/or the new market was considered a restrictive element of the success in the previous approach by Rumelt (1982).

At light of this context, the main objective of this study consists of evaluating the adequacy of the Roberts and Berry (1985) model to the strategic selection of growth and entrance modes into new businesses, in the studied sector, and check the validity of the model in one wider research. In this sense, the main research question is: “Do the optimal strategies of growth and entrance in new businesses follow the logic praised by the model?”

To achieve this main objective, we have as specific objectives:

-

To identify and to characterize the company-case’s growth and entrance modes in new businesses in the last twenty years.

-

To verify the adequacy of these modes to the Roberts and Berry model.

-

To identify the determinant factors of the modes selection and the critical performance factors for positive or negative results of these choices.

The following parts of this paper present, initially, the conceptual framework of the study. After that, the methodological aspects are reported, then the findings and discussion, and, finally, the conclusions and recommendations.

2 Literature review

2.1 Strategies of Growth and Diversification

The diversification of a company can be understood as the entrance in a new business, where the technology and the market are distinct of the effective businesses. It is commonly called corporate venturing, and can be internal or external. Keil (2000) presents possibilities of the external corporate venturing, divided in 3 areas: (1) Corporate Venture Capital, also being able to be characterized by three possibilities – third party funds, dedicated and self-managed funds; (2) Alliances, being able to assume the configuration of alliances without stockholding, direct investments with minority participation or joint-ventures; (3) Transforming Arrangements, after acquisitions or spin-offs.

Maula (2001, p.20) argues that some studies were concentrated in building a more systematic vision of the various alternatives used in the development of new businesses for the corporation, as in the researches of Roberts (1980), and Roberts and Berry (1985). From the pioneering research of Roberts (1980), that defined the alternatives of corporate endeavor in a continuous scale having as one of its extreme the high corporate involvement and high risk enterprises and on the other side the low corporative involvement and low risk enterprises, Roberts and Berry (1985) argued that the mode of selection depended on the context and the desired strategic objectives.

Thus, Roberts and Berry proposed that the degree of innovation and inversely, the familiarity with technologies and markets could be an adequate adjustment for the selection of the optimum strategies of entrance. Accordingly to Dussauge et al (1992, p.90-91), the advantage of the Roberts and Berry’s matrix in relation to the other methodologies of choice, is that it considers the position of the companies with respect to these technologies, in terms of its familiarity. To come to this model, the authors were based on the researches of Rumelt (1982) and Peters (1980), referring to the lesser degree of involved risk in related diversifications, and on the findings of Roberts (1980) related to the degree of involvement of the corporation depending on the degree of familiarity with the new business, and formulated diverse hypotheses, which had been checked in a field research trying to identify the responsible factors for the success or failure of the enterprises.

This field research has deeply studied a highly diversified American company, analyzing the performance and development of 14 new businesses during the period of 1971 the 1977, 6 of which were related to internal developments, 6 to acquisitions and 2 to purchases of minority participation in smaller companies (venture capital), generating a model called “familiarity matrix”, as illustrated in Figure 1. It must be noticed on the graphic representation that the arrows indicate the desired transition throughout the time as long as the familiarity degree increases.

It follows the description of the characteristics and most recommended situations for its use in each strategic mode.

Internal developments: It consists of exploring the internal resources as a base for the establishment of a new business for the company, instead of searching them externally, as for example, in an acquisition. It can assume the situations of (a) basic internal development, when not only the technologies but also the markets are present in the current businesses; (b) market internal development, when there is the presence of new market in the new business; and (c) product internal development, when there is the presence of new technology or new product in the new business. It has as advantage the use of existing resources and as disadvantage the long time for the financial return. Also the non familiarity with determined market or technology can lead to mistakes. Thus, it is more indicated for situations of high familiarity.

Acquisitions: It possesses as main advantage the fast entering in the market; and as disadvantage, the lack of knowledge in the cases in which the new business is not familiar for the parent company. Thus, it is indicated in situations of medium and upper medium familiarity or even high familiarity when it generates operational synergy. The less familiar, the more delayed it will be the synergies obtained with the operation. It can be very attractive for strategic goals, like the attainment of market share. Diversely, mergers are not an isolated mode, but an integrating strategic action resulting from previous actions like acquisitions, joint-ventures, internal developments and venture capital, aiming at the construction of competencies and technological and marketing knowledge in the new business-oriented areas (Berry, 1983, p.47).

Licensing: It presents as advantages, the access to proven technology and lower financial exposition. As disadvantages, are cited the non building of competencies, the involved risk with the absence of own technology development and the dependence on the licenser. Indicated when a relative degree of technological familiarity is possessed, thus allowing fast introduction, adjustments and improvements, and when the company adopts the technological follower strategy due to the lack of competencies and resources to rival with the technological leader.

Internal Ventures: Break-up of new companies or business’ units (BU’s) from the main company. Even though it is similar and it could be misunderstood with the internal development, in this type of strategy the company searches to act in new businesses operating in distinct markets from the effective businesses, and with different products from the existing. In order to guarantee focus and specialization in this new business, it is created the Internal venture (Roberts and Berry, 1985, p.6). As main advantages, are widely discussed the use of the existing resources and the entrepreneur talents’ retention. As cited disadvantages, the uncertain success and the refractory behavior to interaction in the main company. Indicated if there is relative familiarity with market and technology, otherwise there is a great possibility of failure.

Figure 1: Roberts and Berry’s Familiarity Matrix (Roberts and Berry, 1985, p.13)

Joint-Ventures (JV): Alliance between companies in which the participation, investments and the management are shared by the partners. As advantages, it is indicated for reducing the risk in uncertain and expensive ventures for both the companies, and synergies captures, like the synergies of a strong company in technological terms to another with sharp commercialexpertise. Indicated when the company possesses high familiarity in one dimension and low familiarity in the other, being inversely complemented by the partner. JV’s possess as disadvantage the possibility of conflict between partners. It can also be classified as New-style Joint-Venture, in the case of alliances between small companies (that add knowledge and technology) and big ones (that add capital and market knowledge), guaranteeing the synergy.

Minority shareholding: in general they aim at the reduction of risks in businesses of low knowledge domain. It is useful for unrelated diversification and adequate to the businesses of high uncertainty, since it reduces the risk due to the minor addition of resources, and in businesses in which there are average and low familiarities. Its main disadvantages are: (a) the lack of commitment; (b) no evidences of high stimulus to growth; and (c) difficulties to capture the competencies of the invested company. It is recommended when there is low familiarity.

Can assume the conditions of private equity, venture capital or educative acquisition, which are presented as follows:

-

Private equity: acquisition of minority shareholding in medium to big size companies, in general with good potential of financial return in medium term.

-

Venture Capital: minority shareholding in smaller companies, in general with great potential of financial return on the long term, without support to the management. There is a specific mode of venture capital, called Venture Nurturing, situation in which the investing company also gives commercial support and co- manage the new business. As an advantage, it can generate knowledge in new technology or market. Its main disadvantages are: (a) the lack of commitment - problem is lessened when the option the venture nurturing; (b) there is no evidences of high stimulus to growth; and (c) it is vital for the investing company to capture the competences of the invested company. It is adequate to the businesses of high uncertainty, since it reduces the risk due to the minor addition of resources, and in businesses in which there is low familiarity.

-

Educational acquisitions: Acquisitions of shareholding control in smaller high technology companies with the specific intention of fast appropriation of knowledge which is not instantaneously acquired in the Venture Capital. Ideal when used for diversification in completely distinct businesses. It has some disadvantages, as a larger initial investment as in Venture Capital, what increases the risk; and the need of establishing human resources policies that keep key employees from the acquired company (talent retention). It is indicated for situations of low familiarity.

Each of the growth modes presents diverse indications of risk, return, term, strategic adherence, management involvement and knowledge acquisition. The biggest contribution of this model resides in the possibility of choosing the one better indicated for the minimizing of the risks and the increase of the success probability, mainly in situations of diversifications, in special unrelated diversifications, in which the absence of familiarity with the new technology and/or the new market was considered a restrictive element of the success in the previous approach by Rumelt (1982).