HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 05) Año 2016. Pág. 25

Gustavo Hermínio Salati Marcondes de MORAES 1, Fernando de Souza MEIRELLES 2, Alexandre CAPPELLOZZA 3

Recibido: 10/10/15 • Aprobado: 14/11/2015

2. Electronic Government (e-Gov)

4. Presentation and Analysis of Data

5. Conclusions and Recommendations

ABSTRACT: In order to analyze the initiatives of the e-Government of the State of São Paulo, a case study was developed in the Nota Fiscal Paulista program. For data collection, semi-structured interviews were conducted with the program coordinator and with experts, and non-participatory observation and document analysis were also carried out. In the case of the program, the decision-making concerning Information Technology (IT) directly influences on its compliance and consequently the success of the initiative. Regarding the IT governance, business and IT managers make the main decisions together, suiting the needs and possibilities of each group. |

RESUMO: Com o objetivo de analisar as iniciativas de governo eletrônico do Estado de São Paulo, foi desenvolvido um estudo de caso no programa Nota Fiscal Paulista. Para coleta de dados foram realizadas entrevistas semiestruturadas com o coordenador do programa e com especialistas, observação não participativa e análise de documentos. No caso do programa, as tomadas de decisões relativas à Tecnologia da Informação (TI) influenciam diretamente na adesão e consequentemente no sucesso da iniciativa. Em relação à governança de TI, os gestores de negócios e de TI tomam em conjunto as principais decisões, adequando as necessidades e possibilidades de cada grupo. |

The intense use of information technology (IT) by all sectors was also spread in the Public Administration, becoming an indispensable presence.

Called e-Government, or e-Gov, the use of IT together with the Internet as a tool of public management aims to better qualify the provision of services (e-Service) as well as maximize the efficiency of the Public Administration itself (e-Administration), enabling the more effective participation of the citizens (e-Democracy) in the political process (Chadwick, 2009; Medeiros, 2004).

For Shareef, Kumar, Kumar and Dwivedi (2011), concepts and theories about electronic government are in definition, since it is a recent area of study, still under development.

Considered as an essential element in the improvement of the public management, the e-Gov presents itself in different models and stages in different countries, keeping as common guideline the focus in providing good services to citizens (United Nations, 2014).

In the concept of e-Government, IT is an instrument with which, through e-Services, the interaction between citizens and State takes place (Braga, Alves, Figueiredo, Santos, 2008; Medeiros, GuimarãeS, 2005).

We can assume that the implementation of the e-Gov is linked to the desire of citizens (Evans, Yen, 2005; Shareef, Kumar, Kumar, Dwivedi, 2009, 2011), conditioning their adherence to the acceptance, the dissemination and the success of propositions and policies inherent to the e-Gov.

While the private sector has high levels of adoption of technology and automation of operational, productive and administrative processes, the public sector requires a qualitative leap in the provision of services to meet the demands of the society, increasing the adoption of e-Gov (Barbosa, Faria, Pinto, 2005; Diniz, Barbosa, Junqueira, Prado, 2009).

The main objective of this work is to understand the role of IT in e-Government initiatives in Brazil.

The program chosen for this study was the Nota Fiscal Paulista (NFP), which is a pioneering initiative that was developed in the State of São Paulo and which is slowly being replicated in the rest of the country. The program is the initiative to computerize the tax controls that are greater in number of resources involved, registered users and access.

Thus, we sought to identify: how decisions are made concerning TI and how the governance of the NFP program is done; the stage of development of the NFP program; the main motivators for the creation of the program; the main difficulties encountered so far and the main results obtained with the implementation of the program.

The NFP program shows itself as an interesting opportunity for research because it is a program that citizens can voluntarily adhere, and they can win benefits with this support; however, there is a need to make a record in a government website and provide personal information. The system is an incentive of the State (São Paulo) to inhibit tax evasion with the aid of technology.

The findings may aid in a faster implementation of the program in other administrative contexts for e-Gov, generating information useful for the main points to be considered to minimize problems in issues related to Information Technology, as well as contribute to the studies in this area of knowledge.

The use of IT in public administration dates from approximately fifty years ago, whether in administrative or operational activities for the provision of services to citizens (paychecks, statements, information, etc.).

In global terms, the e-Gov was officially formalized with the first Global Forum on Reinventing Government, in January 1999, in Washington – USA. This movement was possible after the development of tools that facilitated the speed of web browsing: the Mosaic browser in 1993 and Netscape in 1994, both developed by North American students (Chahin, Cunha, Knight, Pinto, 2004).

This was followed by other international forums of this nature, and the second Global Forum 'A democratic State and Governance in the 21st Century' was held in Brazil – in Brasília, in the year 2000 (Chahin et al., 2004).

For Lenk and Traunmüller (2002), e-Government, or e-Gov, while expression has its use intensified after the spread of e-commerce by the citizens.

The concept of electronic government has received multiple characterizations:

The focus of the e-Gov is the citizens and the satisfaction of their requirements, through the improvement in the quality and access to public services.

Kakabadse, Kakabadse and Kouzmin (2003) point other aspects that justify the accession of Governments to technologies:

For Diniz, Barbosa, Junqueira and Prado (2009), the implementation of the e-Gov by the public administration is associated with the pressure of a few factors, such as:

[...] the intensive use of ICTs by citizens, private companies and non-governmental organizations; the migration from information based on paper to electronic media and online services and the advancement and universalization of public telecommunication infrastructure and the Internet (Diniz et al., 2009, p. 24).

In the e-Government, stages of development are recognized by the authors who have studied the subject and they offered ways to identify such phases (Andersen, Henriksen, 2005; Baum, di Maio, 2000; Bélanger, Hitler, 2001, 2006; Layne, Lee, 2001; Moon, 2002; United Nations, 2010; Zarei, Ghapanhci, Sattary, 2008).

Among the most used models for this analysis there is the typology of the Gartner Group, presented by Baum and Di Maio (2000). The model consists of four phases:

In this phase, basic information is made available to the public, meaning the presence of the Government on the Internet. The description of processes, the transparency and the accessible information increase the visibility of the government service, thus increasing democracy. There can also be an intranet for government employees.

In the stage of interaction, various applications stimulate the participation of citizens. There is the possibility of contact over the Internet (e-mails), search for information online, availability of documents and forms. Despite the integration of internal processes, there is still the need for the physical presence of the citizen for the execution of the transaction, payment of fees or signing of documents. For government employees, the communication is developed through intranets and e-mail.

At this point, the citizens can perform complete transactions over the Internet with an evolution in the computer applications. There is no need for physical presence in government offices.

The main problems of this phase are the issues of security and customization, such as digital signature.

Internally, processes are redesigned aiming at an increase in the quality of services. The standards are changed, adapting laws and regulations to the dynamism of the technologies. There are evident savings in time, paper and money.

The integration of the systems is complete, offering virtual services to citizens, in different types of channels.

There is the need for the internal adequacy of government services, with a change in the culture, processes and responsibilities of Government employees.

The satisfaction of the citizens increases with the efficiency of processes, and the costs are reduced.

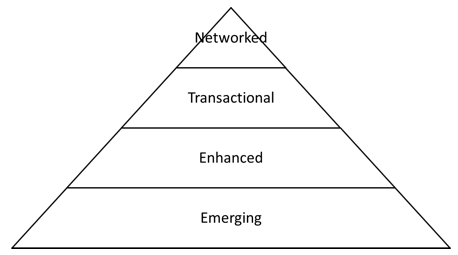

Another recognized model is the United Nations model (United Nations, 2014), which, although adopting distinct nomenclature, presents definitions similar to the model of the Gartner Group. Figure 1 presents the UN Model.

Figure 1: The four stages of development of online services

Source: Based on United Nations (2014)

The stages of development of the e-Gov of the Gartner Group and of the United Nations represent different levels of sophistication of technology, guidance to citizens and administrative transformation and change.

The United Nations has been developing a research on the world situation regarding e-Government and presents a classification of the member states, enabling a reflection on the initiatives and practices of countries in relation to e-Gov.

According to the report published in 2014 (United Nations, 2014), most positions in the top 10 ranking belong to developed countries with high income. This way, we can see that countries with more financial resources develop and launch advanced e-Gov initiatives, providing a favorable environment for the involvement of citizens. Table 1 presents the 10 most developed countries in terms of e-Government.

Table 1.

E-Government Development Index – Top 10 countries

| Classification | Country | Index |

| 1 | Republic of Korea | 0.9462 |

| 2 | Australia | 0.9103 |

| 3 | Singapore | 0.9076 |

| 4 | France | 0.8938 |

| 5 | Netherlands | 0.8897 |

| 6 | Japan | 0.8874 |

| 7 | United States of America | 0.8748 |

| 8 | United Kingdom | 0.8695 |

| 9 | New Zealand | 0.8644 |

| 10 | Finland | 0.8449 |

Source: Based on United Nations (2014)

The challenge of developing and emerging countries is to invest and advance in three main dimensions: online services, telecommunications infrastructure and education. This way, it would be possible to reduce the gap in relation to the developed countries, because there is no point in offering e-Gov services if citizens cannot access the Internet.

The use of information technology by the Brazilian Government dates back to the 1980s, but the use of the word e-Government dates from 1996, with electronic services provided by the Brazilian federal Government (Ferrer, Santos, 2004). Services such as the sending of the Statement of Income Tax, information about social security and Government procurement are possible on the Internet since 1998, and in the year 2000 the Policy of E-Government was defined and instituted and the Information Society Program was launched, thus consolidating and disseminating e-government strategies, the social importance of digital inclusion as well as actions related to information technology in the country, being the e-Gov implemented through legal guidelines and structures in the country (Scartezini, 2004).

Scholars of the subject e-Gov in Brazil proved the success of the e-Government program up to 2003, time of transition of the federal Government, when the program ceases to be a priority driven by four factors pointed out by Pinto and Fernandes (2005):

Such factors may have interfered so that Brazil, which in 2005 ranked in the 33rd position, would end in the 45th place in the UN world classification of e-Gov. In the research conducted in 2010, Brazil was in the 65rd position, meaning that in the last 5 years the Brazilian e-Gov accumulated a loss of 32 positions in the world ranking of e-Gov, and in 2014 Brazil was in the 57rs position (United Nations, 2014).

Despite this noticeable decline, Brazil stands out in specific initiatives, such as the Open Government Partnership, or Open Data, mentioned in the UN report as an example of good practices, by having as its objective a single point of access to public data.

The lack of online services and inadequate telecommunication infrastructure are indicated in the already mentioned report as main causes of the fall of the Brazilian classification.

Currently, the Brazilian Government offers several e-Gov systems to the citizens. Among the main ones we highlight:

To understand the role of IT in the e-Gov initiatives in Brazil, we chose the Nota Fiscal Paulista (NFP) program, which is a pioneering initiative developed in the State of São Paulo and which is slowly being replicated in the rest of the country. Thus, we sought an in-depth understanding of the NFP also showing similar programs that were implemented in other states and cities.

The e-Government program in the State of São Paulo started in 1995, when the then elected State Government took over the administration with the goal of stimulating and implementing the modernization of the Public Administration. The program involved all the Secretaries of State, brought together the governmental structure and heads of various levels in a collective effort (Filho, Agune, 2004).

The issue of digital inclusion of the lower classes was treated and operationalized by the Acessa São Paulo Program, which provides access to the Internet and its services, currently with 629 public stations and 3,400 machines distributed throughout the State (Sao Paulo State, 2011).

Established as a fiscal citizenship action, the Nota Fiscal Paulista program aims: to encourage the consumer of goods and of interstate and intermunicipal transport services to require tax invoice, and to reduce informal trade and the trade of illegal products and to combat tax evasion (Sao Paulo State, 2010; Santos, Mendonça, Cassuce, Rodrigues, 2015).

The operationalization of the incentive occurs as follows: consumers register on the program's website and inform their CPF or CNPJ to issue the invoice with every purchase, receiving reduction in the tax burden; the consumer may not identify their CPF, donating their tax invoices to entities of social assistance or health care, who will receive the credit from that purchase; consumers registered participate in monthly drawings, enforced by the Department of Finance.

The credits obtained by the consumer can be applied in the reduction of the value of the property tax, deposited into Bank checking account or savings account.

The NFP is a specific program of the State of São Paulo, designed with the support of Law 12,685/2007 and Decrees 52,096/2007 and 54,179/2009.

The NFP program offers the following benefits (Sao Paulo State, 2010):

We highlight as advantages of the NFP program:

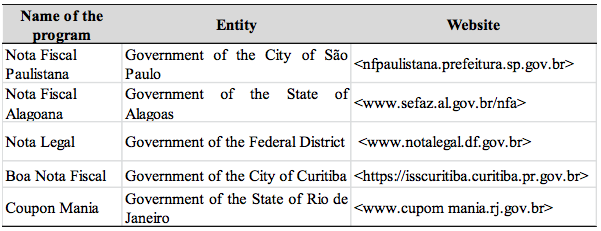

After the NFP program, other initiatives have emerged around the country seeking to interact with citizens in a similar way.

Some of these initiatives were carried out by municipalities, as in the case of the cities of Curitiba and São Paulo, and some by States such as Rio de Janeiro and Alagoas.

Figure 2 presents a summary of some programs similar to the Nota Fiscal Paulista existing in Brazil.

Figure 2: Existing programs similar to the Nota Fiscal Paulista program

Source: Elaborated by the author.

According to the nature of the study and the possibility to researching an area in which there are few studies on the subject, the qualitative or unstructured methods seem to better adapt to the problem proposed, justifying the choice of single case study as a strategy for research (Benbasat, Goldstein, Mead, 1987).

We performed: unstructured interview, participatory observation and document analysis. Through the triangulation of the data, we could make a continuous comparison of the different sources for validation (Eisenhardt, 1989; Yin, 2001).

As it is considered an experiment or research, the method of generalization must be the analytic generalization, in which a theory previously developed serves as a frame of reference for comparison with the empirical results of the case study. Thus, the analysis and the conclusion of the case were elaborated with this orientation, of the analytic generalization.

The choice of the Nota Fiscal Paulista (NFP) program is due to the fact that it is the initiative of computerization of the greatest tax controls, in number of resources involved, registered users and access.

The NFP program shows itself as an interesting opportunity for research because it is a program that the citizen can voluntarily adhere, and they can win benefits with this support; however, there is the need to make a record in a government website and provide personal information. The system is an incentive of the State (São Paulo) to inhibit tax evasion with the aid of technology.

The findings may aid in a faster implementation of the program in other administrative contexts for e-Gov, generating information useful for the main points to be considered to increase the adherence of the citizens.

The study issues addressed were:

- What is the role of the Information Technology in the Nota Fiscal Paulista program?

- How decisions are made regarding the Information Technology and how is the IT governance of the NFP program?

- What is the stage of development of the NFP program?

- What were the main motivators for the creation of the program, and what are the main difficulties encountered so far?

- What are the main results obtained with the implementation of the NFP program?

The information was collected through an interview with the current coordinator of the Nota Fiscal Paulista program, held in the building of the Secretary of Treasury of the State of São Paulo.

The documents available for analysis were annual and monthly reports of the participating municipalities, such as percentage of participation, added value, tax revenue, among others.

The non-participatory observation was made through the presence at meetings with specialists in electronic government.

The coordinator of the Nota Fiscal Paulista program reports directly to the Coordinator of Tax Administration. The main responsibilities of the work are:

Management of all activities, monitoring of the entire schedule of calculation of credits, credit release, and also monitoring of the schedule of drawings, as there are monthly drawings. Assurance that deadlines set in legislation are complied with and coordination of the work of the teams, which is multi-departmental. There are five or six teams, each with a specific activity of work, and coordination of the work of persons (verbal information - coordinator of the NFP program).

According to the respondent, the technology has a fundamental role in the NFP and it is in the strategic category regarding the role and alignment of IT (Henderson & Venkatraman, 1993, 1996). The fact of there is the management of accounts of persons highlights the similarity with the activity of banks, raising the importance of IT in the procedures.

The business areas and the IT area have an interesting synergy within the program, and the coordinator emphasizes that there is some closeness between the areas, with the mutual understanding among employees. The quality of the system is also placed as adequate to the need.

For the moments of decisions in the project, there is a weekly forum, and both the business areas and the technology area are present, sharing decisions.

[...] we hear the IT area to even sometimes find better solutions to those that were thought. Thus, it's pretty equal the decision between the business areas and the IT area (verbal information - coordinator of the NFP program).

There is also a schedule which is accompanied and fulfilled as close as possible, and which contains, for example, the draw dates and credit release dates.

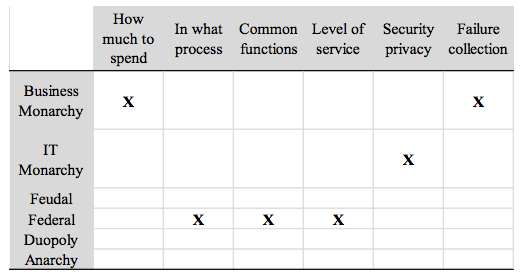

Regarding the IT governance, the decisions on investments in infrastructure are centered on IT executives, while decisions on the use of the technologies are decentralized. However, this happens not only with respect to the Nota Fiscal Paulista program, but to the entire context of the IT of the Secretariat of Finance.

The IT decisions can be characterized according to the standards of decision of Weill and Ross (2006). In Figure 3, we can visualize how the coordinator framed the decision patterns (Weill, Ross, 2004).

Figure 3: Matrix of ITG arrangements of the Secretariat of Finance – Coordinator of the NFP

Source: Adapted of Weill and Ross (2006)

The respondent mentions that the primary motivator for the creation of the NFP program was the creation in the population of the habit of requiring the tax invoice in retail purchases. For the Secretariat of Finance, this act is important because in addition to the increase in revenue, it provides more information about this segment of the economy. For the respondent, in industries, the supervision already has a structured approach, being more difficult the surveillance of the retail sector.

Thus, one of the goals of the creation of the program was the change in the consumer habit, encouraging the requirement of invoice in the retail sector.

Among the difficulties presented in the implementation of the program, there was the cultural difficulty, both internally and externally. As the Secretariat of Finance is an agency that collects taxes, the Nota Fiscal Paulista program has a reverse bias, which is the return of part of the tax. The culture of the Secretariat was guided to the entry of resources and not their returning. Externally there was also this cultural issue: the population had certain fears about the veracity of the money given back.

Currently the program is in a maturity level regarding the technological demands and stage of development, thus it does not require major investments in the short-term.

[...] I think our technological demands are met. There isn't a great technology demand that we are unable to meet. And the stage of development is also of maturity; I think we are in a stabilization phase in the program (verbal information - coordinator of the NFP program).

In relation to complaints from users, the coordinator emphasizes that there are two aspects. There is a group that focuses the complaints on the credit value, claiming that credit is low or possibly even zero in some situations. However, the program is based on the collection of the retail and there are segments in which retailers do not collect taxes, because it is retained at the source.

The other highlight in the complaints is the complaints against retailers, referring to problems of non-transmission of the document to the Secretariat of Finance. In these situations, the consumer has performed the purchase, received the tax invoice with indication of the CPF, but the company did not carry out the transmission.

As the main results obtained by the NFP, we highlight the cultural change of the population's habit, which, according to the respondent, reaches consumers and also retailers.

In another way, there is also the effective tax gain in those sectors, which have shown an increase of revenues. As a third very important factor, there is the amount of information that is passed on by the companies. The entire movement of the companies is registered in the database of the NFP program with a high level of detail. Such information helps in other projects parallel to the Nota Fiscal Paulista, such as projects of online transmission of transactions done in the retail.

When there are incidents or problems in the program, such as the consumer complaints regarding the non-transmission of documents by companies, there is a record in the system itself. The consumer can then make their complaint on the website of the NFP. Occurrences that are not structured are recorded in internal processes, through processes for each of these cases. There is statistical record of all values that are credited, drawings, number of consumers benefited, number of tax invoices processed, among others.

The respondent believes that the main reason that leads individuals to conduct the personal enrollment in the program and require the tax receipt is the perceived benefit. The financial benefits of the program are attractive, both in relation to the credits for purchases and the participation in the drawings.

The coordinator believes that currently the citizens do not have difficulty in using the Internet, consequent completion of registration and use of the benefits acquired in the program, with the exception of a few elderly persons and some lower classes, which may have some difficulty.

[...] my mother-in-law who is 70 years old is using the Internet, my aunt is using the Internet, my cleaning maid is using the Internet, so it has spread, fortunately (verbal information - coordinator of the NFP program).

One of the difficulties for the operation of the program is the availability of resources. In this case, it can be analyzed in relation to the availability of computers to access the program website and the appropriateness of stores to issue the tax invoice. In both situations, easiness is increasingly improved. The availability of computers in Brazil is increasing. Currently there are 152 million computers in use in Brazil and the worn and IT investment increased to 7.6% of the company revenue (Meirelles, 2015). In the case of the adequacy of the companies, the coordinator adds that the easiness is increasing:

Even those sectors, in which trade that was very refractory to issue the tax invoice, today have adapted to the rules, they have the issuer of tax invoice, and we can also see this by the attendants, in the checkouts of various stores, who most often ask if you want to enter the CPF in the invoice or not (verbal information - coordinator of the NFP program).

The coordinator underlines that the distrust of the citizens is one of the main factors for not adopting the NFP program.

[...] the main reason that leads a person to not order the invoice is an unfounded fear that their accounts are being searched by the State. This is a great fear that people have, that all their habits, their accounts, are being searched. And that's not our goal. The goal of the State Government is not the supervision of persons; what does matter is that we have a great volume of data, and when we process this data it doesn't matter what the person did, but what the companies did (verbal information - coordinator of the NFP program).

For the respondent, this mistrust occurs mainly on the part of persons who have some type of professional informality.

The study sought to analyze what is the role of the IT in e-Gov initiatives in Brazil, through a unique case study in the NFP program. For this end, it was necessary to understand the development phase of this initiative.

According to the classification of the Gartner Group (Baum, Di Maio, 2000), which is quite similar to the four stages of development of the online services of the United Nation (2014), we considered that the program could be framed in the Transaction phase, in which citizens can perform complete transactions over the Internet, and the applications are in an advanced computerization phase, in which there is no need for physical presence in government offices.

According to the authors, the main problems of this phase are the issues of security and customization, such as digital signature, which corroborates the opinion of the coordinator of the program, who indicates that it has not yet been possible to convey to the population the expected security, which is the main reason that citizens do not request the Nota Fiscal Paulista.

Baum and Di Maio (2010) highlight that, during the Transaction phase, the internal processes are redesigned, targeting an increase in the quality of services, which occurs constantly in the NFP, in which there is a considerable economy of time, paper and money.

To understand the role of IT in e-Gov initiatives, it is necessary this classification of the development phase of the on-line service, because the higher the stage of development, the greater the technological demand for the service.

In the case of the NFP, which manages the accounts of persons, it raises the importance of IT in its procedures, because the processes are computerized and there can be no failures.

The synergy between business areas and the IT area is fundamental so that the expectations of the public are met in the best possible way. So that such synergy can exist, another highlight is how the IT decisions are taken. The IT governance model should be suitable to the needs of the program, and it cannot leave the business area very dependent of IT managers, nor have the IT managers putting into practice decisions that hamper the operations of the area and which could be conducted in another way.

The IT governance exerted in the Secretariat of Finance facilitates the actions of the managers of the NFP, because business and IT managers make together the main technical and operational decisions, suiting the needs and possibilities of each group.

The results of the NFP have been very significant, and the initiative began to be implemented in other cities and States. This study expects the findings to assist in a faster implementation of similar programs in other contexts, providing useful information for the main points to be considered to minimize problems in issues concerning IT.

We highlight that one of the main limits for the case study methodology has been the lack of rules defined for the generalization inference of the data obtained (Kennedy, 1979; Donmoyer, 2000; Yin, 2001; Zanni, Moraes, Mariotto, 2011; Mariotto, Zanni, Moraes, 2014).

As stated by Stake (1982), the case study does not necessarily need to generate generalizations from the conclusions. The responsibility of generalizing is to the reader (Stake, 1983; Gomm, Hammersley, Foster, 2000; Mariotto, Zanni, Moraes, 2014), which is known as naturalistic generalization. Thus, the generalization sustains the notion of transferability of Lincoln and Guba (2000): it should be understood not the reproduction of the results (generalization) under the same conditions as those kept in previous studies, but the possibility of using the procedures and results found in similar situations, according to the peculiarities of the new contexts.

In the case of this study on the NFP, the responsibility of the researcher was to provide enough contextual information, facilitating the judgment of the reader about the adaptation to other contexts. What is required from researchers is that they illustrate the case appropriately, capturing its unique characteristics (Lincoln, Guba, 1985; 2000; Stake, 1982).

This research was supported by: National Counsel of Technological and Scientific Development (CNPq) and Espaço da Escrita / Coordenadoria Geral da UNICAMP.

AGUNES, R.; CARLOS, J. (2005); Governo eletrônico e novos processos de trabalho. In E. Levy & P. Drago (Eds.), Gestão Pública no Brasil contemporâneo. São Paulo: Fundap.

ANDERSEN, K.; HENRIKSEN, H. (2005); "E-government maturity models: Extension of the Layne and Lee model". Government Information Quarterly. Vol. 23, n. 2, p. 236-248.

BARBOSA, A.; FARIA, F.; PINTO, S. (2005); Organizando os ativos tecnológicos do governo: modelo de referência para a implantação de programas de governo eletrônico centrado no cidadão. Paper presented at the Cladea, Santiago, Chile.

BAUM, C.; DI MAIO, A. (2000); A Gartner's four phases of e-government model. Gartner Group: Research Note.

BÉLANGER, F.; HILLER, J. (2001); Privacy Strategies for Eletronic Government. In M. Abramson & G. E. Means (Eds.), E.Government (pp. 163-196). Lanham: Rowman & Littlefield.

BÉLANGER, F.; HILLER, J. (2006); "A framework for e-government: privacy implications". Business Process Management Journal. Vol. 12, n. 1, p. 48-60.

BENBASAT, I.; GOLDSTEIN, D.; MEAD, M. (1987); "The case research strategy in studies of information systems". MIS Quarterly. Vol. 11, n. 3, p. 369-387.

BRAGA; L. V.; ALVES, W. S.; FIGUEIREDO, R. M. C.; SANTOS, R. R. (2008); "O papel do governo eletrônico no fortalecimento da governança do setor público". Revista do Serviço Público. Vol. 59, n. 1, p. 05-21.

CHADWICK, A. (2009); "Web 2.0: New challenges for the study of e-democracy in an era of informational exuberance". I/S: A Journal of law and policy for the Information Society. Vol. 5.

CHAHIN, A.; CUNHA, M. A.; KNIGHT, P. T.; PINTO, S. L. (2004); e-gov.br: a próxima revolução brasileira: eficiência, qualidade e democracia: o governo eletrônico no Brasil e no mundo. São Paulo: Prentice Hall.

DINIZ, E. D.; BARBOSA, A. F.; JUNQUEIRA, A. R. B.; PRADO, O. (2009); "O Governo Eletrônico no Brasil: perspectiva histórica a partir de um modelo estruturado de análise". RAP - Revista de Administração Pública. Vol. 43, n. 1, p. 23-48.

DONMOYER, R. (2000); Generalizability and the Single-Case Study. In R. Gomm; M. Hammersley and P. Foster (Eds) Case Study Method (pp. 45-69). London: Sage.

EISENHARDT, K. M. (1989); "Building theories from case study research". Academy of Management Review. Vol. 14, n. 4, p. 532-550.

EVANS, D.; YEN, D. C. (2005); "E-government: An analysis for implementation: Framework for understanding cultural and social impact". Government Information Quarterly. Vol. 22, n. 3, p. 354-373.

FERRER, F.; SANTOS, P. (2004); e-Government: O Governo Eletrônico no Brasil. São Paulo: Saraiva.

FILHO, D. N.; AGUNE, R. M. (2004); Gestão dos negócios públicos. In F. Ferrer & P. Santos (Eds.), E-government: o Governo Eletrônico no Brasil. São Paulo: Editora Saraiva.

GOMM, R.; HAMMERSLEY, M; FOSTER, P. (2000); Case study method: Key Issues, Key Texts. London: Sage, 2000.

HENDERSON, J. C.; VENKATRAMAN, N. (1993); "Strategic Alignment: Leveraging Information Technology For Transforming Organizations". IBM Systems Journal. v.32, n.1, p.4-16.

HENDERSON, J. C.; VENKATRAMAN, N. (1996); Aligning Business and IT Strategies. Competing in the Information Age, Luftman, New York, Oxford University Press.

KAKABADSE, A.; KAKABADSE, N. K.; KOUZMIN, A. (2003); "Reinventing the Democratic Governance Project through Information Technology? A Growing Agenda for Debate". Public Administration Review. Vol. 63, n. 1, p. 44-60, 2003.

KENNEDY, M. (1979); "Generalizing from single case studies". Evaluation Quarterly: A Journal of Applied Social Research. Vol. 3, pp. 661-679.

LAYNE, K.; LEE, J. (2001); "Developing fully functional e-government: A four stage models". Government Information Quarterly. Vol. 18, n. 2, p. 122-136.

LENK, K.; TRAUNMÜLLER, R. (2002); Electronic government: where are we heading? Paper presented at the Electronic Government, First International Conference, Aixen-Provence, France.

LINCOLN, Y.; GUBA, E. (1985); Naturalistic inquiry. Newbury Park, CA: Sage.

LINCOLN, Y.; GUBA, E. (2000); The only generalization is: There is no generalization. In R. Gomm; M. Hammersley and P. Foster (Eds) Case Study Method (pp. 27-44). London: Sage.

MARIOTTO, F. L.; ZANNI, P. P.; MORAES, G. H. S. M. (2014); "What is the use of a single-case study in management research?" Revista de Administração de Empresas – RAE. Vol. 54, n. 4.

MEDEIROS, P. H. (2004); E-gov no Brasil: aspectos institucionais e reflexos na governança. Mestrado, Universidade de Brasília (UnB), Brasília.

MEDEIROS, P. H. R.; GUIMARÃES, T. A. (2005); "Contribuições do governo eletrônico para a reforma administrativa e a governança no Brasil". Revista do Serviço Público. Vol. 56, n. 4, p. 449-464.

MEIRELLES, F. S. (2015); Pesquisa Anual de Administração de Recursos de Informática. 26ª ed. São Paulo: FGV-EAESP-CIA.

MOON, M. (2002); "The evolution of e-government among municipalities: rethoric or reality?" Public Administration Review. Vol. 62, n. 4, p. 424-433.

OSBORNE, D. (1997); Banishing bureaucracy: the five strategies for reinventing government. New York: Plume.

PINTO, S.; FERNANDES, C. (2005); Institucionalização do governo eletrônico no Brasil. Paper presented at the Congreso Internacional del Clad sobre La Reforma del Estado y de La Administración Pública, Santiago, Chile.

SANTOS, P. F., MENDONÇA, H. L. A., CASSUCE, F., RODRIGUES, C. (2015); "O impacto do programa Nota Fiscal Paulista na expansão das receitas tributárias do Estado". Revista Espacios. Vol. 36, n. 17, p. 3.

SAO PAULO (ESTADO). (2010); Secretaria de Estado dos Negócios da Fazenda. Nota Fiscal Paulista: manual do consumidor. Available: <http://www.nfp.fazenda.sp.gov.br/pdf/mc.pdf>. Accessed: Jun 22, 2015.

SAO PAULO (ESTADO). (2011); Secretaria de Gestão Pública. Acessa SP. Available: <http://www.acessasaopaulo.sp.gov.br>. Accessed: April 22, 2015.

SHAREEF, M. A.; KUMAR, V.; KUMAR, U.; DWIVEDI, Y. (2009); "Identifying Critical Factors for Adoption of E-government". Electronic Government: An International Journal. Vol. 6, n. 1, p. 70-96.

SHAREEF, M. A.; KUMAR, V.; KUMAR, U.; DWIVEDI, Y. (2011); "e-Government Adoption Model (GAM): Differing service maturity levels". Government Information Quarterly. Vol. 28, n. 1, p. 17-35.

STAKE, R. (1982); "Naturalistic generalization". Review Journal of Philosophy and Social Science. Vol. 7, pp. 1-12.

STAKE, R. (1983); "Case study method: Deacon University". Educational Researcher. Vol. 7, pp. 89-113.

UNITED NATIONS. (2002); Benchmarking E-Government: a global perspective. In United Nations (Ed.). New York.

UNITED NATIONS. (2014); E-Government Survey 2014: E-government for the future we want. In U. Nations (Ed.). New York.

WEILL, P.; ROSS, J. W. (2006); Governança de TI, Tecnologia da Informação. São Paulo: M. Books do Brasil Editora.

Yin, R. K. (2001); Estudo de caso: planejamento e métodos. Porto Alegre: Bookman.

ZANNI, P. P.; MORAES, G. H. S. M.; MARIOTTO, F. L. (2011); Para que servem os Estudos de Caso Único? In: ENANPAD, 2011, Rio de Janeiro, v. XXXV, 1-16.

ZAREI, B.; GHAPANCHI, A.; SATTARY, B. (2008); Toward national e-government developing countries: a nine stage model. The International Information & Library Review, 40, 199-207.

1. Professor do Programa de Pós-Graduação em Pesquisa Operacional da Universidade Estadual de Campinas - Faculdade de Ciências Aplicadas. Doutor em Administração pela FGV-EAESP. Email: gustavo.salati@fca.unicamp.br

2. Professor Titular dos Cursos de Pós-Graduação da FGV-EAESP. Livre-Docente pela FGV-EAESP, Doutor pela FGV-EAESP e Mestre pela Stanford University

3. Professor do Programa de Pós-Graduação em Administração da Universidade Metodista de São Paulo. Doutor em Administração de Empresas pela FGV-EAESP