HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 13) Año 2016. Pág. 7

Ely Mitie MASSUDA 1; José Luiz PARRÉ 2; Cássia Kely Favoretto COSTA 3; Cássio Roberto de Andrade ALVES 4; Guilherme Kenzo dos SANTOS 5

Recibido: 21/01/16 • Aprobado: 25/02/2016

4. The agency relationship between industry and rural producer: An interpretation

5. Incentive mechanisms in the broiler integration contract

ABSTRACT: This study analyzes the relationships between the farmer and processing industry in broilers production. Original contracts of Brazilian processing industry were examined, hence, a primary source of research. Through the Principal-Agent Model, as a theoretical approach Principal-Agent, it aims identify the existing mechanisms of incentives in the legal contract, considering asymmetric information in the agency relationship system. It was also represented analytically whereas industry proposes a contract anticipating the behavior of farmers aimed at maximizing the efficiency ratio. It is concluded that the restrictions legal participation as well as the compatibility restrictions of incentives converge to achieve the index of efficiency that, in turn, depends on the level of effort of the agent, low or high. Analyses and conclusions allow understand the structure of contracts governing farmer and the broiler processing industry in view of Principal-Agent theory. |

RESUMO: O presente estudo analisa a relação contratual entre o produtor rural e a indústria processadora na produção d e frango de corte. Foram investigados contratos originais de indústrias processadoras brasileiras, tratando-se, portanto, fontes primárias de pesquisa. Por meio da abordagem teórica Agente-Principal, utilizado como Referencial Teórico, identificaram-se mecanismos de incentivos existentes no contrato legal considerando as informações assimétricas presentes na relação de agência no sistema. Uma representação analítica da relação contratual porquanto a indústria propõe o contrato antecipando o comportamento do produtor rural e tendo em vista a maximização do índice de eficiência produtiva. Conclui-se que as restrições de participação assim como as restrições de compatibilidade de incentivos convergem para a consecução do índice de eficiência que, por sua vez, depende do nível de esforço do agente, baixo ou elevado. As análises e as conclusões permitiram compreender a estrutura compreender a que regem a relação entre o produtor rural e a indústria processadora de frangos de corte à luz da teoria Agente-Principal. |

The production of poultry is one of the most important activities of the agribusiness in Brazil due to its productive capacity, international market share and technology adoption. In its social dimension, it demonstrates the importance in relat3ion to the number of small and medium sized producers involved in this market.

Since 2004, Brazil is the largest world poultry exporter, and the third largest producer, behind United States of America and China, according to data of 2012. In the same year, 69% of the Brazilian's production was consumed by the internal market. The South region was responsible for 62% of the total production, and the state of São Paulo for 12.7% (ABPA, 2014).

This performance can be attributed, to a large extent, to the governance structure adopted, mostly, since the 1980's. However, only recently, in 29 of august of 2013, the substitute to the PLS 330/2011 that defines the legal cornerstone to this production system was approved by the senate. The said law proposal is meant to legalize the integrated production system, unifying the principles and guarantees of the parts involved. The contract of integrated production is recognized by the Estatuto da Terra, lei 4.504 of 30.11.1994 and by the lei 11.443 of 05.01.2007 (AVISITE, 2013).

The vertical integration system is composed by relations in which the complexity levels are established according to the market, sanitary and quality demands, facing the world evolution. In this context, the relations still permeate between involved agents, which are, the rural producer and the processing industry (Winter, Guarnieri, 2011). The interests and behavior of both parts diverge or converge according to contractual relations, and not always observable by one of parts.

In the specific case of vertical integration for production of broiler, the processing industry (integrator) faces the need to "contract" the rural producer (integrated), but does not have the complete information about him in the execution of the tasks according to their goals. This fact can be analyzed by a principal-agent model in a market with imperfect information. Agency Theory can be used to interpreting the relations between the industry and the rural producer allowing an analysis of the implication of a symmetrical information contained in the vertical integration system.

The Principal-Agent model has been used in researches in the area of agribusiness in Brazil. Mesquita and Sampaio (2008) highlight as main results the decrease in the risk and the incentive to applying high effort in a commercial contract with moral hazard between producers of pineapple in province of Paraíbaand the Pernambuco stock exchange, in Brazil. Sampaio (2007), in a research about the exportation contracts between the producers and exporters of Mango in Rio Grande do Norte, demonstrated that the kind of the chosen contract of most producers is good for both parts and encourage the producer to applying high effort. Oliveira et. al (2001) showed through approach with the matter of moral hazard, that the style of contract between family producers of mamona and biodisel enterprises is appropriated to encourage the efforts of the producers. Guedes and Lavarda (2001) highlighted the specificity of the actives as an eliminating factor of the post-contractual threat and the concentration of agro industries and producers as a factor of contractual scission. Clemente and Silva Júnior (2012) demonstrated the importance of the elaboration and implantation of a structure of incentives in the relations between family farmers and biodiesel enterprises in Brazil.

Regarding the differences in approaches, the approach set forward by the New Institutional Economics was used by Ziebert and Shikida (2004) who noticed that integrated production contract can be used as a mechanism to decrease the uncertainty. Mato Grosso (Brazil) broiler contracts presented a medium specificity of actives, of frequent transactions and reduced uncertainty (Franco et al. 2009). Guedes (2004) concluded that the threat to reputation stands out as an inhibitor element of the opportunistic behavior as well as time and location.

This article analyzed the contractual relation between the rural producer and the processing industry of broiler agro industrial chain under the light of the principal-agent model. It was sought to, through this model, identify the existing mechanisms of incentives in the legal contract between the rural producer of broiler (integrated) and the processing industry (integrator).

Besides this introduction, this article is divided in five sections. Section 2 covers the theoretical bases of the New Institutional Economics and the Agency Theory. Section 3 brings the interpretation of the contractual relation between the processing industry and the rural producer. In section 4, the material and theoretical model of the research is presented. The 5th section discusses the mechanisms of incentive in the integrated poultry contracts. Lastly, in section 6, the final considerations of the article are presented.

Coase (1937) introduced the notion of firm as a complex of contracts and the economy of transaction costs, constructing a new approach known as a New Institutional Economics. Besides the production role, firm would coordinate the action of economics agents as well as market. Willianson (1979, 1995) and North (1991) took the concepts proposed by Coase (1937) leaning on the idea that institutions are the ensemble of rules that direct the interaction between human beings, in such a way to configure the system of trade between individuals and firms.

The fundamental thesis of the New Institutional Economics is that the "institutions are restrictions to human behavior drawn to reduce transaction costs" (Bueno, 2004: 368). According to the author, transaction costs came to exist with the increase of division of labor, which needed the expansion of the size of the markets, of trade, increasing, also, the risks associated to transactions. At ceasing to be economically self-sufficient and starting depending on others to obtain goods, they ended up exposing themselves to contractual risks existing in the transactions.

Transaction costs are costs that come up in the coordination of the economic agent's action, considering that beyond the production costs, the transaction costs also exist (Willianson, 1985).

The transactions can occur in the market or by alternative means to the market. When the market resolves the problems of the transaction by itself, by means of the mechanisms of prices, the negotiations are made by the conventional form, without recurring to some alternative form. It will be made by means of a defined structure of governance when its costs are below the transaction costs via market or price system. The firm will opt for one or other mean depending on the magnitude of the transaction costs. For example, a firms needs inputs that can be bought in the market or can produced in the firm itself. The decision will depend on the transaction costs incurred in the prices and the other structure of governance.

Zylbersztajn (1995) asserts that the main goal of the New Institutional Economics or Economics of Transaction Costs is to study the transaction costs as the inductor of alternative forms of governance, incorporating to an analytic-institutional outline, in such a way that the unity of the analysis is shifted to the transaction.

The transaction costs have their origin in the behavior of human nature, of the contractual man: bounded human rationality and opportunism: "Transaction cost economics characterizes human nature as we know it by reference to bounded rationality and opportunism" (Willianson, 1985: 44-45). Bounded rationality and optimizing behavior are in harmony, since although economic agent wishes to optimize, he cannot reach his goal (Zylbersztajn, 1995).

Opportunism is a form of self-interest that, however, can include self-interest with guile. It does not limit itself to the obvious forms such as lie, fraud and stealing. It takes subtle forms of deceiving, most of the times, including passive and active forms. Not every individual possess the same degree of opportunistic behavior, however it is difficult to determine ex ante those that are from those that are not (Williamson, 1979).

Therefore, given the nature of the contractual man, contracts in general have the role of the institutional element that outlines the effects of bounded rationality and opportunism. The governance structures are constructed to reduce transaction costs. They are alternative forms of institutional arrangements of the transactions that use different coordination mechanisms. According to Conceição (2002: 126), for the institutionalists, who determines the allocation of scarce resources in society "is the organizational structure, in short, their institutions, while the market only fulfills the predominant institutions".

In the same sense, Zylbersztajn (2005) maintains that the firm presented by Coase (1937) has contractual nature. The contractual mechanism is the rule to allocation of resources in society and the market is the exception.

In launching the bases to study the alternative forms of organization of contractual firms, Coase (1937) opened way to the analysis of the firm's internal organization and the relation between themselves, founding the idea that the existence of associated costs to the organization of activities via market can exceed the costs of internal organization.

Agency Theory investigates the divergences and the costs that derive from the separation between management and propriety. The existing conflict between the owner and the engaged task executer to effectuate the tasks in behalf of the former, presupposes that the parts have divergent interests in the transaction conduction (Jensen, Meckling, 1976; Fama, 1980).

Contracts come up as the necessity of bypassing risks and conflicts come up. They are in the center of the New Institutional Economics or Transaction Cost Economics, because they are the institutions that draw the outlines and the collaboration, implementation and monitoring costs, as well as other costs involved. Williamson (1985) notes that multiple costs exist: ex-ante costs and ex-post. Ex-ante costs refer to the elaboration, negotiation, and agreement safeguards. Ex-post costs include those linked to the maintenance and realignment of contract. A complicating factor occurs of the fact of both costs, ex ante and ex post, are interdependent, which requires a simultaneous treatment, instead of sequential. Furthermore, the costs of both kinds are frequently difficult to quantify.

In the contractual perspective it is implicit the incorporation of the bounded rationality concept and the agent's opportunism. In the same sense, intrinsic is the idea of incompleteness of the contracts given the incapacity of foreseeing the future contingencies and, by consequence, breaches that open up space for opportunist actions. Bounded rationality that is a product of the incapacity to learn, interpret or analyze fully the environment also leads the characteristics of the incomplete contracts. "the existence of inevitable contractual gaps leads necessarily to the creation of institutions that permit the continuity of these relations in a known opportunistic environment" (Zylbersztajn, 1995: 49).

Even if the contract is comprehensive, the uncertainties will permeate the relation between the agents. To reduce these uncertainties, the parts involved will establish control and monitoring structures, as well as possible adjustments, which implies on transaction costs. The transactions that occur in a high uncertainty environment certainly will have more rigorous control structures and, therefore, a higher cost.

Opportunism does not mean that all individuals act opportunistically, but if one acting as so is enough for the contracts to pass the necessity of actions of control and monitoring (Zylbersztajn, 1995).

In this environment of uncertainties and due to the agent's bounded rationality and their opportunistic behavior, the New Institutional Economics analyzes the institutional arrangement that achieve the smallest transaction cost. Contracts, given that they represent the ensemble of norms and rules that must be complied by the parts in the transaction, in this case, principal and agent, constitute the unity of analysis of the agency theory.

Every relation in which the situation of an individual depends on the actions of another is a relation of agency. The agent and the principal role are also defined relatively to information. The agent is, usually, that who maintains the information from which the principal does not have access without cost. There is, therefore, an asymmetry of information between the parts (Pratt, Zeckhauser, 1985; Perrot, Roodenbeke, 2005).

This agent relation is denominated principal-agent structure that studies the characteristics of the optimum contract and intervening variables influenced by the behavior and information of the parts involved in the contract. The contract details the relevant obligations to the agent and to the principal and the transferences that must be fulfilled, including the mechanisms of payment to the agent (Mas-Colell et al. 1995; Salanié, 1997, Brousseau, Glachant, 2002; Araújo, 2007).

Jensen and Meckling (1976), Mas-Colell et al. (1995) highlight that, both parts (principal and agent), seek to maximize the utility such that the agent may not act accordantly with the interests of that who hired him, the principal. Making the agent comply with the interests of the principal involves expenses, denominated agency costs.

The basic problem of the agency is that information has a cost, meaning that it does not flow to null costs. If the cost of the information was zero, there would be no agency problem, given that the individual would not depend on the other. As highlighted by Pratt and Zeckhauser (1985: 2), "... in real life full information rarely is freely available to all parts, and so the principal's interest even when their actions and information are not observed by the principal".

In this context, contracts can be formal or informal, of minor or major complexity depending on relation that involves the transaction. According to Neves (1995: 19) "... is a form of coordination of successive production stages. … a contract is an agreement by which the agents oblige themselves to cease or to appropriate, taking or not certain decisions, occurring exchange of property rights". They take the role of reducing uncertainties, given that they establish the involved parts attributes in the transaction, determining each of the parts rights and duties. To guarantee the fulfillment of the established rules, the contract has safeguards dispositions and monitoring and guarantees of adjustments, adequacy and penalties (Neves, 1995).

Besides costs of elaboration and structuring of contracts, Jensen and Meckling (1976) define agency costs as costs related to expenses and monitoring of agents by the principal; agent expenses to demonstrate to the principal that his acts will not harm him; and the residual loses that consists in the reduction of the principals wealth by the possibility of conflict of interests between the agent and the principal. They are monetary and non-monetary costs taken by the parts due the need to implement systems of control and obligations. Costs related to monitoring and incentive are taken to the principle that would lead, at least theoretically, the agent to unveil his behavior. In the same manner, incentives can stimulate the agent to act accordantly to the interests of the principal. To the agent the costs linked to the guarantee of the contract and the penalties in case of damages to the principle are imposed.

According to Sappington (1991), Macho-Stadler and Pérez-Castrilho (1997), independently of the observable result, the agents must receive compensation. They will have interest in making a greater effort if they receive an additional incentive generating an agency cost.

The definition of the remuneration system involves the risk factor, because in deciding to reward a performance that results in a greater effort, the reward will depend on random factors that influence the result (Costa, 2012)

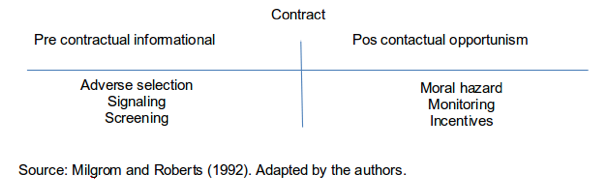

In the context of conflict of interests, asymmetrical information leads to problems denominated adverse selection and moral hazard. The Figure 1 outlines the asymmetrical information problem in relation to the time distribution. The problem of moral hazard occurs after the celebration of contract, that is, the principal cannot monitor or observe the actions of the agents. In other words, the moral hazard is defined when there is an agent behavior that does not align to the principal goal, once that the contract is signed. The existence of post contractual information will lead to a loss of well-being to both parts. In the adverse selection case, the actions of the agent are observed, but the principal has difficulties to assessing it (Akerlof, 1970; Arrow, 1984; Mas-Colell, et al., 1995; Macho-Stadler, Pérez-Castrilho, 1997; Pindyck, Rubinfeld, 2010; Costa, 2012).

As highlighted by Perrot and Roodenbeke (2005), the moral hazard occurs in the impossibility of the principal to observe the real behavior of the agent, as opposed, the adverse selection comes up when the nature of the transacted object is not available to the principal.

Figure 1: Asymmetric information in relation the temporal distribution

One of the forms of market failure occurs when, due to asymmetrical information, adverse selection takes place. In the buyer/seller relation, there is a part that does not have all information that the other possesses. This kind of failure market has origin in the principal-agent relation, because who represents the acting part is the agent and who is affected by his actions is the principal. The principal cannot obtain all the information about the agent, the information holder. As shown, a contract does not possess all the complete information about the behavior of whom was contracted (Pindyck, Rubinfeld, 2010).

The way to reduce the information asymmetry, that is, to obtain the information, is monitoring or offering incentives to stimulate a behavior closer to the conditions of symmetrical information. In accordance with Milgrom and Roberts (1992), the private information may be revealed by signaling and screening. Moral hazard might be controlled through monitoring and incentives contracts.

Both the adverse selection and the moral hazard, derive from asymmetrical information, implying it as an agency problem concerning the principal-agent theory, addressed by Jensen and Mekling (1976).

Although the adverse selection and the moral hazard are attributed to steps that are prior and succeed the contract, respectively, and each case is frequently studied isolated , Mas-Colell et al. (1995) developed a hybrid model that contains both characteristics simultaneously.

The integration contracts between the rural producer (agent) and processing industry (principal) of the enterprises A, B, C, D, E, F, G, H, in their original form, constituted the main instrument of data collecting of this research consisting, therefore, of primary or document sources. The identities of these firms have been preserved considering the confidential nature of contracts. These documents allowed the identification of the characteristics, peculiarities, similarities and existing relations in many contracts.

Sampling was conducted by accessibility (Gil, 2004) determined by the disclosure of documents by contacted companies due to the confident nature of the documents. The contracts were disclosed between February to May 2014. Qualitative data analysis was performed using the content analysis technique (Krippendorff, 2004; Moraes, 1999). The analyzes were performed in the following steps proposed by Moraes (1999) preparation of data; unitarization of the unit content; categorization or units classification into categories; description; interpretation. The constructed categories throughout the analysis process were supported by the inductive-constructive approach.

Based on the principal-agent theoretical model the variables of the study were determined, that is the asymmetry sources of information that generate agency costs. The contractual clauses were enumerated in such a way to observe the regularity of the dispositions, allowing the organization according to the restriction variables of the study: the legal participation restriction and the compatibility of incentive restrictions.

The analysis of contracts consisted in the identification of the ensemble of incentive compatibility restrictions, offered by the industry to the rural producer, so that he applies efforts in the same sense as to achieve the desirable performance that is observed by de Efficiency Index. On the other side, as condition for the contractual relation established, the legal participation restriction were numbered taking into account that the rural producer is subjected to the condition's fulfillment for the participation in the activity. It was also represented analytically whereas industry proposes a contract anticipating the behavior of farmers aimed at maximizing the efficiency ratio.

In this section, an analysis of the contractual relation between the rural producer of poultry (integrated) and the processing industry (integrated) is developed under the perspective of the Principal-Agent theoretical model in context to asymmetrical information.

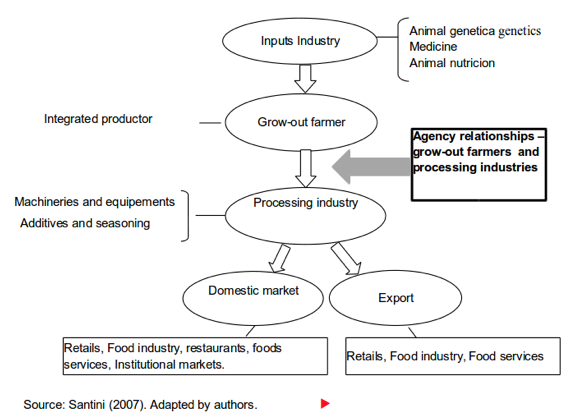

In the broiler agroindustry chain, presented in the Figure 2, multiple kinds of transaction may occur in the different links.

Figure 2: Broiler Agro industrial chain

Concerning the rural production and the processing industry, the broiler production structure in the contractual form is predominant, mainly in the South region of Brazil, where the integration contract are near 100% to the total, and less in the state of São Paulo, where the spot market has more importance ( Zylberztajn, Nogueira, 2002; Zylberztajn, 2005) The agency relation that is established in this link characterizes the rural producer and the processing industry as agent and principal, respectively, as illustrated by Figure 2.

In a general sense, producers and enterprises interact out of the free market, because a contract establishes the articulation between the rural producer and the processing unit, the industry. The forms and techniques of production, quality and quantity, price, terms and agro industrial credit to the producer are anticipated in these contracts. The contracts are meant to coordinate the activities of the links that compose the production chain, whose direction is up to, in general, the processing industry, and known as the integrator. The rural producer is the integrated. This kind of arrangement is known as the vertical integration contract (Winter, Guarnieri, 2011). In this contract established between the rural producer and the processing industry, it is specified the obligations of both parts. After the raising of chickens, the industry promoted the slaughtering and the other links of the production chain.

In the vertical integration, the rural producer (integrated) and the processing industry (integrator) are displaced from the specifications of the full knowledge for decision making. Therefore, the asymmetry of information arises.

The agroindustry, by trusting to the rural producer its production, occurs in risks due to the lack or nonexistence of perfect information about the production itself. Problems of adverse selection and moral hazard occur, in this case. The existence of incentives, monetary or not, can constitute an important factor for the productive performance, both for the producer as well as for the agroindustry.

In the vertical model of integration, this relation involving integrated and integrator in broiler production compasses the perspective of the principal-agent conflict as the processing industries performs hiring delegating part of their deliberation in favor of the producers in asymmetrical information situations. The processing industry is the principal and the rural producer the agent.

The processing industry is responsible for elaborating and offering a contract to the rural producers so that they raise the birds from one day age to the slaughtering age. The agent decides if it is of his interest to make necessary investments to the raising of the birds.

In this relation, the processing industry cannot observe directly actions of the rural producer, but can verify if the results are consistent with their goals, through the agent's action. The fundamental problem for the processing industry consists in elaborating a contract to create an incentive so that the rural producer acts in the best way possible in their point of view.

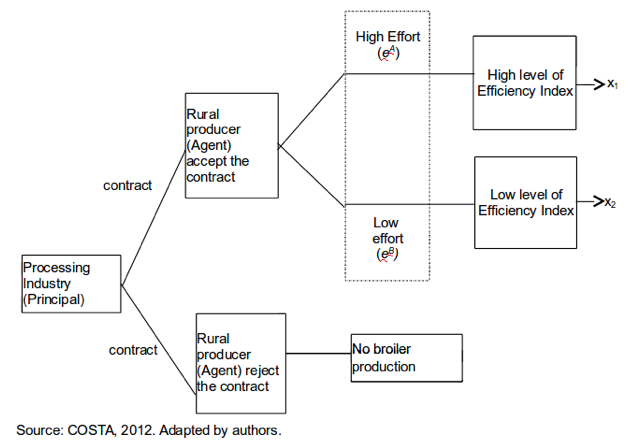

In the Figure 3 it is presented the agency relation between the processing industry (principal) and the rural producer (agent). The industry proposes a contract to the producers that may or may not accept. If the rural producer accepts the proposed contract, pondering the presenting incentives, there can be two behaviors: accomplish high effort (eA) or accomplish low effort (eB). In the first case, the efficiency index will be high while in the second case, this index will be low. It is evident that the industry wishes that the rural producer effectuates high effort, so that it affects its gains positively in comparison to the efficiency level. Therefore, the processing industry is not capable of following the degree of effort made by the rural producer. But it can assess the presented result, that is, the efficiency index.

Figura 3: Agency relation between broiler rural producer and processing industry

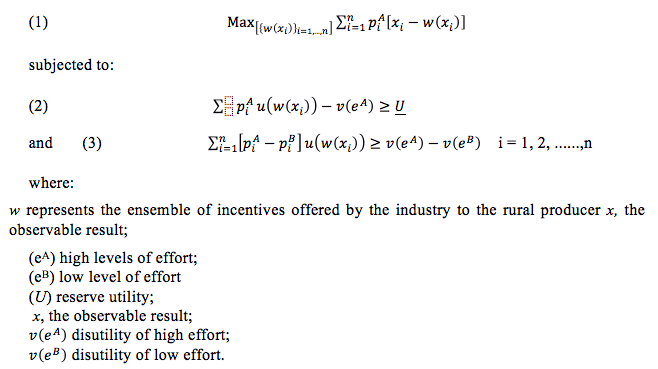

The relation between the rural producer and the processing industry can also be represented in an analytic way. If the grow-out farmer accepts the contract, as shown in figure 3, it is considered that the industry proposes a contract anticipating the behavior of the producer. Its goal is to maximize the efficiency index of broiler production. In this context, the industry must resolve the problem of maximization to obtain the high effort level from the producer.

In equation (1), w represents the ensemble of incentives offered (payoff) by the industry to the rural producer and x, the observable result, corresponding to the efficiency index. This mathematical function does not depend directly on the producer's effort, but of the result of the task for which his was hired.

To obtain its goal, the industry is subjected to participation legal restrictions presented in equation (2). In this condition, the rural producer receives an ensemble of incentives (w) for its participations in the legal contract and incorporates an effort (e) that has a cost, related to the workings of the integration process. The ensemble of incentives (w) that the industry offers to the producer must compensate them for their high level of effort (eA). It is up to the rural producer to take or reject the contract offered by the industry. The aspect that guarantees the external opportunities of the market is denominated reserve utility (U), defined as the minimal level in order for the producer to participate in the contract. In this manner, according to the theoretical model, the contract to be signed must allow the producer to obtain an expected utility greater than (or equal) the reserve, given their high effort.

The equation (3) refers to the incentive compatibility restriction in the analyzed system. The function ![]() can be interpreted as the welfare of the processing industry, obtained from the result of the efficiency index. The relation

can be interpreted as the welfare of the processing industry, obtained from the result of the efficiency index. The relation![]() corresponds to the gap of effort of the rural producer, and that

corresponds to the gap of effort of the rural producer, and that ![]() e

e ![]() the disutility of the high and low efforts, respectively. These producers will choose high level of effort

the disutility of the high and low efforts, respectively. These producers will choose high level of effort ![]() if the awaited utility gain is greater them the implicit costs of perform in it, that is,

if the awaited utility gain is greater them the implicit costs of perform in it, that is, ![]() >

> ![]() (Mas-Colell et al., 1995; Costa, 2012).

(Mas-Colell et al., 1995; Costa, 2012).

Taking as basis the principal-agent model exposed in the previous section, the analysis of eight contracts of broiler integration between the rural producers and the processing industry was made. The main focus consisted in observing the restrictions that the processing industry (principal) is subjected to achieve the highest index of efficiency of production of broiler by farmers.

For such, from the contracts, the restrictions of legal participation and the incentive compatibility were numbered. In the documental research, it was observed that the clauses are similar in all the contracts, presenting differences for the form of presentation and detailing of the contractual dispositions.

For the relation between industry and rural producer to occurs, according to Figure 2, it is necessary that the producer to fulfill a series of conditions, here setting presented, due to the high number of existing clauses in the contracts. These conditions under the scope of the principal-agent model are interpreted as restrictions to legal participation:

1) Initially, and as necessary condition, the producer must be a proprietary or tenant of a rural property.

2) Following the necessary condition, the exclusivity to the integrator industry for the term of the contract and the supply of infrastructure adequate to the development of the activities. The following conditions regarding infrastructure are required:

a. heating of the aviaries, bedding, adoption of techniques, technologies and equipment in the specified standards and the accompaniment by the integrator part in case of repair needs;

b. husbandry (feeding and use of medication prescribed by the integrator industry, sheltering and removal of the birds, preparation for catching of broiler with regards to the hydric diets and feeding and maintenance of the adequate temperature in the aviaries),

c. sanitary and ambiance conditions (norms of biosecurity demanded by the agroindustry and by the environment legislation as, for example, the interdiction of other birds in the property and the immediate notification of mortality higher then 0,2% of the total/daily.

3) Referring to the labor power, all expenses are under the responsibility of the rural producer – from the hiring, labor benefits, tributaries, and accidents, including the transfer of the contract assumed by the producer to the heirs, in the event of his demise. The farmer must provide labor for unloading one day birds that come from integrator.

4) Special attention from the producer must be directed to the supply and shortage of electrical energy, due to the consequences of the loss of control of heating in the aviaries on the flock. The obligation of the integrated in the event of shortage of energy follows from the immediate communication to the accompaniment of supply until the registry to police authority in the event of lack of reply of the responsible enterprise, in the specified term. To the registry, it is added the communication referring to the deaths of the birds or damages or non-function of aviary equipment as the result of electrical energy shortage. In the event of non-compliance with these protocols, it is up to the producer to take the losses caused by the damages.

5) The rules of monitoring are prescribed in the rural producer's mandatory duty to conserve the pathways for the vehicles of the integrating industry, the constant free permission for entry and access to the installations and accompaniment of the creation of birds and the devolution of the leftover feed and medicine.

6) The term of the contract is undetermined for five contracts, and the others stipulate 1, 2 and 6 years.

7) The fines for contractual infractions are present in all contracts except one of them.

8) Fine or rescission are foreseen in all contracts, except one, in the case of high feed conversion rate tax or/and non-compliance with contractual clauses.

In the same sense, it may be observed that if the rural producers obtain a greater reward when their performance in the broiler raising is higher, it will be presented as an incentive to act conforming to the interests of the processing industries.

The compatibility restrictions of incentive are substantiated in the inductions clauses of the rural producers (agent) to the objectives of the processing industry (principal).

1) The industries supply and transport the one-day birds to the rural producer for the raising and the necessary feed and medication providing also the orientations for the handling (techniques of creation, medication and feed, veterinary services) and also the labor force for the removing of the birds from the rural propriety and the reposition of the lots in stipulated terms and according to the needs of the industry.

2) To the rural producers it is permitted the consumption of 0,1% of the chickens raised in the property.

3) The payment of the results obtained by the producers is accomplished by means of the national currency or in percentage to live birds under participation in the partnership agreement accordantly to the efficiency index. It is important to highlight that the objective of the industry is to obtain the greatest possible efficiency index from the producer.

For such the industry depends on the high effort of the rural producer to achieve the result x, observed in the efficiency indexes as could be seen in Figure 3 On the other hand, the industries are subjected to the payment of an ensemble of incentives w that offers to the rural producer.

Considering the analytic way to analyze incentives mechanisms in broiler integration contract, according to equation (1), the maximization of the welfare of the industry depends on the ensemble of the incentives w offered by the industry to the rural producer, materialized in the clauses of compatibility restriction of incentive described and the reached results x, determined by the efficiency indexes. The efficiency index supplies the result of the effort made by the producer, because in it the adoption of the industry recommended protocols are reflected, therefore, represent the result of the task for which the rural producer was hired.

The efficiency index depends, as demonstrated by the analyzed contracts, on the following factors: feeding conversion, that is the quantity of feed consumed in order to produce one kilogram of live broiler, therefore, when the quantity is smaller, lower will be the conversion index, which is desirable. Conversion superior to an established number is subjected to loses in the payment system; medium consumption of feed: quantity consumed per bird, on average, of feed in the date of the lodgment (one day) until the day of slaughter; medium weight: the medium weight of the birds in the date of delivery; death rate: the rate of birds that have died in comparison with the number initially lodged; age: corresponds to the number of days between the lodging and the slaughter; daily growth: daily gain in grams of the birds, on average.

In order to participate in the integrating process, the rural producer submits himself to a series of prescribed requirements such as legal participation, according to equation (2). The rural producer, in receiving the ensemble of incentives (w), applies an effort (e) that imposes a cost. In this sense, w must provide the cost of high effort (eA). The rural producer will accept the contract if the ensemble of incentives outgains the reserve utility (U) that are the opportunities outside of the market. The contract will be celebrated if, because of the high effort, the producer manages to gain an awaited utility equals or superior to the reserve, otherwise the contract will not take place.

For the industry, the results are substantiated in the efficiency indexes (xi) against the ensemble of offered incentives (w) according to the possibilities of high and low effort of the contracted rural producers. High effort ![]() or low (eB) depends on the desutility of the corresponding effort levels

or low (eB) depends on the desutility of the corresponding effort levels ![]() and

and ![]() . High effort will be applied until the baseline that there is an additional gain implicit in executing it, otherwise, high effort will not do.

. High effort will be applied until the baseline that there is an additional gain implicit in executing it, otherwise, high effort will not do.

By the structure of restrictions of compatibility of incentives and legal participation in the analyzed contracts it is possible to observe that the clauses are drawn in such a way to maximize productive efficiency of broiler by the rural producers, materialized on the efficiency indexes.

In the proposed of the New Institutional Economy, the bounded rationality and the opportunism instigate the need of specifics structures of transaction governance. Control and monitoring for facing eventual risks of the opportunistic actions in uncertainty environment are required. The outline and the structuring of these mechanisms imply in costs, denominated costs of transaction. The problem of agency relation can be seen as a contractual question.

The relationship involving the processing industry and the rural producer in poultry production covers the perspective of the principal-agent model. The first effectuates the hiring delegating a part of his deliberations in favor of the producers in situations of asymmetry of information. The processing industry (integrator) is the principal and the rural producer (integrated), the agent. The adaption of the model was possible in the light of the reality by means of the contractual link between the two involved parts in this process, allowing a better comprehension of the contract structure that governs described relation. It is identified, by means of the contracts, the mechanisms of legal restrictions existing in this relation.

In the case of the contracts between the rural producers and the broiler processing industry, the Efficiency Index comes up as the motivating element for the adoption of other incentives, given that these results, in practice, will appear in this index. That is, the adoption of the recommended standards by the integration enterprises, of proper installations, of handling and proper sanitary and environment, that would convert themselves into desirable indexes for both parts.

The compatibility and incentive restrictions come up, therefore, as an ensemble of stimuli for the rural producers that will compensate their effort that, if high, higher will be the reward. The rural producer can accept or reject the industry offered contract. Therefore, accordantly with the theoretical model, the contract will be accepted if it allows the producer to obtain a higher utility than that offered by the market, given their high effort.

The principal-agent theory was shown appropriate to analyze the relation between the rural producer and the poultry processing industry by allowing the analysis of the contractual structure by means of the identified restrictions in the examined documents and in such a way that they manifest. This theory can be used in situations where there is an agency relation in context of asymmetry of information.

The authors gratefully acknowledge industries and farmers who provide contracts making this research possible.

ABPA. (2012); Associação Brasileira de Proteína Animal. Avicultura brasileira em 2012.[accessed in 15 january 2016] Retrieved from http://www.ubabef.com.br/noticias/305?m=62

AKERLOF, G. A. (1970); "The Market for "Lemons": Quality Uncertainty and the Market Mechanism". The Quarterly Journal of Economics, 84 (3), 488-500.

ARAÚJO, F. (2007);Teoria Econômica do Contrato. Coimbra: Almedina.

ARROW, J. K. (1984); The economics of agency. Technical Report. Stanford: Stanford University.

AVISITE. (2013); Senado aprova sistema de contrato integrado entre produtor rural e agroindústria. [accessed in 15 january 2016] Retrieved from http://www.avisite.com.br/clipping/imprimir.php?codclipping=21671

BROUSSEAU, E.; Glachant, J. M. (2002); The Economics of Contractes: theories and aplications. Cambridge: Cambridge University Press.

BUENO, N. P. (2004); "Lógica da Ação Coletiva, Instituições e Crescimento Econômico: uma resenha temática sobre a Nova Economia Institucional". Revista Economia, 5(2), 361-420.

CLEMENTE, F.; Silva Junior, A. G. (2012); "Contratos entre produtores de soja da agricultura familiar e indústria de biodiesel: uma aplicação do modelo Principal-Agente". Estudos Sociedade e Agricultura, 20, 509-527.

COASE, R. (1937); "The Nature of the firm". Economica, 4(16), 386-405.

CONCEIÇÃO, O. A. C. (2002); "O conceito de instituição nas modernas abordagens institucionalistas". Revista de Economia Contemporânea, 6(2), 119-146.

COSTA, C. K. F. (2012); Ensaios sobre a Economia dos Transplantes Renais no Brasil: incentivos e eficiências. Doctorate Thesis. Universidade Federal do Rio Grande do Sul, Porto Alegre.

FAMA, E. (1980); "Agency Problems and The Theory of The Firm". Journal of Political Economy, 88(2), 288-307.

FRANCO, C.;Bonjour, S. C. M.; Pereira, B. D.; Zanin, T. S. (2011); "Análise dos contratos na avicultura de corte em Mato Grosso sob a ótica da Nova Economia Institucional". Revista de Economia e Agronegócios, 9(2), 149-186.

GIL, A. C. (2009); Métodos e Técnicas de Pesquisa Social. São Paulo: Atlas.

GUEDES, P. P. (2004); "Características dos ativos, comportamento dos agentes e a coordenação contratual na cadeia avícola de corte". Paper presented at SOBER - XLII Congresso Brasileiro de Economia e Sociologia Rural. Cuiabá, Brazil.

GUEDES, P. P.;Lavarda, L. B. (2001); "Custos ex post nos arranjos contratuais dos complexos agroindustriais: evidências empíricas a partir dos casos das cadeias do frango de corte e da cevada no Rio Grande do Sul". Paper presented at III Congresso Internacional de Economia e Gestão de Negócios Agroalimentares. Ribeirão Preto, Brazil.

JENSEN, M.C.; Meckling, W.H. (1976); "Theory of the Firm: Managerial Behaviour, Agency Costs, and Ownership Structure". Journal of Financial Economics, 3(4), 305-360.

KRIPPENDORFF, K. (2004); Content Analysis. An Introduction to its Metodology. London: Sage Publications.

MACHO-STRADLER, I.; Pérez-Castrillo, D. (1997); An Introduction to the Economics of Information: Incentives and Contracts. Oxford: Oxford University Press.

MAS-COLELL, A.; Whinston, M.; Green, J. R. (1995); Microeconomic Theory. Oxford: Oxford University Press.

MESQUITA, S. P.; Sampaio, L. M. B. (2008); "Contrato de comercialização com moral hazard entre produtores paraibanos de abacaxi e a Bolsa do Comércio de Pernambuco". Revista Econômica do Nordeste, 39, 105-118.

MILGROM, P.; Roberts, J. (1992); Economics Organization and Management. Upper Saddle River: Prentice-Hall.

MORAES, R. (1999);"Análise de conteúdo". Revista Educação, Porto Alegre, 22(37), p. 7-32.

NEVES, M. F. (1995); Sistema agroindustrial citrícola: um exemplo de quase-integração no agribusiness brasileiro. MSc thesis, Faculdade de Economia, Administração e Contabilidade, Universidade de São Paulo.

NORTH, D. C. (1991); I"nstitutions". The journal of Economics Perspectives, 5(1), 97-112.

OLIVEIRA, M. C.; ARAÚJO JUNIOR, I. T.; SAMPAIO, L. M. B. (2009); "Uma aplicação do modelo principal agente com moral hazard para contratos entre empresas de biodiesel e agricultores familiares de mamona". Paper presented at XIV Encontro Regional de Economia, Fortaleza.

PERROT, J. ; Roodenbeke, E. de. (2005) ; La contractualisation dans les systèmes de santé : pour une utilisation efficace et appropriée. Paris : Éd. Karthala.

PINDYCK, R. S.; Rubinfeld, D. L. (2010); Microeconomia. São Paulo: Pearson.

SALANIÉ, B. 1(997); The Economics of Contracts. Cambridge: The MIT Press.

SAMPAIO, L. M. B. (2007); "Modelo Principal-Agente para contratos entre pequenos produtores e empresa exportadora de manga no Rio Grande do Norte". Revista de Economia e Sociologia Rural, 45, 879-898.

SANTINI, G. (2006); Dinâmica Tecnológica da Cadeia de Frango de Corte no Brasil. Análise dos Segmentos de Insumos e Processamento. Doctorate Thesis, Universidade Federal de São Carlos, São Carlos.

SAPPINGTON, D. E. M. (1991); "Incentives in Principal-Agent Relationships". The Journal of Economic Perspectives, 5(2), 45-66.

WILLIANSON, O. E. (1979); "Transaction-Cost Economics: The Governance of Contractual Relations". Journal of Law and Economics, 22(2), 233-26.

WILLIANSON. O. E. (1985); The Economic Institution of Capitalism. Firms, Market, Relational Contracting. China Social Sciences Publishing House Chengcheng Books Lill: China.

WINTER, M.; Guarnieri, O. (2011); Regime Jurídico do Agronegócio - contratos de integração vertical. Retrieved from http://www.agroanalysis.com.br/especiais_detalhe.php?idEspecial=86&ordem=3

ZIEBERT, R. A.; Shikida, P. F. A. (2004); "Avicultura e produção integrada em Santa Helena, Estado do Paraná: uma abordagem a partir da nova economia institucional". Revista de Economia Agrícola, 51(1), 71-86.

ZYLBERSZTAJN, D. (1995); Estruturas de Governança e Coordenação do Agribusiness: uma Aplicação da Nova Economia das Instituições. Habilitation Thesis, Universidade de São Paulo, São Paulo.

ZYLBERSZTAJN, D. (2005); "Papel dos Contratos na Coordenação Agro-Industrial: um olhar além dos mercados". RER, 3, 385-420.

ZYLBERSZTAJN, D.; Nogueira, A. C. L. (2002). "Estabilidade e difusão de arranjos verticais de produção: uma contribuição teórica". Economia e Sociedade, 11(2), 329-346.1. Professor, UniCesumar – Knowldge Management graduate and Health Promotion. Postdoctoral of the Graduate Program in Economic Sciences (PCE) - PNPD /CAPES University of Maringá). E-mail: elymitie.m@gmail.com

2. Professor, doctoral and graduate program (PCE), University of Maringa, Brazil. E-mail: jlparre@uem.br

3. Professor, doctoral and graduate program (PCE), University of Maringa, Brazil. E-mail: cfavoretto@hotmail.com

4. Scientific Initiation Program, CAPES/University of Maringa, Brazil. Undergraduate student of Department of Economics Sciences (University of Maringa, Brazil). E-mail: cassiorobertodeandradealves@gmail.com

5. Undergraduate student of Department of Law (University of Maringa, Brazil). E-mail: guikenzo.s@gmail.com