Vol. 38 (Nº 33) Año 2017. Pág. 10

Mikhail Ya. VESELOVSKY 1; Marina A. IZMAILOVA 2; Natalya L. KRASYUKOVA 3; Inna V. BITKINA 4; Alexander G. GLADYSHEV 5

Received: 30/05/2017 • Approved: 15/06/2017

ABSTRACT: The article examines the effects of financial sector on the development of the Russian regions in the geopolitical and geo-economic situation complicated for our country. The authors revealed main determinants of the increased role of the financial sector against the background of emerging fundamentally new economic system, based on "financialization" of economic relations, as well as conducted the analysis of their long-term fundamental impact on the global and national economy. The article describes the systemic problems of regional development of the country in terms of a succession of financial and economic crises, turbulence in the economic environment, and geopolitical instability having negative effects on the investment attractiveness of Russian regions and the after-effects of the leading growth of financial risks in these territories. One of the solutions to the problem of equalizing the development level of the regions, proposed by the authors, is actualization of methodological approaches to the spatial development of the country. The need for this measure has grown manifold at the background of integration of Russian economy into the world economic system and the addressing by the regions the problem of integrating their economies into the world economic system. The article presents also the typology of the Russian regions in terms of their economic development and spatial inequality conditions. The authors suggest the approaches to the formation of spatial and regional policies aimed at the ability for point-based problem solution and the emergence of seeds of economic growth. The quintessence of the present research consists in proposals on formation of strategic planning and management system of spatial development of Russia. |

RESUMEN: El artículo examina los efectos del sector financiero sobre el desarrollo de las regiones rusas en la situación complicada geopolíticamente y geoeconómicamente. Los autores revelaron los principales determinantes del papel creciente del sector financiero en el contexto de la aparición de un sistema económico fundamentalmente nuevo, basado en la "financiarización" de las relaciones económicas, así como en el análisis de su impacto fundamental a largo plazo en la economía mundial y nacional economía. El artículo describe los problemas sistémicos del desarrollo regional del país en términos de una sucesión de crisis financieras y económicas, turbulencias en el entorno económico e inestabilidad geopolítica que tienen efectos negativos sobre el atractivo de las regiones rusas en la inversión y las secuelas de los principales Crecimiento de los riesgos financieros en estos territorios. Una de las soluciones al problema de igualar el nivel de desarrollo de las regiones, propuesta por los autores, es la actualización de enfoques metodológicos para el desarrollo espacial del país. La necesidad de esta medida se ha multiplicado en el contexto de la integración de la economía rusa en el sistema económico mundial y el abordaje por parte de las regiones del problema de la integración de sus economías en el sistema económico mundial. El artículo presenta también la tipología de las regiones rusas en términos de su desarrollo económico y condiciones de desigualdad espacial. Los autores sugieren los enfoques para la formación de políticas espaciales y regionales dirigidas a la capacidad de solución de problemas puntuales y la aparición de semillas de crecimiento económico. La quintaesencia de la presente investigación consiste en propuestas sobre la formación de la planificación estratégica y el sistema de gestión del desarrollo espacial de Rusia. |

After a series of financial and economic crises, the Russian economy was again influenced by new global challenges and the accumulated structural and institutional problems that require updating the approaches to pursued economic policy, as well as searching for solutions able to ensure not only macroeconomic stability, but also a significant acceleration in economic growth with the vector directed to the strengthening of the Russian economy in the global space.

The purpose of this article is to identify the role of the financial sector in the new economic environment, as well as analyze the systemic problems of socio-economic development of Russian regions and scientific substantiation of spatial development strategy of the country in conjunction with regional policy.

Relevance of the present work consists in development of theoretical and methodological approaches to the solution of a problem of spatial and regional policy formation, capable of eliminating the uneven economic development of regions. Indeed, in a situation of reassessment of the correlation between the globalization and regionalization processes in favor of the latter, the role of regional forms of cooperation and integration increases multiply.

Under the conditions where the forced globalization of the economy, information space, and technology have led to rapid increase in inequality of income in the countries with the emerging markets, particularly acute is the problem of regional stratification in terms of regional socio-economic development that in turn puts on the agenda the management issues of regional and spatial development of the Russian economy, formation of favorable investment climate in the regions as the basis of their innovation development and integration into the system of world economic relations.

The study was based on the generalization of known approaches of foreign and native scientists whose scientific works are devoted to the financial sector problems and its role in the economy, as well as socio-economic development in global, national and regional framework. The study is based on the concept of a network economy (Held. D., 2002). Within the framework of this concept, the authors reveal the transboundariness and networking of financial institutions and globalization of financial capital, the methodology of quantification as a tool of historical analysis of economic processes (Maddison A., 2007), world-system approach (Amin S., 1973), the theory of new regionalism (Hettne B., 1999), the theory of territorial development (Markusen A., 1987), and the theory of integration (F. Machlup, 1979).

However, the issues of the globalization effects on regional development of Russia, defining its place in a network structure of global economic and geopolitical order, the elaboration of the disbalance equalization mechanism in the regional development, and increase of investment attractiveness of Russian regions in the conditions of financial constraints, remain controversial and require theoretical understanding and clarifying.

Formalization and generalization of the research outcomes was conducted with the use of scientific methods of cognition, such as the dialectical and analogy methods, analysis and synthesis, as well as applying special methods of the empirical cognition: methods for scientific modeling, analysis of economic and statistical indicators, comparative analysis, and expert evaluations.

At the turn of the XX-XXI centuries, the trend of a global nature (Machlup F., 1979), manifested in a noticeable increase of the role of financial sector in economic development, became clearly apparent. This trend, typical for both emerging and advanced economies, is caused by exogenous and endogenous factors. First of all, the increasing role of the financial sector is caused by the formation of a fundamentally new economic system, based on "financialization" of a growing part of economic relations and contracts (Amin S., 1973). Financialization of economy is reflected in the increasing adoption of financial forms (forms of financial contracts) by a growing part of economic relations (contracts).

Agree that financialization of economy is one of an expressions of today’s innovation, the growth element of the organizational capital. The innovativeness of a new type of economic system is conditioned by:

Together with a number of positive qualitative changes caused by financialization of economy, there is also the reverse side of the increased role of financial sector – the development of the financial sector is becoming increasingly divorced from events in the real economy sector that gives an impetus to the formation of financial "bubbles" (Friedman M., 2006). The cumulative risks of socio-economic systems increase, firstly, due to the overall higher level of risk in the financial sector compared to manufacturing sector, and, secondly, in connection with the increase in the share of financial markets in funding firms and corporations, leading to greater volatility in investment flows (Held D., 2002).

The conducted analysis allowed identifying a number of objective determinants that contribute to the enhancement of the role of the financial sector in economic development. First, mention exogenous factors having long-term fundamental nature:

1. Economic globalization. On the one hand, globalization has expanded the range of available investment instruments to investors, and on the other hand, provided access of entrepreneurs of all countries worldwide to the global investment resources (Haas E., 1976). This led to lowering of inter-country capital flow barriers and reducing transaction costs in the implementation of financial services. Globalization has actually abolished or severely limited all national growth limits of the financial sector, ensuring the balancing of supply and demand in the investment market on a global level. This should utilize all previously unmet nationwide demand and supply levels, while total amount of financial assets and financial transactions goes into growth (Held D., 2002).

2. The aging of population in advanced countries was mentioned in the OECD report (OECD, 2006) as the fundamental reason, underlying the steady growth trend in all price parameters and the extension of global capital market instruments. This factor contributes to the global growth of pension funds invested in the global capital market that result in the excess of demand over supply of financial instruments on a global scale, and leads to stable growth and expansion of the global financial market. The weakening of the population ageing factor, emerging after 2010, is compensated by another global factor, which conditions the increase in demand for financial instruments that steadily has been observed for almost 40 years and is increasing significantly as a result of the crisis of 2008-2009 by competitive devaluations of national currencies of the largest world economies. The strengthening of this process in recent years received the name of "currency wars".

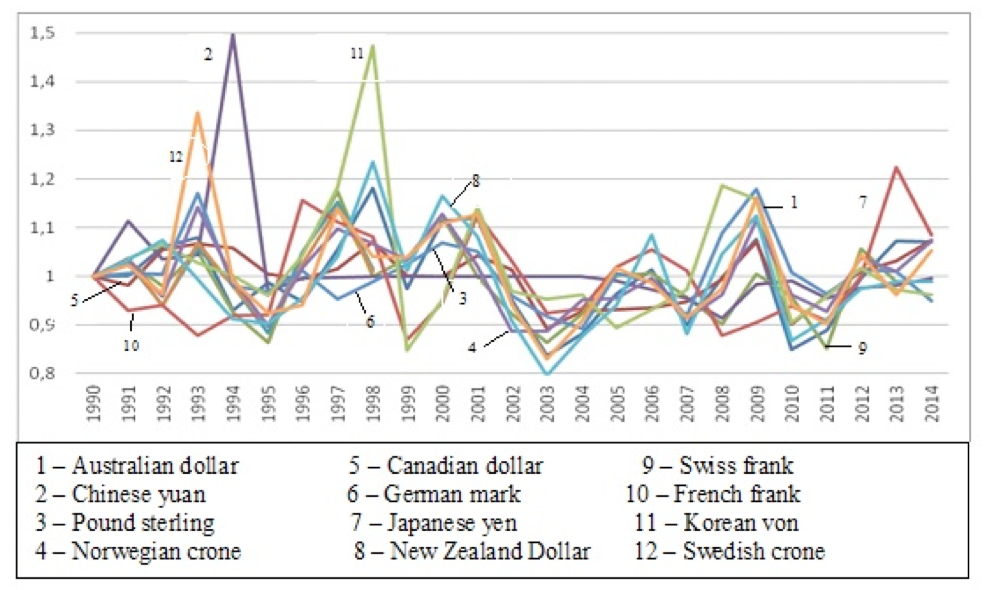

3. Competitive devaluations of national currencies ("currency wars"). The governments of the major countries, with the emergence of the competition processes on a global level, strive to improve the competitiveness of domestic producers by weakening their currencies. Strictly speaking, in the medium and long term, no steady decline was observed for any currency, having the status of a freely-convertible (reserve) currencies (International Monetary Fund, 2014), as the logic of a "currency war" requires constant responses of all members of the reserve currencies club to the devaluation of any currency or multiple currencies simultaneously (Fig. 1).

Source: according to the World Bank

Figure 1. The dynamics of currency exchange rates with respect to USD.

Therefore, the depreciation of currencies occurs in the relatively short term that is changed subsequently to the opposite alternating trend as a result of retaliatory measures of other states. This decrease in the stability of the national currencies in consequence of "currency wars", supplemented by a decrease in the yield of debt instruments due to long-term downward trend in interest rates, have led global investors to the necessity of increasing the share of instruments with higher real yield (for example, equity instruments and securitized inventories). The rising demand for financial assets, including securitized products, as well as a long-term increase in commodity prices have become the main results of the "currency wars". Both contribute to intense growth of the financial sector (Maddison A., 2007).

4. Strengthening the multiplier effect on non-bank markets. The current development of the financial sector is characterized by active implementation of numerous financial innovations, some of which contribute to the growth of the size of financial assets without a corresponding increase in the total advanced capital. Similarly to how banks create multiplier effects, contemporary non-bank institutions also contribute to an increase of multiplier effect in the financial sector. Two most important innovations in this area are, firstly, securitization of assets, and, secondly, the dramatic expansion of the range of underlying assets of derivative financial instruments, the increased diversity of these instruments and their significant sophistication, primarily due to the formation of multilayered instruments (W. Rostow, 1990).

Improving financialization of economy greatly facilitates the transboundary capital flow processes (Markusen A., 1987) creating a new large financial markets, expanding risk management capabilities, and increasing the variety of offered investment opportunities. The main result of the financialization of the modern economy in terms of facilitating and increasing the effectiveness of the global capital floating, is the disclosure for these capitals, especially for the portfolio capitals, fundamentally new regional and industry sectors (Hettne B., 1999).

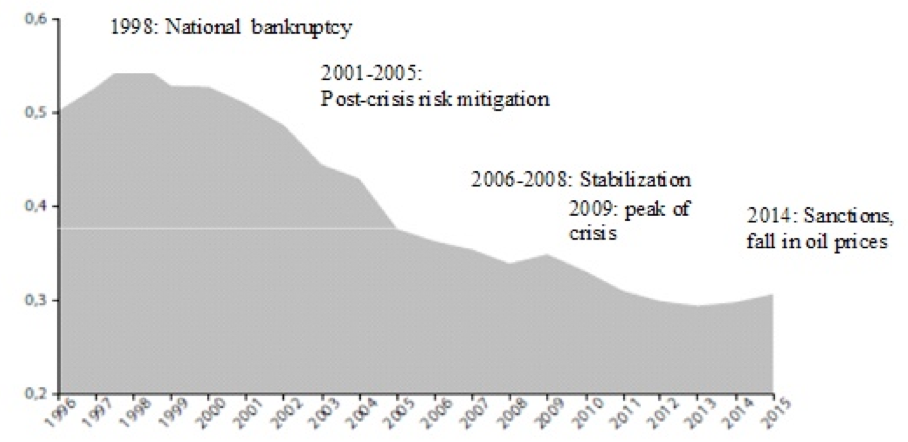

Permanent effects of the global financial factors on the Russian economy, currently taking place at the background of their application with regard to sanction restrictions imposed by Western countries, and counter-sanction measures taken by the Russian government, produce the effects of the uncertainty of the economic environment, have a negative impact on the investment attractiveness of the regions, and increase the investment risks (A. Ulyukayev, 2015) (Fig. 2).

Source: RAEX (Expert RA)

Figure 2. Index of the investment risks dynamics in Russia.

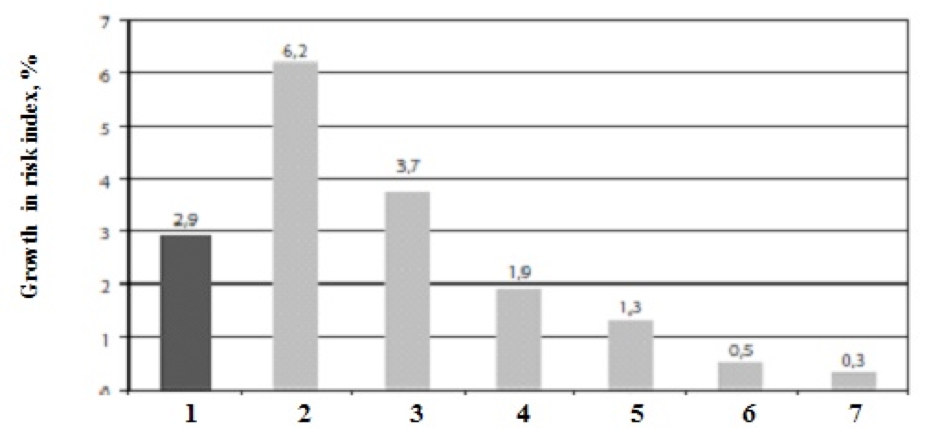

As we can see in the ranking of 2015 (Stolbova A., Kabalinsky D., 2015), the most notable increase is noted in financial risk - in the regions it amounts to 6.2% of the previous year, while economic risk has grown just by 3.7% (Fig. 3).

Source: RAEX (Expert RA)

Figure 3. The dynamics of private equity risk in the rating of 2015: 1 – Integrated risk; 2 – Financial risk;

3 – Economic risk; 4 – Managerial risk; 5 – Social risk; 6 – Criminal risk; 7 – Environmental risk

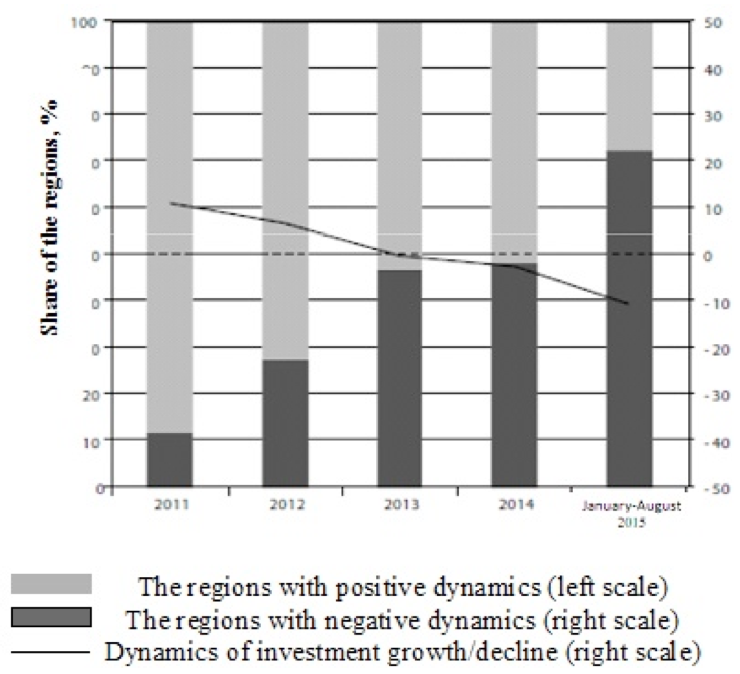

The main reason for this is the increasing scarcity of financial resources of the regional authorities and businesses needed for development against the backdrop of stagnating Russian economy. It should be noted that the growth of regional economies almost completely stopped in 2014 amid the dynamics of wholesale trade turnover, the worst one over the last 15 years (decreased by 3.9%). The slowdown of industrial production growth amounted to 1.7%, while the reduction of investments in fixed capital was 2.7%, falling in 39 constituent entities of the Russian Federation (Fig. 4).

Source: Federal State Statistics Service.

Figure 4. Dynamics of investments into fixed capital.

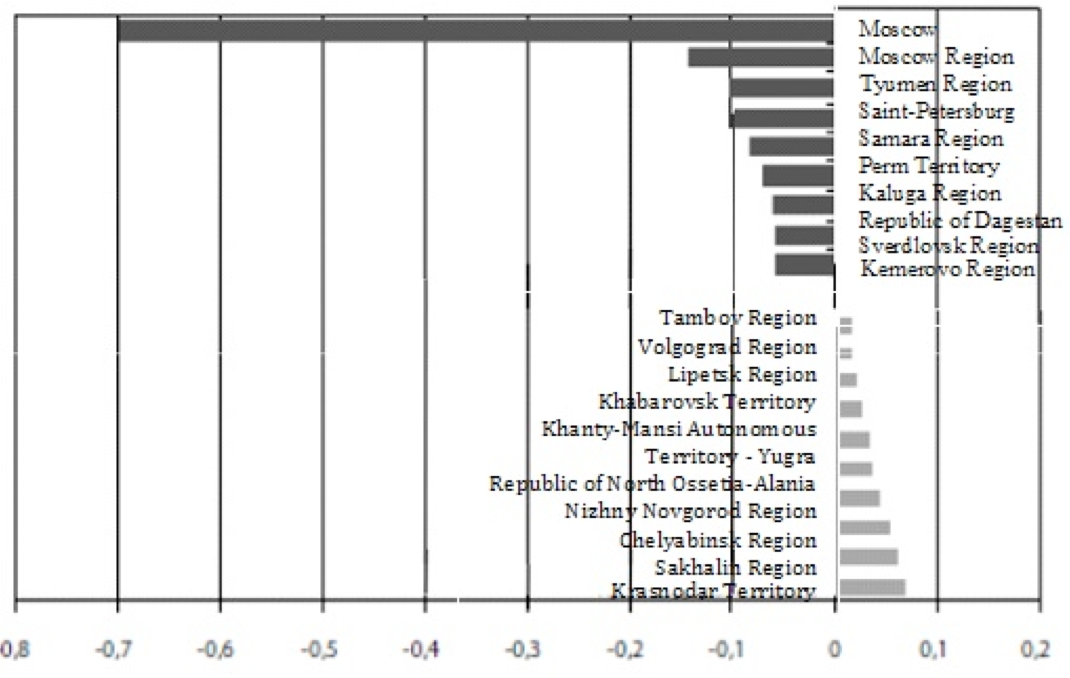

Generation of risks inevitably leads to a gradual erosion of the investment potential in even the most large-sized regions. Yet, this process is not too intense, though the first signs are already visible. According to the ranking of 2015, the traditional leaders such as Moscow city and Tyumen Region have reduced their investment potential by almost 0.7 and 0.1%, respectively (Fig. 5). The main reason for this is the reduction of revenues from oil and gas resources (Stolbova A., D. Qabala, 2015).

Source: RAEX (Expert RA)

Figure 5. The dynamics of the investment potential according to the 2014-2015 ranking.

Accomplished and potential political and financial risks inevitably lead to increased trends and contradictions that emerged in the spatial and regional development of Russia. They generate a number of systemic problems, which include: 1) increase in the gap of socio-economic development of the Russian Federation constituent entities and the formation of the borderline status of "poor" and "rich" regions; 2) the competition of municipal units and constituent entities of the Russian Federation for the right to become a platform of forming a new "cultural-economic" areas; 3) contradictions in the "center-periphery" model emerging in new regions.

One of the instruments to resolve these contradictions is the actualization of methodological approaches to the spatial development of the country and its macro-regions, in particular, outdated approaches to economic regionalization, which was developed as far back as during the Soviet period, with its characteristic economic structure and economic relations system, not taking fully into account the environmental factors. Updating the regionalization system will allow better assessing of investment projects and integrated regional development projects claimed for state support, as well as generating more reasonable territorial projections of the federal and sectoral strategic planning documents.

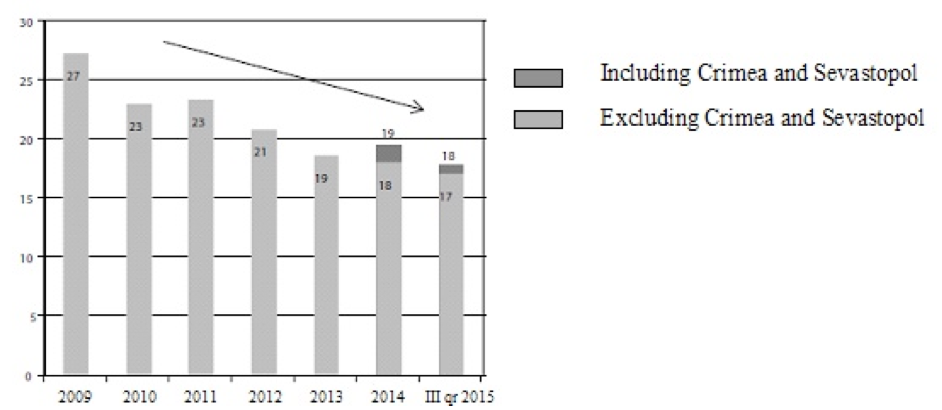

When planning spatial development, it is necessary to design the integration of the regional economies and macro-regions of the country into the global economic system. The interaction of the Siberian and Far Eastern Federal districts with the countries of Asia-Pacific region, as well as Southern and North Caucasian Federal districts with the countries of the Caspian and Mediterranean regions, is of special significance. The ultimate goal of such design should ensure the competitiveness of the economic macro-regions of Russia in the global economy. Accordingly, one of the criteria to evaluate investment projects and integrated development projects claimed for state support, should be availability of certification on macro-regional and (or) global competitiveness of the proposed project. When evaluating and selecting investment projects for state support, the priority must be given to the projects directed on formation of the infrastructure framework of spatial development. At that, it is desirable to concentrate the support and control powers and instruments when implementing these projects at the federal level (Klepach A.N., 2016). At the same time, the federal government gradually, though purposefully continues reducing the transfers into the regional budgets, which as of October 1, 2015, amounted to 17-18% of the total regional budget revenues (Fig. 6).

Source: RAEX (Expert RA)

Figure 6. Dynamics of the share of federal transfers in budget revenues

of constituent entities of the Russian Federation

The elimination of contradictions, overcoming the existing imbalances and disproportions in the spatial development of the country should become one of the priorities of the strategic regional policy along with solving the task of ensuring the global competitiveness of Russian regions through the use of their competitive advantages, increase investment attractiveness, innovation-technological breakthrough, creating a comfortable social environment, etc.

The evaluation of the investment climate in the regions, conducted by the Agency for Strategic Initiatives (The results of the national rating of investment climate in constituent entities of the Russian Federation in 2016, 2016) allowed revealing the regions of Russia, which are most attractive in terms of implementation of investment projects (Table 1), as well as eliminating administrative barriers on the way to improve the business.

Table 1. The results of the national rating of investment climate in the

constituent entities of the Russian Federation in 2016

The change in the index |

Regions |

2016 |

2015 |

- 4.4 |

Republic of Tatarstan |

265.1 |

269.5 |

- 1.8 |

Belgorod Region |

259.7 |

261.5 |

- 11.8 |

Kaluga region |

251.7 |

263.5 |

8.1 |

Tula Region |

251.7 |

243.3 |

8.4 |

Tyumen Region |

251.7 |

243.3 |

5.1 |

Chuvash Republic |

249.9 |

244.8 |

2.7 |

Krasnodar Territory |

249.2 |

246.5 |

7.4 |

Vladimir Region |

248.5 |

241.1 |

5.4 |

Khanty-Mansi Autonomous District – Yugra |

248.0 |

242.5 |

5.8 |

Moscow |

247.8 |

242.1 |

- 7.1 |

Ulyanovsk Region |

247.2 |

254.3 |

7.1 |

Tomsk Region |

245.4 |

238.8 |

11.1 |

Orlov Region |

247.6 |

236.5 |

4.9 |

Chechen Republic |

246.0 |

241.1 |

6.4 |

Kirov Region |

243.5 |

237.1 |

11.0 |

Lipetsk Region |

242.6 |

231.5 |

11.0 |

Republic of Mordovia |

242.5 |

241.1 |

11.0 |

Yamalo-Nenets Autonomous District |

242.5 |

241.1 |

- 17.8 |

Tambov Region |

241.8 |

259.6 |

13.7 |

Republic of Bashkortostan |

241.3 |

227.6 |

At that, among the regions we can distinguish three main typological groups (Golyashev A.V., Grigoriev L.M., 2014) in the context of economic development and the so-called existing "spatial inequality" which adversely affects the way of life of the population in less economically developed regions, and slows modernization and transfer of innovations from the leading regions.

1 The regions with leading economic development, which according to the concept of regional policy, developed by Federal authorities in the first half of the 2000-ies, supposed to act as growth engines "pulling" out economically weak regions. Thus, in 2015, twenty leading regions were defined based on the evaluation of their effectiveness in terms of executive power body activities in the constituent entities of the Russian Federation: Voronezh Region, Chechen Republic, Republic of Tatarstan, Lipetsk Region, St. Petersburg, Sakhalin Region, Tyumen Region, Tambov Region, Nenets Autonomous District, Moscow Region, Republic of Ingushetia, Republic of Mordovia, Chukotka Autonomous District, Belgorod Region, Kursk Region, Republic of Sakha (Yakutia), Rostov Region, Yamalo-Nenets Autonomous District, Khanty-Mansi Autonomous District - Yugra, and Tyumen Region. Compared to 2014, the status of the 38 constituent entities of the Russian Federation had improved, 41 – deteriorated, and 4 - have not changed (the Russian Government has identified the leading regions in terms of the effectiveness of their bodies of power, 2016).

2 Lagging regions, which predominantly use subsidized resources. It should be noted that attempts to promote economic development of such regions by attracting investments do not give the expected economic effect, because investments in underdeveloped regions with less competitive advantages have a low returns. In such regions it is advisable, on the one hand, focusing on public investments to overcome infrastructural constraints, forming the infrastructural framework for territory development, and on the other hand, increasing the efficiency of social policy and developing human capital through appropriate measures and instruments.

3. Regions of the third group that are neither leaders in economic development nor outsiders, need above all, the significant improvement in the institutional environment, whose lack leads to a low rate of innovation transfer (technological, organizational, and managerial) from leading regions.

The regions, in which the competitive advantage is the availability of natural resources, require special approach in the provision of state support. Such support should be provided selectively for the most important national development projects, given the constraints in human and material resources and taking into account the need to avoid high density of similar projects within the same economic region. This work should be accompanied through updating of sectoral strategic planning documents with the aim of establishing a framework of requirements for these projects, assessing their effects on the competitiveness of the national, macro-regional, and regional economies.

The regions of the Extreme North and the Far East must inevitably focus on the development of the supporting framework of these areas, including infrastructure, point-based implementation of the projects, removing existing structural constraints in large urban areas of the macro-region and port areas focused on development, as well as support the infrastructure corridors for the development of these macro-regions.

In the regions, where growth zones are already formed based on existing competitive advantages, it is advisable to provide additional support to successfully implemented projects and economy sectors, including the support provided through incentives that can have a positive effect on economic growth.

When analyzing the growth of competitive advantages of Russian regions, we should refer to the ranking of heads of the regions, which was conducted depending on their contribution to promotion of competition in 2015. The ranking is formed based on the estimates of the two performance indicators of senior officials of Russian regions: "The number of implemented components of the Competition development standard in the constituent entities of the Russian Federation" and "The proportion of achieved target values of the performance benchmarks established in the action plan focused on promotion of competition in constituent entities of the Russian Federation, approved by the higher official of the Russian Federation entity". In accordance with the ranking calculation technique (Ranking of heads of regions in terms of their contribution to promotion of competition in 2015, 2016) based on synthetic classification of regions (Grigoriev L. M., Urozhaeva Y.V., Ivanov D.S., 2011), all regions of the country were divided into 4 groups:

Group I: financial and economic centers and recourse export-oriented regions (9 regions).

Group II: regions with diversified economies based on manufacturing and mining industries (21 regions).

Group III: industrial-agrarian and agrarian-industrial regions (41 regions).

Group IV: less developed recourse and less developed agricultural regions (14 regions).

Based on conducted ranking, the highest rank in terms of the promotion of competition was given to Voronezh Region (the final value estimate – 90.18%), Nizhny Novgorod Region (79.43%), Khabarovsk Territory (76.10%), Republic of Buryatia (75.60%), and Chelyabinsk Region (75.57%). The lowest rank (0%) was given to Republic of Ingushetia, Rostov Region, Tver Region, and Republic of Crimea.

In contemporary conditions, the principles of strategic planning of country’s spatial development should be based on three interrelated approaches to the accentuation of priorities for territorial development (Klepach A. N., 2016):

The efficient and flexible use of special instruments of territorial development is an important, if not leading, direction of the current regional and spatial policy. Among these instruments we can select those tools that are most widely used at present in the Russian Federation, involving the allocation of subsidies and (or) incentives: special economic zones such as industrial production, innovation, port, tourism and recreation; development of industrial parks and technoparks; pilot innovative regional clusters, whose innovative projects are supported by targeted government subsidies; and the priority development areas (PDA).

Since the use of each of these instruments is facing serious problems (in terms of occupancy of the PDA, industrial clusters, and technological parks by residents, and the effectiveness of implementation of innovative development programs of territorial clusters, etc.), a deep analysis is needed to evaluate the effectiveness of these instruments, in particular, evaluation of the effectiveness of tax incentives. In some cases, application of development instruments may have a negative effect causing a decrease in revenues instead of a beneficial effect.

Given this, in subsequent years, it is necessary also assessing the effectiveness of the application of a new instrument of territorial development – the priority socio-economic development areas (PSEDA), currently established in both the constituent entities of the Far Eastern Federal District and the single-industry municipalities (single-industry towns).

We should mention also the instruments of territorial development, whose active application has not yet implemented because of the need for further methodological elaboration. We are talking about industrial clusters, which will be established in accordance with the Federal Law of the Russian Federation dated 31 December 2014 No. 488-FZ "On industrial policy in the Russian Federation".

Please note that while in the above mentioned case of the existing instruments of territorial development, an exhaustive list of benefits is provided in terms of legislation, including incentives and subsidies, universal in general for all created territories, the projects on establishing PDA suggest the formation of a set of necessary measures and instruments of state support at the federal and regional level in accordance with the "initiative from below" based on the needs of the participants of created clusters. It seems that in case of successful implementation of the PDA creation projects, this experience – as strategically significant practice of implementation of set of investment projects in the real economy sector, as well as the best practice in formation of "exclusive" sets of measures – can be subsequently replicated in other regions of the Russian Federation in the implementation of the projects of a similar nature, and can be used to remove at the federal level regulatory and legal constraints concerned the real production development.

The diversity of regional development instruments is significantly ahead of the resolution of systemic issues of spatial and regional policy. At the same time, it gives the ability for point-based problem solution and the emergence of seeds of economic growth, even in the absence of a holistic effective spatial policy.

Given the scale of the Russian Federation, and first of all its total area, the formation of strategic planning and management system of country’s spatial development able to take into account spatial conditions and evaluate the spatial consequences of public policies, seems to be particularly acute (Klepach A. N., 2016). This requires concentrating efforts on the following measures.

First, we need to develop a unified methodology, as well as the mechanism and coordination procedure of strategic documents concerning national and regional development between different levels of management and time planning horizons. At that, a unified procedure of communications and interaction between the state power bodies and local self-government, when developing strategic documents, should be approved.

Secondly, when designing strategies for the development of basic industries, a special attention should be paid to the spatial structure of the economy, determination of the long-term development prospects of territorial units of Russia inseparably linked with the development of the whole country and involvement of not only state institutions but also the business community and the population. It is necessary to coordinate the priorities of regional policy and territorial projections of the activities of the federal development institutions, public corporations, and the key credit organizations. Overcoming existing imbalances and disproportions in spatial development of the regions should be a high-priority problem of the regional policy.

Thirdly, it is necessary to conduct an inventory and evaluation of the effectiveness of the territorial development instruments, first of all, the newly created priority socio-economic development areas. To increase the level of professional training of regional management staff in strategic planning and application of territorial development instruments in the region.

Fourth, to make it mandatory when evaluating investment projects and integrated development projects of the regions, the availability of certification on macro-regional and (or) global competitiveness. When selecting investment projects, the priority should be given to the projects aimed at building infrastructure framework of spatial development, securing support and supervision of such projects by the federal level authorities.

Fifth, to implement the spatial development methodology with regard to Russia and macro-regions, taking into account the new configuration of economic relations and environmental factors. When planning spatial development, it is necessary to provide the integration of the regional economies and macro-regions of the country into global and regional economic systems to ensure the global competitiveness of the Russian economic macro-regions.

New tasks of the state policy in the regional development sphere include the following: 1) lowering the barriers for diffusion of innovations in Russia, including those conducted through the development of transport infrastructure; 2) promoting horizontal cooperation between areas in the framework of the macro-region / economic region to address common challenges; 3) promoting competition between regions for investment resources and human capital; 4) studying decentralization of resources and authority to promote the competitive development of the region with the introduction of special control over the solution of problems in complex areas; 5) increasing mobility of the population, including that conducted through reducing financial and institutional barriers; 6) modernizing social policy in agglomerations as development centers and territories with a decreasing population, strictly coordinating with a prospective resettlement plan of the territories.

The huge scale of the country, the peculiarities of the resettlement and the federal structure, as well as the uneven economic development of certain territories, determine the exceptional importance of the issues related to management of regional and spatial development of the Russian economy and formation of favorable investment climate in the regions as the basis of their innovation development and integration into the world economy. The concept of long-term socio-economic development of the Russian Federation until 2020 suggests not only the image of Russia by 2020, but also a certain spatial development pattern, which is characterized by improved spatial balance of economic growth and the formation of regional growth engines.

However, the attempts to design a comprehensive strategy of spatial development and effective regional policy were failed probably due to the weakness of the spatial vector of economic policy in general. Instead of the previously proclaimed holistic approach to spatial development there has been a shift to point-base solution of the most acute current problems associated with the North Caucasus, Kaliningrad, the Far East, and the Crimea. Despite the seriousness of the border region problems, this creates risks of growing imbalances in the development of other constituent entities of the Russian Federation, especially because the current system of over-concentration of tax revenues at the federal center along with regional redistribution of expenditure commitments, leads to the increase of budget deficits of the regions. The issue of construction of a new regional policy model or spatial dimension of development policy became not less but more relevant.

The methodology for solving relevant problems of regional policy aimed at balanced development of the Russian regions, should be based on competent, thoroughly verified strategy of spatial development of the country, which should be addressed as a single object in the world economic system with a complex spatial organization, functioning as a result of the combined effect of the domestic economic entities at various levels. This strategy should become an instrument to optimize the spatial structure of country’s economy, plan the distribution of productive forces and develop integration infrastructure, create the framework of resettlement and manage migration processes in the context of achieving the priority national objectives for the concerned time period.

In the spatial development strategy, the elements of the spatial structure can be based on any parts of the country, do not necessarily coincided with political and administrative borders, though possessing a certain internal unity within the system of economic relations. This unity can be both potential and actual, implemented in the form of territorial production complexes, clusters, priority development areas, and macro-regions, whose development has a unique geopolitical and socio-economic importance.

Amin, S. 1973. Le developement inegal. Essai sur les formations socials des capitalismes peripheriques, Paris: Editions de Minuit.p. 329 .

Federal'naya sluzhba gosudarstvennoj statistiki [Federal state statistics service] [Text]. Retrieved from http://www.gks.ru.

Friedman, M. 2006. Capitalism and freedom. Chicago. The University of Chicago Press, p. 240.

Golyashev, A.V., and Grigoryev L.M. 2014. Tipy rossijskih regionov: ustojchivost' i sdvigi v 2003-2013 godah [Types of Russian regions: stability and shifts in 2003-2013] [Text]. Analytical report, Retrieved from http://ac.gov.ru/files/publication/a/4363.pdf

Grigoryev, L.M., Urozhaeva, Y.V., and Ivanov, D.S.. 2011. Sinteticheskaya klassifikaciya regionov: osnova regional'noj politiki [Synthetic classification of the regions: framework for regional policies] [Text]. Russian regions: economic crisis and problems of modernization. Moscow: TEIS, p. 357.

International Monetary Fund, 2014. World economic outlook: Legacies, clouds, uncertainties. Washington, рр. 161-165.

Hettne, B. 1999. Globalization and the new regionalism. London: Macmillan, pp. 3-24.

Haas, E. 1976. Turbulent fields and the theory of regional integration. International Organization, 30(2): 173-212.

Held, D. 2002. Globalization: Conceptualizing a moving target. Understanding globalization, the nation – state, democracy and economic policies in the new epoch. Stockholm, p. 115.

Klepach, A.N., et al.. 2016. Strategicheskoe upravlenie razvitiem rossijskoj ehkonomiki v usloviyah mirovoj turbulentnosti [Strategic management of the Russian economy development under global turbulence conditions] [Text]. Analytical report, Retrieved from http://www.econ.msu.ru/science/News.20160412182654_4597/.

Machlup, F.A. 1979. History of thought on economic integration. London: Macmillan, p. 323.

Maddison, A. 2007. Contours of the world economy. Essays in Macro-Economic History. Oxford University Press, p. 448.

Markusen, A.,1987, Regions: Economics and politics of territory. Rowman and Littlefield Publishes, p. 304.

OECD. 2006. Financial Market Trends. 2006/1. No 90.

Pravitel'stvo RF opredelilo regiony-lidery po ehffektivnosti organov vlasti [The Russian Government has identified the leading regions in terms of the effectiveness of their bodies of power] [Text], 2016. Retrieved from http://www.rcb.ru/news/291057/.

Rezul'taty Nacional'nogo rejtinga sostoyaniya investicionnogo klimata v sub"ektah RF v 2016 g. [The results of the national rating of investment climate in constituent entities of the Russian Federation in 2016] [Text]. Retrieved from http://cdn.tass.ru/data/files/ru/reyting-regionov.pdf.

Rejting glav regionov po urovnyu sodejstviya razvitiyu konkurencii v 2015 godu [Ranking of heads of regions in terms of their contribution to promotion of competition in 2015] [Text]. Report, Retrieved from http://ac.gov.ru/files/attachment/9435.pdf.

Rostow, W.W. 1990. Theorists of economic growth from David Hume to the present: with a perspective on the next century. New York: Oxford University Press, p. 712.

Stolbova, A., and Kabalinsky, D. Rejting investicionnoj privlekatel'nosti regionov 2015 goda [The rating of investment attractiveness of regions 2015] [Text]. Retrieved from http://raexpert.ru/docbank/6ce/1b2/d5c/15cfe0ab4b4bd96821c8b07.pdf.

Vsemirnyj bank: Dannye i issledovaniya, statistika [World Bank: Data and research, statistics] [Text]. Retrieved from http://www.worldbank.org/eca/russian/data/

1. University of Technology, 141070, Russia, Moscow Region, Korolev, Gagarin Str., 42. Email: consult46@bk.ru

2. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky Prospekt, 49

3. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky Prospekt, 49

4. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky Prospekt, 49

5. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky Prospekt, 49