Vol. 38 (Nº 33) Año 2017. Pág. 11

Elena Ivanovna KOSTYUKOVA 1; Viktor Sergeevich YAKOVENKO 2; Victoria Samvelovna GERMANOVA 3; Aleksandr Vital'evich FROLOV 4; Svetlana Valerievna GRISHANOVA 5

Received: 30/05/2017 • Approved: 15/06/2017

ABSTRACT: Modern economic reality in the Russian Federation is characterized by the development of a market-based mechanism that requires effective and adequate management, investment and financing decisions from heads of business entities; these decisions should be taken on the basis of obtaining information about the financial condition of the organization. Sustainability of the firm in the market depends on the quality and timeliness of the information which allows not only to find solutions to the financial problems, but also to anticipate the crisis. This is particularly important during the global economy crisis and ongoing stagnation processes in particular sectors of the economy of Russia when financial analysis becomes an objective necessity. In the study the system of indicators for the evaluation of financial condition from the positions of various stakeholders and their information requests is given, taking into account the specificity of enterprises activities of agrarian sector of the economy. This allows to develop the complex of techniques of financial analysis of agricultural organizations, taking into account the interests of different users groups. |

RESUMEN: La realidad económica moderna en la Federación de Rusia se caracteriza por el desarrollo de un mecanismo basado en el mercado que requiere decisiones de gestión, inversión y financiación efectivas y adecuadas de los jefes de las entidades empresariales; Estas decisiones deben tomarse sobre la base de obtener información sobre la situación financiera de la organización. La sostenibilidad de la empresa en el mercado depende de la calidad y puntualidad de la información que permita no sólo encontrar soluciones a los problemas financieros, sino también anticiparse a la crisis. Esto es particularmente importante durante la crisis de la economía global y los procesos de estancamiento en curso en determinados sectores de la economía de Rusia cuando el análisis financiero se convierte en una necesidad objetiva. En el estudio se da el sistema de indicadores para la evaluación de la situación financiera a partir de las posiciones de las diversas partes interesadas y sus solicitudes de información, teniendo en cuenta la especificidad de las actividades empresariales del sector agrario de la economía. Esto permite desarrollar el complejo de técnicas de análisis financiero de las organizaciones agrícolas, teniendo en cuenta los intereses de los diferentes grupos de usuarios. |

These days the questions of reliability of the methods of enterprises financial situation analysis have inadequate attention of scientists and specialists; meanwhile, the effectiveness of management decisions depends on them.

A large number of internal and external financial and economic problems, occurring in businesses, the contradictory of interests of internal and external users groups, financial analysis, and distinguishing features of industry specifics of business activity do not allow developing a unified methodology for financial analysis.

Due to the lack of a standard provision on the analysis of the financial condition of agricultural enterprises, which provided a common approach to the use of techniques and methods of financial analysis, system of indicators and their evaluation, there is a situation when analysis of the same data leads to different results and conclusions.

The carried out analysis of the financial condition of the agricultural enterprises of Stavropol Region in the Russian Federation, first of all, revealed the impossibility of generalizing the integrated assessment of the activity of business entities. In the meantime, the logic of the research involves not only the definition of the categories of financial condition, but also the comparison of business entities according to their level of financial status with each other and with industry averages in this region. For this, many researchers apply the matrix method, which is used in the comparative analysis of the financial condition of the business entities. However, it is more important for authors to identify the category of the financial condition and ability to generate an objective evaluation of the activities of different categories of users. Comparisons with the "sample" enterprise allows identification of competitive advantages of business entity, which means its rating, but do not show the current financial status and level of efficiency, investment attractiveness, credibility.

The foregoing requires development of the most flexible, universal integrated methods for assessing financial condition of the main categories of users and contains indicators for which quantitative and qualitative evaluation methods are defined, as well as integration of the results obtained for the purpose of ranking of entrepreneurial entities within each group based on the scores.

As the data base for the research, information and empirical block has been formed with the data of the Federal State Statistics Service according to regions of the Russian Federation. A substantial array of data and calculated information has been accumulated and analyzed using modern methods and tools for information processing. As a specific methodological tool the system of assessment indicators of investment activity of agro industrial complex has been designed.

Undertaken research is based to some extent on methodical approaches and methodological concepts of a number of national and foreign authors. The following should be particularly distinguished: researches on identifying the most relevant indicators for assessing the financial status and social responsibility (Orlitzky, et. al. 2003) researches on the use of non-financial indicators in the statistical models estimation of activity of the company (Larcker 2003); publications relating to the evaluation of business processes to improve the efficiency of its functioning (Hammer 2001), as well as the development of indicators for sustainable development and break-even analysis (Tisdell 1996).

The present research is not exclusive of the fundamental provisions of the balanced scorecard concept, in this context, the following works should be highlighted: (Kaplan and Norton 1992; Libby, et. al. 2004; Martinsons, et. al. 1999; Qu and Cooper 2011).

During the study of the theoretical foundations of financial analysis issues, special attention was paid to the results obtained in the development of methods for grouping and classifying companies according to various structural and dynamic characteristics (Boguslauskas and Adlyte 2010; Brida and Risso 2010) and sales modelling in management accounting system (Ashley, et. al. 1997), as well as the research developing the concept of added value (Rohrbeck 2012).

A significant number of modern authors’ prospective studies are dedicated to the development of forecasting techniques of the financial difficulties of the company (Sun 2006; Ho, et. al. 2015), as well as the assessment of financial stability (Davis and Stone 2005; Grechenyuk and Grechenyuk 2016; Prochniak and Wasiak 2016; Slabinskaya, et.al. 2015; Tlessova, et. al. 2016). At the same time, from our point of view, essential results have been obtained by the authors concerned with the study of the transformational processes under the impact of the economy crisis. So, in the following researches (Aldamen and Duncan 2016; Nenu and Vintilǎ 2015) the impact of the crisis on the corporate governance system is described; in turn (Akhmetshin and Osadchy, 2015) reveal the peculiarities of accounting during crisis. A number of works (Bobryshev, et. al. 2015; Bobryshev 2015) are devoted to the development of management accounting tools in the greatest extent adapted to the conditions of economic stagnation. Scientific results obtained during examination of methodical approaches to integrated assessment of financial condition deserve special attention (Kyurdzhiev, et. al. 2016). The following results are also of great importance: the special role of inside environment in firms management was identified (Shirokova, et. al. 2015); accounting and analytical tools for searching the ways of balanced development of firms were studied and improved (Yakubiv 2015); methodical approaches to the transformation of existing forms of accounting records which are more suitable for analytical activity were suggested (Bobryshev, et. al. 2014); the concept of the business model of the enterprise under the influence of various macroeconomic factors was disclosed (Magretta 2002).

An important aspect was the study of the differentiation of the territories at macro level, under the impact of crisis factors (Litvin 2015). The works of M.Yu. Kazakov (2014), O.V. Elchaninova (2014), A.N. Gerasimov and E.I. Gromov (2015) are devoted to the problems of finding ways of balanced development of socio-economic systems in conditions of crisis processes in the economy.

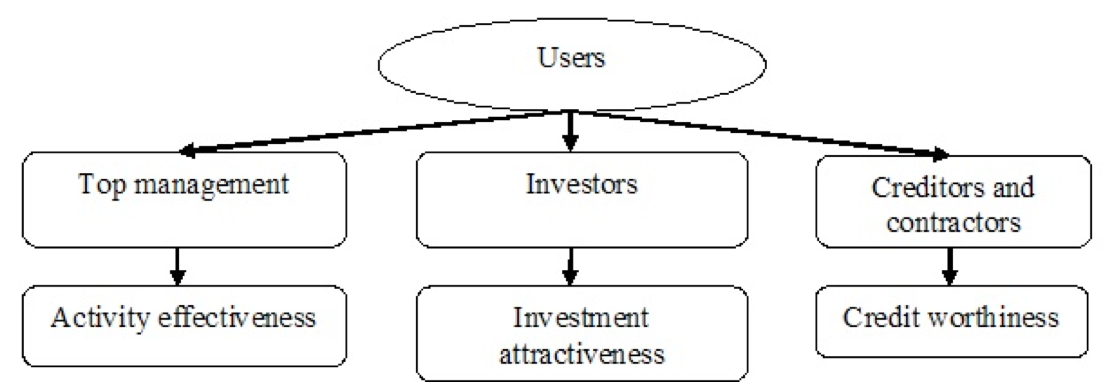

Each user in the process of conducting financial analysis pursues his or her information objectives, which as a rule tend to be specific, and often opposite. Subject to the foregoing, it is logical to assume that a particular group of users do not need to carry out all complex of financial analysis procedures, transforming it, in fact, in statistical, with lots of less informative (for specific user) indicators. According to the authors, it is much more important to calculate and to assess appropriately only those indicators that will contribute to effective decision-making. Assessment of the financial position of businesses should be based on a specific set of financial indicators that make up a system, because any single indicator is not able to reflect the financial condition accurately; moreover, it is obvious that a system of indicators should be oriented towards a specific group of users, because their information goals are different.

The authors believe that such a differentiated system of indicators for different types of users should consist of a small number of most informative indicators (4-6), which will allow to eliminate duplication through the analysis of information received, as well as to reduce the labour required for analytical procedures. The system of indicators for specific groups of users of the financial analysis should reflect the most essential characteristics of financial state of agricultural enterprises according to their interests.

Key factors identifying financial status for each group of users can be the following:

Thus, there is a need to identify financial indicators, which will characterize financial condition in the context of these factors. As a result, we get flexible, adaptive to the activities of agricultural organizations methodology, which should take into account the shortcomings identified during the analysis of financial condition of the agricultural organizations of Stavropol region.

Research has shown that currently used techniques virtually do not take into account sectoral peculiarities of economic entities functioning, resulting in a misinterpretation of the outcomes of analytical actions as a consequence of incorrect managerial decisions. In the opinion of the authors, methods of financial analysis should enable ranking score of emitters’ activities with a view to their arranging by categories of financial condition. This technique should ensure equal steps as intervals for coefficients and their score, which will provide a more objective distribution of farms on the qualifying groups.

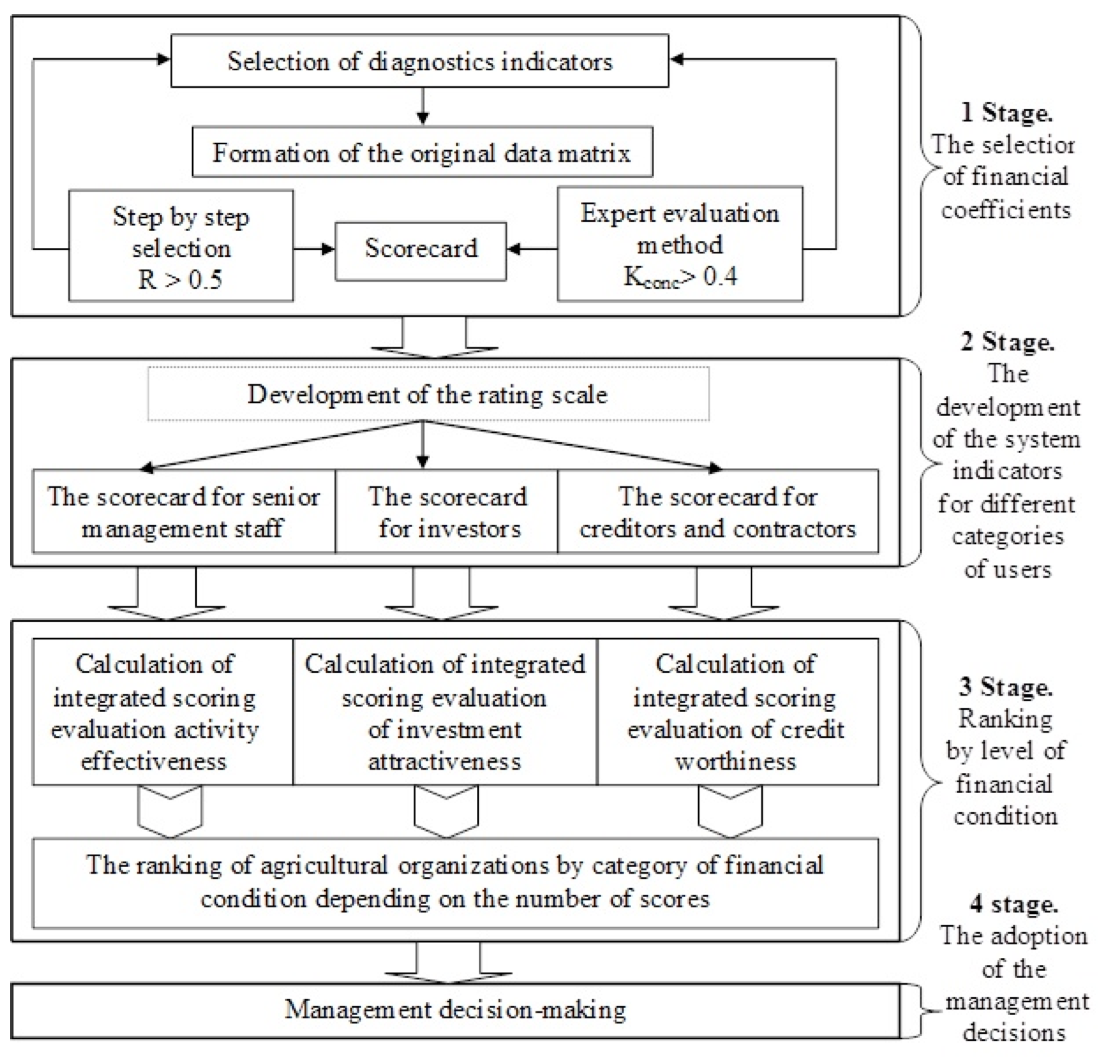

As a result of the carried out researches the block diagram of the algorithm of financial condition evaluation of agricultural organizations by categories was formed (Figure 1).

Source: Author

Figure 1: Integrated assessment algorithm of the financial condition

of the agricultural enterprises by category of users (where R is the pair correlation,

Kconc is the coefficient of concordance (compliance) of expert opinions)

In the first stage, the authors conducted the selection of indicators for diagnosing financial condition of the business entities. The empirical base for the calculation of the selected indicators was the data of accounting (financial) statements of the agricultural enterprises of Stavropol region. As a result, the authors calculated a value of more than 40 financial dynamic coefficients for five years that constituted the original data matrix.

As we have indicated, effective diagnostics of enterprise financial condition should be based on a system of indicators. At this stage it is essential to select precisely those coefficients which most closely reflect the information objectives of each of the categories of users. The difficulty of selection of key indicators for individual categories of users was, primarily, the definition of the main information objective of each of them that, in fact, is an effective indicator.

Most generalizing indicator of the effectiveness of a business entity is a return on equity (Y), which reflects the performance of funds invested in the enterprise (Figure 2).

Source: Author

Figure 2: Major user groups of financial analysis and their information objectives

We have selected coefficients with a pair correlation indicator (R) of more than 0.5 out of all the indicators included in the original data matrix by step-by-step method of selection using correlation and regression analysis that indicates a tight connection between effective and factorial indicators. In addition, we have taken into account the value of determination that shows how many percent factorial indicators affect the effective one.

During the selection of financial coefficients, we have expanded the population of analysis by the method “enterprise-year” up to 21 units of observation; during the step by step selection, indicators with functional dependence were dropped from the original data matrix.

Thus, identifying stochastic dependence of key indicators for each group of users with financial coefficients (Xn), we have formed the system of indicators of enterprise financial condition with the aim of further selection.

Indicator, in most general terms, reflecting the efficiency of funds usage invested in the enterprise, is the return on investment (ROI). This coefficient characterizes the investment management skills and, therefore, can be used as an effective indicator (Y) with correlation and regression analysis. As a result of step-by-step selection from 27 indicators, 13 were selected (Table 2) with the closest (coefficient of pair correlation (R) is more than 0.5) relation.

Table 1: Outcomes of correlation and regression analysis of

financial condition indicators for top management

Indicators |

Pair correlation (XY) |

Regression coefficient |

Student criterion value |

Determination |

1. Absolute liquidity coefficient (X14) |

0.74657 |

51.81445 |

4.89138 |

0.557374 |

2. Solvency ratio (X23) |

- 0.72868 |

- 0.28752 |

- 4.63788 |

0.530979 |

3. Current liquidity ratio (X16) |

0.67671 |

3.73870 |

4.00640 |

0.457937 |

4. Quick ratio (X15) |

0.64963 |

14.52404 |

3.72471 |

0.422026 |

5. Sustainable funding ratio (X5) |

0.59894 |

71.44267 |

3.26017 |

0.358731 |

6. Equity ratio (X3) |

0.59502 |

80.80022 |

3.22706 |

0.35404.7 |

7. Turnover rate of payables (X13) |

0.54968 |

1.24087 |

2.86818 |

0.302149 |

8. Cash turnover ratio (X12) |

0.54461 |

0.18877 |

-2.83047 |

0.296597 |

9. Bankruptcy prediction ratio (X7) |

0.53959 |

52.05033 |

2.79360 |

0.291156 |

10. Asset coverage (X 2) |

0.53903 |

32.07627 |

2.78951 |

0.290551 |

Source: Author

As we have already pointed out, for each of the three scorecards, it is necessary to select a small number of the most informative coefficients (4-6). Thus, financial ratios with high value of pair correlation, selected at the previous stage, have been subjected to expert review. When forming the system of indicators for creditors, we have used only the method of expert assessment, because of the difficulty in allocating the effective indicator for this category of users.

For the purpose of obtaining objective data on the results of the expert study, we have formed a focus group of 30 respondents with high degree of predictability in the field of economic analysis. Expert competency assessment was carried out on the basis of a questionnaire developed for the selection of indicators for three groups of users; the experts were given three questionnaires.

As a result of the expert poll, data table has been received, where financial coefficients with the fewest ranks are included in the system of indicators for a particular group of users, but first, it is needed to assess the degree of consistency of expert opinions.

Table 2: Outcomes of correlation and regression analysis of financial condition indicators for investors

Indicators |

Pair correlation (XY) |

Regression coefficient |

Student criterion value |

Determination |

1. Return on equity (X27) |

0.96964 |

0.83969 |

17.28520 |

0.940210 |

2. Absolute liquidity coefficient (X14) |

0.70234 |

42.23923 |

4.30078 |

0.493288 |

3. Solvency ratio (X23) |

- 0,64301 |

- 0,21985 |

- 3,65969 |

0.413459 |

4. Current liquidity ratio (X16) |

0.62878 |

3.01027 |

3.52478 |

0.395368 |

5. Level of shareholders' equity, % (X25) |

0.61224 |

0.72636 |

3.37524 |

0.374840 |

6. Equity ratio (X 3) |

0.61505 |

72.37313 |

3.40006 |

0.378281 |

7. The ratio of permanent capital and non-current assets (X24) |

0.59914 |

25.31390 |

3.26185 |

0.358968 |

8. Quick ratio (X15) |

0.57585 |

11.15624 |

3.07024 |

0.331607 |

9. Asset coverage (X2) |

0.57131 |

29.45985 |

30.03420 |

0.326393 |

10. Cash turnover ratio (X12) |

0.55282 |

0.16604 |

-2.89175 |

0.305612 |

11. Sustainable funding ratio (X5) |

0.53943 |

55.75682 |

2.79246 |

0.290987 |

9. Bankruptcy prediction ratio (X7) |

0.52999 |

44.30146 |

2.72427 |

0.280892 |

Source: Author

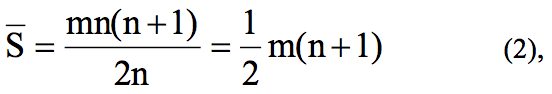

This procedure is performed in the following sequence:

where n is the number of measured parameters,

m is the number of experts (in this case 30).

![]()

It is shown in the theory of expert assessment that if the views of all experts coincide, but among the ranks, given by experts, there are no identical, then the average squared algebraic difference is maximum and may be calculated with the following formula:

![]()

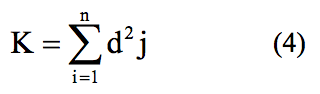

Further, with the aim of determining the statistical significance, Kendal coefficient of concordance is calculated (W):

where K is the squared algebraic differences,

Kmax is the maximum average squared algebraic differences.

If the Kendal coefficient of concordance equals or close to zero, it means almost complete inconsistency of expert opinions, the further work is recommended in case if coefficient of concordance exceeds 0.4. In the selection of financial coefficients of financial condition indexes system for each of the categories of users, Kendal coefficients of concordance exceeded 0.57, therefore, selected at this stage coefficients may be included in the scorecard.

It should be noted that some indicators selected according to experts, should be considered in totality, for example, asset turnover ratios in the scorecard for the creditors were assigned the same ranks, as well as profitability ratios in the scorecard for top management.

Thus, for each of the indicators systems the following financial ratios were selected:

Indicators for top management:

Indicators for investors:

Indicators for investors:

General discussion results in scientific and expert community of methodical aspects of expert assessment of the agricultural enterprise financial condition and their correlation with the results of the studies of foreign authors confirm the view of the researchers on the need for differentiation of indicators to assess the financial condition of enterprises by different stakeholders.

As a result of the research at this stage, it is possible to formulate the following conclusions:

1. There is no single mechanism of enterprise assets and liabilities structure analysis by internal users; it makes it necessary to develop a model for analysis of assets and liabilities, as structured sequence of analytic action.

2. Current methods of financial analysis do not permit summarizing the conclusions about the financial condition of business entities in assessing the position of different categories of users.

3. Mechanism of financial condition analysis does not take into account sectoral specificity, resulting in a misinterpretation of the analytical activities results.

4. There is a need to establish a system of indicators to determine the financial condition category, which would allow timely diagnosing the crisis phenomena in the activities of the organizations of a particular industry.

Akhmetshin, E.M. and Osadchy, E.A. (2015). New requirements to the control of the maintenance of accounting records of the company in the conditions of the economic insecurity. In International Business Management, 9(5), 895-902.

Aldamen, H. and Duncan, K. (2016). Does good corporate governance enhance accruals quality during financial crises? In Managerial Auditing Journal, 31(4-5), 434-457.

Ashley, D.W., Gilbert, J.R. and Arthur, H. (1997). Integration of statistics, simulation, managerial accounting and finance in an executive MBA program. In Proceedings - Annual Meeting of the Decision Sciences Institute, 2, 914.

Bobryshev, A.N. El'chaninova, O.V. and Tatarinova, M.N. et al. (2015). Management Accounting in Russia: Problems of Theoretical Study and Practical Application in the Economic Crisis. In Journal of Advanced Research in Law and Economics, VI, 3(13), 511-519.

Bobryshev, A.N., Golchenko, Y.V. and Kazakov, M.Y. (2014). Directions of municipal territorial and economic transformation in a monopolar highly urbanized region. In Current economic problems, 2(152), 230- 238.

Bobryshev, A.N. et al. (2015). The Concept of Management Accounting in Crisis Conditions, In Journal of Advanced Research in Law and Economics, VI, 3(13), 520-527.

Bobryshev, A.N., Uryadova, T.N., Lyubenkova, E.P., Yakovenko, V.S., Alekseeva, O.A. (2014). Analytical and management approaches to modeling of the accounting balance sheet. In Life Science Journal, 118, 502-506.

Boguslauskas, V. and Adlyte, R. (2010). Evaluation of criteria for the classification of enterprises. In Engineering Economics, 2, 119-127.

Brida, J.G. and Risso, W.A. (2010). Dynamics and structure of the 30 largest North American companies. In Computational Economics, 35(1), 85-99.

Davis, E.P. and Stone, M.R. (2005). Corporate financial structure and financial stability. In Journal of Financial Stability, 1(10), 65-91.

Elchaninova, O.V., Tatarinova, M.N., Grishanova, S.V., Germanova, V.S. and Debeliy, R.V. (2014). Evaluation of Investment Activity of Rural Territory of the South of Russia. In American-Eurasian Journal of Sustainable Agriculture, 89, 7-10.

Gerasimov, A.N., Gromov, E.I. and Gulay, T.A. (2015). Forecasting the indicators of socioeconomic development of the North Caucasus federal district. In Actual Problems of Economics, 163(1), 243-253.

Grechenyuk, A. and Grechenyuk, O. (2016). The structure of assets and capital of the Russian companies and their impact on the liquidity and financial stability. In Economic Annals-XXI, 157(3-4)б 88-90.

Hammer, M. (2001). The superefficient company. In Harvard Business Review, 79(8), 160.

Ho, G.T.S., Choy, K.L., Chung, S.H. and Lam, C.H.Y. (2010). An examination of strategies under the financial tsunami. In Industrial Management and Data Systems, 110(9), 1319-1336.

Kaplan, R.S. and Norton, D.P. (1992). The balanced scorecard-measures that drive performance. In Harvard Business Review, 70(1), 71-79.

Kyurdzhiev, S.P., Mambetova, A.A. and Peshkova, E.P. (2016). An integral evaluation of the financial state of the regional enterprises. In Economy of Region, 2, 586-601.

Larcker, D.F. (2003). Coming up Short on Nonfinancial Performance Measurement. In Harvard Business Review, 81(11), 139.

Libby, T., Salterio, S.E. and Webb, A. (2004). The balanced scorecard: The effects of assurance and process accountability on managerial judgment. In Accounting Review, 79(4), 1075-1094.

Litvin, D.B. et al. (2015). Monitoring of the Parameters of Intra-Industrial Differentiation of the Primary Industry of the Traditionally Industrial Region of Southern Russia. In Journal of Advanced Research in Law and Economics, VI 313, 606- 615.

Magretta, J. (2002). Why business models matter. In Harvard business review, 80(5), 133.

Martinsons, M., Davison, R. and Tse, D. (1999). The balanced scorecard: A foundation for the strategic management of information systems. In Decision Support Systems, 25(1), 71-88.

Nenu, E.A. and Vintilǎ, G. (2015). The impact of liquidity on profitability during the financial Crisis evidence from the Romanian listed companies. In Proceedings of the 26th International Business Information Management Association Conference - Innovation Management and Sustainable Economic Competitive Advantage: From Regional Development to Global Growth, IBIMA, 3273-3280.

Orlitzky, M., Schmidt, F.L. and Rynes, S.L. (2003). Corporate social and financial performance: A meta-analysis. In Organization Studies, 24(3), 403-441.

Prochniak, M. and Wasiak, K. (2016). The impact of the financial system on economic growth in the context of the global crisis: empirical evidence for the EU and OECD countries. In Empirica, 1-43. [cit. 2016-03-30]. Available at 26.01.2017 https://link.springer.com/article/10.1007/s10663-016-9323-9

Qu, S.Q. and Cooper, D.J. (2011). The role of inscriptions in producing a balanced scorecard. In Accounting, Organizations and Society, 36(6), 344-362.

Rohrbeck, R. (2012). Exploring value creation from corporate-foresight activities. In Futures, 44(5), 440-452.

Shirokova, G., Bogatyreva, K. and Beliaeva, T. (2015). Entrepreneurial Orientation of Russian Firms: the Role of External Environment. In Foresight and STI Governance, 9(3), 6-25.

Slabinskaya, I.A., Benderskaya, O.B., Mitrokhin, A.A. and Truhin, A.S. (2015). Methods of company financial stability monitoring. In International Business Management, 9(6), 1091-1096.

Sun, X.-F., J. (2006). An application of support vector machine to companies' financial distress prediction. In Lecture Notes in Computer Science including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics, 3885 LNAI, pp. 274-282.

Tisdell, C. (1996). Economic indicators to assess the sustainability of conservation farming projects: An evaluation.In Agriculture, Ecosystems and Environment, 57(2-3), 117-131.

Tlessova, E.B., Shalbolova, U.Z. and Berzhanova, A.M. (2016). Financial stability diagnostics for construction enterprises. In Actual Problems of Economics, 180(6), 357-367.

Yakubiv, V. (2015). Accounting and analytical methods of diagnostics improvement for enterprises’ organizational development. In Economic Annals-XXI, 3(41), 68-71.

1. Stavropol State Agrarian University, 355000, Stavropol, trans. Zootechnical 12. Email: bobrishevaleksey@yandex.ru

2. Stavropol State Agrarian University, 355000, Stavropol, trans. Zootechnical 12

3. Stavropol State Agrarian University, 355000, Stavropol, trans. Zootechnical 12

4. Stavropol State Agrarian University, 355000, Stavropol, trans. Zootechnical 12

5. Stavropol State Agrarian University, 355000, Stavropol, trans. Zootechnical 12