Vol. 38 (Nº 33) Año 2017. Pág. 17

Olga A. NIKITINA 1; , Yulia V. LITOVSKAYA 2; , Tatyana A. SAVINKOVA 3;, Ekaterina G. ZINOVYEVA 4; Olga S. PONOMAREVA 5

Received: 30/05/2017 • Approved: 15/06/2017

ABSTRACT: The need for use of budget planning mechanism in cost management significantly increases in the context of market economy and severe competition. Construction companies are characterized by long production cycles since the terms of construction are estimated not only for months but years. Due to the low working capital turnover and the availability of work in progress, the need for constant mobilization of own and borrowed resources increases. Therefore, budgeting is the most important tool necessary for the development of the construction company and maximizing its profit. The article presents the implementation results of the budgeting system in LLC “Stroytekhnologiya”, as well as income and expenses budget generation. In addition, the article describes calculation of performance indicators of implemented measures. |

RESUMEN: La necesidad de utilizar el mecanismo de planificación presupuestaria en la gestión de costes aumenta considerablemente en el contexto de la economía de mercado y de una fuerte competencia. Las empresas de construcción se caracterizan por largos ciclos de producción ya que los términos de construcción se estiman no sólo por meses sino años. Debido a la baja rotación de capital de trabajo ya la disponibilidad de trabajo en curso, aumenta la necesidad de movilización constante de recursos propios y prestados. Por lo tanto, el presupuesto es la herramienta más importante necesaria para el desarrollo de la empresa de construcción y maximizar sus beneficios. El artículo presenta los resultados de la aplicación del sistema de presupuestación en LLC "Stroytekhnologiya", así como la generación de presupuesto de ingresos y gastos. Además, el artículo describe el cálculo de los indicadores de desempeño de las medidas implementadas. |

For many years companies have considered their budgets simply as a mandatory estimate of the upcoming annual income and expenses. Now this attitude is changing rapidly because market requires greater competitiveness, and thus companies are forced to be more dynamic. Successful companies constantly boost the accuracy of their forecasts concerning future operations and related resource requirements (Ponomareva 2013). This not only increases the importance of budgeting and planning, but also changes traditional roles of the various own-designed tables, budgeting systems, and software.

The problem of implementation of effective budget planning mechanism is facing most acutely to construction companies. The main feature of the construction is a long production cycle. Rated time required for fulfillment of construction projects is measured in months, therefore the start and end dates of construction project can be not only in different reporting quarters, but even years. A large amount of work in process and low turnover of working capital requires constant mobilization of both own and borrowed resources. In addition, the extent of the construction period in time does not allow quick comparing of incurred material and labor costs with the degree of completion of construction project.

The discrepancy between periods of income and expenses generation with regard to construction project affects planning process and obtaining accounting data on profit and loss, suitable for making managerial decisions. End-to-end management planning requires effective managerial accounting and planning of inventory and financial resource flow of the enterprise at all stages of the financial cycle. Each stage of the financial cycle is one of the factors in generation of the final financial result (profit) of the enterprise, and the more “stages” in the capital turnover of the enterprise, the more complex and extensive should be the budgeting process technology (Nikitina and Slobodyanik 2012).

Topicality of this problem is that budgeting plays an important role in the development of the construction company and obtaining greater profits. Company management is impossible without financial planning of the company operations, as well as without supervising the implementation of the developed financial plans. Therefore, planning and supervising company's operations becomes impossible without generation of a budget as the primary tool for adaptive management.

This article presents the effects of the activities aimed at organization of the budgeting process in a construction company. To achieve the above objective, the authors studied comprehensively the budgeting foundations as a tool for organization’s financial management; gave a brief description and analyzed key enterprise performance indicators; distinguished main features of budgeting in construction company; developed the algorithm of the budgeting system organization at the enterprise; and assessed economic efficiency of the enterprise budgeting system. Research methods include analysis, synthesis, observation, classification, comparison, and generalization.

The main advantages of the budgeting system implementation in LLC “Stroytekhnologiya” in general, and the generation of income and expenses budgets, in particular, can be divided into several groups.

This budget will allow revealing the possible cash gaps and implement preventive measures. Possible delays in payment of accounts receivable will become more predictable that will improve the financial flow management. This will lead to the emergence of the possibility of using credit resources for replenishment of working capital (overdraft, and revolving credit line). Consequently, the financial condition in the context of working assets will become more stable.

Obtaining of accurate financial results will allow adjusting effective system of motivation of each employee (Litovskaya and Ishmetyeva 2013). Thus, for example, for line personnel, whose main function is the execution of specific production tasks associated with the construction, it will be possible to introduce a piecework form of payment for each stage (group of stages) of work performed. For managerial personnel, involved in the generation of income and expenses in the marginal income centers, it will be possible to combine the variable component of remuneration of labor with a marginal profit. Other business units will be able to combine the wages of workers with the work using internal prices for maintenance services (connection to the power source, repair of construction-site equipment, commodity stocks and supplies delivery services, and provision of construction machinery).

Those, for whom the variable component of labor remuneration is formed as a percentage of the marginal revenue, will increase their interest in checking the accuracy of data on provided services, since these costs reduce the marginal profit and, consequently, wages. At the same time, for auxiliary subdivisions, these services result into revenues, i.e. source of income. Emerging self-regulatory supervising mechanism with precise informative display will result in the abolishment of the organizational units, whose main function was supervision of the economic efficiency of subdivisions.

At the same time, the budgeting system requires certain considerable costs for its implementation and maintenance. Calculation of ratios in monetary and real terms, preparation of regulatory cost estimates, budgets classifications, responsibility centers and items in a budget, as well as their revision in case of changes in the market situation and the manufacturing environment requires considerable costs, and especially employees working time. All these works should be carried out with a certain frequency, because too frequent or too sparse revisions of standards can undermine credibility to these standards and budgets in general, as well as reduce the analytical value of the system for managerial decision-making. Besides, well developed budgeting system cannot be used manually. It requires the implementation of computer information systems with special modules that allow processing of such information. The acquisition of such system is associated with the additional cost to the organization.

The effectiveness of the proposed measures with regard to implementation of the budgeting system will be achieved by reducing the following expenditure items:

1) labor costs of specialists involved in the budgeting process of the whole company;

2) labor costs of managerial personnel;

3) losing trades.

Taking into account the proposed recommendations, it will be possible to reduce the number of working hours when budgeting, and the amount of procedures that will provide data for making effective managerial decisions.

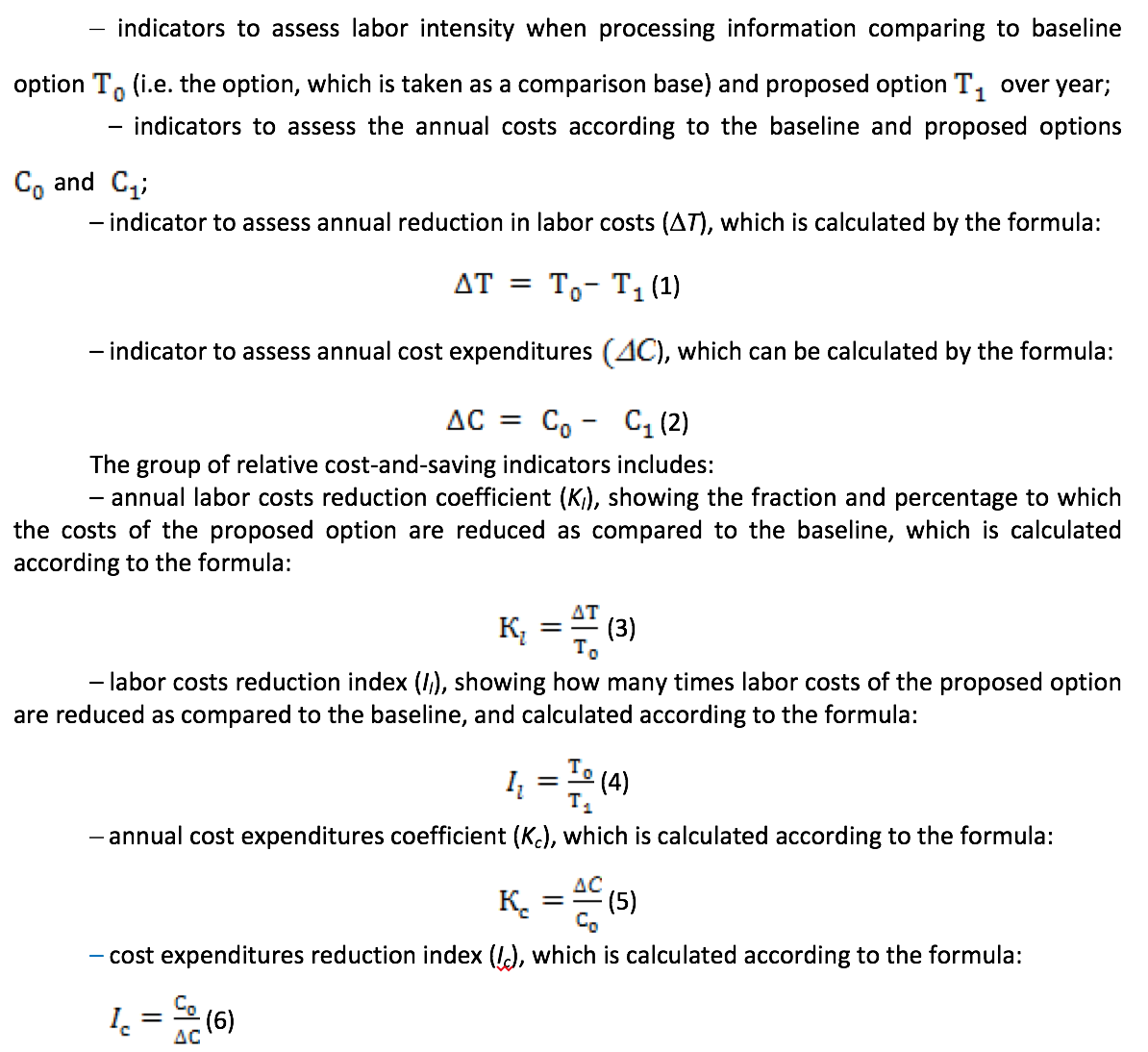

Evaluation of the effectiveness of reducing labor costs of specialists involved in the budgeting of the entire company is associated with the calculation of a number of absolute and relative indicators.

The group of absolute indicators includes:

The above-mentioned baseline period refers to the information processing prior to the implementation of automation tool, while the proposed period refers to that after implementation of the developed automation system (Burtsev 2009).

Table 1 presents the calculation of basic labor intensity depending on types of work.

Table 1. The baseline labor intensity of the budgeting procedure in LLC “Stroytekhnologiya”

Types of work |

Labor inputs, man-month |

Number of specialists |

Total labor inputs man-month |

Collection of primary information |

31.25 |

4 |

125.0 |

Analysis of the actual data |

50 |

4 |

200.0 |

Paperwork management |

9.38 |

4 |

37.5 |

Generating budgets |

93.75 |

4 |

375.0 |

Total labor inputs |

184.38 |

4 |

737.5 |

In consequence of the conducted activities aiming at improvement of the budgeting system in LLC “Stroytekhnologiya”, labor intensity will be significantly reduced and many of the operations will be transformed into obtaining a report on a particular indicator. Based on this circumstance, we calculate labor intensity of budgeting in LLC “Stroytekhnologiya” after implementation of the computerized budgeting system. Obtained results are shown in Table 2.

Table 2. Labor intensity of the budgeting process

after the implementation of the computerized system

Types of work |

Labor inputs, man-month |

Number of specialists |

Total labor inputs man-month |

Collection of primary information |

3.13 |

4 |

12.5 |

Analysis of the actual data |

6.25 |

4 |

25.0 |

Paperwork management |

1.25 |

4 |

5.0 |

Generating budgets |

0.63 |

4 |

2.5 |

Total labor inputs |

15 |

4 |

45.0 |

Calculated cost-and-saving factors of the labor intensity when budgeting in LLC “Stroytekhnologiya” are shown in Table 3.

Table 3. Assessment of reduction in labor costs after the implementation

of computerized budgeting system in LLC “Stroytekhnologiya”

Indicator |

Labor inputs, man-month |

The number of reporting periods in a year |

Total, hours/year |

Manual processing in the budgeting system (Т0) |

737.5 |

12.0 |

8850.0 |

Computerized processing in the budgeting system (T1) |

45.0 |

12.0 |

540.0 |

Cost-cutting (DТ) |

692.5 |

- |

8310.0 |

Calculation of cost-and-saving factors in terms of cost expenditures is given in Table 4. Absolute indicator of labor costs reduction presented in Table 4 shows that the implementation of the computerized budgeting system in LLC “Stroytekhnologiya” will save 8310 hours per year.

Table 4. Assessment of reduction in cost expenditures in LLC “Stroytekhnologiya”

Indicator |

Labor inputs, man-month |

The number of reporting periods in a year |

Total, hours/year |

Labor inputs, man-month |

Manual processing in the budgeting system (Т0) |

737.50 |

8850.00 |

29.56 |

261606.00 |

Computerized processing in the budgeting system (T1) |

45.00 |

540.00 |

29.56 |

15962.40 |

Cost-cutting (DТ) |

692.50 |

8310.00 |

– |

245643.60 |

The labor costs reduction coefficient will be:

Kl = (737.5–45)/737.5 = 0.94

The value of the labor costs reduction coefficient equal to 0.94 means that comprehensive computerization of the budgeting process requires just 6% of the time compared to that at manual processing.

Labor costs reduction index will be:

Il = 737.5/45 = 16.39

This means that the labor cost will be reduced by 16 times.

The monetized cost of the information processing in baseline and proposed option is expressed by value indicators (Table 5).

Table 5. Cost-and-saving factors of budgeting implementation

Description |

Expenditures |

Absolute variations |

Coefficient of costs variation |

Index of costs variation |

|

Baseline |

Proposed option |

||||

Labor intensity |

|

|

|

|

|

|

|

|

|

|

|

Cost |

|

|

|

|

|

|

|

|

|

|

|

Just owing to reduction of labor intensity when creating integrated budgets, the savings from implementation of the computerized budgeting system in LLC "Stroytekhnologiya" will be 245,643.6 rubles/year.

Costs are reduced by 93.9% (15 962.40/261606*100-100) or by factor of 16. Such a significant reduction in costs is due to the computerization of the budgeting system (European Council, 2010). While, prior to the implementation of the budgeting system, information preparation, processing and analyzing were conducted manually, after the implementation of the computerized budgeting system these functions will be executed by software program.

Let us define reduction in labor costs of managerial personnel. According to preliminary calculations, the number of workers out of managerial personnel will decrease by 25 persons (Table 6) that will allow reducing the costs of payroll by 220 thousand rubles per month, or by 2640 thousand rubles per year.

Table 6. Estimated change in the average staffing number and payroll budget

of overhead staff and managers, specialists, and clerks

Period |

Average staffing number, persons |

Including overhead staff |

Monthly payroll budget of overhead staff and managers, specialists, and clerks |

2015 |

297 |

56 |

1 236 |

proposed |

286 |

31 |

1 016 |

In addition to savings from implementing a budgeting system, the enterprise will be able to reduce the number of losing trades. According to the balance of the work, just in 2016, the number of such transactions was 19, while total losses amounted to 783 thousand rubles. According to the forecasts of specialists, after implementation of the budgeting system the losses could be reduced by 85% (Table 7) that will save 665.55 thousand rubles (783 thousand rub.* 85%/100%) per year.

Thus, total savings in thousand rubles will be:

245.6 + 2640 + 665.55 = 3551.15

In addition to the above performance indicators we can calculate also payback time indicator (Tpb) in terms of costs related to software development and implementation of the budgeting system. This indicator is calculated by the formula:

![]()

where Кi – is the capital investment into the budgeting system;

∆C – is the total saving from the implementation of the budgeting system.

Table 7. Losing bargains for 2016

Period |

Number of loss-making projects |

Total loss, rubles |

1st Quarter |

4 |

119 |

2nd Quarter |

5 |

233 |

3rd Quarter |

5 |

167 |

4th Quarter |

3 |

264 |

Total for the year |

19 |

783 |

The cost structure for the implementation of the information system, and income and expenses budgeting process is given in Table 8.

Table 8. Innovation costs of the information system,

and income and expenses budgeting process costs in LLC “Stroytekhnologiya”

Description of costs |

Amount of costs, thousand rubles |

1C 8.2 UPP platform based software |

1 036 |

Development and maintenance of the software by outside organizations |

391 |

Payroll budget of employees from the information technology department |

2 107 |

Hardware (servers, computers, etc.) |

511 |

Training of employees |

133 |

Total |

4 178 |

Thus, the cost of implementing the computerized budgeting system will be 4 178 thousand rubles. Project payback period will be:

Tpb = 4 178 - 3551.15 = 1,18 year or 1.12 * 12 = 14.16 months

Despite the negligible cost-and-saving factor, the actual effect from this implementation is much higher, since the implementation of the computerized budgeting system increases the reliability of the entire infrastructure of LLC “Stroytekhnologiya”, as well as extends information content of the budgeting system.

Computerized budgeting system (Koptyakova and Rakhlis 2013) will provide clear and formalized identification of the driving factors characterizing the enterprise performance results, their circumstantiation for each management level, as well as setting specific tasks for the heads of departments ensuring their implementation.

The effectiveness of the proposed measures on implementation of the budgeting system will be resulted from the reduction of the following expenditures:

1) labor costs of specialists involved in the budgeting process of the entire company;

2) labor costs of managerial personnel.

3) losing trades.

Total savings will amount to more than 3 551 thousand rubles. While the costs of implementing the computerized budgeting system is 4 178 thousand rubles, the project payback period will be 1.18 years or 14.16 months.

Despite complexity and resource intensity of the project, results expected from implementation of the computerized budgeting system in terms of their effect many times exceed costs. In addition, computerization of the budgeting system will provide clear and formalized definition of the driving factors characterizing the performance of LLC “Stroytekhnologiya”, their circumstantiation for each management level, as well as setting specific tasks for the heads of departments ensuring their implementation.

Current studies were taken up to investigate theoretical aspects of budgeting as a tool of financial management of the construction organization. It was revealed that planning company activities, budgeting and monitoring its execution is one of the most important tasks in the enterprise management. Solution of this problem requires a large amount of financial, accounting, and production information.

The main objectives of the budgeting can be successfully fulfilled in case if the work on supervision of financial results (Rakhlis, et. al. 2016) and the company's activities in general are well organized along with financial responsibility centers, which include: planning cash flows and movement of inventory; planning company income and expenses; evaluation of internal indicators of liquidity and profitability of the company and its specific activity areas. This will allow company to move purposefully towards reaching the set goals.

The above concepts are considered with regard to LLC “Stroytekhnologiya”, which is one of the holding’s construction and erection organizations performing the role of general contractor for other construction companies of the holding. Most of the works performed by the enterprise are focused on the major and most constant consumer of construction and repair works in the city. Over 7 years of existence, construction organizations of the holding managed to gain a firm foothold in the construction market of Magnitogorsk.

To improve the management quality, organizations of the holding are implementing ISO 9000 quality management system (Ezdakova 2013). The main disadvantage of the holding is the lack of a comprehensive system of planning, accounting, and management.

To develop budgeting system at the enterprise, we have identified compliance between various functions of subdivisions and the income and expenses budget articles that were used to allocate financial responsibility centers. Development of the dynamic income and expenses budget structure was carried out taking into account the specifics of construction production (Vitkalova and Miller 2011), which forced to develop indicative dynamic budget of income and expenses, where the minimum budget unit was the construction project (resource calculation), while the maximum unit was a group of construction projects (Ivanova and Soldatova 2012).

In this work we have built logical interrelations for income and expenses budget generation in the context of a single construction project, as well as presented a detailed structuring of income and expenditures for the marginal income center ranging from unit cost of a specific type of work through construction projects, groups of projects, and company’s line of business.

Burtsev, V.V. (2009). Upravlencheskij uchet i proizvodstvennoe byudzhetirovanie [Management accounting and manufacturing budgeting]. Modern Accounting, 7, 30-32.

European Council, 25/26 March 2010. Conclusions, EUCO, 7(10), 1-7, 10-11. Date Views 21.01.2017 http://ee.europa.eu/europe2020/documents/.

Ezdakova, E. (2013). Uchet osobennostej stroitelnoj deyatelnosti pri razrabotke i vnedrenii sistemy operativnogo kontrollinga na predpriyatii [Considering peculiarities of the construction activities in the development and implementation of operative controlling at the enterprise]. Proceedings of the 9th All-Russian Research-to-practice conference with international participation “Contemporary problems of regional economy management”. October 08-12, St. Petersburg, Russia, pp. 142.

Ivanova, O.E., and Soldatova, L.I. (2012). Organizatsionno-upravlencheskie podhody k postroeniyu sistemy byudzhetirovaniya organizatsij [Organizational and managerial approaches to design organizations’ budgeting system]. Economic Analysis: Theory and Practice, 10, 46-52.

Koptyakova, S.V., and Rakhlis, T.P. (2013). Assessment of banking system development of the Russian Federation under conditions of financial globalization. Proceedings of the II International Research-to-practice conference “Science, technology and higher education”, April 17, Westwood, Canada.

Litovskaya, Yu.V., and Ishmetyeva, L.E. (2013). Osobennosti motivatsii truda personala na rossijskih predpriyatiyah [Features of labor motivation of personnel in Russian companies]. Economy and Policy, 6(6), 67-71.

Nikitina, O.A., and Slobodyanik, T.M. (2012). Formirovanie investitsionnogo portfelya kommercheskogo predpriyatiya na osnove primeneniya finansovyh i ehkonomicheskih metodov [Setting-up the investment portfolio of the commercial enterprise on the basis of applying financial and economic methods]. Economy and Society, 4(4), 267-274

Ponomareva, O.S. (2013). Upravlenie promyshlennym predpriyatiem: predprinimatelskij i finansovye riski [Management of industrial enterprise: Entrepreneurial and financial risks]. Modern Economy Issues, 11, 243-246.

Rakhlis, T.P., Skvortsova, N.V., Koptyakova, S.V., and Balynskaya N.R. (2016). Development of microelectronics in the circumstances of the innovative and technological growth of the Russian economy. International Business Management, 10(4), 401-407.

Vitkalova, A.P., and Miller, D.P. (2011). Byudzhetirovanie i kontrol zatrat v organizatsii [Budgeting and cost control in the organization]. Moscow: Alpha Press, pp. 104.

1. Nosov Magnitogorsk State Technical University, 455000, Russian Federation, Magnitogorsk, Lenin Ave., 38. Email: line_av@mail.ru

2. Nosov Magnitogorsk State Technical University, 455000, Russian Federation, Magnitogorsk, Lenin Ave., 38

3. Nosov Magnitogorsk State Technical University, 455000, Russian Federation, Magnitogorsk, Lenin Ave., 38

4. Nosov Magnitogorsk State Technical University, 455000, Russian Federation, Magnitogorsk, Lenin Ave., 38

5. Nosov Magnitogorsk State Technical University, 455000, Russian Federation, Magnitogorsk, Lenin Ave., 38