Vol. 38 (Nº 33) Año 2017. Pág. 29

Mihail Nikolaevich DUDIN 1; Natalia Mikhailovna CHEPURNOVA 2; Evgenia Evgenevna FROLOVA 3; Gennady Illarionovich MUROMTSEV 4; Julia Leontevna SMIRNIKOVA 5

Received: 20/05/2017 • Approved: 30/05/2017

ABSTRACT: This article is concerned with the development of the theoretical and methodological foundations of the "goodwill" scientific category, which is formed and created in the course of functioning and development of the enterprises. The practical side of the issue, associated with the sources of formation of the goodwill, one of which is a set of knowledge, skills and expertise of the personnel of the enterprise, is also presented in this article. Based on the materials outlined in this article, the authors can summarize that: • goodwill is a product of intellectual activity or an actual appraisal product of the functioning of the human capital, acquired by the creative work of the personnel (other involved people, including stakeholders and owners/shareholders); • formation of the goodwill occurs under the influence of a number of factors, including knowledge, skills and expertise of the personnel (the said knowledge, skills and expertise can also be considered as the professional competence of the personnel) which are one of the most important sources of human capital and one of the main products of cognitive human activity; • accordingly, the efficiency of the labor activity of the employees largely determines the success of the enterprise in terms of creation of the goodwill. In other words, the qualitative characteristics of the enterprise's personnel largely determine the value of its goodwill (both as an asset and as a product of intellectual activity); • the main aspects and features of formation of the goodwill by the example of activity of the retailers are considered in this article; the conclusions obtained are of practical importance and can be used in the managerial activities of managers and supervisors of the trade network structures. |

RESUMEN: This article is concerned with the development of the theoretical and methodological foundations of the "goodwill" scientific category, which is formed and created in the course of functioning and development of the enterprises. The practical side of the issue, associated with the sources of formation of the goodwill, one of which is a set of knowledge, skills and expertise of the personnel of the enterprise, is also presented in this article. Based on the materials outlined in this article, the authors can summarize that: • goodwill is a product of intellectual activity or an actual appraisal product of the functioning of the human capital, acquired by the creative work of the personnel (other involved people, including stakeholders and owners/shareholders); • formation of the goodwill occurs under the influence of a number of factors, including knowledge, skills and expertise of the personnel (the said knowledge, skills and expertise can also be considered as the professional competence of the personnel) which are one of the most important sources of human capital and one of the main products of cognitive human activity; • accordingly, the efficiency of the labor activity of the employees largely determines the success of the enterprise in terms of creation of the goodwill. In other words, the qualitative characteristics of the enterprise's personnel largely determine the value of its goodwill (both as an asset and as a product of intellectual activity); • the main aspects and features of formation of the goodwill by the example of activity of the retailers are considered in this article; the conclusions obtained are of practical importance and can be used in the managerial activities of managers and supervisors of the trade network structures. |

The goodwill of an economic entity, as an appraisal and management category, has a long history and, prior to formation of a scientific concept, in a simple form, before the appearance of manufactories, the goodwill as the intangible asset was associated with the goodwill of an individual – an honest and productive employee. The goodwill of individuals was of great importance, since the goodwill of their entrepreneurial activities depended on it. Currently, the goodwill (as a scientific category, largely identified with such concepts as "image", "popularity", "business responsibility", etc.) belongs largely to the field of interdisciplinary research (in particular, jurisprudence, management, marketing, economics and accounting). The phenomenon of goodwill is investigated by many experts in different industries, and each of them gives it its own definition. In many ways, these definitions resonate, but one thing remains unchanged: the main source for the formation of the goodwill of the enterprise is its ability to conduct the intellectual activity and to accumulate the human capital (through the effective and intensive use of the quality labor resources "grown" either by the firm itself or brought in from the labor market).

In the modern scientific literature on the issues, related to the personnel, there are many different approaches and characteristics of the efficiency of its use. Thus, the researchers are proposed to distinguish at least three approaches to the efficiency (Fazlollahtabar, Shirazi & Porramezan Ganji 2015; Lewis & Lee 2015):

In other sources, in particular (Quinn 1992; Cherkasov & Smigel 2016; Alleyne & Lavine 2013), the personnel is assessed based on the individual evaluation, depending on the purpose of evaluation. Among the main trends in evaluation the following ones, are outlined: the evaluation of the potential of the employee, the evaluation of the individual contribution, and the certification of the personnel of the enterprise (the combination of the two previous methods). Russian scientist V.R. Vesnin expresses the opinion that all methods of evaluation can be divided into traditional (in which the degree of individual results of an employee is estimated) and non-traditional (according to which the employee is considered in the context of his group interaction) (Vesnin 2001).

At the same time, the bulk of scientific and scientific-publicistic sources consider mainly the short-term results of the work of the personnel of the enterprise, while it is advisable to switch to a two-level analysis of the results of the labor activity of the personnel. So it is proposed to consider separately the results of labor and its consequences. The results of labor should be understood as the currently popular performance indicators, that is, either the amount of works spent on the production of goods (provision of services) or the number of goods (services) produced for a certain period of time. The consequences should be understood as the intangible results of the works performed, which will become apparent later (the image of the enterprise, its goodwill).

Such interpretation coincides with the definition of goodwill as a conditional value of image, reputation, business relations, which is defined as the difference between fair (market) evaluation of the enterprise (for example, taking into account the real value of its shares circulating on the exchange) and the amount of net assets of such an enterprise, reflected in the balance sheet in accordance with the generally accepted methodology of financial accounting (Didenko 2015).

Some of the authors, despite their recognition of the goodwill as the intangible asset, still believe that it is the ordinary overpayment for the assets of the acquired company. In this regard, goodwill has only some characteristics of an intangible asset. The impossibility of its alternative use, the immanence to other assets of the enterprise and the uncertainty of profitability, in their opinion, call into question the expediency of its presentation by the balance method (Alleyne & Lavine 2013). A number of European and American scientists have a similar opinion, considering that the goodwill is not subject to purchase and sales, and therefore cannot be a property object (Mazzi, Andre, Dionisiou, & Tsalavoutas 2017; Matemilola & Ahmad 2015).

According to other scientists, it is advisable to amend the theoretical basis of such a concept as "goodwill" and to distinguish between the goodwill and other intangible assets and to reflect it in the financial accounting and reporting separately. This will allow to determine the advantages of the enterprise against the competitors and to estimate the size of the future economic benefits from its use (Chen & Shroff 2014; Mueller & Supina 2002).

The elements of the goodwill created within the enterprise include: the repute, the business relations, the reputation, the customer base, the loyalty of the shareholders, the advanced management, the popularity of the brand name, the monopolistic advantages, the innovative technologies, the qualification of the personnel, the corporate strategy, the intellectual assets, the managerial qualities, the dominant market positions, the development strategy, high quality products, regular customers, reliable suppliers, the licenses, the influence, the information communications, the promotional events, professional retraining, the intellectual, technological and client capital, know-how, etc.

Methods. In the course of the analysis of the goodwill by the example of the trading enterprise, the general approach to the indicators, allowing to evaluate or to measure the asset should be determined. In our opinion, such indicators can be: the coefficient for the retailer's profit contingency over the average market indicator, or the alternative cost of the retail premises (the possible rental costs of the enterprise, assuming that all available premises are leased).

In the modern literature, the possibility of evaluation of the goodwill and the intellectual assets in general, created using the knowledge, skills and expertise of the employees, are considered in terms of application of a unit, generating a cash flow (Dudin, Sepiashvili, Smirnova, Frolova, & Voykova 2015; Nonaka & Takeuchi 1995). Whereas a unit, generating cash flow, can be only the sources of cash assets that directly create their inflows relatively separately from other assets. It is proposed to consider a department of a trading enterprise to be a unit within such an enterprise. Accordingly, the employee of the department is a factor in the implementation and creation of the goodwill. Depending on the efficiency of the activity of both the individual employee and the collective as a whole, the value of the goodwill that the enterprise gets will change.

The calculation of the effective cost of the goodwill (at the internal level) is proposed to be carried out by comparing the current value of the unit of the retail premises, occupied by the department (while maintaining its specialization), with the profit, obtained by the retailer as a whole from the activities of this department. The calculation should be carried on using the following formula:

![]()

Where:

Gl is the price level of the goodwill of the retailer;

Id is the profit received from the activity of the department included in the business of the retailer;

MP is the market price of the retail premises of the department, included in the business of the retailer;

k is the coefficient of seasonal demand.

The criteria for the evaluation of the effectiveness of use of the existing goodwill must be measured continuously, which allows to diagnose the deviations of the existing level from the value taken for the base. The main reason for the reduction in the price of the goodwill in the short term, in our opinion, (exclusively of the wave of seasonal fluctuations in demand) is the efficiency of human resources. In this case, the concept of basic level of goodwill return should be introduced, and the changes in the level of efficiency of use of the goodwill of the trading enterprise should be monitored based on comparison of the current and basic levels:

![]()

where Gl0 and Gl1 are, respectively, the level of use of the goodwill of the enterprise in the base year and in the current year.

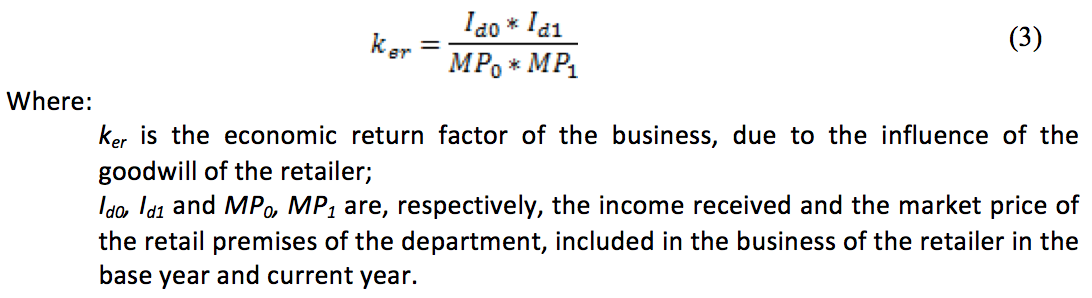

The main problem, when using these approaches, is as follows. It is almost impossible to determine the change in the goodwill level in the case of a simultaneous reduction in sales and in the price of the retail premises. Besides, these two indicators are interrelated to some extent. In our opinion, it is also advisable to use the measurement of the factor of growth of each indicator, as well as the determination of the aggregate of the growth factor to diagnose the possible deviations. The specified calculation becomes possible at use of the economic return factor:

Proceeding from the expression (3), the indicator of the reduction in the price level of the goodwill can be the value of the economic return factor, since if the value of this factor is less than unity, one can speak of a reduction in goodwill price of the enterprise. If the reduction is observed under the influence of a decrease in the sales or income of the enterprise, the reduction in the cost of using of the goodwill can be considered seasonal, but if the enterprise does not take certain actions to maintain the attractive image in order to increase the sales, this process may lead to a constant downward trend in goodwill price. If the reduction in goodwill price is observed due to a reduction in the market price of the retail premises, one can talk about the strategic problems of the enterprise (Dudin & Ivashchenko 2016; Grichnik, Brinckmann, Singh, & Manigart 2014).

To determine the possibility of improvement of the goodwill price within a specific unit of its measurement (the department of the trading enterprise "Tekhnika dlya doma" (“Equipment for home”)), a practical study was carried out, consisting of three consecutive stages, at the first of which the level of goodwill and the factor of economic return of the department under study were determined; at the second stage, the work was carried out with the staff of this department to increase the level of knowledge, skills and expertise in customer-centered service; at the third stage, the level of goodwill and the factor of economic return were re-determined to identify the significant differences in the measured goodwill performance.

Let us consider the personnel development more detailed. The simplicity of the model of work lies in determining one key competence (loyalty of the personnel) and formulation of the values, determining the direction of personnel development. In addition to key competencies, the training in the trade management standards and training in product knowledge were also conducted. These three elements can describe the entire system of development of the personnel of the trading enterprise. In this case, the "mystery shopping" approach was applied; for this purpose, a well-known approach to evaluation of the work of sales consultants and other categories of personnel directly in contact with the client, was reoriented from the evaluation tool to the development tool.

Previously, the service profile was developed – the norms and standards of service were described. Each employee of the department studied these norms and took the exam at the end of a two-week course of studying of goods and the standards of service. Only after the successful passing of the exam, the employee was admitted to the customer service and after that the employee was evaluated, according to the "mystery shopping" program. The evaluation of the personnel was performed according to two indicators: the evaluation of the level of knowledge of goods; the results of the "mystery shopping" (the ability to sell/serve the customer).

The results of the re-measurement of the goodwill level and the economic return factor upon the completion of the development work showed the presence of significant differences in the value of these indicators at the first and third stages of the study. It is also worth noting that the competencies that have been identified as the key ones for the employees of the enterprise, and correlate completely with the values declared by the management of the trading enterprise. That is, it can be said that the structure of the training itself is determined by the values of the enterprise and it is possible to make a direct link between the successful practices and observance of all values. As a result, the observance of the values of the enterprise strengthens the system of training and development, which in turn affects positively the sales results, and this thesis is confirmed by the results of other studies (Tokuhama-Espinosa 2015).

It should be emphasized that the price of retail premises can be significantly influenced by the personnel of the enterprise, which creates the image of a commercial facility, and, ultimately, determines the additional cost of the retail premises. Proceeding from this, in the absence of the response of the management of the trading enterprise to the deviation of the indicators of the efficiency of tactical use of the goodwill (or in the case of an ineffective response), its strategic effectiveness and the actual value of its goodwill are inevitably reduced.

In this context, it is of interest to ensure the prospects for the development of the goodwill. In our opinion, advertising activities alone are incapable of forming the goodwill of a trading enterprise. Moreover, the value of advertising in the process of formation of the goodwill is reduced under the influence of the period of operation of the enterprise. In this case, the factors of service quality, assortment policy and marketing activity come to the fore in the formation of the goodwill. These indicators create the basic price of the goodwill in the process of functioning. The improvement of the effectiveness of the implementation of these indicators certainly faces the problem of labor potential and involvement of the personnel. That is, in fact, the goodwill of a trading enterprise, as it was mentioned above, first of all, depends on the personnel of the enterprise.

According to the results of the theoretical analysis and practical research, one of the main indicators, characterizing the effectiveness of the development of a trading or service enterprise, is the indicator of its goodwill price. This is especially due to the fact that, as a rule, the value of the gross assets of such enterprises is much lower than their market value, or the value of the retail premises that can be leased out. However, this difference is precisely the financial value of the goodwill. The intangible nature of the goodwill is extremely sensitive to various external factors. As is known, the main goodwill growth factors are: the increase in the value of the company's name, the development of the consumer base, the positive morale of the personnel and other similar factors that can generate profit.

According to the performed analysis of the theoretical views of the researchers on the interpretation of the "goodwill" concept, there are three main approaches (Mazzi, Andre, Dionisiou & Tsalavoutas 2017; Mueller & Supina 2002; Filip, Jeanjean & Paugam 2015; Knauer & Wohrmann 2016).

Legal approach. In this approach, the goodwill is considered in terms of certain rights to the objects of non-material nature that can be separable or inseparable from an individual physical or legal entity. According to one group of scientists, such assets are inseparable from the enterprise, while other researchers believe that they can be identified and classified. The objective component of the goodwill as a legal category is the non-property benefit, which is understood as the results of the intellectual activity, the personal non-property benefits, and the subjective component, which is the goodwill forming information, that is, the information provided directly by the legal entity and the results of evaluation of the goodwill performed by the other subjects of law. It should be noted that in the literature there are almost no interpretations of the goodwill in terms of a personal non-property benefit, and the public one or the public evaluation are emphasized; thus, only the subjective side of this concept is considered as a legal category.

If we consider the goodwill based on this point of view, then we should also note the sources of external information, that is, those who carry out the evaluation. On the one hand, the information is submitted directly by a legal entity. At the same time, the advertising as well as the various actions and PR campaigns will be used to attract the attention of the consumers and the counterparties and positively influence the own goodwill. On the other hand, the information can also be provided by other legal entities, namely by the independent rating companies, the subjects of valuation activity and the consumers in general. However, it should be remembered that the ratings and other estimates are not always objective; in particular, they can be formed by the means of unfair competition, that is, the legal entity, so to speak, can get the goodwill instead of developing it.

Given the above, it can be concluded that the goodwill of the legal entity is a personal immaterial benefit of a legal entity, formed on the basis of existing information, the prestige of its trademark, corporate (commercial) denomination, business qualities of a legal entity as a counterparty in the civil legal relations, the evaluation by the consumers and other subjects of civil law, which is materially expressed in the form of a goodwill (non-property asset) of a legal entity.

Two important conclusions can be made from the above definition. First, the basis for the formation of the goodwill is undoubtedly the information that can exist in the form of an external evaluation of a legal entity and its internal evaluation. At the same time, as a result, the non-property asset of the enterprise can also be formed – the goodwill, that can vary depending on the information available (both positive and negative). Secondly, the information is considered truthful, unless otherwise proven in the established order. The external expression of the goodwill is a public evaluation of both the goodwill and the legal entity in general. This can be called a "visible part" of the goodwill, on the basis of which the counterparties make a decision on possibility of entering into legal relations with this entity, and the consumers make a decision on the possibility of acquiring its goods or services.

Unfortunately, not all legal entities conscientiously form their goodwill, discrediting the goodwill of other legal entities, and thereby trying to occupy, if not dominant, then a higher position in the market. Therefore, the consumers and counterparts should be aware of the possibility of "buying" of the goodwill by the individual legal entities via obtaining the first places in the ratings and "independent" estimates. A legal approach to understanding of the goodwill makes it possible to create the prerequisites allowing to express it as the asset of the enterprise, since it ensures the possibility to correlate an understanding of the goodwill in a legal aspect with the criteria for recognition of the assets in the accounting.

Accounting approach. It assumes the understanding of the goodwill only in the course of acquisition or privatization (corporatization). From the accounting point of view, the goodwill is the intangible asset, in fact, in value terms, the amount that the buyer of the enterprise is willing to pay in excess of the book value of its assets. The existence of such a difference is due to emergence – the characteristic of the enterprise as a system, i.e. due to the irreducibility of the properties of the system to the sum of the properties of its elements. Any positive or negative circumstances associated with the image of the company are the elements, forming the price of the goodwill. Thus, the accounting represents the most conservative attitude to the goodwill, arguing that it is possible to identify the goodwill only in case of a reliable evaluation of the business of the enterprise.

Economic approach. According to this approach, the goodwill is broadly understood as a collection of certain non-material assets and resources that have not yet been identified and evaluated. This approach allows to create the prerequisites to express the goodwill as a set of certain identifiable assets, not only in the course of merger of the businesses, but also during the current activity of the enterprise.

Based on this understanding, the goodwill of the enterprise exists during the whole period of existence of a specific subject, and not only during its association with another entity. As a result, the internal goodwill, that is, the aggregate of the intangible assets, generating the opportunities for the enterprise to receive future benefits, may occur in the current activity of the enterprise. The internally created goodwill is a composite category, formed from a set of all intangible attributes of economic activity. The goodwill of the enterprise arises inside the enterprise and is immanent to it; it exists at every point in time of the organization's activities and affects its financial results.

Returning to the information component of the goodwill (as a source of generation of the revenue and profits of the enterprise), it is necessary to note the relationship between the information and the goodwill. This component also requires a definite study. In particular, all the information available at the enterprise can be divided into three parts:

In accordance with the proposed classification, most of the information flows are created or carried out with the help of the personnel. That is, there is a close relationship between this component and the skill level of the personnel. As it is known, the main components that ensure the normal functioning and development of the enterprise are: the objects of labor, the means of labor, the land, the labor and the information. However, the last three ones – the land, the labor and the information – will obviously be the main factors of revenue and profit generation for the trading enterprise. Moreover, if the image of a land plot is not fundamentally dependent on the activities of the enterprise, the information component and the personnel are largely under the regulatory impact of the enterprise. However, the personnel as a center for creation of the added value can be a threat to its receipt. So, in the case of engagement of the employees, whose loyalty to the enterprise was not fully determined, in the service or trading activities, the enterprise faces the threat of losing of the part of the profits, or the price of the goodwill through the undesirable actions of the employees.

At the same time, the reason for the partial loss of the goodwill may be not only the disloyalty of a certain employee (or a group of employees) towards the enterprise. The reason for the threat may also be a confluence of circumstances or lack of competence of a certain employee, or group incompatibility of the team.

Undoubtedly, the managers of all levels try to improve the control over the effectiveness of employees' activities, but this control does not always allow to assess all the components of the threats to the goodwill of the enterprise due to the absence (reduction) of the loyalty of an employee (or the group). For a commercial enterprise, the personnel-related threats can include three main groups of various adverse (undesirable) consequences:

In fact, in this context the enterprise deals with three kinds of social risks. Undoubtedly, each component of social risks deserves the attention to be paid by the of managers of the enterprise, but the subject of our study is precisely the mechanism for evaluation of the threats to the goodwill on the part of the employees, as the least studied in modern business practices. On the basis of such an evaluation, it becomes possible to propose the methods aimed at counteracting the reduction of the goodwill price. In our opinion, the efficiency of the personnel, in addition to training and development of the personnel of the enterprise, depends on such components as:

Each of the above components in case of inefficient implementation can lead to a decrease in the efficiency of the use of labor resources, a decrease in the quality of human capital and a reduction in the goodwill price.

Thus, the modern economic practice requires a personnel development program. Such a program can create the conditions for improvement of the efficiency of the business unit. In our opinion, the efficient personnel, especially in conditions of the sufficient level of professional training, creates the prerequisites for the formation of the positive image of the enterprise, i.e. the efficiency of the personnel development is directly related to the indicators of the goodwill of the enterprise. The higher is the personnel potential of the enterprise as a whole, the more perfect is its goodwill, which is capable of generating the revenue, because: 1) the process of improvement of the goodwill is continuous; 2) the return of the goodwill from its use occurs in the form of creation of the added value.

From the point of view of the influence of the personnel on the creation of the goodwill, the latter can be characterized as a product of the intellectual activity of the enterprise or the actual evaluation product of the functioning of the human capital acquired by the creative work of the persons present in it (the enterprise). Thus, the goodwill in the modern sense characterizes in an integrated manner the activities of the enterprise and is based on a combination of the economic and non-economic components, which causes the emergence of the synergistic effects, as well as the growth of the innovative activity of the business entity, which is extremely important in the transition from the industrialization to the post-industrial economy (Freeman 1987; Kong & Stevens 2011).

In our opinion, it should also be noted that the main prospects for the development of the increase in the price of the goodwill of the enterprise are created not by the entire collective, but by its individual elements, designated herein as the centers of generation (formation) of the income and profit. Accordingly, the management of enterprises should most actively develop the knowledge, the skills and expertise (professional competencies) precisely among the employees of such cents, as this will allow to maximize the added value of the business, as well as to increase the cost of the goodwill of the enterprise, which will positively influence the level of its value for the personnel, management, stakeholders, as well as for the owners (founders or shareholders).

Alleyne, P., & Lavine, M. (2013). Factors Influencing Accountants' Behavioral Intentions to Use and Actual Usage of Enterprise Resource Planning Systems in a Global Development Agency. Journal of Financial Reporting and Accounting, 11(2), 179-200.

Chen, W., & Shroff, P.K. (2014). Fair Value Accounting: Consequences of Booking Market-Driven Goodwill Impairment. Retrieved March 2, 2017, from http:ssm.com/abstract=2420528.

Cherkasov, A.A., & Smigel, M. (2016). Public Education in the Russian Empire during the Last Third of the 19th Century: Parish Schools.

European Journal of Contemporary Education, 18(4), 418-429.

Didenko, D. (2015). Intellektualoemkaya ekonomika. Chelovecheskii kapital v rossiiskom i mirovom sotsial'no-ekonomicheskom razvitii [Intellectual-Intensive Economy. Human Capital in the Russian and World Socio-Economic Development]. Saint Petersburg: Aleteiya.

Dudin, M.N., & Ivashchenko, N.P. (2016). Razvitie institutov "vyrashchivaniya" innovatsionnykh proektov v kontekste stanovleniya venchurnoi ekosistemy [Development Institutions "Cultivation" of Innovation Projects in the Context of the Formation of Venture Capital Ecosystem]. MIR (Modernizatsiya. Innovatsii. Razvitie), 7(3(27)), 70-75.

Dudin, M.N., Sepiashvili, E.N., Smirnova, O.O, Frolova, E.E., & Voykova, N.A. (2015). Neo-Schumpeterian Knowledge Funnel and Foresight Project Development in the System of Establishing Stability of the Competitive Advantages of Enterprise. Journal of Advanced Research in Law and Economics, VI(1(11)), 42-52.

Fazlollahtabar, H., Shirazi, B., & Porramezan Ganji, A. (2015). A Framework for Knowledge Sharing of Enterprise Resources. International Journal of Information and Computer Science, 4, 9-19.

Filip, A., Jeanjean, T., & Paugam, L. (2015). Using Real Activities to Avoid Goodwill Impairment Losses: Evidence and Effect on Future Performance. Journal of Business Finance & Accounting, 42(3-4), 515-554.

Freeman, C. (1987). The Economics of Industrial Innovation. London: Pinter.

Grichnik, D., Brinckmann, J., Singh, L., & Manigart, S. (2014). Beyond Environmental Scarcity: Human and Social Capital as Driving Forces of Bootstrapping Activities. Journal of Business Venturing, 29(2), 310-326.

Knauer, T., & Wohrmann, A. (2016). Market Reaction to Goodwill Impairments. European Accounting Review, 25(3), 421-449.

Kong, C., & Stevens, G.R. (2011). Devising a Neo-Schumpeterian Knowledge Funnel for Understanding Innovation in Produkt and Process. In Shumpeterovskie chteniya (materialy 1-i mezhdunarodnoi nauchno-prakticheskoi konferentsii) [Schumpeter's Readings (Materials of the 1-st International Scientific and Practical Conference)] (pp. 12-18). Perm: Publishing House of the Perm State Technical University.

Lewis, B., & Lee, S. (2015). The Cognitive Enterprise. Tampa, FL: Meghan-Kiffer Press.

Matemilola, B.T., & Ahmad, R. (2015). Debt Financing and Importance of Fixed Assets and Goodwill Assets as Collateral: Dynamic Panel Evidence. Journal of Business Economic and Management, 16(2), 407-421.

Mazzi, F., Andre, P., Dionisiou, D., & Tsalavoutas, L. (2017). Compliance with Goodwill-Related Mandatory Disclosure Requirements and the Cost Equity Capital. Accounting and Business Research, 4(3), 268-312.

Mueller, D.C., & Supina, D. (2002). Goodwill Capital. Small Business Economic, 19(3), 233-253.

Nonaka, I., & Takeuchi, H. (1995). The Knowledge – Creating Company. New York: Oxford University Press.

Quinn, J.B. (1992). Intelligent Enterprise: A Knowledge and Service Based Paradigm for Industry. New York: The Free Press.

Tokuhama-Espinosa, T. (2015). The New Science of Teaching and Learning: Using the Best of Mind, Brain, and Education Science in the Classroom. Teachers College Press.

Vesnin, V.R. (2001). Prakticheskii menedzhment personala [Practical Personnel Management]. Moscow: Yurist, pp. 496.

1. Russian Presidential Academy of National Economy and Public Administration (RANEPA), 119571, Russian Federation, Moscow, Vernadsky prosp., 82 Email: dudinmn@mail.ru.

2. Russian Presidential Academy of National Economy and Public Administration (RANEPA), 119571, Russian Federation, Moscow, Vernadsky prosp., 82.

3. Peoples Friendship University of Russia (RUDN University); 117198, Russian Federation, Moscow, Mikluho-Maclay str., 6.

4. Peoples Friendship University of Russia (RUDN University); 117198, Russian Federation, Moscow, Mikluho-Maclay str., 6.

5. All-Russian State University of Justice (ARSUJ) 117638, Russian Federation, Moscow, Azovskaya str., build. 1, 2.