Vol. 38 (Nº 33) Año 2017. Pág. 38

Tatyana Fedorovna ROMANOVA 1; Olga Valentinovna ANDREEVA 2; Karina Nikolaevna SAMOYLOVA 3; Anna Alexandrovna SUKHOVEEVA 4; Dmitry Gennadevich ROMANOV 5

Received: 11/06/2017 • Approved: 25/06/2017

ABSTRACT: The creation of the adequate social protection system for citizens and the whole society is the part of the state financial and economic support policy. However, the problem of inclusion of the state expenditures for the social protection of the population in the financial security indicators has not been worked out yet in scientific papers. In this study, the factors, requiring the growth of the social expenditures of the state, are identified; the estimation of the threshold and actual parameters of the indicators of financial safety in the social sphere is given; the dynamics and the structure of the state expenditures for the social protection are analyzed; the modern trends in the state policy for the main components of the social protection system are revealed; the key directions for the financial security support in the sphere of social protection of the population are formulated. The study showed the presence of the actual threats to financial security in the field of social protection of the citizens in Russia. The results of the research broaden the theoretical understanding of the state financial policy in the social sphere and are of practical importance for the construction of a system of social protection that meets the requirements of financial security. |

RESUMEN: La creación de un sistema de protección social adecuado para los ciudadanos y toda la sociedad es parte de la política de apoyo financiero y económico del Estado. Sin embargo, el problema de la inclusión de los gastos estatales para la protección social de la población en los indicadores de seguridad financiera aún no ha sido elaborado en documentos científicos. En este estudio se identifican los factores que requieren el crecimiento de los gastos sociales del Estado; Se da la estimación del umbral y los parámetros reales de los indicadores de seguridad financiera en el ámbito social; Se analizan la dinámica y la estructura de los gastos estatales para la protección social; Se revelan las tendencias modernas de la política estatal de los principales componentes del sistema de protección social; Se formulan las direcciones claves para el apoyo a la seguridad financiera en el ámbito de la protección social de la población. El estudio mostró la presencia de las amenazas reales a la seguridad financiera en el campo de la protección social de los ciudadanos en Rusia. Los resultados de la investigación amplían la comprensión teórica de la política financiera del Estado en el ámbito social y son de importancia práctica para la construcción de un sistema de protección social que cumpla con los requisitos de seguridad financiera. |

According to the current National Security Strategy of the Russian Federation for the period until 2020, the national interests are derived from the needs of the citizens and their value orientations, and they are supported by the opportunities, including the economic organization of the state (Ilyin, 2016, p. 6).The economic security makes it possible to ensure the sufficiency of the social existence and the progressive development of the country, to maintain the stability of the standard of living of the population.

The financial security is the integral part of the economic security. Without great deal of discussion on the content of the concept and the indicators of financial security, it should be noted that the equilibrium of the financial flows of the budgetary and extra-budgetary spheres and other monetary funds contributes to the sustainable social and economic development of the state and supports its social stability.

The social policy has traditionally been the most important instrument of the impact of the state on the level of social stability in the society, determining both the proportions of the distribution of the social guarantees and the key priorities of the social development of the state. It is implemented in order to ensure the social security as a set of measures to protect the interests of the country and the people in the social sphere, the development of the social structure and relations in the society, the system of life support and socialization of people, the way of life in accordance with the needs of the progress, the present and the future generations. The more realistic the social policy of the state, the higher the level of social security of the society as a strategic goal of the state.

The purpose of this article is to substantiate, on the basis of the analysis of the dynamics of the state expenditures for the social protection of the population, the need for their inclusion in financial security indicators and to identify the threats to the violation of the economic security of the Russian state in the social sphere. At the same time, the following objectives were set: 1) to determine the factors requiring the growth of social expenditures of the state; 2) to assess the threshold and the actual parameters of financial security indicators in the social sphere; 3) to analyze the dynamics and the structure of the state expenditures for the "Social Policy" (the official section of the budget classification of expenditures); 4) to identify the current trends in public policy on the main components of the system of social protection of the population (pensions, social services, maternity and childhood protection); 5) to formulate the key areas for financial security support in the sphere of social protection of the population.

The crisis in the system of the social protection of the population of the welfare state is being actively studied in scientific papers on the basis of materials from different countries, for example, Canada (Berg, &Gabel, 2017), the European Union (Kuitto, 2016; Sabato et al., 2017). The shift to an active policy in the labor market instead of state expenditures for the social assistance for the unemployed is conceptualized (Iacono, 2017). The issues related to the need to establish the minimum standards for the social protection are raised (Deeming, 2017), which, in our opinion, can be attributed to the indicators of financial security in the social sphere. The possibilities to support the financial security of the population through the application of insurance programs designed to minimize the financial consequences associated with various risks, including the social ones, are constantly under the supervision of specialists (Askerman et al., 2015; Miller, &Hayward, 2017). For Russian scientists, the problem of linking between the current system of formation of the pension resources and the threats to the financial security of the state is of great interest (Weller et al., 2014). More specific threats to security, such as disadvantaged families (Nunn, &Tepe-Belfrage, 2017), and shortened life expectancy as a result of limited social policies (Beckfield, &Bambra, 2016) are also considered.

For the purposes of this study, a list developed by the Institute of Economics of the Russian Academy of Sciences (Senchagov, 2011) is used as the basis for the indicators of financial security in the social sphere. Since the system of financial security indicators is an open system, it can be supplemented with new indicators in proportion to the development, improvement and amplification of the financial flows. We recognize the social expenditures of the state as the expenditures of the budget system (the budgets of public entities and extra-budgetary funds of the state) in the spheres of social protection of the population, education, health, culture, media, physical culture and sports.

There is no universal, universally recognized definition of the sphere of social protection (Romanov, 2015) or a comprehensive list of its objectives. Usually, the social protection is understood as the activity of state or private organizations aimed at the mitigation of certain risks or provision of certain needs of households or individuals. The risks or needs that may require the social protection usually include the illnesses and the treatment, the disability, the old age, the death of a family member, the families with children, the unemployment, the housing and other social vulnerabilities (Eurostat, 2012, p. 10). In Russia there is a problem of the correlation of the concepts: in the official budget classification, the expenditures for the social protection of the population are presented in the section "Social Policy", while the very concept includes a wider range of issues (education, health care, etc.). For the purposes of this study, the official approach is used to construct a classification of expenditures of the budgets; the data on budgetary and extra-budgetary funds of the state are analyzed according to the section "Social Policy".

All the developed countries in the world are experiencing the difficulties in solving the dilemma: the need to constrain the total amount of state expenditure with a steady increase in the social expenditures, including the social protection of the population.

At the same time, it is important to understand that various aspects of the mission of the social policy are not only organically interrelated, but also partly contradict each other. The strains between them are most noticeable during periods of economic difficulties, when the choice between different uses of the resources becomes particularly difficult and responsible (Kuzminov et al., 2015).

The comparison of the countries of the Group of Twenty (G20), which includes the European Union as a whole and 19 countries of the world (including 4 EU-28 countries – Great Britain, Germany, Italy, France) with the largest and quick-growing economies, shows that they spend the most on the social protection in the EU-28. According to the estimates for 2013, the expenditures for the social protection in the EU-28 amounted to 28.1% of GDP, which is significantly higher than in the other two triad countries – Japan (23.1% as of 2011) and the United States (18.6%). As for other G20 countries, only in Brazil more than 20% of GDP were spent on social protection (21.3%), from 17% to 19% were spent in Australia, Argentina, Russia and Canada. On the other hand, in India, Indonesia and Saudi Arabia, less than 4% of GDP is allocated to the social protection. Compared with 2003, the expenditures for the social protection increased in all G20 countries, most notably in South Korea (+ 89%) and Russia (+ 77%), least notably in Canada (+ 6%). In the EU-28, they increased by 10% (Shcherbakova, 2016).

There are a number of factors that entail the inevitable growth of social spending. The authors identified four such factors, the first three of which are independent of the fluctuations in the business cycle, while the fourth one is related to the temporary economic difficulties, but it causes such large-scale consequences that its impact requires some serious research. So, let us define the following factors, the manifestation of which is noted in both Russian and foreign practice.

1) The increase in the cost of the social protection services in the state and in the private sectors, for various reasons, for example, the introduction of new technologies, the expensive research. The growth of the state social expenditures over the past 20 years has been observed on average in the OECD countries and even exceeded the GDP growth. The social protection services refer to the market of imperfect competition; they have low price elasticity, and they are irreplaceable. This is especially evident in the sphere of medical care for elderly people and children.

2) The medical-demographic "diseases of modern civilization" (aging of the population, low birth rate, population decline, morbidity), which, in addition to the current growth in the number of consumers of mainly social services (the sick persons, the pensioners, the people with disabilities), leads to impossibility of normal replacement of the generations in the long run.

Thus, according to the Eurostat's forecast (Eurostat, 2013), during the period of 2014-2080 the processes of aging in the society will grow: in 2014, the share of people of working age accounted for 65.9% of the population of the European Union, and the share of persons in the age of 65-79 years amounted to 13.4%, the share of persons in the age of 80 years and older amounted to 5.1%, but by 2080 the proportion of people of working age will decrease to 56.2%, and the share of the persons in the age of 65-79 and over 80 years old, on the contrary, will increase to 16.4 and 12.3% respectively. The forecast for the Russian Federation, represented by the low, medium and high variants for 2016-2031, published on the official website of Rosstat (Federal State Statistics Service, n.d.), is similar to the forecast for Europe. If weanalyze the data by the middle variant, then in 2016, the share of the persons of working age will account for 57.4% of the total population of the country, in 2031 – 53.6%; the proportion of people older than working age will increase from 24.6% to 28.7%, respectively. But the value of the ratio of the people of working age and olderfor the EU countries in 2014 amounted to 3.56:1, and in 2080 will be 1.95:1. In Russia, this ratio was 2.3:1 in 2016, and 1.86:1 in 2031, that is, it is significantly lower, at least in the starting point.

3) To take the response measures to neutralize the consequences of the first two factors and to ensure the stability of society, as it was noted above, regardless of the phase of the economic cycle (the state policy in the field of demography, migration, education, health, social protection, including the pensions). Thus, the parent (family) capital program has been implemented in Russia in order to improve the demographic situation. During the period of its implementation, certificates were issued to 6.3 million families; it was planned to pay out 304.3 billion rubles in 2016. The termination of this program is being discussed persistently, but the government of the country seeks to continue it, although for the first time since the beginning of its implementation (2007) in 2016 and 2017 the indexation of the parent capital is not provided.

4) The economic crisis, the manifestation of which, on the part of the state's revenues, is the decrease in budget revenues and, on the part of expenditures, the need to finance the anti-crisis actions, including inter alia the support for the categories of citizens more affected by its consequences (temporarily unemployed, socially vulnerable, etc.).

For example, in the USA, the sum, equal to 700 billion dollars, was allocated for the Troubled Assets Release Program in 2009, the general anti-crisis package included the activities to support the banking sector, the large enterprises, the education, the health care, the deposit insurance, the struggle against unemployment and other social costs. The total European anti-crisis plan in 2009 provided for 5 billion euros; in addition, each EU country has taken its own measures. 585 billion dollars were allocated in China for the anti-crisis actions in 2009-2010.

The Government's anti-crisis action plan for 2016, only in terms of social protection envisaged to implement the additional measures in the field of employment of the population, maintaining the achieved level of provision with the state (municipal) services (guarantees) in a number of areas: to provide the certain categories of persons with medications, to provide the disabled with the technical means of rehabilitation, to support the manufacturers of medicines, to help certain categories of borrowers with the mortgage housing loans, etc. Unfortunately, the data on funding of many points of the anti-crisis plan are not available, which makes it impossible to evaluate the feasibility, but a total amount equal to 250 billion rubles was stated by A. Siluanov, the Minister of Finance of Russia (Press center of the RF Ministry of Finance, 2016)

When analyzing the parameters of financial security in the social sphere, the greatest violation of the level of security is observed according to the level of poverty and property stratification of the society (see Table 1).

Table 1.The parameters of the threshold and actual values of the

indicators of financial security in the social sphere

Name |

Threshold |

Actual values |

||

2000* |

2009* |

2010* |

2015 |

|

Average life expectancy, years - among men |

- |

≥77 |

61 |

71.4 |

- among women |

- |

≥85 |

73 |

65.9 |

The average estimated number of births per one woman |

- |

≥2.2 |

1.54 |

1.77 |

Ratio of the number of people of pensionable and working age,% |

- |

≤40 |

50 |

42.7 |

Funds for health, education and culture,% of GDP |

- |

≥15 |

9 |

7.56 |

Share of population with incomes below the subsistence minimum in the whole population,% |

7 |

≤6 |

13 |

13.3 |

Ratio of the average pension to the average wage,% |

- |

≥40 |

37 |

35.2 |

The ratio of the funds (ratio 10% of high-yield and 10% of low-income population), times |

8 |

4-7 |

16.8 |

15.7 |

The ratio of per capita income of the population to the subsistence minimum, times |

3.5 |

- |

3.5 |

3.14 |

Unemployment rate by ILO methodology,% |

5 |

≤4 |

7,5 |

5,6 |

Housing area per capita, m2 |

- |

≥30 |

22 |

24.4 |

Source: * – the data as of 2000, 2009, 2010 – Senchagov, 2011; the data as of 2015 – Rosstat

Among the overall objectives of the implementation of financial policy, a reduction in the level of inflation, the achievement of the macroeconomic stabilization, etc., should be noted; at the same time, all of them should serve one objective – to ensure the welfare of the entire population, which can be judged in the most general form by the reduction of the proportion of the population with the incomes below the minimum cost of living.

According to the Federal State Statistics Service, in 2012-2015 the share of the population with the incomes below the subsistence minimum was decreasing, which means that this objective of financial policy is consistently being resolved. However, the authors consider it necessary to note the existence of the shortcomings in the methodology for determination of the subsistence minimum, which leads to underestimation of its approved size, and as a result, to the inaccurate representation of the information on the number of poor people.

Nevertheless, according to the official statistics, since 2012, the share of the population with average per capita monthly incomes has decreased from 7 to 20 thousand rubles, and without exception, by years in all categories submitted by Rosstat: 7-9, 9-12, 12 -15, 15-20 thousand rubles, due to the growth of the share of the population with incomes of 20 thousand rubles and higher, with the largest increase in the share of citizens with the incomes exceeding 60,000 rubles per month –2 times for the period 2012-2015.

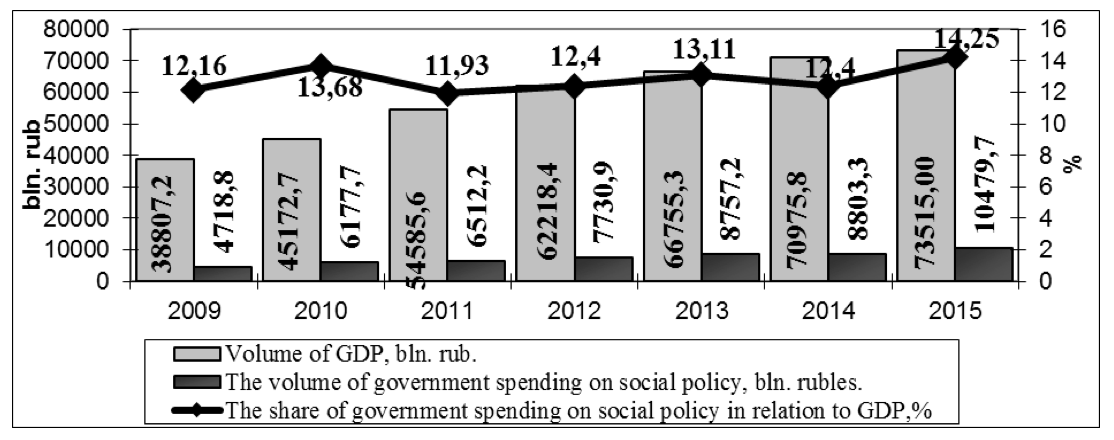

Despite the difficult modern conditions for the development of the economy, there is an increase in the share of government spending on social policy in relation to GDP. So, in 2015, this indicator was 14.25% of the total GDP compared to 12.16% of GDP in 2009 (see Figure 1).

Source: Calculated by the authors on the basis of the annual reports on the implementation

of the consolidated budget of the Russian Federation (Federal Treasury (The Treasury of Russia),

http://www.roskazna.ru

Figure 1. The state expenditures for the social policy in 2009-2015.

The positive dynamics is also demonstrated by the absolute growth of the state expenditures for the social policy. So, in 2011 the state expenditures under the section "Social Policy" of the budget classification of the expenditures amounted to 6,512.22 billion rubles, while by 2015 they had increased by 3,967.53 billion rubles and in this year they were executed in the amount of 10,479.75 billion. rub.

The growth rate of the state social expenditures is much higher than the growth rate of the state expenditures in general. In Russia, the emphasis in public spending is on the support for the national economy, national security, with a steady increase in social spending.

Nevertheless, the trends that currently appear in the financing of the state system of social protectionare highly controversial. Despite the increase in the volume of the state resources in absolute terms, there is a decrease in the specific value of the state expenditures on social security of the population, the reduction in the cost of social services, and the insignificant expenditures for the protection of the family and childhood (see Table 2).

Table 2.The composition and the structure of the public expenditures

under the section "Social Policy" in 2011-2015, in billion rubles.

Name

|

2011 |

2012 |

2013 |

2014 |

2015 |

|||||

Amount, bln. rub. |

Share, % |

Amount, bln. rub. |

Share, % |

Amount, bln. rub. |

Share, % |

Amount, bln. rub. |

Share, % |

Amount, bln. rub. |

Share, % |

|

SOCIAL POLICY |

6,512.22 |

100 |

7,730.89 |

100 |

8,757.18 |

100 |

8,803.27 |

100 |

10,479.7 |

100 |

Pension support |

4,379.59 |

67.25 |

5,007.74 |

64.77 |

5,884.36 |

67.19 |

6,136.77 |

69.7 |

7,009.48 |

66.89 |

Social service of the population |

292.81 |

4.50 |

325.88 |

4.22 |

221.52 |

2.52 |

245.13 |

2.78 |

251.96 |

2.41 |

Social security of the population |

1,307.98 |

20.09 |

1,797.80 |

23.22 |

1,873.38 |

21.39 |

1,932.26 |

21.95 |

2124.02 |

20.27 |

Protectionof the family and childhood |

241.32 |

3.71 |

293.83 |

3.8 |

339.81 |

3.88 |

414.28 |

4.71 |

497.93 |

4.75 |

Applied scientific research in the field of social policy |

0.283 |

0.004 |

0.209 |

0.002 |

0.406 |

0.004 |

0.267 |

0.003 |

0.19 |

0.0018 |

Other issues in social policy |

290.23 |

4.46 |

305.43 |

3.95 |

437.7 |

4.99 |

74.56 |

0.85 |

569.16 |

5.43 |

Source: Calculated by the authors on the basis of the annual reports on the implementation

of the consolidated budget of the Russian Federation (Federal Treasury (The Treasury of Russia),

http://www.roskazna.ru

The analysis of the structure of public spending on social policy reflects a clear shift in funding towards the pension support. Thus, the share of the expenditures under the section "Pension provision" in the period of 2011-2015, accounted for an average of 67.16% of the total amount of public expenditures under the section "Social Policy".

The concentration of the public expenditures primarily under the subsection "Pension support" can be explained by the large contingent of recipients of this type of social transfers, which increases year by year. As of January 1, 2016, there were 45,182,000 retirees in Russia, which is more than the same indicator in 2010 by4,038 thousand people, i.e. on average, the annual growth of pensioners is more than half a million people.

Another factor in the growth of the state expenditures on pension support is the indexation of the size of the pensions for the citizens and the valorization of the pension rights of the elder generation.

From February 1, 2015, the insurance pensions were increased by 11.4%, which was the highest indexation in the last few years. The average size of the old-age insurance pension has increased by 1,261 rubles during the year and amounts to 12,830 rubles. The pensions under the state pension provision have been indexed since April 1, 2015 by 10.3%. The average size of the social pension has increased by 754 rubles and amounts to 8,302 rubles (Pension Fund of the Russian Federation,2015, p.45).

In the current economic situation in the country in 2016, the order of the annual indexation of the pensions was changed. Earlier, until 2016, the pensions were indexed taking into account the growth of the consumer prices (insurance pensions) or the increase in the subsistence level of the pensioner (pensions under the state pension provision).

In 2016, the insurance pensions only for non-working pensioners have been indexed since February 1, 2016 by 4 percent (with the inflation equal to 12.9 percent for 2015), and since April 1, the pensions under the state pension support have beenindexed by 4 percent. In this regard, the authorities decided to compensate the pensioners for the remaining period of 2016 (before the new indexation in 2017) in the form of a lump sum payment, the difference between the inflation rates for 2015 and the indexation conducted from February 1, 2016. The amount of a one-time payment is set at 5,000 rubles. To carry out a lump sum payment to the pension, it is planned to allocate 232.2 billion rubles.

In the medium term, the legislation provides for the following indexation of the pensions:

- the insurance pension – since February 1 to the level of inflation of the previous year (in 2017 – 5.8%, in 2018 – 4.0% and in 2019 – 4.0%);

- the social pensions – since April 1 to the growth rate of the subsistence minimum of the pensioner in 2017 by 2.6%, in 2018 – by 4.5% and in 2019 – by 9.6%.

As a result of the indexation at the end of 2017, the size of the insurance pension should be 13,209 rubles, and the size of the social pension should be 8,859 rubles (Ministry of Finance of the Russian Federation, 2016, p. 32).

In addition to the payment of the various types of pensions, there are a number of other social transfers provided to the privileged categories of the citizens in the pension system. Here we mean: a monthly cash payment; a set of social services, an additional monthly material support; an additional material security for the outstanding achievements and special merits, etc. The basis for the provision of these social transfers is the citizen's belonging to a particular category, which has a special legal status.

In 2015, more than 16 million people received a monthly cash payment. Of them, 270.07 thousand people are the recipients of more than one such payment. The average amount of the accrued monthly cash payments for the country amounted to 1,819 rubles. The largest amount of payments, 42,342 rubles, is provided for the Heroes of the Soviet Union, the Heroes of the Russian Federation, the full Cavaliers of the Order of Glory and the members of their families; meanwhile, the monthly monetary payment to the disabled children was only 1,680 rubles. The authors consider it important to note that the financing of these types of social security is primarily carried out through transfers from the federal budget.

The size of the monthly monetary payment to the federal social security beneficiaries has been indexed by 7.0%since February 1, 2016, and since February 1, 2017, it has been indexed by the inflation rate of the previous year, equal to 5.8%).

Thus, currently, the existing system of social protection of citizens shifts towards the support for the elder citizens and other recipients of the social transfers in the pension system, limiting the amount of financial resources, directed to other areas, primarily to the social service system, as well as to the support of the motherhood and childhood.

Thus, for the last 5 years, the state expenditures for the social services for the citizens have declined both in absolute and in relative terms. In 2011, these expenses were executed in the amount of 292.81 billion rubles and accounted for 4.5% of the total amount of the state expenditures for the social policy, and by 2015 they have reduced to 251.96 billion rubles and became 2.41% of the state expenditures under the section "Social policy" of the budget classification of the expenditures.

In part, this dynamic can be explained by the reduction in the number of social service institutions conducted within the framework of the restructuring of the budget network. So, for example, only in 2014 in the course of optimization 143 social service institutions were liquidated or reorganized. By 2018, the executive authorities of the regions of Russia plan to reduce this network by another 260 social service institutions. Of course, these measures significantly reduce the burden on the budgets, which is quite relevant in the current economic conditions; however, this situation entails a reduction in the number of employees of the social service institutions. According to the Russian Accounting Chamber, in 2014 the average number of employees of the social service institutions decreased by 6.5% (Russian Accounting Chamber, 2016). The fired workers can later join the ranks of the unemployed citizens, which will lead to the need for their social support in the framework envisaged by the social protection system for the legal obligations. In addition, the decline in the amount of the government funding for the social service system creates the risk of increasing of the number of paid social services, while reducing the number of free services, which can adversely affect the quality of life of the vulnerable categories of citizens (Sukhoveeva, 2011).

In regard tothe current skewing of the social policy towards the pension support, the expenditures for protection of the family and childhood are very low. In 2015, 497.93 billion rubles were allocatedfor this direction, which is 4.75% of the total amount of public expenditures under the section "Social Policy". Meanwhile, the subsection "Protection of the Family and Childhood" provides for the expenditures directed to the financing of the social protection for the least protected categories of citizens of our society – orphans and children left without parental care. In particular, under this subsection, the expenses related to: the provision of housing to orphans and children left without parental care; the transportation of minors who have arbitrarily left their families, the orphanages, the boarding schools, the special educational institutions; the implementation of the social support measures in the form of benefits for the guardianship and trusteeship, etc., should be noted.

Thus, it is necessary to look for the mechanisms to smooth out the imbalances in the social policy of the state, including through the reform of the pension system. The following directions of such reform are proposed:

- to refuse to pay the pension (or its fixed part) to the working pensioners;

- to reform the institution of early retirement;

- to raise the retirement age for all pensioners (from January 1, 2017, the retirement age was increased for civil servants in connection with the adoption of the Federal Law of May 23, 2016 No. 143-FZ "On Amending the Certain Legislative Acts of the Russian Federation in Part of Increasing the Retirement Age to the Certain Categories of citizens").

In the course of the study of the expediency of these measures earlier (Andreeva et al., 2016), the authors came to the conclusion that their introduction is really necessary to achieve the long-term balance and effectiveness of the Russian pension system; moreover, the implementation of these measures will reduce the state expenditures and will free up additional financial resources that can be used to finance other areas of social policy. However, these measures relate primarily to the reform of the social insurance system and do not affect any social transfers paid outside its framework. Meanwhile, the authors believe that currently it is also necessary to develop a mechanism to reform the state pension system with regard to the payment of other social transfers other than pensions, aimed both at the optimization of the number and the categories of their recipients, and at the structuring of the grounds for their provision.

The developed market countries that focus on the social transformations concentrate their efforts on the elimination of high differences in the level of incomes of the population, eliminating them through the established system of social protection and various forms of it.

The economic difficulties that are being experienced have a negative impact on theability of the state to implement an adequate social policy. At the same time, only in terms of the availability of the high-quality social services for those who really need them, we can talk about the improvement of the level of welfare of Russian citizens as a whole. The social policy is implemented at the expense of the budgetary and non-budgetary financing. The state expenditures undergo serious changes in the process of application of the new methods of public financial management (program, project), which requires the development of a methodology for assessing their effectiveness. The market model of social policy is characterized by the differentiated approach to different groups of the population, and, to be even more correct, – the targeted approach to each specific household, that is why the role of the state for the able-bodied citizens should be reduced to creation of the conditions for improvement of their employment and development the independence in financing the social services, and state support should be provided to the citizens in case of illness, accidents, old age and loss of employment.

Since the financing of the social sector is multichannel by nature and includes a number of sources: the funds of budgets of all levels, the state extra-budgetary funds, the voluntary medical, social and pension insurance, the enterprises, institutions and organizations, the personal funds of citizens and other sources not prohibited by the law – the estimation of the financing potential is extremely important (taking into account the shadow economy), and on this basis – the development of an adequate financial mechanism and financial policy in this area.

The rise in the welfare of the population, including through a system of social protection that is adequate to modern conditions, should be considered one of the main directions for ensuring Russia's national security in the internal economic activity.

A mandatory condition for the development of the social protection of the population is the prosperity of the economy as a whole, but some specific changes in the approaches to the formation and use of own financial resources of social protection as an independent sector of the national economy are required. There are various solutions to these problems, determined by the need to transform the financial mechanism of social protection of the population.

Over the years of market reforms and legislative changes in the country, an effective model of social policy has not been worked out yet, which creates the threats to the economic security. The need for finding the solutions to the escalated conflict between the inevitability of adoption of the austerity measures in the interests of macroeconomic stabilization, the balance of the budget system and the long-term objectives of the social policy.

The most important direction in the development of the theory of state financial policy for the social protection of the population should be the development of the matters of adequacy of the volume and structure of the expenditures at the expense of the budgets of the budgetary system of the Russian Federation, the improvement of the effectiveness of their financing, the use of the innovative approaches in the planning and forecasting of the financial resources for the social protection of the population, the organization of the internal and external control, etc.

All this constitutes the most important condition for the provision of the financial security of the Russian state, and hence its strengthening and real provision of the social guarantees.

The authors express their gratitude to the Rector of the Rostov State Economic University, Doctor of Economics, Professor A.A. Albekov for the support of their research initiatives. Also, the authors express their gratitude to Doctor of Economics, Professor N.G. Vovchenko and to Doctor of Economics, Professor O.B. Ivanova for their assistance in discussing the results of the study.

Ackerman, S., Barlow, P., Bruning, L., Halvorson, A., Inglis, E., Rosen, S., &Wildsmith, T. (2015). Sustainability in American Financial Security Programs. Paper 6. Washington: American Academy of Actuaries.

Andreeva, O.V., Sukhoveeva, A.A., &Kochetova, A.I. (2016). Kontseptsiya "individualnogo pensionnogo kapitala" – novyi instrument pensionnoi reformy[The Concept of "Individual Pension Capital" Is a New Instrument of the Pension Reform]. Ekonomika i predprinimatelstvo, 11(2): 1052-1054.

Beckfield, J., & Bambra, C. (2016). Shorter Lives in Stingier States: Social Policy Shortcomings Help Explain the US Mortality Disadvantage. Social Science and Medicine, 171: 30-38.

Berg, N., & Gabel, T. (2017). Who Was Affected by New Welfare Reform Strategies? Microdata Estimates from Canada. Applied Economics, 49(14): 1395-1413.

Deeming, C. (2017). Defining Minimum Income (and Living) Standards in Europe: Methodological Issues and Policy Debates. Social Policy and Society, 16(1): 33-48.

Eurostat. (2012). ESSPROS Manual and User Guidelines. http://ec.europa.eu/eurostat/web/products-manuals-and-guidelines/-/KS-RA-12-014. (accessed April 23, 2017).

Eurostat. (n.d.). 2020-80: Projections (Europop 2013). http://ec.europa.eu/eurostat/statistics-explained/index.php/. (accessed April 23, 2017).

Federalnaya sluzhba gosudarstvennoi statistiki[Federal State Statistics Service]. (n.d.). http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/en/statistics/population/demography/#. (accessed April 23, 2017).

Ilyin, V.N. (2016). Ekonomicheskaya bezopasnost v sisteme natsionalnoi bezopasnosti RF [Economic Security in the National Security System of the Russian Federation]. NovaInfo, 1(50): 157-165

Kuitto, K. (2016). From Social Security to Social Investment? Compensating and Social Investment Welfare Policies in a Life-Course Perspective. Journal of European Social Policy, 26(5): 442-459.

Kuzminov, Ya.I., Ovcharova, L.N., & Yakobson, L.I. (Eds.). (2015). Social Policy: Long-Term Trends and changes in Recent Years. Short Version of the Report: Report for the XVIth April International Scientific Conference on the Problems of Development of the Economy and Society, Moscow, 7-10 April 2015. Moscow: Publishing House of the Higher School of Economics, pp. 51.

Iacono, R. (2017). Minimum Income Schemes in Europe: Is There a Trade-Off with Activation Policies? IZA Journal of European Labor Studies, 6(1): 1-15.

Miller, P., & Hayward, D. (2017). Social Policy ‘Generosity’ at a Time of Fiscal Austerity: The Strange Case of Australia’s National Disability Insurance Scheme.Critical Social Policy, 37(1), 128-147.

Ministry of Finance of the Russian Federation. (2016). Byudzhet dlya grazhdan. K federalnomu zakonu ofederalnom byudzhete na 2017 god i na planovyi period 2018 i 2019 godov [Budget for Citizens. To the Federal Law on the Federal Budget for 2017 and for the Planning Period of 2018 and 2019]. http://minfin.ru/en/document/?id_4=116961 (accessed April 23, 2017).

Nunn, A., & Tepe-Belfrage, D. (2017). Disciplinary Social Policy and the Failing Promise of the New Middle Classes: The Troubled Families Programme. Social Policy and Society, 16(1): 119-129.

Pension Fund of the Russian Federation. (2015).Publichnyi godovoi otchet za 2015 g. [Public Annual Report for 2015]. http://www.pfrf.ru/about/isp_dir/. (accessed April 23, 2017).

Press Center of the RF Ministry of Finance.(2016, February 29).Novosti Press-tsentra Ministerstva finansov[News of the Press Center of the Ministry of Finance]. http://www.minfin.ru/en/press-center/. (accessed April 23, 2017).

Romanov, D.G. (2015). Sotsialnaya zashchita naseleniya: ekonomicheskoe soderzhanie I obektivnaya neobkhodimost [Social Protection of the Population: Economic Content and Objective Necessity]. Finansovye issledovaniya, 2(47): 99-107.

Sabato, S., Vanhercke, B., & Verschraegen, G. (2017). Connecting Entrepreneurship with Policy Experimentation? The EU Framework for Social Innovation. Innovation: The European Journal of Social Science Research, 30(2): 147-167.

Schetnaya palata proverila optimizatsiyu v sfere zdravookhraneniya, kultury, obrazovaniya i sotsialnogo obsluzhivaniya[The Accounting Chamber Has Examined the Optimization in the Sphere of Health Care, Culture, Education and Social Services].(2015, April 13). The official site of the Accounting Chamber of the Russian Federation. http://www.ach.gov.ru/press_center/news/21297 (accessed April 23, 2017).

Shcherbakova, E.M. (2016). Sotsialnye raskhody v ES-28 [Social Costs in the EU-28]. Demoskop Weekly, 701-702: 1-27.

Senchagov, V.K. (2011). Obespechenie finansovoi bezopasnosti Rossii v usloviyakh globalizatsii [Ensuring Russia's Financial Security in the Context of Globalization]. Vestnik Rossiiskoi akademii estestvennykh nauk, 3: 14-19.

Sukhoveeva, A.A. (2011).Teoretiko-metodologicheskie podkhody k ponimaniyu sushchnosti i finansovomu obespecheniyu sotsialnoi zashchity naibolee uyazvimykh kategorii grazhdan [Theoretical and Methodological Approaches to Understanding the Essence and Financial Provision of social protection for the Most Vulnerable Categories of Citizens]. Ekonomicheskie nauki,6(79): 160-165

Weller, C., Rhee, N., & Arcand, C. (2014). Financial Security Scorecard: A State-by-State Analysis of Economic Pressures Facing Future Retirees. National Institute on Retirement Security. http://scholarworks.umb.edu/pppa_faculty_pubs/49 (accessed April 23, 2017)

1. Rostov State University of Economics, Russian Federation, 344002, Rostov-on-Don, Bolshaya Sadovaya st., 69

2. Rostov State University of Economics, Russian Federation, 344002, Rostov-on-Don, Bolshaya Sadovaya st., 69

3. Rostov State University of Economics, Russian Federation, 344002, Rostov-on-Don, Bolshaya Sadovaya st., 69

4. Rostov State University of Economics, Russian Federation, 344002, Rostov-on-Don, Bolshaya Sadovaya st., 69

5. Rostov State University of Economics, Russian Federation, 344002, Rostov-on-Don, Bolshaya Sadovaya st., 69