Vol. 38 (Nº 48) Year 2017. Page 17

Svyatoslav Nikolayevich GUSEV 1

Received: 12/06/2017 • Approved: 10/07/2017

ABSTRACT: This article explores possible approaches to constructing growth models suitable for comprehensive analysis, scenario forecasting, indicative planning of reproductive processes and scientific justification of the choice of goals and objectives, priorities and benchmarks, as well as a system of permanent and emergency measures of state regulation of macroeconomic dynamics. The thesis is that such constructions should meet a wide range of requirements – from a combination of cyclic and structural drivers of growth to the operational explanatory variables. Based on the meaningful synthesis of post-Keynesian, neoclassical and author's works, a model corresponds to the published criteria and guidelines. A methodological algorithm is proposed for specifying a selected set of factors that determine an aggregated output based on publicly accessible data of mandatory state statistical observation. It is concluded that the constructed model can be used as a promising tool for strategic programming of economic growth, which allows significantly improving the efficiency of managing its dynamics. |

RESUMEN: Este artículo explora posibles enfoques para la construcción de modelos de crecimiento adecuados para el análisis exhaustivo, previsión de escenarios, Planificación indicativa de los procesos reproductivos y justificación científica de la elección de metas y objetivos, prioridades y benchmarks, así como un sistema de medidas permanentes y de emergencia de regulación estatal de la dinámica macroeconómica. La tesis es que tales construcciones deben satisfacer una amplia gama de requisitos-de una combinación de conductores cíclicos y estructurales del crecimiento a las variables explicativas operacionales. Basándose en la síntesis significativa de las obras postkeynesianas, neoclásicas y de autor, un modelo corresponde a los criterios y directrices publicados. Se propone un algoritmo metodológico para especificar un conjunto de factores seleccionados que determinan una producción agregada basada en datos accesibles al público de la observación estadística obligatoria del estado. Se concluye que el modelo construido puede ser utilizado como una herramienta prometedora para la programación estratégica del crecimiento económico, lo que permite mejorar significativamente la eficiencia de la gestión de su dinámica. |

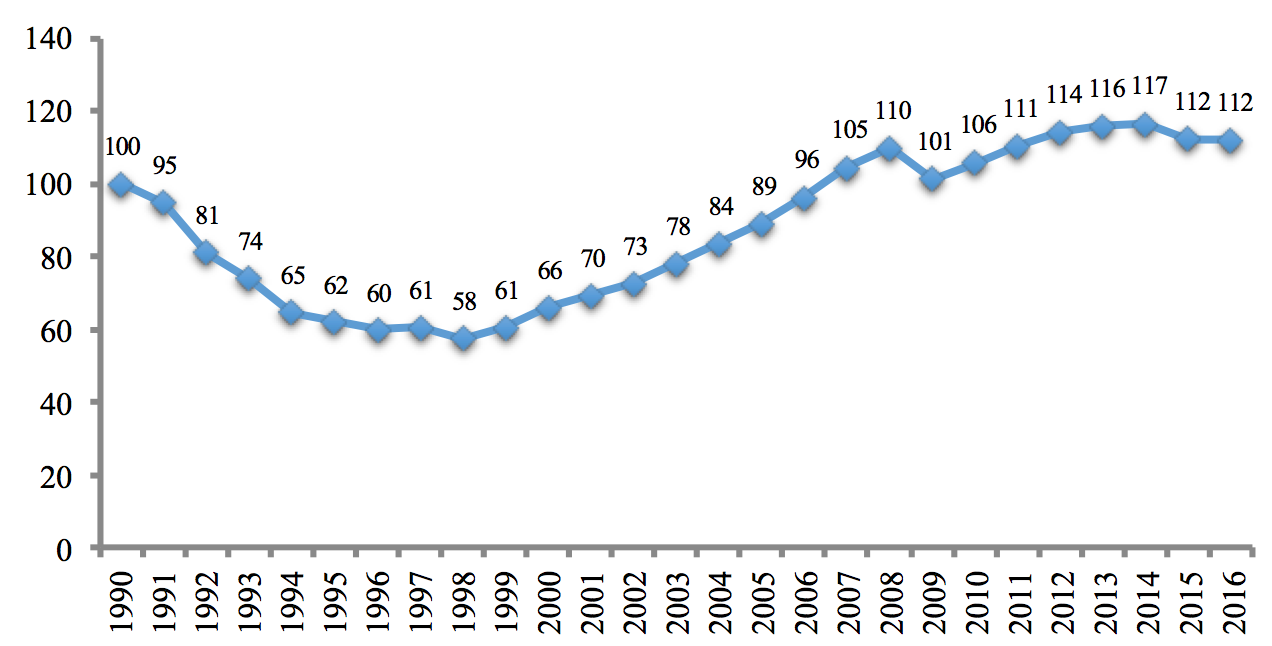

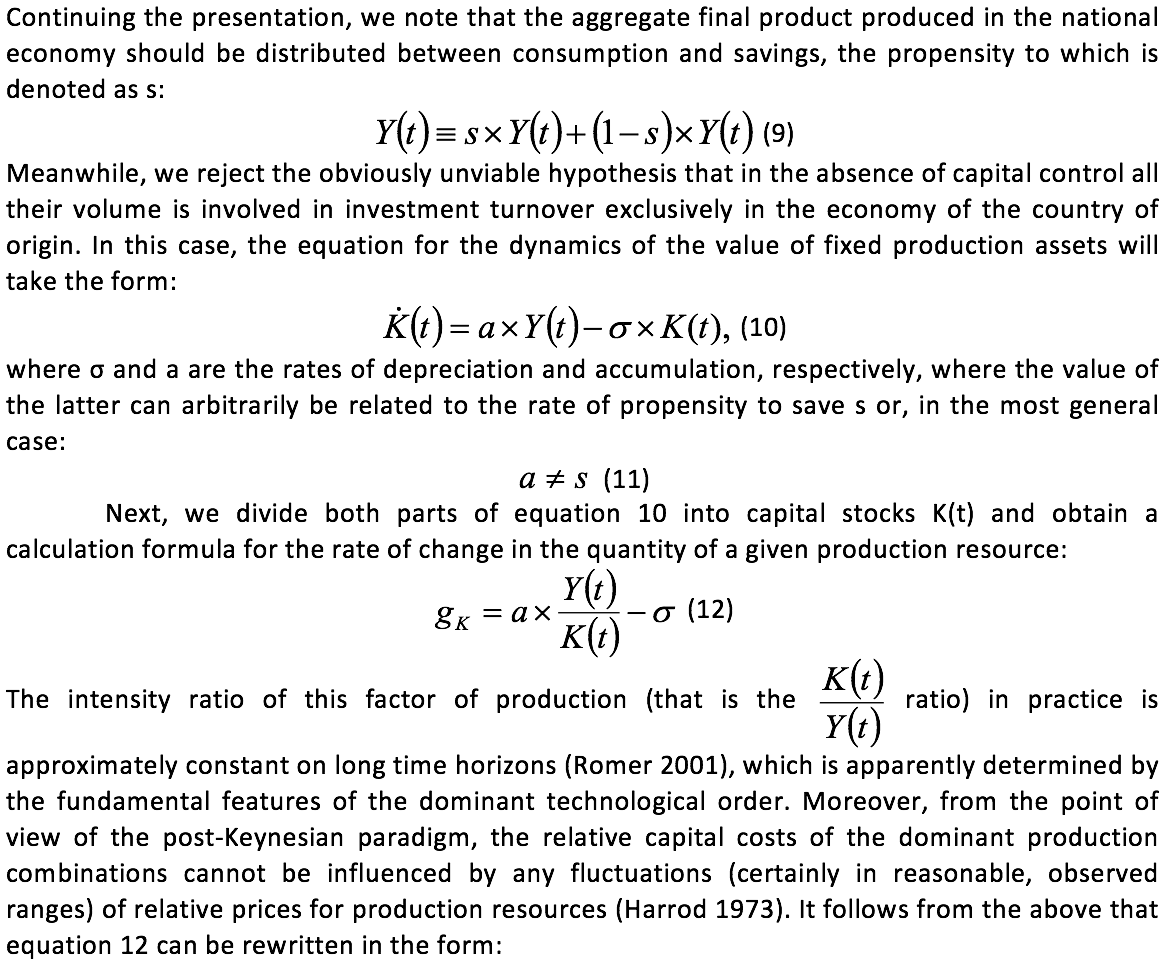

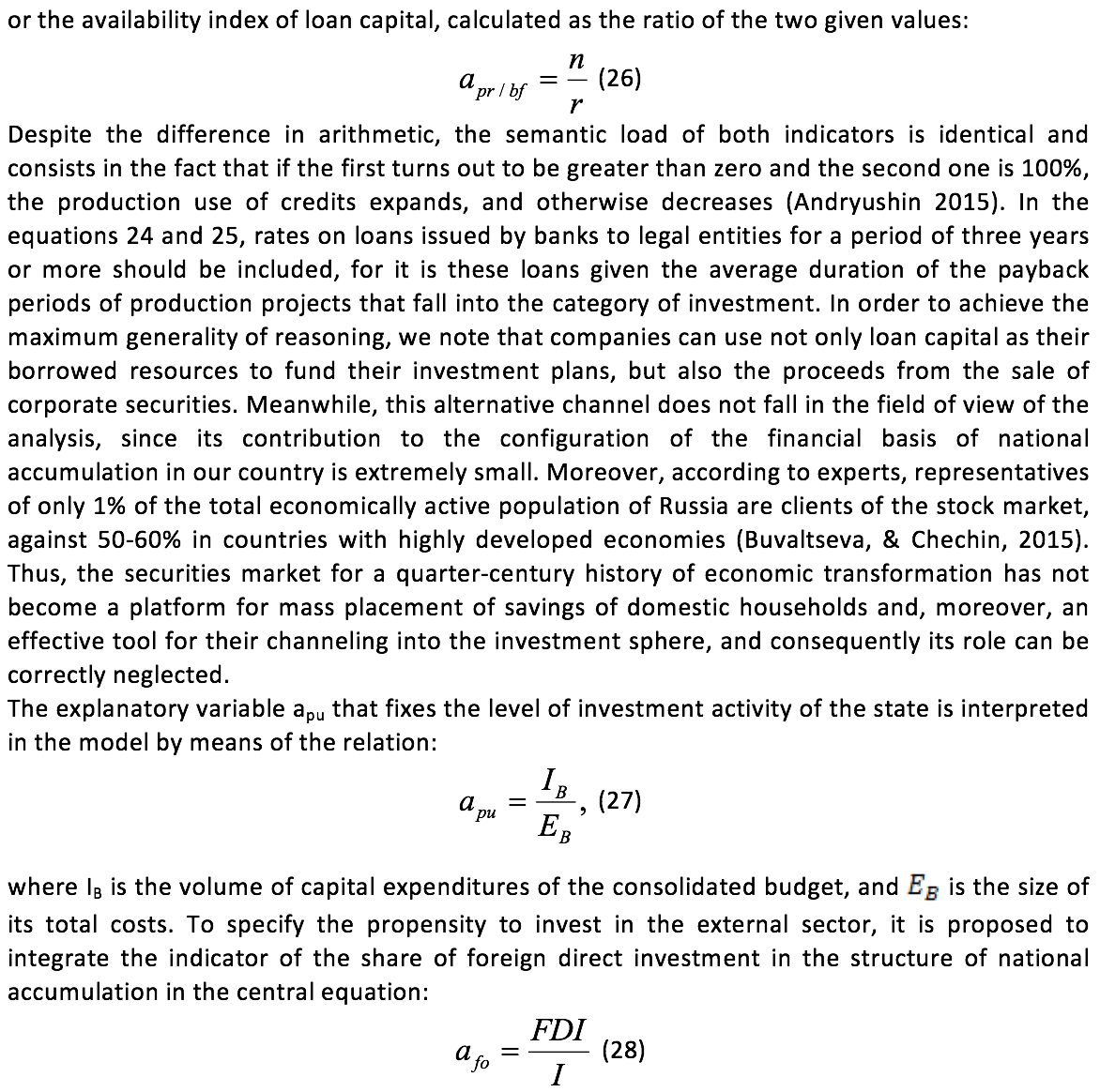

During the twenty-five-year period of transformation, despite the creation of formal market institutions, the main task facing the national economy was not solved: it never managed to reach the trajectory of sustainable, long-term growth, as a result of which the country's gross domestic product (GDP) to this day only slightly (Figure 1) exceeds the pre-reform value of this indicator (Popov 2012).

Figure 1. The index of physical volumes of the GDP of the

Russian Federation in 1990-2016 (in % of the 1990 level)

Thus, the transition stage in the development of the Russian economy can be fully characterized by the phrase "a lost quarter of a century of growth" (In Search of Lost Growth, 2016). As evidenced by the best foreign experience (Mozyas, 2015), such an outcome was not a priori given by certain objective laws of the transformation phase, but was a logical result of the economic policy pursued. In the current situation, the problem of forming a new, scientifically-argued paradigm of state management of macroeconomic dynamics (Mau, 2017), which is based on the ideology of its strategic programming, acquires particular urgency. In turn, the latter should be based on economic and mathematical modeling of reproductive processes, depending on the wide variety of structural and cyclical factors that determine the aggregated output.

The existing models of economic growth in a "pure" form are rather weakly correlated with the tasks of strategic programming of its dynamics. Actually, post-Keynesian and neoclassical constructions are more suitable for describing, explaining and interpreting the properties, features and patterns of economic growth than for forecasting, planning or, even more so, managing reproductive processes. Taking into account this circumstance, we formulate a set of requirements that should be presented to economic and mathematical models intended for strategic programming of the dynamics of the aggregated output. The essence of these criteria is as follows.

Firstly, the "practice-oriented" growth concepts should implement the fullest possible coverage of a wide variety of factors that determine reproductive processes, both from the supply side and from the demand side – that is, to combine both the rich macroeconomic nature of the neoclassical approaches and the Keynesian formulation of the problem of full employment.

Secondly, in the structure of such structures, the availability of inadequate, by modern standards of economic science, and empirically unconfirmed assumptions is unacceptable, for example, the hypothesis of permanent full employment or the equality of domestic investment to national savings that, in the absence of restrictions on the financial account of the balance of payments, may be involved in the investment turnover everywhere, and not only in the economy of the country of origin (Grigoriev & Ivaschenko 2011; Afontsev 2015; Popov 2013).

Thirdly, the desired models should, if possible, ensure the accounting and interpretation of the influence of the external sector of the economic system, both positive and negative. The first can be expressed in the intensive inflow of foreign direct investment and active transboundary transfer of modern achievements of scientific and technical progress, and the second is expressed in excessive export of capital resources abroad, which undermines the investment basis and the resource bases of accumulation in the national economy.

Fourthly, the explanatory variables that make up the concepts must be operational in nature, be in the "zone of responsibility", at least one of the most important – fiscal or monetary – component of economic policy, because otherwise there is a high probability of generating amorphous, devoid of regulatory principle and incompetent, from the point of view of applied tasks of state management of macroeconomic dynamics, developments.

Fifthly, when preparing the baseline conditions and model assumptions, it is necessary to avoid excessive unification, bearing in mind that the contribution of various production resources to aggregated output can vary over a wide range, depending on the type and level of development of specific economies, so that each of them, probably, has its own, and in a certain sense unique set of growth factors.

Finally, in the considered aspect effective constructions should operate with rather simple mathematical functions. The most productive approaches are often based on simple, "elegant" constructions, while more sophisticated ideas and ideas often leave more questions than answers.

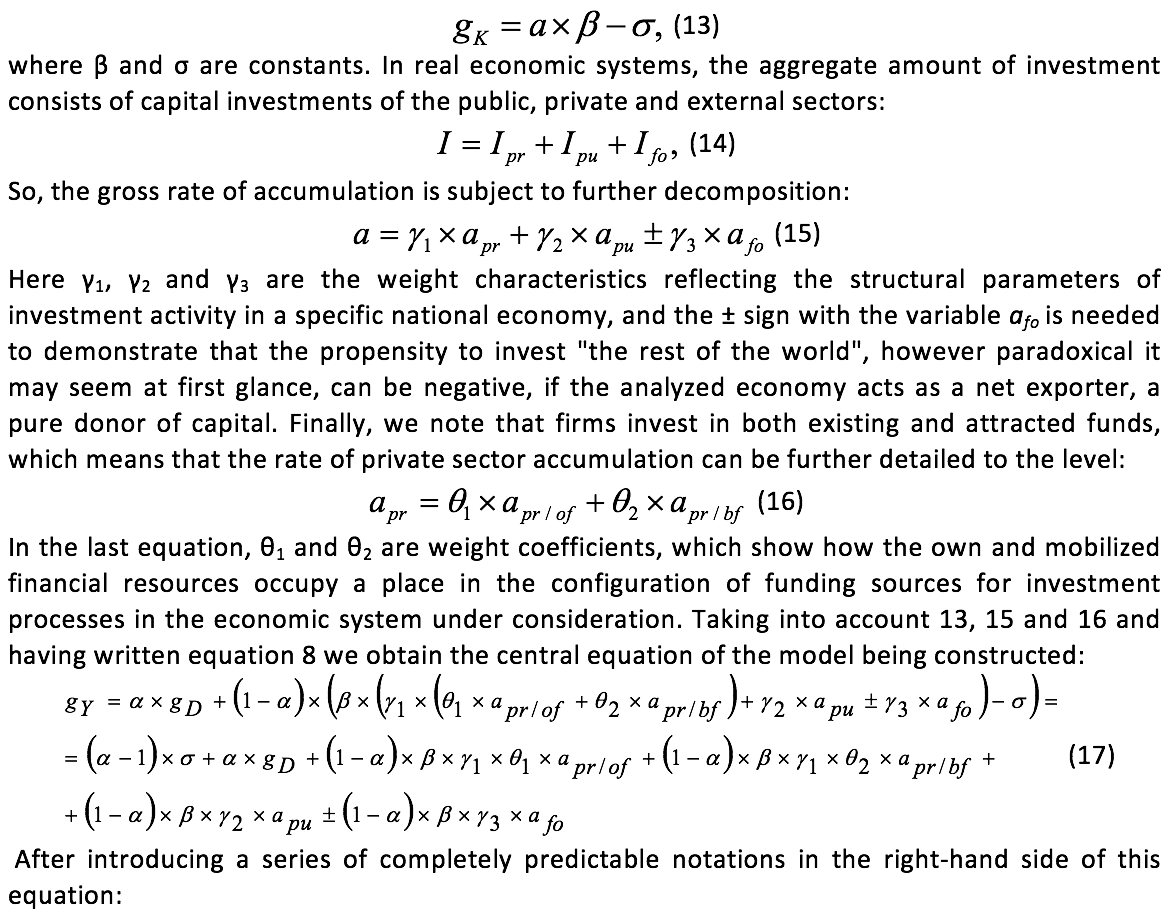

Refining and concretizing the formulation of the tasks from which one can proceed when creating models that are suitable for solving urgent problems of strategic programming of macroeconomic dynamics, let us pass directly to its description. Suppose that in this case the actual volumes of production of the generalized Y(t) are the sum of the balancing of the aggregate demand D(t) and the supply S(t), more precisely, the aggregate demand and potential output, the sizes of which, in turn, are determined by the production capacities of the economic system M(t). Since our concept is built within the hypothesis of a long time, it follows from the foregoing that at any given moment this takes place unambiguously:

![]()

Thus, in essence, we postulate that the productive forces of the national economy determine only a hypothetical, probable output level, while its real trajectory is the result of a two-way interaction with the integral parameters of consumption. We enumerate and characterize the most important properties and features of the function under discussion.

The first. It is logical to assume that this dependence is monotonically increasing in both arguments. In fact, there is no doubt that the expansion of the production potential of the economy and the increase in aggregate demand will have a positive effect on the dynamics of reproduction processes and will ultimately lead to an increase in the actual size of the output. In mathematical form, this condition is obviously equivalent to requiring the positive character of the first partial derivatives of the function 1 and can be written as:

The second. It is quite probable that the studied dependence belongs to the class of linearly homogeneous or, in other words, homogeneous units of unity, so it is true:

In fact, it seems absolutely reasonable to assume that the simultaneous growth of the production capacities of the economic system and the level of aggregate demand will lead to a similar increase in the actual volumes of production.

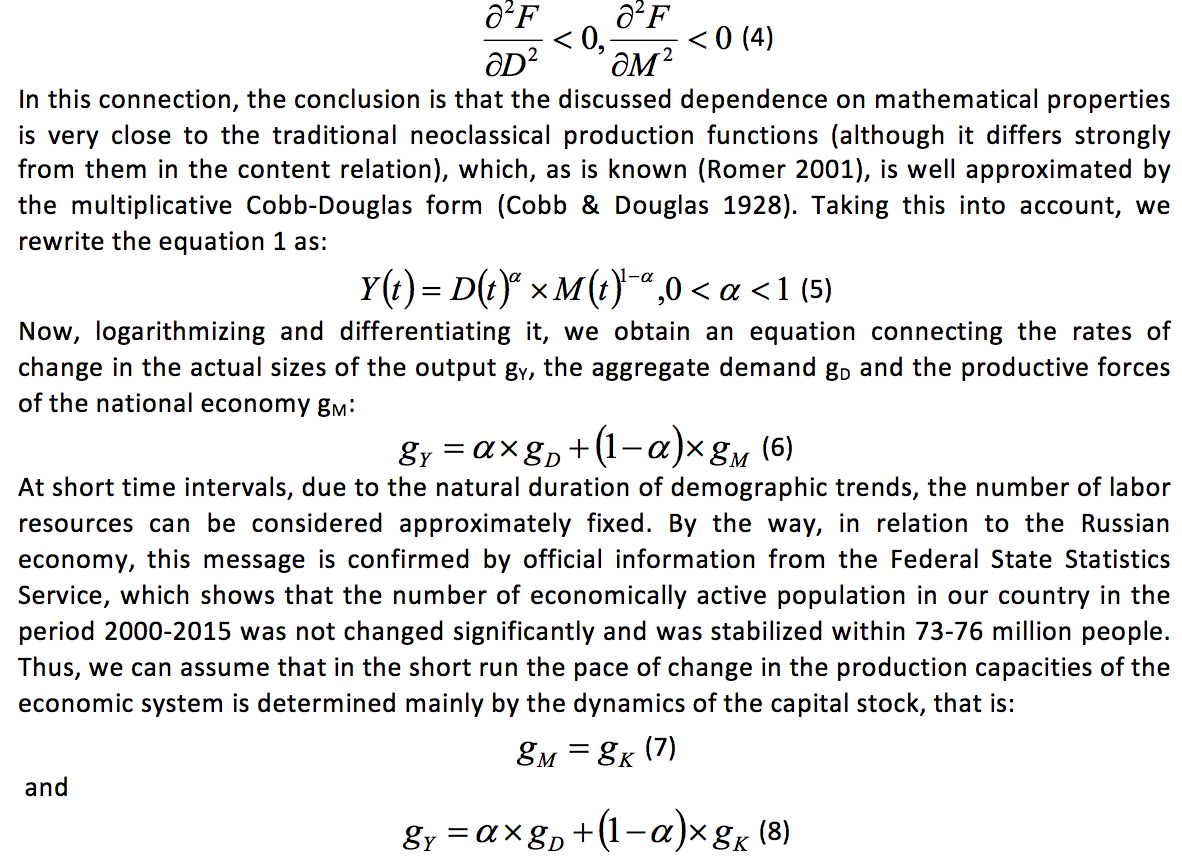

The third. Finally, one cannot exclude that our dependence is inherent in properties that are close in nature to the neoclassical principle of the diminishing marginal product. In the projection on the analyzed situation, it says that each subsequent increase in the value of one of the variable functions, not accompanied by similar changes in the value of the second, will generate an ever smaller contribution to the real output sizes – let us see how plausible this hypothesis is. Suppose that in the economy studied, the purchasing power of the population has increased, and the supply of productive forces has remained the same. It is easy to guess that in this case, firms that are trying to satisfy the increased demands of end users, probably, will be able to multiply the volumes of production of goods and services due to a more flexible combination, the use of available resources. Nevertheless, from the very beginning it is clear that such a reaction of the companies will become more moderate or, rather, damped with each subsequent expansion of aggregate demand, not supported by identical changes in the production capabilities of the economic system.

In the opposite situation, firms using an additional supply of factors of production will almost certainly raise the level of output, but inevitably they will face problems in selling their products because of the former capacity of the markets. Of course, such a discrepancy will force them to continue to be more restrained and not respond so recklessly to the positive dynamics of their productive potential, without regard to an objective assessment of the current state of effective demand for economic benefits. Summarizing the foregoing, one can agree with some reservations that the model being developed satisfies the principle of a decreasing marginal product whose mathematical interpretation has the following form:

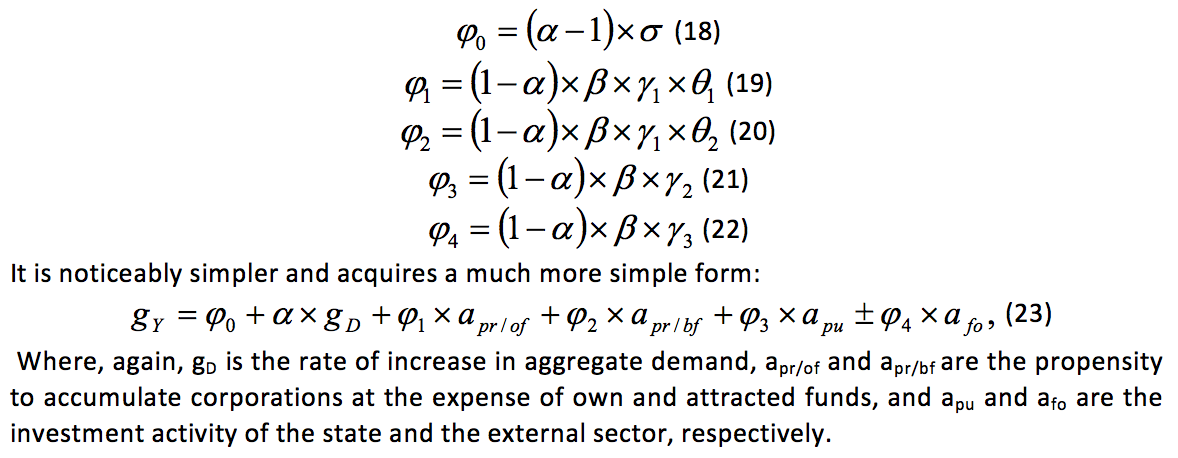

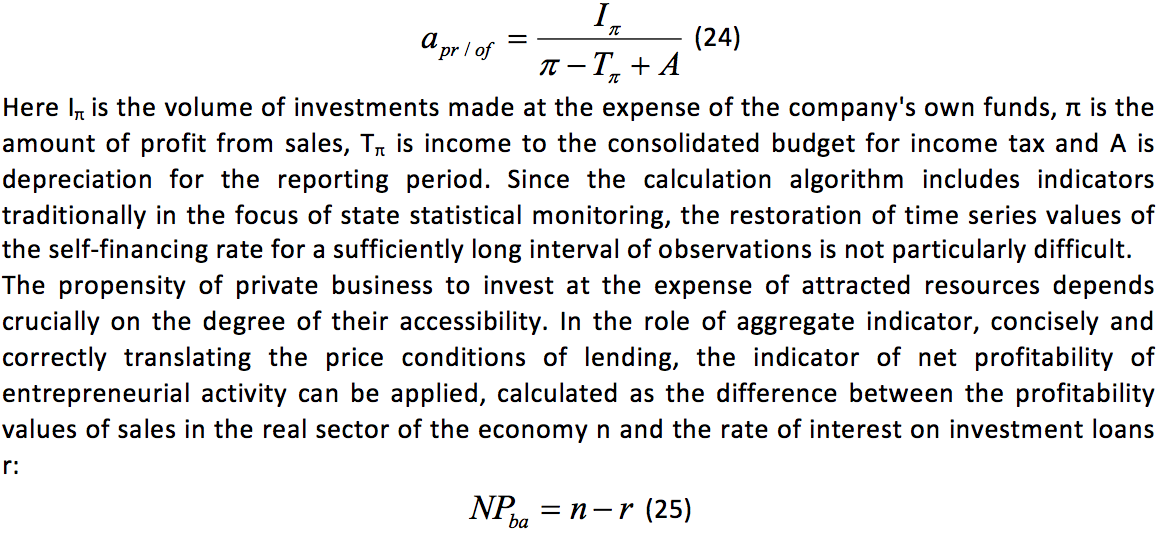

This concludes the mathematical part of the description of the concept of growth being developed. Let us answer the question about how the created design meets the criteria that were originally promulgated. Most likely, it will not be a big exaggeration to say that it is not badly related to the claimed requirements, because, firstly, it has a truly synthetic nature, combining the most fruitful ideas and "attributes" and the neoclassical and Keynesian currents of economic thought. In particular, this is manifested in the fact that the key equation of the concept combines sources of growth that lie both on the supply side and in the demand sphere. Secondly, the model is deprived of inadequate, unacceptable simplifications, for example, the hypothesis of a permanent general loading of the productive forces or equality of domestic investment to national savings. Thirdly, it takes into account the impact of the external sector, which is seen as particularly valuable in relation to the economic system of our country, taking into account the well-known problem of offshorization (Heifets 2009; Heifetz 2012; Heifets 2013), and, in general, the role of the domestic economy in the international capital flow. Fourthly, the developed design is not focused on analysis of a purely long-term period, which automatically would in many respects deprive it of its applied significance. Fifthly, there are no well-distinguishable reasons to assert that the proposed approaches operate with unreasonably complex mathematical tools. Finally, sixthly, as regards the operational nature of the explanatory variables, we will be able to verify this only after their specification, to the implementation of which we will now proceed, beginning with the investment pool indicators that determine the trajectory of the change in the production apparatus of the economic system.

As an explanatory variable reflecting the propensity of private business to invest from existing financial resources, it seems appropriate to use the norm of self-financing of investments (Berezinskaya & Vedev 2014), calculated by the equation:

In order to clarify, we point out that foreign capital enters the economy not only in the form of FDI, and this is true, generally speaking, and, in particular, in relation to the economic system of Russia. Nevertheless, the disclosed approach is justified, since portfolio investments are made through the acquisition of financial instruments and are an independent type of investment activity, often having only a very indirect relation to the accumulation of production capital. In addition, the most part of foreign operators of the domestic stock market is characterized by a pronounced speculative orientation (Buvaltseva & Chechin 2015), which means that the money spent by them for short-term operations in the sale and purchase of securities is isolated in the financial sphere, in no way feeding the processes of reproduction of the main funds of the country. As for other investments, the impressive share of foreign investments in the national economy of Russia belongs to the category of "traveling around" and represents the repatriation of capital previously exported from its borders. In this case, the return of corporate savings occurs, mainly in the form of loans and credits (Heifets 2013) issued by holdings incorporated in offshore and offshore jurisdictions, to affiliated companies operating in the domestic economy. In this case, the integration of other investments (the basis of which forms loan capital) in the numerator of equation 28 is highly likely to lead to an artificial overestimation of the investment activity of non-residents due to the unjustified inclusion of pseudo-foreign transactions in the composition of foreign investments.

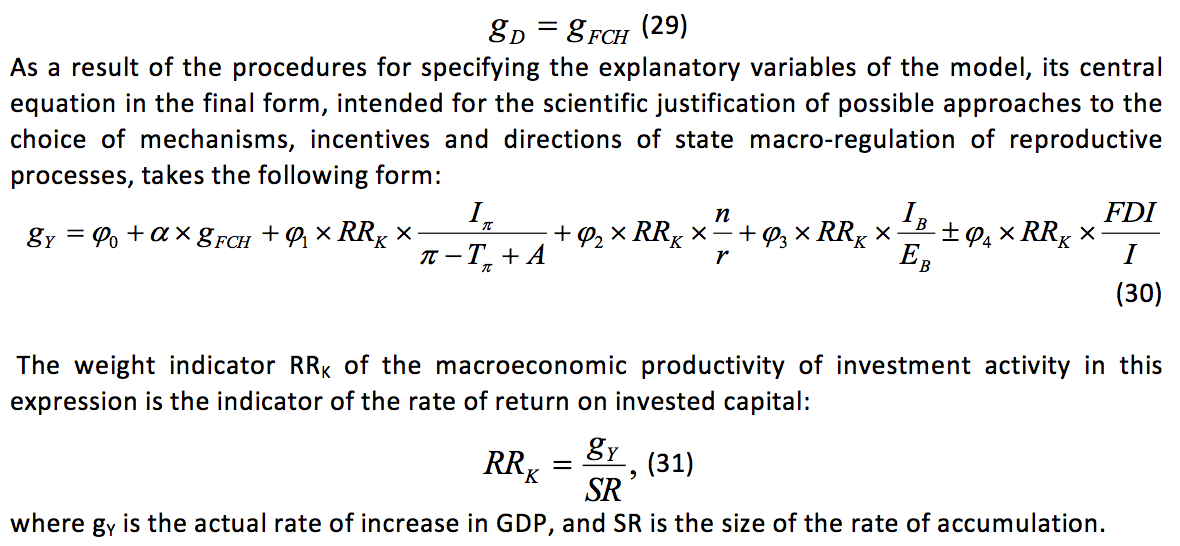

The practical interpretation of the unique explanatory variable gD, not included in the investment pool, is significantly hampered by the fact that the aggregate demand is an extremely complex, multidimensional category that combines the components of final, intermediate and investment consumption. In addition, we have not encountered in the works of domestic or foreign scientists attempts to quantify this fundamental macroparameter of the business environment as a whole or its most important components separately – so that even the proportions between their values (assuming that they are of a sustainable nature, even in the class of economies of one institutional type) are unknown. At the same time, in the proposed concept there are not absolute sizes of the aggregate demand, but its dynamics; moreover, there is no doubt that any market system functions primarily to meet the needs and demands of the final consumers. Given this thesis, it seems reasonable to approximate the trajectory of gD with the rate of change in consumer spending gFCH, that is, taken as the basis equality:

So, now we can affirmatively answer the last question, left uncovered, about whether the key parameters of the described construction are operational. In fact, it includes indicators such as, for example, interest rates for long-term loans and the aggregate volumes of capital expenditures of the state treasury, the finding of which in the zone of direct influence of the monetary and budget-tax "branches" of economic policy is undeniable. In addition, it is fair to say that other indicators of the model are much more detailed, less exogenous, and, most importantly, they are located much closer to the "epicenter" of the government system than its post-Keynesian and neoclassical counterparts. Summarizing, we can assume that our concept is not only another convenient additional "option" for analyzing the characteristic features and trends, factors and patterns of macroeconomic dynamics, but also a promising tool for its forecasting, planning and strategic programming.

Afontsev, S. (2015). The Way Out of the Crisis in Terms of Sanctions: Is the Mission Impossible?. Voprosy ekonomiki, 4, 20-36.

Andryushin, S. (2015). Arguments for the Management of the Ruble Exchange Rate. Voprosy ekonomiki, 12, 51-68.

Berezinskaya, O., & Vedev, A. (2014). Investment Process in the Russian Economy: Potential and Directions of Activation. Voprosy ekonomiki, 4, 4-16

Buvaltseva, V., & Chechin, V. (2015). Development of the Investor Institution in Russia as the Main Participant of the Securities Market. Voprosy ekonomiki, 3, 61-75.

Cobb, W., & Douglas, P.H. (1928). Theory of Production. American Economic Review, 18(1), 139-165.

Grigoriev, L., & Ivaschenko, A. (2011). World Imbalances of Savings and Investments. Voprosy ekonomiki, 6, 4-19.

Harrod, R.F. (1973). Economic Dynamics. London: Macmillan.

Heifets, B. (2009). Offshore Financial Networks of Russian Business. Voprosy ekonomiki, 1, 52-67.

Heifetz, B. (2012). Risks of Russia's Debt Policy against the Background of the Global Debt Crisis. Voprosy ekonomiki, 3, 80-97.

Heifets, B. (2013). Deoffshorization of the Economy: World Experience and the Russian Specificity. Voprosy ekonomiki, 7, 29-48.

Mau, V. (2017). Lessons of Stabilization and Growth Prospects: Russia's Economic Policy in 2016. Voprosy ekonomiki, 2, 5-29.

Mozyas, M. (2015). The Economy of China: Immersion in the "New Normality". Voprosy ekonomiki, 5, 134-158.

Popov, V. (2012). Russia: Austerity and Deficit Reduction in Historical and Comparative Perspective. Cambridge Journal of Economics, 36, 313-334.

Popov, V. (2013). Global Imbalances – the Unconventional Treatment. Voprosy ekonomiki, 1, 69-80.

Romer, D. (2001). Advanced Macroeconomics (2nd ed.). Boston, IL: McGraw-Hill.

V poiskakh utrachennogo rosta [In Search of Lost Growth]. (2016, November 29). Official Site of Sergei Glazyev. Retrieved March 27, 2017, from www.glazev.ru/econom_polit/514/1. Kazan (Volga Region) Federal University, 420008, Russia, Kazan, Kremlin, 18. E-mail: Svatoslav.Gusev@tatar.ru