Vol. 38 (Nº 49) Year 2017. Page 8

Irina Vladimirovna OSINOVSKAYA 1; Marina Vladimirovna PLENKINA 2

Received: 12/06/2017 • Approved: 05/07/2017

ABSTRACT: This article clarifies the significance of the methodic approach to the estimation of efficiency of managerial decisions taken by large companies. The comparative analysis of various approaches to the estimation of efficiency of managerial decisions is performed: cost approach, targeted approach, etc. Various types of efficiency of managerial decisions are considered and the possibility of their complex accounting is proved in the approach offered by the authors. The reasonability of the calculation of the potential adaptability of managerial decisions is emphasized; it includes such characteristics of decisions as reliability, elasticity, and maneuverability. The use of this approach is recommended for the formation of the rating of large companies for the internal use as well as for external users. This approach reflects the competitive positions of a company in the particular operational segments and markets. The possible problems are specified; they can appear during the practical realization of the offered approach to the estimation of efficiency of decisions and direction of their solution. They are connected to the information provision of the actual information space for the estimation of decisions’ efficiency and formation of the estimation indicators’ monitoring system for the online control of changes of efficiency of the decisions taken. Also, the article provides the approbation calculations of several large Russian oil and gas companies and comparison of the ratings obtained with the rating of 10 top oil companies of the world. |

RESUMEN: Este artículo clarifica la importancia del acercamiento metódica a la estimación de la eficacia de las decisiones gerenciales tomadas por las grandes empresas. Se realiza el análisis comparativo de diversos enfoques para la estimación de la eficiencia de las decisiones gerenciales: enfoque de costos, enfoque focalizado, etc. Se consideran varios tipos de eficiencia de decisiones gerenciales y la posibilidad de su contabilidad compleja se demuestra en el enfoque que ofrecen los autores. Se enfatiza la razonabilidad del cálculo de la adaptabilidad potencial de las decisiones gerenciales; incluye tales características de las decisiones como confiabilidad, elasticidad, y maniobrabilidad. El uso de este enfoque se recomienda para la formación de la calificación de las grandes empresas para el uso interno, así como para los usuarios externos. Este enfoque refleja las posiciones competitivas de una empresa en los segmentos operativos y mercados particulares. Se especifican los posibles problemas; pueden aparecer durante la realización práctica del acercamiento ofrecido a la estimación de la eficacia de decisiones y de la dirección de su solución. Están vinculados a la disposición de información del espacio real de información para la estimación de la eficiencia de las decisiones y la formación del sistema de seguimiento de los indicadores de estimación para el control en línea de los cambios de eficiencia de las decisiones tomadas. Además, el artículo proporciona los cálculos de aprobación de varias grandes compañías rusas de petróleo y gas y la comparación de las calificaciones obtenidas con la clasificación de 10 empresas petroleras más importantes del mundo. |

Within the framework of large oil and gas enterprises, the transformations of the management system on the whole, and, in particular, its various levels shall be aimed at solving various problems in all the spheres of the activity of enterprises beginning from the main and auxiliary production and finishing with various strategic directions by means of the adequate tools that require the proving and establishment of the area of their application. Together with it, the complex approach that only takes into account the possible consequences of managerial decisions (MD) will give an important advantage making it possible to actively form the desirable development during the development of the strategy and not to follow the events passively.

During the formation of the system of developing and taking MD, oil and gas companies shall be considered, first of all, as complicated systems with special properties and characteristics. The provision of the efficiency of MD is one of the priority tasks of the operative and strategical management of companies of any profile.

Although the issues of the development of MD are considered thoroughly and rather actively in the publications of domestic and foreign authors, the insignificant coverage of the issues of the methodical character of estimation of their efficiency should be mentioned.

The complexity is that in estimating the efficiency of the activity of large oil companies, on the whole, it is rather difficult to say what share of a timely taken managerial decision is in the obtained result. To obtain the high synergic effect and maintain the adaptive characteristics of the decisions taken, the top management of oil companies, when taking decisions, shall take into account a large aspect of various factors and cover practically all the directions and fields of the activity of the company. Here, the estimation of efficiency of decisions made can be performed in various aspects depending upon the level and complexity of the decisions taken and also upon the level of managers involved in this process.

Taking the decisions inside the company and estimating their efficiency in the operational segments of activity as well as in the other directions, we can focus on the dynamics of change of the key performance indicators (KPI), as, for example, it was mentioned in the work of Burenina I.V, Varakin V.A. (Burenina, & Varakin, 2014). As a result of such an approach, the quantitative estimation of efficiency of the decisions taken will be obtained. Here, this problem can be reduced to a multicriteria one and we can focus on the complex criterion of efficiency of the MD built upon the base of the additive or multiplicative convolution of the approved list in the company KPI. Various applied aspects of the solution of multicriteria problems are considered in the works of Lenkova O.V., Osinovskaya I.V., Lyaskovsky A.V., Steuer R. (Lyaskovsky, 2007; Osinovskaya, & Lenkova, 2011; Steuer, 1992). Taking into account that all decisions in the company are taken to achieve the strategic goals and solution of the set problems, their efficiency can be estimated by means of realization of the targeted approach, focused on the measure of achievement of the goals set by the company. Here also the problem can be reduced to a multicriteria one. At the same time, the measure of achievement of the set goals shall be quantitative or score according to the indicators reflecting the degree of achievement of this goal. The use of qualitative indicators in such an approach is also allowed but with their further transformation into the scores. To solve the targeted multicriteria problem one can use the method of distances (Euclidean distance) that shows the proximity measure of a set of taken decisions to some ideal points, corresponding to the goals of the company in all directions of its activity. The theoretical aspects of using the methods of distances are considered in the works of Galchina O.N., Pozhidaeva T.A., Plenkina V.V., Osinovskaya I.V., Lenkova O.V. (Galchina, & Pozhidaeva, 2009; Plenkina et al., 2013). The methodical principles of using the method of distances are clarified in the early works of G. Young and A. Householder, J.C. Gower, F. Critchley (Young, & Householder, 1938; Gower, 1982; Critchley, 1988). Various aspects of the efficiency and its components are considered in the works of Pirogova E.V., Trofimova L.A., Hamid Saremi, Morteza Pourjafar Devin, Hadi Saeidi, Taylor J. et al. (Pirogova, 2010; Trofimova, 2012; Saremi et al., 2014; Taylor, 2011).

When considering the efficiency of MD, it is reasonable to distinguish not only the targeted aspect but the cost aspect as well. Oil companies perform their activity to get the certain value of profit; therefore, the selection of MD subjected to the realization is based upon the principle of minimization of costs for their realization and maximization of the expected result.

The targeted aspect presupposes making such MD that will allow achieving the goals set by the oil company in various spheres of its activity – from the geological survey to the processing and sale.

The efficiency of MD is provided by the set of peculiarities of quantitative and qualitative character.

The system of development of MD, due to the complexity of the objects of research, shall be based upon the cost and resource approach and also take into account some qualitative characteristics of decisions allowing the companies to perform their activity more efficiently, under conditions of the market, on the one hand, and under conditions of the depletion of the resource base of the oil companies, on the other hand.

Such characteristics reasonably include reliability, elasticity and also flexibility and maneuverability of the decisions that form the potential adaptability of MD in the system. The observance of the triunity of these characteristics will allow providing the significant synergic effect in the activity of oil and gas companies that has a direct economic form.

The estimation of the potential adaptability of MD is clarified in the work of Osinovskaya I.V. (Osinovskaya, 2015). The potential adaptability of MD is the ability of the managerial decision designed for the realization in the particular external and internal conditions of the oil company without the additional costs or with their minimal level to adapt to the new conditions.

The reliability of MD is a possibility of their realization at the particular resource restrictions.

The elasticity of MD is their ability to change without the significant loss of achievement of the set goal (solving of the problematic situation).

The maneuverability of MD is characterized by the possible limit speed of their adaptability with time to the new conditions.

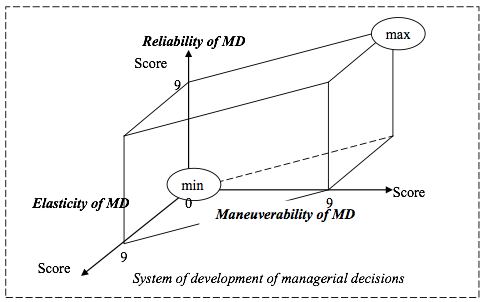

In case of the tools of estimation of the potential adaptability of MD, it is reasonable to use the method of scores that are given by a specially selected expert group. The experts estimate every characteristic according to all alternative variants using a nine-point scale. Then they form the surface of the potential adaptability of MD that is shown in the formalized form in Figure 1.

Figure 1. Surface of potential adaptability of MD

We shall distinguish the potential adaptive characteristics and properties that have already appeared in the particular situations occurred during the realization of MD. The potential adaptability is different from the actual adaptability from the position of dependence of the latter not only on the mechanism of the development of MD but also on the continuously changing dynamic environment of the oil company, its competitors, state policy in the area of taxation, etc.

Thus, the process of development of MD includes the solution of a two-fold task. It is necessary to find such variants of solutions that will have not only potential adaptability but also optimal flexibility during their implementation.

The specified approach to the estimation of the potential adaptability of MD can be used for the selection of different variants of decisions as well as for the estimation of the activity of the oil and gas company on the whole. Table 1 shows an abstract of the comparative estimation of the adaptability of MD taken by oil companies in the financial year.

Table 1. Estimation of adaptability of the MD taken by oil companies (abstract)*

Goals of company in the block of production

|

MD taken in the company |

Results of the accounting period |

Adaptability of MD, score |

|||||||||

Scale, score |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|||

PAO NK Rosneft |

||||||||||||

Maintaining of production and maximal fulfilment of the potential of the existing deposits, considered careful realization of new projects to provide the sustainable production profile and maximal factor of hydrocarbon extraction, and also economically grounded development of non-traditional complicated collectors |

Solutions for perspective

|

Production of oil and hydrocarbons of the company was 204.6 mln tons, that is, by 0.9% higher than the value of the previous year The coefficient of substitution of the reserves of hydrocarbons for 2016 increased by 148% according to the classification SEC The growth was provided due to the integration of the new assets, an increase in production in the deposits in Eastern Siberia and high efficiency of geological and technical measures at the deposits |

Reliability (8) |

|||||||||

Elasticity (8) |

||||||||||||

Maneuverability (8) |

||||||||||||

Adaptability of MD = 24 |

||||||||||||

Rather high goal efficiency of the MD taken by the company in the accounting period is stipulated by their high potential adaptability |

||||||||||||

PAO Tatneft |

||||||||||||

Maintaining of the actual level of oil production at the licensed deposits in Tatarstan (strategic level) |

|

Oil production at the deposits was 28.7 mln tons of oil in 2016. The increase in production was by 5.2% in comparison with the previous period. Due to the depletion of the main deposits, the significant share of all was obtained using the various technologies of enhancing the oil recovery of the layers. In 2016, the production of super viscous oil was 842 thousand tons (+311 thousand tons to the plan; 158.6%) |

|

|||||||||

Note: *The table is composed on the basis of the data, published on the official sites of the oil companies (rosneft.ru; tatneft.ru).

The research of the potential adaptability of MD taken by the oil companies was performed for the following companies: Surgutneftegas (potential adaptability of MD – 23), Gaspromneft (potential adaptability – 24), and Tatneft (potential adaptability – 25). All companies show high target efficiency of MD that is explained by their high potential adaptability. The offered approach to the estimation of the potential adaptability of the MD taken by the oil companied can be the base for formation of rating of the companies. The obtained values of the potential adaptability are correlated with the rating of the oil companies represented on the informational and analytical portal "Oil of Russia". Table 2 shows the abstract of this rating based upon the values of the total joint-stock return and market value, the size of which is also formed as a result of the MD taken by the top management. The top 10 oil companies include two Russian oil companies – Tatneft and NOVATEK. In the performed studies of efficiency of the taken MD, Tatneft also showed high results.

Table 2. Rating of oil companies (abstract), 2016*

Company |

Indicator |

Value |

Note |

Rating |

Cheniere Energy (USA) |

Total joint-stock return |

46.5% |

Activity of the company is connected to the liquefied natural gas (LNG). |

1 |

Market value |

$8.8 bln |

|||

The most significant MD for perspective: - development, construction and operation of the project of liquefied natural gas on the LNG terminal Sabine Pass (project SPL) adjacent to the existing objects of regasification up to six trains; - construction and launch of trains 5-6; - development and construction of additional installations for liquefaction in the district of Corpus Christy, Texas ("Corpus Christi LNG terminal"). |

||||

Tesoro (USA) |

Total joint-stock return |

43.3% |

The type of activity is oil refining. The company possesses six oil refineries in the USA with total capacity of 875 thousand barrels per day. |

2 |

Market value |

$12.7 bln |

|||

Valero Energy (USA) |

Total joint-stock return |

30% |

The company possesses 18 oil refineries with total capacity of 3.3 mln barrels of oil per day. The retail network of the company has more than 5 thousand fuel filling stations. |

3 |

Market value |

$34 bln |

|||

Magellan Midstream Partners (USA) |

Total joint-stock return |

24.3% |

It possesses the longest system of pipelines in the country that transports the refined oil |

4 |

Market value |

$15.4 bln |

|||

Tatneft (Russia) |

Total joint-stock return |

20.8% |

The company gradually develops oil and gas production, oil refinery, petrochemistry, tire complex, network of oil filling stations and block of service structures |

5 |

Market value |

$9.4 bln |

|||

NOVATEK (Russia) |

Total joint-stock return |

11.8% |

The company is engaged in survey, production, processing and sale of natural gas and liquid hydrocarbons |

9 |

Market value |

$24.8 bln |

|||

Note:* The table is composed on the basis of the materials of the article (http://www.oilru.com/news/514304)

"With time the efficiency of the companies in the market, as a rule, decreases gradually to the average values, – says Geffrey Kotzen, the senior partner and Global Director of the direction of estimation of the shareholder value in BCG. – To become a leader according to the size of the added value and take the place among the 10 best companies, the company has to exceed the expectations of the investors significantly. I do not mean it should exceed one or two points the expected results of profit in one of the quarters. I say about the results that change the trajectory of the business drastically" (Informational and Analytical Portal "Oil of Russia", 2016).

The decrease of subjectivity when making the score in the offered approach can be reached due to the detail working out of the scale of score. The scoring shall be interconnected with the actual results of activity of the company.

As a result of the performed research, the methods of scoring the efficiency of MD were corrected at the level of large enterprises of the fuel and energy complex. The offered approach can be used as a base of the scientific formation of rating of these structures for tracing their competitive positions in the branch as well as for the external use, such as rating analytical agencies, investors, shareholders, etc.

Monitoring the efficiency of the taken decisions in terms of such characteristics as reliability, elasticity, flexibility and maneuverability of the decisions which form the potential adaptability in the system, it is necessary to use a big volume of information of the estimation indicators of the achievement of the set goals, key indicators of efficiency, etc. Consequently, it cannot be possible to implement this approach in practice without the formation of the corresponding informational system and internal automated monitoring system.

The advantage of the offered approach is the obtaining of the quantitative estimation of the efficiency of MD for the particular results of activity of the company and the possibility to trace the dynamics of the changing of the competitive positions in the short-term period.

The obtained results can be of interest for the scientists studying the problems of estimation of the efficiency of MD as well as for the managers of various levels of management of the enterprises of the fuel and energy complex.

Currently, we can observe in the scientific literature the interest in the problems of estimation of the efficiency of MD and the multiaspect character of the consideration of this problem. The following efficiencies are distinguished: organizational, economical, psychological, legal, ethic, technological and social efficiency that is described in the works of Pirogova E.V., Trofimova L.A. et al. (Pirogova, 2010; Trofimova, 2012).

The economic estimation of the efficiency of MD is recommended to be performed using the indirect method of comparison of various variants according to the final results and also according to the immediate results (Ivasenko, 2014; Lenkova et al., 2011). In some works, the methods of estimation of the economic efficiency of taking and realization of MD are described on the base of the concept of the value based management (VBM), for example, in the works of Trofimova L.A., Potapov A.V., Tkachenko I.N. (Trofimova, & Trofimov, 2012; Potapov, & Tkachenko, 2010).

The approach offered by the authors can take into account all aspects of the efficiency of MD when estimating their potential adaptability. That increases the significance and value of the performed research and obtained results.

The set goal was achieved during the performed research of the technology of estimation of the efficiency of the taken MD at the level of the large enterprises. The authors tried to move beyond the traditional approaches to the estimation of efficiency of MD and make it complex, reflecting the various aspects of the activity of large companies. In the conditions of the dynamically changing external and internal environment of the company, the managers of various managerial levels have to take tens of MD in the current activity as well as regarding the strategic development. The managerial teams, when they take the decisions collectively or personally, shall follow all the parameters of the efficiency of MD to provide the high degree of their adaptability and reliability. On-line monitoring of changing of efficiency of the MD based upon the complex approach will make it possible to timely perform the correcting actions in all the directions of the activity of the company and thus to provide the competitive advantage.

Finally, it should be mentioned that the practical realization of the offered approach is possible by means of formation of actual information field reflecting such characteristics as reliability, elasticity, flexibility and maneuverability of decisions.

The maintaining of the informational field in the actual mode for any period of time of addressing it is a rather complicated and labor- intensive task that requires the use of modern technical and informational means. It is stipulated also by the fact that it is connected to a significant increase in the volume of information and its correction, improving the quality and a decrease in the terms of its processing during the grounding and taking of MD. Therefore, at the enterprise it is necessary to pay special attention to the solution of the problem of information provision of the process of estimation of efficiency of MD and its integration into the general information space of the activity of the large enterprises.

Burenina, I.V., & Varakina, V.A. (2014). Sistema edinykh pokazatelei otsenki effektivnosti deyatelnosti vertikalno-integrirovannykh neftyanykh kompanii [System of Unified Indicators of Estimation of Efficiency of Activity of the Vertically Integrated Oil Companies]. Naukovedenie, 1.

Critchley, F. (1988). On Certain Linear Mappings between Inner-Product and squared Distance Matrices. Linear Algebra and its Applications, 105, 91–107.

Galchina, O.N., & Pozhidaeva, T.A. (2009). Teoriya ekonomicheskogo analiza: uchebnoe posobie [Theory of Economic Analysis: Textbook]. Moscow. Retrieved February 11, 2015, from http://lib.lunn.ru/KP/Spring2010/gaslchina_pojidaev.pdf

Gower, J.C. (1982). Euclidean Distance Geometry. Mathematical Scientist, 7, 1-14.

Informatsionno-analiticheskii portal "Neft Rossii" [Informational and Analytical Portal Oil of Russia]. (2016). Retrieved February 10, 2017, from http://www.oilru.com/news/514304

Ivasenko, A.G., Nikonova, Ya.I., & Plotnikova, E.N. (2014). Razrabotka upravlencheskikh reshenii: uchebnoe posobie [Development of Managerial Decisions: Textbook] (4th ed.). Moscow: KNORUS. (p. 168).

Lenkova, O.V., Osinovskaya, I.V., & Shalakhmetova, A.V. (2011). Teoriya prinyatiya strategicheskikh reshenii: uchebnoe posobie [Theory of Strategic Decision-Making: Textbook]. Tyumen: Tyumen Oil and Gas State University. (p. 224).

Lyaskovsky, A.V. (2007). Mnogokriterialnoe upravlenie marketingovoi deyatelnostyu organizatsii [Multicriteria Management of Marketing Activity of the Organization]. Publishing House Education and Science s.r.o. Retrieved December 20, 2014, from http://www.rusnauka.com/20_PRNiT_2007/Economics/23721.doc.htm

Osinovskaya, I.V. (2015). Otsenka effektivnosti upravlencheskikh reshenii, prinimaemykh rossiiskimi neftyanymi kompaniyami [Estimation of Efficiency of the Managerial Decisions Taken by Russian Oil Companies]. Teoriya i praktika obshchestvennogo razvitiya, 10. Retrieved June 2, 2017, from http://teoria-practica.ru/rus/files/arhiv_zhurnala/2015/10/economics/osinovskaya.pdf

Osinovskaya, I.V., Plenkina, V.V., & Lenkova, O.V. (2013). Algoritm prinyatiya upravlencheskikh reshenii v slozhnopostroennykh neftegazovykh strukturakh [Algorithm of Managerial Decision Making in the Complicated Oil and Gas Enterprises]. Nauchnoe obozrenie, 1, 262-267.

Pirogova, E.V. (2010). Upravlencheskie resheniya: uchebnoe posobie [Managerial Decisions: Textbook]. Ulyanovsk: USTU. (p. 176).

Plenkina, V.V., Osinovskaya, I.V., & Lenkova, O.V. (2013). Razrabotka upravlencheskikh reshenii v neftegazovykh strukturakh: teoriya i praktika: Monografiya [Development of Managerial Decisions on the Oil and Gas Enterprises: Theory and Practice: Monography]. LAP LAMBERT Academic Publishing. (p. 93).

Potapova, A.V., & Tkachenko, I.N. (2010). Kontseptsiya tsennostno-orientirovannogo menedzhmenta [Concept of Value-Oriented Management]. Izvestiya UrGEU, 5(31), 35-43.

Saremi, H., Devin, M.P., & Saeidi, H. (2014). Decision Model in Development Management. Indian Journal of Fundamental and Applied Life Sciences, 4(S4), 834-838. Retrieved June 2, 2017, from www.cibtech.org/sp.ed/jls/2014/04/jls.htm.

Steuer, R. (1992). Mnogokriterialnaya optimizatsiya. Teoriya, raschet i prilozheniya [Multi-Criteria Optimization. Theory, Calculation and Appendices]. Trans. from English: Moscow: Radio i svyaz. (p. 504).

Taylor, J. (2011). Decision Management Systems. IBM Press. (p. 63).

Trofimova, L.A., & Trofimov, V.V. (2012). Metody prinyatiya upravlencheskikh reshenii: uchebnoe posobie [Methods of Managerial Decision-Making: Textbook]. Saint Petersburg: Publishing House of SPSEU. (p. 101).

Young, G., & Householder, A. (1938). Discussion of a Set of Points in Terms of Their Mutual Distances. Psychometrika, 3, 19-22.

1. Institute of Management & Business, Tyumen Industrial University, 38 Volodarskogo Street, Tyumen, 625000, Russia. E-mail: osinovskaya79@mail.ru

2. Institute of Management & Business, Tyumen Industrial University, 38 Volodarskogo Street, Tyumen, 625000, Russia