Vol. 38 (Nº 57) Year 2017. Page 21

Svetlana V. OREKHOVA 1

Received: 23/07/2017 • Approved: 21/08/2017

ABSTRACT: The article aims to research the reasons of why Russian industrial enterprises tend to use the strategy of institutional isomorphism. The author introduces the notion of ‘institutional rent of an en-terprise’ after clarifying the kinds of economic rents and the essence of the isomorphism theory. Rus-sian enterprises prefer the isomorphism’s strategy due to the specifics of the industrial policy and other institutional factors. This trend resulted in the essential increase of institutional rents over adaptation costs. The use of such a strategy might lead to the operation of economically ineffective enterprises on the market. |

RESUMEN: El artículo pretende investigar las razones de por qué las empresas industriales rusas tienden a utilizar la estrategia de isomorfismo institucional. El autor introduce la noción de ' renta institucional de un en-terprise ' después de clarificar los tipos de rentas económicas y la esencia de la teoría del isomorfismo. Las empresas Rus-Sian prefieren la estrategia del isomorfismo debido a las especificidades de la política industrial y otros factores institucionales. Esta tendencia dio lugar al aumento esencial de los alquileres institucionales sobre los costos de adaptación. El uso de esa estrategia podría conducir a la operación de empresas económicamente ineficaces en el mercado. |

The microlevel decisions are derivatives from the parameters of the institutional environment, innovative externalities and a lot of other external factors. Permanent changes in this environment determine the need to transform the mechanisms of sustainable development of enterprises and shift their goals from maximizing profits to finding new, long-term strategies.

Heavy industry is traditionally the basis of the Russian economy. The development of these industries can serve as a multiplier for other sectors of the economy. On the one hand, the activity of such enterprises has technological character, based on tangible assets, standard procedures for planning and organizing business processes. The specificity of the enterprises activity in the heavy industries makes it very difficult to use flexible business models, i.e. it limits the choice of sources for generating competitive advantages.

On the other hand, we have a lot of empirical evidence (for example, (Skaletskii, 2016; Orekhova, 2017b)) of the fact that investments into various types of resources practically do not affect the profitability of industrial enterprises in Russia. In other words, strategies based on the exploitation of a strong internal environment do not work.

The study of the reasons for this divergence of theory and practice is a non-trivial scientific task. The aim of this work is to study the phenomenon of institutional isomorphism as a main competitive strategy for Russian industrial enterprises.

The solution to this problem involves concentrating on two fundamental challenges:

The activity of the enterprise is the reproduction of two functions: development (creation of competitive advantages) and realization of goals (using competitive advantages). Generation of competitive advantages, thus, constitutes a substantial foundation for the sustainable development of any business.

Competitiveness is the result that fixes the presence of competitive advantages; in the long run this result is obtaining some excess profit (rent) for the given market by an enterprise.

Scientific economic schools that study the problem field of strategic management, put forward various explanations for the sources of competitive advantages of enterprises (the main approaches are in Table 1).

Table 1

Comparative analysis of the main approaches to the formation of sustainable competitive advantages of the enterprise

Comparative evidence |

Main approaches to the formation of sustainable competitive advantages of the enterprise |

||||

Business Process Management |

Marketing |

Resource –based view |

The Dynamic capabilities theory |

Relational view |

|

Period of foundation

|

The mid-1970s. |

Early 1980s |

The mid-1980s |

The mid-1990s |

The end of the 1990s |

Authors/founders |

M. Hammer and J. Ciampi |

M. Porter, J. Tyrol |

B. Wernerfelt, E. Pe-nrose, J. Barney, K. Prahalad, G. Hamel |

D. Teece, B. Kohut, J. Makhoney |

J. Dyer and H. Singh |

Source of advantages |

Internal environment |

External environment |

Internal environment |

Internal environment |

External environment |

The essence of the approach |

Focus on the actions and organizational mechanisms of the firm |

Focus on the analysis of the environment and the competitive position of the firm |

Focus on the formation of a portfolio of VRIO resources |

Focus on creating capabilities to modify resources in accordance with changes in the environment |

Focus on the formation of interorganizational networks |

Definition of the enterprise (firm) |

Firm is a set of processes |

Firm is a separate part of the market |

Firm is a bundle of resources |

Firm is a bundle of resources and capabilities |

Firm is a part of a network that has resources |

Source of profit |

Schumpeterian (entrepreneurial) rents (the effect of using resources) |

Chamberlain (Porter) rents (the effect depends on the level of market power of the firm and the specificity (attractiveness) of the industry market) |

Ricardian rents (the effect depends on the ability to collect and select resources) |

Schumpeterian rents (the effect of allocating resources through the development of organizational capabilities) |

Relational rents (the effect is a result of the interchange relationships within the interorganizational network) |

Interaction with competitors |

Not considered |

Struggle |

Indirect struggle, search for opportunities |

Cooperation |

|

We can explain the economic nature of competitive advantages by a number of external and internal factors, among which the main ones are the creation of value (Porter, 1991; Rumelt, 2003); entrance barriers and the situation in the industry (Schmalensee, 1985; Grant, 2016); the capability to innovate (Hamel, 2000); sensitivity to changes (Grant, 2016); unique resources (Grant, 1991; Collis, Montgomery, 1995); the presence of "isolating mechanisms" (Rumelt, 1984); incompleteness of information and the size of transaction costs (Williamson, 1985); special knowledge (Argote, Ingram, 2000; Nonaka, 1991) and core competences (Prahalad, Hamel, 1990; Rumelt, 2003).

Thus, competitive strategies can be due to the advantages of the internal environment or adaptation to the external environment. Isomorphism is one of the ways to adaptation, which means structural equivalence and similar patterns of relationships of different organizational forms.

The most development of the isomorphism concept has been in works on economic sociology, and, therefore, they based most of the empirical researches on the analysis of public sector organizations (for example (Radaev, 2003; Frumkin, Galaskiewicz, 2004; Caemmerer, Marck, 2009; Klenk, Seyfried, 2016)). Competitive isomorphism is close to the industry approach of M. Porter and suggests that enterprises copy the competitive struggle methods of the stronger market players. The institutional isomorphism, proposed by neo-institutionalists (DiMaggio, Powell, 1983; Powell, 1991; Haveman, 1993; Deephouse, 1996; Dacin, 1997), postulates that organizations compete not only economically but also struggle for political power. In practice, this strategy increases the chances of survival, since it makes firms more legitimate for counteragents.

According to (DiMaggio, Powell, 1983), there are three types of isomorphism:

Within the framework of this typology, they consider the state only as a source of a forced type of isomorphism. The activities of the state determine the rules for the conduct of business operations and affect the flow of goods and resources in the economy.

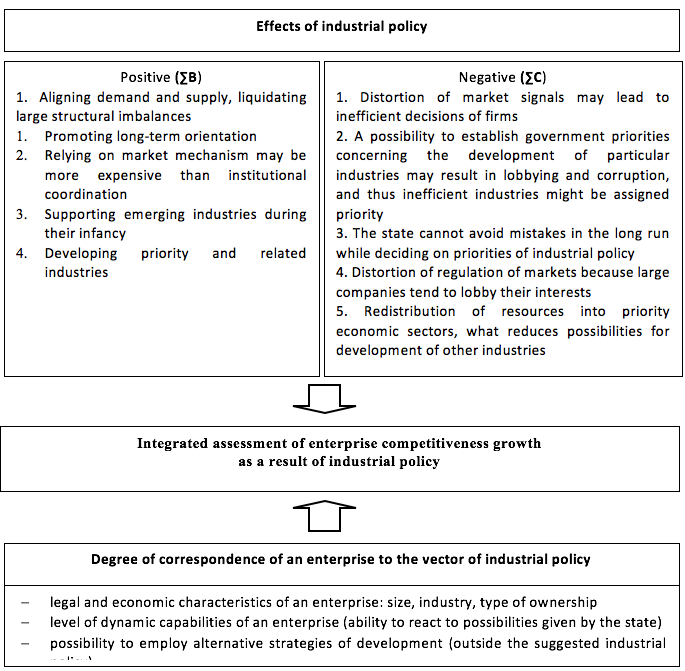

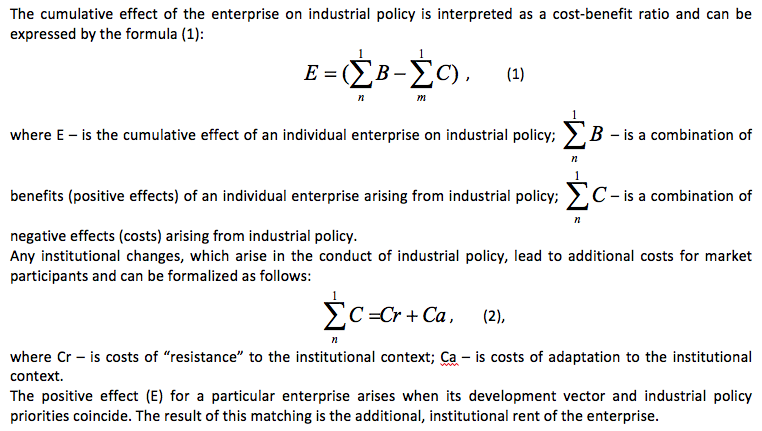

However, the state cannot only limit, but also support this or that activity. In the classic paper (Baumol, 1990), they argued the hypothesis that the contribution of business depends not on the number of entrepreneurs, but on their distribution between productive (innovation) and unproductive (rent seeking) activity. They determined this distribution by external institutional incentives. In the case of an industrial enterprise, such institutional incentives are in the industrial policy and the general economic institutional environment. In addition, a number of internal factors, including organizational and legal and economic characteristics, existing investment projects, contracts, dynamic capabilities determine the company's strategy in general. These factors also determine the possibility of the enterprise to move to the isomorphism strategy aimed at using industrial policy and institutional reforms (Figure 1).

Fig. 1

Factors behind enterprise competitiveness as a result of industrial

policy impact (Orekhova, 2017, 122)

By institutional rent we mean a set of extra benefits of the enterprise from the matching of the vector of its strategic development and the institutional context expressed in the priorities of the state industrial policy.

When the state aims to support weak market players (for example, small businesses, city-forming low-efficient enterprises, etc.), an enterprise can obtain competitive advantages through grants, subsidies, preferential terms of lending, etc., and as a result they obtain institutional rents. In case of a significant differentiation of the economy along technological lines (as the Russian economy), a low level of technological development of an industrial enterprise can also be a source of institutional rent.

Complementing the classification (DiMaggio, Powell, 1983), we call the strategy of obtaining institutional rent (the orientation of the enterprise to profit from the industrial policy of the state) state-oriented isomorphism.

The reasons for the emergence of this type of isomorphism in Russia are numerous and ambiguous.

Thus, (Meyer, Rowan, 1977) distinguished two kinds of premises of institutional isomorphism.

In the conditions of the Russian economy, we can observe both pre-premises for the emergence of institutional isomorphism. The type of the Russian economic system is the state capitalism. The authors (Wooldridge, 2012; Li, Wang, 2012; Musacchio, Lazzarini, 2014) note that in the markets of the BRIC countries the state plays a more active role than it does in the traditional market economy. In such markets we see active, and often "manual" management, as well as the "dual role" of the state (as a market regulator and as its participant). This fact leads to the formation of specific rules of the game in such markets.

The policy of state capitalism is the background for large-scale institutional reforms. One of the principal tasks of industrial policy was to complete the formation of a full-fledged corporate sector in all segments of the economy and start establishing companies of a new type capable of competing with world leading producers. The main approach applied in this period was the creation of the state corporations and development institutions. State corporations were partly a tool for consolidation of the state assets (and in some cases of renationalization of privately owned assets) in a spectrum of strategically important sectors, and partly a way to circumvent existing regulations limiting direct government participation in the financing of production activities of enterprises.

A new round of industrial policy was the enactment of the Federal Law no. 488 “On industrial policy in the Russian Federation” on December 31, 2014. This law provided a powerful impetus to the economy reindustrialization. It is a synchronized process of creation of new high-tech sectors of economy, efficient innovative renewal of its traditional sectors with concurrent, aligned, qualitative, and consistent changes between economic-technological and socio-institutional spheres.

We can state that in Russia there is a dichotomy between the declared (proactive, horizontal, total) and the implemented (active, vertical, selective) industrial policies. This fact is explained by a spectrum of reasons, among which there are objective (for instance, the necessity of the parallel construction of institutional environment and particular development institutions) and subjective ones (designing policy “from top down”, which leads to inability to adequately assess the needs, and, what is more essential, the possibilities of businesses).

Selectivity of industrial policy was to produce a multiplicative effect, which should have sustained general economic growth. What happens de facto is the development of inclusive institutions that target redistribution of rent in favour of large but not effective players, including the state itself.

As a result, the adaptation of enterprises is not rational in the full sense, since the strategic choice is determined by external premises. The dynamic capabilities of enterprises are no longer a source of "reconfiguration of resources" (Teece, Pisano, Shuen, 1997), here they take a different character. These dynamic capabilities are the capabilities of the enterprise to match the institutions of the external environment and be legitimate. In this case, the matching level with the external environment is much more important than technical innovations. Such a strategic orientation can lead to a decrease in cost efficiency. We can use it when institutional rent exceeds the possible cost savings when using other strategies.

Summarizing all the above, we can state that the enterprises, strategically corresponding to the industrial policy vector, can win in any case, even if they cannot effectively generate other types of rents (see Table 1). This is an institutional trap that leads to two negative effects. Firstly, the state, financing the weak players of the market, does not receive the return that it could have received in case of supporting the strong industrial enterprises. Secondly, institutional rent by its nature is local and short-term, which allows to speak about low competitiveness of Russian business in international markets.

Intervention of the state in the economy is a factor of business growth only if its parameters are consistent with the objectives of industrial policy. This statement is at variance with stereotyped ideas that industrial policy is always a kind of protective barrier for domestic business. Such theoretical results are also consistent with Baumole's conclusions about productive and unproductive entrepreneurs in the society.

Argote L., Ingram P. 2000. Knowledge transfer: a basis for competitive advantage in firms. Organization Behavior & Human decision Processes. 82(1): 150-169.

Baumol W. J. 1990 Entrepreneurship: Productive, unproductive and destructive. Journal of Political Economy, 98(3): 893-921.

Caemmerer B., Marck M. 2009. The Impact of Isomorphic Pressures on the Development of Organizational Service Orientation in Public Services. University of Strathclyde. ANZMAC.

Collis D., Montgomery С. 1995. Competing on Resources: Strategy in the 1990s. Harvard Business Review, 73: 118-128.

Dacin M. T. 1997. Isomorphism in context: the power and prescription of institutional norms. Academy of Management Journal, 40: 46-81.

Deephouse D. 1996. Does isomorphism legitimate? Academy of Management Journal, 39 (4): 1024-1040.

DiMaggio P. J., Powell W.W. 1983. The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48: 147-160.

Frumkin P., Galaskiewicz J. 2004. Institutional isomorphism and public sector organizations. Journal of Public Administration Research and Theory, 14 (3): 283-307.

Grant R. M. 1991. The Resource-based Theory of Competitive Advantage: Implications for Strategy Formulation. California Management Review, 33: 114-135.

Grant R. M. 2016. Contemporary Strategy Analysis, 9th edition, Wiley.

Hamel G. Leading the Revolution. /Boston: Harvard Business School Press, 2000.

Haveman H. A. 1993. Follow the leader: Mimetic isomorphism and entry into new markets. Administrative Science Quarterly, 38: 593-627.

Klenk T., Seyfried M. 2016. Institutional Isomorphism and Quality Management: Comparing Hospitals and Universities. In Pinheiro R., Geschwind L., Ramirez F.O., Vrangbek K. (Eds.) Towards A Comparative Institutionalism: Forms, Dynamics And Logics Across The Organizational Fields Of Health Care And Higher Education. Emerald Group Publishing Limited : 217-242.

Li X., Wang X. L. 2012. A Model of China’s State Capitalism. /The Hong Kong University of Science and Technology: March 15.

Meyer J. B., Rowan B. 1977. Institutionalized organizations: formal structure as myth and ceremony. The American Journal of Sociology, 83: 340-363.

Musacchio A., Lazzarini S. G. 2014. Reinventing State Capitalism: Leviathan in Business, Brazil and Beyond. Harvard University Press: Cambridge, MA

Nonaka I. 1991. The knowledge-creating company. Harvard Business Review. November-December: 96-105.

Orekhova S. 2017a. Industrial Policy: Evolution of Scientific Approaches, Russian Specifics and the Impact on Enterprises’ Competitiveness. Journal of the Ural State University of Economics, 1(69): 117-132.

Orekhova S. 2017b. Resources and Sustainable Growth of industrial Metallurgical Enterprises: An Empirical Assessment. Journal of Modern Competition, 3(63): 43-54.

Porter М. Е. 1991. Competitive Strategy: Techniques for analyzing industries and competitors. N. Y., The Free Press.

Powell W.W. 1991. Expanding the Scope of Institutional Analysis. The New Institutionalism in Organizational Analysis. Chicago: University of Chicago Press.

Prahalad С. К., Hamel G. 1990. The Core Competence of the Corporation. Harvard Business Review, 68(3): 79-91.

Radaev V. V. 2003. Sociology of markets: to the formation of a new direction. Moscow: Higher School of Economics Publ.

Rumelt R. P. 1984. Toward a Strategic Theory of the Firm. /in book: Competitive Strategic Management, New York: Englewood Cliffs: 556-570.

Rumelt R. P. 2003. What in the World is Competitive Advantage? Policy Working Paper, 105. The Anderson School, UCLA.

Schmalensee R. 1985. Do markets differ much? American Economic Review, 75(3): 341-351.

Skaletskii E. 2016. Role of the strategy in the relationship between recourses and firm growth in the context of crisis in the emerging market. In materials of the “GSOM Emerging Markets Conference”: 372-377.

Teece D. J., Pisano G., Shuen A. 1997. Dynamic Capabilities and Strategic Management. Strategic Management Journal, 18(7): 509-533.

Williamson O. 1985. The Economic Institutions of Capitalism, N. Y. The Free Press.

Wooldridge A. 2012. The visible hand. The Economist special reports: State capitalism. The Economist, January 21.

The research was carried out with the financial support of the Russian Foundation for Basic Research, title of project “The Theoretical and Empirical Model of Institutional Interaction on Industry Markets in Russia”, № 17-32-01063.

1. Cand. Sc. (Econ.), Associate Prof., Chair of Enterprises Economics, Ural State University of Economics, Russia. Contact e-mail: bentarask@list.ru