Vol. 38 (Nº 62) Year 2017. Páge 3

Vol. 38 (Nº 62) Year 2017. Páge 3

Meruyert Talantovna NURMAGANBETOVA 1; Raushan Erbolatovna TARAKBAYEVA 2; Mahabbat Kenzhekhanova NAKISHEVA 3

Received: 06/10/2017 • Approved: 20/10/2017

ABSTRACT: The issue of improving the efficiency of crisis management at enterprises of any form of incorporation becomes particularly relevant today. The task of executives at Kazakhstani enterprises is to use efficient methods and economic vehicles of crisis management in order to prevent crises or localize them. The article summarizes the relevance of developing the research and practice basis of crisis management at the enterprise. The essence of the "crisis management" concept was explored, key approaches to its definition have been singled out, according to which the latter is aimed at the withdrawal of the enterprise from a crisis state, maintaining its stability and preventing a crisis. An algorithm for step-by-step implementation of crisis management through implementation of successive stages was developed in the article, methods for assessing the efficiency of crisis measures using indicators of the level of the production and financial state of the enterprise were explored. The proposal was made to choose the crisis program depending on the phase of the enterprise life cycle, the economic position of the enterprise at this phase and the present level of threats. Crisis measures that need to be implemented at various stages of the crisis were defined. |

RESUMEN: La cuestión de mejorar la eficiencia de la gestión de crisis en las empresas de cualquier forma de incorporación se vuelve particularmente relevante en la actualidad. La tarea de los ejecutivos de las empresas de Kazajstán es utilizar métodos eficientes y vehículos económicos de gestión de crisis para prevenir las crisis o localizarlas. El artículo resume la relevancia de desarrollar la base de investigación y práctica de la gestión de crisis en la empresa. Se exploró la esencia del concepto de "gestión de crisis", se han estirado enfoques clave de su definición, según los cuales este último está dirigido a la retirada de la empresa de un estado de crisis, manteniendo su estabilidad y evitando una crisis. En el artículo se elaboró un algoritmo para la implementación paso a paso de la gestión de crisis mediante la implementación de etapas sucesivas, métodos para evaluar la eficiencia de las medidas de crisis mediante indicadores del nivel de producción y el estado de la empresa fue explorado. La propuesta se hizo para elegir el programa de crisis en función de la fase del ciclo de vida de la empresa, la posición económica de la empresa en esta fase y el nivel actual de amenazas. Se definieron las medidas de crisis que deben aplicarse en varias etapas de la crisis. |

Taking the uncertainty in economic environment and the globalization processes that have a significant impact on the economy of Kazakhstan into consideration, crisis phenomena may occur at Kazakhstani enterprises at any time, even on the background of stable performance and high efficiency.

Enterprises usually go bankrupt due to failures in financial management, irrational allocation of resources, mistakes in financial and economic planning. Even potentially profitable enterprises may find themselves in a state of bankruptcy due to the fact that management was unable to recognize the crisis in time, predict the occurrence of local problems, and develop an efficient plan of action in order to prevent crisis and its further spread.

Not only crisis causes imbalance in the socioeconomic systems, but it is also one of the inevitable and legitimate stages in their cyclical development. As such, the development of enterprises occurs in cycles, so predictions and avoidance of crisis phenomena and minimization of their consequences is one of the primary theoretical, methodological and applied problems of modern economic science.

A fairly wide range of views on various aspects of crisis management and ways out of the crisis are the subject of research in the papers of many academic economists. For example, P.A. Pokrytan notes that crisis management explores the system of economic relations associated with the emergence of crisis phenomena in the process of economic entities’ operation (Pokrytan 2007, p.17). This definition provides an idea of the subject of scientific research on the problem of crisis management.

As for specification of the essence of crisis management, there are several basic approaches. Supporters of the first approach believe that crisis management should be implemented when an enterprise has already found itself in a crisis situation and its performance indicators have significantly worsened. For example, Koshkin V.I. notes that crisis management is a set of forms and methods of implementing crisis procedures in accordance with a specific debtor enterprise (Koshkin 2000, p. 34). T. Jaques claims that crisis management is efficient management that allows to withdraw the enterprise from crisis, a set of measures aimed at achieving or restoring solvency, liquidity, profitability and competitiveness of the enterprise and capable of leading the enterprise to financial recovery (Jaques 2009, p. 155). This approach is correct but considers the problem of the occurrence of a crisis state at the enterprise as a given fact. In accordance with this approach, crisis management is aimed at overcoming the negative consequences of inefficient management and faulty judgment of the business environment at the enterprise, which have led to profound problems in its operation.

Supporters of the second approach believe that it is more desirable to support the activity of the enterprise in a stable state, despite threats and risks. As such, A.P. Balashov believes that crisis management is a management system based on strategic principles and aimed at maintaining a stable, sustainable state of any socioeconomic system throughout the entire period of its existence; it is complex in nature, able to adapt quickly and vary depending on the external environment (Balashov 2010). V.I. Orekhov and K.V. Baldin note that crisis management is a system of permanent systemic actions by managers aimed at all elements of the organization with the purpose of the prompt and timely response to possible external and internal threats in the efficient functioning or development of the organization (Orekhov 2009, p. 21). As such, it can be determined that one of the tasks of crisis management is to preserve the economic system in the equilibrium state by properly responding to threats of the business environment.

The third approach to defining the essence of crisis management underlines the need to prevent the crisis at the enterprise. For example, a number of researchers believe that crisis management should be understood not only as management focused on the withdrawal of the enterprise from the state of crisis, but also management that can predict and warn insolvency in advance, in accordance with the developed program of increasing competitive advantages and financial recovery (Kryzhanovskiy 1998, p. 35). E.A. Utkin notes that crisis management is management focused on preventing possible serious complications in the market activity of the enterprise, ensuring its stable, successful management with a view to extended recovery on the modern basis and own savings (Utkin 1997, p. 122).

It can be said that crisis management should combine measures to prevent the emergence of a crisis, maintaining the enterprise in a stable state and, if necessary, withdrawal of the enterprise from the crisis. V.V. Znamenskiy calls crisis management its special kind aimed at prevention, the most prompt and efficient elimination of possible complications, threats and negative consequences of crisis phenomena, as well as restoring the stable functioning of socioeconomic systems and creating prerequisites for sustainable development (Znamenskiy 2014, pp. 31-32). P.V. Ushanov understands crisis management as management that predicts the danger of the crisis, analyzes its symptoms and measures to reduce negative consequences of the crisis, and uses its factors for subsequent development (Ushanov 2010, p. 72).

It can be concluded that crisis management in modern business should ensure stable functioning of the enterprise due to timely detection of threats to the external and internal environment and responding to them; in the event of deterioration of the enterprise operation, it should urgently implement measures to overcome the crisis phenomena. It is necessary to analyze various scenarios for the course of events and develop operating procedures in the event of possible aggravation of contradictions within the enterprise or with the external environment within crisis management.

Based on the generalization of approaches to the definition of the essence of crisis management, the author’s interpretation of this concept is proposed. Crisis management is a management system aimed at early detection of the enterprise's contradictions with the external environment or in its internal environment with a view to preventing crisis phenomena at the enterprise first of all; in case of a probability of the crisis situation, it is aimed at reorganization of implementation of business processes in accordance with the current management conditions; in the event of a crisis , it is aimed at developing a mechanism to overcome the crisis, providing for implementation of appropriate procedures and a deep rethinking of the principles of the enterprise operation.

Analysis of literature sources revealed the existence of various approaches to introducing crisis management in the enterprise operation. For example, N.V. Rodionova considers crisis management by models based on controlling, reengineering, financial diagnostics, financial rehabilitation, investment management, personnel management, consulting management, innovative crisis management (Rodionova 2011). V.S. Mikhel singles out pre-crisis management in the enterprise operation, which contains development and implementation of preventive strategies; management under crisis, which aims to develop and implement tactical response plans for crisis and elimination of crisis situations; and post-crisis management, which is described by the development and implementation of strategies for increased and improved recovered results (Mikhel 2012). V.I. Fuchedji reveals the role of crisis management in the enterprise management system through its relationship with financial management (Fuchedji 2012).

Despite the multiple studies of crisis management, the author believes that development of efficient algorithms, instruments, mechanisms and models of crisis management remain insufficiently researched.

The purpose of the study is to develop a methodology for assessing the efficiency of crisis measures using indicators of the level of the production and financial state of the enterprise and their application within the algorithm for identifying the type of crisis management depending on the phase of the life cycle and evaluation of efficiency of the chosen crisis measures aimed at preventing proliferation, limiting the consequences of the crisis, liquidating damage and restoring the vital activity of the enterprise.

Overcoming the crisis state of the enterprise requires integrated application of crisis management in each specific case, which is done throughout the entire period of the enterprise operation, because the probability of the crisis exists at all stages of its development. Elimination of crisis phenomena is possible due to the formation and application of mechanisms, algorithms and models of crisis management under conditions of cyclical development.

At the same time, there are no integrated mechanisms of crisis management that would consider both the phase of the enterprise life cycle and the evaluation of the production and financial state of the enterprise and the group of crisis measures related to the type of crisis management. It is most expedient and efficient to combine these components into a single algorithm – a comprehensible and precise sequence of executive actions aimed at achieving the stated goal.

In order to form such a mechanism, an algorithm was developed to identify the type of crisis management depending on the phase of the life cycle and an assessment of the efficiency of selected crisis measures of the enterprise, based on determining the necessary crisis measures in accordance with the phases of the enterprise life cycle and their evaluation using indicators of the level of production and financial state. The proposed algorithm reflects the detailed step-by-step implementation of crisis management in 7 consecutive stages:

1. Determining the phase of the enterprise life cycle.

2. Identifying the type of crisis management.

3. Defining management measures in accordance with the type of crisis management.

4. Forming the crisis program.

5. Evaluating the results of the crisis measures at the enterprise on the basis of indicators of the level of production and financial state.

6. Evaluating the adequacy of implementation of the crisis program.

7. Determining the phase of the enterprise life cycle, given the efficiency of crisis management.

The first step is to determine the phase of the enterprise life cycle. Based on the life cycle, the enterprise passes through 4 phases of development (growth, peak, recession, crisis) during its operation, which regularly repeat. The crisis has three stages of development – rise, exacerbation and presence – which match the phases of the life cycle. The first stage of the crisis corresponds to the rise and peak of the cycle, because the enterprise enjoys an increase in the positive financial result and a stable financial condition but fails to allocate funds for diagnosing future development trends during these periods, which ultimately leads to a decline in demand for products or services and further to the recession phase, which corresponds to the stage of exacerbation, with the presence of a depressive state being described by the emergence of a crisis at the enterprise.

In order to preserve the efficiency of the enterprise operation, it becomes increasingly relevant and necessary to determine the forecasted development trends that indicate future changes in the phases of the life cycle and enable the adoption and application of efficient managerial decisions on the organization of future operation.

As a result of determining the phase of the enterprise cycle, the type of crisis management is chosen at the time of the analysis, which will determine the areas of crisis measures (the second stage), taking the specifics of the development of the crisis situation into consideration.

The growth phase corresponds to preventive crisis management focused on the search and forecasting of the trends in the external and internal environment that may adversely affect the enterprise operation.

During the peak phase, active crisis management should be applied, which, aside from monitoring the environment, is aimed at forming the preventive measures and adaptive crisis measures.

Responsive crisis management is applied in the phase of recession. Its purpose is to identify weaknesses in the enterprise operation, localize and monitor their condition, as well as introduce corrective measures, if necessary.

During the crisis phase, measures are applied to eliminate the crisis phenomena that already exist, as they describe the passive type of crisis management.

The third stage is to define management measures in accordance with the type of crisis management. At the present stage of development, much attention in the academic economic literature is paid to the problem of applying crisis measures which would yield tangible results in overcoming crisis phenomena and situations that are emerging or have already emerged, without significant expenditures on their implementation (Bowers, Hall, and Srinivasan 2017; Sahin, Ulubeyli and Kazaza 2015; Avanzi, Silva, Foggiatto, Santos, Deschamps, Freitas Rocha Loures 2017; Tena-Chollet, Tixier, Dandrieux and Slangen 2017). In the opinion of the author, the best approach is to distribute selected crisis management measures by groups in accordance with the types of crisis management that correspond to the phases of the enterprise life cycle. In the event of determining the enterprise state on the border of two development phases, it is expedient to use mixed crisis measures corresponding to management types.

As such, all crisis measures can be divided into 7 groups, namely: preventive, preventive-active, active, active-responsive, responsive, responsive-passive and passive.

The proposed approach to the division and application of crisis measures in accordance with the phases of the enterprise life cycle simplifies the process of making managerial decisions and allows to forecast and control crisis phenomena. Timely application of certain measures allows to delay the arrival of the recession phase or accelerate the withdrawal from the crisis state.

After determining the area of crisis measures, a crisis program (the fourth stage) is formed, based on the use of economic instruments and methods of crisis management. Such a program should be aimed at preparing and predicting the crisis, preventing its spread, limiting its consequences, eliminating damage and restoring the enterprise operation.

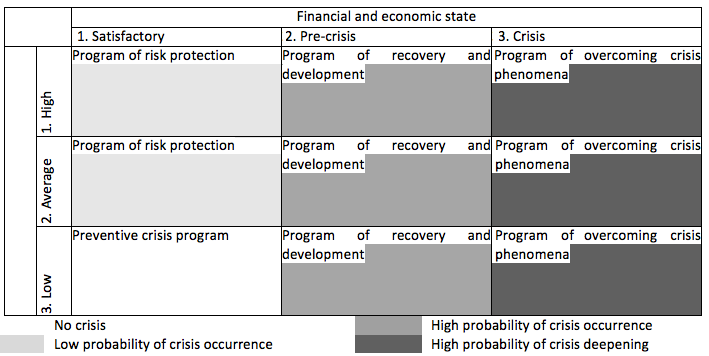

Table 1.

Choosing the enterprise crisis program, depending on the level of the

existing threats and the financial and economic state of the enterprise

First of all, it must be noted that economic imbalance and deterioration of financial and economic state can be caused by such threats as unjustified entry of the enterprise into new markets, unfavorable conditions for concluding deals, deterioration of relations with business partners, suppliers, creditors, banks and consumers, frequent changes in the enterprise strategy, changes in the management structure, growth of conflicts, revocation of licenses, etc.

An enterprise must implement a preventive crisis program in order to prepare and predict the crisis in case of a satisfactory financial and economic state and a low degree of threats. Preventive measures should be aimed at increasing flexibility within the enterprise, developing preparatory plans for avoiding crisis situations and preventive measures to implement these plans. Such measures primarily include strategic controlling, formation of insurance funds, strategic reserves of funds, technical means, etc.

If the financial situation in general is assessed as satisfactory, while the level of threat occurrence is high, the enterprise management should focus on implementing the program of risk protection, which consists in preventing the emergence of a crisis, creating all necessary conditions to prevent its slightest manifestation and further spread. The main measures aimed at neutralizing the threats of the financial crisis are insurance of the corporate financial risks, sale of excess or unused assets, taking measures to recover accounts receivable, saving investment resources, saving current expenses, solving strategic tasks, expansion of export activities, etc.

If the financial state of an enterprise is described as pre-crisis, then the program of recovery and development should be implemented in order to prevent the crisis deepening and further bankruptcy, aimed at eliminating insolvency and restoring financial stability. The enterprise management should pay special attention to establishing relationships with suppliers and buyers, evaluating their own competitive advantages, studying the strengths and weaknesses of competitors, etc. in the pre-crisis state.

Crisis areas of the enterprise operation in this case should include diversification aimed at increasing sales, acceleration of the enterprise working capital turnover, strengthening control over receivables and payables, relief of overdue debts, optimization of cash flows, capital structure, assets and investments, search for ways to reduce the cost of production, modernization of obsolete equipment, etc.

If the enterprise has already found itself in a crisis state, the executives should implement a program to overcome the crisis, immediately respond to the crisis situation, promptly organize the work of specialists to solve tasks, take risky and out-of-the-box decisions, coordinate the actions of all participants, constantly monitor the implementation of crisis measures and their results. It is necessary to make the decisions that will allow to ensure cash receipts to restore solvency in the shortest possible time.

Urgent measures to accelerate the receipt of funds include raising additional capital, creating the most favorable conditions and highly specialized proposals for loyal and "profitable" clients, release of costly employees, maintenance of the customer base, any ways to encourage clients (exhibitions, presentations, websites, branded stores), development of a number of proposals simultaneously.

At the next, fifth stage, the crisis program is evaluated on the basis of indicators of the level of the production and financial state of the enterprise, which must take a number of certain factors of influence on the enterprise into account, and act more as indicators of production and financial activity.

It is advisable to choose indicators that will most fully describe the state and capabilities of the enterprise depending on the crisis stage and have a deterministic dependence. One of the main aspects is the unidirectional nature of indicators. It means that the growth in the value of each of the coefficients indicates an increase in the enterprise resilience to crisis situations and in the efficiency of crisis measures taken.

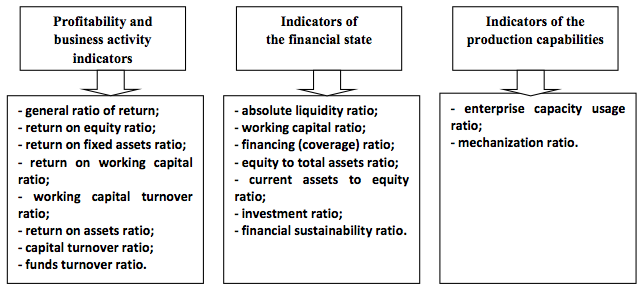

The crisis state often reveals due to inefficient use of the capacity of enterprises, which results in lost solvency and a negative financial result (loss) for the enterprise. Other important indicators, the deterioration of which leads to bankruptcy are indicators of financial sustainability, as they underlie the analysis of the crisis occurrence probability. Proceeding from this, the key ratios were determined, which in their essence are expedient to systematize and divide into 3 groups: profitability and business activity indicators of the enterprise, indicators of the financial state of the enterprise, and indicators of the enterprise production capabilities (Figure 1).

Figure 1

Indicators of the level of production and financial state of the enterprise

Processing of the source data results in normalized values of the model indicators, after which the actual and predicted value of the indicators under study can be found. If the actual value is more than the predicted one, it is necessary to adjust the crisis measures and re-evaluate the crisis program. If efficient measures are chosen, the actual value will be less than the predicted one, which indicates the expediency of implementing the crisis program (sixth stage).

The seventh stage is to define the life cycle phase, taking the efficiency of the crisis management implemented by determining the impact of crisis measures on the change in the forecasted development trend of the enterprise into consideration.

The crisis at the enterprise may be revealed by a fall in sales, liquidity and solvency, reduction in production and current assets turnover, overdue receivables, high costs, low output profitability, etc. As such, the important parameters of the enterprise operation that can help evaluate the level of the enterprise viability include production volumes, income, product prices, profit, cost, own and raised capital, capital turnover, formed reserves, insurance reserves, volumes of payables and receivables, cash availability, level of tax payments, labor and logistics management productivity, internal standards for the use of economic resources, etc.

Economic vehicles are an effective means of preventing, identifying, localizing and neutralizing the crisis, overcoming crisis consequences with minimal losses, preventing bankruptcy and liquidating the enterprise. For example, the toolkit of crisis management should include rehabilitation, restructuring and reengineering. Tariffs, prices, sanctions and fines should be considered as instruments of the mechanism for managing the economic security of the enterprise (Sennewald 2016).

In the opinion of the author, economic vehicles should be considered both from outside and from within the enterprise. External economic vehicles are instruments that are used externally in relation to the enterprise and represent economic levers at the state, sectoral and regional levels. Internal economic vehicles are used at the level of the enterprise and factors influencing its operation in the internal environment.

Crisis economic vehicles include the following groups of instruments: indicators of economic performance, utilization of resources in the system of crisis management of the enterprise, indicators of business activity, liquidity and solvency, financial sustainability, cash flows.

The researchers believe that instruments for the cash flows analysis, taking the tactical management needs into account, deserve special attention. The analytical indicators considered by them allow the enterprise to identify shortcomings in the management of short-term free funds in due time and avoid undesirable surpluses of funds by diverting them to passive operations, which will help to repay the shortage of funds in the future (Shaitova, n. d.; Rezida and Efimov 2014).

Implementation of the main functions of crisis management is possible through the systematic analysis of the results of economic activities, assessment of the state of available economic resources utilization and the financial and economic state of the enterprise.

Results of economic activities are formed as a result of various types of activities: operating, investment, financial. Within these types, subtypes can be singled out, each having its own results. For example, it is appropriate to consider the results of production, sales and marketing activities in the structure of operational management; the results of various types of financial transactions in financial management; the results of investment activities in the field of real and financial investment in investment management. Economic results of activities should be considered not only as volumetric parameters, but also as financial results – the volume of profit or loss that is formed as a result of the relevant type of activity.

The prerequisites for obtaining financial and economic results are the aggregate of traditional (mineral, raw materials, financial, material, technical, labor) and strategic resources (innovative, intellectual, information, organizational), as well as abilities, competencies and opportunities for their efficient use, which altogether define the resource potential of the enterprise, the cumulative effect of which lies in interrelation between the elements of strategic and traditional resources that leads to achieving greater results than in cases when they function separately (Ligonenko 2013).

As a result of the efficient economic performance of the enterprise and rational use of available resources, it becomes possible to secure the growth of its value in the future, achieve a good financial and economic state and increase competitiveness of products.

Depending on whether the enterprise is currently in the state of crisis or efficiently developing, executives of Kazakhstani enterprises should efficiently use various methods and tools of crisis management. In case of high efficiency of the enterprise, it is sufficient to take crisis preventive measures, while in case of increasing competition, decreasing efficiency and increasing probability of bankruptcy, it becomes necessary to take radical crisis measures.

Analysis of scientific approaches to definition of the economic essence of the crisis management concept and the use of the proprietary approach to the definition of the crisis at the enterprise allowed to provide the independent definition of this concept, which, unlike the existing ones, takes into consideration the main task of tackling crisis phenomena – overcoming contradictions in the economic system of the enterprise – and the degree of the crisis phenomena depth.

The importance of Kazakhstani executives’ understanding of the need to take measures to prevent crisis situations at the enterprise is worth noting. Measures to prevent crisis situations should be taken by the enterprise management long before such situations emerge. Enterprise management should primarily rely on its own resources, rather than on improving legislation to prevent bankruptcy of enterprises or state support on the way to overcome the financial and economic crisis. This requires timely response to the emergence of problems in economic activities, efficient use of economic vehicles of crisis management, and having proprietary mechanism to prevent crisis and bankruptcy.

Economic vehicles of crisis management are a combination of economic means used to assess the probability of a crisis occurrence, prevention, identification, localization, neutralization, overcoming crisis consequences with minimal losses, preventing bankruptcy and liquidation of the enterprise, which will allow to influence the parameters of the crisis management system of the enterprise, and regulate financial and economic processes towards strengthening economic potential and gaining competitive advantages.

The mechanism of crisis and bankruptcy prevention should be introduced into the financial and economic mechanism of the enterprise. This will allow responding to the emergence of crisis processes in a timely manner and preventing the crisis at the enterprise in the shortest possible time.

The developed algorithm allows to define the phase of the enterprise life cycle, choose the appropriate type of crisis management, and form a rational crisis program, which is evaluated using an integral indicator and indicates the appropriateness and efficiency of its implementation. The proposed algorithm will help delay the arrival of the recession phase or accelerate the withdrawal from the crisis phase, as well as qualitatively manage the enterprise activities and be ready for unexpected changes in the changing internal and external market environment. Timely application of crisis measures at the appropriate stage of the enterprise development will allow not only to save enterprises from bankruptcy, but also to prevent crisis situations in their future operation.

Avanzi, D. da Silva, Foggiatto, A., Santos V.A., F. Deschamps, E. de Freitas Rocha Loures. (2017). A framework for interoperability assessment in crisis management. Journal of Industrial Information Integration, 5, 26-38

Balashov A.P. (2010). Antikrizisnoye upravleniye [Crisis management]. Novosibirsk, pp. 346.

Bowers, M. R., Hall, J. R. and Srinivasan, M. M. (2017). Organizational culture and leadership style: The missing combination for selecting the right leader for effective crisis management. Business Horizons, 60(4), 551-563

Fuchedji V.I. (2012). Antikrizisnoye finansovoye upravleniye v obespechenii ustoychivosti sistemy upravleniya predpriyatiyem [Crisis financial management in ensuring sustainability of enterprise management system]. New University. Series: Economics and law, 11 (21), 20-23.

Jaques T. (2009). Issue and Crisis Management: Quicksand in the Definitional Landscape. Public Relations Review, 35(3), 280-286.

Koshkin V.I. (2000). Antikrizisnoye upravleniye: 17-modulnaya programma dlya menedzherov. “Upravleniye razvitiyem organizatsii” [Crisis management: 17-module program for managers. "Managing the organization development"]. Module 11. Moscow: INFRA-M, pp. 512.

Kryzhanovskiy B. G. (1998). Antikrizisnoye upravleniye [Crisis management]: textbook. Moscow: PRIOR, pp. 432.

Ligonenko L.A. (2013). Teoretiko-metodologicheskiye osnovy antikrizisnogo upravleniya [Theoretical and methodological bases of crises management]. Property relations in the Russian Federation – 2013, 3, 67-72.

Mikhel V.S. (2012). Antikrizisnoye upravleniye v rossiyskikh korporatsiyakh [Crisis management in Russian corporations]. Entrepreneur’s guide, 14, 145-151.

Orekhov V.I. (2009). Antikrizisnoye upravleniye [Crisis management]: textbook (GRIF). Moscow: INFRA-ENGINEER, pp. 544.

Pokrytan P.A. (2007). Teoriya antikrizisnogo upravleniya [Theory of crisis management]: workbook. – Moscow: Publ. center of EAOI, pp. 237.

Rezida R.Ya. and Efimov O.N. (2014). Antikrizisnoye upravleniye finansami organizatsii [Crisis management of the organization's finance]. NovaInfo.Ru, 28, 175-180.

Rodionova N.V. (2011). Antikrizisnyy menedzhment [Crisis management]. Moscow: UNITY-DANA, pp. 680.

Sahin, S., Ulubeyli, S. and Kazaza., A. (2015). Innovative Crisis Management in Construction: Approaches and the Process. Procedia - Social and Behavioral Sciences, 195, 2298-2305

Sennewald, C. A. (2016). Curtis Baillie: Crisis Management. Effective Security Management (Sixth Edition), pp. 189-195

Shaitova N.Zh. (n. d.). Antikrizisnoye upravleniye finansami pri ugroze bankrotstva [Crisis management of finance in the face of bankruptcy]. NovaInfo.Ru, 113, 118-120.

Tena-Chollet, F., Tixier, J., Dandrieux, A. and Slangen, P. (2017). Training decision-makers: Existing strategies for natural and technological crisis management and specifications of an improved simulation-based tool. Safety Science, 97, 144-153

Ushanov P.V. (2010). Antikrizisnoye upravleniye kak novaya paradigma upravleniya [Crisis management as a new management paradigm]. Efficient crisis management, 1, 66-79.

Utkin E.A. (1997). Antikrizisnoye upravleniye [Crisis management]. Moscow: Tandem; EKMOS, pp. 400

Znamenskiy V.V. (2014). Krizisy, antikrizisnoye upravleniye, genezis antikrizisnogo upravleniya [Crises, crisis management, genesis of crisis management]. Risk management, 1, 31-40.

1. Turan University, 050013, Republic of Kazakhstan, Almaty, Satpaev St. 16-18-18a; E-mail: ermek004@mail.ru

2. Turan University, 050013, Republic of Kazakhstan, Almaty, Satpaev St. 16-18-18a

3. Al-Farabi Kazakh National University, 050040, Republic of Kazakhstan, Almaty, al-Farabi Ave., 71