Vol. 39 (# 06) Year 2018. Page 31

Vladimir Anatolevich ERMAKOV 1; Elena Mikhailovna BURMISTROVA 2; Nikolay Borisovich BODIN 3; Alexander Alexandrovich CHURSIN 4; Elena Aleksandrovna SHEVEREVA 5

Received: 29/10/2017 • Approved: 15/11/2017

3. Modern Tendencies of Financing International Trade

4. Letters of Credit in Foreign Trade Transactions in Russia

ABSTRACT: Letters of credit refer to effective and secure financial instruments for securing payments in international trade. Certain practical aspects of using letters of credit for international sales transactions are considered herein. The main purpose of this study is to analyze the practice of using documentary letters of credit in foreign trade, and to determine effective ways to improve letter of credit (L/C) payment methods for importers/exporters. Relevant empirical research methods are applied herein, as well as indicator techniques and secondary analysis of the results of a global survey of experts in international trade financing. This study allows to make the following conclusions: • In international practice, commercial L/Cs are most widely used in foreign trade transactions. • However, their volume in international payments has decreased for the last year. Most experts believe that the main reason for such decline is a decrease in foreign trade turnover. • Unlike countries with developed financial markets, the share of payments using L/Cs remains rather small in Russia, and it amounts to about 0.15% of the total volume of payment transactions in the banking system. • At the same time, over the past 5 years there has been a twofold increase in the volume of payments, in value terms, with the use of L/Cs. This study allows identifying the main problems that retard improving L/C payment methods for foreign trade transactions, namely: low availability of L/Cs for small and medium-sized businesses; cost and complexity of compliance with regulatory requirements, including Basel III; growing global risks. In the author's opinion, the blockchain technology may become one of the promising ways for improving L/C payment methods for international transactions. This technique may help to solve one of the main problems in global trade — the huge document flow while conducting transactions between several entities. The use of this technology will save time and money for customers, and it may ultimately transform trade finance for the benefit of businesses around the world. |

RESUMEN: Las cartas de crédito se refieren a instrumentos financieros efectivos y seguros para asegurar pagos en el comercio internacional. Ciertos aspectos prácticos del uso de cartas de crédito para transacciones de ventas internacionales se consideran aquí. El objetivo principal de este estudio es analizar la práctica de usar cartas de crédito documentarias en el comercio exterior y determinar formas efectivas de mejorar los métodos de pago de cartas de crédito (L / C) para los importadores / exportadores. Aquí se aplican los métodos de investigación empírica pertinentes, así como las técnicas de los indicadores y el análisis secundario de los resultados de una encuesta mundial de expertos en financiación del comercio internacional. Este estudio permite llegar a las siguientes conclusiones: • En la práctica internacional, los L / C comerciales son los más ampliamente utilizados en las transacciones de comercio exterior. • Sin embargo, su volumen en pagos internacionales ha disminuido en el último año. La mayoría de los expertos cree que la razón principal de tal disminución es una disminución en la rotación del comercio exterior. • A diferencia de los países con mercados financieros desarrollados, la proporción de pagos que utilizan L / C sigue siendo pequeña en Rusia, y representa aproximadamente el 0,15% del volumen total de transacciones de pago en el sistema bancario. • Al mismo tiempo, en los últimos 5 años ha habido un aumento doble en el volumen de pagos, en términos de valor, con el uso de L / C. Este estudio permite identificar los principales problemas que retrasan la mejora de los métodos de pago de L / C para las transacciones de comercio exterior, a saber: baja disponibilidad de L / C para pequeñas y medianas empresas; costo y complejidad del cumplimiento de los requisitos reglamentarios, incluido Basilea III; crecientes riesgos globales. En opinión del autor, la tecnología blockchain puede convertirse en una de las formas prometedoras para mejorar los métodos de pago de L / C para las transacciones internacionales. Esta técnica puede ayudar a resolver uno de los principales problemas en el comercio global: el enorme flujo de documentos al realizar transacciones entre varias entidades. El uso de esta tecnología ahorrará tiempo y dinero a los clientes y, en última instancia, puede transformar la financiación del comercio en beneficio de las empresas de todo el mundo. |

Foreign trade plays a key role in economic development and is a powerful factor in the economic growth of all countries, regions, and the entire world community. In the conditions of global instability, mitigating the risks and ensuring the safety of international settlements become a prerequisite for the successful closing of any foreign trade transaction (Baboshkina 2016).

In the case of sanctions and the current limitation of funding opportunities in the financial market, it is especially relevant to use L/Cs that combine the capabilities of a settlement instrument, mitigating risks and obtaining financing.

It seems that the current global practices in international settlements and basic trade finance techniques are not properly known to a great number of importers/exporters, and it has caused this article to appear. These trade and export financing transactions are conducted only by first-class Russian banks in cooperation with the world financial market leaders that have provided those Russian banks with credit facilities for trade finance transactions. Foreign trade is the locomotive of the world development and cooperation.

All developed countries, such as the OECD (Organization for Economic Co-operation and Development) members, encourage their national exports in every possible way through the system of export credit agencies (hereinafter referred to as the ECA), thus reducing commercial and political risks by providing insurance coverage. However, this applies specifically to export finance transactions with terms of 3+ years and amounts from 1 million US dollars or Euros. For shorter periods and smaller amounts, when the transactions are structured without ECA (trade finance), the banks themselves take the country and commercial risks. Banks are extremely interested in supporting national exports through trade finance mechanisms. Moreover, the L/C is the main element in such mechanism (Ermakov 2014).

Large importers/exporters that engage experts in foreign trade and international settlements actively apply the L/C payment method (Ermakov and Shkvarya 2010). As for small and medium-sized businesses, their capabilities are limited not only from the financial point of view, but also by the sporadic nature of their transactions, which makes irrational the engagement of such specialists on an ongoing basis. Banks are also not eager to work on trade finance with small businesses due to the small number of their transactions and the amounts of their contracts and financing. Of particular concern is the poor awareness of regional banks and potential customers about the possibilities of trade and export financing and existing advantages of L/C.

These are the regions that have a key prospect for developing their industrial production and, accordingly, the need to purchase modern equipment for update and renovation purposes. In the current conditions of economic volatility, foreign exporters will increasingly insist on using L/Cs since those provide the maximum guarantee that their clients (importers) shall effect payments (Holbrook 2010).

It is quite important to identify and demonstrate in the most comprehensive way the versatility of this form of international settlements. Particular attention is paid to obtaining financing/deferred payment for applicants from top class European and global banks at the prices of the European money market (Libor, Euribor) in the form of post-financing L/Cs and deferred payments with subsequent discounting.

The study results are relevant not only for the Russian Federation, but also for the CIS countries, Eastern Europe and other emerging markets, where the level of money market rates is high.

A number of tasks are being performed in this study to achieve the above goal:

The problems of using L/Cs have been learnt applying the systematic approach, which takes into account the socio-political and organizational aspects of international trade.

This study relies on empirical research methods, in particular the methods of observation and comparison, as well as secondary analysis of publications of the global studies results.

The following are the information sources for the collection and analysis of data reflecting the development of foreign trade: official reports of the Bank for International Settlements, the International Chamber of Commerce, the World Trade Organization, the World Bank Development, the Russian Federal State Statistics Service, etc., as well as the RETHINKING TRADE & FINANCE global survey.

With the fall of the Berlin Wall in 1989, trade barriers also collapsed. Since then, global trade has been developing along the trajectory of growth, both in volume and in value terms. The growth of the world economy is largely due to the expanded trade. From 1990 to the end of 2008, the growth of global trade was about double the global GDP growth. Now, the world economy is facing a new reality: global trade growth has been below the global GDP growth five years in a row.

Largely around the world, trade certainly depends on finance, including access thereto and/or risk mitigation. Trade finance is directly related to the effectiveness as a driving force for economic recovery, growth and international development — perhaps even stability and safety (Vaubourg 2016).

Analyzing the global and regional implications and trends in trade finance (including supply chain financing), it is important to distinguish between trends in foreign trade in goods and services and trends in the monetary value of foreign trade in goods and services.

According to the survey conducted by the International Chamber of Commerce (ICC) in 2016, the global trade finance activity has increased in quantitative terms. Despite market and operational problems, 89% of respondents believed that their bank's ability to meet the needs of clients in trade finance remained stable or their ability to satisfy customers had increased. However, the share of respondents who reported an increase in trade financing activity in physical terms decreased from 63% in 2015 to 52% in 2016 (ICC Global Survey on Trade Finance 2016).

It is also worth noting that 39% of respondents reported an increase in interest from their clients in the financing solutions for their supply chains. Clearly, trade is increasingly seen from the point of view of commercial relations ecosystems represented by cross-border supply chains, and thus, supply chain financing is becoming an increasingly important element of the banks' proposals for financing and mitigating risks in international trade (Alav 2016).

Over the past few years, trade finance, and therefore its instruments, have become a high-risk business because it may be used in certain financial crimes. Thus, 21% of respondents reported increasing requirements for their bank guarantees and standby L/Cs; 15% of banks reported an increase in injunctions; and 13% of respondents reported an increase in charges of fraud.

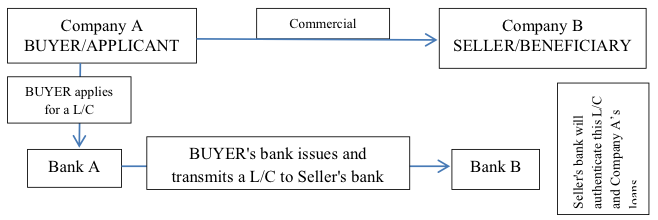

L/Cs are widely used in the foreign trade in goods (World Trade Organization, n. d.). They represent payment obligations usually taken by the buyer's bank (importer, Company A) on its behalf to the seller (exporter, Company B), or its bank (see Figure 1) (Wood 2008).

Fig. 1

Payment mechanism using L/Cs in foreign trade

The L/C provides a seller with a guarantee that relevant purchase will be paid for, and it bears a series of obligations for such seller (delivery terms, submission of documentation) and relevant buyer (in particular, that if such buyer fails to pay, its bank shall cover the outstanding amount) (Niepmann and Schmidt-Eisenlohr 2017).

In the international practice of trade financing, there are two types of L/Cs: commercial and standby. General characteristics of standby and commercial L/Cs (Mugarur 2017):

At the same time, there are a number of differences between these types of L/Cs, which are shown in Table 1.

Table 1

Differences between Standby and Commercial L/Cs

|

Standby L/C |

Commercial L/C |

Purpose of payment |

Standby L/C is not the main method of payment. Standby L/Cs are the secondary payment instruments, serve as a guarantee, and will be used if the primary payment instrument is not working. |

Commercial L/Cs represent the main method of payment in international sales. This means that when a L/C is issued, the supplier is to be paid for the goods purchased directly through such L/C. Such supplier will be paid by the bank only upon proper submission of such commercial L/C. |

Governing rules |

ISP 98 and UCP 600 |

UCP 600 |

Complexity of submission |

Relatively simple documentary payment requirements. |

Relatively detailed and complex documentary payment requirements. |

Further, there are several types of commercial L/Cs depending on their payment terms (see Table 2).

Table 2

Main Types of Commercial L/Cs and Their Use in Trade Finance Schemes

Main types of L/Cs |

Description |

Payment at sight L/C |

Payment in favor of the Supplier is made by the Bank upon proper submission of relevant documents at the Buyer's expense |

Postfinancing L/C |

Payment in favor of the Supplier is made by the Bank upon proper submission of relevant documents, and the Buyer is given a deferred term for such payment for a specified term |

Deferred payment L/C (a deferral is given by the Seller to the Buyer) |

Payment in favor of the Supplier is made by the Bank on the deferral expiration date at the Buyer’s expense upon proper submission of relevant documents |

L/C with deferred payment and discounting |

Payment in favor of the Supplier is made by the Bank before the deferral expiration date upon proper submission of relevant documents, and the Buyer is given a deferred term for such payment for a specified term |

Revolving L/C |

Payment in favor of the Supplier is made by the Bank at the Buyer’s expense upon proper submission of relevant documents for a certain part of the delivery at certain intervals (the Supplier shall have a guarantee of payment for equal lots of goods and services shipped with a predetermined regularity) |

Transferable L/C |

Payment in favor of the final Supplier and the Reseller is made by the Bank upon proper submission of relevant documents by the Reseller at the Buyer’s expense. The Russian laws apply certain restrictions for this type of payments |

Standby L/C |

Payment in favor of the Beneficiary is made by the Bank upon proper submission of relevant documents at the Applicant's expense. Instrument similar to guarantees |

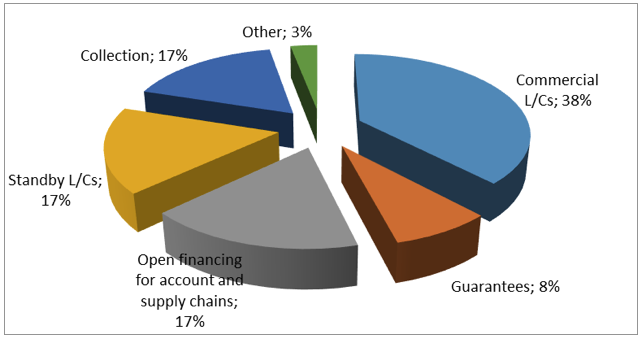

Currently, the commercial L/C is the main tool in the portfolio of trade finance and risk mitigation solutions that will support cross-border trade in the near future (see Figure 2).

Fig. 2

Range of Trade Finance Products (ICC Global Trade and Finance Survey 2015)

In 2016, there was a decrease in the volume of commercial L/Cs. Partially, this decline was directly due to certain significant decline in the cost of global trade.

Moreover, as the study results show, the measures taken recently by banks have a negative impact on their ability to maintain and develop their business in financing trade (Park, Lee and Koh, 2014).

The logics supporting the suggestion that one can expect an increase in using trading instruments to cover the risk of default was also confirmed in a survey in 2016, where it was reported that standby L/Cs amounted to almost 8% for export transactions.

Open financing of accounts and supply chain, which reached 16% of the range of products, should be understood in the context of the fact that the respondents of this survey usually proceeded from traditional operations on trade finance. Such increase in the figures for financing the supply chain from almost 15% in the 2015 edition is not surprising, as the SCF methods and products, including factoring, continue to grow, although more slowly than in recent years.

Guarantees amount to 17.25% of all trade finance instruments. This is not a surprise since the use of demand guarantees and standby L/Cs to cover risks of default is gaining momentum in the current volatile trading environment. The fundamental nature and value of bank guarantees and standby L/Cs are based on the fact that these instruments are trusted, independent and usually firm obligations for making payments in the event that some financial obligations or performance obligations are not met.

According to the ERC Trade Register report for 2008-2015, Loss Given Default (LGD) rates were 27% for import L/Cs, 40% for export L/Cs, 35% for import/export loans and 65% for performance guarantees (ICC. TRADE REGISTER REPORT, 2016).

During 2008-2015, the average contract maturity for short-term trade financing products was 122 days for import L/Cs, 133 days for export L/Cs, 160 days for import/export loans, and 582 days for performance guarantees.

The documentary L/C has been used in the world economy for over 150 years, and it still plays an important role in foreign trade. It is estimated that L/Cs annually constitute bank liabilities for more than $100 billion. At least 60% of the commodity transactions are made using L/Cs (United Nations Conference On Trade And Development Sgs Société Générale De Surveillance S.A., n. d.).

International trade is the exchange of capital, goods and services across international borders between people belonging to different languages, cultures and law systems. Whereas L/Cs are a means of payment in foreign trade, it is obvious that standardized rules should be established to manage them on a global basis in order to ensure uninterrupted functioning there of.

The International Chamber of Commerce (ICC) is an organization that issues such standardized rules. These rules — Uniform Customs and Practice for Documentary Credits (UCP) — are regularly updated.

The Uniform Customs and Practice for Documentary Credits by the International Chamber of Commerce in the 2007 version No. 600 (hereinafter referred to as the UCP) are the legal basis for L/Cs in international settlements. The Regulation of the Bank of Russia No. 383-P dated June 19, 2012 "On Money Transfer Rules” governs L/Cs circulation in Russia.

The use of L/Cs in foreign trade transactions as a payment instrument based on the UCP terms is beneficial to both contract parties (importers/exporters). The very essence of a L/C is aimed at the successful closing of a transaction and proper settlements thereon. According to the UCP terms, the L/C is a written obligation of a bank (issuing bank) to a seller (beneficiary) in accordance with the buyer’s (applicant) instructions to make payment, acceptance, negotiation or deferred payment for a specified term against the submitted documents, provided that these documents are proper and correspond to the list specified by such applicant (The Uniform Customs and Practice for Documentary Credits, 2007).

Despite the fact that L/Cs are the main form of settlements for foreign trade contracts, their share on the Russian banking market is still small and amounts to about 0.15% of the total volume of payments.

At the same time, over the past five years, there has been a significant increase in the volume of L/Cs. For example, for the period 2012–2016, the number of settlements using L/Cs in Russia increased by 176.4%, and the volume of payments using L/Cs increased more than twice in value terms (see Table 3).

Table 3

Payment Transactions Using L/Cs in Russia for 2012–2016

Parameter |

2012 |

2013 |

2014 |

2015 |

2016 |

2012/2016 variance |

|

+/- |

% |

||||||

Number of payments, million |

2,499 |

2,639.90 |

2,647.40 |

2,565.70 |

2,567.40 |

68.40 |

2.7% |

including L/Cs |

0.072 |

0.096 |

0.12 |

0.119 |

0.199 |

0.13 |

176.4% |

Volume of payments, billion, RUR |

393,158.40 |

450,048.10 |

524,362 |

521,503.40 |

513,173.20 |

120,014.80 |

30.5% |

including L/Cs |

252.7 |

355.9 |

494.4 |

440 |

775.3 |

522.60 |

206.8% |

Unlike countries with developed economies and financial markets, the Russian infrastructure for providing L/C payments looks rather modest. Currently, only a few large banks, such as Vnesheconombank, Roseximbank, Sberbank, VTB, Investtorgbank, Promsvyazbank, etc., finance the exports of Russian companies using L/Cs.

For example, Vnesheconombank's L/C network covers about 30 countries in Europe, Asia, Southeast Asia, the Middle East, Africa, Latin America, and ex-USSR countries. As for trade finance operations, within the established documentary limit, Vnesheconombank issues uncovered reimbursement obligations, confirms L/Cs and performs settlements thereon. Based on relevant applications properly submitted by its customers, Vnesheconombank issues L/Cs for settlements with suppliers of goods and services.

Vnesheconombank conducts L/C settlements in clearing currencies under intergovernmental and interbank agreements, including repayment of India's and Vietnam's state debt to Russia on loans granted during the period of the former USSR.

Roseximbank provides settlement services and currency control of foreign trade transactions, and it provides financial and guarantee support for exports through confirmed L/Cs. Such L/Cs provide foreign buyers of Russian products with access to financing payment under an export contract through a L/C issued by a foreign bank and confirmed by Roseximbank.

A global survey of participants in trade finance allows identifying the main problems that retard improving L/C payment methods in foreign trade transactions.

Experts note that there is a global trade finance deficit now. Perhaps this is due to a slowdown in global trade and the uncertainty of the global economy. According to the experts' opinion, there is a certain toughening of the trade financing availability.

The number of banks supporting or increasing the available credit lines is down; more than 20% of banks have reduced their credit facilities. As the banks report, the main reason is that more strict credit criteria are applied now. This leads to almost 50% reduction in trade credit facilities for SMEs, 30% for commercial customers, 25% for corporate clients, and 20% for financial institutions.

Other factors of reduction are limitations in the capital distribution and deterioration in the creditworthiness of participants.

Russia belongs to the regions with the largest unmet demand for trade financing. The share of rejected transactions is more than twice as high as the share of proposed transactions. For example, trade financing proposals from Russia accounted for only 5% of all proposed transactions, with 12% of deviations.

Weak economic conditions due to low oil prices and ongoing sanctions contributed to the perception of a higher risk that affected the level of trade finance availability.

The study results confirm the experts' concern that regulatory requirements prevent banks from responding to market demand for trade finance. Russia refers to the countries with the highest regulatory influence to prevent financial crimes.

Other significant obstacles associated with more traditional measures include the low credit rating of the country, issuing banks or debtors, insufficient collaterals and previous disputes.

Financing of transactions in international trade is related to the possibility of occurrence of risk events, which can lead to adverse consequences.

In general, the longer the maturity of the bank's credit risk is, the more risky such deals are. Short-term trade finance products, including import and export L/Cs, are proposed by the banks with a low level of credit risk. By definition, short-term trade finance products have short contractual maturities and are often issued on a transaction basis (i.e., they are not renewable). This reduces the risk for banks, as they can react to deterioration in credit quality.

Since 2015, there has been a trend of aggravation of geopolitical risks: from the slowdown of the Chinese economy and migration to geopolitical turbulence and sluggish growth. According to experts, the most prohibitive factors for business with export financing in new markets are political instability, sanctions and regulatory barriers. Moreover, a significant problem is corruption, which is exacerbated during times of political instability, when the threat of power change becomes more real.

In general, it should be noted that trade finance risks are growing, the factors that can provoke defaults are different, but the evidence of growing defaults is clear. For example, claims paid by members of the Berne Union in the context of short-term credit insurance, which is predominantly an open account for defaults on trade receivables, have risen from $2 billion in 2014 to $2.16 billion in 2015.

Therefore, it is no wonder that 40% of respondents predict that the demand of their customers for confirmed L/Cs as the least risky financing instrument will increase. Such demand is due to the increased risk anticipation by international traders operating in global markets. The external environment has become complex, with significant negative geopolitical dynamics, shaping global risks and security, with persisting post-crisis economic problems in many countries and the current problems around country, banking and commercial risks on a world-wide basis.

The growth in demand for confirmed L/Cs is due to a number of advantages of this instrument for financing foreign trade transactions:

The UCP terms greatly facilitate relations of the parties, as they do not need to study the specifics of the national legislation of their counterparty in the field of settlements and they should just comply with a set of internationally recognized rules and customs that are equally understood and interpreted.

A payment is made only upon fulfillment of the L/C terms and conditions and submission of relevant shipping documents.

The bank’s obligation is not contingent with the primary contract. The UCP state that the L/C by its nature is a transaction that is separated from the contract of sale or another agreement on which it can be based. Banks are in no way connected to or obliged by such a contract, even if the L/C has any reference thereto. The bank processes documents only, not goods (services).

The bank’s obligation is conditional. A payment under the L/C is made only upon proper submission of relevant shipping documents specified therein.

The documents must be presented strictly within the validity term of the L/C.

The fact of payment shall cancel all legal obligations. Once the bank has effected the payment in accordance with the relevant documentation properly presented, it has no right of recourse to the beneficiary.

There is a presumption of irrevocability for any L/C.

These basic merits of L/Cs are well-known and successfully applied in practice. However, the list of L/C advantages remains open and concerns not only settlement relations. Each L/C enables not only to mitigate the non-payment and non-delivery risks, but also to obtain financing and deferred payment.

Despite the above advantages, this form of settlements has not yet been widely used in Russia, unlike in developed countries.

At the same time, experts predict the growth of this trade finance sector, as well as further improvement of the existing products and the emergence of new ones.

For example, implementation of the blockchain technology will allow simplifying the settlements for international trade operations (Krainer 2017). The world's first company, which in September 2016 carried out a real trade deal using blockchain, was the Irish dairy producer Ornua. The British bank Barclays and the Israeli startup Wave arranged the payment under the L/C for $100 thousand to secure the export of cheese and butter of the Irish cooperative to the Seychelles trading company.

This transaction on the Wave platform took less than four hours. Traditionally, this process takes from seven to ten days because of difficulties in processing related documentation, including the exchange of original documents using courier services, but cryptographic protection and blockchain verification mechanisms allowed all transactions to be performed via Internet without the need for third-party verification.

The financial conglomerate HSBC and the investment division of Bank of America started to use blockchain to simplify their settlements on foreign trade transactions (Parker 2016). Currently, more than 17 banks in the world have announced the introduction of blockchain in their financial transactions.

In Russia, Alfa-Bank jointly with S7 Airlines conducted the first L/C transaction using blockchain with smart contracts at the end of 2016. Pilot mode of launching this technology demonstrated that the duration of the transaction processing through a L/C had been reduced from 10 days to 4 hours (Alfa-Bank with S7 Airlines conducted the first transaction using blockchain, 2016). Moreover this technology will significantly reduce the bank’s costs. A bank must have a large back-office to examine the documentation in order to process L/Cs. If blockchain is used, a bank shall form a transparent environment where its clients may see that the terms of their contracts have been properly met. Whereas each step is recorded in a smart contract, none of the chain participants can make unauthorized changes. Currently, L/Cs are a service for large companies due to the high service fees. Introducing blockchain technology in international payments will reduce their cost and increase accessibility for private entrepreneurs and individuals.

Since the commencement of trade, safety of settlements has been the key problem to contracting: both parties are at risk, and in the event of a foreign trade transaction such risks increase due to differences in legislation, mentality, political environment, etc.

This study represents a research of modern tendencies in financing of foreign trade transactions, as well as the analysis of using L/Cs in foreign trade transactions in Russia. Based on the study results, the following conclusions may be formulated:

Documentary transactions completely remove these risks from participants in international trade, and a Russian or a foreign bank shall guarantee their 100% completion, in one form or another. The use of a documentary transaction creates a higher comfort for the buyer and the seller, since such transaction involves a third independent person (the bank), which assumes the obligation to pay against the submission of a certain set of documents.

In the international practice of trade financing, there are two types of L/Cs: commercial and standby. Commercial L/Cs are used more often in foreign trade transactions.

The decrease in the volume of commercial L/Cs in international settlements in 2016 may be explained by a decrease in the volumes of international trade.

Despite the fact that L/Cs are the main form of settlements for foreign trade contracts in the world, their share on the Russian banking market is still small and amounts to about 0.15% of the total volume of payments.

It should be noted there has been certain positive dynamics in using L/Cs in Russia for the last 5 years. In value terms, the volume of payments using L/Cs has increased more than twice.

The main problems that retard improving the L/C payment method for foreign trade transactions are the following: low availability of L/Cs for small and medium-sized businesses; cost and complexity of compliance with regulatory requirements, including Basel III; growing global risks.

Blockchain technology, which is gaining popularity in the world payment system, may become one of the promising ways for improving the L/C payment method for international transactions.

This technology may help to solve one of the main problems in global trade — the huge document flow while conducting transactions between several entities. The use of this technology will save time and money for customers, and it may ultimately transform trade finance for the benefit of businesses around the world.

This paper was financially supported by the Ministry of Education and Science of the Russian Federation on the project No. 26.1146.2017/4.6 “Development of mathematical methods to forecast efficiency of using space services in the national economy”.

Alavi, H. (2016). Mitigating the Risk of Fraud in Documentary Letters of Credit. Baltic Journal of European Studies, 6(1), 139–156

Alfa-Bank with S7 Airlines conducted the first transaction using blockchain. (2016). Date View September 17, 2017 https://alfabank.ru/press/news/2016/12/21/1.html

Baboshkina A.A. Actual Aspects of Trade Financing in the World Market. The Russian Foreign Economic Bulletin, No 10, 2016, pp. 67–77

Ermakov V.A. (2014). Trade and Export Financing as a Tool to Increase Efficiency and Reduce Risks of Foreign Trade Transactions. Proceedings of the Conference ’’Problems and Pprospects of Economic Development of the Rocket and Space Industry until 2030 and its Resource Support’’, November 21-23, Moscow.

Ermakov V.A. and Shkvarya L.V. (2014). The Role of Export Credit Agencies in the Innovative Development of the Economy. Economics and Entrepreneurship, 12-2 (53-2), 178–182

Holbrook D. (20100. Documentary Letters of Credit: Banks' Obligation to Payee May Involve Duty of Good Faith. Banking Law Journal, 127(9), 857–862

ICC Global Survey on Trade Finance 2016. (2016). Date View September 17, 2017 https://iccwbo.org/publication/icc-global-survey-trade-finance-2016/

ICC Global Trade and Finance Survey 2015. The official website of United States Council for International Business. (2015). Date View September 17, 2017 http://www.uscib.org/icc-banking-commission-global-survey-highlights-impact-of-trade-finance-gap-on-smes/

ICC. Trade Register Report. (2016). Date View September 17, 2017 https://iccwbo.org/global-issues-trends/banking-finance/access-trade-finance

Krainer, R.E. (2017). Economic Stability under Alternative Banking Systems: Theory and Policy. Journal of Financial Stability, 31, 107–118.

Mugarura, N. (2014). The Letter of Credit, its Resilience and Viability in Securing International Commercial Transactions. Journal of International Trade Law and Policy, 13(3), 246–264

Niepmann, F. and Schmidt-Eisenlohr, T. (2017). International Trade, Risk and the Role of Banks. Journal of International Economics, 107,. 111–126

Park, K.S., Lee, H.Y. and Koh, Y.K. (2014). An Empirical Analysis on the Effectiveness of Credit Risk Management in International Trade: Focusing on International Factoring. Journal of Korea Trade 18(3), 35–52

Parker, L. (2016). Bank of America Merrill Lynch, HSBC, and IDA develop a blockchain prototype solution for trade finance. Date View September 17, 2017 https://bravenewcoin.com/news/bank-of-america-merrill-lynch-hsbc-and-ida-develop-a-blockchain-prototype-solution-for-trade-finance/

The Uniform Customs and Practice for Documentary Credits (UCP 600). The 2007 vesrion No. 600 issued by the International Chamber of Commerce, Art. 2, 2007

United Nations Conference On Trade And Development Sgs Société Générale De Surveillance S.A. Documentary Risk In Commodity Trade. (n. d.). unctad.org›en/docs/itcdcommisc31_en.pdf

Vaubourg, A.G. (20160. Finance and International Trade: A Review of the Literature. Revue d'Economie Politique, 126(1), 57–87

Wood J.S. (2008). Drafting Letters of Credit: Basic Issues under Article 5 of the Uniform Commercial Code, UCP 600, and ISP 98. Banking Law Journal, 125(2), 103–149.

World Trade Organization. Trade Finance And Smes. Bridging the gaps in provision. (n. d.). Date View September 17, 2017 https://www.wto.org/english/res_e/booksp_e/tradefinsme_e.pdf

1. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6

2. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6

3. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6

4. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6

5. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6