Vol. 39 (# 11) Year 2018. Page 30

Igor BAYEV 1; Ekaterina EVPLOVA 2; Ekaterina GNATYSHINA 3; Darya GORDEEVA 2; Olga IVANOVA 2; Dmitry KORNEEV 2; Pavel RYABCHUK 4

Received: 12/10/2017 • Approved: 11/11/2017

3. Data, Analysis, and Results

ABSTRACT: This article considers the solution of a problem of improving the efficiency of industrial leasing process as a product of large-scale import substitution programs in emerging markets. Economic squeeze has led to a decrease in performance among industrial enterprises forcing emerging markets to look for new long-term sources of financing for technological re-equipment necessary for import substitution industries. The nature of industrial production with a high degree of processing and science intensity is specific, as the payback period of large-scale import-substituting programs significantly exceeds the average offers in the emerging loan market. Thus, there is a need for long-term financing. State support programs for industry based on subsidies, stock assets and earmarking are characterized by low efficiency. We have to departure from the practice of funding technical re-equipment at the enterprise to the practice of providing the enterprise with a plant asset ready for operation on a leasing basis. Large production holdings and the state budget will be the lessors and the balance holders of the program. We have provided an algorithm for managing leasing efficiency of these projects through the cumulative leasing effect. We have also provided a number of recommendations on methodological foundations for managing the leasing efficiency of financing import substitution industries. |

RESUMEN: Este artículo considera la solución de un problema de mejora de la eficiencia del proceso de arrendamiento industrial como producto de programas de sustitución de importaciones a gran escala en mercados emergentes. La contracción económica ha llevado a una disminución del rendimiento entre las empresas industriales, obligando a los mercados emergentes a buscar nuevas fuentes de financiación a largo plazo para el reequipamiento tecnológico necesario para las industrias de sustitución de importaciones. La naturaleza de la producción industrial con un alto grado de procesamiento y la intensidad de la ciencia es específica, ya que el período de recuperación de los programas de sustitución de importaciones a gran escala supera significativamente las ofertas promedio en el mercado emergente de préstamos. Por lo tanto, existe una necesidad de financiamiento a largo plazo. Los programas estatales de apoyo a la industria basados en subsidios, activos accionarios y asignaciones se caracterizan por una baja eficiencia. Tenemos que abandonar la práctica de financiar el reequipamiento técnico de la empresa a la práctica de proporcionar a la empresa un activo de planta listo para la operación en régimen de arrendamiento financiero. Las grandes explotaciones de producción y el presupuesto estatal serán los arrendadores y los titulares del programa. Hemos proporcionado un algoritmo para gestionar la eficiencia de arrendamiento de estos proyectos a través del efecto de arrendamiento acumulado. También hemos presentado una serie de recomendaciones sobre fundamentos metodológicos para la gestión de la eficiencia del arrendamiento de financiar las industrias de sustitución de importaciones. |

Level of investment in fixed assets and market demands both have an impact on the economic effect of industrial enterprises. The investment activity of the enterprise as a sensitive mechanism is influenced by many internal and external factors. Thus, the long-term goal of the national scale is to transform domestic economy, namely – to depart from the raw material structure to the high-tech one. In the context of growing external economic threats, it requires significantly greater consolidation of management efforts at all levels (from the federal to the industrial enterprise management).

This is why intensifying investment activity as a basis of economic growth and effective import substitution (steadily declining due to economic sanctions in recent years) is also a basis for the growth of industrial production in the structure-forming sectors of emerging markets (Rosstat Report, 2017). The issue of state support necessary for import substitution and real investment growth has been repeatedly brought up by the bully pulpit in order to reduce country’s dependence on imports.

Physical and moral depreciation of fixed assets is an inherent limitation for effective import substitution in the machine building industry. In Russia, dynamics of investment in fixed assets is in close correlation with the output indices movement in the manufacturing sector. This calls to an impending decline in industrial production on the back of reduced level of investments. In the context of investment resource scarcity and low availability of "long" resources used for intensifying technical re-equipment process and increasing independence from imports, there should be used various methods and tools for long-term investment. Financial leasing is one of such tools. Leasing as an investment activity is widely used in developed market. Therefore, it can become one of the major tools for attracting long-term investments. Numerous well-known modern studies devoted to the issues of evaluating leasing efficiency provide different methods for estimating leasing according to the following approaches:

According to economics literature analysis, there is a methodological gap in leasing efficiency assessment and management in the context of influencing environmental factors and methods of receiving enterprise financial management. The lack of scientifically grounded methodological base does not allow targeting financial and organizational efforts of state authorities and business entity management in solving the problems of activating the process of import substitution and increasing the highly-processed output of industry. This research is a fundamental basis for developing a balanced strategy of technical re-equipment based on a fundamentally new approach to financing investment activities of industrial enterprises, which goal is to develop a concept of leasing efficiency management based on a particular methodology designed for considering internal and external factors that affect industrial enterprises in emerging markets.

We have used a wide range of methods to study the problems of managing leasing efficiency: system approach, economic and mathematical modeling, strategic analysis, project analysis and methods as synthesis of techniques available from special theories: development modeling and cash flow management.

Methodology of progressive development of an industrial enterprise provides for its study as an economic system that implements various goals, which achievement requires available methodological and managerial support. Naturally, economic system is a manufacturing process management, which goal is to achieve production goals. In other words, relationships between the system subjects are a subject of economic development management, and particular economic effect is a goal of this system.

Domestic production and import substitution are supported by the modern state policy within the framework of a state program "Development of Industry and Enhancing Its Competitiveness". It is focused on reducing the share of imports used by domestic producers until 2020. As part of the program, there were allocated targeted loans to producers from the federal budget, state purchases of foreign goods were reduced, and credit relaxation – decreased. We have analyzed the output and the level of investment in machinery and equipment. Analysis shows that state support is ineffective, as its means allocated from the federal budget are withdrawn to the tax haven, and equipment is being purchased at unreasonably high prices. Thus, government has to increase the efficiency of state support by targeting technical re-equipment. On the other hand, industrial import substitution also has to be stimulated.

In the situation described above, one should use various methods and tools for long-term investment in order to intensify technical re-equipment and increase the independence from imports. The process of leasing non-current assets is one of such tools. As an investment activity, leasing is widely used in developed market. Thus, it can become one of the major tools for attracting long-term investments in Russian industry. Naturally, leasing is not a panacea for all problems. Although its use is not always advisable when it comes to investments, this financing scheme can bring tangible results with reasonable methodological support.

According to the Expert Agency's research (2017), total value of the subject matter of a lease amounted to RUB 742 billion in 2016 (96.4% of the level recorded in 2012). At this stage, potential of leasing financing is far from being exhausted. Thus, the share of leasing in the nominal GDP grew by 0.3 points (up to 1.2%) in 2016. The number of lease agreements has increased by 38.6% during this period. However, positive growth rates do not speak of strategy quality. Modern Russian leasing market is characterized by a large share of vehicle lease agreements (air, land, sea and railway). Basically, these assets are purchased by the country's largest commodity corporations that use machinery for transporting either raw materials and soil, or passengers. According to the same Agency (2017) 75.7% of the subject matter thereof were vehicles. The share of machinery and metallurgical equipment amounted to only 2.4% in 2016 (2.9% in 2015). Certain legal restrictions imposed on taxation by the state have led to a decrease in the efficiency of this investment tool. Thus, we can conclude that in Russian practice, leasing, despite great potential, is not a tool for mass technical re-equipment of industrial enterprises characterized by high-level processing and science intensity: machine building industry, robotic industry, machine tool industry, etc.

Leasing efficiency management is based on the process of identifying the concept of leasing efficiency and on best methodological experience in evaluating leasing efficiency in science and practice. The very concept of leasing efficiency should be treated in two ways: its efficiency as a tool of business investment comparing to alternative financing schemes (only for lessee) and its efficiency in terms of synergistic (cumulative) effect (all process subjects). The management team and owners of the enterprise are interested in how effective will be the lease. In this regard, efficiency comes down to an increase in the value of the company after leasing was used with allowance for alternative loan. Investors (business owners) are interested in reducing the cost of technical re-equipment. Thus, they have to choose right financing schemes.

State authorities, setting a goal to stimulate import substitution in industry, are interested in forming a cumulative effect.

In the context of ongoing economic sanctions and limited "long" investment resources for financing import substitution projects, the range of potential investors is narrowing to large export corporations and government funds. Projects in this area are peculiar due to their payback period and high capital intensity. The process of targeting the use of investor's resources in manufacturing new types of equipment requires a methodological basis for managing the environment necessary for generating a cumulative effect: from the entity manufacturing the leased asset to the state budget. The early research on leasing efficiency from the standpoint of its participants (Ryabchuk, 2004) shows that leasing effect is concentrated in the nonindustrial sector (credit institutions and leasing companies). This worsens the climate for import substitution, which improvement is necessitated by modern conditions.

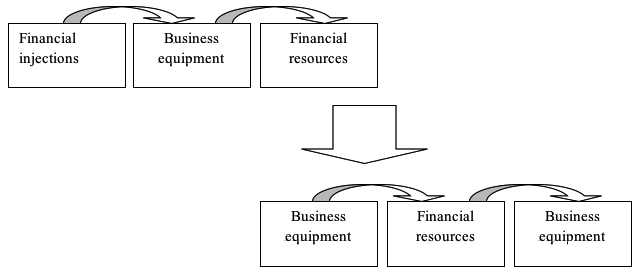

Thus, sufficient import substitution is not achievable without any changes in the paradigm of technical progress efficiency management at the industrial enterprises: from allocating investment support, withdrawn to the tax haven, to targeted financing of leased modernization. It is also not possible to significantly improve efficiency indicators and ensure long-term competitiveness at macro- and micro-levels. Thus, we have to departure from the practice of funding technical re-equipment at the enterprise to the practice of providing the enterprise with a plant asset ready for operation on a leasing basis (Figure 1).

Figure 1

Change in the concept of import substitution in industrial enterprises on a leasing basis

Solving the problem of transition to an effective and sustainable technical re-equipment of an industrial enterprise on a leasing basis requires a change in scientific and methodological approaches to management, methodology improvement and application of new progressive methods and techniques.

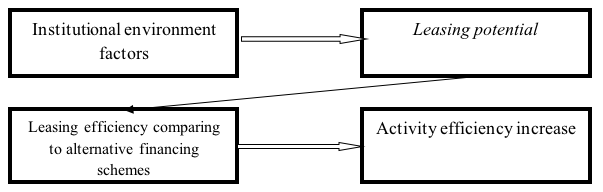

Based on the above, we suggest a chain of successive cause-and-effect relationships for interconnected and interdependent components of the leasing process:

Institutional environment factors → "leasing potential" → leasing deal efficiency → activity efficiency increase (Figure 2.).

Figure 2

Cause-and-effect relationships between the components of industrial leasing process

Investment decisions are based on the leasing potential and its dependence on the choice of institutional environment elements. The industrial enterprise is affected by a variety of factors. Kuvshinov M.S. has studied the impact of variational environment factors on the investment climate and investment attractiveness of industrial enterprises (Kuvshinov, 2009). Institutional environment factors that affect leasing efficiency are significantly different from the investment climate factors. Leasing as a tool for industrial investment has its own specific features, different from portfolio investments or investment through non-targeted lending. Therefore, variational environment factors can be limitedly useful for the purposes of our research. Thus, leasing process as a multifaceted economic phenomenon is affected by a variety of external and internal factors.

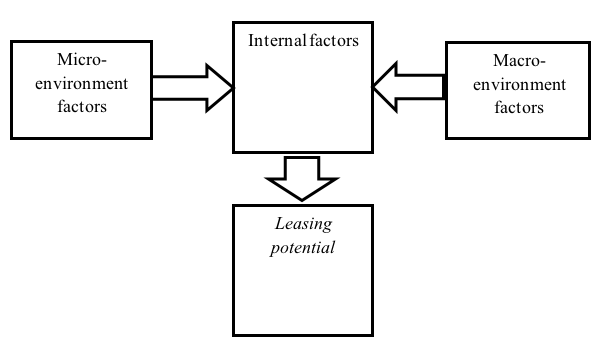

Institutional environment factors are represented by internal (enterprise) and external (macro- and micro-environment) factors.

The important and significant tools for managing the indicators of external environment involve (Figure 3): micro-environment factors and macro-environment factors.

In our opinion, micro-environment factors are:

Figure 3

Leasing potential formation under the influence of internal and external factors: diagram

Macro-economic environment factors are the following:

The investor considers the following indicators of internal environment as significant ones: the scale of an economic entity, degree of state’s participation in the authorized capital stock, risk level, financial visibility, longtermnessof prospects for managing, positive dynamics in entity's capitalization, innovation activity level. The internal environment of an industrial enterprise is assessed by the indicators used in business activity analysis, including traditional ones (asset liquidity, solvency, financial stability, business activity and enterprise profitability indicators), as well as by the indicators used in the process of analyzing non-current assets.

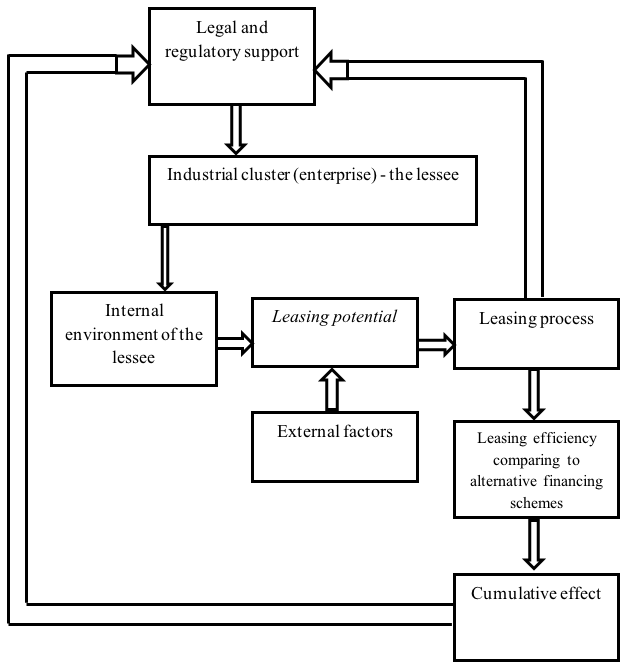

Leasing potential formation under the influence of internal and external environment of the enterprise provides the lessor with a basis for financing the leasing process. It will be effective with methodological support comparing to alternative financing schemes. If one wants to choose an optimal set of measures to manage the efficiency of the process, he/she has to estimate the cumulative leasing efficiency, which structure allows developing a package of management decisions and measures to regulate the economic entity and state authorities that allow fixing leasing effect in the industrial sector. The growth of management efficiency and industrial enterprise capitalization is the criterion of managerial decision efficiency. The substantiated choice of values for the parameters of leasing process elements ensures an increase in enterprise efficiency for long periods and reduces the risks of economic losses. Government agencies, focused on import substitution and production growth, consider decision efficiency as net present value accumulation for reinvestment purposes during the leasing process. Based on the structure of cumulative leasing efficiency, there are formed conditions for effective import substitution through the legal and regulatory tools used to support leasing.

The generalized scheme of the place of leasing efficiency among the factors of its improvement (Figure 4) is characterized by the process circular due to its certain properties described in the first paragraph of the section.

Figure 4

The place of leasing efficiency among the factors of its improvement: generalized scheme

Powerful decisions and government programs for import-substituting industry development in the structure-forming sectors of state economy against the backdrop of increasing economic sanctions can be successfully implemented through the leasing operations. This investment tool can be effective during the process of creating import-substituting industries on the med-term horizon. In the future, domestic equipment leasing will reduce the share of imported equipment. However, solution of this problem requires serious interference of the state bodies stimulating investment activity.

The methodological form of such support can be state support for import substitution through the recommended solutions:

developing a method for assessing the change in accumulated economic effect while implementing tax incentives for industrial import substitution that allow identifying whether the leasing profitability is low comparing to alternative financing schemes. This will lead to the formation of a basis for a balanced fiscal policy.

developing a method for assessing the change in dynamics of assets and industrial enterprise performance based on the contractual capital value that allows identifying reserves to improve the efficiency of financial policy management at the enterprise.

applying the integrated assessment method to assess asset value, performance, tax burden and leasing profitability allowing to diagnose the type of industrial enterprise development (growth/regress).

Methodological approaches will help to achieve target criteria and increase the efficiency of import substitution management.

Thus, current development level of the theory of investment-decisions (namely – the issues regarding the use of financial leasing) and the ever growing need for technical re-equipment based on investment resources attracted by industrial enterprises require the state to develop theoretical provisions and methods for managing the efficiency of the industrial leasing process.

Investment activity analysis makes it possible to formulate the thesis about the relevance of the studies of various financing schemes and mechanisms of plant asset purchase, including the leasing ones.

As from the day of emergence, leasing has evolved from the transfer of long-term assets for the purpose of temporary use to an effective and multifaceted mechanism for updating non-current assets in all spheres of business activity. Each stage of leasing development is characterized by its own properties and distinctive characteristics. In leasing, crystallization of symbiotic relationships between the credit properties and purchase has predetermined its development vector.

Structural and functional characteristics of the leasing system and the links between its elements contribute to the solution of the problem of increasing leasing efficiency. The process of improving conceptual and terminological apparatus raises the research quality and equivalence to real business processes.

The leasing process unites a lot of diverse participants, which number varies depending on the specific nature of a particular contract. Its implementation reflects its commercial, administrative, legal and investment aspects. Structural and functional analysis of the leasing system showed its diverse species composition. The scientific literature has accumulated multiple studies devoted to the classification of leasing deals, knowledge of which contributes to our understanding of what is the role and significance of leasing. Leasing availability and advantages are closely related to the number of such macroeconomic factors as availability of loan market funds, presence/absence of sanctions. Leasing market is closely correlated with business activity. The degree of productive forces development affects the nature of leasing deals, objects and value.

Industrial enterprises make particular leasing deals in the context of institutional environment as a system of legal and regulatory support for the leasing process and its financial management. The latter provides for an individual set of tools affecting the performance. In the course of the leasing process implementation, such tools can involve methods and techniques of financial management, as well as external and internal factors.

As leasing combines the duality of credit and purchase, its efficiency is linked with the process of assessing alternative financing schemes. Methodological basis of leasing efficiency management designed for a lessee will allow the management team and owners of an industrial enterprise to develop a set of methods and techniques for the effective investment activity management. The substantiated choice of values for the parameters of leasing process elements ensures an increase in enterprise efficiency for long periods and reduces the risks of economic losses.

Targeting financial resources for import substitution and creation of new production facilities based on leasing requires a methodological framework for managing the structure of cumulative leasing effect, which makes it possible to fix the effect in the industrial sector.

Amembal, S.P. (1991). Eguipment Leasing: A Complete Handbook. McGraw-Hill, 844.

Auto Leasing (Oceana's Legal Almanac Series Law for the Layperson). (2005). Oxford University Press. USA, 111p.

Brealey, R.A., Myers, S.C., Allen, F., & Mohanty, P. (2012). Principles of corporate finance. Tata McGraw-Hill Education.

Brighem E.F. (1992). Fundamentals of Financial Management. The Dryden Press.

Contino, R.M. (1996). Handbook of equipment leasing: A deal maker's guide. American Management Association.

Contino, R.M. (2006). The Complete Equipment-Leasing Handbook: A Deal Maker's Guide with Forms, Checklists, and Worksheets. AMACOM, 550 p.

Bogart, D. (2007), Celeste Hammond Commercial Leasing: A Transactional Primer. Carolina Academic Press, 510.

Durinck, E., Jansen, K., Laveren, E., & Huile, C. (1990). Leasing and the pie approach to capital structure. Tijdschr. vooreconomieen management. Leuven.

Myers, S. C., Dill, D. A., & Bautista, A. J. (1976). Valuation of financial lease contracts. The Journal of Finance, 31(3), 799-819.

Nevitt, P., Fabozzi, F. (1999). Equipment Leasing. McGraw-Hill Education, 470.

Sharpe, S. (1995). Capital Market Imperfection and the Incentives to Lease. Journal of Finance. Vol. 39. 271-294.

Paul, L. (2017). World Leasing Yearbook 2017. 38th ed. Euromany Institutional Investor Publication.

Goremykin, V.A. (2003). Leasing. Moscow. Dashkov and K Publishing and Trading Corporation, 944.

Rosstat Report. (2017). [Electronic resource]: /http://kprf.ru/crisis/edros/76030.html.

Zubkova, O.V., Chepurnov E.L. (2008). Leasing efficiency evaluation method based on cash flow analysis. Bulletin of South Ural State University, Series "Economics and Management", 14 (114), 30-34.

Kovalev, V.V., Kovalev V.V. (2015). Corporate finance and accounting: concept, algorithms, indicators: textbook. Мoscow. Prospekt Publishing House, 1000.

Kuvshinov, M.S. (2009). Fundamentals of the theory of investment climate formation at the enterprise: monograph. Chelyabinsk. South Ural State University, 256.

Kuzminova, A.JL. (2000). Evaluating and managing leasing efficiency as a tool for industrial investment: author's abstract on the competition of a scientific degree of the Cand.Econ.Sci: 08.00.05. Chelyabinsk, 21.

Kulishov, Yu.O. (2015). Improving agro-industrial leasing as form of financing the reproduction process in agriculture: Saratov Region: author's abstract on the competition of a scientific degree of the Cand.Econ.Sci: 08.00.05. Saratov, 22.

Petrova, E.A. (2014). Credit risk assessment at securitization of operating leasing assets: author's abstract on the competition of a scientific degree of the Cand.Econ.Sci: 08.00.05. Moscow, 22.

Leasing Market Following the Results of 2016: Reactive Recovery. (2017). [Electronic resource]: http://raexpert.ru/researches/leasing/2016/part1#

Ryabchuk, P.G. (2004). Evaluating and managing cumulative efficiency of leasing deals in the industry: PhD dissertation abstract (Economics): 08.00.05. Chelyabinsk: South Ural State University, 24.

Salagor, I.R. (2014). Housing leasing as a tool of financial mechanism in the real estate market: author's abstract on the competition of a scientific degree of the Cand.Econ.Sci: 08.00.10. Tomsk, 23.

Shtele, E.A., Kondaurova, K.O. (2016). Efficiency of return leasing as a source of financing: practical and theoretical aspects of application. Bulletin of the Siberian Institute of Business and Information Technology, 3 (19), 100-101.

Shuvalov, A.S. (2014). Modernizing agricultural production by means of the leasing mechanism: author's abstract on the competition of a scientific degree of the Cand.Econ.Sci: 08.00.05. Moscow, 22.

1. Department of Economics and Management, South Ural State University, Lenin street, 76, 454080, Chelyabinsk, Russian Federation

2. Department of Economics, Management and Law, South Ural State Humanitarian-Pedagogical University, Lenin street, 69, 454080, Chelyabinsk, Russian Federation.

3. Department of Pedagogy and Psychology, South Ural State Humanitarian-Pedagogical University, Lenin street, 69, 454080, Chelyabinsk, Russian Federation

4. Department of Economics, Management and Law, South Ural State Humanitarian-Pedagogical University, Lenin street, 69, 454080, Chelyabinsk, Russian Federation. Email: pryabchuk@yahoo.com