Vol. 39 (Number 12) Year 2018. Page 18

Vol. 39 (Number 12) Year 2018. Page 18

L.S. SHAKHOVSKAYA 1; V.I. TIMONINA 2

Received: 01/11/2017 • Approved: 30/11/2017

ABSTRACT: The Russian companies increase the power on production of gas and expand the presence in the world market, owing to realization of new projects and cooperation with other companies. However increase of the competition and the sanctions inflicted on the Russian companies complicate plans. Nevertheless, such companies as “Gazprom”, “Rosneft” and “NOVATEK” sees the future of the Russian power in development of new shelves, especially Arctic shelves. |

RESUMEN: Las empresas rusas aumentan la potencia en la producción de gas y amplían la presencia en el mercado mundial, gracias a la realización de nuevos proyectos y la cooperación con otras empresas. Sin embargo, el aumento de la competencia y las sanciones infligidas a las compañías rusas complican los planes. Sin embargo, compañías como "Gazprom", "Rosneft" y "NOVATEK" ven el futuro de la potencia rusa en el desarrollo de nuevas plataformas, especialmente plataformas árticas. |

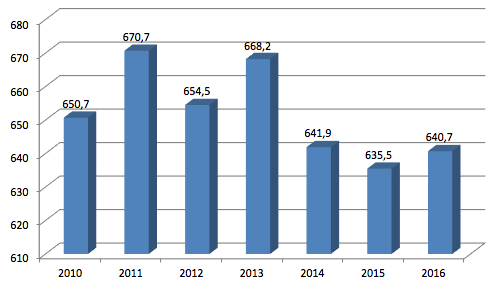

The share of Russia in the world market of gas does not exceed 5%, however the state energy strategy provides increase in an indicator up to 12% by 2035 year of the total amount of the world market. It will become possible only at a growth in volumes of production of gas twice in comparison with the indicator recorded in 2016 year.

Figure 1

Gas production in Russia (billion cubic meters)

As the Russian gas projects are generally focused on the foreign markets, owing to become complicated situation at world level, the companies faced a number of problems: a problem on attraction of foreign investments, dependence on foreign technologies and falling of the world prices of oil. If the two first problems have the decision and many companies look for "new ways" for production of domestic technologies, then the last problem is promoted by active development of spot trade in gas, at the same time under threat gets investment payback, especially it concerns expensive Arctic projects.

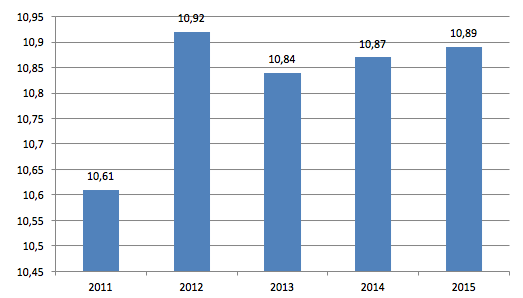

In Russia there is a set of large projects which purpose to expand presence of Russia in the world market of natural gas. One of them - “Sakhalin-II” (Sakhalin Energy) which shareholders are “Gazprom” (50%), “Shell” (27,5%), “Mitsui” (12,5%) and “Mitsubishi” (10%). Two processing lines annually receive about 14,9 billion cubic meters of liquefied natural gas, 11 million tons which it is exported to the countries Asia - Pacific region. In 2015 year it became known that “Sakhalin Energy” plans to construct the third processing line with power up to 5,4 million tons in a year [1]. The company signed contracts for development of the project with “Shell Global Solutions International” company and the Russian project institute “Giprogazcentr”. The investment decision on construction of the third line will be made in the second half of 2017 year.

Figure 2

Gas production of the company “Sakhalin Energy”

The “Rosneft” company together with "ExxonMobil" realizes the project on gas production - "The Far East LNG". Launch of the project in exploitation is planned for 2018 - 2019 years. According to some information, the project capacity will make 5 million tons in year, which source of raw materials will form - fields of the “Sakhalin-I” project and reserves of “Rosneft” in the Far East. Within only the “Sakhalin-I” project about 7 billion cubic meters of natural gas are extracted, having realized the project and using stocks in the Far East, the company will increase a production indicator at least twice [2].

The gas project of “Gazprom” - “The Baltic LNG” with a power up to 10 million tons in year provides expansion to 15 million tons in year. According to some information, investments into the project are estimated at 50 billion rubles. Productivity will make 660 thousand tons in year with a possibility of expansion to 1 million tons in year by 2020 year, when the new international ecological standard will come into force. Plans of “Gazprom” in the future provide construction of the 1,26 million tons of gas floating plant in a year, the fleet of ship-fuelers, the gas pipeline, and also the organization of gas terminals abroad: in Finland, Germany and Sweden.

In 2016 year the USA blocked exploration works on the Arctic shelf, at the same time such the company as “Shell” and “ExxonMobil” have postponed implementation of the projects because of high expenses and ecological standards. The Russian companies, despite some problems, continue to form plans of large-scale development of the Arctic region.

“Yamal - LNG” it’s project which is at a stage of practical realization which power reaches 16,5 million tons in year, he formed in cooperation with the companies: “Total and CNPC” - 20%, “Silk Road Fund” - 9,9 % [4]. Strategically advantageous position of the project, according to many experts, will allow exporting gas not only to Europe, but also to Asia-Pacific countries. In 2014 year the project has faced a financing problem. Attraction of investments has become complicated after introduction of the USA of sanctions. However, at the end of 2014 year the project has received 150 billion rubles from “National Welfare Fund”, which has bought issued bonds “Yamal - LNG”. In 2015 year “NOVATEK” company has agreed with the Chinese "Fund of the Silk Way" about granting a loan about 730 million euro’s for construction financing. After the contract on a loan the fund of China has bought 9% shares of “Yamal - LNG”. According to the head of the “NOVATEK” company Leonid Mikhelson: "Signing of binding documents selling a share in the project of “Yamal - LNG” is an important step to implementation of our long-term development strategy. As a result of closing of the transaction we will reach target structure of shareholders which is optimum and will promote planned financing of the project and its further successful realization" [3].

In February 2017 year it became known that the “Gazprom” company has put to the world market in two months - 27,6 billion cubic meters of gas that is 24,9% more, than for the same period of last year. At the same time consumers in the EU (European Union) have increased purchase of the Russian gas: Germany for 27, 6%, France for 53%, Austria for 109, 8%, Hungary for 21, 2% [5]. Besides the EU demand for the Russian gas begins to increase also in Africa. So, the Egyptian holding company has signed the contract with “Rosneft”, French “Engie” and Omani “OTI” on supply of LNG (liquefied natural gas) for amount of 1 billion dollars. In 2016 year “Rosneft” has put the first LNG party of 156 thousand cubic metres, and continues negotiations on deliveries of the following parties [6].

Thus, the Russian companies realize the idea about updating of a record of export and expansion of presence in the world market.

Russia keeps the positions of the key supplier in the world market (34% in the market of the EU), however, it is necessary to trade in gas in the aggravated competitive conditions (emergence in the European market of gas from the USA, the kept-back conditions of cooperation with Iran) that will perhaps lead to price wars not only in the gas market, but also on oil. But, is and the encouraging circumstances which, perhaps, will help to constrain competitive wars is joint activities for development of gas fields by the Russian companies with their foreign partners, as well as with the largest foreign suppliers of gas in various countries and regions of the world, such as “Shell”, “ExxonMobil”, “Total”, “CNPC”, “Silk Road Fund” or the French “Engie” and Omani “OTI”.

Production natural and associated petroleum gas: http://min energo.gov.ru/node/1215. (accessed 24.02.2017).

Muted optimism. The review Russian LNG - projects: http://ogjrussia.com/issues/article/sderzhanniy-optimizm-obzor-rossiyskih-spg-proektov. (accessed 24.02.2017).

“Novatek” and “Fund of the Silk Way” have signed final binding agreements on the project of “Yamal - LNG”: https://neftrossii.ru/content/novatek-i-fond-shelkovogo-puti-podpisaliokonchatelnye-obyazyvayushchie-soglasheniya-po-proektu-yamal-spg. (accessed 25.02.2017).

Arctic: from plans before development: https://neftrossii.ru/ content/arktika-ot-planov-do-osvoeniya. (accessed 25.02.2017).

Export of Gazprom has grown since the beginning of year by 25%: https://neftrossii.ru/content/eksport-gazproma-vyros-s-nachala-goda-na-25. (accessed 26.02.2017).

Egypt has signed the contract with “Rosneft”: http://tass.ru/ekonomika/3998444. (accessed 27.02.2017).

1. Head of the Department of World Economy and Economic Theory. Volgograd State Technical University. Economics and Management Faculty. Volgograd, Russia. e-mail: mamol4k@yandex.ru

2. Undergraduate student of the Department of World Economy and Economic Theory. Volgograd State Technical University Economics and Management Faculty. Volgograd, Russia. e-mail: timonina.vika96@yandex.ru