Vol. 39 (Number 18) Year 2018 • Page 4

Nubia Isabel DÍAZ Ortega 1; Marisol MAESTRE Delgado 2; Juan Manuel GARCÍA Ospina 3

Received: 29/12/2017 • Approved: 15/01/2018

ABSTRACT: The objective of this research was to analyze the determinants of the capital structure of smes of Cucuta and its Metropolitan area, based theoretically on authors such as: (Diamond, 1989; Fame & Miller, 1972; Jensen & Meckling, 1976), (Petersen & Rajan, 1994; Stiglitz & Weiss, 1981) Kim, 1978; Myers & Majluf, 1984), among others. Methodologically, we used an econometric model of panel data covering the years 2008-2015 with a sample formed by 104 small and medium-sized enterprises. It is noted that the short-term debt and profitability are the most influential explanatory factors at the time of the companies make the decision to borrow. |

RESUMEN: El objetivo de la investigación consistió en analizar los factores determinantes de la estructura de capital de las pymes de Cúcuta y su área metropolitana, sustentándose teóricamente en autores como: (Diamond, 1989; Fama & Miller, 1972; Jensen & Meckling, 1976), (Petersen & Rajan, 1994; Stiglitz & Weiss, 1981) Kim, 1978; Myers & Majluf, 1984) entre otros. Metodológicamente, se utilizó un modelo econométrico de panel de datos que comprende los años 2008-2015 con una muestra que se conformó por 104 pequeñas y medianas empresas. Se aprecia que el endeudamiento a corto plazo y la rentabilidad son los factores explicativos más influyentes al momento de las empresas tomar la decisión de endeudarse. |

In the course of the twenty-first century smes represent a very important group of companies within the entrepreneurial fabric in many countries of the world, due to its ability to contribute to the gross domestic product, generate jobs and income redistribution. In various investigations repeatedly highlights these benefits of SMES, for example the World Bank (2015), OECD (2013), European Commission (2016) Zevallos (2007). All of these studies show that smes are an important part of the backbone of the world economy.

In the same way, Angle, and Caballero (2014) analyze the relevance of the smes in the Colombian territory where they have a high proportion in the generation of jobs and a good participation in the GDP, data that coincide with those of the report of the ECLAC (2013), smes occupy 98.7% of the corporations in Colombia, generate a large part of the national employment, La Republica (2014). Its importance is undeniable in the country, and there is a general consensus about its great contribution to economic and social development.

In this order of ideas, smes are considered to be very flexible to adapt to economic changes, however, in studies of ECLAC (2013) presents weaknesses that require comprehensive policies in areas such as finance, innovation, technological development and human capital and production linkages. In the work of Ferraro, Goldestein, Zuleta & Garrido (2011), comparative research carried out in Argentina, Colombia and Mexico argue that there should be services that enable assistance on issues such as the provision of promoting entrepreneurial culture, training, technical advice, that is to say, a comprehensive policy that accompanies the financing. In sum, all of these arguments can be clearly inferred from the presence of the disadvantages such as the structural weakness, the lack of strategy and planning, difficult access to credit and thus investment in technology, working capital and knowledge (Beltran and others, 2004).

This scenario, added to the fact that from the point of view internal Stephanou and Rodríguez (2008) added that smes have other difficulties for their inherent characteristics such as the informality, the limited availability and reliability of the financial statements, management skills and family structures that impede their development. In this regard, in a study carried out in the various states of Mexico by the Network Pymex-Cumex (2009) present within their main barriers poor in accounting, tax and financial, as well as, in the management and administration that are very necessary to improve their access to external financing. Other studies addressed this same common denominator, the poor financial and administrative management since they are typically managed by its owners in a 70% and 80% in the world (Waldo 2011). From this perspective, are managed by their owners that are suitable for little people management without knowledge in financing and that maintain the conservation of the property (Belly, 2000). According to the authors mentioned above, indicate this special feature from the internal point of view of smes: management problems.

All these facts contribute to the study of the financing, however, it is essential to its implementation in small and medium-sized enterprises by their particular characteristics such as: do not operate in a financial market complex, are family businesses where the majority of the resources are themselves, there is a unification between ownership and management, information asymmetry Pérez, Satter, Bertoni and Field (2015). Smes in Cucuta and its metropolitan area have characteristics of imperfect information, exposed by the country's financial markets to situations such as: the concentration of credit, the limited availability of long-term financing, and the incipient development of the stock market Tenjo, Lopez and Samudio (2000). It follows the inadequacy of resources or use of internal resources that are often provided by the same owner, family or friends, which limits their capacity for growth and realization of new investment projects.

Consequently, the need arises to carry out an analysis of the main factors that determine the structure of capital of smes in Cucuta. Right now, there is not a study that deepens on the determinants of the capital structure. The proposed research seeks to fill a gap in the literature on the behavior of the indebtedness of the companies and at the same time serve as a point of departure for the formulation of appropriate policies of access to credit for this business sector.

The companies to develop their activities require investing in different classes of active for which they need resources that are called sources of funding, Azofra (1987) considers the financial structure as the result of the study of the origins and applications of the resources used in the company. Cuervo (1994) identifies the investment with the composition of the active, the capital structure with the composition of the liabilities and the financial structure is the analysis of both structures. Includes the total current liabilities long-term debt, common and preferred shares that are used to finance the operations of the company. Is the amount of permanent debt in the short term, long term debt, preferred stock or items that are used to finance the operations of a business. The capital structure is part of the financial structure and represents permanent sources of financing of the company. (Moyer, 2005; McGuiga & Kretlow) cited by Mondragon-Hernández, (2013).

It can be said that the capital structure of the various sources of financing a company at a given time and can be with their own resources or non-resource, that is to say, internal or external funding. The structure you choose the company depends, among other factors, on their resource needs, your financial situation, the financial leverage, the way in which generates its own resources and the objectives of its business strategy. There is no standard model but several theories that try to explain the optimal capital structure.

It can be said that the capital structure of the various sources of financing a company at a given time and can be with their own resources or non-resource, that is to say, internal or external funding. The structure you choose the company depends, among other factors, on their resource needs, your financial situation, the financial leverage, the way in which generates its own resources and the objectives of its business strategy. There is no standard model but several theories that try to explain the optimal capital structure.

Initially, the theories on capital structure began to take a lot of force in the mid-20th century with the developments of Durand (1952) this traditional theory held that the moderate use of indebtedness could reduce the cost of capital that generates value in the company. The postulates of the classical theory said that if it increases the external debt, the greater the risk of insolvency by both the actions of the company. To this end, the mix of financing should try to achieve a minimum capital cost of giving as a result a maximum value of the company. There was an optimal capital structure and the financial plan should be hit with the right mix of debt and capital, Lopez-Dumrauf (1999).

A few years later, Modigliani and Miller (1958) under a scenario of perfect capital markets showed the irrelevance of the traditional theory and that financing decisions are irrelevant. The weighted average cost of capital is constant and independent of the proportions between equity and loans. If increases the indebtedness the highest rate of interest that require creditors is compensated with the best performance for the shareholders. The value of the company depends on its operating result, so, the financial manager should focus on the performance of its assets to a lesser extent the funding decisions.

Subsequently, on the basis of criticism it received to his theory Modigliani and Miller made a correction in (1963) and introduced his theses taxes of societies; suggest that given the tax advantage by debt the company could borrow. To be deductible to the interests of the income tax for the cost of this borrowing supports the state and the value of the company is increased by the tax effect.

The seminal work of Modigliani and Miller to be very controversial laid the basis for the development of a large number of modern financial theories that try to show the importance of financial decisions. Many authors used conceptions with incidence of other factors from the concept of imperfect markets, such as: the agency costs (Diamond, 1989; Fame & Miller, 1972; Jensen, 1986; Jensen & Meckling, 1976), asymmetric information, (Petersen & Rajan, 1994; Stiglitz & Weiss, 1981). There are two large flows, the theory of the trade-off (Brennan & Schwartz, 1978; Kim, 1978; Kraus & Litzenberger, 1973) or the balance of the structure of the capital and profits and the theory of pecking order or hierarchy of the preferences. (Myers, 1984; Myers & Majluf 1984).

The agency costs are defended as the analysis of the conflicts of interest between the owners of capital and its administrators and propose that it is possible to search for an optimal financing structure that minimizes agency costs and maximize the value of the company. The theory assumes that essentially is that the role of the investor and the administrator are not configured in one and the same person. And the theory of asymmetric information indicates that the various agents do not have access to the same level of information, which generates wasteful decisions by the fact does not receive adequate information, which affects at the time of funding.

However, the two most influential theories on the subject of the capital structure are the trade-off and the pecking order; these two major trends are based on the existence or not of an optimal capital structure.

Theory of the trade-off or the balance of the capital structure. On the basis of the costs that would be incurred by having financial difficulties and the costs of agency, seeks to establish the optimal combination of financial sources. The financial structure should avoid the extreme use of leverage to maximize tax savings not failing in situations of financial insolvency. In this conception are the effects of the theory of signals and the theory of the agency.

Theory of Hierarchy of preferences (pecking order). He claims that there is no optimal capital structure defined in the company, the debt-equity mix be determined by its need for funding. The companies prefer a scale of hierarchies, to use in the first place the internal to the external financing, after if is external, used in the first place debt and finally turn to the issue of titles.

The analysis of the information was made by using the data that provides the platform SIREM (System of Information and Business Report), which contains data of approximately 27 thousand companies required to report information to the Superintendence of Colombian Companies. Through this information it can be obtained data from a general profile of the companies belonging to a particular sector, region, years, activity code, number of employees, balance sheet, results, sales figures, etc. The data were taken from companies that meet the parameters of the definition of SMES for Colombia according to Mypymes 590 Law from 2000 added with the law 905/2004, taking into account that they are all those economic units made by a natural person or a legal entity, in entrepreneurial activities, agricultural, industrial or services, rural or urban, in small businesses companies with assets with 501 to 5,000 minimum legal monthly wages and a number of employees between 11 and 50; medium-sized enterprises that have assets between 5,001 to 30,000 times the minimum legal monthly wage and have between 50 and 200 employees.

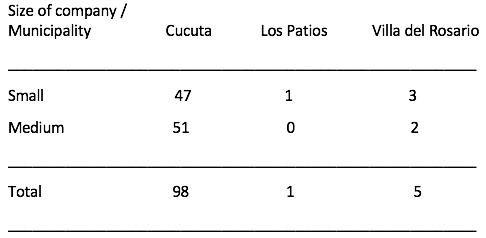

After to apply multiple filters to refine the information the work was done with a balanced panel that contains data of 104 companies, from the year 2008 to 2015. Figure 1 shows the distribution of SMES by size and location of the company.

Table 1

Distribution of smes

Own elaboration (2017)

To establish the determinants of long-term debt to SMES of Cucuta and its metropolitan area it were used an econometric modeling of panel data for the period 2008-2015, it was possible to find the data of a group of SMES, with a total of 603 observations. In a panel data model is considered both the temporal dimension such as structural, cross-sectional, which enables you to capture the heterogeneity of the data and incorporate a dynamic analysis. This model was applied in the form of fixed effects, where it aims to capture the differences between the units of analysis for characteristics of each one of them, through the constant term. (Gujarati, D. & Porter, D, 2009) The panel model with fixed effects is represented as well:

Yit = my+ βXit+ εit

Where:

i is the company.

t is the period.

Yit is the level of indebtedness in the long term.

μi is the fixed adjudicated effect to each company, and it is constant over time.

β, is a vector of k estimated parameters (one for each explanatory variable).

Xit is the observation of the i-th firm at time t to the k explanatory variables.

εit is the random error term.

The explanatory variables that compose the model are:

The volatility of earnings before interest and taxes (UAII), measured by its standard deviation.

The fiscal protection other than debt, calculated as follows: [depreciation/UAII]i,t.

The opportunity for growth, calculated as follows: [(assets-capital+ Fixed assets)/

Assets]i,t - [(ln capital assets fixed assets)/assets]i,t-1

• Profitability: [i]f/asset UAII,t

• Retention of profits, determined by the index [retained earnings/profits after interest and taxes]i,t

• Tangibility, found by using the following ratio: [tangible fixed assets/asset]i,t

The size of the firm, as measured by the logarithm of the sales [lnventas]i,t

• The structure of short-term capital, through the index [short-term debt/asset]i,t

• Age of the company: [activity in years]i,t

• Cost of debt: [financial charges/passive].

The estimation process began with the measurement of the explanatory variables of indebtedness and then proceeded to run the data panel models in Stata 13 statistical program for fixed effects and random effects, to find as an explanatory variable affects the structure of capital. It was used the Hausman test and it was determined that the fixed effects model was fitted to the data. The standard errors of the coefficients are robust, that is to say, that are adjusted to prevent heteroscedasticity and autocorrelation.

Table 2

Estimates for smes and the Metropolitan Area of Cucuta

Variables |

(1) |

(2) |

(3) |

Small Enterprise |

Medium Enterprise |

SMES |

|

Capital structure in the short-term |

0.496*** |

0.529*** |

0.504*** |

(0.0886) |

(0.0879) |

(0.0592) |

|

Ln(volatility of the UAII) |

0.00419 |

0.00140 |

0.00258 |

(0.00562) |

(0.00475) |

(0.00390) |

|

Fiscal protection |

0.000672** |

0.000675 |

0.000693 |

(0.000260) |

(0.000492) |

(0.000420) |

|

Grow opportunity |

0.187** |

0.0602 |

0.128* |

(0.0893) |

(0.102) |

(0.0685) |

|

Profitability |

-0.352*** |

-0.446*** |

-0.343*** |

(0.0854) |

(0.159) |

(0.0576) |

|

Retained earnings |

-0.000544** |

-0.000273 |

-0.000555 |

(0.000229) |

(0.000787) |

(0.000373) |

|

Tangibility |

-0.0104 |

0.337*** |

0.138 |

(0.134) |

(0.118) |

(0.101) |

|

Ln(sales) |

0.0202* |

0.0519** |

0.0245** |

(0.0119) |

(0.0223) |

(0.0124) |

|

Debt cost |

0.0681 |

-0.0475 |

0.0372 |

(0.0519) |

(0.0924) |

(0.0493) |

|

Constant |

0.0791 |

-0.482 |

-0.00949 |

(0.175) |

(0.345) |

(0.183) |

|

Border crisis |

-0.0457* |

0,0182 |

-0.0358* |

(0.0269) |

(0.0279) |

(0.0200) |

|

Observations |

298 |

305 |

603 |

R-Squared |

0.828 |

0.377 |

0.704 |

Numbers of companies |

51 |

53 |

104 |

Fixed effects of company |

SI |

SI |

SI |

Fixed effects of the year |

SI |

SI |

SI |

Dummuy of the border crisis |

SI |

SI |

SI |

Own elaboration (2017 |

|||

Robust standard errors in parentheses, *** p<0.01, ** p<0.05, * p<0.1 |

|||

The results presented in Table 2 show that it was estimated separately small, medium-sized companies and smes. The variables that are statistically significant and its relations with the long-term debt to are the following:

For small businesses, the structure of short-term capital (+ ), fiscal protection (+ ), Growth Opportunity (+ ), the profitability (-) and (-); for medium-sized enterprises, capital structure in the short term (+ ), profitability (-), tangibility (+ ) and the size of the company( +); while for smes, capital structure in the short term ( +), Growth Opportunity (+ ), profitability (-) and the size of the company (+ ).

Table 3

Determinant variables of the capital structure

Independent variables |

Small |

Medium |

Smes |

International |

Colombian |

Structure of short-term capital |

+ |

+ |

+ |

|

- |

Fiscal protection |

+ |

|

|

+,- |

- |

Grow opportunity |

+ |

|

+ |

- |

+, - |

Profitability |

- |

- |

- |

- |

- |

Utilities retention |

- |

|

|

- |

- |

Tangibility |

|

+ |

|

- |

+ |

Company size |

|

+ |

+ |

|

+ |

Own elaboration (2017)

Table 3 is a summary of the main determinants of the capital structure of smes of Cucuta and its metropolitan area, and its positive relationship (+) and negative (-), compared to a long-term debt, and it is compared with research conducted in the field at international level and in Colombia.

Of the nine variables studied, five are significant for small business, four for medium-sized companies and three for smes and only two are explanatory notes for the three groups of companies, and there is no contradiction between the independent variable and the long-term debt.

In the small, medium and smes increased borrowing in the short term, which may mean that have resorted to the use of debt in the short term in order to resolve the problems of resources by increasing its indebtedness, could be interpreted as a reaction to the advantage offered by this type of credit, as well as the ease of adaptation of this kind of credit to the financial needs and to lower costs of the transaction of this type of contract. (Jun and Jen 2000)

Also for the three groups of companies, the negative relationship between profitability and debt ratios is based on the theory of pecking order, the increase in indebtedness when low profitability, is the option that companies use when their internal funds. (Jensen, Meclking, 1976). Both the national and international studies corroborate this result as shown in Table 3.

The smes have a predominant place in the economy of Cucuta and its metropolitan area and their contribution to the generation of employment and GDP is relevant, however, require ongoing financial resources to expand and grow.

There are factors that determine the long-term debt to the company studied by many investigations from the theoretical point of view and in the field, the way to get resources depends on various factors.

This research performed an empirical analysis in the SMES of Cucuta and the metropolitan area, comprising a period from the year 2008 up to 2015, to identify the determinants of capital structure using as a methodological tool an econometric model of panel data.

The determinants factors of the capital structure and its positive and negative relationship are : for small businesses, the structure of short-term capital ( +), fiscal protection (+), growth opportunity (+), the profitability (-) and utilities retention (-); for medium-sized enterprises, capital structure in the short term (+ ), profitability (-), tangibility ( +) and the size of the signature ( +); while for smes, capital structure in the short term (+ ), growth opportunity (+ ), profitability (-) and the size of the company ( +). It was found two explanatory variables for the three groups of companies, small, medium-sized and smes: short-term debt and profitability.

The study shows that the structure of capital of SMES of Cucuta and its metropolitan area depends on the behavior of a number of factors, the results to be compared, some are endorsed by the theoretical models and research of the same type, there is no evidence that any of them in particular. The findings of the study show that these companies use a financial structure concentrated in the short term.

Angulo F. Caballero, H (2014). Investment strategies in working capital applied by micro, small and medium-sized enterprises Colombian textile trade in the municipality of Medellin. Magazine,Business Dimension.Col12 No.2 p.69-82. Available at: https://www.uac.edu.co/images/stories/publicaciones/revistas_cientificas/dimension-empresarial/volumen-12-no-2/articulo05.pdf . (Accessed:16 June 2016)

Azofra, V.(1987). The capital structure of the company: explanatory factors. Doctoral Thesis. University of Valladolid.

Belly, E.(2000). Management of small and medium industries in member countries of the AndeanGroup. Andean Development Corporation. EAFIT University. Available at: https://repository.eafit.edu.co/bitstream/handle/10784/622/1999_1_Enrique_Barriga.pdf;jsessionid=8C515BE6AA9FFE349441F69BA9139BCE?sequence=3 . (Accessed: 22 June, 2016)

Beltrán, and others (2004). Smes, a challenge to the competitiveness. Universidad Externado de Colombia. Faculty of Business Administration.

Brennan, Michael J. Schwartz, Eduardo S. (1978). Corporate Income Taxes, Valuation, and the Problem of Optimal Capital Structure. Journal of Business, 51 (1), 103-114. Available in: http://www.anderson.ucla.edu/faculty/eduardo.schwartz/articles/7.pdf

ECLAC. Economic Commission for Latin America and the Caribbean (2013). Economic prospects for Latin America. 2013. SME policies for structural change. Available at: http://www.cepal.org/es/publicaciones/1463-perspectivas-economicas-de-america-latina-2013-politicas-de-pymes-para-el-cambio . (Accessed 22 June 2016)

European Commission. (2016).The State Council of the SMES. Available at: http://www.ipyme.org/es-ES/PoliticasMedidasPYME/ConsejoGeneralPYME/Paginas/ConsejoEstatalPYME.aspx . (Accessed: 21 June 2016)

Crow, C. (1986). Investment and Financing in the Spanish industrial company. Economic Research, Vol. 2. 1986 Supplement. P. 231-245.

Diamond, Douglas W. (1989). Reputation Acquisition in Debt Markets. Journal of Political Economy, 97 (4), 828-862. Available at: Http://core.ac.uk/download/pdf/6519112.pdf

Dimer R. (2011) Decision-making in the financing and the HME. Notebooks of Cimbage. No14. Available at: http://bibliotecadigital.econ.uba.ar/download/cuadcimbage/cuadcimbage_n14_03.pdf (accessed 22 June 2016)

Durand, David (1952). Cost of Debt and Equity Funds for Business: Trends and Problems of Measurement. A chapter in Conference on Research in Business Finance, 215-262. New York: National Bureau of Economic Research. Available at: Http://www.nber.org/chapters/c4790.pdf

Fame, Eugene & Miller, Merton H. (1972). The Theory of Finance. New York: Holt, Rinehart and Winston.

Ferraro, C, E, Goldestein Zuleta, L & Garrido, C. (2011), Removing Barriers: the financing of smes in Latin America. Eclac-AECID. Available at: http://www.cepal.org/es/publicaciones/35358-eliminando-barreras-financiamiento-pymes-america-latina . (Accessed 21 June 2016)

Gujarati, D. & Porter, D. (2009). Econometrics. Fifth Edition. Mac Graw-Hill. Mexico.

Jensen, Michael (1986). Agency Costs of Free Cash Flow, Corporate Finance, and takeovers. American Economic Review, 76 (2), 323-329. Available at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=99580

Michael Jensen, Meckling, William H. (1976). Theory of the Firm: Managerial Behavior, Agency Cost and Ownership Structure. Journal of Financial Economics, 3 (4), 305-360. Available in: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=94043

Jun, S. G., and Jen, F. C. (2000): "Trade-off model on debt maturity structure", Working Papers, State University of New York

Kim, E. (1978). To Mean-Variance Theory of Optimal Capital Structure and Corporate Debt Capacity. Journal of Finance, 33 (1), 45-63. Available at: http://webuser.bus.umich.edu/ehkim/articles/1978-03_Mean-Variance_JF.pdf

Kraus, Alan. Litzenberger, Robert H. (1973). To State-Preference Model of Optimal Financial Leverage. Journal of Finance, 28 (4), 911-922.

The Republic. (2014). Small and medium-sized companies also take advantage of the good economic times. Available at: http://www.larepublica.co/peque%C3%B1as-y-medianas-empresas-tambi%C3%A9n-aprovechan-el-buen-momento-econ%C3%B3mico_149511 . (Accessed 18 June 2016).

López-Dumrauf, G (1999). The optimal capital structure of the firm. How to improve financing decisions. Available at: http://www.dumrauf.com.ar/spanish/art.htm (Accessed June 20, 2016).

Myers, Stewart C. (1984). The Capital Structure Puzzle. Journal of Finance, 39 (3), 575-592. Available in: http://dspace.mit.edu/bitstream/handle/1721.1/2078/SWP-1548-15376697.pdf,http://www.nber.org/papers/w1393

Myers, Stewart C. Majluf, Nicholas S. 1984). Corporate Financing and Investment Decisions When Firms Have Information the Investors Do Not Have. National Bureau of Economic Research, NBER. Working Paper 1396. Available at: hhtp://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.334.7154&rep=rep1&type=pdf

Modigliani, Franco. Miller, Merton H. (1958). The Cost of Capital, Corporation Finance and the Theory of Investment. American Economic Review, 48 (3), 261-297. Available in: https://www2.bc.edu/~chemmanu/phdfincorp/MF891 papers/MM1958.pdf

Modigliani, Franco & Miller, Merton H. (1963). Corporate Income Taxes and the Cost of Capital: A Correction. American Economic Review, 53 (3), 433-443. Available at: https://www2.bc.edu/~chemmanu/phdfincorp/MF891 papers/MM1963.pdf

Mondragon-Hernández, S. (2013). Capital structure of the automotive sector in Colombia: An Application of the Theory of Hierarchy of preferences. Accounting books. Vol. 14, p. 219-243. Available at: http://revistas.javeriana.edu.co/index.php/cuacont/article/view/6074 . (Accessed 20 June 2016)

OECD. (2013). Organization for Economic Cooperation and Development. Issues and policies on smes and entrepreneurship in Mexico. Available at: http://idbdocs.iadb.org/wsdocs/getdocument.aspx?docnum=38822197 . (Accessed 18 June 2016)

Perez, J, Satter, S. Bertoni, M.D. (2015). Basis for a model of financing structure in the latin american SMES. Accounting books, 16, p. 179-204. Available at: http://dx.doi.org/10.11144/Javeriana.cc16-40.bpme (accessed 22 June 2016)

Petersen, Mitchell. Rajan Raghuram G. (1994). The Benefits of Lending Relationships: Evidence from Small Business Data. Journal of Finance, 49 (1), 3-37. Available in: 1994 https://www2.bc.edu/~strahan/petersen rajan.pdf

NETWORK SME-CUMEX (2009). A comparative study of the administrative and financial profile of the small company in Mexico: entities of the state of Mexico, Hidalgo, Puebla, Sonora and Tamaulipas. Journal of the Research Center University of La Salle. Volume 33 Number 9 jan-jun p 5-30 2010. Mexico.

Stephanou, C. Rodriguez, C. (2008). Colombia. Bank financing for small and medium-sized enterprises. The World Bank. Available at: http://www-wds.worldbank.org/external/default/WDSContentServer/WDSP/IB/2012/04/02/000333037_20120402010024/Rendered/PDF/416100REPLACEM0entobancariocompleto.pdf (accessed 23 June 2016).

Stiglitz, Joseph, Weiss, Andrew (1981). Credit Rationing in markets with imperfect information. American Economic Review, 71 (3), 393-410.Available in: http://pascal.iseg.utl.pt/~aafonso/eif/pdf/crrinf81.pdf .

Superintendence of Companies (2016). Information System and Business Report. SIREM. On-line database. Available at: http://www.supersociedades.gov.co/asuntos-economicos-y-contables/estudios-y-supervision-por-riesgos/SIREM/Paginas/default.aspx . (16 June 2016).

Tenjo, F. López, E. Samudio, N. (2006). Determinants of the Capital Structure of the Colombian companies. Drafts of Economy. 380 Studies Division of the Bank of the Republic. Available at: http://www.banrep.org/docum/ftp/borra380.pdf (accessed 23 June 2016)

The World Bank (2015). World Development Indicators.

Available at: http://data.worldbank.org/data-catalog/world-development-indicators/wdi-2015 . (Accessed 18 June 2016)

Valdo,J.(2010).Familybusinesses.

Available at: http://www.jcvalda.woedpress.com/2010/06/12/empresas-familiaresduenos-al-ataque/ . (Accessed: 1 March 2013)

Zevallos, E. (2007). Restrictions on the environment for business competitiveness in Latin America. Comparative analysis Fundes International. Available at: http://iberpyme.sela.org/Documentos/ANALISISCOMPARADO07.pdf (accessed 22 June 2016)

Article derived from the research project Analysis of the determining factors of the capital structure in the pymes of Cúcuta University of Pamplona

1. Postdoctoral in Sciences of the organizations. Faculty of Economics and Business, University of Pamplona, Pamplona Email: ndiaz712@hotmail.com . Orcid id: 0000-0001-7950-8664

2. Master's Degree in Education. Faculty of Economics and Business,University of Pamplona, Pamplona, Colombia. Email: mmaestre24@hotmail.com . Orcid Id: 0000-0002-0548-2710

3. Candidate for a master's degree in Economics. Active researcher. Colombian Observatory of Science and Technology. Email: Juanmgarcia22@gmail.com Orcid Id:0000-0002-5194-6467