Vol. 39 (Number 18) Year 2018 • Page 11

Dzhamilya Safuatovna ZAKHAROVA 1; Anzor Uvaysovich SOLTAKHANOV 2; Olga Aleksandrovna ZHDANOVA 3; Knarik Karapetovna ARABYAN 4

Received: 17/01/2018 • Approved: 28/02/2018

ABSTRACT: The paper studies the relationship between the exchange value of the ruble and the dynamics of processes in the Russian economy in 2014-2017, which is influenced by sanctions imposed by the United States, the European Union and a number of other countries. The aim of the study was to confirm or deny the legitimacy of the orientation toward the ruble as an objective indicator of the country's economic activity, as well as to study the impact of the Western sanctions and oil prices on economic growth in Russia. As the subject of the study, the hypothesis was considered that the reason for the fall in the volume of the gross domestic product and the Russian national currency rate after the introduction of external economic restrictions were not sanctions, but that fall accidentally coincided with the moment of their introduction, a collapse in oil prices, while a small number of other circumstances having indirect relation to the sanctions. The study concluded that the impact of the Western sanctions had an insignificant effect on the change in the level of gross domestic product and the inflation rate, and the ruble rate objectively reflects the current state of the Russian economy, since it is in minimal and indirect dependence on the sanctions factor. |

RESUMEN: El documento estudia la relación entre el valor de cambio del rublo y la dinámica de los procesos en la economía rusa en 2014-2017, que está influenciada por las sanciones impuestas por los Estados Unidos, la Unión Europea y varios otros países. El objetivo del estudio fue confirmar o negar la legitimidad de la orientación hacia el rublo como un indicador objetivo de la actividad económica del país, así como estudiar el impacto de las sanciones occidentales y los precios del petróleo sobre el crecimiento económico en Rusia. Como tema del estudio, se consideró la hipótesis de que la razón de la caída en el volumen del producto interno bruto y la tasa de la moneda nacional rusa después de la introducción de restricciones económicas externas no eran sanciones, sino que la caída accidentalmente coincidió con el momento de su introducción, un colapso en los precios del petróleo, mientras que un pequeño número de otras circunstancias tienen relación indirecta con las sanciones. El estudio concluyó que el impacto de las sanciones occidentales tuvo un efecto insignificante en el cambio en el nivel del producto interno bruto y la tasa de inflación, y la tasa del rublo refleja objetivamente el estado actual de la economía rusa, ya que es mínima e indirecta dependencia del factor de sanciones. |

After the imposition of economic sanctions against Russia, the leaders of the United States, Canada, Australia and the EU, as well as Western mass media and "independent experts" almost immediately began to assert that sanctions proved to be a successful measure for achieving the set goals. As such a goal, Russia's coercion was called, through economic pressure, to the settlement of the situation (the restoration of the former status of Crimea and the de-escalation of the conflict in Donbass), which arose after the coup d'etat in Ukraine. In accordance with the proposed algorithm of the sanctions regime, the closure of international financial borrowing markets for Russia should have worsened the investment attractiveness of the Russian economy, slowed its growth, and most importantly, provoked a depreciation of the ruble in order to provoke discontent on the part of citizens who had to compel the Russian government to go on political concessions to the West. Contrary to the expectations of the initiators of the sanctions, the desired political changes did not occur, and the exchange value of the ruble in the period of 2014-2017 under review did not change according to the scenario set by them, but did so in accordance with the classical fundamental factors of the financial market. Of course, the worsening borrowing conditions in foreign financial institutions to some extent contributed to a slowdown in Russia's economic growth, but was not determinative for the exchange value of the ruble. This circumstance was a prerequisite for opening a discussion on the effectiveness of sanctions as an instrument of political pressure on the economies of countries with high domestic industrial and resource potential, which the Russian Federation undoubtedly belongs to. The world experts took opposite positions in this discussion. For example, Fitch analysts were in agreement with the opinion of the majority of Russian economists, stating in "Fitch Revises Outlook on Russia to Stable" that the Russian economy remained well managed under the sanctions conditions, and the ruble depreciation was only a consequence of the collapse of the oil prices in 2014 (Fitch, 2016). Western financial experts hold a different view, as exemplified by that of American economists from Citigroup, who argued that sanctions were the key cause of the current decline in the growth of the economy and the devaluation of the ruble exchange rate, in their work "Crimea and Europe: the impact of sanctions on Russian and European economies (Cholodilin and Netšunajev, 2016). For all its debatability, the question of the effectiveness of economic sanctions against Russia and their impact on the ruble exchange rate has been little studied from the scientific point of view. In this regard, the purpose of this work was to study and confirm the hypothesis that the reason for the fall in the national currency of Russia after the introduction of external economic restrictions was not sanctions, but they accidentally coincided at the moment of their introduction with a collapse in oil prices. The obtained results speak in favor of the fact that the ruble rate in the period from 2014 to 2017, as well as in other time intervals, primarily reacts to the state of the national economy and oil prices, practically not reflecting the change in the magnitude of external sanctions pressure. The importance of this study is that its results indicate the ineffectiveness of sanctions as a tool working to reduce the activity and growth of the Russian economy, showing that the domestic policy of the state can effectively regulate the exchange rate regime, negating the impact of sanctions.

To date, one can observe a three-year period of decline in the exchange value of the ruble, in order to provide a balanced assessment of the relationship between changes in the exchange rate, Russia's economic activity and sanctions. The empirical method of research was chosen as it allowed comparing the actual state of the exchange rate with the governmental acts on its regulation, with the prices for oil, as well as with other external and internal economic and political factors over a certain time interval. For analysis, the following sources were used: information Central banks of Russia, Rosstat, Citigroup, rating agency Fitch, the conclusion of international experts, related materials of leading media. As a result of the analysis of various data, the character of the ruble's dynamics was established, conclusions were drawn for reasons that had an impact on the strengthening or weakening of the Russian currency at any given time. In order to investigate the relationship between the oil price and the ruble exchange rate, an econometric method was used to study the relationship between the dynamics of the ruble exchange rate and the price of oil. To do this, an econometric model was used (Shiryaev 2015), reflecting the relationship between the price of oil in US dollars and the US dollar against the ruble, presented in more detail below, in section "Peculiarities of national dependence."

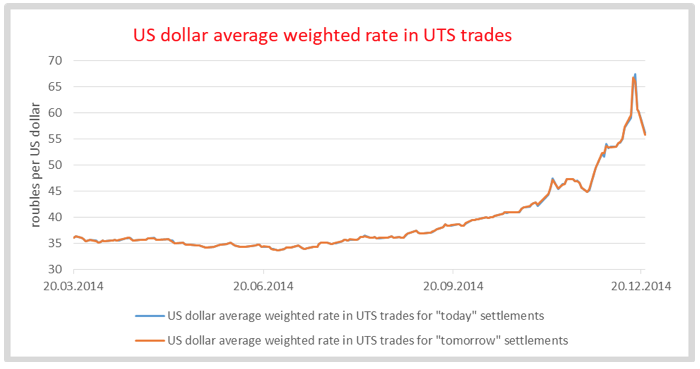

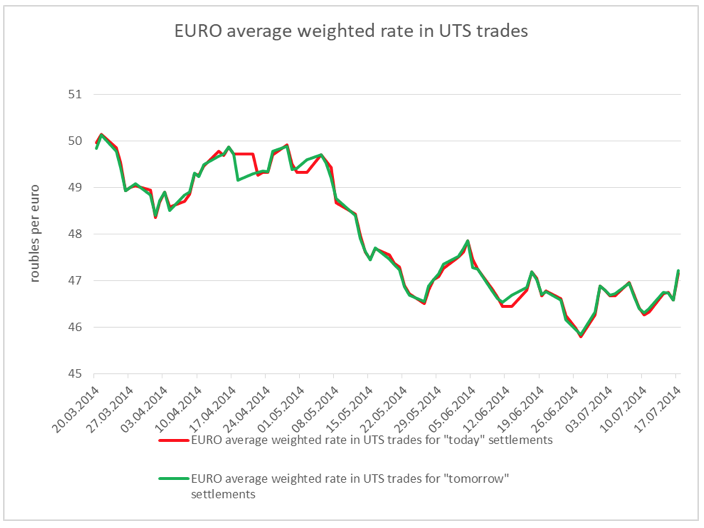

The West argues that restricting access to the EU financial market by Russian banks, major defense and energy companies, the imposition of an embargo on arms and the supply of dual-use goods to Russia, limited investment and access to high technology, led to a weaker ruble and a sharp slowdown in economic growth in the country. As evidenced, experts usually change the official exchange rate of the ruble against the US dollar and the euro since the end of March 2014, when sanctions were introduced, until December 2014 (Figure 1). For nine months, the ruble has really fallen very seriously against the dollar – from 36.2 rubles for 1 US dollar in March, to 66.04 rubles for 1 US dollar in December.

Figure 1

US dollar average weighted rate in UTS trades (from 20.03.2014 to 22.12.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

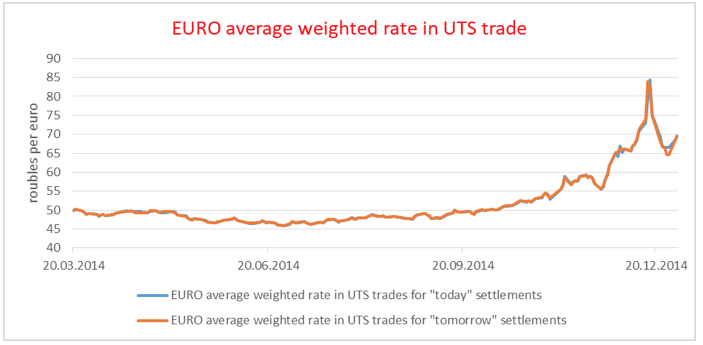

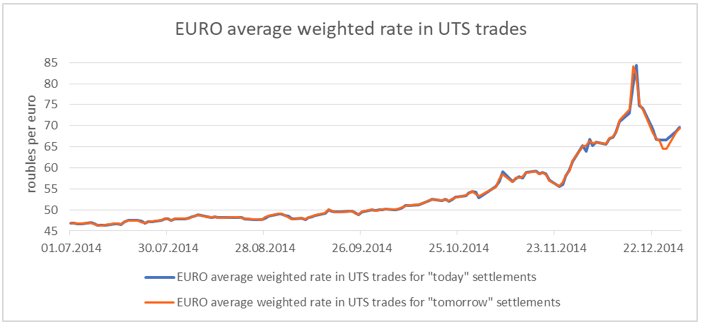

During the same time, i.e., from March to December 2014, the ruble fell against the euro from 50.41 rubles for 1 euro to 74.34 rubles for 1 euro (Figure 2).

Figure 2

EURO average weighted rate in UTS trade (from 20.03.2014 to 22.12.2014)

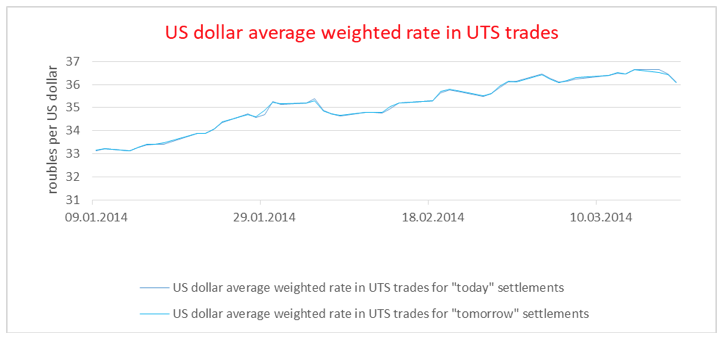

The record depreciation of the national currency was obvious (Figure 3). However, specialists could not escape the fact that the ruble began to decline long before the sanctions were introduced, because in early January 2014 the ruble cost 33.15 rubles for 1 US dollar, and by March it fell by as much as 8 percent.

Figure 3

US dollar average weighted rate in UTS trades (from 09.01.2014 to 19.03.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

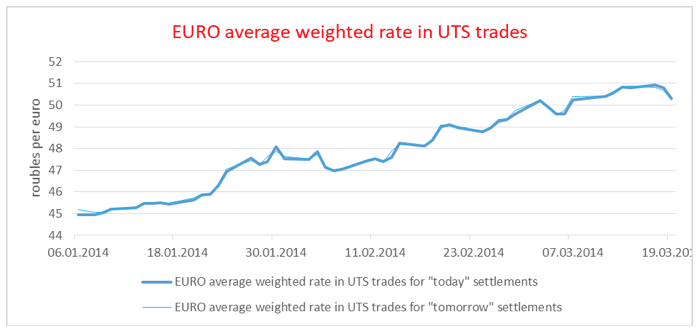

The January value of the national currency relative to 1 euro, amounting to 45.07 rubles, by March reached 50.41 rubles (Figure 4).

Figure 4

EURO average weighted rate in UTS trade (from 09.01.2014 to 19.03.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

Considering the dynamics of the ruble exchange rate in a slightly wider range, namely, from January to December 2014, one can reasonably say that the slowdown in the growth rate of the Russian economy began long before the sanctions.

It remains to add that experts attribute the slowdown to the economic recession in Europe, which led to a reduction in consumption and a decline in prices for basic commodities, including prices for Russian gas, which since 2010 has been continuously cheaper for European consumers, and a decrease in revenues from its sale indirectly affected the national currency of Russia.

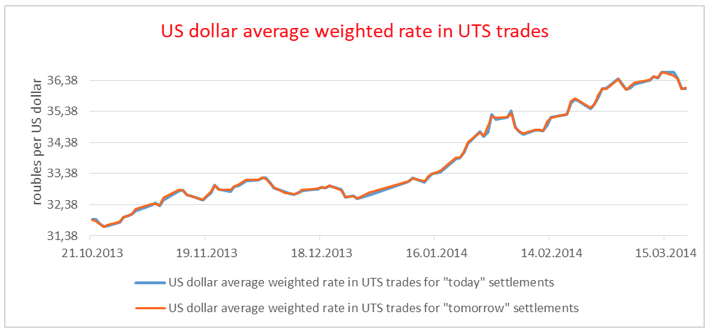

A month before the first protests took place on Independence Square in Kiev on November 21, 2013, the exchange rate of the Russian currency to the US dollar was 31.84 rubles. The growing political uncertainty in the country, having not only huge borders with Russia, but colossal economic, historical and family ties, could not but affect the state of the Russian financial market. As the tension in Ukraine escalated, the ruble rate fell, reaching 36.45 rubles for 1 US dollar by the time sanctions were imposed, i.е., since October 2013, after less than six months it has weakened by more than 11 percent (Figure 5).

Figure 5

US dollar average weighted rate in UTS trades (from 21.10.2013 to 20.03.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

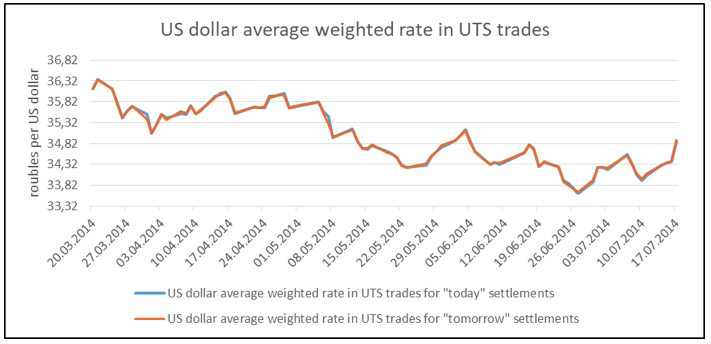

Following the chronology of the events, the most interesting thing starts here, because at the time of the entry into force of the main sanctions, contrary to forecasts, the ruble rate did not fall, but, on the contrary, from March to July it showed a positive trend, having strengthened to 33.84 rubles against the dollar, and to 46.18 rubles against the euro (Figures 6-7) (data of the Central Bank on 01.07.2014).

Figure 6

US dollar average weighted rate in UTS trades (from 20.03.2014 to 17.07.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

-----

Figure 7

EURO average weighted rate in UTS trade (from 20.03.2014 to 17.07.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

-----

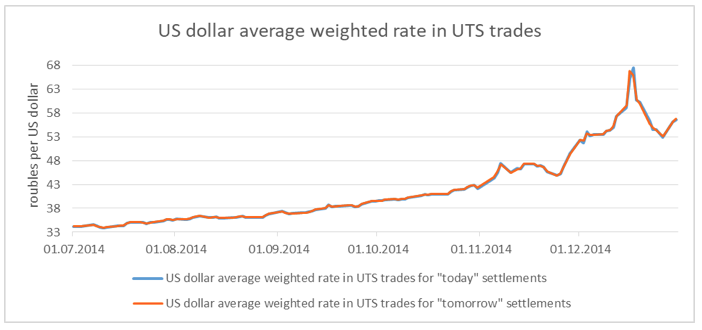

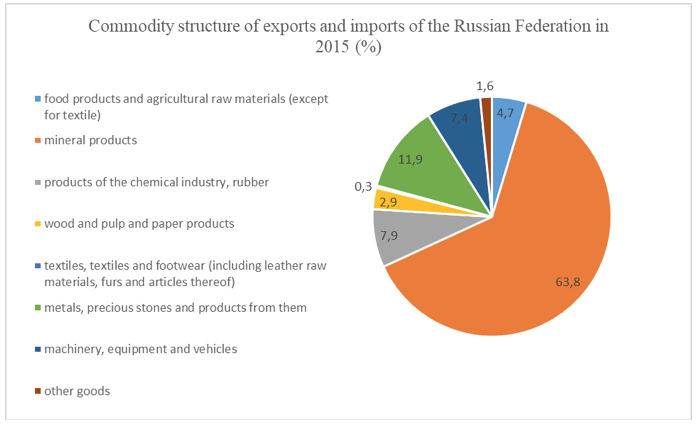

And only after the decline in oil prices in the summer-autumn of 2014 did the ruble become uncontrollable (Figures 8-9).

Figure 8

US dollar average weighted rate in UTS trades (from 01.07.2014 to 30.12.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

-----

Figure 9

EURO average weighted rate in UTS trade (from 01.07.2014 to 30.12.2014)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

-----

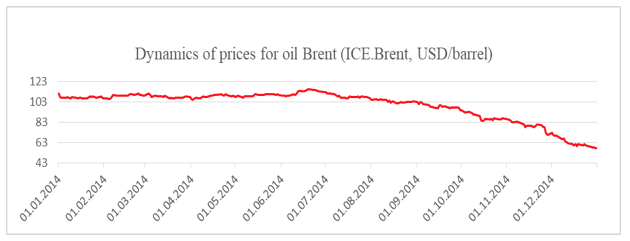

3.3. Oil Economy – Oil Currency

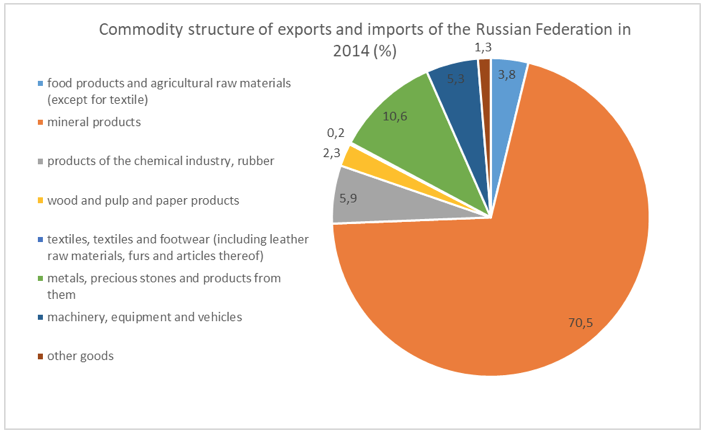

It's no secret that most of the Russian budget is formed from revenues derived from the sale of raw hydrocarbons (The structure of Russia exports for 2014, 2014). This means that the ruble directly depends on the amount of dollars received from the sale of the main export goods: oil and gas (Figure 10).

Figure 10

Сommodity structure of exports and imports of the Russian Federation in 2014 (%)

-----

Figure 11

Сommodity structure of exports and imports of the Russian Federation in 2015 (%)

(The commodity structure of Russia, exports and imports, 2016)

As Russia is one of the largest exporters of oil and gas in the world, no matter what they say, the Russian economy is closely linked to the global economy, especially to the European economy. However, oil is much more important for the stability of the ruble and the Russia’s economy as a whole. In 2014, the total volume of Russian exports of crude oil amounted to 223.4 million tons about 153.9 billion US dollars worth (Export by the Russian Federation of crude oil for 2000-2015 (according to the Federal Customs Service of Russia and Rosstat) – 2015) (Figure 11).

Despite such impressive figures, the year 2014 was fatal for the ruble due to a collapse in oil prices. If at the end of 2013 the price of a barrel of North Sea oil Brent reached 111 US dollars at an average annual cost of 108.7 dollars per barrel, at the end of 2014 the price for Brent fell to 57.33 US dollars per barrel, having fallen 48% in just one year.

After the 2015 New Year holidays, the price of the barrel of Brent dropped below $ 50, and on January 13, an intermediate minimum of $ 45.13 per barrel was recorded (Figure 12).

Figure 12

Dynamics of prices for oil Brent (ICE.Brent, USD/barrel)

(Statistics from the site Yandex quotes, 2014-2015)

All this was a decisive factor in the fall of the ruble exchange rate, which dropped by 72.2% to 56.24 rubles per dollar in 2014, and by 51.7% to 68.37 rubles per euro. It is likely that this very circumstance inspired Barack Obama during the annual message to the nation before the US Congress, to pronounce on January 20, 2015 the phrase that became winged that "Russia is isolated, with its economy in tatters" (President Obama, State of the Union, 2015).

In support of their conclusions, based on empirical study of the facts, the authors cite a few quotations from the Citigroup survey published in September 2015 under the heading "Russia is not too concerned about sanctions", where the following statements were made by the chief economist of an authoritative financial conglomerate: "We believe that sanctions have a negligible impact on Russia's GDP, explaining only 10% of the observed decline in production volumes". Further, in the text, it is noted that "the widespread opinion in the West that sanctions had a significant impact on Russian GDP stems mainly from the fact that their introduction in early and mid-2014 coincided with the beginning of a significant slowdown in the Russian economy. In the third quarter of 2014, Russia's GDP for the first time since the crisis of 2008-2009 showed a negative rate of quarterly growth. However, it was in the third quarter that the decline in oil prices began, which was the key factor in the fall in GDP. Oil prices remain the key factor leading to a fall in GDP, it is the decline in oil prices that explains about 90% of the reduction in production". (Sharoyan 2015). Alternative opinion.

During the research on the existence of the relationship between the exchange rate and the state of the economy, the authors noticed that different views on the same processes lead to different results, often very contradictory. For example, completely opposite to the opinion of American economists from Citigroup, and therefore deserving to be voiced, are the conclusions by European financial analysts on the question of what the ruble's exchange rate responded to in 2014, sanctions or falling oil prices. This is the work of Kholodilin and Nechunayev, published in a series of working papers by the Bank of Estonia, and earlier at the Free University of Berlin, under the title "Accession and Punishment: The Impact of Sanctions on the Economy of the Russian Federation and Europe". It categorically affirms that it was sanctions, and not the drop in oil prices, that influenced the ruble depreciation and the decline in the Russian economy by 90% (Cholodilin and Netšunajev 2016). In the authors’ opinion, the conclusions of the Bank of Estonia analysts not only radically differ from the assessment of the ruble's behavior by the Bank of Russia and the Ministry of Economy of the Russian Federation, but also contradict the results of a wide range of other serious and unbiased studies.

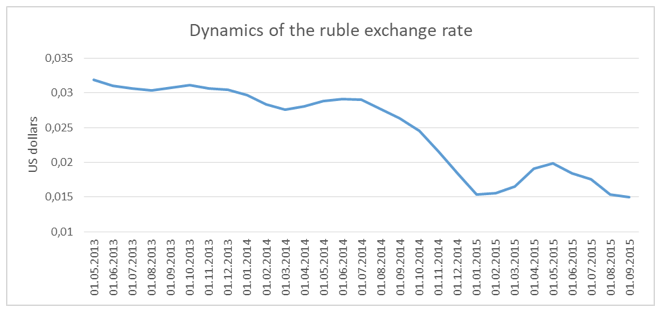

In order to more accurately assess the degree of dependence of the ruble exchange rate on world oil prices, the level of dependence of the Russian economy on oil production and sales, and also to determine the relationship between the ruble exchange rate and the growth of the Russian economy, the econometric method was used. First, a linear graph of the change in the exchange rate of the ruble in US dollars for 31 months was made, covering the time interval from March 2013 to September 2015 (Figure 13).

Figure 13

Dynamics of the ruble exchange rate

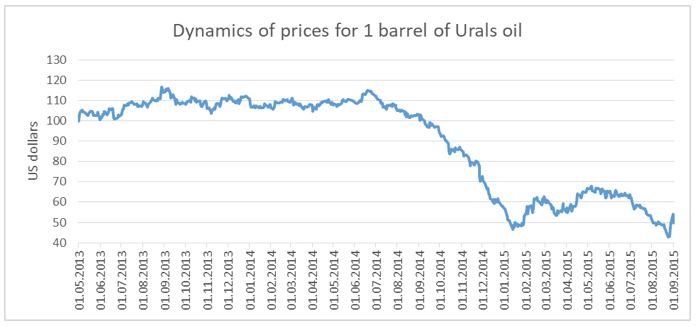

Then, a chart is drawn of the price dynamics for Russian Urals oil in US dollars for the same period (Figure 14).

Figure 14

Dynamics of prices for 1 barrel of Urals oil

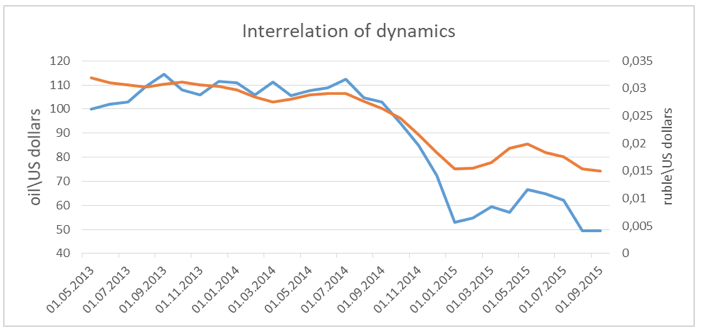

After overlaying the graphs on each other, it is seen that the visually descending lines of both trends are almost identical (Shiryaev 2015) (Figure 15).

Figure 15

Interrelation of dynamics (Shiryaev 2015)

This is a strong argument for the assertion that the direction of the dynamics of oil prices and the ruble trend is in very close dependence. In turn, the exchange value of the ruble, in our case declining relative to the dollar, directly and indirectly, affects the state of the Russian economy, since it makes imports more expensive, and domestic products are cheaper, stimulates the development of manufacturing industries, and also increases the size of the currency revenues in ruble terms. The last circumstance in 2014 was commented by Russian President Vladimir Putin in an interview with TASS: "We do not expect the budget to be in dollars – in rubles. The value of the ruble fell, it lost some 30% depreciation. We used to sell goods that cost 1 dollar, but received 32 rubles for it. And now the goods were sold for a ruble, but we received 45. The budget revenues increased, but not decreased". Then he added: "Are we harmed? Yes, we are, but not fatally".

Continuing the topic of changing the ruble rate after the imposition of sanctions, it should be noted that the decline in oil prices has become the key, but by no means the only factor contributing to economic destabilization in Russia in 2014. Some support for negative trends at the initial stage of the crisis was the desire of the Central Bank of Russia to control inflation in an attempt to keep it at 5 percent. For this purpose, on November 5, 2014, the financial regulator refused to regulate the ruble's exchange rate, while strengthening the already powerful devaluation pressure on the national currency. The Central Bank believed that this decision would reduce the activity of speculators who launched a global game on exchange rate differences, that by the end of the year the rate of price growth will slow down and inflation will be kept at an acceptable level. Meanwhile, due to the strong fall in the ruble, Russian business began to compensate for its losses by revising price tags for goods upwards, while ordinary citizens who remembered well the consequences of the 2008 crisis had a desire to secure their dollar savings, which contributed to a sharp outflow of the currency assets of the population from the banking sector. The volume of purchasing cash currency by individuals across the country increased by 5-6 times, which caused a deficit of dollars and euros even in exchange offices (Chibisova, Chibisov and Soltakhanov 2015).

In addition, on the morning of December 16, 2014, reacting to the uncontrolled devaluation and panic that appeared on the foreign exchange market, the Central Bank raised the key rate at night emergency meeting from 10.5 to 17 percent, having conditioned its actions by "increased devaluation and inflation risks" (Figure 16).

Figure 16

Dynamics key rate of the Bank of Russia in 2014 (%)

(Statistics from the site Consultant Plus, 2017)

This became the largest increase in interest rates since 1998, which instead of appeasing the market, only increased the degree of panic. This event broke the back of the ruble, which reacted almost instantly, on the same day, rolled up on the exchange trades to a mark of 80 rubles for 1 dollar and 100 rubles for 1 Euro. After that, December 16, 2014 began to be called "Black Tuesday", by analogy with "Black Tuesday" on September 11, 1994, when for one day at the Moscow Interbank Currency Exchange the ruble exchange rate against the dollar decreased by 27 percent. It is interesting that the beginning of the sharp fall of the ruble in 2014 was on the 20th anniversary of the "Black Tuesday" (Chibisova, Chibisov and Soltakhanov 2015). Commenting on what is happening, the head of the Central Bank Elvira Nabiullina said: "The weakening of the rate is a signal for the Russian economy to adapt to the new conditions. We really need to learn how to live in the ruble zone, rely more on our own sources of financing (Head of the Central Bank Nabiullina urged to learn to live in a new reality with a weak ruble, 2014). In the end, contrary to the forecasts of the Central Bank, the inflation rate in 2014 more than doubled than expected and amounted to 11.36%, which was 4.9% more than in the previous 2013 (Table 1).

Table 1

Dynamics of consumer prices by group of goods and services (month to the previous month, %)

(Statistical compendium Prices in Russia 2016, 2016)

|

Inflation |

Core inflation |

Increase in prices for food |

Increase in prices for food |

Increase in prices for fruit and vegetable |

Increase in prices for non-food products |

Increase in prices for non-food products without gasoline |

Increase in prices for paid services |

2014 |

||||||||

January |

0.6 |

0.4 |

1.0 |

0.5 |

5.8 |

0.3 |

0.3 |

0.5 |

February |

0.7 |

0.5 |

1.2 |

0.7 |

5.1 |

0.4 |

0.4 |

0.4 |

March |

1.0 |

0.8 |

1.8 |

1.3 |

5.3 |

0.7 |

0.6 |

0.5 |

April |

0.9 |

0.9 |

1.3 |

1.2 |

2.3 |

0.6 |

0.6 |

0.7 |

May |

0.9 |

0.9 |

1.5 |

1.3 |

2.4 |

0.5 |

0.5 |

0.8 |

June |

0.6 |

0.8 |

0.7 |

1.1 |

-2.8 |

0.4 |

0.4 |

0.9 |

July |

0.5 |

0.6 |

-0.1 |

1.0 |

-8.1 |

0.4 |

0.3 |

1.4 |

August |

0.2 |

0.6 |

-0.3 |

0.9 |

-10.7 |

0.5 |

0.4 |

0.7 |

September |

0.7 |

0.9 |

1.0 |

1.2 |

-1.2 |

0.6 |

0.5 |

0.3 |

October |

0.8 |

0.8 |

1.2 |

1.0 |

2.8 |

0.6 |

0.6 |

0.6 |

November |

1.3 |

1.0 |

2.0 |

1.3 |

8.7 |

0.6 |

0.6 |

1.2 |

December |

2.6 |

2.6 |

3.3 |

2.2 |

12.9 |

2.3 |

2.5 |

2.2 |

In the whole year (December to December) |

11.4 |

11.2 |

15.4 |

14.7 |

22.0 |

8.1 |

8.0 |

10.5 |

In 2015, inflation was 12.8%, in 2016 prices rose by only 5.4%, and this year the Ministry of Finance declared to keep it at around 4%. Of course, some pressure on the ruble and the Russian economy during the period under review was present, but it was more political than economic, the main reasons for the weakening of the ruble in 2014 after the introduction of sanctions objectively are oil prices and the policy of the Central Bank of Russia.

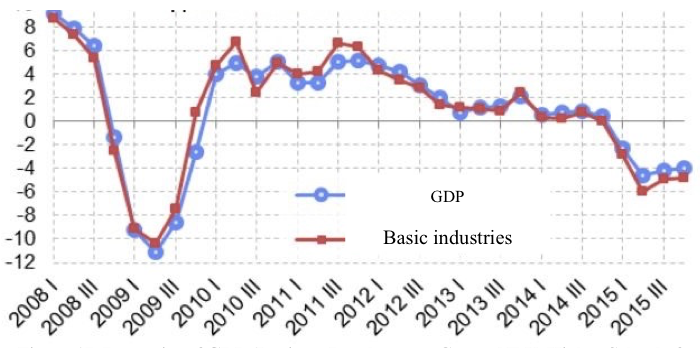

The negative shock caused by the events of 2014: the fall in oil prices, anti-Russian sanctions and the countermeasures taken by the Russian Government to limit imports, had a significant impact on the dynamics of the Russian economy in 2015, causing a decline in production and a slowdown in economic growth (Figure 17). Especially active drop in economic indicators was observed in the first half of the year. Basically, due to the weakening of the ruble from January to June 2015, Russia's GDP fell by 5.2 percent overall, and by the end of the year, the GDP contraction was 3.7 percent.

Figure 17

Dynamics of GDP (Institute Development Center NRU, Higher School of Economics; 2016)

Due to the fact that Russian exports in value terms declined by 31 percent (Sberbank of Russia, 2016), the state budget's foreign exchange earnings also declined significantly. In an effort to compensate for the decline in export earnings, Russia has significantly increased the volume of oil sold abroad to 140.6 million tons, increasing exports by more than 7 percent compared to the same period of the last year. Despite this, foreign exchange earnings from oil exports still fell by 42%, amounting to only 56.23 billion US dollars for the period January-July 2015, while in the same period of the last year it was possible to earn almost one hundred billion US dollars.

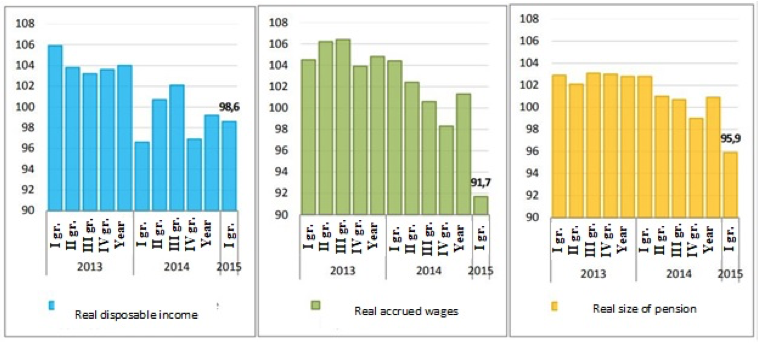

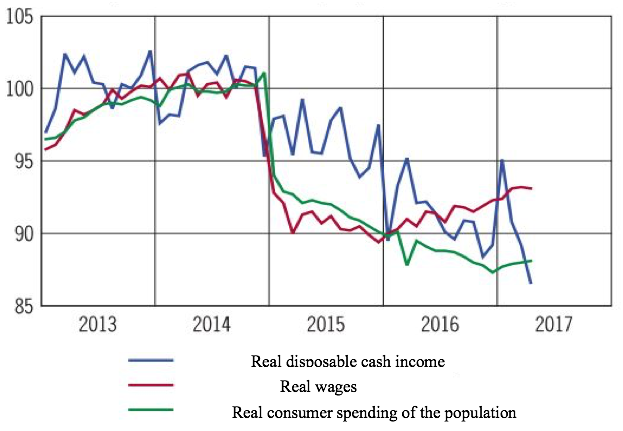

The collapse of the ruble due to a double fall in oil prices caused an almost double rise in prices for imported goods, is one of the inflation drivers. From January to May 2015, inflation reached 8.3 percent, while in the same period last year it was only 4.2 percent, by the end of September, annual inflation increased to 15.8 percent, and by the end of the year amounted to 12.9 percent. The real incomes of citizens and their wages decreased by 4% and 10%, respectively, therefore the consumption rates decreased, the savings tactics began to prevail among the population – money was no longer spent as before, and the lion's share of income was kept for a rainy day (Figure 18).

Figure 18

Consequences of the weakening of the ruble for the Russian economy

(Institute for Management of Social Processes, Higher School of Economics, 2015)

All these factors, and especially the decline in consumer demand, slowed down the growth rate of the economy in Russia. The lack of money forced people to cut costs, as a result of which industrial enterprises and exporters could no longer build up and develop their businesses as before, accordingly, the tax revenue decreased. The reduction in production led to an optimization of staff and an increase in unemployment, the official level of which for the year was 5.6 percent of the economically active population registered in employment service bodies, exceeding last year's level by 0.3 percent, while unofficial statistics claimed that by the end of 2015 the hidden unemployment in Russia was 20 percent.

In March 2016, the US and its allies extended sanctions against Russia, to which Ukraine's sanctions were added, and in June, Vladimir Putin, as a retaliatory measure, extended the food embargo by the end of 2017. In the autumn of 2016, American sanctions were expanded, the new "blacklist" included dozens of citizens and legal entities, large enterprises and organizations of Russia (RIA Novosti, 2016). By this time, the Russian economy has learned to operate under sanctions, adapted to external challenges and was able to successfully solve a number of internal problems, resulting in the stabilization of the ruble. It turned out that a significant role in this was played by the decision of the Central Bank in 2014 to make the national currency free float, completely abandoning the currency interventions, while linking the discount rate to the inflation rate (Chibisova, Chibisov and Soltakhanov 2015). Eliminating the need to move between the tightly controlled borders of the bi-currency basket corridor, the ruble at the end of 2014 strongly depreciated at first, but eventually found a point of balance and began to stabilize.

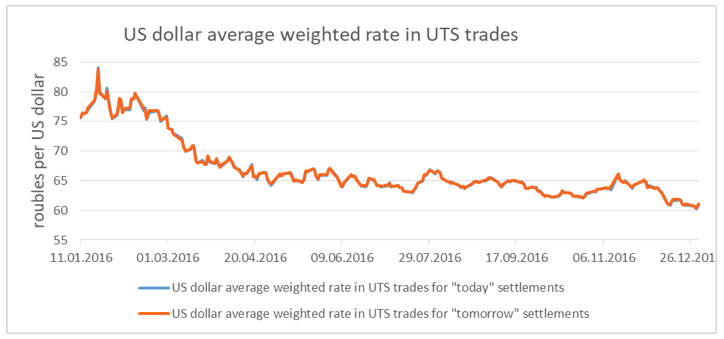

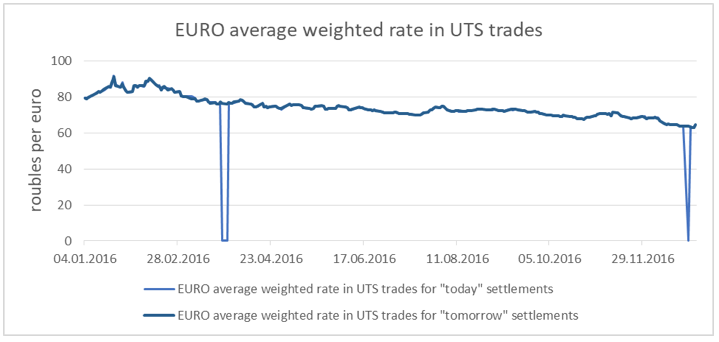

In 2016, the ruble strengthened against the dollar and the euro by 20 percent, and in the average annual terms, its rate was 66.9 rubles for 1 US dollar and 74.06 rubles for 1 euro (data of the Central Bank on 01.07.2017), which, of course, is associated with the strengthening of oil prices (Figures 19-20).

Figure 19

US dollar average weighted rate in UTS trades (from 01.01.2016 to 31.12.2016)

-----

Figure 20

EURO average weighted rate in UTS trade (from 01.01.2016 to 31.12.2016)

(Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017, 2017)

From January to December 2016, the cost of oil Brent benchmark rose from $ 28.51 (as of January 18, 12:20 MSK) to $ 56.14 (as of December 31, 12:20 GMT) per barrel. The cost of Russian Urals crude oil, tied to the quotes of Brent, was less than $ 30 in January, and in December it rose to $ 52.08 per barrel (Reuters, 2016). The financial block managed to stabilize the economy after the crisis of 2014-2015 due to the stabilization of the national currency with relatively stable, albeit low, oil prices, which was ensured due to an increase in oil production and sales on the global markets, although supply exceeded demand.

The achievements of the Ministry of Finance and the Government are tightening of fiscal policy in conditions of a monetary deficit, transition to the targeted financing of budgetary projects, and, most importantly, rather forced, but nevertheless adopted course for the use of own resources and import substitution. This gave rise to many industries in the civil and military sectors, thereby neutralizing the effect of sanctions on a wide range of areas. Russia's budget in 2016 was prudently tailored based on Urals oil prices of $ 50 per barrel and the US dollar rate of 63.3 rubles, which made the economy well-managed even under sanctions. As a result, at the end of the year, inflation in the country reached a record low level for the recent history of Russia and amounted to 5.5-5.8% percent. The fact that 2016 can be called the year of stabilization of the Russian economy was also confirmed by analysts of the leading rating agency Fitch, who stated that the decline in production in Russia's economy for the year almost stopped, and that in 2017 one should expect growth of 1.3 percent, and in 2018 by 2 percent (Fitch Ratings, 2016).

According to the statement of the head of the Ministry of Economic Development of Russia Maxim Oreshkin, Russia faced 2017 with a great and positive experience of managing the economy under the conditions of sanctions. In late July, he said he did not expect an extraordinary change in the ruble or any financial problems due to new sanctions against Russia, approved by the US Congress on July 25. "We have a floating exchange rate, there are always fluctuations, so here some movements are possible, but we do not expect anything extraordinary at all," the minister said, adding that he "does not plan to aggravate the macro-forecast due to sanctions" (Oreshkin 2017). In terms of overall economic growth, 2017 can be considered the beginning of an uptrend. In the first quarter, the growth of the Russian economy amounted to 0.5 percent, and in the second quarter – 2.7 percent, having formed an average figure for the first half of the year at 1.6 percent. In the context of what has been said, it is indicative that in the first quarter, the capital outflow was recorded at $ 17.5 billion, and the second quarter ended with an inflow of $ 2.8 billion (Zadornov 2017).

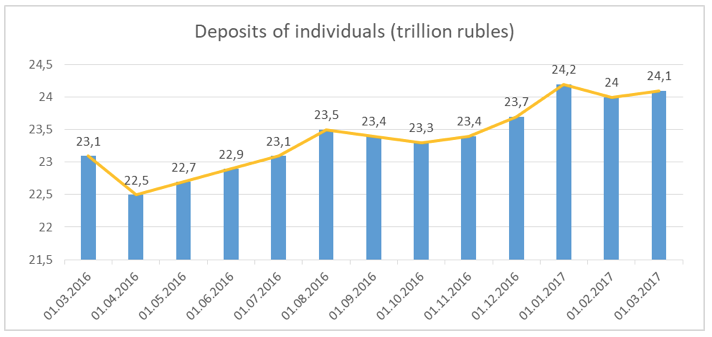

Today, the ruble exchange rate is stable and periodically demonstrates some strengthening due to the continuing recovery in oil prices and weak US dollar policy, tight budget policy and the optimal key refinancing rate that the CBR set on June 19, 2017 at 9 percent per annum (Bank of Russia, 2017). Thanks to the stability of the ruble exchange rate, people began to trust the national currency again and finally got used to the current situation of sanctions, as seen from a growing volume of ruble deposits. (Figure 21)

Figure 21

Deposits of individuals (trillion rubles)

(On the dynamics of the development of the banking

sector of the Russian Federation in February 2017)

Despite the fact that the ruble has not yet fully recovered its purchasing power, which was noted at the end of 2013 before the introduction of sanctions and the fall in oil prices, it has acquired a sufficient potential for Russia's overall economic growth in the near future.

Despite the fact that the results of the study confirm the minimal impact of sanctions on the exchange rate stability of the ruble, which even in the period of their operation continued to serve as an objective indicator of the development of the Russian economy, the question of further reaction of the national currency and the country's economy to possible changes in the sanctions regime remains open. This means that it is impossible to exclude the appearance of other points of view on the problem highlighted in the paper. The uncertainty of the period during which sanctions will be applied can be considered in two aspects: negative and positive. The negative side of the matter is that regardless of the objectives of sanctions, their action will not only complicate Russian relations with Western countries in the economic sphere, but also contribute to the growth of tensions in international politics, make constructive cooperation impossible on a number of crucial challenges that need prompt resolution with the participation of Russia. The conditionally positive side of the extension of the sanctions regime is the possibility of continuing studying the behavior of the exchange rate, and the dynamics of the economy of the state as a whole, under sanctions.

In recent months, people have begun to spend more, including goods that were deferred to "better times", wages are slowly rising, the average bill for the same basket has fallen for three years, and now it has started to grow (Zadornov 2017) (Figures 22).

Figure 22

Real wages, disposable incomes, consumer spending of the population in real terms

(with the exception of the seasonal factor, 2014 = 100%) (Report on monetary policy, 2017)

What does this mean for the Russian economy? The answer is obvious from the results of this research: if the ruble is stable and predictable – people spend and consume more, then companies receive more money for their products, using the money entrepreneurs begin to produce more, increase the number of jobs, pay more in wages and taxes to the federal budget. The more money in the budget, the more programs the state will be able to finance, pay more pensions and salaries, build more roads, hospitals, airports. To date, the state of the ruble is such that working under the current scheme of sanctions, it is able to ensure economic growth in 2017 at a level of more than 2 percent. New sanctions of the United States could become the most ambitious since 2014, but as the last western limit, they will be offset, if Russia focuses on the development of key areas of the economy, develops the inner potential, if it starts reducing, and in future eliminates the petrodollar dependence.

Based on the above, one can say with a high degree of certainty that the goal of this research has been achieved, the ruble rate can be considered an objective indicator of the state of the Russian economy, and the hypothesis of the minimal impact of sanctions on its market value has been confirmed.

Chibisova E.I, Chibisov O.V. and Soltakhanov A.U. (2015). The exchange rate, its step-by-step movement towards the bi-currency basket and the transition to free conversion under conditions Sanctions. Russian Business, 15, 2437-2450

Cholodilin K. and Netšunajev A. (2016). Crimean: The impact of sanctions on the Russian and European economies. DIW Discussion Papers, 1569, 13

Chronology of the introduction of sanctions and Russia's response in 2014-2016. The network edition of RIA Novosti. (2016). Date View November 17, 2017 https://ria.ru/spravka/20160915/1477047949.html

Comments on the State and Business January 21 – February 4, (2016). Institute "Development Center" NRU "Higher School of Economics", 107, 8

Dynamics of US dollar and euro exchange rates against the ruble and indicators of exchange trades 2013-2017. Bank of Russia. (2017). Date View November 17, 2017 http://www.cbr.ru/hd_base/Default.aspx?Prtid=micex_doc

Export of the Russian Federation of crude oil for 2000-2015 (according to the Federal Customs Service of Russia and Rosstat). (2015). Date View November 17, 2017 http://www.cbr.ru/statistics/credit_statistics/print.aspx?file=crude_oil.htm.

Fitch Revisions Outlook on Russia to Stable; Affirms at 'BBB-'. Fitch Ratings, Ltd. (2016). Date View November 17, 2017 https://www.fitchratings.com/site/pr/1013171

Head of the Central Bank Nabiullina urged to learn to live in a new reality with a weak ruble. TASS. (2014). Date View November 17, 2017 http://tass.ru/ekonomika/1650298

Incomes and expenditures of the population: major changes in 2015. (2015). Moscow: Institute for Management of Social Processes, Higher School of Economics, pp. 2.

On the dynamics of the development of the banking sector of the Russian Federation in February 2017. The Bank of Russia. (2017). Date View November 17, 2017 http://www.cbr.ru/analytics/bank_system/din_razv_17_02.pdf

Oreshkin: New US sanctions will not significantly affect the ruble exchange rate. JSC "AEI" PRIME (2017). Date View November 17, 2017 http://1prime.ru/state_regulation/20170726/827725360.html

President Obama's State of the Union. National Archives and Records Administration. Medium. (2015). Date View November 17, 2017 https://medium.com/@ObamaWhiteHouse/president-obamas-state-of-the-union-address-remarks-as-prepared-for-delivery-55f9825449b2 ).

Report on monetary policy. Bank of Russia. (2017). Date View November 17, 2017 http://www.cbr.ru/publ/ddcp/2017_02_ddcp.pdf)

Russia in figures 2016. The commodity structure of Russia's exports and imports. Federal State Statistics Service. (2016). Moscow: Rosstat, pp. 507.

Sberbank of the Russian Federation. News of the global economy. (2016). Date View November 17, 2017 www.sberbank.ru, document: nge_22-28fev.pdf

Sharoyan S. (2015). Citi assessed the contribution of sanctions to the fall of the Russian economy. Date View November 17, 2017 http://www.rbc.ru/finances/28/09/2015/560949839a7947b23fa7cd0c

Shiryaev D.V. (2015). Analysis and consequences of depreciation of the Russian ruble. Young Scientist, 24, 618-622.

Statistics from the site Consultant Plus. The key rate set by the Bank of Russia. (2017). Date View November 17, 2017 http://www.consultant.ru/document/cons_doc_LAW_12453/886577905315979b26c9032d79cb911cc8fa7e69/

Statistics from the site Rosstat. Statistical compendium Prices in Russia (2016). Date View November 17, 2017 http://www.gks.ru/free_doc/doc_2016/cena_2016.pdf

Statistics from the site Yandex quotes. Dynamics of prices for Brent crude (ICE.Brent, USD per barrel). (2017). Date View November 17, 2017 https://news.yandex.ru/quotes/1006.html

The Bank of Russia decided to reduce the key rate to 9.00% per annum. The Bank of Russia (2017). Date View November 17, 2017 http://www.cbr.ru/press/keypr/

The structure of Russia's exports for 2014. Rating data (2014). Date View November 17, 2017 http://total-rating.ru/1445-struktura-eksporta-rossii-v-2014-godu.html).

Zadornov, M. (2012). There is no hope for the removal of sanctions. Date View November 17, 2017 http://www.banki.ru/news/interview/?id=9885844

1. Plekhanov Russian University of Economics, 117997, Russia, Moscow, Stremyanny per. 36

2. Plekhanov Russian University of Economics, 117997, Russia, Moscow, Stremyanny per. 36

3. Plekhanov Russian University of Economics, 117997, Russia, Moscow, Stremyanny per. 36. E-mail: olga.angel@bk.ru

4. Russian Presidential Academy of National Economy and Public Administration (RANEPA), 119571, Russian Federation, Moscow, Vernadsky prosp., 82