Vol. 39 (Number 18) Year 2018 • Page 12

Tatiana Mikhailovna VAZHENINA 1; Natalia Grigoryevna GRUSHEVSKAYA 2

Received: 05/12/2017 • Approved: 15/01/2018

ABSTRACT: This article provides an evaluation of the investment attractiveness of Russian regions for foreign investors. It regards some theoretical and methodological grounds for evaluating the investment attractiveness of Russian regions. This work provides an evaluation of the investment attractiveness of Russian regions for investors based on national investment attractiveness ratings. The authors have evaluated regions’ investment attractiveness based on the “new integral evaluation method” by V.L. Sazykin. The work explains that it is reasonable and appropriate to use this method since it can be used when it is necessary to rank regions based on an investment attractiveness evaluation and to carry out a comparative analysis of regions’ attractiveness. It presents comparative characteristics of the investment attractiveness of regions, which identifies the incommensurability of the results. This work also detects some “bottlenecks” which affect region's investment attractiveness for foreign investors, and suggests some ways of eliminating them. |

RESUMEN: Este artículo proporciona una evaluación del atractivo de inversión de las regiones rusas para los inversores extranjeros. Considera algunas bases teóricas y metodológicas para evaluar el atractivo de inversión de las regiones rusas. Este trabajo proporciona una evaluación del atractivo de inversión de las regiones rusas para los inversores en función de las calificaciones de atractivo de inversión nacional. Los autores han evaluado el atractivo de inversión de las regiones en base al "nuevo método de evaluación integral" de V.L. Sazykin. El trabajo explica que es razonable y apropiado utilizar este método, ya que puede utilizarse cuando es necesario clasificar las regiones según una evaluación de atractivo de inversión y realizar un análisis comparativo del atractivo de las regiones. Presenta características comparativas del atractivo de inversión de las regiones, lo que identifica la inconmensurabilidad de los resultados. Este trabajo también detecta algunos "cuellos de botella" que afectan el atractivo de la inversión de la región para los inversores extranjeros, y sugiere algunas formas de eliminarlos. |

High investment attractiveness of a region is one of the main factors of its successful economic and innovative development which boosts its and its society’s prosperity.

Lately, a great number of evaluation methods have been developed by foreign and domestic authors, and they present the results in a different form – rating, type classification, or quantitative classification. The rating form is rather popular since it is more compact, easier for investors to perceive and quite informative at the same time. International ratings do not always take into account countries’ (regions’) peculiarities, which nowadays leads to creation of national ratings (Blum, 2013; Panaseykina, 2010; Izyumova, 2011).

Currently, there is no specific method for the evaluation of investment attractiveness approved by the government of the Russian Federation, which explains the existence of a great number of methods. Ratings based on different methods are often incommensurable.

Currently, there are a lot of definitions of investment attractiveness, which leads to a great number of ways to evaluate it (Vazhenina and Grushevskaya, 2017). As there is no common method, the results are non-uniform and incommensurable (Koroleva and Filatova, 2017; Mahmudova et al., 2016; Tarasova and Scherbakova, 2016).

The investment attractiveness rating by Expert RA Rating Agency is based on the comparative evaluation of regions taking into consideration two independent characteristics: investment potential and investment risk. Such evaluation allows to rank regions based on their investment potential and investment risk. Complete ratings of the investment potentials and investment risks of Russian regions have been made but not presented in this article. The final investment attractiveness rating by Expert RA Rating Agency presented in Table 1 (Investment Attractiveness Rating 2015) divides regions into groups based on the potential-risk ratio.

Table 1

Russian Regions’ Investment Attractiveness Rating 2015

Rating score |

Name of the subject of the Russian Federation |

||||

1 |

2 |

||||

Maximum potential — minimum risk |

Moscow Oblast |

|

|||

Saint Petersburg |

|

||||

Krasnodar Krai |

|

||||

Medium potential — minimum risk |

Belgorod Oblast |

|

|||

Republic of Tatarstan |

|

||||

Low potential — minimum risk |

Voronezh Oblast |

Tambov Oblast |

|||

Kursk Oblast |

Tula Oblast |

||||

Lipetsk Oblast |

Leningrad Oblast |

||||

High potential — moderate risk |

Moscow |

Sverdlovsk Oblast |

|||

Medium potential — moderate risk |

Rostov Oblast |

Samara Oblast |

|||

Republic of Bashkortostan |

Khanty-Mansi Autonomous Okrug |

||||

Perm Krai |

Chelyabinsk Oblast |

||||

Niznhy Novgorov Oblast |

Krasnoyarsk Krai |

||||

Novosibirsk Oblast |

Irkutsk Oblast |

||||

Kemerovo Oblast |

|

||||

Low potential — moderate risk |

Bryansk Oblast |

Astrakhan Oblast |

|||

Vladimir Oblast |

Volgograd Oblast |

||||

Ivanovo Oblast |

Stavropol Krai |

||||

Kaluga Oblast |

Udmurt Republic |

||||

Ryazan Oblast |

Chuvash Republic |

||||

Smolensk Oblast |

Kirov Oblast |

||||

Tver Oblast |

Orenburg Oblast |

||||

Yaroslavl Oblast |

Penza Oblast |

||||

Komi Republic |

Saratov Oblast |

||||

Arkhangelsk Oblast |

Ulyanovsk Oblast |

||||

Vologda Oblast |

Tyumen Oblast |

||||

Kaliningrad Oblast |

Yamalo-Nenets Autonomous Okrug |

||||

Primorsky Krai |

Altai Krai |

||||

Khabarovsk Krai |

Omsk Oblast |

||||

Sakhalin Oblast |

Tomsk Oblast |

||||

Sakha Republic |

|

||||

Minor potential — moderate risk |

Kostroma Oblast |

Republic of Mordovia |

|||

Oryol Oblast |

Kurgan Oblast |

||||

Nenets Autonomous Okrug |

Republic of Khakassia |

||||

Novgorod Oblast |

Amur Oblast |

||||

Pskov Oblast |

Sevastopol |

||||

Republic of Adygea |

Mari El Republic |

||||

Low potential — high risk |

Republic of Karelia |

Zabaykalsky Krai |

|||

Murmansk Oblast |

Republic of Crimea |

||||

Republic of Buryatia |

|

||||

Minor potential — high risk |

Republic of Kalmykia |

Chechen Republic |

|||

Kabardino-Balkar Republic |

Altai Republic |

||||

Karachay-Cherkess Republic |

Kamchatka Krai |

||||

Republic of North Ossetia-Alania |

Magadan Oblast |

||||

Chukotka Autonomous Okrug |

Jewish Autonomous Oblast |

||||

Low potential — extreme risk |

Tyva Republic Republic of Dagestan |

Republic of Ingushetia |

|||

The “maximum potential — minimum risk” group includes three regions: Moscow Oblast (9th in the Regions’ Investment Risk Rating and 2nd in the Investment Potential Rating), Saint Petersburg (7th in the Regions’ Investment Risk Rating and 3rd in the Investment Potential Rating), and Krasnodar Krai (1st in the Regions’ Investment Risk Rating and 4th in the Investment Potential Rating).

The “high potential - moderate risk” group includes two regions: Moscow (14th in the Regions’ Investment Risk Rating and 1st in the Investment Potential Rating) and Sverdlovsk Oblast (26th in the Regions’ Investment Risk Rating and 5th in the Investment Potential Rating).

The “medium potential — low risk” group includes two regions – Belgorod Oblast (6th in the Regions’ Investment Risk Rating and 7th in the Investment Potential Rating) and the Republic of Tatarstan (8th in the Regions’ Investment Risk Rating and 7th in the Investment Potential Rating).

Tyumen Oblast belongs to the “low potential — moderate risk” group being 13th in the Regions’ Investment Risk Rating (Table 2) and 31st in the Regions' Investment Potential Rating (Table 3) (Tyumen Oblast in Figures, 2016).

Comparing the investment risk rating presented in Table 2 and the investment potential rating presented in Table 3 with the investment attractiveness rating, it is hard to find the relation between these elements. Unfortunately, the method does not demonstrate the relation between investment potential and investment risk when dividing regions into groups. That is why the rating method does not make it clear how investment potential and investment risk are interrelated. In addition, the rating does not grant any specific position to any region, which makes it hard to understand which region is the best. For instance, which regions are better: those having medium potential and minimum risk or those having high potential and moderate risk.

Table 2

Excerpt from the Russian Regions’ Investment Risk Rating 2015

Risk rating |

Subject of the Russian Federation |

Risk-weighted average |

Rating of investment risk constituents |

|||||

Social |

Economic |

Financial |

Criminal |

Environmental |

Managerial |

|||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1 |

0.150 |

18 |

2 |

22 |

21 |

10 |

1 |

|

2 |

0.160 |

3 |

12 |

11 |

14 |

35 |

6 |

|

3 |

0.164 |

8 |

10 |

34 |

13 |

9 |

2 |

|

4 |

0.170 |

16 |

20 |

3 |

15 |

50 |

5 |

|

5 |

0.176 |

6 |

16 |

25 |

7 |

3 |

42 |

|

6 |

0.176 |

4 |

4 |

26 |

4 |

12 |

63 |

|

7 |

0.177 |

5 |

17 |

1 |

37 |

48 |

44 |

|

8 |

0.179 |

22 |

3 |

13 |

22 |

38 |

22 |

|

9 |

0.179 |

2 |

5 |

4 |

32 |

33 |

69 |

|

10 |

0.188 |

10 |

9 |

53 |

20 |

14 |

4 |

|

11 |

0.194 |

9 |

25 |

10 |

18 |

40 |

48 |

|

12 |

0.200 |

7 |

50 |

24 |

17 |

16 |

29 |

|

13 |

0.202 |

28 |

11 |

8 |

51 |

45 |

26 |

|

14 |

0.208 |

1 |

33 |

6 |

46 |

29 |

73 |

|

15 |

0.209 |

58 |

1 |

7 |

16 |

47 |

62 |

|

-----

Table 3

Excerpt from the Russian Regions’ Investment Potential Rating 2015

Potential rating |

Subject of the Russian Federation |

Share in overall Russia's potential |

Rating of investment potential constituents |

||||||||

Labor |

Consumer |

Production |

Financial |

Institutional |

Innovation |

Infrastructural |

Natural resources |

Touristic |

|||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

1 |

13.873 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

84 |

2 |

|

2 |

5.906 |

2 |

2 |

3 |

2 |

3 |

2 |

2 |

50 |

3 |

|

3 |

4.683 |

3 |

3 |

2 |

3 |

2 |

3 |

5 |

85 |

4 |

|

4 |

2.856 |

4 |

4 |

7 |

4 |

4 |

22 |

6 |

28 |

1 |

|

5 |

2.596 |

7 |

5 |

5 |

7 |

5 |

7 |

48 |

12 |

7 |

|

6 |

2.486 |

5 |

6 |

6 |

5 |

7 |

5 |

21 |

41 |

6 |

|

7 |

2.374 |

14 |

14 |

15 |

11 |

13 |

16 |

78 |

1 |

9 |

|

8 |

2.018 |

10 |

9 |

10 |

10 |

10 |

4 |

31 |

57 |

12 |

|

31 |

0.982 |

34 |

27 |

19 |

27 |

17 |

25 |

58 |

46 |

27 |

|

32 |

0.964 |

28 |

31 |

32 |

34 |

33 |

40 |

64 |

13 |

23 |

|

According to the rating provided by the experts of the rating agency, Tyumen is not highly evaluated.

The investment attractiveness rating by ASI is called the National Investment Rating. An excerpt from the rating is presented in Table 4 (Bukharova, n.d.).

Table 4

Excerpt from the National Investment Rating 2015

Region |

Final rating |

Regulatory environment |

Institutes for business |

Infrastructure and resources |

Small businesses |

1 |

2 |

3 |

4 |

5 |

6 |

Republic of Tatarstan |

1 |

A |

A |

A |

B |

Kaluga Oblast |

2 |

A |

A |

C |

A |

Belgorod Oblast |

3 |

C |

A |

A |

B |

Tambov Oblast |

4 |

B |

A |

B |

C |

Ulyanovsk Oblast |

5 |

B |

A |

C |

C |

Kostroma Oblast |

6 |

B |

A |

C |

B |

Krasnodar Krai |

7 |

A |

C |

B |

B |

Rostov Oblast |

8 |

B |

B |

B |

B |

Chuvash Republic |

9 |

A |

C |

B |

B |

Tula Oblast |

10 |

B |

B |

C |

C |

Penza Oblast |

11 |

D |

A |

C |

A |

Khanty-Mansi Autonomous Okrug - Yugra |

12 |

C |

B |

B |

A |

Moscow |

13 |

B |

B |

C |

C |

Voronezh Oblast |

14 |

B |

B |

C |

C |

Tyumen Oblast |

15 |

D |

A |

C |

B |

According to this rating, the top three are the Republic of Tatarstan, Kaluga Oblast, and Belgorod Oblast.

Thus, having studied the ratings provided by two rather reputable agencies, one may conclude that the results of the ratings based on different methods are incommensurable. Such incommensurability may be caused by using different calculation methods and different indicators.

For more accurate evaluation of the region's investment attractiveness, it is necessary to include all Russian regions into the list of items to be evaluated: Central Federal District, Northwestern Federal District, Southern Federal District, North Caucasian Federal District, Crimean Federal District, Volga Federal District, Ural Federal District, Siberian Federal District and Far Eastern Federal District.

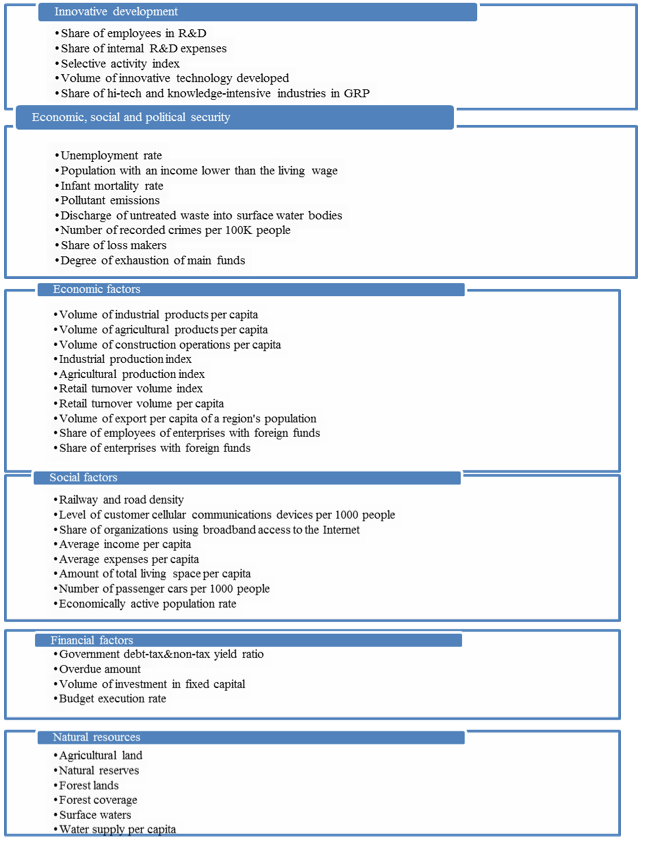

To evaluate investment attractiveness, 43 indicators were selected (Mezentseva, 2016a; Mezentseva, 2016b). The list of indicators is specified in Figure 1.

Fig. 1

List of indicators used for evaluation of investment attractiveness

The statistical data used in the evaluation were taken from the website of Goskomstat (the State Committee for Statistics) and covered the year of 2015. Due to the lack of statistical data, the indicators do not include tourism and legal factors. Moreover, since there is no publicly available information, the weights of the indicators have not been taken into account, and that is why the method regards the weights of all indicators as equal.

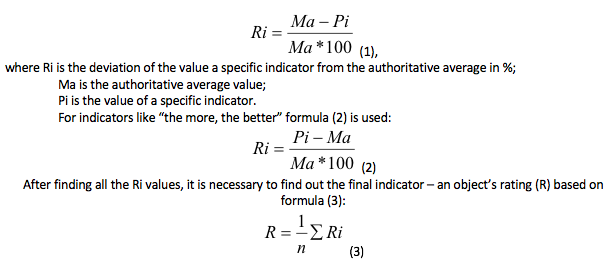

A great number of methods are used for evaluating investment attractiveness, and most of them use the integrated index when forming a final rating. This work uses the integral evaluation method by V.L. Sazykin (2204) to evaluate investment attractiveness. It allows for evaluation of the region’s rating, and it also helps determine in what way one region is worse or better than another.

2.3. Mathematical formulation of the method (Vneshneekonomicheskiy tolkovyi slovar (Foreign Economy Dictionary), 2001):

Instead of average values of the entire group, the new method suggests using the average values of the highest level – the “authoritative” average (for Russia's subjects – average data for Russia). As the work regards all regions, let us use the arithmetic mean as the “authoritative” average.

After finding the “authoritative” average, it is necessary to find the standardized deviations of indicators. To do so, based on the type of the indicator, the following formulas are used:

For indicators like “the less, the better” formula (1) is used:

The authoritative average and standardized deviations have been calculated but they are not presented in this article. Table 5 presents the top twenty regions of the final Russian Regions’ Investment Attractiveness Rating.

Table 5

Excerpt from the Russian Regions’ Rating – Determining a Region's Rating based on an Authoritative Rating

Name of region |

Final indicator |

Rating |

Moscow |

101.2 |

1 |

Saint Petersburg |

66.9 |

2 |

Sakhalin Oblast |

59.3 |

3 |

Tula Oblast |

34.9 |

4 |

Moscow Oblast |

34.4 |

5 |

Magadan Oblast |

29.7 |

6 |

Lipetsk Oblast |

25.8 |

7 |

Niznhy Novgorod Oblast |

25.5 |

8 |

Tyumen Oblast |

19.2 |

9 |

Republic of Tatarstan |

16.6 |

10 |

Kaluga Oblast |

16.1 |

11 |

Sakha Republic (Yakutia) |

15.3 |

12 |

Chukotka Autonomous Okrug |

13.9 |

13 |

Leningrad Oblast |

12.9 |

14 |

Sverdlovsk Oblast |

10.5 |

15 |

Tomsk Oblast |

8.6 |

16 |

Belgorod Oblast |

8.1 |

17 |

Kursk Oblast |

7.8 |

18 |

Kamchatka Krai |

7.6 |

19 |

Voronezh Oblast |

6.9 |

20 |

Based on the results obtained, one may conclude that Moscow is the leader in the investment attractiveness rating, being far ahead of Saint Petersburg (34.3 points). Tyumen Oblast is the 9th, and its investment attractiveness is a bit better than that of the Republic of Tatarstan (the difference is 2.6 points).

The three ratings based on different methods (the rating based on V.L. Sazykin's method, the rating by Expert RA and the rating by ASI) are compared in Table 6.

Table 6

Comparison of ratings

Name of region |

Rating (V.L. Sazykin’s method) |

Position in the ASI rating |

Position in the Expert RA rating |

Moscow |

1 |

13 |

High potential — moderate risk |

Saint Petersburg |

2 |

26 |

Maximum potential — minimum risk |

Sakhalin Oblast |

3 |

54 |

Low potential — moderate risk |

Moscow Oblast |

4 |

22 |

Maximum potential — minimum risk |

Tula Oblast |

5 |

10 |

Low potential — minimum risk |

Magadan Oblast |

6 |

66 |

Minor potential — high risk |

Niznhy Novgorod Oblast |

7 |

46 |

Medium potential — moderate risk |

Lipetsk Oblast |

8 |

34 |

Low potential — minimum risk |

Tyumen Oblast |

9 |

15 |

Low potential — moderate risk |

Kaluga Oblast |

10 |

2 |

Low potential — moderate risk |

Republic of Tatarstan |

11 |

1 |

Medium potential — minimum risk |

Sakha Republic |

12 |

41 |

Low potential — moderate risk |

Leningrad Oblast |

13 |

20 |

Low potential — minimum risk |

Sverdlovsk Oblast |

15 |

47 |

High potential — moderate risk |

The results of the evaluation of the investment attractiveness of Russian regions for 2015 are as follows: the top five include Moscow, Saint Petersburg, Sakhalin Oblast, Moscow Oblast, and Tula Oblast.

When comparing the results of the investment attractiveness ratings, one should note that the results are incommensurable since the former are based on different approaches to evaluation, as well as different indicators. Thus, for instance, the national investment attractiveness rating mostly focuses on surveys among investors, i.e. they take into account investors’ opinion on the following indicators: satisfaction with measures taken by public and municipal bodies responsible for issuing permits; the time within which such a permit is granted or the time within which a new enterprise is added to the State Register; evaluation of the quality of road networks given by entrepreneurs. Thus, the national investment attractiveness rating provides mostly a subjective evaluation. The Expert RA rating is mainly based on statistical data, and the weight of indicators is determined by expertise. V.L. Sazykin’s method also can take into account the weights of indicators, but, due to the impossibility to survey investors all over Russia, this work regards the weights of indicators as equal, and that is why errors are possible. To obtain more accurate results when evaluating investment attractiveness and determining the final rating, it is necessary to take into account the weights of indicators. V.L. Sazykin’s method is good because it not only shows a region’s position in the rating but also helps understand how good the region is. Thus, V.L. Sazykin’s method can be used in case it is necessary not only to rank regions based on an evaluation of investment attractiveness but also to carry out comparative analysis of the state of regions’ attractiveness.

The issues regarding the attraction of investment in the Russian economy are becoming more and more topical under the current social and economic circumstances. Currently, Russia’s investment attractiveness in general is decreasing. Most foreign investors are concerned about the country’s economic and political problems: instability of the Russian currency, red-tape impeding the business registration and administration processes in Russia, unstable oil prices, etc. (Weinbender, 2016). The financial sanctions have significantly affected the activity of investors from Japan, the EU, and the USA. (Lyubanenko, 2016; Lyubimov et al., 2014).

The new economic conditions influenced by the sanctions have emphasized the issues regarding the stable development of regions and their investment attractiveness. The turbulent external environment and abrupt change in a number of important economic parameters require specific administration over the development of the regional economy (Mezentseva and Naymushina, 2016).

Nevertheless, the Russian economy is quite experienced in raising the attractiveness of the country in general and its individual regions. Thus, in the regions interested in foreign funds the government implements various state aid systems in order to support investment projects (tax incentives, investment tax credits, state guarantees, etc.).

The main provisions and results of this work can be used by the subjects of the Russian Federation for evaluating their investment attractiveness and developing measures to improve their investment attractiveness.

This work used the V.L. Sazykin’s method which had not been used for determining regions’ investment attractiveness before. The method allows to understand in what way one region is better than another. The investors do analyze and evaluate not only the macroeconomic, regional and industry-specific levels but also the investment attractiveness of a certain subject which would determine the way an investment project could be carried out (Vazhenina and Nikonova, 2015; Pryamye inostrannye investitsii v Rossii (Direct Foreign Investment in Russia), n.d.). As there is no publicly available information about investors’ opinion on the quality of the investment management system in Russian regions, the evaluation was based only on statistical indicators, which implies certain inaccuracy in such analysis. This method can be used for evaluating the investment attractiveness of the subjects of the Russian Federation taking into account the subjective factors influencing regions’ investment attractiveness.

Agency for Strategic Initiatives – National Investment Rating. [Electronic resource]: (n.d.) http://asi.ru/investclimate/rating (Accessed on 12.12.2016)

Blum, E. A. (2013). Obzor metodik otsenki investitsionnogo potentsiala regiona [Reviewing Methods for Evaluation of a Region’s Investment Potential]. Molodoi Uchenyi (Young Scientist), 137-141.

Bukharova O.V. (2014). V Rossii zapustili sait dlya inostrannykh investorov [Russia Launches a Website for Investors] [Electronic resource]: Internal portal Rossiyskaya Gazeta. https://rg.ru/2014/06/23/investinrussia.ru-site-anons.html (Accessed on 08.01.2017)

Investment Attractiveness Rating 2015 [Electronic resource]. (n. d.). http://raexpert.ru/docbank/6ce/1b2/d5c/15 (Accessed on 06.11.2016)

Izyumova O.N. (2011). Analiz metodicheskikh podhodov k upravleniyu i otsenke investitsionnoy privlekatelnosti i investitsionnogo potentsiala regiona [Analysis of Methodological Approaches to Management and Evaluation of Investment Attractiveness and Investment Potential]. [Electronic journal]: Electronic journal Upravlenie ekonomicheskimi sistemami (Managing Economic Systems). http://uecs.ru/uecs-35-352011/item/748 (Accessed on 19.12.2016)

Koroleva A.M. and Filatova I.B. (2017). Otsenka potentsiala razvitiya regionov Uralskogo Federalnogo okruga [Evaluating the Development Potential of the Ural Federal District regions]. In the collection: Sovremennye trendy rossiiskoi ekonomiki: vyzovy vremeni – 2017 [Current Trends in Russian Economics: Challenging Times – 2017]. Materials of the International Scientific and Practical Conference, pp. 317-321.

Lyubanenko A.V. (2016). Islamskaya bankovskaya sistema kak istochnik investitsiy v rossiyskuyu ekonomiku [Islamic Banking System as an Investment Source for the Russian Economy]. Taurida Scientific Messenger, 4(9), Pp. 43-45.

Lyubimov S.V., Lyubimov I.S. and Lyubanenko A.V. (2014). Povyshenie effektivnosti protsedury verifikatsii v realizatsii investitsionnykh programm [Improving the Efficiency of Verification of Investment Programs]. Proceedings in Cybernetics, 4(16), 89-92.

Mahmudova M.M., Koroleva A.M., Shakirova E.V. and Efimenko E.L. (2016). Investitsionnaya privlekatelnost severnogo regiona [Investment Attractiveness of the Northern Region]. Proceedings of Higher Educational Institutions. Sociology. Economics. Politics, 1(48), 27-32.

Mezentseva, O. E. (2016a). Finansirovanie NIOKR kak faktor issledovatelskoy i innovatsionnoy aktivnosti v Tyumenskoy oblasti [R&D Funding as a Factor in Research and Investment Activities in Tyumen Oblast]. Journal of Economy and Entrepreneurship, 1-2 (66-2), 1011-1013.

Mezentseva, O. E. (2016b Sistemnyi analiz i prinyatie resheniy v naukoemkom proizvodstve [Systemic Analysis and Decision-Making in Hi-Tech Production]: tutorial. Tyumen: TIU, pp. 198.

Panaseykina V. S. (2010). Otsenka investitsionnoy privlekatelnosti territorialnykh obrazovaniy: osnovnye kontseptsii [Evaluating Investment Attractiveness of Subnational Entities]. Society: politics, economics, law, 2

Pryamye inostrannye investitsii v Rossii [Direct Foreign Investment in Russia] [Electronic resource]: National Rating Agency, 2013. http://www.ra-national.ru. (Accessed on 25.12.2016)

Sazykin V.L. (2004). Novyi metod integralnoi otsenki [New Integral Evaluation Method]. Vestnik of the Orenburg State University, 12

Tarasova O.V. and Scherbakova M.A. (2016). Investitsionnaya privlekatelnost Tyumenskoy oblasti [Investment attractiveness of Tyumen Oblast]. In the collection: Sovremennye trendy rossiiskoy ekonomiki: vyzovy vremeni – 2015 [Current Trends in Russian Economy: Challenging Times – 2015]. Materials of the International Scientific and Practical Conference with International Participation, pp. 194-197.

Tyumenskaya oblast v tsifrakh [Tyumen Oblast in Figures]. Territorial body of Federal state statistics service in Tyumen Oblast. (2016). Tyumen, pp. 258.

Vazhenina T.M. and Grushevskaya N.G. (2017). Utochnenie ponyatiya investitsionnogo klimata i faktory ego formirovaniya [Explaining Investment Climate and Understanding the Factors of Its Formation]. In the collection: Sovremennye trendy rossiiskoi ekonomiki: vyzovy vremeni – 2017 [Current Trends in Russian Economics: Challenging Times – 2017]. Materials of the International Scientific and Practical Conference, pp. 58-61.

Vazhenina T.M. and Nikonova A.S. (2015). Nekotorye teoreticheskie aspekty investitsionnoy deyatelnosti kompanii [Some Theoretical Aspects of a Company’s Investment Activities]. In the collection: ]. Materials of the International Scientific and Practical Conference with International Participation, pp. 290-293.

Vneshneekonomicheskii tolkovyi slovar [Foreign Economy Dictionary]. (2001). Moscow: INFRA – M.

Weinbender, T. L. (2016). Izmenenie pokazateley rossiyskoy ekonomiki v usloviyah ogranicheniy [Changes in figures of the Russian Economy under limitations]. Rossiya i Evropa: svyaz kultury i ekonomiki [Russia and Europe: interrelation of the culture and economy] (Russia and Europe: Relations between Culture and Economics): Materials of the XIVth International Scientific and Practical Conference. Prague, Czech Republic: Publisher: WORLD PRESS s.r.o., pp. 465-467.

1. Federal State Budget Educational Institution of Higher Education "Industrial University of Tyumen"/IUT, Russia, 625000, Tumen, Volodarsky Street, 38; E-mail: a_ahilgov@mail.ru

2. Federal State Budget Educational Institution of Higher Education "Industrial University of Tyumen"/IUT, Russia, 625000, Tumen, Volodarsky Street, 38