Vol. 39 (Number 18) Year 2018 • Page 21

Makka Alaudinovna KHAMATKHANOVA 1

Received: 28/02/2018 • Approved: 03/02/2018

ABSTRACT: The main methods and models of managing financial resources within a company are considered. It is defined that the traditional and progressive management methods are applied in managing financial resources. It is proved that fundraising is an essential prerequisite for the efficient functioning of any company. The main methods of fundraising are own and borrowed funds. When mobilizing own funds as financial resources, a company should optimize its capital structure. Therefore, it is reasonable to use methods of optimizing the capital structure that include optimization of the capital structure by managing the effect of financial leverage, optimization of the capital structure to minimize the financial risk and terms of fundraising, and optimization of the capital structure by the minimum cost of capital. |

RESUMEN: Se consideran los principales métodos y modelos de gestión de recursos financieros dentro de una empresa. Se define que los métodos de gestión tradicionales y progresivos se aplican en la gestión de los recursos financieros. Está demostrado que la recaudación de fondos es un prerrequisito esencial para el funcionamiento eficiente de cualquier empresa. Los principales métodos de recaudación de fondos son fondos propios y prestados. Al movilizar fondos propios como recursos financieros, una empresa debe optimizar su estructura de capital. Por lo tanto, es razonable utilizar métodos de optimización de la estructura de capital que incluyan la optimización de la estructura de capital mediante la gestión del efecto del apalancamiento financiero, la optimización de la estructura de capital para minimizar el riesgo financiero y los términos de recaudación de fondos, y la optimización de la estructura de capital mediante el costo mínimo de capital |

Financial resources have an exclusively determining effect on the performance of any business; they are unique-specific resources that are converted into any other kind of resources, thereby creating conditions for adequate functioning and economic development (Balabanova 2013; Gorfinkel 2013). Therefore, in order to determine such economic category as financial resources it is important not only to reveal certain hidden features and trends of their accumulation, allocation and distribution, but also to choose the optimal and effective schemes, mechanisms, methods, tools and structures of impact on their turnover while mobilizing the company’s financial resources (Dikalo 2014).

Relevant general scientific methods were applied herein while systematizing models and methods of managing the company’s financial resources, including search for the optimal method of formation thereof, namely: the method of analysis and synthesis, the analogy method, the modeling method, and the pair wise comparison method. As a result, the optimal method to be applied while forming the company’s financial resources in order to maximize its ROI has been found in this study.

Under stable economic conditions, the process of resource formation is activated taking into account the actual needs of the company’s business, the cost of production, and relevant expectations for obtaining a certain result. The situation changes somewhat provided the company’s financial capacity is limited due to an economic decline. As the practice shows, the company’s cash flow shall decrease under such conditions, and it is forced to mobilize its material resources in small lots, to search for cheaper and possibly less qualitative production resources, to reduce the development costs and the budget to acquire intangible resources. Therefore, under the conditions of a depressed state of the economy, there is an urgent task to search for managerial decisions to increase the resources of business entities in the context of limited financing.

If the company’s business is many years old, it shall usually transform available traditional resources that have low cost, if used for a long time. However, this economically advantageous situation shall not last long, because the low productivity of such assets adversely affects the overall result of the company’s business and gradually exacerbates the problem of reducing the turnover. That is why the company’s management is better to look for a new method of managing its financial resources than to ensure low costs of fundraising (Isaeva 2014).

It is difficult to interpret the “risk” zone from the economic point of view. It seems counterproductive to activate the resource formation if the relevant resource is very expensive and has low productivity. However, the practice shows that such cases are not unique. First, this may be indicative of improper competence of the executives who decide to start the resource formation, or about the influence of other non-economic factors. Speaking about managing the company’s financial resources, it should be kept in mind that a specific feature of such resources is that they need to be converted into other types of resources in order to participate in the production. As for financial resources, we consider this transformation feature to be unique.

To understand how a company may mobilize its resources with limited fundraising, it is necessary to analyze the model of transformation of the company’s financial resources into other assets, and this presupposes a set of related elements - input, core and output - if the procedural approach is applied (Pimenov 2016).

The output for this model is resources that can be transformed into the company’s assets for a certain business model to achieve the expected results. The core is the company’s assets themselves, being formed because of transformation of the company’s financial resources. The output is the results of the company’s business. The economic interpretation of such transformational feature of financial resources is most fully reflected in the liquidity concept. The theory and practice of financial management consider liquidity as the asset’s ability to be realized in a short period with the least losses of its real market value. The main quantitative indicator thereof is the liquidity of the relevant asset (Pimenov 2016).

Therefore, the liquidity should be considered as a defining feature of classifying liquid assets as a part of financial resources.

The model of transforming the company’s financial resources into its assets provides for at least three variants: the progressive, single and regressive transformation prism (see Figures 1, 2 and 3).

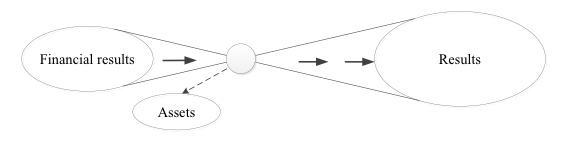

Figure 1 shows the progressive model of the transformation prism.

The progressive (optimal) model of the transformation prism illustrates the situation when assets are formed from a small set of financial resources that can bring considerable results (see Figure 1). In other words, the multiplier of the correlation of results and financial resources is > 1.

Fig. 1

Progressive (Optimal) Model of the Transformation Prism

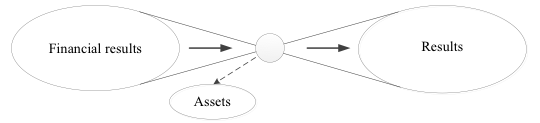

Figure 2 shows the single model of the transformation prism.

Fig. 2

Single Model of the Transformation Prism

The single model of the transformation prism represents as much of the result as proposed for resource selection (see Figure 2), i.e. it illustrates the situation when assets that are capable of bringing significant results are formed from a major set of financial resources. In other words, the multiplier of the correlation of results and financial resources approaches 1.

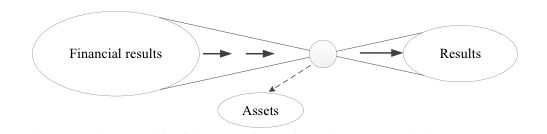

Figure 3 shows the regressive model of the transformational prism.

Fig. 3

Regressive Model of the Transformational Prism

The regressive model of the transformation prism demands input parameters, but it produces poor results at the output (see Figure 3), i.e. it illustrates the situation when assets that are capable of bringing minor results are formed from a major set of financial resources. The multiplier of the correlation of results and financial resources is <1. The capacity of financial resources to be transformed is important not in itself, but in a temporal aspect. This means (Dikalo 2014):

Firstly, the constant readiness of the resource for transformation at any time and without restrictions. At the same time, during such transformation, financial resources should not lose the value accumulated therein or a small part thereof.

Secondly, it is important that, with the growth of the period, the transformation feature of the resource will not significantly decrease, and the maintenance costs will not increase.

Thus, the fact follows that any correlation of certain types of assets with financial resources shall depend on the period such correlation is made for.

The financial management refers to one of the most important elements in the company’s management system. It produces the main incentives for economic activity and provides its production, scientific, marketing elements with everything they need, thereby contributing not only to their effective functioning, but also to the whole company (Dikalo 2014).

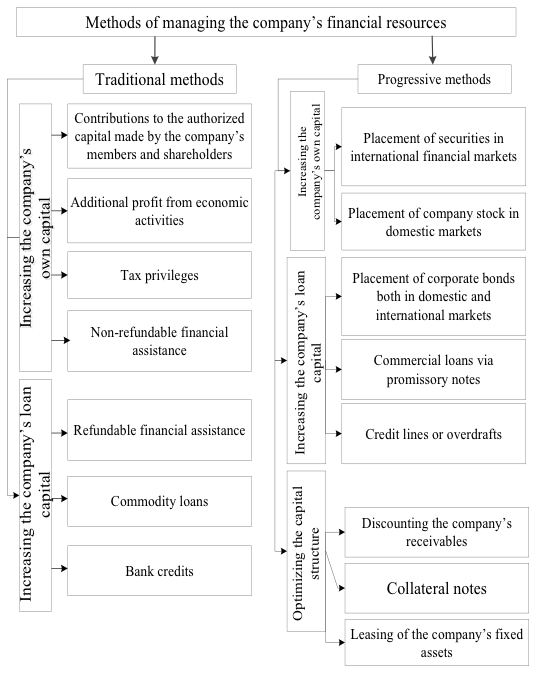

The transition of the country’s economy to market relations requires the most effective financial management, which in turn significantly depends on the reasonability of the applied methods. At the same time, the development of financial management in Russia calls for the expansion of, first of all, such management methods that can be successfully applied in practice, taking into account the specifics of financial resources management under the Russian conditions. In the scientific literature, there is no unity of opinion on the classification of methods for managing financial resources. Having analyzed certain sources (Angrykova 2014; Makhovikova 2016; Khamatkhanova 2016; Khamatkhanova 2015; Sharinova 2014), a classification scheme for dividing the methods of managing the company’s financial resources into traditional and progressive ones was developed (see Figure 4).

Fig. 4

Classification Scheme for Dividing Methods of Managing the Company’s

Financial Resources into Traditional and Progressive Ones

The class of traditional methods includes such groups of methods as:

Obtaining contributions to the authorized capital made by the company’s founders and shareholders,

Earning additional profit from economic activities,

Obtaining tax privileges, and

Obtaining non-refundable financial assistance.

Obtaining bank credits,

Obtaining commodity loans, and

Obtaining refundable financial assistance.

The class of progressive methods includes the following groups:

Placement of depositary receipts in international financial markets, and

Placement of derivative securities to the company’s stock.

Obtaining bank credits,

Obtaining commodity loans, and

Obtaining refundable financial assistance.

The class of progressive methods includes the following groups:

Placement of depositary receipts in international financial markets, and

Placement of derivative securities to the company’s stock.

Placement of corporate bonds both in domestic and international markets,

Obtaining commercial loans via promissory notes, and

Obtaining commodity loans.

Discounting the company’s receivables,

Using collateral notes, and

Obtaining the company’s fixed assets in leasing.

It is necessary to note that the above classification allows determining three important features of progressive methods in comparison with the traditional ones (Angrykova 2014; Makhovikova 2016; Khamatkhanova 2015):

Such non-traditional methods involve special financial instruments — stock of various types,

A special group of progressive methods allows solving the task of optimizing the structure of assets, fundamentally different from the point of view of increasing the efficiency of financial and economic activity, and

Groups and subgroups of progressive methods are precisely those methods that allow involving additional financial resources both on domestic and international financial markets.

The main methods of managing financial resources are two groups of traditional methods, namely: the groups for increasing their own capital and the groups for increasing their loan capital. Their optimization is the basis for managing financial resources of any domestic industrial enterprise. Each company should determine how to optimize its capital structure at the expense of its own or borrowed funds. To represent the role of own and loan capital, let us consider their comparative characteristics by criteria, reflecting the essence of each of these concepts.

Table 1 shows a comparative analysis of own and loan capital in the context of managing the company’s financial resources (Kokins 2007; Lytneva 2014; Financial Resources Management (FiRM); Finding Financial Support Resources (web-resource)).

Table 1

Comparative Analysis — Own and Loan Capital

Own capital |

Loan capital |

|

Degree of complexity to mobilize/borrow |

Simplicity to mobilize/borrow is related to decisions of the company’s owners |

Difficulty to mobilize/borrow is connected with the dependence on the decision of creditors |

The right to participate in managing the company |

It gives the full or limited right depending on the content of documents |

As a rule, the right to participate in managing the company is excluded |

The right to profit |

It gives the right to participate in distribution of profits |

Participation in distribution of profits is limited to interest payments under a loan agreement |

The nature of refund |

Including interest and dividends paid to the owners |

Including payments related to capital servicing, as well as repayment of debts |

Tax burden or mechanism for calculating payments |

Accrued taxes or payments to the owners of capital in the form of interest or dividends |

Payment of interest for loan capital is registered as the costs and expenses and, as a consequence, are not included into the taxable base (tax savings) |

Priority of return in case of bankruptcy |

At the end of the line |

First, depending on means of securing obligations |

Term |

Unlimited |

Restricted under capital raising agreements |

Loan collateral |

None |

Mostly required |

Fixed repayments |

Dividends are paid according to the net profit received, dividend policy and availability of funds |

The amount paid to the creditor is fixed and stipulated in the loan agreement |

Degree of independence |

Strengthening financial stability and increasing financial independence |

Threatens to increase financial instability and financial risks |

Mobilizing a significant amount of its own funds is cheaper for domestic companies, but there is a problem of lack of their formation sources. Borrowing a significant amount of capital is quite expensive, but it has many sources with different conditions and terms of use.

Each company should try to optimize the structure of its own funding sources. To do this, in modern theory there are several methods for optimizing the capital structure, the most common of which are given in Table 2.

Table 2

Methods for Optimizing the Capital Structure

Method characteristics |

|

Optimizing the capital structure by controlling the degree of financial leverage |

The degree of financial leverage determines the ROI growth while borrowing. According to this method, the most effective will be a ratio of own and loan capital, in which the increase in net profitability of equity and the degree of financial leverage will have the greatest values. |

Optimizing the capital structure by minimizing the financial risk and the borrowing terms |

This model refers to the choice of cheaper options for financing different groups of the company’s assets applying a conservative, aggressive, compromise approach. |

Optimization of the capital structure by taking into account the minimum cost of capital |

The method provides for the estimation of own and loan capital by its individual elements, as well as valuation of capital for its weighted average cost. |

Taking into account the fact that among the tools used in managing financial resources, a progressive method of managing financial resources should play a special role. Therefore, we assume that the whole set of methods for managing financial resources should be used to influence the formation of such proportions of own and borrowed funds, thereby providing an additional increase in the profitability of equity capital, and most importantly, creating favorable conditions for financial stability for the prospect of emerging from a crisis or development.

Traditional and progressive management methods are applied in managing financial resources. The traditional methods include increasing both own and loan capital. The progressive methods include increasing both own and loan capital and optimizing the structure of the company’s assets, which in turn are divided into subgroups specified herein.

Fundraising is an essential prerequisite for the efficient functioning of any company. As a rule, either you mobilize your own funds or borrow money from other persons. Mobilizing a significant amount of its own funds is cheaper for domestic companies, but there appears the problem of lack of their formation sources. Borrowing a significant amount of capital is quite expensive, but it has many sources with different conditions and terms of use.

When mobilizing own funds as financial resources, a company should optimize its capital structure. Therefore, it is reasonable to use methods of optimizing the capital structure that include optimization of the capital structure by managing the effect of financial leverage, optimization of the capital structure to minimize the financial risk and terms of fundraising, and optimization of the capital structure by the minimum cost of capital.

It is important that the set of methods for managing financial resources should ensure that the company’s own and borrowed funds generate such proportions that provide an additional ROI growth and favorable conditions for financial development.

Angrykova K.U. (2014). Upravleniye finansami predpriyatiya [Financial Management for Companies]. Modern Scientific Research & Innovations, 11 [web-resource]. Date View September 17, 2017 http://web.snauka.ru/issues/2014/11/40862

Balabanova L.V. (2013). Upravleniye finansovymi resursami [Managing Financial Resources]. Moscow: Center for Educational Literature, pp. 468.

Dikalo S.V. (2014). Upravleniye finansovymi resursami promyshlennykh predpriyatiy [Managing Financial Resources for Industrial Enterprises]. All-Russian Economic Journal, 1, 156–160.

Financial Resources Management (FiRM) (web-resource) Date View September 17, 2017 https://www.monash.edu/vpfinance/our-divisions/firm

Finding Financial Support Resources (web-resource) Date View September 17, 2017 http://www.cancer.net/navigating-cancer-care/financial-considerations/financial-resources

Gorfinkel V.Ya. (2013). Ekonomika predpriyatiya (firmy) [Economics for Companies]. Textbook. Saint-Petersburg: Prospekt, pp. 640.

Isaeva, E. V. (2014). Mekhanizm otsenki finansovoy ustoychivosti predpriyatiya, opirayushchiysya na kontseptsiyu svobodnogo denezhnogo potoka [Mechanism for Assessing Financial Stability for Companies Based on Free Cash Flow Concept]. Financial Business, 2, 42–46.

Khamatkhanova M.A. (2015). Formirovaniye global’noy sistemy finansovykh tsentrov [Formation of Global System of Financial Centers]. Fundamental Research, 12, 859–863.

Khamatkhanova M.A. (2016). Investitsionnoye sotrudnichestvo Rossii i Slovakii v sovremennyh usloviyakh [Investment Cooperation between Russia and Slovakia in Modern Conditions]. Economics & Entrepreneurship, 3 (P. 1), 438–441.

Kokins G. (2007). Upravleniye rezul’tativnost’yu: kak preodolet’ razryv mezhdu ob’yavlennoy strategiyey i real’nymi protsesami [Performance Management: How to Bridge the Gap between the Declared Strategy and Real Processes]. Moscow: Alpina Business Books, pp. 315.

Lytneva N.A. (2014). Sovremennyye podkhody sovershenstvovaniya metodologii mekhanizma upravleniya ustoychivym razvitiyem promyshlennykh predpriyatiy [Modern Approaches to Improving the Methodology of Managing Sustainable Development for Industrial Enterprises]. OrelGiET Scientific Notes, 1 (9), 121–127.

Makhovikova G.A. (2016). Analiz i otsenka riskov v biznese: uchebnik dlya akademicheskogo bakalavriata [Risk Analysis & Assessment in Business: a Textbook for Academic Baccalaureate]. Moscow: URAIT Publishing House, pp. 464.

Pimenov N.А. (2016). Upravleniye finansovymi riskami v sisteme ekonomicheskoy bezopasnosti: uchebnik i praktikum [Managing Financial Risks for Economic Resilience: Theory & Practice]. Moscow: URAIT Publishing House, pp. 413.

Sharinova G.A. (2014). Byudzhet predpriyatiya kak instrument v upravlenii finansami [Company Budget as a Tool in Financial Management]. Economics, Entrepreneurship & Environment (International Journal), 1 (57), 52–54.

1. Tyumen Industrial University, 625000, Russia, Tyumen, Volodarskogo, 38; Email: E-mail: a_ahilgov@mail.ru