Vol. 39 (Number 19) Year 2018 • Page 23

M. ARISTARKHOVA 1; O. ZUEVA 2; M. ZUEVA 3

Received: 01/02/2018 • Approved: 20/02/2018

ABSTRACT: The article proposes quantitative assessment of the tax stability represented by the cover ratio of tax payments; composition ratio of tax debt and paid tax payments; the rate of the tax debt growth. Quantitative assessment of tax stability based on the developed measures system should be carried out in the planned and actual mode with subsequent leveling of the resulting deviations. It is assumed that such work should be carried out on the basis of the developed model of tax stability management. |

RESUMEN: El artículo propone una evaluación cuantitativa de la estabilidad fiscal representada por la relación de cobertura de pagos de impuestos; índice de composición de la deuda tributaria y pagos de impuestos pagados; la tasa de crecimiento de la deuda tributaria. La evaluación cuantitativa de la estabilidad tributaria basada en el sistema de medidas desarrolladas debe llevarse a cabo en el modo planificado y real con la subsiguiente nivelación de las desviaciones resultantes. Se supone que dicho trabajo debe llevarse a cabo sobre la base del modelo desarrollado de gestión de la estabilidad tributaria. |

Today, enterprises and companies see one of all their main tasks in ensuring their own economic development. One of such development sides is financial stability, which in turn determines the tax stability. Negotiations about tax stability are increasingly beginning to sound among the scientific community and practitioners.

The study of tax stability in its various aspects was carried out - E. V. Akchurina, E. V. Chigchurenko; A. N. Tsilichko, V. A. Borodin [3], P. In Malakhov, Savitskaya and others.

As before, there remain in the discussion field - studies related to the peculiarities of its combination with financial stability, the composition of exo and endogenous factors affecting it, the reasons for presenting this category in a temporal aspect, the composition of its determining factors, the possibilities for its quantitative representation and management.

Accordingly, the aim of this article was the development of the tax stability management model. Achieving this aim required the following tasks:

The tasks are solved and set out in the article.

In the scientific plan, it is proposed to introduce the category of "tax stability", allowing to characterize the ability of the enterprise to meet its tax obligations and ensuring its maintenance of the intended rhythm of functioning. The necessity of recognizing the influence of exo and endogenous factors on it, the possibility of representing it in a temporal aspect and quantitatively, is substantiated.

In the methodical plan, an approach to the quantitative assessment of the research category was developed with the use of the proposed measures - the cover ratio of the tax payments; composition ratio of tax debt and paid payments; the rate of the tax debt growth. The created quantitative assessment of tax stability predetermined the possibility of managing it. Tax stability management can be implemented using the following components - planning of tax stability based on historical data; the assessment of the actual state of tax stability; analysis of the causes and perpetrators of the deviations that arise between the planned and actual equation of tax stability; development and implementation of measures to eliminate the deviations that have arisen. Detailed filling and interrelation of the named components are presented in article by a model of tax stability management. The basis of the developed model is simulation modeling, which allows experimenting with various initial data, which cannot be taught by analytical methods.

In practical terms, the use by enterprises of the results obtained in the course of the study will provide the latter with the achievement of a sustainable economic state.

At the current stage of economic development, especially in the context of its instability and variability, issues related to the economic enterprise stability, which predetermine the special significance of such concepts as financial stability and tax burden, acquire particular urgency.

Concerning the essence of financial stability, disputes among scientists and practitioners do not stop. Accordingly, its semantic boundaries are constantly changing. Without dwelling on this scientific polemic, we will single out the essence of this category from the position of G. V. Sovitskaya, who believes that: "The financial enterprise stability is the ability of a business entity to function and develop, to maintain the balance of its assets and liabilities in a changing internal and external environment, guaranteeing its permanent paying capacity and investment attractiveness within the limits of the risk acceptable level". This definition contains an important characteristic of financial sustainability - the ability of the company to respond on their obligations in a timely manner.

An important type of the company's obligations is the tax, which a number of researchers - E. V. Akchurina, E. V. Chipurenko, A. N. Tsilichko, are presented as a tax burden, which represents the specific weight of the company's tax obligations (excluding insurance contributions to state budget funds) in revenue. Therefore, we are rightly noted by V. A. Borodin and P.V. Malakhov in the article "The tax burden as a component of the financial stability of the company, that "... this coefficient needs to be improved, since it does not take into account all aspects of taxation affecting the activities of economic entities". The same authors, albeit not very boldly, make a proposal that financial stability should be supplemented by tax stability and that this measure has certain advantages over the measures of the tax burden, since with its help it is possible not only to control the value of the enterprise's own circulating assets, but also to analyze the mandatory payments to the budget.

Acquaintance with this article has left an insistent desire to understand the essence of tax stability, with the help of which, in the opinion of these authors, it is possible to solve a number of problems.

Acquaintance with this article has left an insistent desire to understand the essence of "tax stability", with the help of which, in the opinion of these authors, it is possible to solve a number of problems. Therefore, we take the liberty to state our own thoughts on this matter.

Taking into account the limited size of this article, without considering the opinions of scientific schools and the proposals of dictionaries (such a study was conducted!) about the essence of tax stability, we will distinguish that this category represents the enterprise's ability to meet its tax obligations, despite influencing on its economic disturbances (external and internal environments), while maintaining the intended mode of operation.

However, the private ability of an company to pay its taxes as a property of tax stability results from the enterprise's general capacity to meet all its obligations.

At the same time, one can also say that financial and tax stability are integral elements of a single mechanism for the enterprise's effective functioning, that is, overall economic stability.

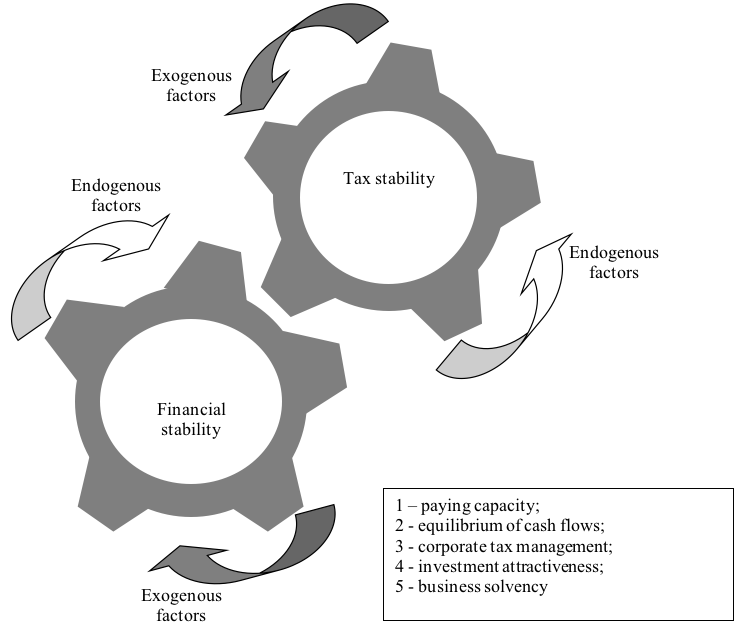

Taking into account the above, it is possible to present a general scheme of interaction between financial and tax stability (Figure 1). Rotating under the influence of endogenous and exogenous factors, the "gear of financial stability" activates the "gear of tax stability", which, in turn, is also influenced by internal and external factors. Clinging to each other "beards" - areas, they force the whole economic stability mechanism of the enterprise to work, which entails the stability and effectiveness of its functioning.

It is important to remember that the tax burden, although it is not an measure that can assess the tax stability, but correlates with it, through inverse dependence, as the higher the tax burden at the enterprise, the more unstable is the tax stability due to the large share of tax payments to revenue, and vice versa, a reduction in the tax burden, as a rule, entails an increase in tax stability.

Fig. 1

The interaction mechanism of financial and tax stability

Changes in the state of tax stability are influenced by external influences (exogenous factors) and from within the company itself (endogenous factors).

The endogenous factors that cause a change in the state of tax stability should be attributed to the taxation regime applied; enterprise's geographical position; development level of tax planning and forecasting in the company; participation in the shadow economy, etc.

Among the exogenous factors it is necessary to include - a change in the level of economic development; change in tax legislation; change in the tax burden, change in the control level by the tax authorities "change in the inflation level.

An enterprise may also be affected by other external and internal factors, depending on its activities and functioning environment, as in the case of internal factors.

It is important to note that the enterprise is affected daily by both positive and negative endogenous and exogenous factors, which seem to balance the existing system, not allowing it to "shrink" and "expand" excessively. However, with uneven exposure, a collapse of the system may occur, entailing the system's inability to return to its equilibrium position.

With a strong impact of negative endo- and exogenous factors and a weak but stable effect of positive factors, a situation arises when the system can exist only along a trajectory lying "near" the equilibrium, that is, the so-called "local stability" situation. The situation, in which the system is able to continue its existence under any trajectory, is called global stability and, as a rule, manifests itself in long periods.

Considering the tax stability as the enterprise's ability to meet its tax obligations, in spite of the economic disturbances affecting it, it is necessary to allocate time intervals, each of which corresponds to specific types of tax stability: operational - from 1 to 40 days; tactical - from 30 days to 1 year; strategic - from 1 year to 3 years.

It is necessary to understand that in addition to factors directly influencing tax stability, there are factors that determine it.

Among these are the viability of the company, its flexibility and adaptability.

Tax stability as an measure of the tax potential of an enterprise needs a quantitative representation, as well as its constant adjustment, taking into account the impact of external and internal factors, the specifics of the implementation of activities.

Tax stability is the enterprise's ability to meet its tax obligations... It is clear that the obligations must be met on time and according to the planned volumes.

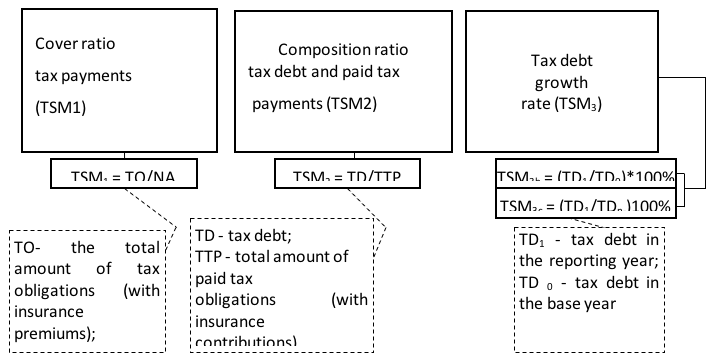

Therefore, this ability must be constantly monitored, which in turn makes it absolutely necessary to present it through the measures system, because tax stability as an economic category is a large set of characteristics and is in a constant relationship - interdependence with the enterprise's financial stability. Accordingly, it is proposed to present the tax stability with the following measures: coverage ratio of tax payments (TSM1); composition ratio of tax debt and paid tax payments (TSM2); the rate of the tax debt growth (TSM3).

The proposed measures on several sides characterize the enterprise's ability to seek funds for paying taxes. The first of them makes it possible to estimate the share of taxes in the enterprise's net assets, that is, with its help, the degree of its encumbrance by tax payments is established.

The next measure reflects the share of debt in the total amount of taxes paid.

The third measure allows you to assess the tax debt in the dynamics.

Selected measure are presented in (Figure 2)

It is assumed that the calculation of these measures should be carried out in the planned and actual mode. At the same time, it is possible for deviations caused by a variety of "causes" to occur. The presence of deviations allows us to characterize the tax stability by the following types: type A, type B, type C, type D.

Type A defines absolute tax stability, that is, all deviations in the valuation measures are positive.

Type B corresponds to a surplus tax stability characterized by a situation where one of the valuation measures deviations is negative, and the remaining deviations are positive.

Figure 2

Tax stability performance measures

Type C - deficit tax stability, that is, two deviations of the valuation measures are negative, the rest are positive.

Type D - critical tax stability: all deviations of measures are negative.

Each identified type of tax stability predetermines the nature and composition of work on the optimal change in its level and the expansion of the company's capacity to meet its tax obligations in a timely and full manner.

Proceeding from the above, we can say that the tax stability by using its own indicators system can be subjected to management, that is, in relation to it, a set of management measures can be applied that allows to eliminate the revealed deviations and thereby bring the system to a state close to ideal.

The tax stability management of an enterprise is an impact on its tax component with the aim to conducting it in a state corresponding to the enterprise's financial position.

Tax stability is a dynamic category associated with the most important financial measures of the company and is represented by a wide range of different factors.

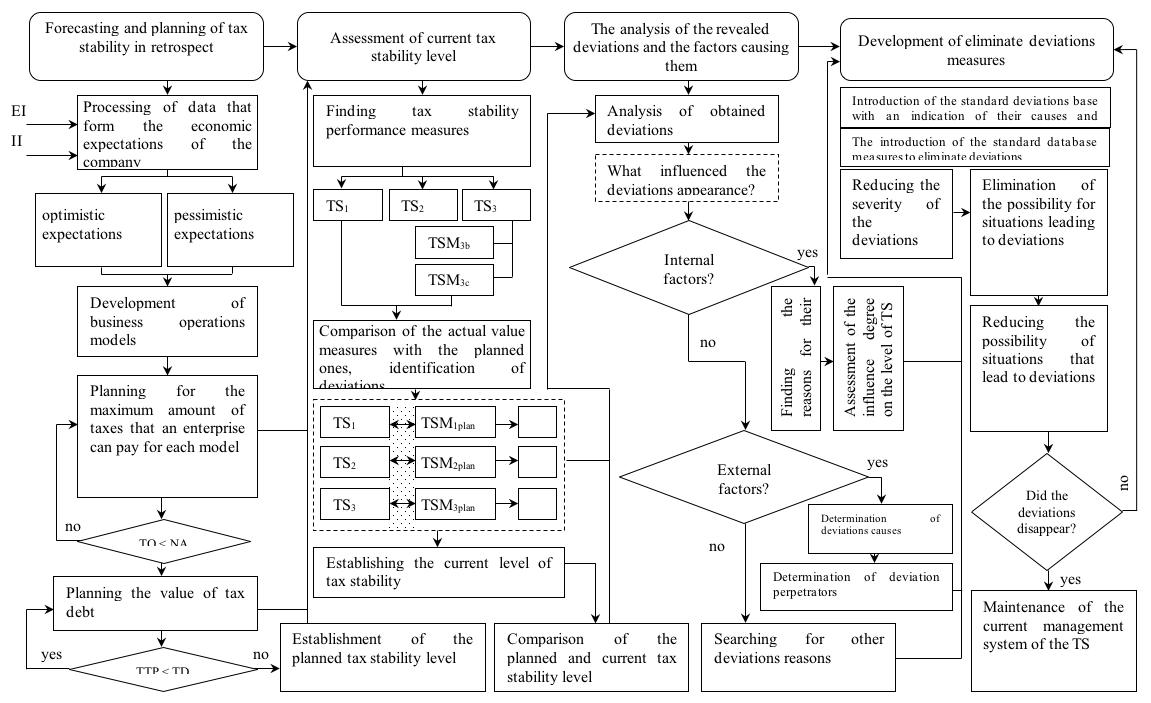

Tax stability can be represented by measures system that make it possible to obtain a comprehensive description of it in the planned and actual sections. Accordingly, there is a need to timely identify the deviations that have arisen and eliminate them. In this regard, there is a need to develop a model of tax stability management, which makes it possible to systematically represent the functioning of each of its structural elements, as well as their joint actions.

The development of such a model required the solution of the following tasks:

The structural stages of the system under consideration are:

This task is of a complex nature, covering all stages of tax stability management. The selected stages are interrelated; almost each of them has a cyclicity. These circumstances make it impossible to separately examine each stage. In this connection, it seems obvious to resort to simulation modeling that allows experimenting with different initial data and obtaining results that are not possible to obtain an analytical solution to the problem.

Due to the fact that tax stability can be measured at intervals of different time duration, the technology of the management system should be guided by the strategic, tactical and operational levels of enterprise management in general.

The developed model reflects the technology of functioning of each system component, it determines the planned and current levels of tax stability, thereby creating prerequisites for the formation of measures to eliminate identified deviations, as well as to prevent and prevent risk situations.

When describing the model, the parameters and notation presented in Table 1 were used. The very same simulation model of management of the enterprise's tax stability is presented on (Figure 4).

Table 1

Parameters and designations used in the description simulation model of tax stability management

Parameters |

Description |

EI |

External information necessary for the formation of economic expectations of the company and the development on their basis of the business operations models |

II |

Internal information necessary for the formation of economic expectations of the company and the development on their basis of the business operations models |

TS |

Tax stability |

TO |

Total amount of tax obligations of the company |

NA |

The value of net assets of the company |

TTP |

Total amount of tax obligations paid by the enterprise |

TD |

The value of the company's tax debt |

TSM1,2,3 |

The actual values of the tax stability performance measures |

TSM1plan, TSM2plan, TSM3plan |

Planned values of the tax stability performance measures |

|

Positive or negative deviations, revealed during the comparison of planned and actual values of the tax stability performance measures |

Planning of the tax stability level should be carried out on the basis of retrospective data - that is, based on information on the level of the enterprise's tax stability for the previous several years, as a rule, five.

Using external information received from outside, from outside the company, and processing it in an appropriate way, the company can generate its own economic expectations regarding the level of tax stability.

Optimistic expectations are justified by the positive effects of endogenous and exogenous factors, strong and proven relationships with partners, favorable political and economic environment, which often entail an increase in the activity and efficiency of the enterprise, and hence, increasing tax stability.

Pessimistic, on the contrary, are typical for situations with a strong negative influence of external and internal factors, a weak and unreliable network of cooperation with contractors, a complex political situation and an economic crisis, which in turn swings the "tax stability pendulum", deflecting it into a deficit.

Working with the model of tax stability, it is important to correctly form economic expectations, because on their basis schemes for the implementation of economic operations are developed. Unreasonable expectations lead to erroneous planning of activities, which directly affects the tax stability of the company.

The developed models of conducting economic operations should be as detailed as possible and not only correspond to the expected economic situation, but also be aimed at achieving tax efficiency of economic activity.

Once the models of operations have been developed, the maximum value of taxes that an enterprise can pay for each model should be planned, based on the establishment of such values of tax obligations that would allow the company to effectively carry out its activities and develop. At the same time, it should be noted that the forecasted value should not exceed the value of the enterprise's net assets; otherwise it should be clarified again and re-planned.

In addition, special attention should be paid to planning the value of tax debt. It should not exceed the amount of tax obligations paid. If such excess exists, it is necessary to return and once again to clarify the value of tax debt.

As a result of the performed operations, the planned level of the enterprise's tax stability is established, which corresponds to the economic expectations of the company, its activities, and also takes into account the results of general economic planning at the enterprise.

The next component of the model is the implementation of the compliance assessment of the actual level of tax stability to the planned level. For this purpose, the planned and actual value of the proposed measures is highlighted.

Figure. 3

Simulation model of tax stability management

The selected measures values are compared with each other and identify deviations that can take both positive and negative values. Such work is rationally carried out in (Table 2) "Analysis of tax stability deviations".

Table 2

Analysis of tax stability deviations

Measure |

Structural components of the measure |

Plan |

Fact |

Δ |

Measures to eliminate deviations (Δ) |

|

|

|

|

|

|

The obtained values of deviations allow us to talk about the current tax stability state and develop solutions to improve it. To this end, the enterprise again, based on historical data, should systematize all deviations of a given nature that took place, highlighting their causes and perpetrators. Based on the experience of the past, the enterprise should stimulate the composition of activities that allowed the elimination of a specific deviation. That is, two bases should be created: the base of typical deviations with the identification of the cause and the perpetrators, and the basis for standard measures to neutralize deviations.

Particularly it should be emphasized that it is advisable to implement measures that reduce the possibility of occurrence of new risk situations, that is, prevention and prevention activities.

Upon completion of all tax stability management activities, all identified deviations should be maximally leveled or eliminated completely.

If deviations are not formed, then the policy of maintaining the current tax stability management system at the formed optimal level should be implemented.

The developed simulation model is a solution to the applied task of creating a technology for the operation of the tax stability management system and reflects the cyclical management of the latter, while at the same time detailing it as much as possible.

The tax component of the any enterprise's activity is its absolutely independent subsystem, which should have an independent management structure and production structure. The essence of the activity of such a subsystem should be the management of the tax flows of the company. Obviously, an economic category should become the object of such management. As such, it is proposed to adopt tax stability, which, as justified in the article, is the ability of the enterprise to respond to its tax obligations, despite the economic disturbances affecting it, while maintaining the intended mode of operation. In the above description, an important point is the enterprise's capacity to meet its obligations. In other words, the correct informing of counterparts about the significance of the tax stability of a particular company gives them an answer to the question of the possibility and expediency of carrying out joint operations with it. Hence, we need an assessment of the significance of tax stability. Based on the opinions of well-known scientific schools on this issue

[E.R. Antysheva [1], P.V. Malakhov, Sobchenko [5], M.E. Tsibareva [6], N.V., G.L. Potapova, etc.] in this study, the possibility of representing the tax stability of measures system is justified, because it is a large set of characteristics and is in constant interrelation and interdependence with the enterprise's financial stability.

As such measures proposed - the cover ratio of tax payments; composition ratio of tax debt and paid tax payments; the rate of growth of tax debt. Models for determining these measures are presented in the article and technologies for their calculation are singled out. But this is only part of the case, because the allocated measures should be subject to management in order to ensure the enterprise's tax stability.

During the study, the composition of the stages of this type of management was established - forecasting and tax stability planning; assessment of the current tax stability level; analysis of the revealed deviations of planned values of measures from actual ones, development of measures to eliminate deviations.

And again, the point to put early because the enterprises taking to the practical application of these materials, must face the need to solve a whole range of tasks that reflect the specifics of their activities. In particular, clarifying the composition of information sources for the measures calculation, developing a standard list of causes of deviations and their culprits, the composition of measures that allow to level deviations.

Undoubtedly, all the ideas worked out will be subsequently finalized by life itself and economists, the horizons for this are open! One thing is obvious, that the use of the results obtained by the enterprises in the course of this study will provide the latter with the achievement of economic stability state.

ANTYSHEVA, E.R. The policy of financial risk management at the enterprise. Siberian Academy of Finance and Banking. Year 2006, number 4, p. 77-78.

ARISTARKHOVA, M.K., ZUEVA, M.S. Assessment of the enterprise's taxation. Bulletin of the Ufa State Aviation Technical University. Year 2014, number 1, p. 167-173.

BORODIN, V.A., MALAKHOV, P.V. The tax burden as a component of the enterprise financial stability. Economic analysis: theory and practice. Year 2009, number 32, p. 10-16.

LAPIN, V.N. On the issue of the tax management system. Bulletin of the Saratov State Social and Economic University. Year 2010, number 4, p. 83-87.

SOBCHENKO, N.V. Comprehensive methodology for assessing the economic stability of enterprises based on innovative activity. Science Journal of Kuban State Agrarian University. Year 2011, number 67, p. 1-9.

TSIBAREVA, M.E. The content of the concept of "economic stability" of the firm. SU Bulletin. Year 2008, number 7, p. 195-202.

1. Department of Tax and Taxation, Ufa State Aviation Technical University Federal State Budgetary Educational Institution of Higher Education, Ufa, Russia. ninufa@mail.ru

2. Department of Tax and Taxation, Ufa State Aviation Technical University Federal State Budgetary Educational Institution of Higher Education, Ufa, Russia

3. Department of Tax and Taxation, Ufa State Aviation Technical University Federal State Budgetary Educational Institution of Higher Education, Ufa, Russia