Vol. 39 (Number 19) Year 2018 • Page 25

KHLYNIN, E.V. 1; SORVINA, O.V. 2; GRYAZEV, M.V. 3; SABININA, A.L. 4

Received: 12/01/2018 • Approved: 15/02/2018

ABSTRACT: The paper provides the results of the research concerned with the complex estimation of in-vestment projects economic efficiency. The authors define the main theoretical bases and methodolog-ical principles that can help build the structural system for investment management at a business enter-prise and elaborate the economic and mathematical model for its implementation. The development of the theoretical-methodological bases for the complex estimation of investment projects economic effi-ciency is achieved by means of proving the hypothesis about the dependence of the investment deci-sion-making not only on investment economic efficiency but also on the economic entity status. The research is based on the basic concepts of the systems theory together with the general scientific methods of analysis and synthesis for qualitative and quantitative description of the complex estimation of investment projects economic efficiency. To implement the complex estimation of investment projects economic efficiency it is suggest-ed that dependence between investment economic efficiency and the economic entity status should be defined. It is recommended that the economic entity status should be described by means of indicators – when put together, they form the corresponding cluster or the hypercube of values where position-ing of the enterprise, defining its real and future position, and building the trajectory of its strategic development are done. The structural system organized on the basis of the defined methodological principles allowed developing its main elements and elaborating the economic and mathematical model for the complex estimation of investment projects economic efficiency. The results of the research on the complex estimation of investment projects economic effi-ciency can substantially contribute to the theoretical and methodological grounds and methodological approaches to the business enterprise investment activity. The practical use of the achieved results can help in making efficient investment decisions that can improve the economic entity status and imple-ment the desired trajectory of strategic development. |

RESUMEN: El documento proporciona los resultados de la investigación relacionada con la estimación compleja de la eficiencia económica de los proyectos de inversión. Los autores definen las principales bases teóricas y los principios metodológicos que pueden ayudar a construir el sistema estructural para la gestión de inversiones en una empresa comercial y elaborar el modelo económico y matemático para su implementación. El desarrollo de las bases teórico-metodológicas para la estimación compleja de la eficiencia económica de los proyectos de inversión se logra al demostrar la hipótesis sobre la dependencia de la toma de decisiones de inversión no solo sobre la eficiencia económica de la inversión sino también sobre la entidad económica estado. La investigación se basa en los conceptos básicos de la teoría de sistemas junto con los métodos científicos generales de análisis y síntesis para la descripción cualitativa y cuantitativa de la estimación compleja de la eficiencia económica de los proyectos de inversión. Para implementar la estimación compleja de la eficiencia económica de los proyectos de inversión, se sugiere que se defina la dependencia entre la eficiencia económica de la inversión y el estado de la entidad económica. Se recomienda que el estado de la entidad económica se describa por medio de indicadores: cuando se combinan, forman el grupo correspondiente o el hipercubo de valores donde se ubica la empresa, definiendo su posición real y futura y construyendo la trayectoria de la empresa. su desarrollo estratégico está hecho. El sistema estructural organizado sobre la base de los principios metodológicos definidos permitió desarrollar sus principales elementos y elaborar el modelo económico y matemático para la estimación compleja de la eficiencia económica de los proyectos de inversión. Los resultados de la investigación sobre la estimación compleja de la eficiencia económica de los proyectos de inversión pueden contribuir sustancialmente a los fundamentos teóricos y metodológicos y los enfoques metodológicos de la actividad de inversión de la empresa comercial. El uso práctico de los resultados logrados puede ayudar a tomar decisiones de inversión eficientes que pueden mejorar el estado de la entidad económica e implementar la trayectoria deseada de desarrollo estratégico. |

The rationalization of approaches and methods while managing the investment projects is one of the most important economic challenges; it is the focus of attention of both scientific community and empirical economists who are in charge of making decisions about investments. It is so because of the need to enhance investment activity, its impact on the economic growth of economic entities and economic advance of the society in general.

Taking into consideration the main stages of investment projects managing, it is necessary to stress the fact that estimation of investment economic efficiency performed by generally-accepted and conventional methods and tools prevent from getting a univocal and clear (and sometimes unambiguous and categorical) result, hence, investment decisions cannot be considered economically rational and relevant. In fact, to estimate economic efficiency of investments, the theory and practice of investment projects management implements methods and tools that are based on the analysis of economic indicator values, among which there are Net Present Value (NPV), Simple Payback Period (PP) and Discounted Payback Period (DPP), Internal Rate of Return (IRR), Average Range Ratio (ARR), Profitability Index (PI), etc. However, having in mind the results of these methods’ implementation, it is necessary to state the obvious that economic indicator values not always lead to making the right investment decision. Simultaneous use of several economic indicators for investment projects efficiency estimation may lead to mixed results [1]. Moreover, commonly known economic criteria for investment project implementation that exit for economic indicators are not valid enough from a theoretical point of view and infeasible from a practical one. A mention should be made that it is not because of the probabilistic mechanism that is the basis for economic indicators calculation and that implies the use of verifiable methods to forecast future money flow, but, in the first instance, because of theoretical-methodological bases for investment projects economic efficiency estimation being poorly developed and ill-defined.

For example, a commonly known economic criterion for investment project implementation is a positive value of NPV. Technically, the criterion is incontrovertible. However, some obvious questions arise:

Giving a negative answer to the first question and a positive one to the second and third, we doubt the existing criterion for NPV.

Another example is the economic efficiency estimation of investment projects on the basis of PP or DPP. For this economic indicator there is no accurate criterion; only recommended values are available. For this reason, the use of economic efficiency estimation of investment projects on the basis of PP or DPP implies some subjectivity when making a decision and requires some empirical experience.

Other methods of investment projects efficiency estimation also have their drawbacks. As a result, some decisions can be taken to implement those investment projects that make no economic sense and to turn down those that might provide the economic growth and development for economic entities.

Realizing the drawbacks of various methods of investment projects economic efficiency estimation, many theoretical and empirical economists engaged into this field of knowledge came up with the results proving economic efficiency of using this or that method; besides they suggested that an integral criterion for investment projects efficiency estimation should be used. This criterion presupposes the grouping of different economic indicators into one on the basis of fundamental principles [2-4].

In our opinion, to get the relevant and objective investment project efficiency estimation it is not enough to be driven only by some minor manipulations. The methodological approach itself that shapes decision-making about investments should be changed as well. Any investments from the point of view of their economic efficiency should be studied not separately and in isolation of an economic entity, but with due regard to its real economic status and prospects for further development, in line with the strategy implemented. The suggested methodological approach provides the complex estimation of investment projects economic efficiency. To introduce this methodological approach, a hypothesis is put forward – investment projects efficiency estimation is influenced not only by self-generated characteristics such as deadlines, investment volume, yearly money flow volume, discounting rate, etc., but also by economic indicators proper to the economic entity which is ready to implement them.

The methodological approach for the complex estimation of investment projects economic efficiency is built on such methodological principles as complexity and integrity, consistency, analyticity, economic efficiency, and innovativeness.

Taking into consideration the main methodological principles of the complex estimation of investment projects economic efficiency, as a matter of priority, some attention should be paid to complexity and integrity. Complexity and integrity of estimation is established through the fact that to define and estimate investment projects economic efficiency it is necessary to consider not only their efficiency from a conventional perspective (a relative excess of return from investment projects as compared to the costs of project implementation), but also the status of economic entity. Many economists emphasize the need for the complex estimation of investment projects economic efficiency. For example, V.A. Drabenko stresses that “the project should not be viewed independently from the business that is implementing it… The project that proved to be efficient for one business might turn out to be inefficient for the other due to a number of objective and subjective reasons.” [5]

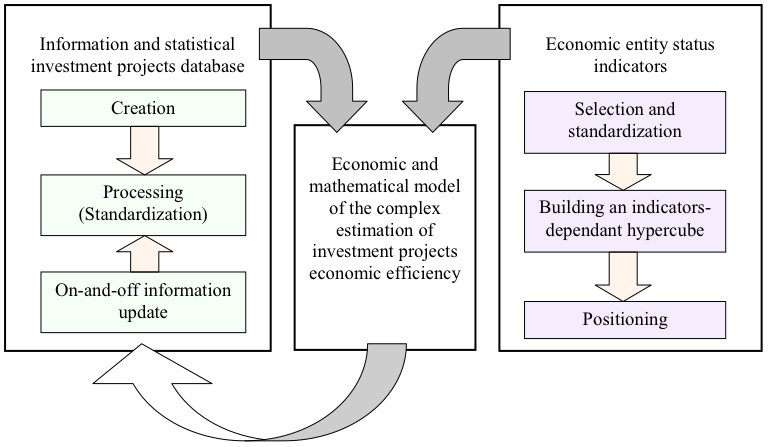

Thus, only a complex estimation of the trends in investment efficiency indicators and the status of economic entity will lead to making decisions about the relevance of investment projects implementation. A complex approach to estimate the investment economic efficiency implies the database creation, processing and on-and-off updating of information and statistical investment projects database, selection and standardization of economic entity status indicators, building an indicators-dependant hypercube and positioning a business enterprise in this hypercube. These actions and steps will allow building an economic and mathematical model of a complex estimation of investment projects economic efficiency. (Fig. 1).

Fig. 1

Structural system of the main elements interaction in complex

estimation of investment projects economic efficiency

The first element of the complex estimation of investment projects economic efficiency is the information and statistical database. The information and statistical database is created by means of gathering information about investment projects, implemented in a business or industry before, such as NPV, PP and DPP, IRR, ARR, PI, etc. The information gathered about investment projects needs to be standardized, because it has a number of dimensions and can influence the economic efficiency of investment. It will result in unification of diversified information about investment project economic efficiency. On-and-off information update in the information and statistical database provides a dynamic record of changes that occur in the business enterprise or in the external environment.

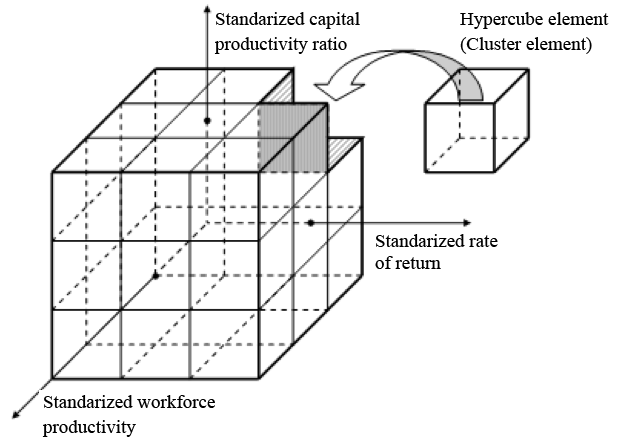

The economic entity status indicators serve as the second element of the complex estimation of investment projects economic efficiency. This element comprises the selection of economic entity status indicators and their standardization. The number and composition of enterprise economic status indicators must be defined, on the one hand, by the coverage of economic entity performance features and, on the other hand, by the practical relevance of the developed model of the complex estimation of investment projects economic efficiency. We recommend using two or three economic entity status indicators such as, for example, rate of return, workforce productivity, capital productivity ratio, financial strength, paying capacity, etc. It should be emphasized that it is relevant to select the most significant indicators that can help estimate the degree of business corporate strategy implementation. To describe all possible positions of the enterprise in the space of the chosen economic entity status indicators, a hypercube of indicators values is built (fig.2). The positioning of the enterprise in the hypercube of values for economic entity status indicators provides the opportunity to define its real and future positions in the space of chosen indicators.

Fig. 2

Hypercube (cluster) of standardized values for

three indicators of the economic entity status

The interaction of two abovementioned elements of the complex estimation of investment projects economic efficiency helps define those investment project characteristics that should be taken into consideration when making an advantageous managerial decision about investment project implementation, and in particular, the values of real economic entity status indicators. Having this in mind, the estimation of investment projects economic efficiency should be considered a complex one.

To make managerial decisions about economic relevance of investment projects implementation on the basis of a set up correspondence between the values of investment efficiency indicators and economic entity status indicators, it is necessary to organize all the information in a form of the structural system that comprises three interdependent elements (fig.1). Information about investment management organized in such a way presupposes the use of complexity and integrity principle, which is one of the main methodological principles in the complex estimation of investment projects economic efficiency.

The structural properties of the system provide the systematic understanding for the separate elements of the complex estimation of economic entity efficiency. For instance, the indicators containing information about the economic entity status as an element of the system must be presented in the form of a cluster which is a kind of the system (fig.2). Such a cluster has a definite number of dimensions that depends on the number of economic entity status indicators. The business enterprise defining the composition of its economic status indicators when implementing complex estimation of investment projects economic efficiency creates and forms its own specific cluster. In cluster analysis, the structural system describing the corresponding cluster of economic entity status indicators which is formed to implement the complex estimation of investment projects economic efficiency is an n-dimensional hypercube [6].

As any system, the cluster of economic entity status indicators has a definite structure that consists of a corresponding number of cluster elements (hypercube elements). The number of cluster elements depends on the number of dimensions of a shaped cluster of economic entity status indicators and a number of defined ranges of values. It is advisable that attention should be paid to the fact that cluster elements are interrelated. These interrelations are defined by the existing trajectories of strategic development that provide the grounds for reaching economic entity status described by the shaped cluster.

Thus, the cluster of economic entity status indicators presented in the form of the system of cluster elements describes many feasible economic entity statuses in the context of those indicators of financial and operating performance that provide the grounds for building and forming the cluster in question. Every moment of time the economic entity status matches the definite cluster element. The implementation of a managerial decision to make these or those investments leads to the change in the enterprise economic status against the indicators of financial and operating performance and results in the cluster element change. The essence of the complex estimation of investment projects economic efficiency lies in the implementation of those investment projects which help introduce the necessary trajectory of strategic development capable to describe the dynamics of the enterprise economic status. Investment projects that cannot support the introduction of the necessary trajectory of strategic development should be turned down. That is why the cluster of economic entity status indicators should be viewed as a dynamic system, with its pace of development depending on investment decisions made earlier.

It is necessary to pay attention to the fact that the implementation of on-and-off information update in the statistical investment projects database caused by changes in the external environment provides the opportunity, firstly, to view the system as a structure and, secondly, to have a feedback mechanism within the system.

Any cluster formed by economic entity status indicators has analytic properties. This fact is proved by analyticity of economic entity status indicators themselves. When proving that the analyticity principle is observed in theoretical-methodological description of the complex estimation of investment projects economic efficiency, it should be mentioned that the enterprise status is defined by a numeric value of economic entity status indicators.

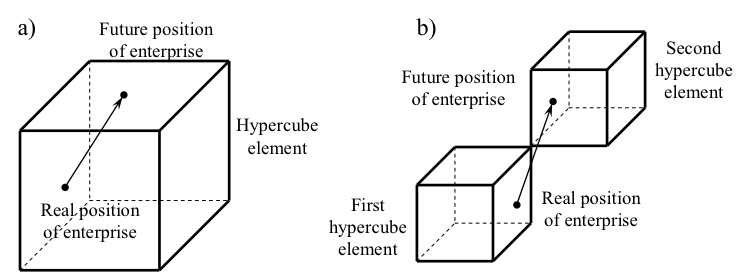

The presence of analytical relationships in economic entity status indicators lets us define the real and future enterprise position in a formed cluster, i.e. perform its positioning (fig. 3).

Positioning of the enterprise by means of defining its real and future position in the space of the hypercube of standardized values of economic entity status indicators leads us to defining the trajectory of its strategic development. In the first option (fig. 3a) the trajectory of enterprise strategic development is entirely situated in one element of the hypercube of standardized values. Accordingly, to make a decision about economic efficiency of the investment, it is necessary to use the economic-mathematical model corresponding with this element of the hypercube. In the second option (fig. 3b) the trajectory of the enterprise strategic development starts at one element of the hypercube and ends at the other one. Hence, the estimation of investment economic efficiency should be done on the basis of the economic-mathematical model built for that element of the hypercube which corresponds with the future position of the economic entity.

Fig. 3

Options for enterprise positioning in the hypercube of

standardized values of economic entity status indicators

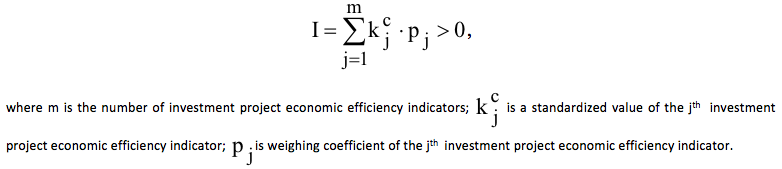

Thereby, the analyticity of the complex estimation of investment projects economic efficiency is defined not only by numerical values of economic entity status indicators, but also by the interconnections of the cluster of economic entity status indicators and investment efficiency indicators. It should be noted that there is a stochastic dependence between these groups of indicators, and it lets us build the economic and mathematical model of the complex estimation of investment projects economic efficiency, that is:

The complex estimation of investment projects economic efficiency presupposes the implementation of the economic efficiency principle in the theoretical-methodological bases for investment management.

The proof of reaching the efficient results in the complex estimation of investments is the structure of the economic and mathematical model. The structure of the economic and mathematical model is formed by different indicators of investment economic efficiency, which are joined together by means of weighing coefficients. In accordance with the assumption that all the indicators included into the structure of the economic and mathematical model can highlight various aspects of investment projects economic efficiency, it should be concluded that the result achieved by using the model is an efficient one.

It should be stressed that the economic efficiency principle can be applied to the economic and mathematical model because its structure depends on real values of economic entity status indicators. In case of small-scale changes in the economic entity status that are within the borders of the cluster element under analysis the structure of the economic and mathematical model does not change and allows investment projects efficiency estimating. On the contrary, to adequately estimate investment economic efficiency when some substantial changes in the economic entity status going beyond the borders of the cluster element take place the structure of economic and mathematical model should be reconsidered. Under these conditions the new and reconsidered number of indicators of the economic and mathematical model leads to investment projects efficiency estimating.

Consequently, the adequate estimation of investment projects economic efficiency is performed by the corresponding modifications of the economic and mathematical model structure applied in case of the change in the economic entity status.

Among methodological principles applicable for the complex estimation of investment projects economic efficiency there is the principle of innovative development, which should also be mentioned. The innovativeness of the complex estimation of investment projects economic efficiency is formed as a result of on-and-off update of the economic and mathematical model that is based on the detailed and updated weighing coefficients values or the change in the model structure.

On-and-off update of the economic and mathematical model used for the complex estimation of investment projects economic efficiency provides its adjustment to the constantly changing external environment. From the systematic approach perspective, this fact lets us view the economic and mathematical model as a system open for external interferences. Besides, on-and-off update of the economic and mathematical model applied for the complex estimation of investment projects economic efficiency is done as a result of getting the detailed and updated indicators of the corresponding investment projects that are being implemented. Such an update of the economic and mathematical model should be viewed as a self-developing system or a feedback system.

Thus, the ability of the economic and mathematical model to register external interferences together with a component of self-development provide the application of the innovativeness principle when implementing the complex estimation of investment projects economic efficiency.

The implementation of the abovementioned theoretical-methodological bases make it possible for one or several economic and mathematical models of the complex estimation of investment projects economic efficiency to be build, with each of them being in line with the real values of economic entity status indicators or the values that the business enterprise is only going to reach. The investment project is put into life if the condition of the economic and mathematical model is observed; otherwise the investment project is turned down. All completed investment projects depending on the economic and mathematical model applied can more or less influence the intensity of improvement in economic entity status indicators.

As a result of theoretical-methodological studies concerning the implementation of the complex estimation of investment projects economic efficiency the following conclusions can be drawn:

Khlynin E.V., Khoroshilova E.I. Modern approaches to an estimation of efficiency of investment investments in a fixed capital // Basic researches. 2011. № 8-1. P. 239-243.

Brealey R., Mayers S. Principles of corporate finance. Trans. from Engl. М.: JSC «Olympus-Business», 1997. 1120 p.

Stoyanov E.S. Financial management: the theory and practice: the Textbook / Under ed. E.S. Stoyanovoj. 5 ed., adv. and add. M.: PH «Perspectiva», 2006. 656 p.

Byrman G. Capital investments. The economic analysis of investment projects: the Textbook for high schools. Trans. from Engl. under ed. L.P. Belych. M.: Unity, 2003. 631 p.

Drabenko V.A. Method of an estimation of innovative projects in development of business // Problems of modern economy. 2009. № 1.

Mandel I.D. The analysis of cluster. M.: Finance and statistics, 1988. 176 p.

Sorvina O.V. Strategic the approach as a basic element of methodology of strategic management of industrial expenses of the enterprise // News of the Tula State University. Economic and jurisprudence. 2014. № 3-1. P. 179-188.

Khlynin E.V., Koroleva K.E. Definition of economic principles of formation of the concept of an integrated estimation of efficiency of investment investments in a fixed capital of the enterprise // News of the Tula State University. Economic and jurisprudence. 2013. № 1-1. P. 209-226.

Tinkova E.V., Tinkov S.A. Economic an estimation of investments and innovations in the industry: the Textbook. Kursk: Business polygraphy. 2016.215 p.

Daskovskij V.B., Kiselev V.B. Perfection of an estimation of efficiency of investments // the Economist. 2009. № 1. P. 43-56.

Daskovskij V.B., Kiselev V.B. Once again about discrepancy of estimations of efficiency of investments // the Economist. 2010. № 7. P. 79-92.

Balynin I.V. Estimation of productivity of investment projects: rules, parameters and the order of their calculation // the Economic analysis: the theory and practice. 2016. № 6. P. 26-41.

Sazonov S.P., Penkov P.E., Mamedov F.N. Estimation of economic efficiency of investment projects // Business. Education. Right. The bulletin of the Volgograd institute of business. 2014. № 4. P. 24-27.

Komarova N.S. Complex the approach to an estimation and forecasting of efficiency of investment projects of the industrial enterprises // the Bulletin of Irkutsk State technical University. 2013. № 10. P. 308-312.

Varfolomeev V.P., Kondratov S.V. Management the company on key parameters of efficiency // the Economic analysis: the theory and practice. 2016. № 8. P. 134-146.

Vilenskij P.L., Livshits V.N. About typical errors at an estimation of efficiency of investment projects // Economy and mathematical methods. 2014. № 1. P. 3-23.

Damodaran A. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. Wiley Finance. 2012. 992 p.

Morellec E., Schürhoff N. Corporate Investment and Financing under Asymmetric Information. Original Research Article // Journal of Financial Economics. 2011. Vol. 99. Iss. 2. Р. 262–288.

Gordon L.A., Iyengar R.J. Return on Investment and Corporate Capital Expenditures: Empirical Evidence // Journal of Accounting and Public Policy. 1996. № 15. Р. 305–325.

Décamps J.-P., Mariotti T., Villeneuve S. Investment Timing under Incomplete Information. Mathematics of Operations Research. 2005. Vol. 30, No. 2. 500 р.

Gilchrist S., Williams J.C. Investment, Capacity and Uncertainty: A Putty-Clay Approach. National Bureau of Economic Research. 2004. 36 р.

1. Doctor of economics, professor of chair, Tula State University

2. Doctor of Economics, Professor of Chair, Tula State University

3. Doctor of Technical Science, Professor of Chair, Rector, Tula State University

4. Doctor of Economics, Associate Professor, Chair, Tula State University