Vol. 39 (Number 19) Year 2018 • Page 26

Fedor Ya. LEGOTIN 1; Ainura A. KOCHERBAEVA 2; Viktor E. SAVIN 3

Received: 27/01/2018 • Approved: 20/02/2018

ABSTRACT: The article considers the prospects for using blockchain technology as a source of financial innovation. The theoretical interpretation of the process of cryptocurrencies occurrence in the context of definitions of electronic funds and virtual payment services is carried out. Cryptocurrencies show impressive dynamics of growth, but this is due to the rapidly growing public interest, which provokes demand in the market and limits supply. The study clarifies the growth factors of the cryptocurrency, gives an assessment of the prospects and forecasts various scenarios for the cryptocurrency system development. In the course of the correlation-regression analysis of the Bitcoin price dynamics, it is determined that the observations approximations best correspond to the polynomial model of the third degree and the exponential model. For both of them, the determination coefficient is close to the boundaries of the confidence interval. Based on the analysis of the Bitcoin market price dynamics, it is concluded that the demand for cryptocurrency has been formed not by its intrinsic value, but by market expectations, as well as by the level of interest and involvement of participants in this virtual network (via network effect). Based on the example of the financial market, it is shown that the possibilities of blockchain technology are versatile. The prospects for its development are determined by the needs of decentralization in order to improve the sustainability and security of business processes. |

RESUMEN: El artículo considera las perspectivas de utilizar la tecnología blockchain como fuente de innovación financiera. Se lleva a cabo la interpretación teórica del proceso de ocurrencia de criptomonedas en el contexto de las definiciones de fondos electrónicos y servicios de pago virtual. Las criptomonedas muestran una impresionante dinámica de crecimiento, pero esto se debe al rápido crecimiento del interés público, lo que provoca una demanda en el mercado y limita el suministro. El estudio aclara los factores de crecimiento de la criptomoneda, da una evaluación de las perspectivas y pronostica varios escenarios para el desarrollo del sistema de criptomonedas. En el curso del análisis de correlación-regresión de la dinámica de precios de Bitcoin, se determina que las aproximaciones de las observaciones se corresponden mejor con el modelo polinomial de tercer grado y el modelo exponencial. Para ambos, el coeficiente de determinación está cerca de los límites del intervalo de confianza. Con base en el análisis de la dinámica de precios del mercado de Bitcoin, se concluye que la demanda de criptomoneda no se formó por su valor intrínseco, sino por las expectativas del mercado, así como por el nivel de interés y participación de los participantes en esta red virtual ( a través del efecto de red). Basado en el ejemplo del mercado financiero, se muestra que las posibilidades de la tecnología blockchain son versátiles. Las perspectivas de su desarrollo están determinadas por las necesidades de la descentralización para mejorar la sostenibilidad y la seguridad de los procesos comerciales. |

The global economy of the free and open market is experiencing a period of irreversible transformation. There is a completely new type of economic and social relations. All this is characterized by the production of knowledge, integration of technology and development of information non-centric networks. Financial markets problems associated with excessive centralization make it necessary to transform the existing system of international banking cooperation and financial flows logistics.

An alternative of the solution was blockchain technology. It is a distributed database, which is formed as a continuously growing chain of blocks with transactions records. The electronic imprint of these transactions became the foundation for cryptocurrency development. The most well-known and common example of a decentralized blockchain network is Bitcoin. Bitcoin cryptocurrency has gained extraordinary popularity in the last two years due to a number of reasons. One of the most important factors was the mistrust of market participants in the world financial system (Belomyttseva, 2014).

We will try to analyze the prospects and risks of the cryptocurrency development in the financial markets and assess the possibilities of using blockchain technology in other areas of activity.

Bitcoin is a currency, a digital unit of value that people use to exchange goods, services, or exchange for other currencies, the exchange rate of which tends to fluctuate significantly compared to traditional fiduciary (fiat) money. The key differences between bitcoin and fiat money are decentralization; unaffected inflation; anonymity (to a certain extent); transparency; impossibility to cancel transactions. Derivative cryptocurrencies usually differ from each other by the cryptographic algorithm, which is the basis of the emission.

Electronic money is usually understood as the value in monetary terms, which is stored on an electronic medium, issued by the issuer when receiving money from other persons in an amount not less than the emitted money value, and is accepted as a means of payment by persons other than the issuer. The common between Bitcoin and electronic money is their information nature and digital format.

Virtual currency is also different from electronic money, which acts as a surrogate of payment means. In formal terms, it appears as: a means of exchange; an estimated monetary unit; a means of value storage, but it does not have payment properties in any jurisdiction. This definition differs from that proposed by the ECB, which defined virtual currency as a type of unregulated digital money. It is issued and controlled by its developers, and is used and accepted by members of a particular virtual community (European Central Bank, 2012). Later, the use of the term "money" in relation to virtual currencies was found to be incorrect. Virtual currency is already defined as "a digital image of value which is not issued by a central bank, credit institution or electronic money institution, and which, in some circumstances, can be used as an alternative to money" (European Central Bank, 2015). The most general definition is provided in the FATF report, which states that virtual currency is a means for expressing value which can be traded in a digital form and which functions as (1) a means of exchange; and/or (2) a monetary unit of account; and/or (3) a means of value storage, but does not have the status of a legal tender (FATF/OECD, 2014). In case of cryptocurrency, the formalization of money in various forms, as a participant in the exchange, reaches the highest point of abstraction (Kosogayev, 2015). The combination of blockchain technologies and cryptocurrency provides the transfer of information that does not need centralized administration.

The advantage of blockchain technology is its openness and reliability. The distributed nature of the database makes it resistant to hacker attacks and tampering attempts. Information in the database is very difficult to change, delete or fake. However, all the data can be easily checked and tracked. The technology allows seeing the entire chain of any asset transactions, which minimizes the risks of fraud or errors in accounting and auditing. Further, blockchain-based solutions spread to other components of the financial market. The use of this technology will increase financial inclusiveness at low maintenance costs.

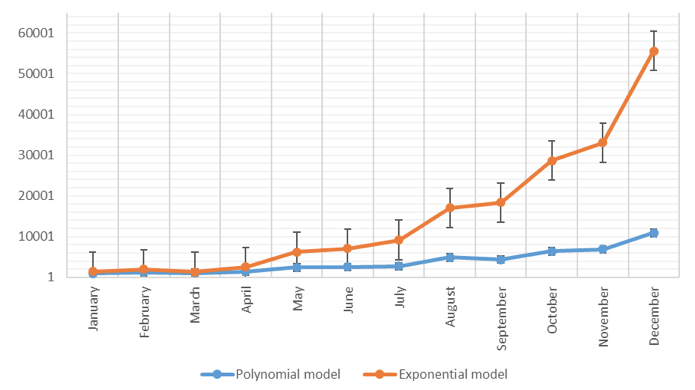

Processes with trends or with variable dispersion are typical for the unstable rapidly growing concept of cryptocurrencies. One of the problems in determining the model structure is the establishment of nonlinearities in the process under investigation and their type. The dynamics of cryptocurrency is a nonlinear phenomenon. There are various ways to set the prediction problem, but in any case it affects the following components of the process: the deterministic trend, the random trend, short-term changes, seasonal effects, the rate of the process change, dispersion or standard deviation as a measure of process dispersion. According to the process components that need to be predicted, the problem of mathematical model development is posed.

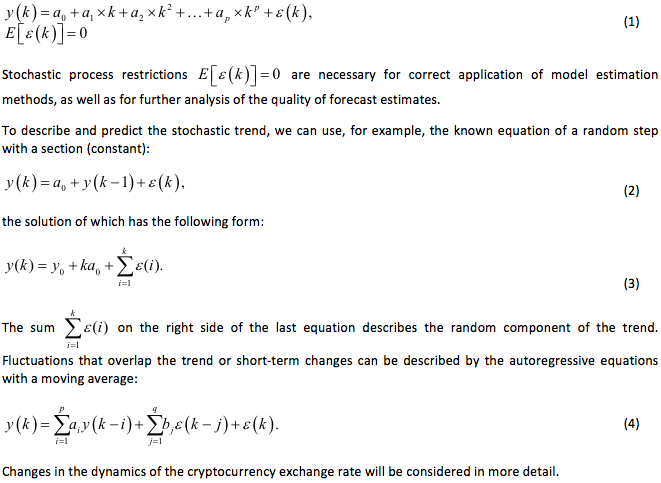

Let us consider some possibilities to create a mathematical description of compound processes of different nature. If we describe a deterministic trend with a polynomial from time of arbitrary order, then the trend forecast determination is reduced to substituting the desired time value k in this equation and applying unconditional mathematical expectation:

Cryptocurrencies based on blockchain technology have already become a significant element in the modern financial market and a significant investment object. At present, we can observe an increase in the diversity of cryptocurrencies represented in the information environment (Figure 1).

Fig. 1

Structure of the cryptocurrency by the size of capitalization for 2015-2017

Bitcoin is still the leading currency, which determines the trend not only for the use of cryptocurrency, but also for the whole spectrum of the blockchain technology development. Certainly, it makes sense that most of the new cryptocurrency will develop on the basis of Bitcoin and as its derivation. At the same time, there is a tendency when the number of transactions increases in the currency that allows quick withdrawal of funds (Table 1). Here is a constant conjugation with the increasing use of cryptocurrency.

Table 1

Daily number of transactions with cryptocurrencies

Period |

Bitcoin |

Etherium |

DASH |

Monero |

Litecoin |

08.2016 |

201,595 |

20,242 |

1,582 |

579 |

4,453 |

12.2016 |

221,018 |

40,895 |

1,184 |

435 |

5,520 |

05.2017 |

219,624 |

45,109 |

1,549 |

1,045 |

3,432 |

08.2017 |

261,710 |

42,908 |

1,238 |

1,598 |

3,455 |

12.2017 |

286,419 |

47,792 |

1,800 |

2,611 |

3,244 |

Dynamics shows that the concentration of the volume of a particular cryptocurrency is not much different from the concentration of other resources in the society.

It should be noted that all cryptocurrencies are based on the starting value of Bitcoin. Therefore, it is Bitcoin that determines events in the market of cryptocurrencies. Let us analyze and build models for describing Bitcoin indicators. Table 2 shows the dynamics of changes in the exchange rate of Bitcoin in 2017.

Table 2

Changes in the exchange rate of Bitcoin cryptocurrency for 2017

Month |

BTC/USD |

Absolute deviation |

Growth rate, % |

January |

982.43 |

|

|

February |

1,222.66 |

240.23 |

124.453 |

March |

1,086.12 |

-136.54 |

88.8325 |

April |

1,415.81 |

329.69 |

130.355 |

May |

2,492.60 |

1,076.79 |

176.055 |

June |

2,520.61 |

28.01 |

101.124 |

July |

2,703.38 |

182.77 |

107.251 |

August |

4,866.51 |

2,163.13 |

180.016 |

September |

4,371.54 |

-494.97 |

89.8291 |

October |

6,372.40 |

2,000.86 |

145.77 |

November |

6,891.34 |

518.94 |

108.144 |

December |

10,911.04 |

4,020.08 |

158.335 |

Table 2 allows determining that the largest growth rates of cryptocurrency currency in 2017 were in August and December, the growth rate compared to the previous months was 73% and 50%, respectively. The most "unprofitable" was September, during which the cryptocurrency value decreased by 494.97 dollars.

One of the most common methods for predicting the dynamics of market indicators is the trend model. The Microsoft Excel package allows automating the development of trend models and their analysis. To assess the model adequacy, the determination coefficient can be used (referred to as R2). To select the best trend model, several different options should be calculated. For the Bitcoin exchange rate in 2017, 6 different models were developed and their determination coefficients were calculated (Table 3).

Table 3

Determination coefficients of Bitcoin trend models for 2017

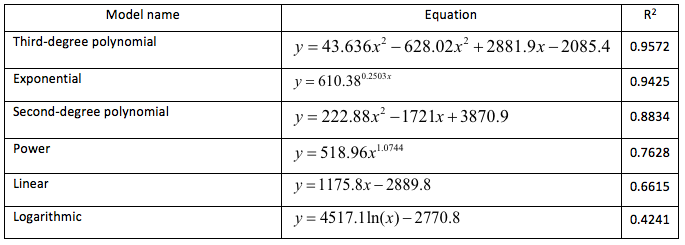

Table 3 shows that the third-degree polynomial model and the exponential model best correspond to observations. For both of them, the determination coefficient is close to the boundaries of the confidence interval (0.95); in statistics, it is considered as an indicator of good correspondence between the actual data and the calculated data. Figure 2 shows the dynamics of the Bitcoin exchange rate and the trend lines, which correspond to the third-degree polynomial model and the exponential model.

Fig. 2

Schedule of the BTC/USD rate and trend models of its approximation

As you can see, both models confidently predict the growth of Bitcoin's value in the future. At the same time, it is possible that the value of Bitcoin will decrease and the level of availability of other currencies will increase. Cryptocurrencies have recently demonstrated impressive growth dynamics, but this is due to the rapidly growing public interest in cryptocurrencies, which provokes demand in the market, while limiting the supply. The peak of excessive demand has probably already been achieved or will be achieved at the nearest moment. Next, we should expect the stabilization of the dynamics. Therefore, after the inevitable decrease in the exchange rate, their volatility, perhaps, will fall.

Drawing parallels between the direction of the market price chart and various publications about Bitcoin in the media allows concluding that the demand for cryptocurrency is subject to strong fluctuations and is largely due to the market's expectation of further value (Uperyaka, 2014). Exchange rate determination depends only on the network effect, and the ratio of supply and demand, while the limitation of the emissions volume will result in the deflation of the currency value in the presence of the network effect (Trubnikova, 2014).

In case of transactions with cryptocurrency, their number will increase. According to various estimates, no more than 2.5% of the total number of transactions is accounted for the transactions with blockchain. Currently, there is a tendency of increasing the share of non-cash payments (Genkin, 2013). This is primarily due to the fact that cryptocurrencies often rely on small payments, which will be much cheaper due to distributed processing. Hence, it can be concluded that the change in the number of transactions will be affected by the transfer commission factor.

The use of blockchain opens up new areas for the application of this technology. These include, first of all, trading platforms, corporate governance systems, property rights databases, networks and payment systems for retail e-commerce, public procurement systems, budget management and fiscal functions implementation, traditional or parametric insurance. Undoubtedly, blockchain technologies are used primarily in standardized trade. Trading stocks or other financial instruments determines the trend in this direction. The use of blockchain technology is not limited to the transactional business of financial institutions, that is, payments, settlements and related services (Sherman, 2015). This crypto technology can be used in many business processes. It is possible to create corporate distributed databases using blockchain, which will take into account the needs of each individual company and organize interaction between all participants providing necessary level of security and confidentiality (Motkova, 2016).

The risks of application of blockchain technology should be considered separately. A lot of studies deal with this problem. The article of Popova, & Bandurko (2017) considers the problem of the influence of credit, market, operational and financial risks on the processes occurring in the crypto economy. Glotov, & Mikhailov (2017) focus on the aspects of information security associated with blockchain technology, and information risks. In the context of our study, we identify the following main risks:

1. Technological. Technological risks include: the absence of a single emission center or verification center, which could determine the correctness or adaptability of the transaction; cryptocurrency reception is frequently impossible in a number of means of payment and companies, as the equipment for reception of cryptocurrency should support cumulative updating and all transactions should be personalized; with the increase in the number of cryptocurrencies and their forks, the number of transactions and the processing time are proportionally increasing; the risk of dependence on the online environment, in the absence of access to the network, cash flow is impossible.

2. Legislative. This includes mainly the imperfection and undeveloped common position regarding the application of blockchain technology and, accordingly, the regulation of cryptocurrencies.

3. Organizational. This group of risks includes transaction completion issues: each transaction must remain in a single system of calculation, so the standards of the blockchain must be open; thus, all transactions must be available, which violates the secrecy of transactions. Financial institutions are not ready to work in unified competitive conditions. The disclosure of information about the customers and account activity creates a significant challenge to business sustainability.

In general, the advantages of blockchain technology include (Vorontsova, & Meleshenko, 2016): cheaper financial transactions, the absence of intermediaries, registration and authentication of documents, user identification and information storage; provision of intellectual property protection, anonymity of transactions, security and accessibility; reduction of costs for maintaining various registries, management of enterprises, conclusion and execution of contracts. Increasing interest in blockchain is observed not only among corporate market participants, but also among individuals who also try to use technology to create the final product (Korchagin, 2016).

The widespread introduction of technological innovations will contribute to their minimization and creation of new financial products. The application of technological innovations in the financial sector will create prerequisites for unshadowing based on blockchain technology. This will increase inclusiveness, transparency of financial flows and reduce the costs for participants in contractual relations. It becomes obvious that the possibilities of blockchain technology are very versatile. The new and prospective fields of application include, first of all, trading platforms, corporate governance systems, property rights databases, networks and payment systems for retail e-commerce, public procurement systems, budget management and fiscal functions implementation, traditional or parametric insurance, etc. One of the inevitable consequences of blockchain introduction in manufacturing technologies of industrial companies and financial institutions should be considered the reduction of information transfer costs and, as a consequence, systemic risks in operating activities.

Cryptocurrencies have recently demonstrated impressive growth dynamics, but this is due to the rapidly growing public interest in cryptocurrencies, which provokes demand in the market, while limiting the supply. The peak of excessive demand has probably already been achieved or will be achieved at the nearest moment. Next, we should expect the stabilization of the dynamics. Therefore, after the inevitable decrease in the exchange rate, their volatility, perhaps, will fall. Drawing parallels between the direction of the market price chart and various publications about Bitcoin in the media allows concluding that the demand for cryptocurrency is subject to strong fluctuations and is largely due to the market's expectation of further value. Based on the analysis of the Bitcoin market price dynamics, it can be concluded that the demand for cryptocurrency has not been formed by its intrinsic value, but by market expectations, as well as by the level of interest and involvement of participants in this virtual network.

Belomyttseva, O.S. (2014). On the Concept of Bitcoin Cryptocurrency within the Context of Financial Regulators and Private Electronic Currency. Problems of Accounting and Finance, 2(14), 26-29.

European Central Bank. (2012). Virtual Currency Schemes. Frankfurt am Main: ECB. (p. 54).

European Central Bank. (2015). Virtual Currency Schemes – a Further Analysis. (2015). Frankfurt am Main: ECB. (p. 37).

FATF/OECD. (2014). Virtual Currencies: Key Definitions and Potential Risks in the Field of Anti-Money Laundering. (p. 28). Retrieved March 22, 2018, from http://www.eurasiangroup.org/files/FATF_docs/Virtualnye_valyuty_FATF_2014.pdf

Genkin, A.S. (2013). Cash Substitution: Global Trend and Its Manifestation in Domestic Practice. Financial Journal, 3, 109-116.

Glotov, V.I., & Mikhaylov, D.M. (2017). Minimization of Risks in the Credit and Financial Area (Blockchain). Economics. Taxes. Law, 10(6), 16-23.

Korchagin, S. (2016). On the Current Trends in the Development of Blockchain Technology. Svobodnaya mysl, 4(1658), 31-38.

Kosogayev, P.A. (2015). Cryptocurrency as an Economic Institution. Journal of the Tver State University. Series: Economics and Management, 3, 164-169.

Motkova, M. A. (2016). The Use of Information Technology in the Banking Services for Corporate Clients. Journal of Rostov State Economic University (RINH), 3(55), 164-169.

Popova, E.M., & Bandurko, S.A. (2017). Analysis of Financial Risks in Crypto-Economics Taking into Account Information Influence. Journal of Saint Petersburg State Economic University, 6(108), 36-40.

Sherman, A.A. (2015). Block Chain Can Store Not Only Transactions. Retrieved March 22, 2018, from http://futurebanking.ru/post/2933

Trubnikova, E.I. (2014). Cryptocurrency Phenomenon: Characteristics, Background, Institutional Analysis of the Market. Infocommunication Technologies, 12(3), 90-94.

Uperyaka, M. (2014). Bitcoin. Present and Future of Cryptocurrency. Topical Issues of the Innovation Economy, 7, 173-178.

Vorontsova, E.A., & Meleshenko, E.G. (2016). Blockchain: Panacea or Threat for Storing and Transmitting Information. Synergy of Sciences, 5, 93-101.

1. Dr.Sci. (Economics), Professor, Department of Corporate Economics, Ural State University of Economics (62, 8-Marta Str., Ekaterinburg, 620144, Russian Federation). E-mail: caercauthor@yahoo.com

2. Dr. Sci. (Economics), Professor, Kyrgyz-Russian Slavic University named after B.N. Yeltsin (44, Kiyevskaya Str., Bishkek, 720000, Kyrgyzstan). E-mail: ainura_koch@mail.ru

3. Dr. Sci. (Economics), Professor, Kyrgyz-Russian Slavic University named after B.N. Yeltsin (44, Kiyevskaya Str., Bishkek, 720000, Kyrgyzstan). E-mail: bgusavin@mail.ru