Vol. 39 (Number 19) Year 2018 • Page 33

Galina Alekseevna BUNICH 1; Yuriy Aleksandrovich ROVENSKIY 2; Leonid Pavlovich DASHKOV 3

Received: 05/03/2018 • Approved: 18/03/2018

ABSTRACT: Factoring is one of the oldest forms of lending. Factoring development was encouraged by the development of international trade and transformed in accordance with the specifics of socioeconomic formations. The development of international trade and processes of globalization of the financial and economic sector led to the factoring development in line with new requirements. Factoring began to develop particularly actively in the Russian Federation after the sanctions were announced by the countries of the European Union and the USA. Encouraging the circulation process and the efficiency of using the working capital, factoring undergoes significant changes during the development of infrastructure, tools and the formation of new client segments. Based on the modern trends in the development of factoring in the Russian Federation, prerequisites and strategic areas for factoring development are formed, along with the new types and tools, including international factoring, world factoring and other types and forms. |

RESUMEN: Factoring es una de las formas más antiguas de préstamos. El desarrollo del factoring fue fomentado por el desarrollo del comercio internacional y se transformó de acuerdo con los detalles de las formaciones socioeconómicas. El desarrollo del comercio internacional y los procesos de globalización del sector financiero y económico llevaron al desarrollo del factoraje en línea con los nuevos requisitos. El factoring comenzó a desarrollarse de forma particularmente activa en la Federación de Rusia después de que las sanciones fueran anunciadas por los países de la Unión Europea y los EE. UU. Al incentivar el proceso de circulación y la eficiencia en el uso del capital de trabajo, el factoraje sufre cambios significativos durante el desarrollo de la infraestructura, las herramientas y la formación de nuevos segmentos de clientes. Sobre la base de las tendencias modernas en el desarrollo del factoraje en la Federación Rusa, se forman requisitos y áreas estratégicas para el desarrollo del factoraje, junto con los nuevos tipos y herramientas, que incluyen factoraje internacional, factoraje mundial y otros tipos y formas. |

The form of lending, which is today called factoring, is one of the oldest ones and has deep historical roots. This form of commodity lending was used in trade relations in Babylon, and later the Roman Empire, the prototype of factoring was used by merchants in 4000 BC.

Factoring is also relevant today, it forms mechanisms and tools that are in demand by the modern market.

The study is based on official statistics of the Bank of Russia, results of banks surveys, as well as a series of surveys of representatives of the SME lending market.

Philologically, the word factoring has Latin roots and comes from facio, the interpretation of which determines – the one who does.

Factoring reached its greatest development in the XIVth century in England, which was due to the emergence of capitalist relations and intensive development of textile production. The remoteness of production from the markets encouraged the development of factoring intermediation. In fact, the factors of that time fulfilled not only and not so much financial functions, but also the main function in the process of commodity exchange – the function of selling goods. Factors should have known the state of regional markets, currency and national legislation, solvency of buyers, conditions and places of storage and ensuring the safety of goods. House of Factors carried out functions with signs of modern factoring in England in the XVIIth century.

As can be seen from the functions of the historical factor, it performed not only the functions of a financial intermediary, but primarily had to provide marketing functions – acted as a distributor.

At the end of the XIXth century, more advanced factoring began to be used in the USA. Hundreds of factoring companies were created to service German and English merchants.

Due to the insufficient development of trade infrastructure, communication systems and slow risky transportation of goods, the manufacturing enterprise selling goods in the territory of another state was forced to use the services of intermediaries to find buyers, store goods, collect proceeds, sell goods to the principal (a person, on behalf of which the agent carries out intermediation). The mechanism of entrepreneurial activity based on mediation developed during the period of colonization of the American continent by the European countries. Metropolitan countries exported industrial goods to colonies in large quantities. And factoring companies not just stored commodity stocks (tobacco, furniture, textiles, footwear, clothing, cosmetics and perfumes) for European principals and sold them on behalf of producers, but factors were agents – "del credere" (if in the agency agreement contained a "del credere" clause, the agent received an additional commission from the principal for guaranteeing the buyer's solvency). Local commodity producers also resorted to factoring due to the great remoteness of cities and settlements in the USA, as well as differences in the legislation of different states (Ekimova 2016; Ermilova and Finogenova 2017).

As factoring companies capitalized, resources were formed for early repayment of buyers' debts and payments to producers of goods – principals.

Factoring began to intensively develop in European countries in the second half of the 20th century. The development of commercial lending was due to the formation of a highly competitive market. Factors of competitiveness were not only the quality and price of goods, but also the terms of payments for the goods sold. Due to the lack of own resources and preference of commodity lending in comparison with banking, trade intermediaries first sought to sell the product to the end user, and then settled with the producer of the goods.

However, the producers of goods themselves experienced a shortage of working capital and could not provide installments to intermediaries. Therefore, the prevailing conditions of commodity reproduction, lending relations and the consumer market in Europe determined the prerequisites for intensive factoring development.

Factors financed the producers of goods immediately after the shipment of products. At the same time, producers of goods could make advances to distributors and sell goods with a deferred payment, without threat to their solvency. All this ultimately encouraged the sale of goods and accelerated capital turnover while reducing the risks of non-recurring accounts receivable.

Factoring is a kind of short-term loan (up to 180 days) to the seller who receives the proceeds from the sale of the goods immediately after shipment from the bank (which charges a certain discount for this) without waiting for payment for the goods from the buyer. In this case, the seller is called a creditor, the buyer is a debtor, while a bank or other factoring intermediary that is a financial agent is a factor.

The precursor of financial factoring is the import factoring of the "colonial" type, in which traders were agents for the sale of goods on the markets of goods from unknown producers.

At the end of the XXth century, the pace of factoring development multiplied. The world turnover of the factoring market in 2000 amounted to 456 bn euros, and in 2003 its volume increased by 160%. Globalization and formation of the international financial and commodity markets determine the development of international commodity-money relations, as well as financing and risk reduction mechanisms, factoring being one of them.

Tens of thousands of factoring companies operate today worldwide, with the largest share of the factoring market – over 70% – falling on Europe, 15% on America and Asia each. As such, this structure once again emphasizes the priority of Europe as a center for international trade.

The ratio of the factoring turnover to GDP indicates the role of factoring in the economic system of the country. Offshore Cyprus leads in terms of this indicator – more than 20%, Italy takes the second place – about 12%, UK is in the third place – 10%. This figure is about 1% in the USA and less than 0.1% in the Russian Federation. This indicator indirectly reveals the development of the country's financial and credit system, instruments and methods of encouraging the economic system.

A new direction in factoring emerged in the second half of the ХХth century – international factoring. The factors of globalization, integration and international cooperation determined the formation of a new factoring mechanism (Bunich 2017).

Three international factoring groups were formed in the 50s-60s of the XXth century: Heller International Group, International Factors Group S.C., Factors Chain International.

The first international factoring association – the International Factors Group (IFG) – was established in 1960, and includes about 60 companies from 41 countries. An electronic system operates in IFG that is used to assess the creditworthiness of debtors and the transfer of information by factoring companies on the international level.

The international factoring association – the Factors Chain International (FCI) – was established in 1968, and includes 190 factoring companies from 50 countries. The FCI members served 48% of the volume of domestic factoring and 64% of international factoring in 2005. FCI also created a data transfer system.

Legal regulation of factoring is carried out in accordance with the UNIDROIT Convention on International Factoring, signed in Ottawa on May 28, 1988 (Bunich 2016).

The UNIDROIT Convention determines that factoring is a service that meets two of the four conditions:

The UN General Assembly adopted a resolution on regulating the assignment of receivables in international trade, as well as GRIF – General Rules for International Factoring – in 2002. On the basis of these requirements, national legislation is formed in countries that implement factoring.

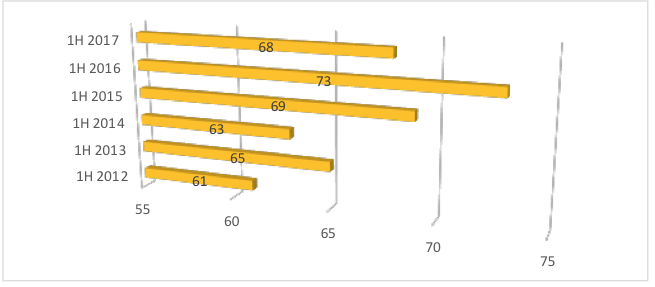

Factoring is intensively developing in Russia, despite the global and macroeconomic factors that influence the Russian economy (Figure 2). For example, over the first half of 2017, the aggregate factoring portfolio in the Russian market increased by 30% compared to the same period of the previous year, with an average turnover for the factoring portfolio of 68 days (minimum is 25 days and maximum is 192 days (Figure 1).

Figure 1

Dynamics of the turnover of the Russian factoring portfolio for the first half-year, mln rub

(Information review of the factoring market. Association of Factoring Companies, 2017)

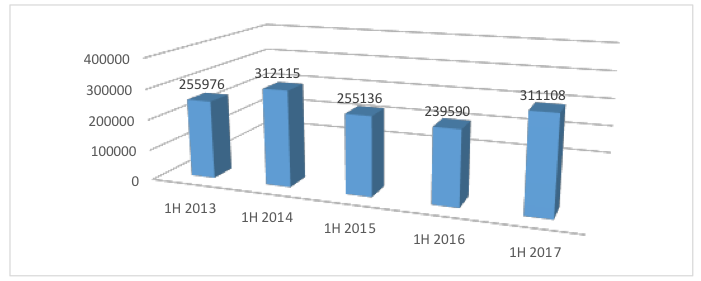

The Russian factors have funded the turnover of 741 bn rubles (which is more than 11% over the same period of the last year) (Figure 2). (Bunich 2017).

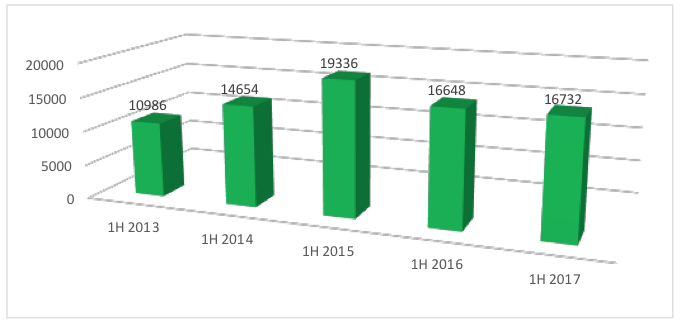

The total income of Russian factoring companies in the first half of 2017 amounted to about 17 billion rubles. (Figure 3).

Figure 2

Dynamics of Russian factoring for the first half-year, mln rub (Information

review of the factoring market. Association of Factoring Companies, 2017)

-----

Figure 3

Dynamics of income of factoring companies in the Russian Federation

(Information review of the factoring market. Association of Factoring Companies, 2017)

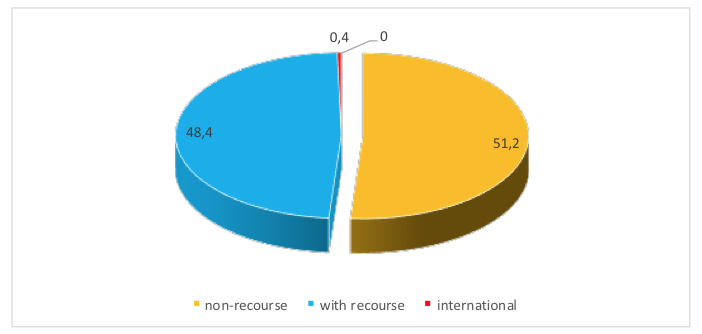

Non-recourse transactions occupied the largest share in the portfolio – more than 51%, while the volume of transactions with recourse amounted to about 48% (Figure 4).

Figure 4

Structure of factoring types in the Russian market, % (Information review

of the factoring market. Association of Factoring Companies, 2017)

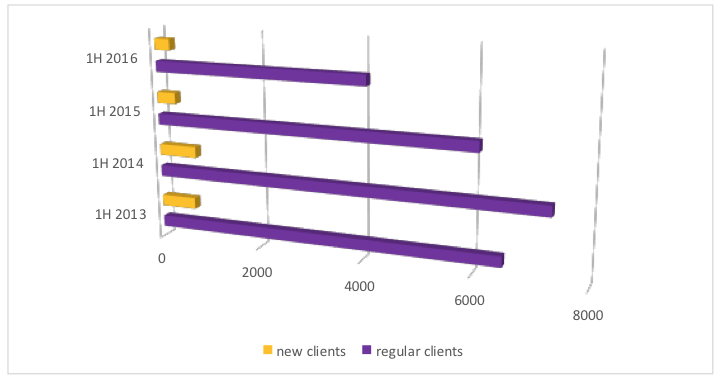

There was an active growth of customers in 2017 (Figure 5). More than 4.5 thousand companies used factoring operations in 2017 in total, while the number of newly attracted customers was more than 900, and the number of debtors was about 9 thousand, with the number of new debtors for the first half of 2017 amounting to more than 1.2 thousand.

Figure 5

Dynamics of clients in the Russian factoring market (Information review

of the factoring market. Association of Factoring Companies, 2017)

Among the regions of Russia, factoring is developing the most actively in Moscow, the share of which is more than 50%. This is primarily due to the high concentration of chain shopping malls (Table 1), as well as the high development of logistics systems and wholesale trade in the Moscow region.

The Volga region ranks second among the Russian regions (more than 20%), and the Central Federal District ranks third (about 13%).

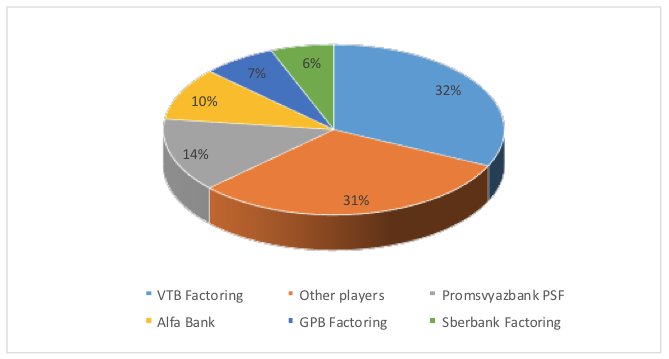

The volume of international factoring from the aggregate portfolio was 0.4%. VTB Factoring, Promsvyazbank, Credit Europe Bank, Group of National Factoring Companies were leaders in this segment (Figure 6).

Figure 6

Structure of leaders in factoring in the Russian Federation (Information

review of the factoring market. Association of Factoring Companies, 2017)

-----

Table 1

Structure of the portfolio of Russian factoring by industries (01.01.2017)

Industries |

Factoring, mln rub |

Share in the portfolio, % |

Clients |

Production |

125,597 |

45.4 |

627 |

Wholesale trade |

117,568 |

42.5 |

71.1 |

Services |

7,389 |

2.7 |

166 |

Other |

26,168 |

9.5 |

98 |

Dynamic trends in the factoring development in the Russian Federation indicate the demand for this financial service, especially in the context of financial instability and sharp fluctuations in consumer demand.

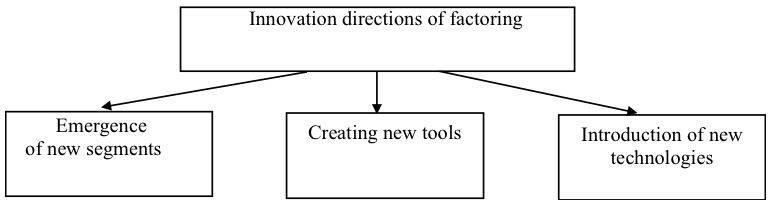

Historically, the current form of lending is today being transformed in the system of formation of (Figure 7):

- new business segments,

- creation of new tools,

- development of technology for factoring infrastructure environment.

At the same time, one or the other direction may develop in priority at different stages of the development of financial turnover.

Figure 7

Areas of factoring development (Compiled by the authors)

For example, according to experts, one of the most important new areas of Russian factoring in 2018 should be factoring at government order, as a new edition of chapters 43 and 24 of the Civil Code of the Russian Federation will come into force in July 2018. This new capacious factoring niche will cause the Russian factoring portfolio to increase several or dozens of times, which will lead to increased competition in the factoring market, but probably will decrease margins.

New factoring tools are created in connection with macroeconomic factors of the country's economic development and in connection with the development of globalization processes at the international level.

This is confirmed by the emergence and intensive development of international factoring. International factoring actually began to develop actively in the factoring market of the Russian Federation after the EU and the USA declared sanctions against Russia. Russian corporations were encouraged to develop production and export products to attract currency funds and develop their operational and economic activities. Despite the fact that the volume of international factoring today is not great and accounts for about 0.4% in the portfolio of Russian factoring, the pace of its development is rapidly increasing.

World factoring can also develop in connection with the development of the global financial and international trade market. Transnational corporations and international regional and transnational banks can become participants in these factoring schemes.

Innovation technologies in the Russian factoring market are:

- use of blockchain technology (formation of a pilot factoring project with the use of blockchain in January 2017);

- EDI technology or electronic data interchange in the factoring market is in its early stage of introduction, while the documents for the deal are made not in paper form, but in the electronic form of a high-tech algorithm. For example, the turnover of the factoring market in Russia will increase by 7% in 2017 only due to significant deals in the real sector of the economy and the introduction of factoring in trade, including through the spread of EDI technology. Conference 3 of the Association of Factoring Companies (AFC) “Factoring in Russia. Dialogue of professionals” was devoted to the problems of introducing electronic data interchange into Russian factoring. A round table was held in Moscow in spring 2016 – "Paper-free factoring". The following dependence was established during the discussion: on average, out of 40 Russian factoring companies, 20 do not work with electronic document flow, 7 of them are only planning to start this work, and one in 40 companies has tried and refused to use the EDI technology.

Problems of introduction of electronic document flow are:

- increase in the cost of factoring due to roaming for sending information;

- costs of the implementation of the system;

- need for staff training;

- need for paper carriers for tax authorities.

At the same time, the advantages of EDI factoring are undeniable:

- monitoring of the money flow;

- convenience of maintaining the archive records;

- quality and speed of customer service is increased;

- exclusion of the possibility of counterfeiting and fraud, as well as various unintentional errors;

- cost of processing and sending paper documents is reduced.

1. Factoring is one of the oldest types of commercial lending, facilitating the acceleration of sales and circulation of working capital.

2. Factoring is transformed, reflecting the features of socioeconomic relations in society: its forms, types, mechanisms change.

3. Dynamics of factoring development in the Russian Federation allows to predict not only an increase in the volume of factoring in general, but also the introduction of factoring in new areas and regions of the country.

4. Development of factoring in the Russian Federation determines the growth of competition, the number of factoring intermediaries in the market, and an increase in marginal profit.

5. Factoring development will be developed in the following directions in priority:

- creation of new segments,

- formation of new tools, and

- development of technology for factoring infrastructure environment.

Bunich G.A. (2016). Strategicheskiye innovatsii v mekhanizme upravleniya finansovoy bezopasnostyu rossiyskikh kommercheskikh bankov [Strategic innovation in the mechanism of managing the financial security of Russian commercial banks]. Issues of regional economics, 29(4), 25-30

Bunich G.A. and Podlesnova A.Yu. (2017). Tendentsii razvitiya faktoringa v Rossii [Trends in factoring development in Russia]. Economics and entrepreneurship, 8-1 (85-1), 647-650

Ekimova K.V., Bolvachev A.I., Dokhoyan Z.M., Shemetkova O.L. and Sekerin V.D. (2016). Improvement of the methods for assessing the value of diversified companies in view of modification of the herfindahl-hirschman model. Journal of Internet Banking and Commerce, 21(s4), 14

Ermilova M.I and Finogenova Y.Y. (2017). The Impact of Macroeconomic Factors and Economic Cycles on the Cost of Housing. International Journal of Ecological Economics and Statistics, 38, 68-77.

Informatsionnyy obzor rynka faktoringa. Assotsiatsiya faktoringovykh kompaniy [Information review of the factoring market. Association of Factoring Companies]. Date View December 01, 2017 http://asfact.ru/faktoring-rossii-v-1-polugodii-2017-goda/

1. Plekhanov Russian University of Economics, 117997, Moscow, Stremyanny Lane, 36; E-mail: bunich-ga@yandex.ru

2. Plekhanov Russian University of Economics, 117997, Moscow, Stremyanny Lane, 36

3. Russian University of Cooperation, 141 014, Moscow region Mytischi, st. B. Voloshina, 12