Vol. 39 (Number 19) Year 2018 • Page 34

N.V. GRYZUNOVA 1; , K.V. EKIMOVA 2; , D.S. ZAKHAROVA 3; , K.V. ORDOV 4; , V.V. KOLMAKOV 5; , T.P. DANKO 6 , V.D. SEKERIN 7

Received: 05/03/2018 • Approved: 05/04/2018

ABSTRACT: A monetary policy (MP) is an integral part of state economic policy. The MP of the state solves a variety of problems, one of which is to improve the competitiveness of national business, achieve independence from the monetary policy of other countries, expand the flow of domestic lending (which is determined by the scarcity of external lending), and secure stability and sufficient reinvestment in the real sector of the economy. This problem is explored in detail by the Russian economic school, but it is raised far less often in the papers of foreign researchers. The authors justified the need for adjustments to the elements of the transmission mechanism for better response from entities in the real sector of the economy to growth drivers through modification of lending and investment channels of the transmission mechanism, based on adjusting short-term and long-term targets of the structural development of the national economy. The models of channels proposed by the authors will reduce the working capital deficit for enterprises and liquidity shortage for small businesses, and will help banking regulator absorb the liquidity. |

RESUMEN: Una política monetaria (MP) es una parte integral de la política económica estatal. El MP del estado resuelve una variedad de problemas, uno de los cuales es mejorar la competitividad de las empresas nacionales, lograr independencia de la política monetaria de otros países, expandir el flujo de préstamos internos (que está determinado por la escasez de préstamos externos) , y asegurar la estabilidad y una reinversión suficiente en el sector real de la economía. Este problema es explorado en detalle por la escuela económica rusa, pero se plantea con mucha menos frecuencia en los documentos de investigadores extranjeros. Los autores justificaron la necesidad de ajustes a los elementos del mecanismo de transmisión para una mejor respuesta de las entidades del sector real de la economía a los impulsores del crecimiento a través de la modificación de los canales de préstamo e inversión del mecanismo de transmisión, basados en ajustes a corto y largo plazo. objetivos a plazo del desarrollo estructural de la economía nacional. Los modelos de canales propuestos por los autores reducirán el déficit de capital de trabajo para las empresas y la escasez de liquidez para las pequeñas empresas, y ayudarán al regulador bancario a absorber la liquidez. |

Changes in the global financial market within the last decade reveal a need to change the model of economic development; these transformations gradually cover Russia as well. Changing external conditions have led to deep internal structural problems, especially in countries with limited foreign investment, such as Russia. Major discussions have been devoted to creating an open economy and achieving international capital mobility for a long time. However, numerous studies (Gerberding, Seitz and Worms 2017) have only proved the doubtfulness of advantage for any country. At present, major accents have shifted to discussing the conditions for achieving sustainable economic growth and independence of the national MP from environmental factors and more financially powerful countries and, of course, to welfare improvement. The financial and technological "vector" of the state development will depend on the readiness of both government and national business bodies to switch to an investment and innovation model of economic growth.

The MP inflation targeting strategy, carried out in many countries, acted as a shock absorber, on the one hand, by smoothing the impact of external shocks on the economy functioning. On the other hand, improving financial management efficiency, renewing fixed assets (FA) and developing infrastructure, introducing new technologies and increasing labor productivity have a profound effect on the interest rate system. The transmission mechanism of the monetary policy is a mechanism that expands its influence on both the economy as a whole and various sectors of the economy in particular – for example, on the price dynamics and on inflation, as a result. Change in the key rate level influences the economy through the following major channels: interest, lending, currency, asset prices. (Of course, there can be more transmission channels). The main stress in the article is made on modification of lending and investment channels.

Acceleration of lending growth is one of the best crisis predictors. Var and panel analysis methods were most often used for evaluation. The authors used database (The Central Bank of the Russian Federation, n. d.) in the article. Authors (Tobias and Boyarchenko 2013) draw attention to the following fact: "... the growth of financial threats is primarily due to "lending papers" and "politicians ignore lending at their own peril and risk... ". In the case of crisis phenomena localization, the MP influences the economy through interest rates (Danko, Ekimova, Bolvachev, Zarova, Shemetkova, Solovyova and Sekerin 2016). The change in the key rate influences interest rates in terms of the following instruments: loans to fund the investment projects secured by collateral; loans secured by bonds placed to fund the investment projects and included in the Lombard list; loans secured by lien provided by leasing companies.

The Russian banking system is experiencing a structural shift at the moment: the process of bank ranking unfolds in the perspective of increasing reliability, stability and sustainability; the structure of the loan portfolio of banks changes; the share of the regulator's funds in the structure of the commercial bank balance sheets is dynamic again; institute of insuring deposits of small business is introduced; the structure of mandatory reserves of the CBR (the Central Bank of Russia) changes; etc.

In order to revive investment and consumer demand, the CBR will continue to reduce the key rate in the next two years and experiment with bonded debts similar to monetary experience in 2009-2010, when a number of leading central banks were forced to bring the level of interest rates to zero or close to it under the crisis pressure. As this traditional MP tool has now exhausted its capabilities, central banks began using extraordinary MP methods, such as "quantitative monetary easing", to further stimulate demand and meet the inflation target. Their essence consists in acquisition of state and private assets by central banks through currency emission. Countries that practice the regime (QE) include the Bank of England, which implemented a program of purchasing securities totaling 200 bln pounds from January 2009 to February 2010. Subsequently, the Bank of England held a bond purchase totaling 375 bln pounds in the period from October 2011 to July 2012 (Coeurdacier, Hélène and Pablo 2013).

There is also a structural excess of liquidity in Russia, its size being defined as the positive difference between the obligations of the Bank of Russia to lending institutions and the Bank of Russia requirements to them for refinancing operations, see Tables 1 and 2. To localize this problem, central bank bonds (CBB) were issued for a relatively long period (up to 1 year).

Table 1

Structure and dynamics of the largest banks’ liabilities

(Top 30 in the banks ranking, compiled by the authors)

Item name |

2013% |

2014% |

2015% |

Loans, deposits and other CB funds |

0.46 |

7.03 |

3.04 |

Funds of lending institutions |

1.81 |

3.31 |

5.2 |

Client funds (non-lending institutions) |

93.40 |

87.95 |

89.9 |

Deposits of individuals |

65.94 |

66.62 |

64.74 |

Financial liabilities measured at fair value through profit |

0.00 |

0.00 |

0 |

Issued debentures |

2.89 |

0.41 |

0.39 |

Defferred tax liabilities |

0.00 |

0.00 |

0.21 |

Other liabilities |

1.39 |

1.26 |

1.14 |

Provisions for possible losses on contingent lending liabilities |

0.03 |

0.03 |

0.02 |

Total liabilities |

100 |

100 |

100 |

The authors carried out a study based on bank balance sheets to simulate a lending channel on microeconomic data. Accounting for the role of the monetary policy influence on the volume of bank lending has become widespread, for example, in papers (Bacchiocchi and Fanelli 2015; Eichengreen 2015; Cottarelli 2013; Dell’Ariccia, G., Laeven, and Suarez 2013).

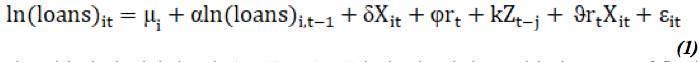

Proceeding from the dynamics of liabilities, the authors obtained the dependence of the bank loan portfolio:

where i is the bank index, i = 1,..., N; t = 1,..., T is the time index; µ i is the vector of fixed effects for banks included in the sample; ln (loans) is the logarithm of the volume of the bank loan portfolio; Z tj is the vector of check macroeconomic variables (the authors believe that three variables play a strategically important role: for organizations and legal entities it is the ratio of internal lending to revenue; at the macroeconomic level it is the ratio of the real exchange rates pace to the dynamics of the ratio of official reserves to GDP (they have reached their high since 2014 now in Russia); Xit is the individual banking characteristics that influence the volume of loan offerings (type of license, compliance with Basel III); r is the monetary policy indicator (interbank lending rate); α, δ, φ, k, ψ are the parameters to evaluate; εit is the random error.

The resulting data indicated that the volume of firms’ lending was influenced by monetary aggregates rather than interest rates set by the CBR in 1999-2007. Similar results are reflected in (Kuttner and Mosser 2002) but with additional consideration for inflation of asset prices. The authors managed to find a slight influence of the REPO auction operations rate on lending offering, but this influence was variable. For example, the share of the Bank of Russia in liabilities averaged up to 10% in 2011, compared to less than 2% by mid-2008; recent years are presented in Tables 2 and 3.

Table 2

Structure of highly liquid assets of the largest banks

(Top 30 in the banks ranking, compiled by the authors)

Item name |

01 May 2016, % |

01 May 2017, % |

cash in hand |

(43.57%) |

(35.23%) |

funds on accounts with the Bank of Russia |

(38.86%) |

(36.93%) |

funds on Nostro accounts in banks (net) |

(6.06%) |

(4.30%) |

interbank loans placed for up to 30 days |

(0.00%) |

(0.60%) |

highly liquid Russian securities |

(10.59%) |

(22.94%) |

highly liquid securities of banks and the state |

(1.08%) |

(0.00%) |

highly liquid assets with due consideration for account discounts and adjustments (based on Directive No. 3269-U dated 31.05.2014) |

(100.00%) |

(100.00%) |

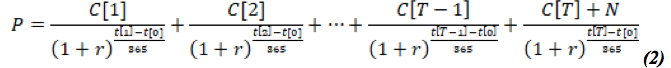

A change in priorities can be observed in shaping loan portfolios and investment policy by investors and lending institutions of different levels. Many banks change the balance sheet structure referring to subordinated bonds, FLB and CBB. It is common for central banks to place their own bonds in global MP practice. These operations are particularly intensively used in countries with emerging financial markets (for example, central banks of South Korea, Israel, Brazil, Chile, South Africa). Central bank bonds are quite attractive for lending institutions. First of all, their holders receive guaranteed income. Secondly, if the lending institution needs additional liquidity earlier than bonds mature, it can use them as collateral for operations in the currency market or to raise refinancing from the central bank. Besides, the lending institution can sell them either in the secondary market or, if it is allowed, to the central bank.The effective bond yield can be calculated using the following formula:

where r is the effective yield, extracting the root resulted in 9.75%, which is now a very desirable result; C(i) is the coupon payment at time i; t[0] is the current date; t[i] is the date of the i-th coupon payment; N is the denomination; P is the current price (including ACI); T is the number of payments on the bond.

At present, duration and volatility are significant (Dudin, Gryzunova, Frolova and Shuvalova 2016). The terms of issue of subordinated bonds will be a tool for banks resolution, many of which (banks) will be switched to the terms of basic license (without compliance with Basel III), if their liquidity is restored. The main risk for them is possible non-insurable non-payments.

Table 3

Structure of current liabilities of the largest banks

(Top 30 in the banks ranking, compiled by the authors)

Item name |

01 May 2016, % |

01 May 2017, % |

deposits of individuals with a term of more than one year |

(49.59%) |

(38.61%) |

other deposits of individuals (including individual entrepreneurs, with a term of up to 1 year) |

(31.50%) |

(42.37%) |

deposits and other funds of legal entities (for a term of up to 1 year) |

(15.99%) |

(17.31%) |

including current funds of legal entities (without individual entrepreneurs) |

(8.52%) |

(9.53%) |

funds on LORO correspondent bank accounts |

(1.06%) |

(0.06%) |

interbank loans received for up to 30 days |

(0.97%) |

(0.78%) |

own securities |

(0.00%) |

(0.00%) |

liabilities on interest payment, arrears, accounts payable and other debts |

(0.89%) |

(0.87%) |

expected outflow of funds |

(14.95%) |

(14.80%) |

current liabilities |

(100.00%) |

(100.00%) |

Bonds are positioned as an alternative source of lending and refinancing of the national economy of own and borrowed capital. The mechanism of interaction between the MP and the competitiveness of companies is described by a set of macroeconomic indicators and competitiveness indicators of organizations (Shaytura, Stepanova, Shaytura, Ordov and Galkin, 2016). Intensive stimulation of investment activities of banks by the regulator now comes to the fore, a multilevel banking system is being created for the purpose of supporting the investment channel. The authors propose a matrix approach to link the competitiveness indicators and characteristics of the MP, Table 4.

Table 4

Investment channel

Columns in the matrix |

|

J- macro indicators |

i- micro indicators |

Oil price |

Investment in FA and R&D |

Increase in real income of population |

ROI, ROA, return on sales, liquidity |

Inflation=4% - constant |

Inflation of prices for main production assets |

Growth pace М2= |

=Lending as a function of debt = constant |

Increase in net bank lending |

Reinvestment=6%-8% constant |

Total debt = |

= uncovered interest parity |

Many authors have long recognized the problems of business cycles (Tobin 1978) and the need to create an investment channel for the transmission mechanism (Mishkin 2010), but neither the universal elements of these channels nor the methods for their accounting have been defined so far. For example, (Bruno and Hyun 2013b) propose to consider risks and introduce adjustment on cash flows; the authors of (Kuttner and Shim 2013) claim that tax savings created by lending portfolios should be taken into account. The authors consider the investment channel through the prism of expanding the use of bonds as a tool for restructuring the banks' debts and suggest that it is necessary to link the interaction schemes with the competitiveness indicators.

The authors believe that modification of the lending channel of the transmission mechanism will create the following advantages: the securities market gets a drive in the form of large amounts of resources; since the key rate and associated investment lending rates drop, there will be an increase in investment in the real sector of the economy, although not always secured.

Expanding the freedom of actions of banks with a basic license should become a possible area of stimulating the investment activity of banks; banks under rehabilitation can restructure debts into subordinated bonds with the condition of conversion into stocks, which will create the potential for expansion of influence and control. As a result, banks will receive an "amortization pillow" and extend the debt maturity.

Creating a solid production foundation for regulating the "value" of money in circulation will enable to achieve the main goals of not only the monetary policy, but also of any state: raising the level of national welfare and increasing economic growth rates (Nikeriasova, Ordov and Khvostenko 2016).

Bacchiocchi E., and Fanelli.L.(2015) Identification in Structural Vector Autoregressive Models with Structural Changes, with an Application to US Monetary Policy. Oxford bulletin of economics and statistics, 77(6): 0305–9049

Bruno, V. and Hyun S. S. (2013b) “Capital Flows and the Risk‐taking channel ofm onetary policy”, working paper Princeton University.

Coeurdacier N., Hélène R. and Pablo W. (2013) “Financial Integration and Growth in a Risky World”, manuscript, London Business School and SciencesPo.

Cottarelli, C (2013). “Mountains of debt: the cliffs, slopes and uncharted territories of today’s public finances in advanced economies”, presentation at Boston College, 18 February.

Danko T. P., Ekimova K V , Bolvachev A.I, Zarova E. V, Shemetkova O.L., Solovyova M.G. and Sekerin V. D., (2016). Assessment of the competitive potential of the region through an integrated system of rating positioning. Global Journal of Pure and Applied Mathematics, 6: 2361-2367

Dell’Ariccia, Giovanni, Laeven, L. and Suarez G. (2013) “Bank Leverage and Monetary Policy’s Risk‐Taking Channel: Evidence from the United States” working paper, International Monetary Fund.

Dudin M.N., Gryzunova N.V., Frolova Е.Е. and Shuvalova E.B. (2016). The Deming cycle (PDCA) concepts as an efficient tool for continuos quality impro-vement in the agribusiness. Asian Social Science, 11(1): 230-246

Eichengreen B.(2015) Monetary Regime Transformations. New York: Oxford University Press, pp. 86.

Gerberding C., Seitz F. and Worms A. (2017) Money-Based Interest Rate Rules, Lesson from German Data: Deutsche Bundesbank Discussion Paper Series 1. Economic Studies, 6: 37

Kuttner, K. and Shim, I. (2013). “Taming the real estate beast: the effects of credit and housing-related tax policies on house prices and credit”, BIS mimeograph.

Kuttner, K., and Mosser, P. (2002). “The Monetary Transmission Mechanism: Some Answers and Further Questions”. Federal Reserve Bank of New York Economic Policy Review, May.

Mishkin, F. S. (2010) The Economics of Money, banking and Financial Markets. Alternative Edition. Moscow: Higher School of Economics (State University), pp. 9.

Nikeriasova, V.V., Ordov, K.V. and Khvostenko, O.A. (2016). Financial mechanism for the implementation of strategic and operational financial decisions of modern enterprises. International Journal of Environmental and Science Education, 11 (17): 10177-10184.

Shaytura, S.V., Stepanova, M.G., Shaytura, A.S., Ordov, K.V. and Galkin, N.A. (2016). Application of information-analytical systems in management. Journal of Theoretical and Applied Information Technology, 90 (2): 10-22.

The Central Bank of the Russian Federation. (n. d.). Date View November 17, 2017 www.cbr.ru

Tobias, A. and Boyarchenko, N. (2013). “Intermediary Leverage Cycles and Financial Stability”, Federal Reserve Bank of New York Staff Report No. 567.

Tobin J.(1978) Monetary Policies and the Economy: The Transmission Mechanism. Southern Economic Journal, 44(3): 421-431.

1. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny per., 36

2. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny per., 36

3. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny per., 36

4. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny per., 36

5. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny per., 36

6. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny per., 36

7. Moscow Polytechnic University, 107023, Russian Federation, Moscow, Bolshaya Semenovskaya St., 38; E-mail: bcintermarket@yandex.ru