Vol. 39 (Number 19) Year 2018 • Page 35

Marina Alekseevna IZMAILOVA 1; Tatyana Dmitrievna KRYLOVA 2; Natalia Vladimirovna KNYAZEVA 3; ,Alexander Ivanovich BULEEV 4; Tatiana Valerievna SHUTOVA 5

Received: 05/03/2018 • Approved: 11/04/2018

ABSTRACT: This article studies prospects of the modernization of the service industry infrastructure using the public-private partnership mechanism. The anticipated result of reforms should be the improvement of the quality and accessibility of the services rendered to the population. The article reveals conceptual approaches to the understanding of the essence and advantages of the public-private partnership. The evolutionary transformation of the forms of business involvement to the implementation of the public infrastructure projects is demonstrated from the state order to the integrated investment project with the possibility of achieving the maximum synergetic effect in solving infrastructure problems. Characteristics of the public-private partnership are given and compared with the state order for the implementation of the infrastructure project. Based on the results of the comparative analysis we have formed the understanding of the public-private partnership as the most flexible form of cooperation between public authorities and the private sector which allows extracting and protecting mutual interests of the parties. Based on the structural analysis main advantages of applying the public-private partnership mechanism are revealed. The assessment of the business climate in the service industry in Russia characterized by the decrease in demand for services, the reduction in the number of contracts concluded and in the number of employees, the increase in the prices for the services provided, the reduction in the profits – all these factors convincingly indicate deterioration in the economic situation of the service enterprises and the persistence of the unfavorable business climate on the Russian service market. We prove the possibility of using tools of the public-private partnership in the development of the social infrastructure, in ensuring the improvement of quality, the accessibility and expansion of the range of services, as well as in achieving the economic sustainability of service organizations. It is concluded that the public-private partnership is promising not merely in developing the service industry infrastructure, but also in modernizing the entire Russian economy. |

RESUMEN: Este artículo estudia las perspectivas de la modernización de la infraestructura de la industria de servicios utilizando el mecanismo de asociación público-privada. El resultado anticipado de las reformas debería ser la mejora de la calidad y la accesibilidad de los servicios prestados a la población. El artículo revela enfoques conceptuales para comprender la esencia y las ventajas de la asociación público-privada. La transformación evolutiva de las formas de participación empresarial para la implementación de los proyectos de infraestructura pública se demuestra desde el orden estatal hasta el proyecto de inversión integrada con la posibilidad de lograr el máximo efecto sinérgico en la resolución de problemas de infraestructura. Las características de la asociación público-privada se dan y se comparan con el orden estatal para la implementación del proyecto de infraestructura. Sobre la base de los resultados del análisis comparativo, hemos formado la comprensión de la asociación público-privada como la forma más flexible de cooperación entre las autoridades públicas y el sector privado que permite extraer y proteger los intereses mutuos de las partes. Con base en el análisis estructural, se revelan las principales ventajas de aplicar el mecanismo de asociación público-privada. La evaluación del clima empresarial en la industria de servicios en Rusia se caracteriza por la disminución de la demanda de servicios, la reducción en el número de contratos celebrados y en el número de empleados, el aumento en los precios de los servicios prestados, la reducción en el beneficios: todos estos factores indican convincentemente un deterioro de la situación económica de las empresas de servicios y la persistencia del clima comercial desfavorable en el mercado de servicios ruso. Probamos la posibilidad de utilizar herramientas de la asociación público-privada en el desarrollo de la infraestructura social, para garantizar la mejora de la calidad, la accesibilidad y la expansión de la gama de servicios, así como para lograr la sostenibilidad económica de las organizaciones de servicios. Se concluye que la asociación público-privada promete no solo desarrollar la infraestructura de la industria de servicios, sino también modernizar toda la economía rusa. |

The article aims to analyze the applicability and prospects of using the public-private partnership mechanism for the modernization of the service industry infrastructure, which will improve the quality and the accessibility of the services provided. The basis for the analysis should be the assessment of the business climate in the service industry with the identification of factors restricting its development, as well as the disclosure of benefits of the public-private partnership as an instrument for the progressive development of the Russian service industry.

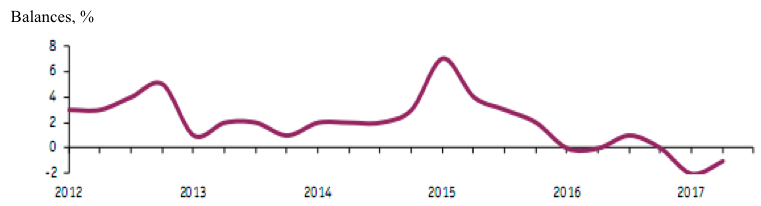

The relevance of this study is determined by the need to remove contradictions between the unsatisfactory state of the service industry and its social significance in the human capital development recognized as the key factor in the formation of a new form of economy. According to the study, the dynamics of the entrepreneurial confidence index in the service industry suggest that despite the compensation of critical values of the end of 2015 and the beginning of 2016, a stable trend towards the escape of this industry from stagnation has not formed yet. The obvious reason for this situation is the lack of service demand against the backdrop of the continued decrease in real incomes of potential consumers. Thus, in August 2016 the real disposable cash income of the population decreased by 8.3% compared to August of the previous year. A similar decline was last observed about 8 years ago at the rise of the previous crisis in December 2008. Under these conditions, it is necessary to find additional resources to reduce the cost of the services rendered to the population by making them affordable, qualitative and various. Such resources can be provided by the commercial economical sector on principles of mutually beneficial cooperation with the state which becomes a new impetus for the development of the country's economy. Thus, as of March 2017, 1,825 public-private partnership projects have been implemented in Russia, the amount of private investments in which exceeds 700 billion rubles. 425 projects were launched in 2016. Main PPP trends in 2017 should be as follows: the increase in the number of municipal concession projects in the social sphere and in the sphere of land improvement; the consolidation of communal concessions; the launch of road concession projects in the regions; the expansion of concession agreement facilities; the expansion of the use of concessionary mechanisms in Russia.

In connection with the foregoing, theoretical and practical problems of disposal of the public-private partnership mechanism in the modernizing of the country's economy, with the service industry as one of its important sectors, require comprehension.

The survey results are based on scientific papers of foreign scientists (Akintoye A, Beck M., Hardcastle C., Akitoby B., Hemming R., Schwartz G., Bennett J., Iossa E., Delmon J., Klijn E.-H., Teisman G. R., etc.) who paid attention to a broad range of problems related to the public-private partnership, in particular, to the development and regulation of public-private partnerships, public investment and project risk management, infrastructure development, including the social field. The results of this study also rely on scientific papers of Russian scientists studying the establishment of the public-private partnership in Russia (Alpatov A.A., Pushkin A.V., Japaridze R.M.), as well as regional (Deryabina M.A., Kabashkin V.A.) and industrial (Fedorova E.A., Gurina V.A., Dovzhenko S.E.) specifics of cooperation between authorities and business in the implementation of infrastructure projects, the incitement of investment and innovation activities in the framework of public-private partnerships (Eganyan A.). At the same time, we observe the incompleteness of the theoretical basis for studying the public-private partnership mechanism in the course of the service industry modernization. Much attention is paid to the coverage of the study results obtained by Russian scientists and analysts of the Center for Market Research of the Institute for Statistical Studies and Economics of Knowledge of the Research University "Higher School of Economics" regarding the state of the business climate in the service industry. We also used the data on the best Russian experience in implementing public-private partnership projects in rendering the social services to the population.

The interest in studying the state and prospects of the service industry modernization is predetermined by a number of circumstances. The most important of them is the inability of the physically and morally outdated infrastructure of the service sector to meet the needs of modern society, taking into account the prevailing economic situation in the country. It is crucial to develop appropriate theoretical and methodological approaches to the modernization of the service industry, and thus to the achievement of higher quality of the services rendered to the population.

The involvement of businesses in the implementation of state infrastructure projects in Russia and the post-Soviet space has undergone certain evolution over the past 25 years (Varnavsky V.G., Klimenko A.V., Korolev V.A., 2010; Veselovsky M.Y., Abrashkin M.S., Aleksakhina V.G., Pogodina T.V., 2015) from the participation of private companies in certain stages (design, construction, service rendering) to the turnkey project implementation, often including the target service rendering to the population. The transition from the "classical" state order to the integrated investment project enables to achieve the maximum synergetic effect in solving infrastructure problems (Delmon J., 2009). This relatively new form of a long-term interaction between the state and business on mutually beneficial terms in the implementation of infrastructure projects aimed at solving socially important problems is called the public-private partnership (hereinafter, PPP). Thus, PPP is one of implementation methods of infrastructure projects (Kwak Y.H., Chih Y.Y., Ibbs C.W., 2009) which is based on a long-term mutually beneficial cooperation of public and private partners. Moreover, business as a private party of the PPP, in the interests of a public partner, has the right to participate in the creation of an infrastructure facility (design, financing, construction, reconstruction) and in its subsequent service support (operation, maintenance) to make its own profit. It should be noted that the PPP is a more flexible form of cooperation between public authorities and business in the implementation of an infrastructure project than the state order or privatization (Gerrard M.B., 2001). Furthermore, with properly structured relations between the parties, this form is more secure for an investor than leasing.

According to experts, a growing interest in the PPP mechanisms has been recently observed in the country. The interest is shown by both public authorities and the private sector of the economy initiating a constructive dialogue on the possible implementation of the PPP mechanisms used worldwide, conditions for their adaptation to the Russian reality, the forecasting of positive results and negative effects of the PPP application in various spheres of the economy, giving special attention and priority to the sectors requiring immediate modernization, including the social sphere, health care, education, etc. (Alpatov A.A., Pushkin A.V., Dzhaparidze R.M., 2010). The attractiveness of PPP projects is largely determined by their essential characteristics: a long-term nature of cooperation, a guaranteed distribution of risks and areas of responsibility between the partners, the possibility of full or partial financing of the creation of an infrastructure facility by a private partner (Kabashkin V.A., 2010).

A long-term nature of PPP projects is determined by the need to return the invested assets by a private partner (Akitoby, Hemming & Schwartz G., 2007; Akintoye, Beck & Hardcastle 2008) and the complexity of such projects (obligatory merging of the creation and operation and/or maintenance of the agreement facility). The term of the PPP agreement or the concession agreement or another type of contract with the PPP characteristics, as a rule, is determined by three factors: 1) the payback period of the investments; 2) the needs of the public party in the goods, jobs, services provided by the private partner; 3) the engineering and technical specifics of the facility, for example, the timing and the frequency of mandatory capital repairs or the overall service life of the construction site.

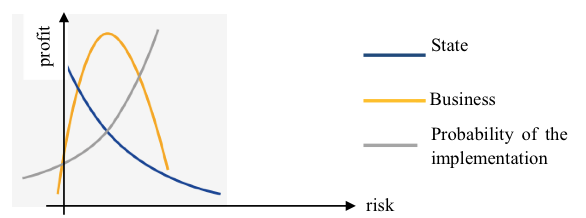

The emergence of risks in infrastructure projects (Akintoye A, Beck M., Hardcastle C., 2008) is determined by a possible change of design indicators that directly affect the project income and the expenses of each partner. In this regard, it is required to find the best solution for risk sharing between the partners based on clear structuring of their relations (Pongsiri N., 2002, Veselovsky M.Y., Gnezdova J.V., Menshikova M.A., Izmailova M.A., Romanova J.A., 2015), which is currently the greatest challenge in the preparation of PPP projects (Figure 1).

Figure 1

The probability of the implementation of the PPP project

Unlike the "state order", the creation of a facility within the PPP requires mandatory financing performed by the private partner, while the public party is entitled to partly reimburse its costs for the establishment of the facility, as well as to fully or partially finance the costs associated with the exploitation and/or technical service of the agreement facility.

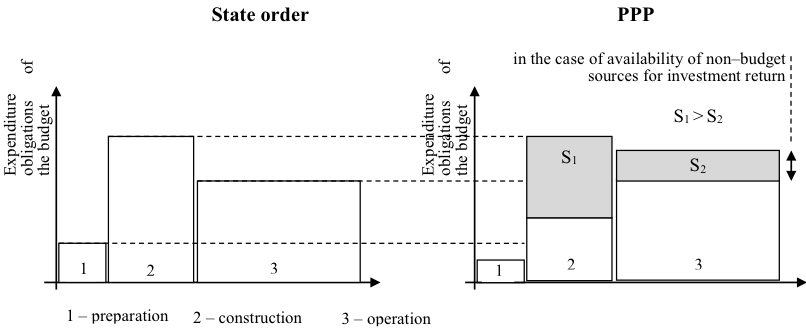

Figure 2 on the left shows the planned budget expenditures for the infrastructure project implemented through the "classic" state order followed by the transfer of the management to a state institution (or a state enterprise), while Figure 2 on the right shows the planned budget expenditures in the case of a similar infrastructure project using the PPP mechanisms where the entire life cycle from the creation to the operation (maintenance) is provided by the private partner (Practical handbook for investors "Public-private partnerships in the countries of the Eurasian Economic Union", 2017).

Figure 2

Approaches to the planning of the budget expenditures for the implementation

of infrastructure projects: the state order vs. the PPP

In simple terms, Figure 2 demonstrates the example when in the course of the PPP project implementation the public partner bears the expenses associated with the involvement of consultants in the preparation of financial and legal models for the PPP project at the preparatory stage, while the costs associated with the development of the project documentation and its harmonization are entrusted on the private partner. At the construction stage the public partner partially cofinances the establishment of the facility (approximately 30%) and fully pays for the maintenance and/or the operation of the facility by the private partner (there is no other source of return on investment other than the budget), and also reimburses the private partner for the investment at the stage of the facility creation by fixed payments during the whole project term, taking into account the profitability and the cost of the involved financing (S2).

It can be noted that under these assumptions the budget expenditures in case of the PPP mechanisms application will be higher than the "classical" state order (S2>S1) which is confirmed by a number of projects being implemented. However, it is important to note that the resources required to implement a project through direct budget financing are not always available in the budget ("public procurement"), in which case the PPP can be the only, albeit more expensive, way to raise additional financial resources by installments to solve urgent socio-economic objectives. In many projects it is also possible to partly transfer the costs to the consumer (toll roads, payment for the utility services at a tariff) and/or to provide the private party with the opportunity to render the additionally paid services using the agreement facility (commercial services in the field of health care and hotel services at cultural and sports facilities, etc.) (Pethe A., Ghodke M., 2002). In this case, the investor will have an additional source of return on investment and the budget burden associated with the project implementation may be reduced.

However, the appropriateness of the PPP mechanisms application is determined not only by the urgency and the possibility of additional commercial operation of the facility. It is also important to keep in mind risks (Van Ham H., Koppenjan J., 2001) which the public partner can transfer to the private partner in PPP projects, thereby reducing their own potential costs in the implementation of the project. Regardless of the form of the implementation of an infrastructure project, it is always subject to external factors affecting the costs and the revenues of the project relative to the planned ones (Klijn E.H., Teisman G.R., 2000). These factors include political (protests and rallies which can delay the implementation of the project and lead to additional costs), economic (inflation growth and the growth of the exchange rate can significantly affect the cost of facility creation), and many other events that, as a rule, lead to a rise in the cost of the creation and operation of the facility. At the same time under the state order all these risks are borne by the budget, and in the case of PPP additional costs are distributed among the participants, and their proper distribution is the basis for considering the PPP as a more effective (S2) form of a partnership between public authorities and the private sector when implementing infrastructure projects.

Thus, the public party will always strive to reduce its direct financial participation in the implementation of the PPP project, especially prolonged one, and to shift most of the risks, especially commercial (demand risk), to the private party. In turn, the private partner will seek to share with the public party the most significant risks that the public party can manage better, for example, currency, inflation, political, land, legislative ones (Eganyan A., 2015; Sylvestrov 2008). There is a well-known practice of successful implementation of PPP projects without any budgetary participation (most projects in heating and water supply, some projects in social sectors: high-tech medical care, bath and laundry services, cinemas, cultural heritage and tourist facilities, certain types of facilities in the physical culture and sport), and projects with significant budgetary participation both at the creation and operation (rehabilitation centers, kindergartens, low-traffic roads) (Deryabina M.A., 2008).

The result of the PPP structural analysis makes it possible to distinguish main positive aspects of this mechanism application (Table 1).

Table 1

PPP advantages

Advantages of the PPP partner |

|

For the public |

For the private partner |

obtaining of the possibility: |

|

to attract business to invest in the creation of the facility, which provides a prospect for the implementation of infrastructure projects in the lack or absence of budget funds |

to partly transfer revenue risks to the state on the basis of the implementation of the repayment guarantee mechanism |

to combine stages of design, construction and operation in a single project, which will lead to an improvement in the quality of the facility, reducing the risk of the overstatement of the initial project cost |

to invest in a long-term project on a returnable basis with a fixed yield against the state guarantees (obligations) |

to acquire not a facility, but a new service with payments corresponding to the parameters (volume, quality) of its delivery, which ensures the expansion of the non-state sector in the economy and improves the life quality of the population |

to increase the revenue from the project through the provision of additional paid services and adoption of cost-cutting solutions |

to attract advanced competencies and technologies of the private partner, enabling the application of innovative solutions in the implementation of infrastructure projects |

to apply advanced technologies and effective management methods during the implementation of the project, thereby increasing the operating revenue |

to increase the efficiency of the project implementation due to the new quality of the project management based on the mechanism of market competition and involvement of professional business managers |

to obtain the access to state institutions, to participate in discussion of the project implementation and making strategic decisions on them, to harmonize plans for the development of business and state, to form a positive image using social advertising tools |

Thus, the high potential of PPP which has not yet been fully understood by all the subjects of the Russian economy may be in demand in its various branches, including the service industry as the most socially important branch of the national economy.

The results of the survey conducted by Russian scientists ("The Business Climate in the Real Sector and the Service Industry of Russia" in the second quarter of 2017) in which more than 5,000 directors of service organizations took part convincingly indicate the continued unfavorable business climate in the Russian service market. The entrepreneurial assessments of the level and dynamics of main performance indicators of service organizations following the results of the second quarter of 2017 remained practically unchanged in comparison with the previous period, the balances of positive and negative opinions remained in the zone of negative values:

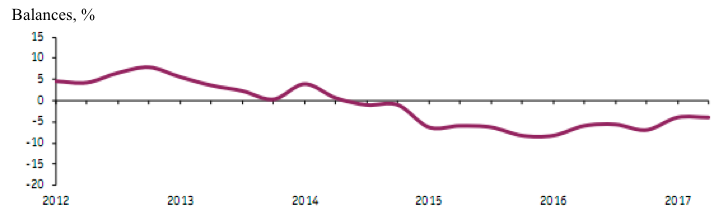

The index of entrepreneurial confidence retained the value of the previous quarter and amounted to -4% (Figure 3).

Figure 3

Dynamics of the index of entrepreneurial confidence in the service industry

In the beginning of 2017 the index of entrepreneurial confidence left the record low range of the previous two years and increased by 3 p.p. at once. However, this increase did not develop further, as evidenced by the retention of the indicator value at -4% in the second quarter. The assessment of this indicator is ambiguous: on the one hand, this is the best result for the last 2.5 years; on the other hand, it is not merely significantly worse than the pre-crisis values of 2012-2013, but also is below the zero level that delimits zones of high and low entrepreneurial confidence. The negative value of the entrepreneurial confidence index had been preserved for 3 years indicating the persistence of an unfavorable business climate in the Russian service industry. The predominantly positive business mood was demonstrated in the second quarter of 2017 only by entrepreneurs providing insurance, tourism, sanatorium and resort services, as well as services in the field of art and entertainment (in these segments the business confidence index ranged from +1 to + 5%). In the other service activities negative indicator values were formed.

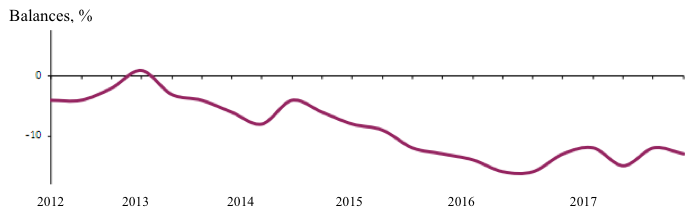

The demand for the services in the second quarter of 2017 continued to decline even more intensively than a quarter earlier. The balance of estimates of the change in the indicator (-13%) was 2 percentage points lower compared to the previous quarter (Figure 4). At the same time, about 40% of respondents answered that the level of demand in the organization was below the "normal" level (in 2013-2014 such estimates were given by no more than a third, and in 2012 by less than a quarter of entrepreneurs).

Figure 4

Dynamics of the demand for services in service organizations

The estimates of the dynamics of the quantity of services are provided. According to the generalized opinions of entrepreneurs, the balance of assessments of the change in this indicator was equal to -13% which was 3 percentage points lower than the value of the previous quarter. The employment in the service industry based on the survey results showed the same rate of decline in the previous quarter (-7%).

The study of the dynamics of prices for the services provided allowed ascertaining the stabilization (85%) of entrepreneurs. At the same time, 7% of respondents reported an increase in prices for services (tourism, spa, dental) and 8% reported a decline in the pawnshop, advertising and real estate business, while the balance in changes of this indicator took a negative value in two consecutive quarters (Figure 5).

Figure 5

Dynamics of pricing (tariffs) for services in service organizations

The analysis of the financial and economic situation in the service industry based on the results of the survey of entrepreneurs which in turn was guided by the assessment of the volume of profits received made it possible to identify the deterioration in the financial status of service organizations: the balance of estimates of changes in the volume of profits received repeated the value of the previous quarter (-16%). At the same time, despite the pronounced negative value this was the best result for the period from the beginning of 2015. The decrease in profits was noted in all of the observed services, with the most intensive one in the segments of advertising and transportation. According to the survey, insurance companies were the closest to positive financial results, the balance of estimates in this kind of activity almost reached the neutral position amounting to -1%.

Figure 6

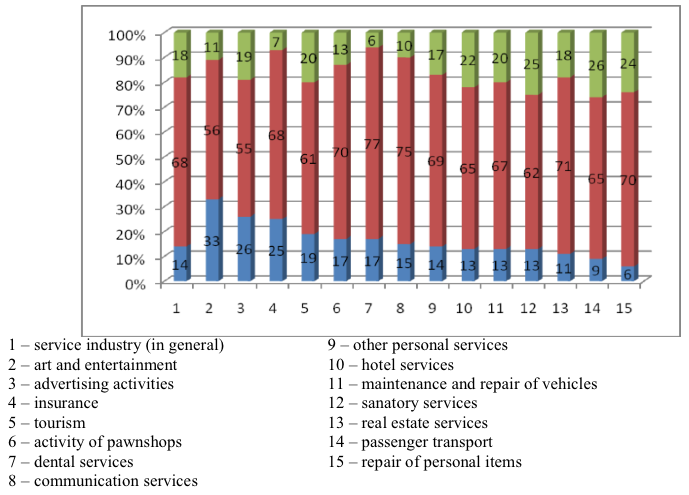

Assessment of the economic situation in service enterprises by the types of their economic activity

Estimating the economic situation of organizations in the second quarter of 2017 (Figure 6), 15% of managers reported a "favorable" economic situation, 67%- a "satisfactory", and 18% - an "unfavorable" economic situation (this distribution of estimates repeated the results of the previous survey period). The largest number (33%) of positive opinions was expressed by the entrepreneurs engaged in the field of art and entertainment, and negative (26%) - by the managers of passenger transport enterprises.

The assessment of the competitive potential of business changed little compared to the previous quarter and remained mostly negative. 78% of entrepreneurs considered the competitive position of their organizations to be "normal" and the balance of "high" and "low" ratings was equal to -14%. The negative balances developed in all types of services, except for dental practice where positive and negative estimates of the indicator were equal. The business competitiveness was assessed most pessimistically by realtors and the balance of estimates in this segment was equal to -24%.

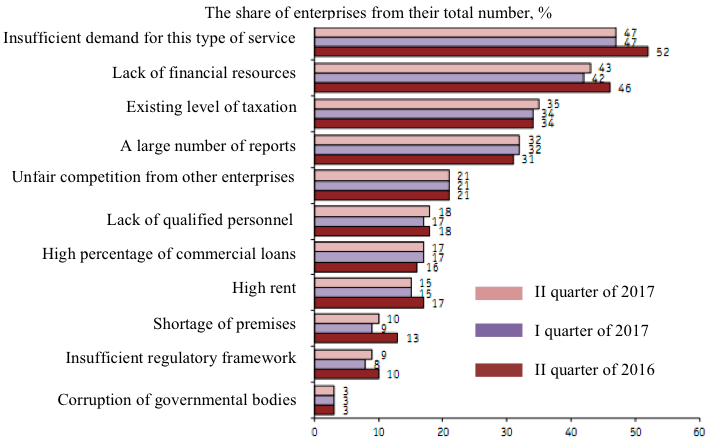

The study of factors limiting the activity of service enterprises makes it possible to identify a whole set of them. The top position of the rating is occupied by a lack of demand for services, but compared to 2016 the significance of this problem decreased (-5%). 43% of entrepreneurs noted the negative impact of the lack of financial means in the enterprises, 35% of entrepreneurs noted the existing tax rates, 32% - the large reporting load. Significant pressure of other limiting factors on business, such as unfair competition, a shortage of qualified personnel, high rental and loan rates, were mentioned by 15 to 21% of respondents, even less of them mentioned the lack of premises, a gap in the legislation and corruption of governmental bodies (Figure 7).

Figure 7

Assessment of factors restricting activities of service enterprises

Summarizing the results of the study and taking into account the market surveys data provided by the Rosstat (Federal State Statistics Service), it can be stated that the business climate in all the basic sectors of the country's economy (industry, construction, trade and services) is largely determined by the state of effective demand from the end consumer of goods and services, i.e. the part of the population. At the same time, service enterprises are particularly dependent on consumer demand. The service is rendered only at the time of consumption and an industrial enterprise can afford to store it as opposed to a service company. Moreover, even in force majeure situations the service industry is rarely supported by the state, it virtually has no bonuses from fluctuations in oil prices and exchange rates, as well as from import restrictions. Therefore, the chronic reduction in effective consumer demand with the transition of households to the selective savings model had a particularly strong impact on activities of service enterprises. According to the Rosstat, a permanent drop in real disposable money income has been observed for almost 2 years, and during these years, the results of entrepreneurial surveys revealed worsening of the business climate in the service industry. Consequently, it is vital for a wide range of service enterprises to find new mechanisms to produce quality services accessible to the public, and the public-private partnership should be recognized as one of them.

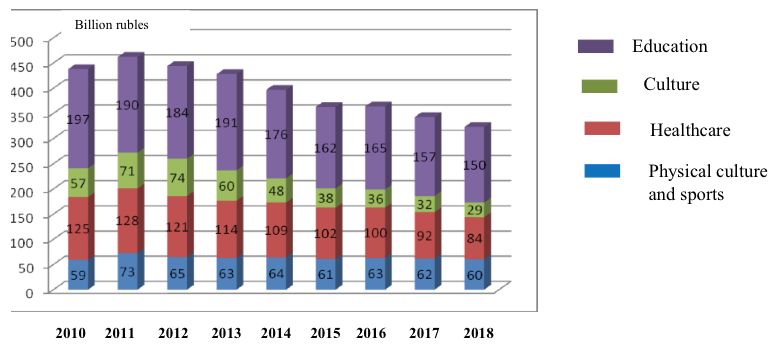

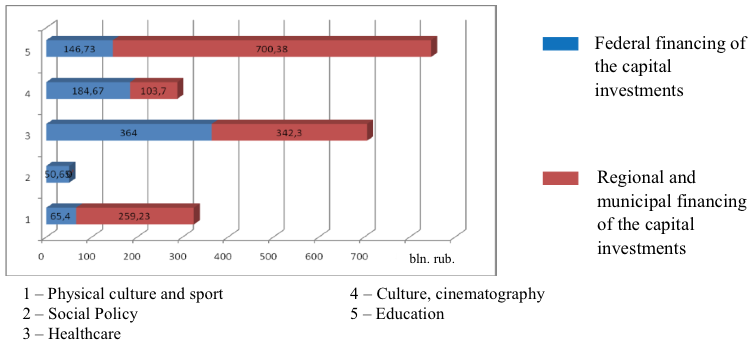

The improvement of the population welfare, the realization of rights and freedoms of citizens, the satisfaction of needs and interests of the society, the achievement of high quality of life largely depend on the provision of social infrastructure facilities. To ensure the sustainable development of human capital in the Russian Federation, it is required to overcome negative trends in reducing the accessibility of social infrastructure facilities for citizens and the depreciation of fixed assets of education, healthcare, physical culture and social services (Silvestrov S.N., 2008). In the context of the social infrastructure development, it is necessary to focus the attention on the improvement of the quality of the services rendered to the population through the involvement of non-state sector companies. In Russia, the market of private operators in healthcare, education and social services is being formed which will later enable to apply more effectively various PPP models for the efficient management of social infrastructure facilities (Fedorova E.A., Gurina V.A., Dovzhenko S.E., 2014; Yurieva T.V., 2015). This goal setting becomes very relevant under the conditions of the insolvency of the state budget to provide necessary financing to the construction of social facilities, the growth of which for the past 5 years was virtually nominal. In real terms (adjusted for the inflation index) expenditures of the federal budget and the subjects of the Russian Federation had negative dynamics (Figure 8). It should be noted that the education sector has the biggest impetus in increasing funding (The Best Practices for Implementing the Public-Private Partnership Projects in the Social Sphere, 2016).

Figure 8

Aggregate governmental expenditures on social infrastructure facilities

(industries/budgets of appropriate levels)

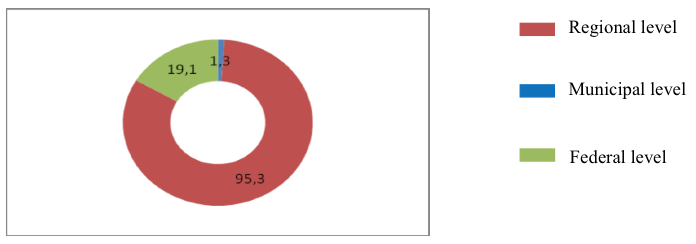

It should also be emphasized that the workload of the budgets of the constituent entities of the Russian Federation for the creation of social infrastructure facilities is significantly higher than that of the federal budget (Figure 9).

Figure 9

Aggregate governmental expenditures from the federal budget, the budgets

of the constituent entities of the Russian Federation and municipalities of an

investment nature for the period 2010-2015

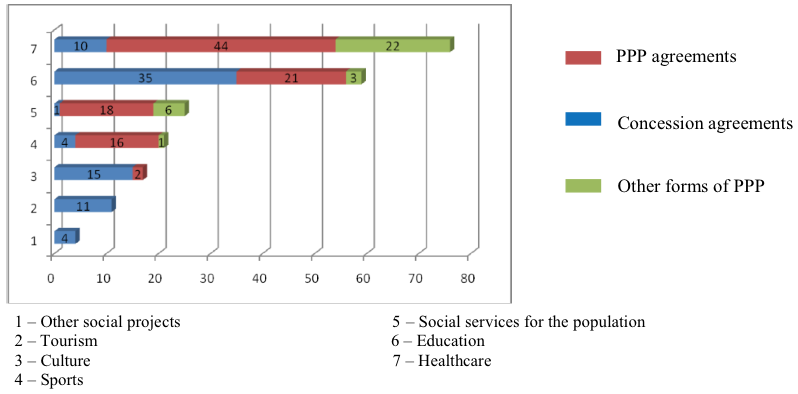

Thus, the data presented and other expert assessments point to the existing unmet need of the social sphere in the development of its infrastructure. In this connection, the problem of the improvement of the efficiency of disposal of the budgetary funds and incitement of the private sector investments inflow into the social sphere on the PPP principles becomes the focus of attention of the government, economists and scientists. Nowadays 212 PPP projects are being implemented in the social sphere, 172 of which have passed the stage of commercial closure (the agreements between public and private partners have been concluded).

Noting that in Russia the PPP market has not achieved the stage of formation yet, it would be interesting to compare it with respect to the participation in the social sphere with foreign markets. Thus, in the countries with a developed economic system the ratio of private sector investments in the social infrastructure based on PPP principles to nominal GDP is in the range of 3-4% (Bennett J., Iossa E., 2006). In Russia, the total amount of private investment in PPP projects in the social sphere slightly exceeds 100 billion rubles (Figure 10). Thus, taking into account Russia's GDP at the level of 120 trillion rubles, less than 0.1% of the potential for attracting investments into the social infrastructure has been used.

The financing of PPP projects in the social sphere, as a rule, is associated with significant difficulties due to the heterogeneity of demand, the complexity of predicting the consumer flow and the social impact assessment. To participate in social projects, a private investor should obtain substantial guarantees from a public party. To simplify the system of relations with investors, we used to divide facilities of the social infrastructure into two groups: 1) projects with the state guarantee for minimum profitability; 2) projects in which the flow of payments were driven by the consumer demand. In the first case, the financial model and risks of the project are understandable to the investors, which ensures higher investment attractiveness of the project. In the second case, the project is assessed as highly risky, and therefore it either loses its attractiveness or requires other guarantees. However, in both cases investments in the social projects are generally considered more risky and less marginal than, for example, investments in transport infrastructure projects.

Figure 10

The volume of private investment in PPP projects

in the social sphere (billion rubles)

Analyzing the dynamics of the PPP development in the social sphere, the increase in the number of projects should be noted, which at the beginning of 2016 amounted to 95 projects in comparison with the previous year. One of the reasons for this is the budget deficit and the growing development of the PPP sphere in the country. Main priority sectors in the implementation of PPP projects are healthcare and education. To a lesser extent, projects are being implemented into the sphere of tourism, culture, sports and social services for the population (Figure 11), but according to the experts, these sectors are the most promising for attracting business to the implementation of PPP projects.

Figure 11

The number of PPP projects in the social sphere

The study of the current PPP project market has made it possible to identify the best practices, significant and problematic aspects of their implementation, which are necessary for the subsequent replication of similar projects in the regions of the Russian Federation.

The best practices for implementing PPP projects in the constituent entities of the Russian Federation are the projects that meet the following criteria:

The implementation of the project using one of the forms of PPP;

The implementation of the project in the social sphere, namely in the field of healthcare and education, culture and cultural heritage, physical culture and sports, social services for the population;

The commercial closure of the project (signing of a document certifying the legal relationship of the parties to the project);

The measured socio-economic effect of the project;

The effective allocation of the rights and obligations of the parties, as well as the existing risks within the project;

The possibility of replicating/scaling the implementation of the PPP project in other regions of the Russian Federation.

The examples of the implementation of the strategy for the involvement of the private investment in the social infrastructure facilities, which have significantly improved the quality of services rendered to the public in public-legal entities, are given below (Table 2).

Table 2

The Best practices for implementing the PPP projects in the social sphere

Industry |

Facilities built |

Healthcare |

The Center for extracorporeal hemocorrection and transclinic physiology of the Samara region; the network of centers of general practitioners in municipalities in the Ulyanovsk region |

Education |

Construction of preschool and general education institutions in the Yamal-Nenets Autonomous District |

Social services for the population |

Construction and operation of a municipal bath in Novosibirsk

|

Physical culture and sports |

Construction of an ice palace of sports in Ulyanovsk |

Culture and cultural heritage |

Reconstruction and improvement of the park of culture in Syzran Reconstruction and restoration of the museum-reserve "Polotnyany Zavod" in the Kaluga region |

The projects within which a final social service is provided to the population by the private operator have been selected as the examples. The collection of the best practices as the PPP market develops will be regularly updated with new cases.

The existing budgetary constraints of the subjects of the Russian Federation have the greatest impact on the availability of quality services meeting modern standards and objectives of socially-oriented development. Moreover, the traditional prevailing funding for such industries as the defense industry complex or the transport sector is several times higher than the expenditure on the social sectors. This is due to a number of factors. For instance, in the transport infrastructure the increase in investments (in 2016 the total volume of investments in PPP projects in the transport sector amounted to more than 1.1 trillion rubles, 70% of the total market volume in monetary terms) allows to achieve a greater multiplier effect since it leads to a significant increase in the speed of transportation raising the capacity of transport routes, greater accessibility and expansion of the range of transport services for citizens and improving the investment climate in the country. However, despite all the positive aspects it is important to adhere to the balanced development of industries and to avoid any significant tilt towards any of them, especially in the situation of an unsatisfactory state of the public infrastructure in the social sphere.

Due to the high social importance and efficient nature of the interaction between public and private partners, there is a need to create a monitoring system in the field of PPP projects. The monitoring should be conducted to assess quantitative and qualitative indicators, with the acceptable costs for all participants. It should provide appropriate penalties for the improper quality and the violation of the volume of services provided, as well as take into account particularities of each project and the scope of its implementation.

In modern conditions, the public-private partnership based on the principle of mutual benefits for authorities and business community becomes one of the most effective mechanisms for modernizing the Russian economy, including the infrastructure development and increasing the investment attractiveness of the regions and municipalities. In the sphere of services, the use of the PPP mechanisms leads to a healthy business climate accompanied by unchanged expansion of the assortment, as well as the quality and accessibility of the services provided to the population of the corresponding territory. Consequently, there has recently been a steady demand for infrastructure investments, new interesting and mutually beneficial proposals are coming to project participants, the pool of investors is expanding and the number of infrastructure companies interested in a long-term partnership is growing.

The potential for the PPP mechanisms’ implementation in the domestic economy apart from modernizing its infrastructure is also largely determined by another no less important result related to the achievement of new quality of the state property management and increased financial returns from the state economic assets, to which the state does not lose the ownership (as opposed to the privatization policy). Consequently, the PPP as a new concept of interaction between state and business communities should act as a stimulating factor for the transformation in the Russian entire economic environment.

Akintoye, A., Beck, M. & Hardcastle, C. (2008). Public-Private Partnerships: Managing Risks and Opportunities. John Wiley & Sons.

Akitoby, B., Hemming, R. & Schwartz, G. (2007). Public Investment and Public-Private Partnerships. IMF Economic Review. Issues 40. Washington D.C.: International Monetary Fund. Retrieved October 26, 2017 from http://www.ebrd.com/country/sector/law/concess/about/pppimf.pdf

Alpatov, A.A., Pushkin, A.V. & Japaridze, R.M. (2010). Gosudarstvenno-chastnoe partnerstvo: Mekhanizmy realizatsii [Public–private partnership: Implementation mechanisms]. Moscow: Alpina Pablisherz.

Bennett, J. & Iossa, E. (2006). Delegation of Contracting in the Private Provision of Public Services. Review of Industrial Organization, 29(1/2), 75-92.

Delmon, J. (2009). Private Sector Investment in Infrastructure: Project Finance, PPP Projects and Risk. Alphen Aan Den Rijn, The Netherlands: Kluwer Law International.

Delovoy klimat v realnom sektore i sfere uslug Rossii vo II kvartale 2017 goda [The business climate in the real sector and service segment in Russia in the second quarter of 2017]. (2017). Moscow: NIU VSHE.

Deryabina, M.A. (2008). Gosudarstvenno-chastnoe partnerstvo: teoriya i praktika [Public-private partnership: theory and practice]. Voprosy ekonomiki, 8, 64-78.

Eganyan, A. (2015). Investitsii v infrastrukturu. Dengi, proekty, interesy. GCHP, kontsessii, proektnoe finansirovanie [Investments in infrastructure. Money, projects, interests. PPP, concessions, project financing]. Moscow: Alpina Pablisher.

Fedorova, E.A., Gurina, V.A. & Dovzhenko, S.E. (2014). Upravlenie gosudarstvenno-chastnymi proektami v otrasli ZHKKH [Management of public-private projects in the housing and utilities sector]. Menedzhment v Rossii i za rubezhom, 2, 37-45.

Gerrard, M.B. (2001). Public-Private Partnerships: What Are Public-Private Partnerships, and How Do They Differ from Privatizations? Finance and Development, 38(3), 48-51.

Kabashkin, V.A. (2010). Sovershenstvovanie upravleniya proektami, realizuemymi na usloviyakh gosudarstvenno-chastnogo partnerstva [Improvement of the management of the projects implemented on the basis of the public-private partnership]. Finansovyi analiz: problemy i resheniya, 3(27), 2-5.

Klijn, E.H. & Teisman, G.R. (2000). Governing Public-Private Partnerships: Analyzing and Managing the Processes and Institutional Characteristics of Public-Private Partnerships. Public-Private Partnerships: Theory and Practice in International Perspective, 84-102.

Kwak, Y.H., Chih, Y.Y. & Ibbs, C.W. (2009). Towards a Comprehensive Understanding of Public Private Partnerships for Infrastructure Development. California management review, 5(2), 51-78.

Luchshie praktiki realizatsii proektov gosudarstvenno-chastnogo partnerstva v sotsialnoi sfere [The best practices for implementing the public–private partnership projects in the social sphere]. (2016). Moscow: Agentstvo strategicheskikh initsiativ, Tsentr razvitiya gosudarstvenno-chastnogo partnerstva.

Pethe, A. & Ghodke, M. (2002). Funding Urban Infrastructure: From Government to Markets. Economic and Political Weekly, 37(25), 2467-2470.

Pongsiri, N. (2002). Regulation and Public-Private Partnerships. International Journal of Public Sector Management, 15(6), 487-495.

Prakticheskoe rukovodstvo dlya investorov "Gosudarstvenno-chastnoe partnerstvo v stranakh Evraziiskogo ekonomicheskogo soyuza" [Practical guide for investors "Public-private partnership in the countries of the Eurasian Economic Union"]. (2017). Moscow: Tsentr razvitiya GCHP.

Sylvestrov, S.N. (2008). Gosudarstvenno-chastnoe partnerstvo v innovatsionnykh sistemakh [Public-private partnership in innovative systems]. Moscow: Izdatelstvo LKI.

Van Ham, H. & Koppenjan, J. (2001). Building Public-Private Partnerships: Assessing and Managing Risks in Port Development. Public Management Review, 3(4), 593-616.

Varnavsky, V.G., Klimenko, A.V. & Korolev, V.A. (2010). Gosudarstvenno-chastnoe partnerstvo: teoriya i praktika [Public-private partnership: theory and practice]. Moscow: ID GU VSHE.

Veselovsky, M.Y., Abrashkin, M.S., Aleksakhina, V.G. & Pogodina, T.V. (2015). Features of State Regulation of the Economy in Terms of Its Transition to Innovative Way of Development. Asian Social Science, 11(1), 288-296.

Veselovsky, M.Y., Gnezdova, J.V., Menshikova, M.A., Izmailova, M.A. & Romanova, J.A. (2015). Mechanism of Use of Public and Private Partnership in Order to Develop Innovative Economy. Journal of Applied Economic Sciences, 10(5/35), 625-634.

Yurieva, Т.V. (2015). Mekhanizmy vzaimodeistviya publichnykh i chastnykh partnerov [Mechanisms of interaction between public and private partners]. Nauchnoe obozrenie, 8, 284-291.

1. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49

2. Institute of Commodity Logistic Research and Wholesale Market Situation, 125319, Russia, Moscow, Chernyakhovsky Str, 16

3. Institute of Commodity Logistic Research and Wholesale Market Situation, 125319, Russia, Moscow, Chernyakhovsky Str, 16

4. Institute of Commodity Logistic Research and Wholesale Market Situation, 125319, Russia, Moscow, Chernyakhovsky Str, 16

5. University of Technology, 141070, Russia,Moscow Region,Korolev,Gagarin str.,42; E-mail: shutova_tv@mail.ru