Vol. 39 (Number 19) Year 2018 • Page 41

Bahram Shabani DIZ Abadi 1; Peyman BARZEGAR Keliji 2; , Mostafa ABEDINI 3

Received: 04/01/2018 • Approved: 03/02/2018

ABSTRACT: With increasing competition in production and services, organizations needed indicators and patterns to test their performance. One of the most successful tools is the implementation of strategic plans of the organization for balancing a scorecard. The purpose of this study is to evaluate the performance of financial institutions in Mazandaran province. Balanced Scorecard is an appropriate tool for designing performance evaluation and measuring them from four perspectives: Financial, customer, internal processes and growth and innovation.This research has been carried out using a balanced scorecard model and fuzzy analytic network process in evaluating the performance of financial institutions in Mazandaran province. The method of this research is descriptive and used to collect the information needed to conduct research from various types of field methods, libraries, observation and some interviews. Following the Delphi process, 22 final indicators were found to be effective in financial institutions of the province. Subsequently, using the fuzzy analytic network process, the indicators of income increase, innovation degree and margin of profit were identified as indicators of the performance evaluation of financial institutions of Mazandaran province, indicating that financial indicators as the most important indicators in The evaluation of the performance of these institutions is considered. Finally, they were chosen among the more important and practical indicators for performance evaluation. |

RESUMEN: Con la creciente competencia en producción y servicios, las organizaciones necesitaban indicadores y patrones para probar su desempeño. Una de las herramientas más exitosas es la implementación de planes estratégicos de la organización para equilibrar una tabla de puntuación. El propósito de este estudio es evaluar el desempeño de las instituciones financieras en la provincia de Mazandaran. Balanced Scorecard es una herramienta adecuada para diseñar evaluaciones de desempeño y medirlas desde cuatro perspectivas: financiera, cliente, procesos internos y crecimiento e innovación. Esta investigación se ha llevado a cabo utilizando un modelo de cuadro de mando integral y un proceso de red analítica difusa para evaluar el desempeño financiero. instituciones en la provincia de Mazandaran. El método de esta investigación es descriptivo y se utiliza para recopilar la información necesaria para realizar investigaciones de varios tipos de métodos de campo, bibliotecas, observación y algunas entrevistas. Tras el proceso Delphi, se descubrió que 22 indicadores finales eran efectivos en las instituciones financieras de la provincia. Posteriormente, utilizando el proceso de red analítica difusa, los indicadores de aumento de ingresos, grado de innovación y margen de ganancia se identificaron como indicadores de la evaluación del desempeño de las instituciones financieras de la provincia de Mazandarán, indicando que los indicadores financieros son los indicadores más importantes en La evaluación de la el rendimiento de estas instituciones se considera. Finalmente, fueron elegidos entre los indicadores más importantes y prácticos para la evaluación del desempeño. |

In today's world economic literature, it is quite clear that the role and importance of the financial system, the money and capital market, and, consequently, financial and credit institutions as the operating arms of this system and the means of economic development of countries. It is not possible to develop sustainable economic growth without the development of financial markets. Hence, financial and credit organizations play a central role in this field. (Farneti, 2009) has expanded the banking services in the world through the networks of information and communication technology and the development of banks and virtual and semi-virtual financial institutions And the presence of a private banking system in the country, high competition in the banking industry. (Wu et al., 2009). Competitiveness, durability, new service delivery, continuous change in the needs and demands of customers, has pushed banks to develop their strategies in such a way that while retaining current customers, attract new customers by providing more desirable services. Therefore, the performance of organizations must be measured by a performance measurement system that provides a comprehensive view of the business to managers (Momeni & etal, 2011). Therefore, it’s very important to maintain and maintain their performance, banks can play a significant role in continuous development and optimal allocation of resources; In certain circumstances, in order to determine the methods of investment and accountability, other than the financial performance of banks, their non-financial performance should also be assessed for all shareholders, which performs these functions through criteria such as service quality, Customer Satisfaction and Personnel Satisfaction (Wu et al., 2009) Kaplan & norton (1992) have developed a new method for measuring performance under the title of "Balanced Scorecard."

In traditional performance evaluation systems, managers emphasize financial metrics in performance measurements, but in the current era, this issue has been severely criticized because it offers a mere focus on financial performance with poor results in performance evaluation. In the conventional method of balanced scorecard, in addition to the financial scale, the performance of the organization is also evaluated from three perspectives of the customer, business processes and growth and learning. (Alam Tabriz & Mohammad rahimi, 2009). On the other hand, the main components of each performance evaluation system are the indicators and criteria of that system, because the relationship between the performance evaluation model and the external and internal environment of the organization is determined by indicators and criteria. In fact, a set of performance indicators and the relationship between their results form a performance evaluation model.

The importance of the role of indicators in evaluating the proper and proper functioning of the organization is quite evident. Organizations should adopt principles and frameworks in designing and selecting criteria for performance evaluation. Criteria should be designed and selected to enable the effectiveness and effectiveness of the performance evaluation system. But in most cases organizations are neglected at this stage and generally choose criteria that the ability to measure and evaluate reveal the different dimensions of the organization, both domestic and foreign, and can not address the long and fundamental problems of the organization that has so far been out of date (de Waal, 2010: 81).

Discussions and interviews with industry experts, consultants and top executives indicate that they provide reasons for responding to this issue, but what they all strongly emphasize and as the main answer is that the current performance evaluation model The company and the defined indicators do not have the ability to accurately and comprehensively measure all activities of the company. They believe that the appraisal of the company's performance is not based solely on the results obtained from the company's financial activities. They have reasons that financial indicators can not be used in all parts of the organization, they can not predict future threats and opportunities, employees do not trust their results, and these results are unrealistic, the ability to measure certain aspects of company activity, such as customer satisfaction do not offer.

Therefore, according to the above mentioned materials and studies carried out in the field of financial institutions in the country and specifically in Mazandaran province, the problem and research questions have been designed in a way that is appropriate to the actual space of the institutions studied. This point in the statement of the problem is as follows and is also expressed in assumptions that the indexes do not have the necessary characteristics. That this research the problem is designed to do is to assess the performance indicators of financial institutions (banks) in order to be able to measure the performance of the company comprehensively and on the other hand, in the current context, whether the indicators have the desired characteristics? In the form of the following questions:

Is performance benchmarks used by the code agency?

What is the status of indicators of performance evaluation in financial institutions in Mazandaran province?

Shirouyehzad & et al. (2017) conducted a research entitled Performance Evaluation and Organization Prioritization Based on Knowledge Management and Safety Management using the DEA Method. The proposed method was implemented in automotive industry in Isfahan province. The results revealed that among the 12 decision-making units, there are 4 efficient units, which are output customer satisfaction, and 5 efficient units, which are considered as incident events. In a ranking with customer satisfaction as an outlet, Sepahan Pump Atlas Company was the first to find the ideal solution for the first time through an incredibly efficient method of data envelopment analysis and similarity. In the ranking of incidents as output, Sepahan Atlas Pump Company was ranked for the first time through the strong productivity method, and the company's artisan was ideally suited for the first time by analyzing data coverage and similarity.

Karsak & Karadayi (2017) conducted a research to provide a framework for assessing the health performance of areas using the obscure data envelopment analysis method. The proposed vague DEA approach, the fourth set is a more realistic decision-making method for assessing the performance of relative health care, as well as determining the best health care district in Istanbul.

Sharma et al. (2016) conducted a study entitled Modeling the performance of rail transport services by analyzing data coverage for Indian railway lines. A model used by the Indian Rail Company through the DEA to evaluate the performance of different areas and monitor the improvement in the field of a transportation service provider; it can identify the inefficient areas of the parameters for improvement across regions and along the time dimension. The large workforce for all dysfunctional areas before using resources can show the level of policy seen. In addition, for the equivalent kilometer, use of non optimal resources. Given the importance of adequate quality of service can be one of the major findings of inefficient areas.

Fenyves & et al. (2015) conducted a research on the financial performance of agricultural companies using the DEA method. Based on the analysis of the company data, DEA's selection is provided for comparing and analyzing the performance of appropriate corporate profits. Regression calculations were used to evaluate the variables. The bench marking module is used to calculate the research statistics.

De Felice & Petrillo (2013) integrated the BSC model into the Analytic network process (ANP) by presenting the proposed MAB model to assess the performance of the fashion industry. Following this research, he concludes that the proposed multi-criteria balanced scorecard approach can solve the problem of neglecting the analysis of strategic measures and timing of solving the BSC model

BENTES etal. (2012) used the BSC and AHP models to evaluate the performance of the operating units. Use the scorecard to extract key performance indicators and the AHP model to prioritize alternatives. He introduces this method as an effective and complementary interactive method for performance evaluation .

Dodangeh & Rosnah (2011), in a fuzzy design study, states that EFQM is widely used in Europe and around the world, and is the basis for most international, national and regional awards. This is a special tool that can help identify areas of development. However, the current model of the EFQM has some problems and problems that can not distinguish priorities in areas.

Awasthi et al. (2010) used his paper entitled "A Fuzzy Multi-criteria Approach to Assess Supplier Performance" of Three-Way Evaluation. Not a good step, including criteria for evaluating suppliers' environmental performance. In the second step, the rate of expertise of selected criteria and different options against each of the criteria has been identified. At this stage, the linguistic rates have been created through fuzzy Topsis to create a comprehensive functional score for each option, and in the third step, analysis of the sensitivities associated with The effect of the weight of the criteria on the environmental performance assessment of the suppliers has been examined. The strength of the applied approach is its practical ability to provide solutions that are under the circumstances that do not have some amount of information in hand.

Jyoti & Deshmukh (2008) assessed the performance of the National Research and Development Organization using the DEA-AHP Integrated Methods. Provides comparative performance for national R & D organizations, not only on the basis of output but also on the basis of output quality and more comprehensive and more realistic results for decision-makers in the national benchmark of R & D organizations and inefficient organizations.

The purpose of this study is to investigate and analyze in terms of data collection. The statistical population of this research includes all experts in financial institutions of Mazandaran province, which are familiar with the performance evaluation topic, and considering that the title of this research has been mentioned and the aim of presenting the model has been named from the managers of bank branches and senior managers as the statistical community. In this research, 12 people have been used to analyze fuzzy Delphi and to analyze the fuzzy analytic network process.

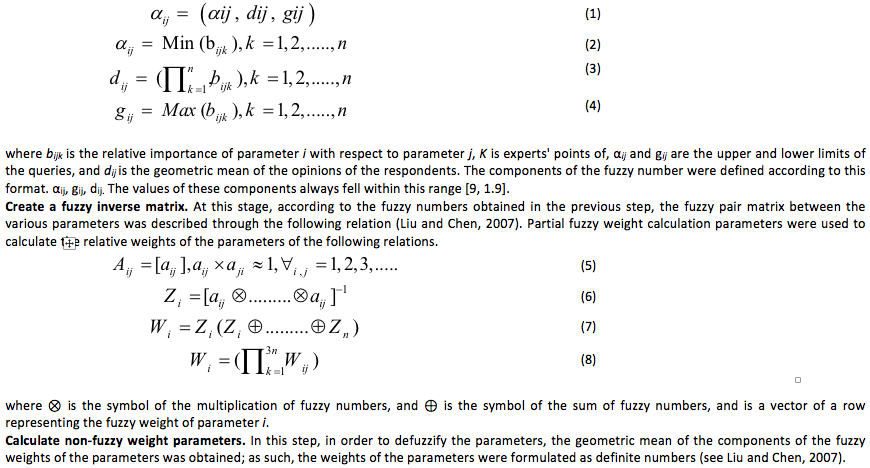

In this study, the method proposed by Liu and Chen (2007) was used to implement the fuzzy Delphi analysis process. The process of this method involved the following steps.

Collet experts' opinions. First, the experts were asked to scrutinize the parameters influencing a given decision in terms of importance, using a qualitatively or, if possible, quantitatively scale (Very Important = 9; Important = 7; Relatively Important = 5; Minimally Important = 3; Not Important = 1).

Calculate fuzzy numbers. To calculate fuzzy numbers, αij values were considered, based on the opinions expressed by the experts (Ataei, 2010). Fuzzy numbers at this stage could be calculated based on different membership functions such as the triangular or trapezoidal state. Considering the high application and simplicity of the triangular method, a fuzzy number was defined through the following relations (Liu and Chen, 2007).

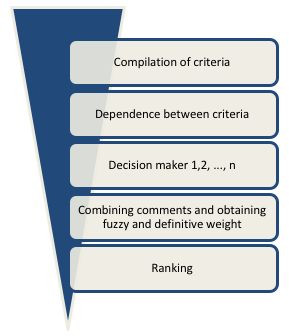

The proposed model has become the focus of this research is based on partnerships pyramid structure and selection process consists of four steps in the process of transplantation, Figure 1.

The first step: selection criteria to prioritize the factors affecting

Step Two: Identify the relationship between criteria

Step Three: Calculate weights of the criteria

Step Four: Ranking Options and Indicators

Figure 1

Fuzzy Analytic network process

To determine the relationship of dependency, the analytic network process technique, developed by the hierarchical analysis process, is used to determine the relative importance of the criteria. The analytic network process has been developed for this purpose, without considering the assumptions about the one-way hierarchical relationship between decision levels, to more realistic conditions for decision-making. In order to replace the discretion, the linear form of top-down and strictly hierarchical model of the hierarchical analysis process model, the model of the analytic network process, is the structure of the flexible network.

The relative importance or elemental power of the element is measured by the bipolar scale, similar to that of the hierarchical analysis process. The analytic network process, in comparison with the hierarchical analysis process, can establish the interrelations between decision levels and indices by obtaining compound weights, from The process of forming a cloud matrix runs. The purpose of the cloud matrix in the analytic network process is the partitioned matrix, each sub matrix of which is a set of relationships between two elements or clusters in the network structure. Without regard to the assumption of dependency among the criteria, experts or decision makers are asked to evaluate all the proposed criteria through paired comparisons. They respond to questions such as "which criteria should be taken into consideration in the unit evaluation and how much more?".

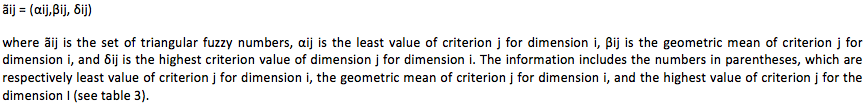

Although experts who use their competencies and mental abilities to make comparisons, it should be noted that the process of analytical hierarchy analysis does not fully capture the reflection of the style of human thinking. In other words, the use of fuzzy sets has more compatibility with linguistic and sometimes vague human descriptions, and it is therefore best to use long-term prediction and real-world decision making using fuzzy sets (using fuzzy numbers). Since the numbers used in this method are triangular fuzzy numbers, we have investigated the fuzzy scales used in the fuzzy hierarchical process analysis process method: Calculation of Triangular Fuzzy Numbers: Considering the relative importance of the values calculated in the previous step, triangular fuzzy numbers are calculated to integrate all expert opinions. The set of triangular fuzzy numbers is defined as follows.

Therefore, in this research, the full fuzzy analytic network process (ranking of options) has been used. The final weight obtained in previous steps in the obtained preferences (the result is the average of the expert opinions). It has been shown that the questionnaire of this section with the spectrum of the type five is shown in the table below. It is determined that after the weight multiplication of each index in the average of the opinion poll's preference, the numbers obtained in the options column are aggregated, and the resulting weight forms the weight of each option, which is ultimately based on the best option (Daogdviren et al., 2008 ) (see table 1).

Table 1

Linguistic values and mean of fuzzy numbers

|

very little |

Low |

medium |

Much |

too much |

Negative indicators |

1 |

0.75 |

0.5 |

0.25 |

0 |

Positive Indicators |

0 |

0.25 |

0.5 |

0.75 |

1 |

(Daogdviren & et al., 2008).

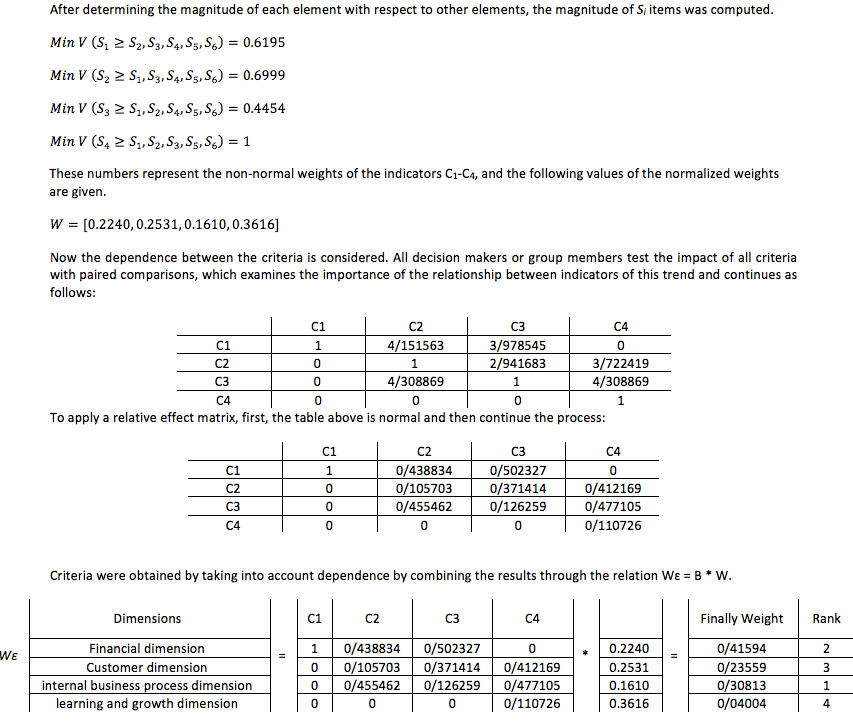

In this sub-section, the indicators extracted from the literature were processed through the fuzzy Delphi, which involved four stages. In the first stage, according to the options shared, the difference between the two stages was less than the threshold value (0.1), in which case, the polling process was terminated (Cheng & Lin, 2002). The indicators were used for finalization and the final indicators were also found (see Table 2).

Table 2

List of initial and finalized indicators:

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

first fuzzy number (MIN) |

second fuzzy number (GEOMEAN) |

third fuzzy number (MAX) |

defuzzied Number [4] |

First round |

Second round |

third round |

Fourth round |

||

Financial dimension |

EPS |

3 |

2 |

3 |

3 |

2 |

3 |

3 |

3 |

3 |

2 |

3 |

2 |

2 |

2/620741394 |

3 |

2/844814651 |

|

|

|

|

ROI |

3 |

2 |

2 |

2 |

2 |

4 |

4 |

3 |

2 |

2 |

3 |

4 |

2 |

2/632148026 |

4 |

3/841962994 |

|

|

|

|

|

ROE |

3 |

3 |

3 |

3 |

2 |

2 |

3 |

2 |

2 |

3 |

3 |

3 |

2 |

2/620741394 |

3 |

2/844814651 |

|

|

|

|

|

ROA |

3 |

2 |

3 |

3 |

3 |

3 |

3 |

3 |

2 |

3 |

3 |

3 |

2 |

2/803965796 |

3 |

2/799008551 |

|

|

|

|

|

Revenue growth |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

5 |

4 |

4/151563262 |

5 |

4/962109184 |

|

|

|

|

|

Net profit margin |

5 |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

3 |

4/129295218 |

5 |

4/717676196 |

|

|

|

|

|

Fixed assets turnover rate |

4 |

4 |

4 |

4 |

4 |

2 |

3 |

4 |

4 |

4 |

4 |

4 |

2 |

3/68606167 |

4 |

3/578484582 |

|

|

|

|

|

Receivables turnover rate |

4 |

4 |

4 |

2 |

3 |

3 |

3 |

4 |

4 |

3 |

3 |

3 |

2 |

3/269676531 |

4 |

3/682580867 |

|

|

|

|

|

Inventory turnover ratio |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

4 |

3 |

3 |

3 |

3 |

3/634241186 |

4 |

3/841439704 |

|

|

|

|

|

Operating cash flow ratio |

3 |

4 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

4 |

3 |

3/722419436 |

4 |

3/819395141 |

|

|

|

|

|

Customer dimension |

Customer satisfaction |

4 |

3 |

4 |

4 |

3 |

4 |

4 |

4 |

3 |

3 |

3 |

2 |

2 |

3/349009284 |

4 |

3/662747679 |

|

|

|

|

Customer relationship |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

3 |

4 |

4 |

3 |

3 |

3/722419436 |

4 |

3/819395141 |

|

|

|

|

|

Customer retention rate |

4 |

3 |

4 |

3 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

3 |

3/722419436 |

4 |

3/819395141 |

|

|

|

|

|

Customer acquisition rate |

5 |

4 |

4 |

3 |

4 |

4 |

4 |

5 |

4 |

4 |

5 |

4 |

3 |

4/129295218 |

5 |

4/717676196 |

|

|

|

|

|

Customer complaint rate |

5 |

4 |

5 |

4 |

4 |

5 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4/30886938 |

5 |

4/922782655 |

|

|

|

|

|

Customer profitability |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

5 |

4 |

5 |

4 |

4 |

4 |

4/229485054 |

5 |

4/942628737 |

|

|

|

|

|

Degree of innovation |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4/151563262 |

5 |

4/962109184 |

|

|

|

|

|

Service quality |

5 |

4 |

4 |

4 |

5 |

4 |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

4/30886938 |

5 |

4/922782655 |

|

|

|

|

|

Image and reputation |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

4 |

3 |

3 |

4 |

3 |

3/722419436 |

4 |

3/819395141 |

|

|

|

|

|

Market share rate |

4 |

3 |

4 |

4 |

4 |

3 |

4 |

4 |

3 |

2 |

3 |

3 |

2 |

3/349009284 |

4 |

3/662747679 |

|

|

|

|

|

internal business process dimension |

Product defect rate |

4 |

4 |

4 |

4 |

3 |

4 |

3 |

4 |

4 |

4 |

4 |

4 |

3 |

3/812737172 |

4 |

3/796815707 |

|

|

|

|

Product return rate |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

4 |

3 |

4 |

3 |

3/812737172 |

4 |

3/796815707 |

|

|

|

|

|

Innovation ability |

4 |

5 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4/151563262 |

5 |

4/962109184 |

|

|

|

|

|

New product development ability |

4 |

5 |

5 |

5 |

5 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4/389743692 |

5 |

4/902564077 |

|

|

|

|

|

The number of new products developed |

4 |

4 |

5 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4/151563262 |

5 |

4/962109184 |

|

|

|

|

|

Process capability |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

3/905246303 |

4 |

3/773688424 |

|

|

|

|

|

Productivity |

3 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

3 |

3/722419436 |

4 |

3/819395141 |

|

|

|

|

|

Production plan achievement |

4 |

4 |

4 |

5 |

3 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

3 |

4/05321927 |

5 |

4/736695182 |

|

|

|

|

|

Duration of production time |

5 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

5 |

4 |

4/229485054 |

5 |

4/942628737 |

|

|

|

|

|

Equipment failure rate |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4/07507706 |

5 |

4/981230735 |

|

|

|

|

|

learning and growth dimension |

Staff education and training |

3 |

4 |

4 |

3 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

3 |

3 |

3/634241186 |

4 |

3/841439704 |

|

|

|

|

Employee empowerment level |

3 |

3 |

3 |

3 |

4 |

4 |

3 |

4 |

3 |

4 |

3 |

3 |

3 |

3/301927249 |

4 |

3/924518188 |

|

|

|

|

|

Employee attendance |

4 |

4 |

4 |

3 |

4 |

4 |

3 |

4 |

4 |

3 |

4 |

4 |

3 |

3/722419436 |

4 |

3/819395141 |

|

|

|

|

|

Employee turnover |

4 |

3 |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

4 |

3 |

3/812737172 |

4 |

3/796815707 |

|

|

|

|

|

Employee Loyalty |

4 |

4 |

5 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

5 |

5 |

4 |

4/30886938 |

5 |

4/922782655 |

|

|

|

|

|

Number of proposals from staff |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

3 |

4 |

4 |

4 |

4 |

3 |

4/05321927 |

5 |

4/736695182 |

|

|

|

|

|

Staff work time |

5 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4/229485054 |

5 |

4/942628737 |

|

|

|

|

|

Average staff productivity |

4 |

5 |

5 |

5 |

5 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4/389743692 |

5 |

4/902564077 |

|

|

|

|

|

Staff performance evaluation |

5 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4/229485054 |

5 |

4/942628737 |

|

|

|

|

|

Team performance |

4 |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4/229485054 |

5 |

4/942628737 |

|

|

|

|

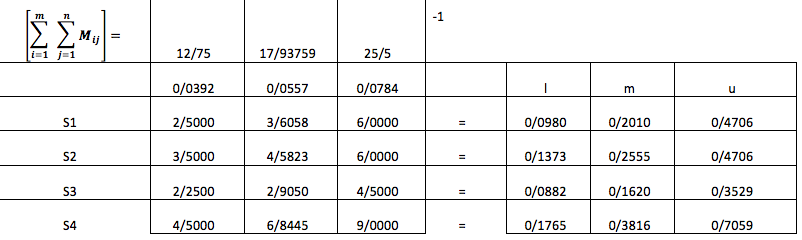

This section is divided into seven sub-parts, including weighting and dimensioning information. The sub-components were analyzed according to the method of fuzzy network analysis process, and were further developed to analyze the identification of the effective factors. In this section, due to constraints of space, only one sample is presented. After the questionnaire was designed, copies of it were submitted to the 12 industry experts who participated in the study. Next, confirmation and the criteria for analysis were considered. At this stage, the comparison was paired with the relative importance of all the questionnaires. Accordingly, the matrix of paired comparisons was created, and the importance coefficient of the main indicators of performance evaluation, as well as the pairwise matrix of the coefficient of significance of indices relative to the index, were computed .

Given the relative importance of the calculated values in the previous step, triangular fuzzy numbers were calculated to integrate all expert opinions. The triangular fuzzy set was defined via.

Table 3

Matrix of Triangular Fuzzy Numbers

1 |

2 |

3 |

4 |

|||||||||

dimensions |

1 |

2 |

3 |

1 |

2 |

3 |

1 |

2 |

3 |

1 |

2 |

3 |

Financial dimension |

1 |

1 |

1 |

0/5 |

0/66742 |

1 |

0/5 |

1/189207 |

2 |

0/5 |

0/749154 |

2 |

Customer dimension |

1 |

1/498307 |

2 |

1 |

1 |

1 |

1 |

1/33484 |

2 |

0/5 |

0/749154 |

1 |

internal business process dimension |

0/5 |

0/840896 |

2 |

0/5 |

0/749154 |

1 |

1 |

1 |

1 |

0/25 |

0/31498 |

0/5 |

learning and growth dimension |

0/5 |

1/33484 |

2 |

1 |

1/33484 |

2 |

2 |

3/174802 |

4 |

1 |

1 |

1 |

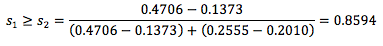

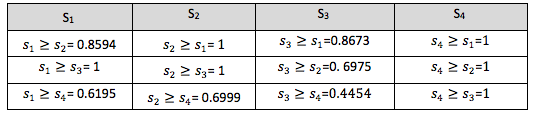

At this stage, using the definitions of the fuzzy network analysis process, the coefficients of each of the pairwise matrices were calculated.

The magnitude of each element on other elements was calculated (see table 4).

Table 4

The magnitude of each element on other elements was calculated

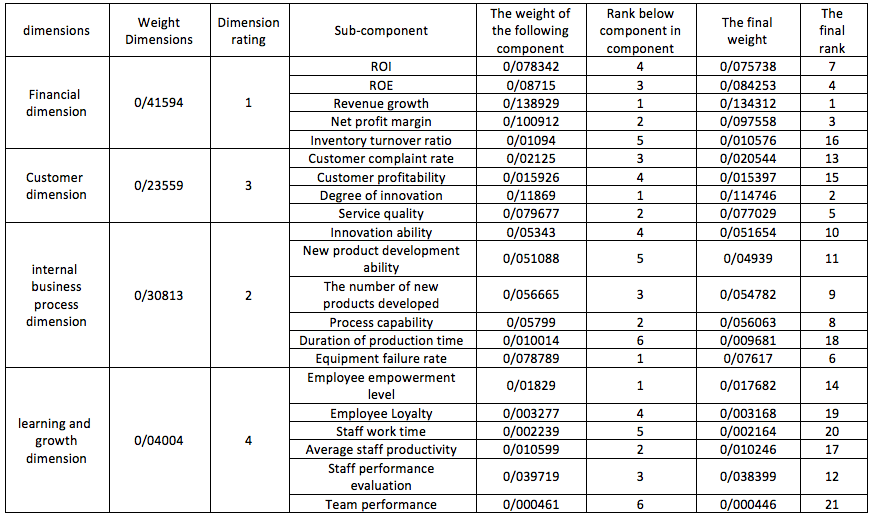

Table 5 shows the total weights of indicators calculated based on the relationships mentioned above and the processes, along with final weights .

Table 5

Final weighting of indicators

Following the review of existing literature, it has been identified in the field of financial performance assessment in banks and financial institutions, which various methods and indicators have been introduced and applied to date to examine the results of financial decisions in these institution. But it makes space difficult for analyzing the results, ignoring many aspects, such as the interaction of these indices with each other. At the same time, they emphasize that existing studies in the field of value creation in organizations have always provided an appropriate model for monitoring the business strategies used by organizations. Awareness of the functional status of banks has made it possible to identify the strengths and weaknesses that make strategic managers more active in comparison with competitors and gain more market share. Providing services and production of multiple products and providing resources from sources of resources, has created sensitivity to the realization of goals, continuous improvement of quality, has improved the customer and citizen satisfaction, the performance of the organization and management, and staff.

In the case of performance evaluation with a consistent and consistent viewpoint, the public sector promotes and responds to executive agencies and public confidence in the functioning of organizations and the efficiency and effectiveness of the government. In the nongovernmental sector, it also boosts resource management, customer satisfaction, national development assistance, new capabilities, sustainability, and the promotion of a global class of companies and institutions. As long as they become capable of survival, organizations must recognize that they need to be present in the national and international arena, and they must be the guiding principle of continuous improvement. This principle can not be achieved unless it is achieved by improving performance management. This improvement can be achieved by obtaining feedback from the inner and peripheral environment and analyzing the strengths and weaknesses of the organization and its opportunities and threats, and accountability and customer satisfaction by creating and applying an appropriate performance evaluation system. It’s need for flexibility in the programs and goals of the organizations in today's dynamic environment of great help. Evaluating and measuring its performance and its development into culture and organizational culture promotion. This results from the comparison of this research with past research, most of which confirm that unit performance is the most important consideration in the success of organizations. In this research, it seems that due to the difference in the industry, this is a more important and obvious risk factor. The difference and superiority of this research with past research is that:

It has been made that the indices presented in the research are not proportionate to the type of industrial and service activities and their operation. On the other hand, due to these factors, in the present research, we tried to select industrial and academic indicators of appropriate proportions according to The industry concerned.

As we mentioned in the fuzzy section, fuzzy numbers are closer to the truth, so let us examine the importance of evaluating the performance of the units, so that we can more accurately determine the element that depends on the organization's life.

Cover all dimensions. In the research that was presented in the background, each has some kind of defect in dimensioning, but the model used in this research.

In this study, it was found that at first indicators were identified in financial institutions (banks), which list of these indicators based on the Fuzzy Delphi method. In the following, using the fuzzy analysis process method, the identified indicators showed that the financial dimension and then the internal business processes were considered to be the most important for the evaluation of the performance of a financial institution and were presented. This result Endorsed the research on financial institutions. In the following, under the components of this approach, which was eventually shown, income growth, margin and return on equity were introduced as the main criteria in this study for evaluating financial institutions. Therefore, managers and decision makers can be advised to measure and evaluate these indicators to assess institutions and base their policies on these indicators, and can also be strengthened to institutions that are based on these indicators. The evaluation was conducted among them, recommended that these indicators be based on their work and their facilities in these fields At the end of the study, the researchers also offered suggestions:

Evaluation using banks performance BSC and ranking them with using VIKOR technique and comparison with the results of this study.

Evaluation of banks performance using EFQM and ranking using fuzzy ANP.

Assessing the performance of banks using BSC or scourge using ELECTRE and comparing the results with this research.

Evaluation of banks performance using BSC and degradation using FAHP-TOPSIS and comparing its results with the present study.

Evaluation of banks performance using BSC and verifying using FTOPSIS-TOPSIS and comparing the results of two techniques

Alam Tabriz, A., Mohammad Rahimi, A. (2009), Production Management and Operations Management Approaches in the Evaluation and Improvement of Business Processes, Commercial Publishing.

Ataei, M. (2010), Fuzzy Multi-criteria Decision Making, First Printing, Shahrood, Shahrood University Press, 234.

Awasthi, A., Chauhan, S. S., & Goyal, S. K. (2010). A fuzzy multicriteria approach for evaluating environmental performance of suppliers. International Journal of Production Economics, 126(2), 370-378.

Bentes, A. V., Carneiro, J., da Silva, J. F., & Kimura, H. (2012). Multidimensional assessment of organizational performance: Integrating BSC and AHP. Journal of business research, 65(12), 1790-1799.

Cheng, C. H., & Lin, Y. (2002). Evaluating the best main battle tank using fuzzy decision theory with linguistic criteria evaluation. European journal of operational research, 142(1), 174-186.

Chuang, L. M. , Ho, C. M. , Shiu, J. J., & Huang, H. P. (2011). Towards an analytical framework of corporate performance measurement in chemical industry: balanced scorecard perspective, Problems and Perspectives in Management, 9(3), 63-74.

Dağdeviren, M., Yüksel, İ., & Kurt, M. (2008). A fuzzy analytic network process (ANP) model to identify faulty behavior risk (FBR) in work system. Safety Science, 46(5), 771-783.

De Felice, F., & Petrillo, A. (2013). Optimization of automotive glass production through business process reengineering approach. Procedia-Social and Behavioral Sciences, 75, 272-281.

De Waal, A. A. (2010). Performance-driven behavior as the key to improved organizational performance. Measuring Business Excellence, 14(1), 79-95.

Dodangeh, J., Yusuff, R. M., Ismail, N., Beik, M. Y. I. M. R., & Jassbi, J. (2011). Designing fuzzy multi criteria decision making model for best selection of areas for improvement in European Foundation for Quality Management (EFQM) model. African Journal of Business Management, 5(12), 5010-5021.

Farneti, F. (2009). Balanced scorecard implementation in an Italian local government organization. Public Money & Management, 29(5), 313-320.

Fenyves, V., Tarnóczi, T., & Zsidó, K. (2015). Financial Performance Evaluation of agricultural enterprises with DEA Method. Procedia Economics and Finance, 32, 423-431.

Jyoti, Banwet, D. K., & Deshmukh, S. G. (2008). Evaluating performance of national R&D organizations using integrated DEA-AHP technique. International journal of productivity and performance management, 57(5), 370-388

Karsak, E. E., Karsak, E. E., Karadayi, M. A., & Karadayi, M. A. (2017). Imprecise DEA framework for evaluating health-care performance of districts. Kybernetes, 46(4), 706-727.

Liu, Y. C., & Chen, C. S. (2007). A new approach for application of rock mass classification on rock slope stability assessment. Engineering geology, 89(1), 129-143.

Momeni, M., Maleki, M. H., Afshari, M. A., Moradi, J. S., & Mohammadi, J. (2011). A fuzzy MCDM approach for evaluating listed private banks in Tehran Stock Exchange based on balanced scorecard. International Journal of Business Administration, 2(1), 80.

Sharma, M. G., Sharma, M. G., Debnath, R. M., Debnath, R. M., Oloruntoba, R., Oloruntoba, R., ... & Sharma, S. M. (2016). Benchmarking of rail transport service performance through DEA for Indian railways. The International Journal of Logistics Management, 27(3), 629-649.

Shirouyehzad, H., Shirouyehzad, H., Mokhatab Rafiee, F., Mokhatab Rafiee, F., Berjis, N., & Berjis, N. (2017). Performance evaluation and prioritization of organizations based on knowledge management and safety management approaches using DEA: A case study. Journal of Modelling in Management, 12(1), 77-95.

Wu, H. Y., Tzeng, G. H., & Chen, Y. H. (2009). A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard. Expert Systems with Applications, 36(6), 10135-10147.

1. Faculty member of Farvardin University, Ghaemshahr, Iran

2. Faculty member of Farvardin University, Ghaemshahr, Iran. Corresponding author: peyman.barzegar2016@gmail.com

3. Faculty member of Farvardin University, Ghaemshahr, Iran