Vol. 39 (Number 19) Year 2018 • Page 42

Bota D. BAITARAKOVA 1; Rayhan K. TURYSBEKOVA 2; Farrukh A. GAJIYEV 3; Zhuldyz K. SUBEBAEVA 4; Makpal T. SYRLYBAEVA 5; Barkhudar Sh. GUSSENOV 6

Received: 03/02/2018 • Approved: 27/02/2018

ABSTRACT: The article discusses the features of the model investment project, to generate additional value and ensuring the growth of the Gross domestic product (hereinafter GDP), which is one of the main conditions of national economy modernization and transition to the high-tech way of development. Rationale funding strategy the investment project involves the selection of methods of financing, determination of financing sources of investments and their structure. |

RESUMEN: El artículo analiza las características del proyecto de inversión modelo, para generar valor adicional y garantizar el crecimiento del producto interno bruto (en lo sucesivo, PBI), que es una de las principales condiciones de modernización de la economía nacional y la transición al modo de desarrollo de alta tecnología . Estrategia de financiación racional El proyecto de inversión implica la selección de métodos de financiación, la determinación de las fuentes de financiación de las inversiones y su estructura. |

The global trend of business development testifies to accelerate the renewal of products, production assets and a corresponding growth in the demand for investment projects and project activities (Shevelkina Ksenia Leonidovna, 2014).

To successfully develop in conditions of tough competition on the world market Russia can only in the process of comprehensive modernization of its economy. One of the important factors hindering socio-economic development of Russia is the state and level of development of transport infrastructure. According to the Ministry of transport of the Russian Federation, international standards to meet today only a small percentage of Federal and regional highways (Painvin N., 2010).

Transport infrastructure is a set of roads (pavement), civil engineering, designed for vehicle traffic (bridge structures, viaducts, and overpasses), hydraulic structures (tunnels), road service, road construction, road services. Well-functioning infrastructure reduce transport costs, affect the speed of passenger and freight, reduce capacity constraints, increase the availability of transport services and improving the investment climate in the country as a whole (Gussenov B. S., 2015).

The country's involvement in global trade and accession to the world trade organization (hereinafter WTO) lead to increasing the burden on the domestic road network, involve a significant increment of the transit trade flows, which inevitably necessitates the development of transport infrastructure to bring it in line with technical, economic and environmental indicators of economically developed countries (to ensure year-round availability of transport infrastructure, construction and reconstruction of transport communications to bridge the technological gap from advanced transport systems, the upgrading of the technological base with the use of innovative technologies) (Simakova E. K., 2014).

Due to the fact that transport infrastructure is the responsibility of the state and the state is interested in its development, responsibility for the development of transport infrastructure in the country coupled with high costs traditionally carry the bodies of state and municipal management. In the short to medium term in Russia designated priority projects on construction of new and reconstruction of existing transport infrastructure, the volumes of financing which go beyond the capabilities of the Federal, regional and municipal budgets. Therefore, project implementation will require the involvement of various extra-budgetary sources, including through the participation of private capital, however, according to estimates of the Ministry of transport of Russia, the annual deficit of private investment of the order of 650 billion rubles per year (Shevelkina Ksenia Leonidovna, 2014).

World experience shows that the successful solution to the problem of overcoming the lack of investment at the Federal, regional and municipal levels for development and innovation infrastructure upgrade is possible on the basis of wide use of mechanisms of state-private partnership, allowing for a mutually beneficial conditions to attract private financial resources for development and proper functioning of transport infrastructure (Ehlers, T., 2014). Public-private partnership (hereinafter PPP) with its modern funding mechanisms on the basis of mutually agreed policy and coordination of joint actions of the public and private sectors can intensify their joint efforts in the provision of financial resources to the process of modernization and development of transport infrastructure, while maintaining the inherent powers and functions of the state (Gussenov B. S., 2015).

The increase in demand for transport services in the coming years as a consequence of growth of international trade accompanied by an increase in the need for capital investment in transport infrastructure that is supported by the following assessments of the OECD (the organization for economic cooperation and development): the need for roads and railroads in the world 6 has been achieved for the period 2010-2019. 225,5 billion. USA per year during the period 2020-2029. 292,6 billion. USA per year, respectively. This means that the significance and relevance of private business in the infrastructure sector PPPs over time will increase (Federal state statistics service of the Russian Federation, 2018). The concept of long-term socio-economic development of the Russian Federation for the period up to 2020 envisages that one of the principles of the state's relations with business entities, should be the development of public-private partnership to reduce business investment risks, primarily in the areas of research and development, dissemination of new technologies, development of transport and energy infrastructure (Gazprombank, 2018).

An important element of modern policy of the Russian state to intensify the process of increasing investment in the transport infrastructure of the economy should be a combination of financial contributions of the state and private business, a comprehensive support of investment activity, creation of favorable investment climate, through the PPP mechanism. Experts predict that in the coming years in infrastructure projects through public - private partnerships the government will attract about $ 1 trillion. rubles, which opens new horizons in the development of this direction. According to Transport strategy of the Russian Federation for the period up to 2030, the local road network are paved, which in the future should connect all settlements of the country, its predominant development will be in the Central black earth region, the Northern Caucasus, the Volga region, southern Urals, Siberia and the far East. Research on the problems of financing transport infrastructure through the mechanism of public-private partnership is very important (Main directions of budgetary policy for 2017).

In the process of the study were used General methods of research: methods of analysis of financial statements: horizontal, vertical, ratio, comparison, and other.

To study the transport infrastructure of Russian Federation were used General scientific and special research methods:

- review of the regulatory framework;

- analytical method;

- studying of foreign experience;

- the possibility of application of instruments of state - private partnership;

- economic-mathematical calculations.

At the international level, many citizens, especially in countries with economies in transition, are faced with the "infrastructure deficit" in the form of congested roads, poorly maintained trails and recreational facilities, deteriorated schools, hospitals, water supply and water purification systems and other infrastructure are either absent or worn down or require urgent repair (Vickerman R., 2002). Such problems lead to a significant loss to society from the reduction of the birth rate and reduce competitiveness to increase accidents, health problems of the population and reducing life expectancy (Painvin N., 2010).

Many governments came to the conclusion that some tax revenues to address the infrastructure problems is not enough (OECD, 2008). Infrastructure includes roads, Railways, hospitals, schools and other things that has a direct impact on the lives of citizens. In many countries there is an urgent need to "improve" existing infrastructure created decades ago (Tolkacheva O. P., 2013). In addition, the challenge of finding funding for brand new projects, especially social projects needed to address problems of rapidly growing economies and an aging population. In view of budgetary constraints, and in a number of countries and the budget deficit, the state is unable to allocate sufficient investments for development and modernization of infrastructure. This situation has created the need for States to involve quite uncharacteristic for itself to the activities of the private sector. In the end, this kind of cooperation is called "public private partnership"(Simakova E. K., 2014).

To attract extra budgetary funding and created tools of the PPP. Of course, in a crisis, the constancy of demand to the business of the state is the most important tool to reduce risks of private investment, on the one hand, and strengthening the confidence of credit institutions to such a joint PPP-project (Painvin N., 2010).

"The development of mechanisms of interaction between government, public, business and civil society structures, institutions and mechanisms of public-private partnership" is one of the priority directions of formation of institutional environment of innovative development, outlined in the "strategy of socio-economic development of the Russian Federation until 2020" (Shevelkina Ksenia Leonidovna, 2014). The inclusion of mechanisms for public private partnerships in the process of overcoming the constraints to economic development – "market failures", both infrastructure and development of human capital (education, health, housing, etc.), will allow Russia to reach a new level of economic development by achieving a new quality of economic growth. But at the present time in Russia there is no uniform legal platform for the implementation of investment projects with use of mechanisms of state-private partnership. It is a limiting factor to achieve the targets of the "Strategy-2020". The current legal regulation in the field of implementation of investment projects using PPP mechanisms in the framework of the "Strategy 2020" does not allow to ensure the full implementation of government functions in this area.

The use of mechanisms of public-private partnerships has increased significantly in recent years due to the fact that public and private sector are working together to develop and upgrade vital infrastructure (Inderst, G., 2015 forthcoming). The European Bank for reconstruction and development (EBRD) readily supports the initiative of the governments of its countries of operations in this area. The experience of different countries in the field of public-private partnership is different, and information about these experiences, both positive and negative, is extremely useful. In case of insufficiency of financial resources, both public and private sector, is fundamentally important be efficiency and best value for money and quality (Simakova E. K., 2014).

We can distinguish three main points that contribute to improving the efficiency of PPP mechanisms:

– In the selection of projects under the PPP bodies of Federal and municipal level need to improve quality and, most importantly, timely elaboration of the proposed draft and to offer detailed rules for every project to hold a competition to choose a professional and creditworthy private operator (Zusman, E. V., And Kornev, M., 2012).

At the regional level requires the development of contract models, instruments, guarantees and insurance, improvement of regional legislation and its "coupling" with the Federal. Collectively, they should provide acceptable risks of private investment in public infrastructure. The state thus requires precise execution of its contractual obligations.

– Need more effective use of our General - professional and professional potential. On the one hand is the continuous training of civil servants involved in the management of investment and development of joint public - private projects. On the other – the resultant attraction of a rich practice of the victories and failures of the private professional "capital" of the participants in modern production and trade-economic process (Inderst, G. and Stewart, F., 2014).

PPP is an alternative to direct budget financing of capital investments at the deficit and budget surplus. This means that the state controlling industry, related public infrastructure, providing public and government services, can do much more within existing resources, to turn them from the budget, force, legislative and other investment leverage, by attracting private resources to the state task, because the state is involved in project risk management. It uses a very specific and valuable resource - the ability for the legal system and political stability to create a "corridor of the future" that generates certainty for the investor and the return on private investments (Sutherland, D., et al., 2009). This understanding of PPPs is fundamentally different from the models that have until now promoted in Russia under the guise of PPP: "clubbing" of business and government, the social responsibility of business, charity, subsidies to private business and even the privatization. These points of view on PPP, of course, have a right to exist, but they must be clearly separated from the understanding of public - private partnership the PPP Centre of «Vnesheconombank», which is based on risk sharing. It is this fundamental feature of the PPP is a plan for private business, especially in a crisis (Painvin N., 2010).

Within the concept of PPP, the state customer, which, based on the evaluation of the project and their own possibilities, and takes the PPP is an alternative to direct budget financing of capital investments at the deficit and budget surplus. The state participates in such projects, based on its understanding of risks, taking into account the prospects for economic policy, focused on long-term growth. In addition, the crisis state is the best borrower. Through the PPP mechanism it can use this power for the balance of the budget, to create comparable in reliability to the sovereign rating of the project risk management. This involves using not only the power quality of the power vertical. Repayment of pension Fund money invested in any infrastructure project largely will be determined by the mechanisms of tariff regulation, for example, a change in fare management tool in the hands of the state, which it can use for the next 15-20 years. In other words, there is a demand for high quality public administration (Main directions of budgetary policy for 2017).

Reliability assurance by a state of its obligations under the project, the most difficult question. The easiest and effective way PPP is an organization of new construction with payment in installments. In Russia this scheme is not yet operational - funding organizations do not understand how the state will fulfill its obligations for the duration of the project after the object is constructed, because in our legal system budget law prevails over the contract. For example, in Kazakhstan the law on concessions spelled about six different forms of project support by the state guarantee, the guarantee, the guarantee of the purchase of products or services, security of property, other group forms (table 1.). In the Russian law on concession agreements, this issue is left for discussion in the formation of the agreement. Obviously, this will take place in the framework of the budget legislation, legislation on public procurement, restrictions on the pledge of public property or guarantees of unitary organizations, etc. Everything that's not working now when long-term projects, from the words "concession" or "PPP" is not included.

Table 1

Process groups of project management

Process groups of project management ("life cycle of the project») |

Process group management infrastructure project in PPP model |

Group of processes of initiation |

Identification, prioritization and selection of models for implementing project in PPP model |

Group planning processes |

Comprehensive examination and justification |

Process group execution |

Tender process and award of contract |

Process group monitoring control |

The construction and operation of |

A group of processes completed |

Contract management |

Monitoring of the project (monitoring, evaluation of the project) |

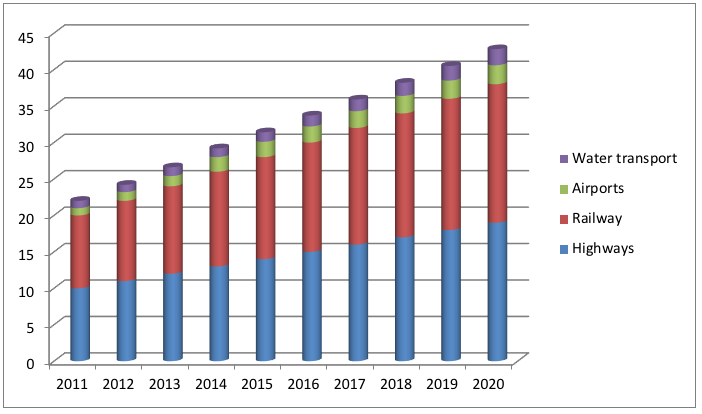

In a situation where there is a significant imbalance in the provision of infrastructure required sequence of actions for creation of the effective mechanism of management of infrastructure projects. In Russia the volume of investments of the state in infrastructure projects has a share in GDP of the order of 1-2%. The current situation in the country caused by the financial crisis continues to worsen with the shortage of liquidity and the decline of the economy (Figure 1.) (Federal state statistics service of the Russian Federation, 2018).

Figure 1

The growth of transport infrastructure in Russia, billion USD

As was established by the government of the Russian Federation, limiting the proportion of funds invested in infrastructure projects together with the funds previously placed on long-term deposits with «Vnesheconombank» to Finance anti-crisis measures, cannot be more than 60% of the NWF (national welfare Fund). It is assumed that the placement of funds in such projects will stimulate domestic demand, which will affect the increase in economic growth.

Resource provision of the state program of the Russian Federation "transport system Development" for the period 2013-2020 is provided from a variety of sources, presented in table 2.

Table 2

Budget allocations from the state program of the Russian Federation

"transport system Development" for the period 2013-2020. (billion roubles).

Year |

Total |

Federal spending |

At the expense of the national welfare Fund |

Due to the consolidated budgets of the constituent entities of the Russian Federation |

Extrabudgetary sources |

||

The state program, only |

The subprogramme "Road economy» |

Subprogramme "Development of Expressway under the PPP» |

|||||

2013 |

|

707 |

175 |

14 |

- |

- |

- |

2014 |

|

739 |

211 |

20 |

- |

- |

- |

2015 |

|

735 |

225 |

15 |

- |

- |

- |

2016 |

|

764 |

244 |

16 |

- |

- |

- |

2017 |

|

784 |

255 |

17 |

- |

- |

- |

2018 |

|

892 |

268 |

18 |

- |

- |

- |

2019 |

|

1032 |

283 |

18 |

- |

- |

- |

2020 |

|

1198 |

297 |

19 |

- |

- |

- |

2013- 2020 |

12 295 |

6853 |

1 956 |

137 |

150 |

59 |

5233 |

When developing the system of management of development infrastructure need to identify territorial unbalanced development and to identify the sources of budget financing at different levels of the budget system. As practice shows, the sources of financing from the budget are never enough, therefore, for the implementation of infrastructure projects important for attracting private investment. For Russia, the urgent need is such a system in conjunction with modern instruments, will be used to provide funds projects with a long payback period for institutional investors, subject to established restrictions on investing (Federal state statistics service of the Russian Federation, 2018).

A huge role in the development of road, transport, social and other types of infrastructure is the state of the financial market infrastructure, the use of a variety of financial and investment instruments for the implementation of projects.

One of the tools to ensure long-term financial resources for project financing of infrastructure can be considered a relatively new tool of the stock market infrastructure bonds, which effectively accumulate private capital for infrastructure development. Still, the concept of infrastructure bonds is not enshrined in law despite the fact that the draft Federal law "On peculiarities of investment in infrastructure through infrastructure bonds" was introduced in the State Duma in 2009. According to the project, "Infrastructure bond – a bond issued by a specialized design organization with the purpose of raising funds intended for the financing of creation and (or) the reconstruction of infrastructure, execution of obligations on which is provided in accordance with the procedure stipulated by this Federal law."28 Usually, the Issuer of such bonds upon completion of construction of the object gets it in concession for a certain period of time (over 10 years). For the use of infrastructure projects with third parties may apply (for example - toll road). There is a limit on issuance of infrastructure bonds: the concessionaire may release them in order to obtain resources for the development of the planned project.

Russia already has some experience in the placement of infrastructure bonds. Among the first projects the construction of toll roads using funding of such bonds are as follows: the road Saint Petersburg – Moscow (backup the existing M10), Western high-speed diameter in St. Petersburg, the alternate M-1 "Belarus" Moscow-Minsk (the investor of JSC "Main road"). Issuers of infrastructure bonds by a number of companies, including JSC "Russian Railways".

The implementation of infrastructure projects based on concession agreements and the borrowing of private capital through the issue of the concession bond is a new step in the development of infrastructure. As a result, new challenges emerge financial, social and economic considerations for the implementation of which the concessionaire bears the monetary liability as at the end of construction and after decades (in contrast to the standard of the contractor and the contractor).

Another link in the chain management infrastructure projects in the budget deficit, in the case of cutting the funding of projects using the resources of institutional investors are the contracts life cycle. They are the mechanism of interaction between the sources of private and public investment into projects (Schwartz, J. Z., Ruiz-Nuñez, F., & Chelsky, J., 2014).

The contract life cycle, like a concession agreement is a mixed agreement, which includes elements of a construction contract and paid services. The liability of the members is as follows. The contractor realizes it, sets in operation, is engaged in repair and maintenance during the period under contract, using its own resources (material, human, etc.). Investor, in turn, charge for the use of the object and transfers it directly to the customer (authority). The latter pays for public services rendered when using the completed project, during the term of the contract at the expense of budgetary funds. As a rule, the amount is fixed and stated in the contract that minimizes the investor's risks in case of fluctuations in the demand for services of the object (in which income from the operation can crawl down), transferring process design risks on the customer.

This form is beneficial to each party. Life cycle contracts - effective the dispenser the risk of the customer and contractors. It is also characteristic that the amount of funds which the public partner pays the contractor, not associated with the number of users of the object, which in fact eliminates the risk of the private partner and changes in market demand. In the end the public legal education goes with the lowest possible cost completed and functioning infrastructure, which consumers enjoy for free.

In cases where the contractor's remuneration directly depends on the quality of his work, there is an incentive to complete the contract works (in order for the object supported consumer properties as long as possible), which serves as a motivation for innovation and engineering initiatives in achieving results with the lowest costs (Vecchi V., Gatti S., Hellowell, M., 2015 forthcoming).

Unfortunately, this established relationship in the model of formation of transport infrastructure in Russia is still lacking. Probably, the Federal law No. 44-FL "On contract system in procurement of goods, works, services for state and municipal needs", namely the contents of Chapter 3 on how to conduct an open and two-stage competition in the future will affect the improvement of the situation in the field of public contracts on the basis of state-private partnership in infrastructure projects.

Summing up on the principles of project financing as an effective instrument of management of transport infrastructure it is possible to allocate the basic criteria:

Sources of funding projects for a longer period of time are:

1) the Budgets of all levels;

2) The Central Bank of the Russian Federation;

3) Commercial banks;

4) Pension Fund (PFR, NPF);

5) International financial institutions and export credit agencies. List the main difficulties encountered in the financing of transport infrastructure:

1) the Limited capacity of budgets of all levels, often implementing global projects becomes unrealistic in the absence of significant public investment;

2) Insufficient development of legislation and the system of investor protection;

3) Projects to develop transport infrastructure in Russia mostly have a long payback period, and typically, revenue on the implementation of the projects is the ruble, which becomes a barrier to attracting funding in foreign currency;

4) the Lack of liquidity in the market – the scarcity of money and assets in the Lombard list of the Central Bank, short term provide Central Bank funding to commercial banks, and restrictions on investment of PFR and NPF.

As options for overcoming these problems can be offered:

- Initiation by the Bank of Russia of measures to increase the money supply (including the bonds issued by the Government of the Russian Federation, increase of terms of crediting of commercial banks, etc.);

- Improvement of long-term financing by the Central Bank of the Russian Federation secured by foreign currency;

- Improving methods of hedging foreign currency risks and risks of interest rate volatility;

- Expansion of functions of PFR and NPF to invest retirement savings and of programs of refinancing of Bank of Russia.

• PPP is an approach to providing services in the field of infrastructure, which is fundamentally different from traditional public procurement

• Due to the fact that the private partner carries out the construction or reconstruction of the facility, but is responsible for its subsequent operation, the PPP creates incentives for the use of long-term commercial approach

• In a PPP, the private partner takes on not only the functions of construction and operation, but the financing of the project

• The most common form of financing projects is a scheme under which loans are provided directly to the project company without recourse or limited recourse

• The only source of repayment is project generated revenue stream

• Banks are not willing to take responsibility for what is not in their competence, so they strive to ensure that the project company as much as possible the risks have shifted to the various contractors of the project (e.g., construction contractor and a contractor for the operation and maintenance of)

Summing up, it should be noted that for the proper formation of the effective mechanism of management of infrastructure projects and their financing requires a sound plan of consecutive steps taken by the state, which would form a market environment where public-private partnerships will play a key role in the development of infrastructure in Russia. Effective tool in the implementation of this program will be the formation of the concession market, which implies reform of the current model of economic relations at the institutional level and the modernization of the economic life of Russia in General.

Federal law "On amendments to the Federal law "On securities market" with the aim of creating favourable conditions for investment in bonds of the concessionaire", as of 04.07.2012.

Gazprombank. (2018). Mechanisms and instruments of financing infrastructure projects. Gazprombank.ru

Gussenov B. S. (2015).Development of foreign economic activities in the age of globalization Tutorial LAP LAMBERT Academic Publishing, p. 316

Main directions of budgetary policy for 2017 and the planning period of 2018 and 2019. The single portal of the budget system of the Russian Federation. http://budget.gov.ru/epbs/content/conn/content/path/Contribution%20folders/documents/Osnovnie_napravleniya_budgetnoi_politiki.pdf

Painvin N. (2010). High Speed Rail World Europe: Large, Varied and Complex. URL: http://www. scribd. com/radhika_grover/d/44659568-Fitch-HighSpeed-Rail-Projects-Apr2010, p.189.

Simakova E. K. (2014). Formation of system of effective management of the financing of infrastructure projects. Vestnik of Saint-Petersburg law Academy, No. 1 (22), p. 85.

Shevelkina Ksenia Leonidovna. (2014). The FINANCING of TRANSPORT INFRASTRUCTURE through PUBLIC-PRIVATE PARTNERSHIP// Thesis. 185с.

The Federal law of April 5, 3013, No. 44-FL "On contract system in procurement of goods, works, services for state and municipal needs" (as amended on 2.07.2013) // SL the Russian Federation. – 08.04.2013. – No. 14. – St. 1652.

Tolkacheva O. P. (2013). The infrastructure component of the efficiency of innovative management // Collection of articles of interuniversity scientific-practical conference LIST them. Joseph Kotin. – SPb. Publ LMST them. Joseph Kotin, pp. 56 - 63.

Vickerman R. (2002). Private financing of transport infrastructure: some UK experience. Centre for European, Regional and Transport Economics, The University of Kent at Canterbury, UK. URL: http:// www. pfingsttagung08.tuberlin. Papers/vickerman-private_financing_transport_infrastructure. Pdf, p.67.

Zusman, E. V., And Kornev, M. (2012). Contracts life cycle: proejtcontra // Economics and life. No. 11, p. 47.

Ehlers, T (2014), “Understanding the Challenges for Infrastructure Finance”, BIS Working Papers, No 454, BIS, Basel.

Inderst, G. and Stewart, F. (2014), Institutional Investment in Infrastructure in Emerging Markets and Developing Economies. PPIAF, World Bank Group.

Inderst, G. (2015 forthcoming), Financing Infrastructure Investment in the UK and Europe.

Sutherland, D., et al. (2009), "Infrastructure Investment: Links to Growth and the Role of Public Policies", OECD Economics Department Working Papers, No. 686, OECD Publishing, Paris. DOI: http://dx.doi.org/10.1787/225678178357

OECD (2008), Public-Private Partnerships: In Pursuit of Risk Sharing and Value for Money, OECD Publishing, Paris. DOI: http://dx.doi.org/10.1787/9789264046733-en

OECD (2008), “Public-Private Partnerships In Pursuit of Risk Sharing and Value for Money”;

Schwartz, J. Z., Ruiz-Nuñez, F., & Chelsky, J. (2014). “Closing the Infrastructure Finance Gap: Addressing Risk. Financial Flows Infrastructure Financing”

Vecchi V., Gatti S., Hellowell, M. (2015 forthcoming), “Government Policies to Mitigate the Risks of Infrastructure Projects: A Framework for Classification And Analysis”. Federal state statistics service of the Russian Federation. 2018. gks.ru

1. Accounting and auditing. Master, senior lecturer. Zhetysu state University named after I. Zhansugurov. The faculty of law and Economics. Taldykorgan.king_bara@mail.ru

2. Accounting and auditing. Master, senior lecturer. Zhetysu state University named after I. Zhansugurov. The faculty of law and Economics. Taldykorgan.

3. Accounting and auditing. Master, senior lecturer. Zhetysu state University named after I. Zhansugurov. The faculty of law and Economics. Taldykorgan.

4. Department of public administration and management. Master, senior lecturer. Zhetysu state University named after I. Zhansugurov. The faculty of law and Economics. Taldykorgan.

5. Department of public administration and management. Master, senior lecturer. Zhetysu state University named after I. Zhansugurov. The faculty of law and Economics. Taldykorgan.

6. Doctoral student. Master of economics. Department of public administration and management. Zhetysu state University named after I. Zhansugurov. The faculty of law and Economics. Taldykorgan.