Vol. 39 (Nº22) Year 2018. Page 8

Vol. 39 (Nº22) Year 2018. Page 8

Elena A. DZHANDZHUGAZOVA 1; Marianna M. ROMANOVA 2; Tatiana V. ZHUBREVA 3; Elena L. DRACHEVA 4

Received: 02/02/2018 • Approved: 05/03/2018

4. Implications and Conclusion

ABSTRACT: Nowadays the problem of introduction of resort fees in the territory of the Russian Federation is most acute and relevant. Therefore, this article is devoted to theoretical and practical issues of charging a resort fee, which has been introduced on a pilot basis from January 1, 2018 in four Russian regions. The authors have studied and systematized the results of public opinion polls on the introduction of resort fees in Russia, and analyzed the Russians' attitude towards the initiative. The main methods of studying the problem were system and retrospective analysis, expert assessments and sociological measurement based on the Internet questionnaire survey and opinion polls. In the course of the research a special attention was given to study the practices of implementing resort fees in foreign countries. The authors, basing themselves on the analysis of Russian and international experience, adduce arguments for and against the collection of resort fees. The article also substantiates existing approaches of media promotion of social and civil initiatives used in the field of tourism and resort policy. |

RESUMEN: Hoy en día el problema de la introducción de tasa turística en la Federación Rusa es muy grave y actual. En este contexto el presente artículo se dedica a las cuestiones teóricas y prácticas sobre el cobro de tasa turística que está experimentalmente introducida en cuatro regiones de Rusia a partir de 1 de enero de 2018. Los autores han estudiado y clasificado los resultados de encuestas de opinión sobre el cobro de tasa turística en la Federación Rusa, y también han analizado la actitud ante esta iniciativa. Los métodos principales del estudio del problema planteado son: el método de análisis sistemático y retrospectivo, los métodos de evaluación de expertos y dimensión sociológica, realizados sobre la base de cuestionarios en línea y encuestas sociológicas. En el estudio se prestó especial atención al estudio de la práctica de aplicación de tasas turísticas en países extranjeros. En la base del análisis de la experiencia rusa e internacional los autores han presentado argumentos a favor yen contra del cobro de tasa turística, y además han presentado enfoques de la promoción de iniciativas sociales y civiles en la política de recreación y turismo |

In 2017, the debates about the advisability of introducing the resort fee in some regions were remarkable for severity and social activity. Interest to the problem of resort fee introduction in modern conditions is quite natural and predictable, since, according to the enacted law, the resort fee will start to charge from tourists in the Crimea, the Krasnodar Territory, the Altai and the Stavropol Territories after May 2018. The introduction of a resort fee is intended as an experiment that will last until the end 2022. The law points out that the fee should not exceed 100 rubles per day and the maximum rate of resort fee in 2018 should be under 50 rubles per day (Federal law No. 214-FL, 2017).

Despite the stepwise introduction and support on initiatives from local authorities that will be entrusted to determine the size of the resort fee and periods of its collection independently, the passed law had caused serious public outcry and once again showed that the society is very sensitive to implementation of any additional financial burden on the budget of citizens. Even if the accepted decision is explained by such a necessity as the perfection of the resort infrastructure.

The problem of resort infrastructure maintenance and development has never lost its relevance, and it is very difficult to resolve it at the regional level without the involvement of additional financial sources. Additional targeted fees are one of the ways of solution to the financing problem, as they allow filling up regional resort budgets. (Dzhandzhugazova, 2010; Fartash et al., 2018; Davoudi et al., 2018). Thus, according to the Government of the Russian Federation estimation, a resort fee introduction will allow raising the budget of Stavropol Territory by 2.02 billion rubles, the Krasnodar Territory by 8.3 billion, and in the Crimea budget will increase by 16.4 billion rubles. All the proceeds will be used for the maintenance, repair and reconstruction of the resort infrastructure (RIA Novosti, 2017).

As scientific tools to conduct this study the authors selected such general scientific and special methods, as method of system analysis, method of retrospective analysis, method of expert assessments and sociological measurement based on the Internet questionnaires and polls.

The information base of the study consists of statistical materials and analytical development of the Federal Agency for tourism of the Russian Federation (Rosturizm), scientific-research and project working outs of the Research Institute “The Hospitality Industry” of Plekhanov Russian University of Economics; publications in authoritative Russian and foreign periodicals; electronic content of the Russian and foreign Internet portals.

The article uses materials of the meeting of the State Council Presidium “On measures to enhance the investment appeal of the health resort sector in Russia” held in August of 2016 in the Altai region. The authors analyzed the Federal law “About carrying out experiment on the development of a resort infrastructure in the Republic of Crimea, Altai Territory, Krasnodar Territory and Stavropol Territory”.

The basis of the study consists of the data published in the journals “Russian Federation today” and “Parliamentary newspaper”, which analyzed the results of search engines “Yandex” and “Google” for 2017. There are several hundreds of laws being discussed, and the law on the introduction of resort fee in four regions of Russia has become the most debated topic these days, it got ahead the whole number of such important issues as Moscow renovation, “forest amnesty”, children's rest, pensions, etc.

The conclusions drawn by authors are based on the analysis of polls of Fund “Public opinion”, the Internet poll of RIA Novosti, the Internet poll of media service of the web-portal “Rambler”, survey of tourist service “tutu.ru” and “Biletix” and “Aviasales” search services, and channels of social media “Kommersant FM”.

We should note that the introduction of a resort fee is not just a reaction to the difficult geopolitical situation caused by the economic crisis and sanctions that negatively affected the revenue part of the Russia's budget. These factors have pushed state structures towards the search for additional opportunities for development of regional tourist and resort infrastructure, the condition of which objectively reduces the competitiveness of Russian resorts (Romanova & Kulgachev, 2017). In a definite sense, joining in 2014 of Crimea, whose resort infrastructure was in a deplorable state and required immediate renovation, has become the catalyst of the formation of legislative initiative on introduction of resort fee.

In turn, the process of inclusion of Crimea into the Russian tourist and recreational complex has revealed several serious regional problems that have to be solved at a local level and may require the attraction of local financial resources.

The issues of resort fee introduction were observed at the meeting of the State Council Presidium “On measures to enhance the investment appeal of the health resort sector in Russia”. As a part of this meeting, the President instructed the Government to introduce a resort fee of a regional scale in Russia. He emphasized that the fee collection has to be organized with a clear understanding of the goals, tasks and processes of administration, and it has been proposed to create a clear mechanism of control over its expenditure (The official website of the President of the Russian Federation, 2016).

Enacted in 2017, the Federal law “About carrying out the experiment on the development of the resort infrastructure in the Republic of Crimea, Altai Territory, Krasnodar Territory and Stavropol Territory” implies a two-stage approach to the introduction of resort fee. According to the law, the experiment is carried out in four pilot regions with subsequent spread to the entire territory of the country. The similar sequence of actions is justified considering that a resort fee was repeatedly introduced on the territory of the USSR and the Russian Federation before, but it wasn't always advantageous from both economic and administrative-legal point of view (Federal law No. 214-FL, 2017).

Despite the positive aim of the legislative initiative on the introduction of resort fee, the majority of Russians took it negatively. The results of dozens of polls conducted in the first half of 2017 and a rather tense discussion in popular social media evidence it.

Here we specify the most large-scale surveys conducted with the aim to study public opinion on the issue of resort fee introduction in Russia, they are:

1. The survey of Fund “Public opinion”. The survey polled 1500 people in 53 regions of the Russian Federation. The purpose was to identify citizens’ attitude to the resort fee introduction in some regions.

2. The online survey RIA “Novosti”. The survey polled over 55,000 people.

3. The online survey of popular web portal “Rambler”. The survey polled 6500 people.

4. The survey of the popular tourist portal “tutu.ru”. The survey polled 18000 people.

5. The survey carried out online by search engines “Biletix” and “Aviasales” to see what their clients think about the resort fee.

6. The survey on social media channels carried out by journalists of “Kommersant FM” with a purpose of finding out the attitude of their listeners to the resort fee.

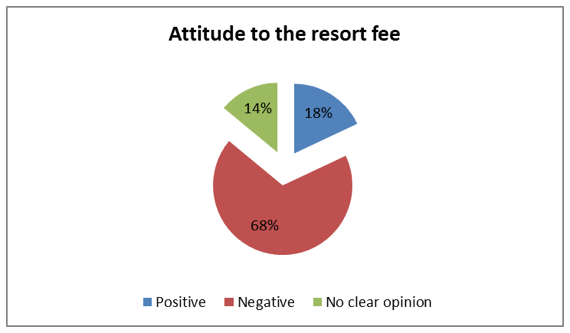

The results received from the sociological research, despite the minor fluctuations of values, have shown the whole picture of a negative attitude of citizens to the introduction of a resort fee. Fig.1-4 shows all the generalized data of all the surveys.

Figure 1

The structure of answers to the question: How do

you feel about the introduction of the resort fee?

Analysis of the survey results, aimed on revealing the Russian Federation citizens' perception of the resort fee, showed that almost two thirds of respondents (68%) have negative attitudes, only one out of five (18%) has positive attitude, and 14% of respondents had no clear opinion on this issue.

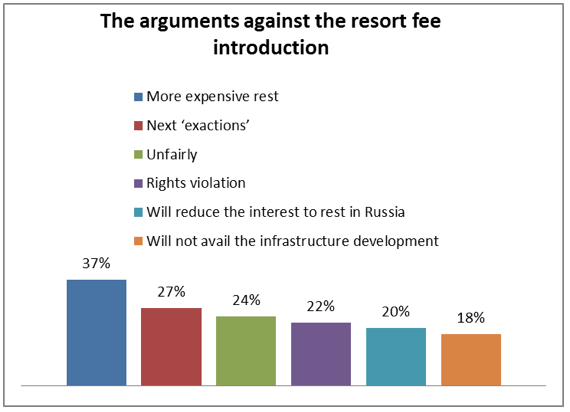

During the study, respondents gave arguments that reveal the reasons for their negative attitude to the resort fee (Fig.2). The obtained results allow us to identify specific concerns of citizens, what certainly clarifies the existing situation and gives an ability to draw valid conclusions.

Figure 2

The arguments given by the respondents with

negative attitude to the resort fee introduction.

Results given in Fig.2 showed that the majority of respondents (37%) are worried that after the fee introduction tourism will become more expensive. This concern is shared not only by consumers themselves, but also by representatives of tourist and resort industries. The latter understand that managing of resort fee will also require expenditures, which will be additionally passed on to the consumers. The significant number of respondents (27%) actively discuss the issue that the resort fee is just regular taxes for citizens, that also include fees for capital repairs, transport tax, etc. In continuation of this point of view, 24% of respondents find the introduction of a resort fee to be unjust. Furthermore, a significant proportion of respondents (22%) believe that the resort fee introduction is a violation of their civil rights. Many of them are surprised by the idea of paying tourist tax for a rest in the country of their own. Another two large groups of citizens explain their dislike of the resort fee by non-subjective reasons. Thus, in particular 20% note that the introduction of fee will reduce the interest to resting in Russia, and 18% of respondents believe that it will not help the development of the resort infrastructure. At the same time, respondents are rather optimistic about the impact of the resort fee introduction (Fig.3).

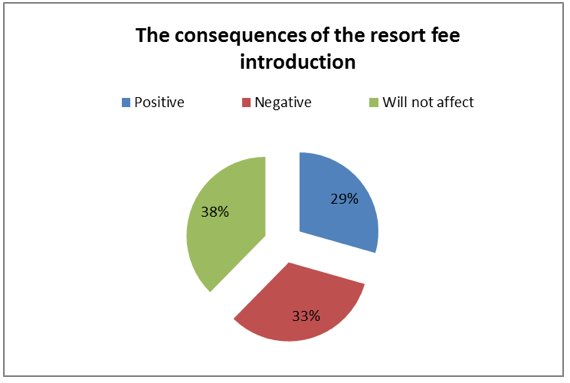

Figure 3

Opinions of the respondents regarding

consequences of resort fee introduction

Only one third of respondents (33%) believes that the consequences will be negative. Slightly less than one third (29%) of respondents suggested that they will be positive, and allow to develop tourism infrastructure and new types of tourism (Dzhandzhugazova, 2016a). About 38% of respondents believe that it would not have impact at all. Such results, in our view, are associated mostly with the fact that majority of citizens consider this measure being temporary and simply do not believe that the initiative of introducing the resort fee will be brought to a successful completion. It is connected with the fact that the passed law will be in effect only until December31st, 2022, thus having experimental nature. However, the Russians, despite a skeptical attitude towards the resort fee introduction, have their own views on the ways of spending the money raised (Fig.4).

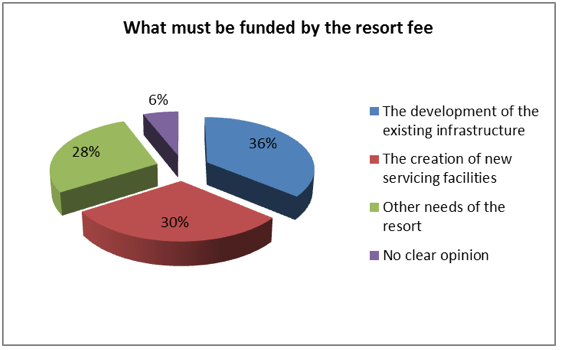

Figure 4

The results of the answer to the question

“What needs to be funded from the resort fee?”

The data analysis in the Fig.4 allows to conclude that the major part of respondents (66%) thinks that the funds should be directed to the development of the existing resort infrastructure (36%) and the creation of a new one (30%). At the same time, 28% of respondents admit that resorts may devote funds for other needs. Similar distribution of respondents’ opinions drew attention to another tender spot of a public debate on the introduction of resort fee – “What the received funds will be spent on?”

Here we should note that this question is important for both common citizens, who shall be charged with the resort fee, and travel industry professionals (Dzhandzhugazova et al., 2016b). The text of the Law (Federal law №214) indicates that the experiment on resort fee introduction is held “for the development of the resort infrastructure with the aim of conservation, restoration and development of resorts; for the formation of uniform tourist space and the creation of favorable conditions for sustainable development of tourism”.

Unfortunately, the majority of citizens and experts consider this rather grounded phrase to be no more than a “figure of speech” and such mistrust is explicable. Thus, for example, there is no clear understanding of the issues related to the managing and organization of the fund-raising process itself at the municipal level. In addition, there are terminological gaps, requiring a clarification of such questions as “What constitutes a ‘resort fee?’”, “Is it ‘fee’ or ‘tax’ and how these terms differ from each other”? If the resort fee is a tax, why the organization of its collecting is imposed on local self-government bodies, and not to a tax inspectorate?

Moreover, the skepticism is enhanced by the lack of clear positions from business and government on this issue; their views are mostly based on the results of local and foreign experience of resort fee implementation. At the same time, in our opinion, initiatives on the introduction of the resort fee demand good informational and elucidative follow-through, since public opinion must be not only studied, but also made ready! (Dzhandzhugazova et al., 2016c).

The experience shows that the press illuminates the initiative on the resort fee introduction as thrilling news, but often it does not even get into the basis of the issue nor in the details of it (Dzhandzhugazova, Adashova & Andreeva, 2012). In some cases, the media representatives had no clue about that the “resort fee” is not a “know-how”, as that it was introduced in different years, including the Soviet times, which many Russians remember as “the triumph of social justice”. In general, the question is not even about the need of imposing a resort fee, but about the means of its collection and management of the raised funds! Our content analysis of hundreds of reviews of Russian social networks shows that many people fear that a good cause could turn into an another “rip-off”. To correct mistakes of the past and overcome an existing negative attitude to the offered resort fee it is necessary to take a deeper look into the history of the question, and thus make the necessary conclusions.

A resort fee existed in the legal system and economical practices of the Soviet Union too: based on the Ordinance of the CEC and SNK USSR on August 17, 1933 it was introduced for partial reimbursement of costs for the improvement of resorts and improvement of consumer services of vacationers. Citizens had disbursed it when getting registration in passports in areas, and in the periods of the year determined by People's Commissariats of Finance of Union republics in agreement with the local People's Commissariats of health. Since May 7, 1936, a resort fee was replaced by a single stamp duty (Tolkushin, 2001). After the collapse of the USSR Government adopted the Law of the RSFSR from the December 12, 1991 “About the resort fee collection from the natural persons”, which provided that natural persons had to pay for staying in resorts. Vacationers had to pay the fee at the place of their temporary stay within three days. Administration of hotels and other accommodation facilities, apartment-mediation bureau, while directing citizens in places of temporary stay, acted as the fundraisers.

The resort fee rates were established by the republics’ governments within the Russian Federation and by Executive committees of territorial and regional Councils of People's Deputies. The marginal resort fee rate was not more 5% of the statutory minimum wage. Considering the size of the minimum wage was 900 rubles starting from April 1st, 1992, the upper limit of the resort fee stood at the level of 45 rubles, which is comparable to a modern resort fee parameters. Both the old and the existing legislations have defined preferential categories of citizens who are exempt from paying a resort fee.

The fee wasn't collected from individuals residing in hotels, municipal, departmental and cooperative houses, in private houses of citizens, as well as in tents and vehicles. Exemptions from resort fee were also envisaged. Such categories of citizens as children under the age of 16, disabled of war and labor, citizens who visit the area on a matter of official concern, senior citizens visiting their children and vice versa, and some others were exempt from paying the tax. Despite the fact that the size of the tourist tax was rather low in 2004, it has been abolished because the mechanism of its collection and distribution of funds wasn't clear, and also due to its inefficiency, as the cost of its administration exceeded the proceeds gained from tourists. (Tolkushin, 2001)

In this regard, we should remember that the resort fee collection was in effect in a period when the country was facing difficult times due to the collapse of the Soviet Union and the subsequent economic crisis and default, which led to a sharp decline in the number of vacationers on Russian resorts. During the specified period, the number of vacationers in Sochi resorts went to a five-fold decrease compared to the time of “developed socialism”, and starting from 1991 it almost reached a 2.5-3 fold decrease. (Dzhandzhugazova, 2004)

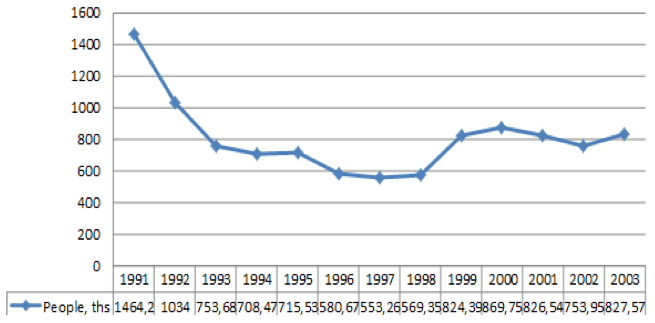

Figure 5 illustrates the data of State Statistics Department of the city of Sochi, clearly showing the dynamics for the number of vacationers for the period of 1991-2003.

Figure 5

Dynamics of the vacationers number for the period of 1991-2003

Presented dynamics of the vacationers’ numbers demonstrates a sharp decrease, and thus stresses the uselessness and even the harm of the introduction of additional fees in these periods. It is absolutely clearly that this experience has to be taken into account in modern conditions, as a significant number of people oppose the resort fee introduction. At the same time, the funds raised with a resort fee should support the maintenance and development of the existing resort infrastructure and should visibly enhance the quality of service, including improving the quality of beaches and other public areas of resorts. (Ruban, Zubrilina & Yashalova, 2017). Resort services consumers have to feel the improvement of the resort services, otherwise even moderate fees will be taken negatively by citizens, and and that undoubtedly they will change their attitude to the Russian resorts.

This is especially actual for the resorts of the Crimea, that still have a rather weak infrastructure and very bad resort service. In this situation a big responsibility is imposed on local resort authorities, who must be constantly engaged in a dialogue with their guests. They must help the tourist society to understand what was made with the use of the collected funds, and publicly discuss the projects of modernization of the resort infrastructure with tourists as well. Here, in our opinion, it is expedient to use the experience of the city of Moscow and Moscow city authorities, who hold regular electronic referendums on the portal “Active citizen” since 2014. This form of feedback with citizens allows not only to reduce the degree of social tensions, but also to obtain interesting and useful national initiatives. (Dzhandzhugazova, 2010)

In addition, if tourists, who pay resort fee, will really see out comes of this initiative introduction, then the negative attitude will be gradually overcome. Moreover, if in future authorities improve the mechanism of fee collecting, then all this will remove a superfluous burden from “resort fee operators”, which by law are legal entities or individual entrepreneurs providing hotel services of temporary accommodation for collectives or individuals.

World practice has also accumulated a considerable experience in the field of charging a resort fee. For example, in Belarus the resort fee is a local tax. Resort fee is collected from natural persons for their stay in sanatorium-resort organizations, health-improving centers, rest homes, boarding houses and others health-improving institutions. The tax base of a resort fee is determined by the cost of the stay, and the rate of a resort fee is set depending on the kind of sanatorium-resort organization, but it must not exceed 5%. If we take into account the fact that the taxable base is a stay price, then the resort fee generates a decent sum, considering that the price of stays in sanatorium-resort institutions has grown significantly in recent years. (Zaslavskaya, 2006)

In Italy, the resort fee has a rich history. It was repeatedly cancelled and re-entered over the years. Currently, the resort fee is a levy of a local level, which natural persons pay for living in the hotels situated in the territories of tourist zones and in historical cities. The procedure of taxation is executed while taking into account the large number of criteria, but within the set maximum of not more than 5 euros per night.

In the USA, the resort fee exists in the form of a hotel tax (Hotel Tax), which also belongs to levies of a local level. Its collection serves the purpose of the development of a tourism infrastructure, including the construction of tourism branch objects.

In Germany, a whole number of cities put levies on tourists as well. For example, in Berlin, this tax was introduced in 2014, and it equals 5% of the room rate. Herewith, the guests are exempt from this tax if they arrive to the city for business purposes.

In Portugal, inter alia in Lisbon, from January 1, 2016 the tourist city fee of local importance was also introduced. It is charged per each guest older than 13 years for €1 per night but not morethan of 7 nights, i.e. the fee doesn't exceed €7 per guest for the whole stay.

Since January 1, 2018, government taxes on accommodation were updated at hotels in UAE, Saudi Arabia, Greece, and in the city of Frankfurt am Main. The changes apply both to the new bookings and ones made in 2017 with dates of residence in 2018. According to the local tax policy, guests pay them on the spot at the hotel. In Greece, the tax rate may vary from 0.5 to 4 euro per night depending on the hotel category (for 5* it is €4; for 4* – €3; for 3* – €1.5; for 1*– €0.5, and for apartments – €0.5).

In Frankfurt am Main since January 1, 2018, the new city tax is set at the rate of 2 euro per person per night. Business travelers are exempt from paying taxes if they confirm the business purpose of the trip.

In the UAE and Saudi Arabia since January 1st, 2018, a new value added tax (VAT) came into operation. According to the Council of the Gulf countries cooperation (GCC), VAT on accommodation at a hotel equals 5% of a room rate.

In General, we can note that a resort fee as a local tax is widely used in the world resorts and tourist centers. Local authorities create procedures and terms for its collection while considering the time of a year and local peculiarities. Tourists mostly pay the tax for staying at hotels and other objects of collective accommodation, its rate has a limit, and some categories of citizens are exempt from paying it. (Zaslavskaya, 2006)

The resort fee problem is not just actual, it is of serious public importance, as resorts and tourist centers will always need additional funding, which allows them to maintain and develop resort infrastructure. Tourists, by-turn, using this infrastructure should participate in its creating and sustaining. However, we must not forget that people choose their own place of rest, and that means charging resort fees can cause frustration and reduce interest to the places with resort fees. In this regard, in our view, institutions of local self-governing from above described areas have to make the procedure clear for tourists, especially regarding the information on the expenditure of collected funds. It is very important to create the control system of fee collection, and to ensure targeted use of the funds collected. In addition, it is necessary to study periodically public opinion regarding the tourists’ attitude towards the terms and procedures of a resort fee collection to feel the mood of society. Very often, the people's discontent is caused not by the fact of fee collection itself, but by the illiterate actions from the local authorities and the opacity of the processes.

Davoudi, S.M.M., Fartash, K., Zakirova V.G., Belyalova A.M., Kurbanov R.A., Boiarchuk A.V., Sizova Zh.M. (2018). Testing the Mediating Role of Open Innovation on the Relationship between Intellectual Property Rights and Organizational Performance: A Case of Science and Technology Park. EURASIA Journal of Mathematics, Science and Technology Education, 14(4), 1359-1369.

Dzhandzhugazova, E.A. (2004). Formation of development strategy of the regional tourist-recreational complex. Moscow: AST.

Dzhandzhugazova, E.A. (2010). Tourism and innovational development: the project FSEE HEE “RSUTiS” “Living map of Russia”. Modern problems of service and tourism, 3, 66-72.

Dzhandzhugazova, E.A., Adashova, T. A. & Andreeva, T.S. (2012). Actual problems of studying of the Russian Federation tourist resources based on application of information technologies. Moscow: Academia.

Dzhandzhugazova, E.A., Blinova, E.A., Orlova, L.N. & Romanova, M.M. (2016a). Innovations in hospitality industry. International Journal of Environmental and Science Education, 11(17), 10387-10400.

Dzhandzhugazova, E.A., Ilina E.L., Latkin, A.N. & Kosheleva, A.I. (2016b). Development of creative potential of cinema tourism. International Journal of Environmental and Science Education, 11(11), 4015-4024.

Dzhandzhugazova, E.A., Kosheleva, A.I., Gareev, R.R., Nikolskaya, E.Yu. & Bondarenko, A.P. (2016c). Business administration in hotel industry: problems and solutions (by the example of the Russian Federation). International Journal of Applied Business and Economic Research, 14, 651-660.

Fartash, K., Davoudi, S.M.M., Baklashova, T.A., Svechnikova, N.V., Nikolaeva, Yu.V., Grimalskaya, S.A., & Beloborodova, A.V. (2018). The Impact of Technology Acquisition & Exploitation on Organizational Innovation and Organizational Performance in Knowledge-Intensive Organizations. EURASIA Journal of Mathematics, Science and Technology Education, 14(4), 1497-1507.

Federal law of 29.07.2017 No.214-FL. (2018). “About carrying out experiment on the development of a resort infrastructure in the Republic of Crimea, Altai Territory, Krasnodar Territory and Stavropol Territory”. E-resource Portal.ru, URL: http://www.garant.ru/products/ipo/prime/doc/71632774/ (accessed: 10.01.2018).

RIA “Novosti”. (2018). Experts told about the impact of resort fee collection on the Russians. August 10, 2017. URL: https://ria.ru/tourism/20170810/1500135762.html. (accessed: 14.01.2018)

Romanova, M.M. & Kolachev, I.P. (2017). Forecasts of tourism development in Russia. Problems and prospects of the hospitality industry and tourism. A collection of articles, 1, 145-151.

Ruban, D.A., Zubrilina, O.A. & Yashalova, N.N. (2017). Tourist accommodation in new rural destinations: the problem of adequate in the light of interregional comparison. Espacios, 38(28) 35-43.

The official website of the Russian President. (2018). The state Council Presidium meeting on improving investment attractiveness of Russian resorts on August 26, 2016. URL: http://kremlin.ru/events/president/news/52769. (accessed: 12.01.2018)

Tolkushin, A.V. (2001). History of taxes in Russia. Moscow: Yurist.

Zaslavskaya, E.M. (2006). Taxation of natural persons by resort (hotel, recreational) fee (tax) in legal practice of foreign countries. Taxes, 15, 25-28.

1. Hospitality and Tourism Department, Plekhanov Russian University of Economics, Moscow, Russia. Contact e-mail: Dzhandzhugazova.EA@rea.ru

2. Hospitality and Tourism Department Plekhanov Russian University of Economics, Moscow, Russia

3. Restaurant Business Department, Plekhanov Russian University of Economics, Moscow, Russia

4. Tourism Department, "Moscow State Autonomous Educational Institution of the Higher Education " Moscow State Institute of the Tourism Industry named after Yu.A. Senkevich". Kronstadt Parkway, Moscow, Russia