Vol. 39 (Nº22) Year 2018. Page 28

Vol. 39 (Nº22) Year 2018. Page 28

Tatiana M. KOVALEVA 1; Oleg A. KHVOSTENKO 2; Alla G. GLUKHOVA 3; Evgeny V. MOZHAROVSKY 4

Received: 03/02/2018 • Approved: 02/03/2018

ABSTRACT: The goal of the article is to develop theoretical provisions of assets securitization in the Russian Federation, to analyze the problems and prospects of its development. The main result of the research is the development of suggestions for expansion of the objects of securitized assets through the mechanisms of securitization of income from personal income tax. |

RESUMEN: El objetivo del artículo es desarrollar disposiciones teóricas de titulización de activos en la Federación de Rusia, para analizar los problemas y las perspectivas de su desarrollo. El principal resultado de la investigación es el desarrollo de sugerencias para la expansión de los objetos de los activos titulizados a través de los mecanismos de titulización de los ingresos del impuesto a la renta personal. |

During the last ten years the financial market of the Russian Federation has changed a lot as far as the formation of different financial instruments aimed at improving efficiency is concerned. Securitization of assets has occupied an important position among the instruments of financing. During a relatively short period of time since 1968 when the Federal National Mortgage Association (Fannie Mae) started issuing guaranteed mortgage securities (MBS), securitization of assets has become a widely spread instruments of financing.

Securitization of assets as a specific instrument of financing on the one side allows attraction of substantial financial resources creating new possibilities for state structures and companies and on the other side allows formation of different securities satisfying the needs of investors. According to the data of SIFMA the volume of emission of securities guaranteed with the help of assets securitization mechanism in the USA only in the year 2015 was 1879 billion dollars.

In the RF securitization of assets has been actively used since the year 2004. According to statistical data the volume of securitized assets during the period from 2004 to 2016 was much more than 567 billion rubles. Issuing securitized assets means emission of securities guaranteed by money flows from the objects of securitized assets. The list of objects of securitized assets used in the RF is limited and includes mortgage credits payments, automobile credits payments, leasing payments and future export income. At the same time the history of securitization market in the RF shows that mechanisms of increasing the number of objects of securitized assets which allow attracting money and regulating liquidity of financial market in general have not been developed yet.

The authors of the article have developed suggestions on expanding the objects of securitized assets by way of using mechanisms of securitization of assets for pension fund tax payments which can help to attract additional money to the budget system of the RF, to regulate the liquidity of its financial market aiming at its long-term development.

We consider the research of mechanisms of increasing the number of objects of securitized assets in the field of personal income tax payments and securitization of insurance payments to be very important and useful for the development of the RF financial market in general.

Mechanism of securitization appeared in the year 1934 and was stipulated by the creation of Federal Housing Administration in the USA. From the very moment of its foundation the Federal Housing Administration has been developing governmental programmes aimed at increasing the availability of credit for the poor population (Kopeikin and Tuktarov, 2008).

The term “securitization” appeared much later. It was connected with the deal made in 1977 under the name "Bank America Issue". Transaction support was performed by the bank Salomon Brothers. When writing an article about issuing securities backed by mortgage claim rights the reporter of the newspaper Wall Street Journal Ann Monroe asked the bank Salomon Brothers to comment the mechanism of securities issue. The Head of the Mortgage Department Lewis Ranieri suggested using the term “securitization” (Kondrat, 2011).

The International Financial Market in the end of the 70-s of the last century was characterized by the decrease of the role of bank crediting and its replacement by operations in the securities market. There appeared scientific research assuming attraction of financing at full displacement of banks from the process.

Among the founders of this theory is the Swiss banker Hans Peter Bar, the author of the book "Securitization of assets". In the relationship between the creditor and the borrower, the following phases of change are identified by him:

- in the first phase banks perform traditional functions and receive interest margins;

- the second phase is characterized by the direct relationship between investors and borrowers. The role of banks is only in supporting transactions (earning commission for investment banks);

- the third phase is characterized by the final exclusion of banks from the capital flow process. Even the services of investment banks may now be not in demand (Bar, 2006).

Let’s consider the most common definitions of securitization given in scientific sources.

1. Asset Securitization is the structured process whereby interests in loans and other receivables are packaged, underwritten, and sold in the form of “asset-backed” securities (Comptroller’s Handbook on Asset Securitization, 2016).

2. Securitization is a process of averaging and packaging of financial instruments in the new instruments that can be sold (Black’s Law Dictionary, 2009).

3. Securitization is a process by which a company packages its illiquid assets as a security. For example, when a company makes an initial public offering, it effectively packages the company's ownership into a certain number of stock certificates. Securities are backed by an asset, such as equity, or debt, such as a portion of a mortgage. Securitization allows a company access to greater funding to expand its operations or investments, or some other reason (Farlex Financial Dictionary, 2009).

4. Securitization is a financial transaction in which assets are collected in a single pool, and then securities that reflect the interest payments in the pool are issued (Risk-glossary, 2016).

5. Securitization is backed lending, in which the company gets a loan backed by assets or group of assets (Peter, 2006).

6. Securitization is a process of formation of the pools of financial obligations and their shaping that allows financial assets to freely circulate among many investors. Thus, securitization allows to turn the original obligations in the purchase object (Davidson et al., 2003).

7. Securitization is a process of taking many individual assets and combining them into a group,or pool,so that investors may buy interests in the pool rather than in the individual assets.The creation of collateralized mortgage backed securities is one example.The process increases the number of possible investors due to the ability to sell shares in the pool at relatively modest prices. In addition, because of the high degree of predictability inherent in large groups of things, the process of securitization increases predictability,lowers risk,and therefore increases value (Evans & Evans, 2007).

8. Securitization is packaging of loans or receivables in a pool using mechanisms of credit enhancements and the subsequent sale of the packed assets to investors. Investors buy repacked assets in the form of securities or a loan that are backed by this pool of assets. Thus, the securitization transforms illiquid assets into liquid (Garner, 2009.)

9. Securitization is the process of pooling various types of debt -- mortgages, car loans, or credit card debt, for example -- and packaging that debt as bonds, pass-through securities, or collateralized mortgage obligations (CMOs), which are sold to investors (Lightbulb Press Dictionary of Financial Terms, 2008).

10. Securitization is financing or refinancing of any assets of the company that generate revenues – for example, claims that arise in the ordinary course of business, by means of “conversion” of such assets in the tradable, liquid form through issue of bonds or other securities. In doing so, the company (originator) transfers a pool of its assets to a specially established entity, which in turn issues debt securities backed by the transferred assets (Securitisation in Russia, 2005).

Despite the long period of the mechanism functioning, there is no common definition of the concept "securitization". Economic literature and legal regulations contain various interpretations of securitization. At the same time two main groups can be distinguished: one is based on the description of securitization as a definite process, the other is based on the indication of the economic essence of securitization (Tuktarov, 2008).

The first group should include the definition reflected in the Law on Securitization of Singapore: "Securitization in its basic form is a process in which assets or rights for them are sold or otherwise transferred to the Special Purpose Vehicle (SPV) that attracts cash by issuing securities backed primarily by this asset".

Identical definition is given in the US Rules on the Securities (ABS Rules): "Securitization is a financial technique in which financial assets, in most cases less liquid, are collected together and converted into tools that can be offered and sold on the securities market" (Kopeikin and Tuktarov, 2008).

At the same time, in addition to defining assets securitization by the process, it is necessary to define securitization by the indication of its essence which is in "conversion" of certain assets into securities of the stock market such as bonds and participation certificates. Though the main word here is figurative ("conversion"), it successfully reflects the essence of securitization in which some financial assets are being represented through securities of the stock market due to their sphere of application possessing a high degree of liquidity (they are traded on the exchange market, they are transferred by way of records on the account and they are replaceable within the same issue) (Fabozzi, 2005).

Securitization appeared and was developing as a logical continuation of the general trend of increasing the role of securities. When considering securitization from an economic point of view, there is a tendency to improve sources of financing in risk management and to increase the role of financial instruments on the securities market. When considering securitization from a legal point of view, it is the result of the development of two centuries-old trends in law: reducing the level of responsibility and seeking security (Ulyukaev, 2010).

Securitization can be viewed both in its narrow and broad meaning. The principal difference of securitization in a broad and narrow meaning is the role of a bank or its absence in the process of securitization. In a broad meaning, securitization is the substitution of a bank loan for the financing of companies by the issue of securities, with the exclusion of a bank as a credit intermediary in the movement of funds (Nikolova, Rodionov and Mottaeva, 2016). In a narrow meaning, securitization is an innovative financing technique involving the pooling of illiquid financial assets in the form of bank loans into portfolios of homogeneous assets that secure issued bonds (Berzon and Teplova, 2013).

When studying economic literature and international regulations we extended the definition of securitization of assets of organizations as issuance of backed securities, the execution of which is carried out at the expense of income from the portfolio of assets or rights for these assets, by a special insurer.

Existing publications of researchers of economic science are mainly devoted to securitization of so-called banking assets: mortgages, consumer loans and auto loans. As a rule, these publications reflect the advantages of securitization transactions and describe the opportunities of applying foreign experience in the Russian Federation without taking into account possible risks that arise in the process of securitization and problems that impede the development of this mechanism mainly caused by gaps in the legislative regulation. It is necessary to single out the work of S.B. Pakhomov (2005) devoted to expansion of objects of securitized assets through securitization of debt obligations of the subjects of the Russian Federation. It is also worth noting the publication of D. Sobolev (2008) who studies securitized assets with the help of income from commercial real estate. The scientific work of N.I. Berzon and Teplova (2013) provides the list of new forms of securitization of cash flows where taxes, duties and fees are proposed as one of these forms without a description of the emission mechanism.

At the same time, there are no scientific studies devoted to the development of methodological approaches and proposals on the expansion of objects of securitized assets through mechanisms of securitization of income from personal income tax and securitization of insurance fees.

The goal of the study is to develop theoretical provisions for securitization of assets of organizations in the Russian Federation, to analyze problems and prospects for development.

The realization of this goal predetermined the need of solving the following tasks:

- to make proposals on risk management in the process of securitization;

- to view the peculiarities of the emergence and development of assets securitization in the Russian Federation;

- to reveal the problems impeding the development of assets securitization and suggest possible ways of solving them;

- to investigate the legislative background of the securitization of assets in the organizations of the RF ;

- to develop proposals for expanding the objects of securitized assets through the mechanisms of securitization of personal income tax collection and securitization of insurance fees for compulsory pension insurance.

In the process of research the following methods were used: theoretical (dialectical logic, methods of scientific abstraction); diagnostic (analyzing, modeling); empirical (comparison and generalization, grouping); experimental (observation and practical calculations); methods of mathematical statistics and graphical representation of results.

Experimental base of the research was OJSC Capital Bank "Trust".

There were three stages in the research:

1. At the first stage the theoretical and methodological basis of securitization mechanism and the approaches of various scientists to these problems were studied. In the end of this stage the key priorities in the development of financial risks management were revealed.

2. At the second stage of the study there was made the analysis of the emergence and development of securitization of assets of commercial organizations in the Russian Federation. International experience in the use of securitization was also examined. The result of this stage was the identification of the possibility of using this experience in commercial organizations of the Russian Federation taking adaptation into account.

3. At the last stage the problems impeding the development of securitization of assets of commercial organizations were revealed and possible solutions were suggested. There was also examined legislative support for asset securitization transactions. The result of the work at this stage was the development of recommendations for expanding the objects of securitized assets through securitization of income from personal income tax and securitization of insurance fees for compulsory pension insurance; the model of securitization of potential cash flows was proposed.

In our opinion, securitization of assets of organizations can be defined as the issuance by a special purpose vehicle (SPV) of backed securities, the execution of which is carried out at the expense of income from the portfolio of assets or rights for these assets.

The importance of securitization of assets is significant because it has a number of undeniable advantages for both the originator and the investors. The originator should be understood as an economic entity (usually a bank) that transfers to the special purpose vehicle (SPV) a portfolio of assets secured by cash flows from these assets.

Study of international securitization practices allowed classifying securitization according to distinctive features:

1) according to the type of asset. Depending on the type of cash flow generated, asset securitization is divided into two groups: securitization of existing claims and securitization of future claims;

2) according to the mechanism of execution. There are two generally recognized schemes of securitization: classical and synthetic.

The international practice of conducting transactions of classical securitization testifies to a large number of legislative barriers in contrast to synthetic securitization. As a result, in some countries, such as Germany, the basis of this market is the mechanism of synthetic securitization.

The study of the mechanisms of conduction and emission of local and international securitization transactions made it possible for the authors to identify the risks that affect securitization and to propose measures that allow, within the framework of the RF legislative field, eliminating or substantial reducing the specific type of risk.

Three groups of risks affecting securitization of assets were identified and presented:

- risks affecting the protection of cash flow;

- risks connected with the structure of originator and participants in the transaction;

- risks of securitized assets.

1. Risks affecting the stability of the cash flow are:

a) bank set-off of claims to the account holder (presentation of counterclaims to the account holder (SPV). In order to eliminate this risk the bank account agreement should contain a ban on offsetting counterclaims from the bank;

b) bankruptcy of the bank (imposition of a moratorium on the satisfaction of creditors' claims by the Central Bank of the Russian Federation when the powers of the executive bodies are suspended). In order to reduce this risk, the SPV should direct cash flows to the bank with the highest ratings, with high stability. Lowering of the rating of this bank makes it possible for them to be transferred to a bank that has a rating comparable to the previous one;

c) bankruptcy of the originator. In accordance with paragraph 4 of Art. 134 of the Federal Law on Insolvency (Bankruptcy), payments to individuals in accordance with employment contracts are included in the first and second priority of creditors. As the rights of claims are pledged by the SPV, and the claims of creditors for obligations secured by a pledge are satisfied at the expense of the aggregate value of the collateral to other creditors, the originator should have a minimal staff because employment contract payments to employees when the originator is bankrupt have priority over payments on other obligations.

2. In order to reduce the risks arising in the process of securitization of assets, the SPV and the participants in the transaction must meet the following requirements:

а) restrictions in the structure of share capital;

b) restrictions on activities. The need for restrictions is caused by the risk of a decrease in solvency when performing non-core activities not related to the fulfillment of obligations;

c) restrictions on reorganization;

d) the necessity not to have staff.

e) the need to analyze the conflict of interests of the organizers (investment companies and banks) and rating agencies that receive commissions on the results of the issue of securities. As a consequence, there is a conflict of interest in the fulfillment of obligations, as they are interested in increasing the volume of transactions in order to receive commissions based on their results.

f) provision of guarantees. The originators and the managers of the securitization funds have a potential wide battery of external tools for credit enhancement – that is, granted by financial entities outside the originator of the credits granted to the fund-, aimed at improving the levels of liquidity, risk, etc., perceived by potential investors (Peña-Cerezo et al., 2016).

3. Securitized assets are subjected to the following types of risks:

а) credit risk (the possibility of non-performance or improper performance by the counterparty of its obligations for the transaction). The initial aim of mitigation individual credit risk of participants conducted to the huge notional volumes outstanding traded and finally have exagerated the credit risk borne by the financial sector (Calistru, 2012). Subordination of assets is proposed as one of the measures to reduce credit risk. Subordination of assets is the placement of several classes of securities with different rights within a single issue of collateralized securities. A common form is the division of issue of collateralized securities into several classes: A, B, C, D. Transferring principal debt to the owners of securities of lower grades occurs provided that full repayment of principal debt to the holders of securities of senior classes was made;

b) risk of early repayment;

c) risk of borrower default;

d) tax risk. This risk is connected with the possibility of changes in fiscal policy initiated by the state which infringe the rights and interests of the parties having transaction. Securitization is heavily subjected to tax risk, as the life cycle of collateralized securities under securitization in some cases is more than forty years. The most common to reduce tax risk is to choose the jurisdictions of countries with the most stable legal system, such as Luxembourg and Ireland;

e) interest rate risk. The main reasons of interest rate risk may be: - unpredictable changes in the economic environment; - inconsistencies in the timing of assets and liabilities;

f) country risk (actions of a sovereign government or economic and political changes in the country). Key factors:

- political programs of the ruling and future potential elite;

- structure of the balance of payments of the economy and its dependence on the limited range of goods;

- stability of monetary and credit policy;

- level of life and social homogeneity of the population in general.

When planning international transactions country risks can be "doubled".

It was established that sustained economic growth accompanied by significant inflation, low level of total borrowings to GDP, together with the lack of long-term financing on the domestic market, contributed to the development of securitization in the Russian Federation targeted at the international market, which was followed by its reorientation to the domestic market (Kandyba and Perova, 2013). During the period from 2004 to 2016 the total volume of asset securitization transactions was 567,013.1 million rubles. When considering the structure of transactions, one can note the dominance of certain groups of assets in the total volume of the securitization market - mortgage lending (69%) and car loans (8%). The average maturity of the issued collateralized securities for auto loans is 5.6 years, for mortgage lending - 27.4 years.

In order to develop the securitization market for corporate assets in the Russian Federation, a study was carried out on the legislative support of securitization transactions in such countries as France, Spain, Italy, Portugal, Argentina, Luxembourg, which made it possible to establish the differences of approaches of legal regulation: by a single comprehensive legislative act and by the adoption of a list of legislative acts in this field. When examining the legislation of the European countries, there was studied the two-level legal system connected with the mandatory application of regulations to the treaty obligations of the European Parliament and the Council of Law, dated June 17, 2008, No. 593/2008 also referred to as Rome I).

Also, a separate research was made of the emergence, development and current state of the securitization of the US mortgage market, as the most developed in the world, which is of considerable interest for Russian practice. It is established that the Graham-Leach-Bliley law, adopted in 2000, contributed to the rapid growth of securitization in the USA, as the law abolished the prohibition on the ownership of bonds and securities by banks, which had been introduced by the Glas-Stigall Act of 1933 and separated banking and investment activities (Mozharovsky, 2013). As a result, during the period from 2000 to 2006 the number of issued securities which were collateralized by assets (ABS), increased from 281.5 to 753.9 billion dollars and the number of issued mortgage securities (MBS) by financial organizations from 101.7 to 917.4 billion dollars. The financing of the US mortgage market was provided by market participants performing specialized functions. Banks were attracting clients and giving loans. Loans were collected in homogeneous portfolios and sold to investors as collateralized by these securities portfolios. In order to increase the interest of investors in securities, banks attracted rating agencies that assigned credit ratings to securities. Subsequently, investment banks modified already issued securities in collateralized debt obligations (CDO) and sold to investors (Uzun and Webb, 2007).

As a result of the analysis of participants in the scheme of securitization of mortgage assets in the US, a conflict of interest has been established. Most of the banks' income was got from fees for servicing and issuing loans. As a result, banks issued large volumes of loans in the shortest possible periods of time. Borrowers with more than 620 points of credit score passed a formal check. Then the formation of portfolios of these loans, their sale, and receipt of refinancing and transfer of risks from the banking balance took place. At the same time, checks of increased complexity were carried out for borrowers with a credit score of less than 620 points, since these mortgage loans were more difficult to securitize.

The research showed that during the first two years, the default declaration of 20% is more likely to happen with borrowers with a credit rating of 621 to 625 than with borrowers with 615 to 619 points. As a result, during the period from 2006 to 2016, there was a multiple decrease in the volume of securities issued with ABS from $ 753.9 million to $ 186.1 billion and a multiple decrease in the issue of mortgage securities (MBS) by financial institutions from 917.4 to 96, 8 billion dollars.

The problems of securitization of assets in the RF can be conditionally divided into economic and legislative. The first group involves the decrease of the demand of international investors for structured finance instruments due to the bankruptcy of Lehman Brothers, a company with a centuries-old history and over $ 500 billion assets. In the interbank lending market, there were significant liquidity problems. For some time, the securitization mechanism practically did not function. As a result of this, there was not only the substitution of external securitization by the internal one but also the replacement of private originators by the state ones.

Legislative problems revealed in the process of preparing and conducting securitization transactions are caused by the gaps in a wide range of legal acts. Until July 1, 2014, securitization of assets of organizations was regulated only by the Law "On Mortgage Securities", No. 152-FZ, November 11, 2003. It regulated only securitization of residential and non-residential real estate. It should be noted that on April 2, 2009, Anatoly Aksakov, President of the Association of Regional Banks of Russia, submitted to the State Duma of the Russian Federation the bill of the Federal Law "On Securitization". Until now the Law "On Securitization" approved in the first reading by the State Duma of the Russian Federation has not been adopted.

We can formulate the main priorities for the development of asset securitization in Russia.

State support of asset securitization market is necessary as far as changes in the legislation concerned, in the part of:

- inclusion of highly reliable securities guaranteed by assets in the Security List of the Central Bank of the Russian Federation;

- cancel of restrictions on investment of the National Welfare Fund resources in securitization of highly reliable assets;

- standards on terminology concerning participants of a transaction;

- amendments in the field of taxation.

As a separate measure necessary for the development of securitization of assets of organizations in the Russian Federation, the authors of the article proposed the institution of preliminary coordination of consequences of a transaction with tax administrative bodies.

This procedure should be carried out as follows: the taxpayer applies to the tax authority for a public service with the provision of all the necessary information on the planned transaction. After the Federal Tax Service of the Russian Federation makes the analysis of the information and documents in 60 calendar days or in 90 calendar days as when making desk tax audit of the tax return, the taxpayer receives a conclusion on the results of the transaction verification. If the taxpayer fulfills the conditions he is exempt from tax liability. In case of securitization of assets of organizations it is advisable to set a 1 billion rubles limit on the amount of transaction. As this procedure is a public service, it is necessary to establish a certain fee for it in the form of state duty. The authors suggest introducing a state duty in amount of 200 thousand rubles if the transaction amount exceeds 1 billion rubles plus 0.01% from the amount exceeding 1 billion rubles, but not more than 1 million rubles, when obtaining an opinion on the results of verification of a transaction of securitization of organizations’ assets, similarly to property cases.

The analysis of the Federal Law, December 21, 2013 No. 379-FZ "On Introducing Amendments to Several Legislative Acts of the Russian Federation" made it possible to establish the peculiarities of the Russian securitization market, as well as the gaps and contradictions which have a significant negative impact on the securitization market in general. Taking into account the subject hierarchy of federal laws, it was revealed that certain provisions of this draft law concerning the impossibility of suspension, seizure or writing off of funds on a nominal account, contradict the provisions of the Tax Code of the Russian Federation (RF Tax Code). We have studied negative court practice in the field of possible tax consequences of securitization transactions on the example of the JSC KB Trust, which received an unreasonable tax benefit in the form of an overstatement of a loss of 150.2 million rubles and an unpaid profit tax of 86.4 million rubles. So, inconsistency was found between national and international legislation of the Tax Code of the Russian Federation, as well as the lack of the concept "securitization" in the Russian legislation. It was also established that Federal Law No. 379-FZ, December 21, 2013 regulating securitization transactions does not affect the area of state finance.

Taking into account that the market of securitization of organization’s assets in the Russian Federation is limited by the number of objects for securitization, models of securitization of income from personal income tax and securitization of insurance premiums for compulsory pension insurance are proposed for the first time in this context.

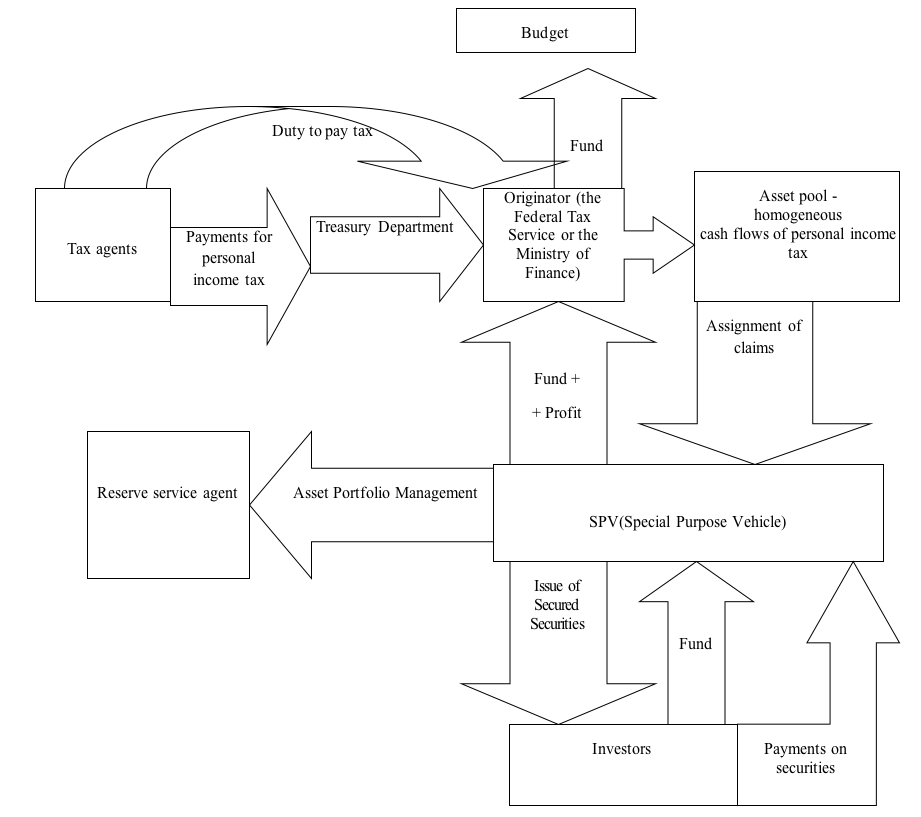

In our opinion, securitization of income from personal income tax should be understood as securitization, where the SPV is issuing securities, the execution of which is carried out through income from personal income tax from tax agents. Financing is carried out by placing these securities on the stock market. The model of securitization of potential cash flows from personal income tax is presented on Figure 1. The process of securitization of income from personal income tax includes several stages that show the activities of participants in this process from the payment of personal income tax by a tax agent to the redemption of securities guaranteed by this income from personal income tax.

Figure 1

The Model of Securitization of Potential Cash Flows from Personal Income Tax

1. Formation of portfolio of assets - income from personal income tax with a high degree of homogeneity in terms of liquidity and non-repayment risk.

Liquidity, that is, the frequency of cash flows from personal income tax receipts from tax agents, is fixed by Federal Law No. 137-FZ , July 27, 2006. The tax agent calculates, makes deductions from the employee's salary once with the final calculation of the income based on the results of each month and transfers personal income tax to the budget.

2. Accumulation of a portfolio of assets. Portfolio assets are advance payments on personal income tax paid monthly by a limited list of tax agents. The rights of claims for future cash flows on personal income tax are in this case security. The originator represented by the Federal Tax Service, which simultaneously performs the functions of a service agent, accumulates and maintains a portfolio of assets - receipts of advance payments on personal income tax. The mechanism of accumulating assets outside the structure of the Federal Tax Service which is responsible for the completeness of collection and control over the accuracy of calculation of personal income tax, is to allocate the portfolio of assets on the balance sheet of the SPV (the accumulating organization). From the judicial point of view SPV is an organizational and legal structure created for strictly defined and limited purposes. Then the Federal Tax Service of Russia directly sells the rights for the assets to the SPV. When the portfolio is sold, rights for the assets are transferred to the SPV, which, in turn, is the issuer of the securities.

3. Issue and placement of securities. It is conducted with the interaction of the participants: SPV (issuer of securities), underwriter, reserve service agent, legal company, audit organization and rating company. At the same time, the Ministry of Finance of the Russian Federation may act as an alternative to the Federal Tax Service of the Russian Federation (FTS of Russia) involved in this securitization scheme as an originator. After the issue of securities on the stock market, the money received from the sale is received by the SPV, which transfers these funds to the budget through the Federal Tax Service of Russia.

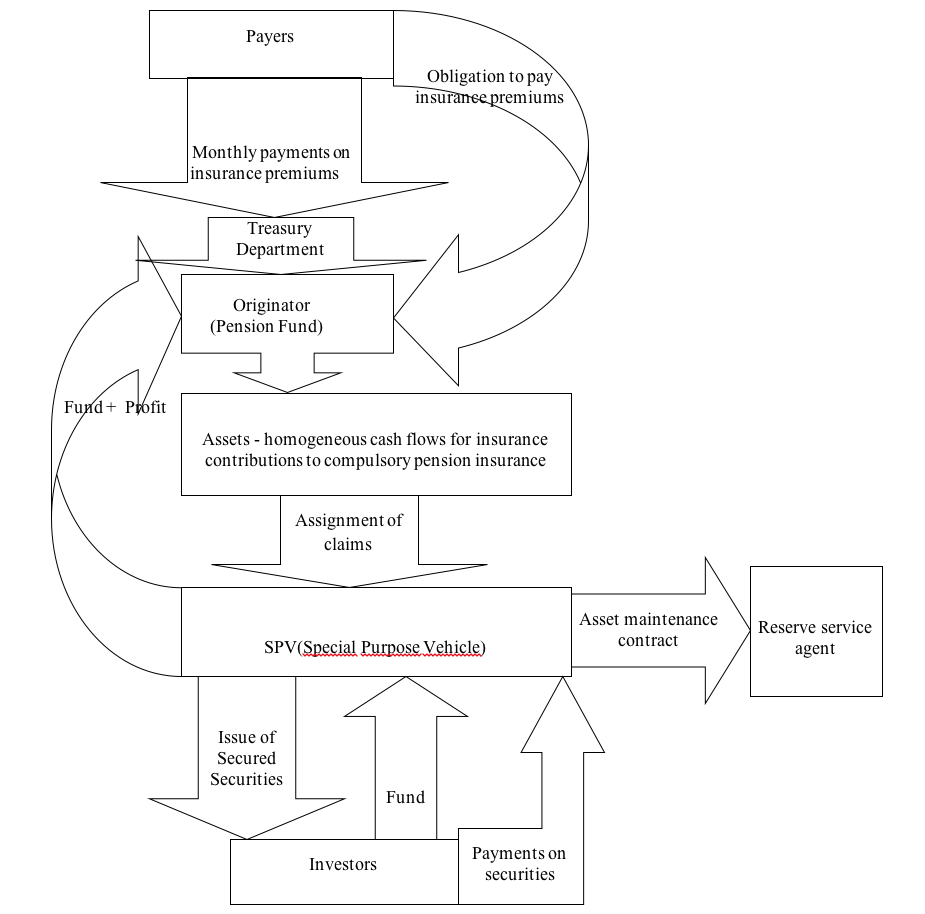

4. Accumulation of funds for making payments on securities. Payments on personal income tax which are paid by tax agents to the territorial offices of the Federal Treasury for constituent entities of the Russian Federation are accumulated by the originator. Then the Federal Tax Service of Russia transfers the data of advance payments on personal income in accordance with a limited list of tax agents to the account of SPV. SPV collects these cash flows to pay off securities and pay interest on them. Then the redemption of securities takes place. In support of the above mentioned N.I. Berzon and T.V. Teplova (Berzon and Teplova, 2013) provide a list of new forms of securitization of cash flows, where taxes, fees and duties are proposed as one of the new forms. The list is not limited. The securitization process is practically unlimited; any debt that generates cash flow can be pooled and offered to investors. Taking into account a similar economic nature and urgency of personal income tax and insurance premiums for compulsory pension insurance, we consider it advisable to give suggestions on expanding the objects of securitized assets through securitization of insurance premiums for compulsory pension insurance. The securitization of insurance premiums for compulsory pension insurance means the process in which the rights of claim for future cash flows on direct insurance premiums are sold or otherwise transferred to the SPV which attracts funds through placement of securities guaranteed in the first turn by these rights of claim on the stock market. The model of securitization of potential cash flows on insurance premiums can be shown as follows (Figure 2).

Figure 2

The Model of Securitization of Insurance Fees on Compulsory Pension Insurance

It is necessary to adopt legislative acts allowing state departments and constituent entities of the Federation to establish specialized societies where they could be beneficiaries for the purpose of using and transferring certain tax payments to secure debt obligations.

The same suggestions are made in the publications of S.B. Pakhomov, the Chairman of the State Borrowing Committee of the City of Moscow, (Pakhomov, 2005).

The large-scale implementation of securitization mechanisms of insurance premiums and income from personal income tax will increase the liquidity of the ruble debt market in general. At present the question of the development of the assets securitization market of the Russian Federation is controversial, as, taking into account that it followed the trends of the development of the US assets securitization market, the national securitization market of the Russian Federation will reproduce the same trends but with all the imperfections in the legislative basis.

The recommendations on changing the legislation in the field of assets securitization and proposals for expanding the objects of securitized assets presented in the article will increase the potential of the national assets securitization market of organizations aimed at improving the financial security of the state, as well as increasing the stability and competitiveness of the financial system of the Russian Federation.

In accordance with the established goals and on the basis of the research the following conclusions were made:

1. The study of the mechanisms of conducting and issuing transactions of local and international securitization allowed us to identify the risks that affect securitization and to propose measures that make it possible, within the framework of the RF legislative field, to eliminate or significantly reduce the occurrence of a specific type of risk.

There were revealed and represented three groups of risks influencing securitization of assets:

- risks affecting the protection of cash flow;

- risks associated with the structure of the originator and participants in the transaction;

- risks of securitized assets.

2. The emergence of securitization in Russia is closely connected with the implementation of the first transaction: in 2004, the gas company Gazprom attracted $ 1.25 billion, issuing securities guaranteed by future export contracts.

The preconditions for the emergence of securitization in Russia are revealed:

- continued economic growth, accompanied by significant inflation;

- the possibility of obtaining financing in international markets;

- low volume of borrowings to GDP;

- lack of supply of long-term financing in the domestic market.

The above-mentioned factors contributed to the development of securitization in the Russian Federation, targeted at the international capital market.

The total volume of transactions of securitization of assets issued during the period from 2004 to 2016 amounted to 567,013.1 million rubles, which allows us to talk about the formation and development of the national securitization market for Russian mortgage assets. At the same time, the high homogeneity of the internal securitization market allows us to conclude that there is a shortage of objects of securitized assets and imperfect legal and regulatory framework.

3. The main problems of securitization of assets of organizations in the Russian Federation, which are conditionally divided into economic and legislative ones, are revealed and thoroughly described.

The research revealed that in order to solve the problem of attracting long-term investments, it is necessary to take a decision to include highly reliable guaranteed securities in the Pawn List of the Bank of Russia. It is necessary to make legislative amendments in order to remove the restriction on investing the funds of the National Welfare Fund in securitizing highly reliable assets.

It also seems reasonable to propose to organize an institution for preliminary coordination of the consequences of the transaction with the tax authorities necessary for the development of securitization of assets of organizations in the Russian Federation.

4. The analysis of Federal Law No. 379-FZ , December 21, 2013 "On Making Amendments in Several Legislative Acts of the Russian Federation" made it possible to establish the peculiarities of the Russian securitization market, gaps and contradictions which have a significant negative impact on the securitization market in general.

We found a discrepancy between national and international legislation and the Tax Code of the Russian Federation, as well as the absence of the very concept of "securitization" in the Russian legislation. We also established that Federal Law No. 379-FZ, December 21, 2013 regulating securitization transactions does not affect the area of public finance.

5. The number of objects for securitization in the Russian assets securitization market is limited.

There is no experience of securitization of income from personal income tax and securitization of insurance premiums in the Russian Federation.

The international experience of securitization of these types of assets in the markets of such countries as the USA, Italy and Argentina was studied.

For the first time the mechanisms of securitization of income from personal income tax and the securitization of insurance premiums are proposed in the context of the topic under consideration.

The recommendations on changing the legislation in the field of assets securitization and proposals for expanding the objects of securitized assets presented in the study will increase the potential of the Russian securitization market targeting at improving the financial security of the state, as well as the sustainability and competitiveness of the financial system of the Russian Federation.

Bar, H.P. (2006), In: Alekseev, Y.M., Ivanov, O.M., editors. Asset Securitization: Securitization of Financial Assets – Innovative Technology of Banks Funding; Transl. from German. Moscow: Wolters Kluwer, pp. 624.

Berzon, N.I, and Teplova, Т.V. (2013), Innovation in financial markets. Publishing house of the Higher School of Economics.

Calistru, R.A. (2012), The Credit Derivatives Market – A Threat to Financial Stability, Procedia - Social and Behavioral Sciences, VOL 58, NO 12, pp. 552-559.

Comptroller’s Handbook on Asset Securitization. (2016), Retrieved from: http://www.occ.gov/ [Last accessed on 2017 Jan]

Davidson, A, Sanders, A, Wolff, L.L., and Ching, A (2003), Securitization: Structuring and Investment Analysis. Hoboken, New Jersey: John Wiley & Sons.

Dictionary of Financial Terms (2008), New York: Lightbulb Press, pp. 812.

Evans, L.D., and Evans, O.W. (2007), Complete Real Estate Encyclopedia. New York: The McGraw-Hill Companies, Inc.

Fabozzi, F.J. (2005), The bond market: analysis and strategy. Moscow: Alpina Business Book.

Farlex Financial Dictionary (2012), Huntingdon Valley, PA: Farlex Inc.

Garner, B.A. (2009), Black’s Law Dictionary. 9th ed. St. Paul: West Group.

Glossary of terms of mortgage financing and securitization (2007), The International Finance Corporation, Moody's.

Kandyba, M., and Perova, E. (2013), The second life of Russian securitization. Review of legislation. Pricewaterhouse Coopers International Limited, 16 (87), pp. 221.

Kondrat, E.N. (2011), Securitization of assets as a way to strengthen the liquidity of credit institutions and the mechanism for ensuring financial security. Legislation, vol.8., pp. 39-47.

Kopeikin, A.B, and Tuktarov, Y.E. (2008). Mortgage securities. Moscow: The Institute for Urban Economics, p. 42.

Mozharovsky, E.V. (2013), International experience of asset securitization using the example of the United States. Issues of economics and law, 2(56), pp. 162-167.

Nikolova, L.V., Rodionov, D.G., and Mottaeva, A.B. (2016), Securitization of bank assets as an innovation of a multifaceted nature. International Journal of Economics and Financial Issues, Vol.6, pp. 318.

Pakhomov, S.B. (2005), Debt instruments of budgetary and investment policy of the subjects of the Federation. Stocks and bonds market, Vol. 13, pp. 54.

Peña-Cerezo, M.Á., Rodríguez-Castellanos, A., and Ibáñez-Hernández, F.J. (2016), Primary yield and multitranche structure in securitization issues: Explicative factors. European Research on Management and Business Economics, 22(3), p. 111.

Peter, J.A. (2006), Practitioner’s Guide to Securitisation. London: City and Financial Publishing.

Securitisation in Russia: Ways to Expand Markets and Reduce Borrowing Costs. Position Paper of the International Financial Corporation’s Technical Working Group on Securitization. March 2005. Retrieved from: http://www.ifc.org/ [Last accessed on 2017 Jan]

Sobolev, D. (2008), A new draft of the Russian law on securitization. Law. Vol. 12.

Tuktarov, U. (2008), Securitization and assignment of future claims. Encyclopedia of Russian securitization. St. Petersburg: Lubavin.

Ulyukaev, S.S. (2010), Securitization of assets: a global macroeconomic phenomenon. International banking operations, Vol.3, p. 71.

Uzun, H., Webb, E. (2007), Securitization and risk: empirical evidence on US banks. The Journal of Risk Finance, Vol. 8 Issue: 1, pp.11-23'

1. Doctor of Economic Sciences. Head of the Department of Finance and Credit. Samara State University of Economics, Samara, Russia. E-mail: fikr@bk.ru

2. Candidate of Economic Sciences. Associate Professor of the Department of Finance and Credit. Samara State University of Economics. Samara, Russia. E-mail: khvostenko@samtfoms.ru

3. Candidate of Economic Sciences. Associate Professor of the Department of Finance and Credit. Samara State University of Economics. Samara, Russia. E-mail: hecate1@mail.ru

4. Candidate of Economic Sciences. Deputy Head of Inspectorate. Inspectorate of the Federal Tax Service of Russia for Oktyabrsky district of the city of Samara, Russia. E-mail: hollywood101@mail.ru