Vol. 39 (Number 24) Year 2018 • Page 13

Aziya KULUBEKOVA 1; Saule YEGEMBERDIYEVA 2; Tolkyn AZATBEK 3; Madina YELPANOVA 4

Received: 07/05/2018 • Approved: 20/05/2018

ABSTRACT: The article describes the risk factors affecting the efficiency of the business entities of the oil sector. The risk analysis of the oil companies is made. The main problems are identified and the risk management measures are given. |

RESUMEN: El artículo describe los factores de riesgo que afectan la eficiencia de las entidades comerciales del sector petrolero. El análisis de riesgo de las compañías petroleras está hecho. Se identifican los principales problemas y se dan las medidas de gestión de riesgos. |

The oil and gas industry is exposed to various types of risks that have negative impacts on the economic activity of the entity and require their management. The development and extraction of deposits are frequently accompanied by the typical risks in the ongoing activities of the enterprises, which are inherent to all the economic entities as well as to the oil companies and the complex as a whole.

The oil and gas complex is characterized by a high level of accidents, emergencies, catastrophes in the workplace. Huge human resources and capital are involved in the development of mineral resources. Therefore, it is necessary to manage risks during the work performance of the oil companies in order to reduce the risk exposure to the entity and to organize efficient and cost-effective production.

The modern researches made on the risk management primarily focus on the formation of groups of risk factors affecting specific types of risks. Moreover, the major research efforts are aimed at clarifying the list of risk factors for specific types of risk as well as at the development of impact assessment procedures of these factors on the dynamics of the relevant risks. According to the opinion of modern authors such as I.Z. Gafijatov (2007), E.A. Konovalova (2009), H.F. Kloman (1999), A.F. Andreev (1997), K.J. Arrow (1971), А.А. Medeu (2002), V.I. Terehina (1998), when making the analysis of factors it is important to identify those ones that affect a particular type of risk.

The main purpose of our research consists in identifying the risk factors and analyzing the risks of oil companies.

In the market economy the business entity itself has the liability for obligations. All the consequences of the inefficient use of resources are entirely borne by the owners, the administration and staff of the enterprise. The level of risk depends on many factors such as the factors dependent on the company's activities and those that are independent. The risk factors affect the specific risks selectively and they are able to provide an integrated impact on the whole group of risks (Gafijatov, 2007).

Under uncertain conditions any activity is characterized by the relevant risks. Accordingly, there is a need to study, to monitor and to assess risks of the oil-producing companies (Konovalova, 2009). The existing risks are varied and can be divided into many categories. The versatility of the notion of risk is due to a variety of factors that characterize a particular specific activity, as well as the specific features of uncertainty under which this activity is carried out. The factors contributing to the emergence of a particular type of risk and defining its character are risk factors.

All risk factors can be divided into 2 groups: internal factors arising in the course of business activity of the enterprise; external factors that exist outside the company. The internal factors should include all those actions, processes and things arising from the activities of the company, both in management and in the sphere of circulation and production. The group of internal factors usually includes a balanced development, focus and scientific approach to the management activities and related services of the company to develop effective enterprise development strategies, estimates characteristics of reliability of functioning of technical systems in the company, the level of education of staff and so on. The category of external risk factors includes political, scientific-technical, socio-economic and environmental factors. The specific risk external factors are trading on the exchange markets, the behavior of competitors, the development of scientific and technical progress and others. In addition, it is possible to classify the risk factors in the degree of company’s reaction on the impact of these factors. From this point of view the risk factors can be divided into: the objective factors - the factors that the companies cannot influence; the subjective factors - the factors that are regulated by the companies.

The analysis of the areas of the theoretical research in the field of the efficient risk management allows us to conclude that these studies have neglected a number of problems, the underestimation of which during the practical use, can lead to incomplete or incorrect assessment of the impact of the certain risk factors on the relevant risks.

The first problem is that a number of risk factors affecting the dynamics of several types of risks are not emphasized. These risk factors can exclude each other. Thus, inflation is a significant impact on foreign exchange, credit and interest rate risks in investments made in securities. The deterioration of the political situation, in turn, leads to an increase in investment, political and country risks. Moreover, the presence of one of the integral factors for a particular type of risk in the group of the risk factors should be the basis for a mandatory comprehensive review of all related types of risks. For example, inaccurately certain amount of collateral (one of the credit risk factors) leads to the occurrence of liquidity risk and operational risk, as the use of software "requires a comprehensive information system and significant opportunities for internal control".

The second challenge is to show the risk factors only as the factors of direct exposure to specific types of risks. The study of these risks implies that there are two basic approaches:

Approach1 - quite a strong tendency to selective risk analysis with consideration of the impact of all the factors on the risks can be traced. However, the combined effect of risk integral factors on the whole risk groups is ignored, which greatly reduces the effectiveness of the recommendations generated by the optimization study of risks;

Approach 2- the follower of this approach try to identify the risk integral factors for specific types of risk, but they do not take into account the generalized impact of such factors on the risk groups associated with them (Kloman, 1999).

Most risk factors are native, i.e. the factors are inherent to some specific risks and do not affect the other kinds of risks. An example of the native factor is the possible decline in the price of gold, which has an impact only on the market risks and has no effect on the organizational and technical and production risks. At the same time, there are several risk factors simultaneously influencing several types of risks, or so-called risk integral (generalized) factors.

An example of such an integral risk factor is the increase in energy prices, which has an impact on the market risks, as well as the impact on the organization (the possible failure of the system of production). The first group of factors is offered to include: dishonesty or partners’ professional mistakes (third parties); dishonesty or professional mistakes of employees, etc. The second group of factors is offered to comprise: changes in the national currency exchange rate against the major world currencies; the level of inflation and others.

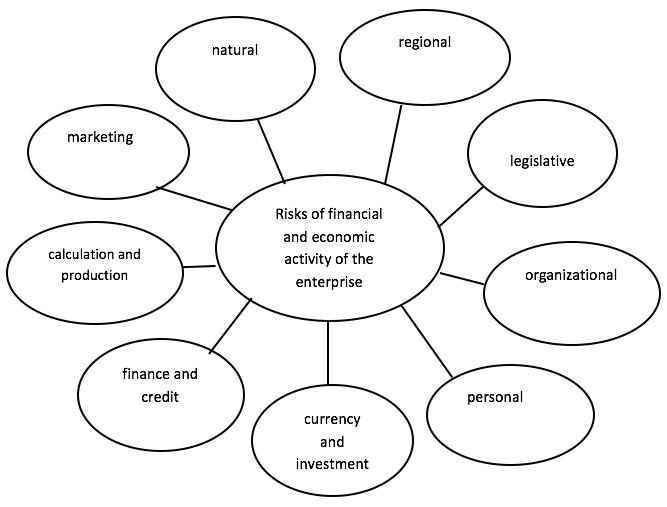

Taking into consideration the above risk factors, risks can be classified as follows:

Figure 1

Risk classification according to the risk factors, authorʼs

According to this scheme, the regional risk characterizes the features of the region where the financial and economic activity of the enterprise is planned or has already been carried out; the natural risk occurs due to the negative influence of natural disasters; the political risk characterizes both the ability to change the socio-political climate in the country and the region and the prospects for development; the legislative risk is due to the possibility of sudden changes in the various legislative acts affecting the financial and economic activity of the enterprise; the transport risk comprises the probability of loss of assets (property, facilities, etc.) during transport or transportation; the organizational risk is caused by the internal factors within the company; the property risk characterizes the degree of probability of loss of property due to theft, sabotage, negligence, etc.; the personal risk occurs when the particular person, his business and moral qualities depend on the final results of the financial and economic activities; the marketing risk characterizes the conditions of the market (demand, supply, prices) where the financial and economic activity of the enterprise is carried out; the production risk happens due to the development of new techniques, technologies and production activities; the calculation risk refers to the probability of loss due to incorrectly selected time, the method and timing of payment; the investment risk occurs due to the choice of investing in order to obtain economic benefits for a certain period of time; the currency risk characterizes the effect of changes in exchange rates on the financial and economic activity of the enterprise; the credit risk implies the overall of all the risks associated with the process of evaluation of the borrower; the financial risk characterizes the analysis of the financial and economic activity of the enterprise on the basis of financial statements.

The oil and gas industry as a system is characterized by a number of specific features that distinguish it from the other branches of material production. The most significant of these in terms of the risk assessment are: high dependence of indices and criteria of cost-effectiveness on the natural environment, the level of use of developed and extracted hydrocarbon resources; the dynamic nature (variation in time) of the environmental factors; the probabilistic nature of most of the technical and economic indicators of the development of the oil and gas fields; changes in reproductive patterns of investment across the industry in the direction of increasing their share allocated to compensate production decline on the former fields; longer duration of the implementation of the oil and gas projects; high capital intensity of oil and gas, need for large initial investment, long period of recovery of the initial capital and others.

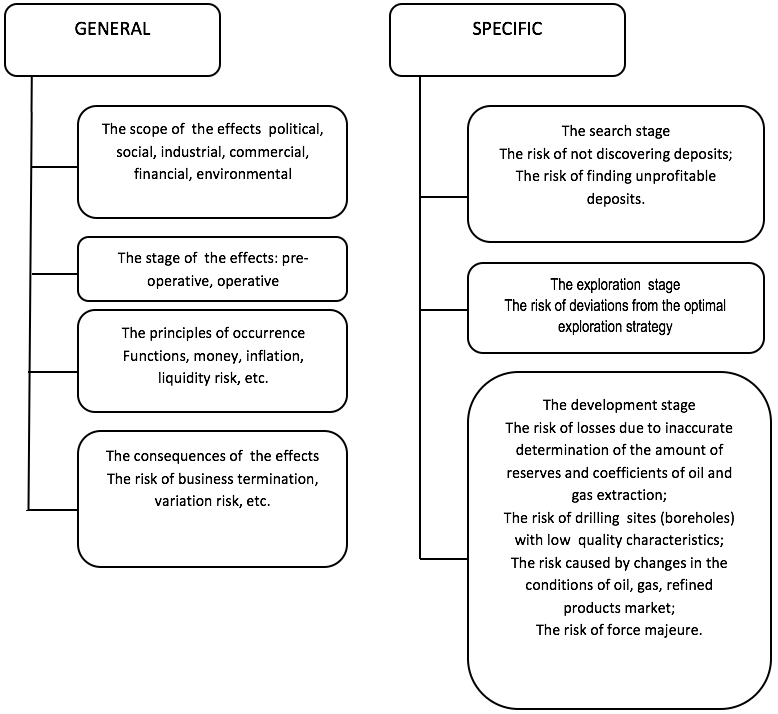

These features of the oil and gas industry have an impact on the formation of the system of risks, which are classified by us as follows (Figure 2):

Figure 2

Classification of risks in the oil and gas industry, it is made

by the author on the following book: (Andreyev 1997)

In addition to those risks there are some specific in the oil and gas industry: the risk of unexplored deposits; the risk of developing unprofitable deposits; the risks associated with inaccurate determination of geological and commercial characteristics of the developed object (the volume of geological reserves, the level of oil and gas extraction, the volume of recoverable reserves, the dynamics of hydrocarbon production, etc.); the risks associated with the completion of the project; the risks associated with the terms of the commodity market of oil, gas, petroleum products; the risk due to the qualities of the project participants; the risk caused by the increased occurrence of force majeure.

All of the factors that could potentially affect the increase in risks are divided into two groups: objective and subjective. The objective factors are the factors that do not depend directly on the activity of the companies: the political and economic crises, inflation and competition, economic conditions, customs duties, the presence or absence of MFNT. The subjective factors characterize the internal environment of the organization. Such factors include the productive potential, the level of technical equipment, the substantive and technological situation, work organization, the extent of cooperative relations, the level of labor productivity, the choice of the type of contract with the investor, customer, etc.

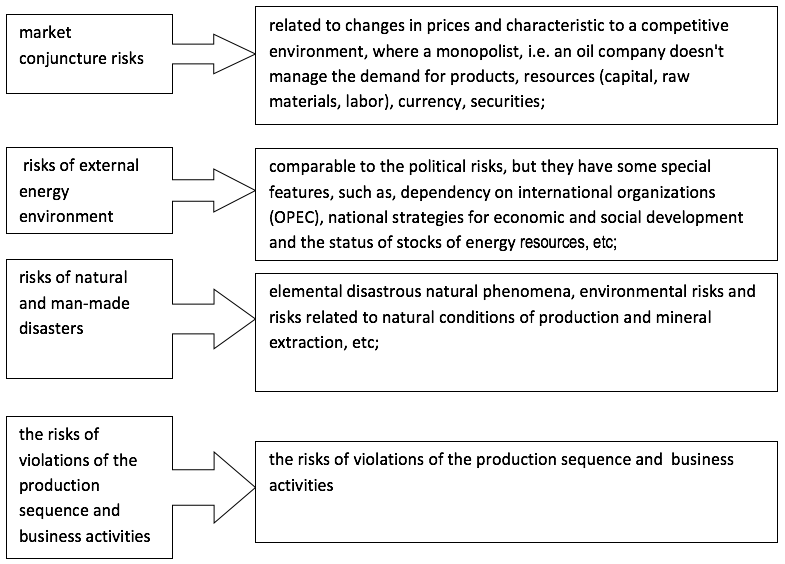

According to the general classification of risks in economic activities of the oil companies one should bare in mind the following ones:

Figure 3

Specific risks of economic activities of the oil companies, authorʼs

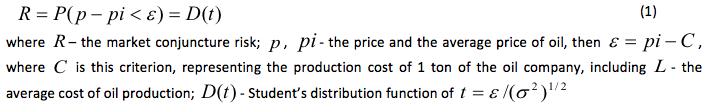

The market conjuncture risks are the risks of market price changes on products, services that is typical for commodities, one of which is oil, and the factors of production: human resources, equipment, land and availability of capital. As a whole the market conjuncture risks resemble of the market risk. The market risk is the risk of business activity of the oil company in a competitive environment (Arrow, 1971). For oil companies, this risk is determined using the following formula:

In the calculation of the market conjuncture risks, there are two logical questions: what price to take for basic prices – world or selling ones of the oil company and for what period to calculate the price of oil? According to the Kazakh economist A.A. Medeu, it is preferable to take the selling price of the company since the dynamics of the world prices for the various grades of crude oil does not reflect the real situation, besides they are set by the oil traders - resellers on the Exchange, so you should take the oil spot price of oil producing companies, and here we agree with it (Medeu, 2002).

There are three possible ways of influencing and managing the market conjuncture risks: the first – devaluate tenge; the second – decrease the real oil cost; the third – hedge the risks at future and optional exchanges.

Firstly, the tenge rate is prerogative of the National bank of the republic of Kazakhstan. Though, having favourable conjuncture in the world market of oil and petroleum products the oil companies own large financial resources that contribute to the economy of Kazakhstan and make tenge more stable that in its turn increases the market conjuncture risk.

Secondly, to reduce the cost of oil production will hardly be possible without large capital investments. Thirdly, you must set the volumes of oil to be insured and to define hedging instruments. Ideally, you can hedge the entire volume of crude oil, but it is fraught with a significant current costs and lost profits if conditions are favorable. Therefore, it is necessary to determine, in advance, how much of the product the company will hedge just to meet two requirements: first, it is possible to receive revenues from rising of oil prices, and secondly, it is proposed to reserve an acceptable level of risk. The volume of product, which is required, can be determined by the following formula:

There is no need to hedge, if the risk equals or falls down 20% and vice versa; there is no need to increase the share of the hedged products, if the risk equals or exceeds 50%. In the latter case, the average oil price falls below its cost and the cost of hedging goes beyond the positive effect of its application. The risk level of 0,25 is considered to be low when the company can lose approximately about a quarter of the capital.

The financial activities of the company in all its forms are associated with many risks and their degree of influence on the results of this activity significantly increases in the market conditions. The risks associated with this activity are highlighted in a special group of financial risks, which play the most significant role in the overall "risk portfolio" of the enterprise.

Some scientists-economists (Terehina, 1998) propose three measures to determine the financial sustainability of the company in order to determine the extent of funding risk. These indicators are: surplus (+) or deficiency (-) of own funds; surplus (+) or deficiency (-) own, medium- and long-term borrowed sources of formation of reserves and costs; surplus (+) or deficiency (-) of the total value of the main sources for the formation of reserves and costs. These figures correspond to the figures of provision of reserves and costs by the source of their formation.

The analysis of absolute indices of the financial sustainability, which include the study of stocks and expenses, equal to probable risk losses.

The activities of the oil companies are of permanent and stable nature and the risks associated with the activities remain unchanged year by year. However, under the influence of external and internal risk factors the risks can change the probability of their occurrence and the amount of the potential damage (Annual Report of GSO«KazMunajGaz», 2015).

In accordance with the applicable risk classifier the risks can be represented as follows:

Table 1

Classification of the risk area of the oil companies, authorʼs

Risk area |

|||

Production risks (connected with production) |

Non-production risks (connected with non-production business-processes) |

Environment risks(almost uncontrolled or uncontrolled) |

Risks of investment projects |

Risks of technological process, risks of the organization of planning and approval of the Production program |

Risks of strategic and intermediate term planning, financial stability risks, personnel risks, risks of information technology, etc. |

Counterparty risk, market risk, etc. |

|

There is a score scale evaluation of the risks of the oil companies.

Table 2

Score scale assessment of the risks of the oil companies, authorʼs

Score |

1 |

2 |

3 |

4 |

5 |

Degree of impact |

Inconspicuous |

Conspicuous |

Extensive |

Critical |

Crucial |

Loss due to the risk |

Up to working holding capacity |

Up to holding capacity |

Minimum to 25% of liquidity loss or 50% of profitability loss |

Minimum to the whole loss of profitability or up to 25% of the own capital losses |

Starting with the minimum of profitability or total loss of 25% of own capital losses |

Frequency (possibility) |

Very seldom (once every 7 years) or the possibility to happen to 5% |

Sometimes(approximately once every 5 years) or the possibility to happen to25% |

From time to time (once every 3 years) or probability of 40% |

Often (once a year), or probability of 80% |

Very often (once every six months and more), or probability of more than 95% |

It is also necessary to point out the major risks in the oil companies such as “KazTransOil”.

Table 3

The risks of JSC "KazTransOil" oil companies (Annual Report ofJSO «KazTransOjl», 2015).

Risk |

Risk management measures |

The loss of equipment or failure of the equipment / facilities |

Maintenance and repairs Reconstruction, modernization of equipment Development of optimal modes of equipment operation Modern equipment diagnostics Improving the skills of employees |

Accidents of technogenic nature |

Conduct fire and tactical exercises and training Conduct training in fire safety measures Purchase of services for the protection of industrial facilities from fires Increase of staff training Voluntary property insurance against damage |

Accidents related to the production leading to disability and death |

Arrangements for the safe work Internal control of occupation safety and health Implementation of the plan of measures for the improvement and enhancement of working conditions, prevention of occupation injuries and diseases |

Environmental risks |

Obtaining permits for emissions in the full amount Compliance with the limits on emissions into the environment Compliance with the rules of operation of the equipment Development of technological modes of operation of equipment and facilities Ecological insurance |

Reduction or cessation of supply of oil |

Contracts with consignors and the attraction of new ones |

Partnerships with oil transport companies from other countries |

Conclusion of freight forwarding contracts as part of the organization and transport of Kazakh oil transit through the pipeline systems of other countries |

The main environmental problem is the solution of the issue of utilization of associated petroleum gas. The increase in emissions compared with last year due to the introduction of amendments to some legislative acts of the Republic of Kazakhstan. According to Paragraph 3, Article 30-5 of the Law "On Oil" flaring of associated petroleum gas in flares was banned (Law of the Republic of Kazakhstan No. 463, 2011). In accordance with these requirements, 177 flares where the associated petroleum gas was flared were extinguished. On the basis of the preliminary agreement of MEP of the Republic of Kazakhstan the relevant permits for special use of natural resources were issued. In connection with the amendments to the legislative documents the moratorium on gas flaring was lifted.

Taking into consideration the above mentioned information, we can conclude that it is necessary to study the risk factors that affect the efficiency of the oil companies. The identification and analysis of risks are extremely important as they are the necessary stages of managerial decision-making process in the oil industry, the essence of which is to identify the risks, to determine their specificity, to point out the characteristics of their implementation including the study of the amount of the potential economic damage. A serious problem is the study of the risk change over time, as well as the degree of correlation between the different risk factors. It is not possible to ensure the effective and targeted risk management without such an analysis. The risk assessment is to give potential partners the necessary information to make management decisions and provide measures to avoid possible financial and economic losses.

The oil companies need to develop risk management measures, before having the risk factors, in order to minimize or completely avoid them.

Andreev, A.F. (1997). Basics of project analysis of the oil and gas industry. Moscow.

Annual Report of GSO «KazTransOjl» (2015). Retrieved from: http://www.kaztransoil.kz/

Annual Report of JSO «KazMunajGaz» (2015). Retrieved from: https://azskmg.kz/

Arrow, K.J. (1971). Essays in the Theory of Risk. Bearing, Chicago Markham Publishing Company.

Gafijatov, I.Z. (2007). Identification and analysis of project risks at oil industry enterprises. Eurasian International Scientific and Analytical Journal, 1(21): 97-103.

Kloman, H.F. (1999). Integrated Risk Assesment. Current Views Of Risk Management. USA.

Konovalova, E.A. (2009). Fuzzy risk assessment of oil companies. Russian Entrepreneurship, 1(26): 118-123.

Law of the Republic of Kazakhstan No. 463-IV "On State Regulation of Production and Turnover of Certain Types of Oil Products" from July 20. (2011). Retrieved from http://online.zakon.kz

Medeu, A.A. (2002). Upravlenie riskom investicionnoj dejatel'nosti v neftegazovoj otrasli jekonomiki Kazahstana. Almaty: Gylym.

Terehina, V.I. (1998). Financial management of a company. Moscow: Jekonomika.

1. L.N.Gumilyov Eurasian National University, Astana, Kazakhstan

2. L.N.Gumilyov Eurasian National University, Astana, Kazakhstan

3. L.N.Gumilyov Eurasian National University, Astana, Kazakhstan

4. L.N.Gumilyov Eurasian National University, Astana, Kazakhstan

5. Korkyt Ata Kyzylorda State University, Kyzylorda, Kazakhstan