Vol. 39 (Number 24) Year 2018 • Page 14

Angel MESEGUER-MARTINEZ 1; Maria Jose RUIZ-ORTEGA 2; Gloria PARRA-REQUENA 3

Received: 22/01/2018 • Approved: 22/02/2018

ABSTRACT: The mediation effect of absorptive capacity on the relation between structural social capital and innovation performance is analysed. This relation is first theoretically modelled and is subsequently empirically tested within the setting of an artificially-generated spatial agglomeration, namely, the firms settled in a young science park. Results show that science-push absorptive capacity does not drive structural social capital towards innovation performance in this science park but demand-pull absorptive capacity does. Recommendations to firms and science park managers are provided. |

RESUMEN: Se analiza el efecto mediador de la capacidad de absorción en la relación entre el capital social estructural y la los resultados de la innovación. Primero se modeliza la relación y luego se comprueba empíricamente en una aglomeración artificial de empresas, un joven parque científico. Los resultados muestran que la capacidad de absorción de conocimiento científico no media la relación mientras que la del conocimiento de mercado sí. El trabajo ofrece recomendaciones a empresas y gestores de parques científicos. |

Innovation is regarded as a key factor for the economic development and competitive advantage of firms. It can have profound effects on the economy and society and is considered as the bedrock of economic development (Simmie, 2005). In the current context, characterised by radical changes, hyper competition (Cho and Pucik, 2005), and high levels of uncertainty on demand and technology (Kyrgidou and Spyropoulous, 2013), it is considered that firms focused on continuous innovation can keep persistent profits (Roberts, 2001).

Due to its relevance, it is important to focus on the effective innovation of organizations (Gianiodis et al, 2014), which can be captured by measuring innovation performance (Crossan and Apaydin, 2010). Moreover, in order to innovate effectively, firms must properly use two specific types of knowledge, namely technology and market knowledge (Murovec and Prodan, 2009). Hence, it is necessary to take into account the effect of these two types of knowledge on the firms' innovative process (Gupta, Tesluk and Taylor, 2007).

Thus, innovation requires the convergence of different forms of knowledge, which is not always available within the organization. Consequently, innovation is not perceived as a series of isolated events deriving from inventors, but as the result of interactions and knowledge exchanges that involve a diversity of interdependent actors (Zheng, 2010). The relationships with other agents are essential for innovation performance, as they grant access to external knowledge and resources.

In this vein, the social capital theory highlights the relevance of social relationships in the economy. Social capital is `the sum of the actual and potential resources embedded within, available through, and derived from the network of relations possessed by an individual or social unit´ (Nahapiet and Goshal, 1998: 243). By allowing firms access external knowledge, it is widely agreed that social capital has a positive effect on innovation (García-Villaverde, Parra-Requena and Ruiz-Ortega, 2010).

The structural dimension of social capital refers to the configurations and patterns of connections between network actors. It concerns both the localization of the contacts within the social structure and the interactions that can provide advantages (Nascimento, Selig and Pacheco, 2017; Nahapiet and Goshal, 1998). It can be analyzed from the perspective of the network ties and network configuration.

Structural social capital is chiefly considered to have a positive impact on innovation performance. Dense and cohesive social networks enable learning and the exchange of knowledge and resources, which ultimately fosters innovation performance (Tsai and Goshal, 1998; Zheng, 2010; Parra-Requena, Ruiz-Ortega and García-Villaverde, 2013). Nonetheless, such networks can also generate problems of redundancy in the information exchanged (Koka and Prescott, 2002), “myopia” or lack of attention to competitors in order to obtain new information outside the network (Inkpen and Tsang, 2005), as well as opportunity costs that arise from the time, money, and energy needed to keep and expand the actor´s social network (Zheng, 2010).

In light of these controversial results, we consider that the availability of structural social capital is necessary but not sufficient to generate innovation performance. In order to utilize external knowledge effectively to innovate, firms must have specific skills that enable them to utilize this external knowledge available through their social network (Waarden, 2001). Thus, the extent to which firms take advantage of the external knowledge depends on the ability of organizations to identify valuable knowledge in the environment, assimilate it and exploit it properly to generate an effective innovation.

The concept of absorptive capacity can be a key factor in explaining the mechanisms that drives structural social capital towards innovation performance. Absorptive capacity is the firm's ability to (i) identify valuable external knowledge, to (ii) assimilate it or transform it in order to increase the firm´s knowledge base, and to (iii) apply it through innovation or the development of competitive actions (Cohen and Levinthal, 1990). It is a dynamic capability which, as such, confers organizations the ability to rearrange resources and capabilities in order to adapt to a changing environment (Zahra and George, 2002).

Furthermore, absorptive capacity is closely related to innovation performance, since it enables the use of environmental knowledge for innovation (Lane, Koka and Pathak, 2006) and allows the absorption of the two fundamental types of knowledge for innovation, technological and market knowledge (Freeman and Soete, 1997).

We believe that through the maintenance of frequent and strong relationships with their contacts, firms are able to access relevant knowledge and resources from the environment. This enables them to obtain better innovation performance, as long as they orient their ties towards the creation and strengthening of their absorption capacity. Accordingly, the objective of this study is to analyse the mediator role of the absorptive capacity, both of technological and market knowledge, to explain how the network ties lead to innovation performance.

Drawing on the social capital theory, the absorptive capacity approach and the innovation theory we introduce a model to explain these relations. Subsequently, the model is empirically tested in a young science park from Spain. These entities host and support innovative firms with the aim of promoting technological innovation (Korolev, Sekerin, Bank, Gorokhov and Arutyunyan, 2017) across their member firms, giving rise to artificially-generated agglomeration of firms.

The mechanisms that allow firms to effectively absorb technological and market knowledge vary greatly (Lichtenhaler, 2009). Therefore, the science-push absorptive capacity and the demand-pull absorptive capacity, being the two types of absorptive capacities that allow firms to absorb technological and market knowledge (Murovec and Prodan, 2009), drive the relation between structural social capital and innovation performance in different ways.

Market knowledge is considered to be easily transferrable (Molina-Morales, Capó-Vicedo, Tomás-Miquel and Expósito-Langa, 2012).

The mere geographic co-localization of firms within agglomerations foster business contacts in which market information is shared (Malmberg, 2003). Therefore, social networks with high levels of structural social capital drive organizations to the standardization of their market knowledge bases (Rogers, 1995). This improves the market knowledge-related learning processes within the network, which enhances the capacity to identify, assimilate, and exploit valuable market knowledge available in the network of contacts (Murovec and Prodan, 2009).

For its part, the market knowledge captured thanks to the demand-pull absorptive capacity enables organizations to identify innovation opportunities with high degrees of certainty about the market acceptance of their innovations (Smith, Collins and Clark, 2005). In this line, it has been argued that the main determinant of innovation is demand (Freeman, 1982). Organizations need to make use of the experience and knowledge from the agents in their environment to monitor the evolution of their markets (Jantunen, Puumalainen, Saarenketo and Kyläheiko, 2005). Control and investments on the demand side allow the introduction of and boost to new products in markets and a higher level of security for business opportunities (García-Villaverde et al., 2010). Hence, market knowledge is critical to identify which innovations will be successful.

Therefore, that the availability of structural social capital is necessary but not sufficient to generate innovation results. Only firms that are able to leverage the strength of their relationships to develop and apply their demand-pull absorptive capacity will have positive innovation performance (Murovec and Prodan, 2009) because demand-pull absorptive capacity enables firms to capture the potential of their structural social capital in order to generate innovation results (Zhang and Wu, 2013).

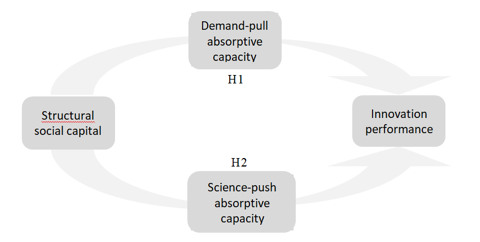

Based on these arguments we pose the following hypothesis:

H1: Demand-pull absorptive capacity has a mediating effect on the relationship between structural social capital and innovation performance.

As opposed to market knowledge, technological knowledge is difficult to transfer as it is of tacit nature and, as such, it can only be transferred through close personal contact (Dyer and Nobeoka, 2000). Due to the tacit nature of technological knowledge, strong, frequent, and close network ties set an environment conducive to the transfer and assimilation of technological knowledge (Tiwana, 2008). Organizations must therefore establish frequent contacts and personal relationships in order to absorb this type of knowledge (Dyer and Nobeoka, 2000). When network ties are characterized by (1) high levels of strength, frequency, and closeness; and (2) manage similar domains of knowledge, are able to identify and absorb relevant technological knowledge from the environment and develop their base of technological knowledge, which is a relevant determinant of science-push absorptive capacity (Cohen and Levinthal, 1990; Murovec and Prodan, 2009). Hence, the availability of structural social capital improves the organization´s capacity to identify, assimilate, and exploit technological knowledge in their environment (Murovec and Prodan, 2009).

Science-push absorptive capacity enables organizations to recognize and assimilate relevant knowledge sources from the environment (Zahra and George, 2002), playing a key role for innovation performance. Technological knowledge is highly relevant for the innovation processes in which organizations explore and transform external knowledge as it helps identify the new opportunities that technological evolution offers (Zahra and George, 2002).

In this way, the capacity to absorb technological knowledge supports the organizational innovation processes by allowing the retention and reactivation of additional knowledge (Garud and Nayyar, 1994), which improves innovation performance (Lane et al., 2006). Hence, a good absorption of technological knowledge enables firms to successfully approach the technical aspects of new applications, which must incorporate the technological component necessary to cover the needs addressed by the innovation.

By means of an innovation process underpinned by technological knowledge available in the environment, firms have the chance to overcome the uncertainty inherent to innovation (Simmie, 2005) and to adapt to the changing environment (Cabanelas, Cabanelas-Omil and Vázquez, 2013). Beyond being part of a dense network with strong ties, firms need science-push absorptive capacity to leverage the strength, frequency, and closeness of network ties in order to innovate effectively. Consequently, firms are able to adequately exploit external technological knowledge in order to fulfil the ever changing market needs and adapt to environmental changes (Jantunen et al., 2005) through an effective innovation (Zhang and Wu, 2013).

Based on these arguments we pose the following hypothesis:

H2: Science-push absorptive capacity has a mediating effect on the relationship between structural social capital and innovation performance.

Figure 1

Model

The model was empirically tested through a case study conducted on firms located in the Science and Technology Park of Albacete (Spain). The analysis was performed on May 2011. At that time, the ASTP held 32 technology-based member firms. However, only firms located before 2011 were included in the study in order to ensure the consistency of the results. This condition applies to 28 of the 32 firms and hence only data from these 28 companies was utilized in the study. Data was provided by firm managers and staff in charge of the offices in the ASTP in individual meetings. Twenty-four valid and completed questionnaires were obtained, so the response rate was 85.7%. The mean age of the firms was 8.28 years. Regarding the size of the firms in the sample, the mean number of employees per firm was 15, however the deviation was above 300 (311.82).

Innovation performance: Following Friedrich, Mumford, Vessey, Beeler and Eubanks (2010), we consider process innovation and product innovation as outcomes of innovation. Innovation performance was measured based on the scale used by Murovec and Prodan (2009), comprising the following six items: (i) “the company increased its range of products and services”, (ii) “the company increased its reference markets, or accessed new markets”, (iii) “the company increased its production flexibility”, (iv) “The company increased its production capacity”, (v) “the company reduced its production labour cost”, and (vi) “the company reduced its cost of materials and production energy”. Interviewees answered each item according to a 5-point Likert scale.

Structural social capital: Structural social capital was measured as the network configuration through a three-item scale developed by Maula, Autio and Murray (2003). The scale comprises the following three items: (i) “we keep frequent relationships with our contacts”, (ii) “we know our contacts personally”, and (iii) “we keep tight social relationships with our contacts”. Interviewees answered each item according to a 5-point Likert scale.

Absorptive capacity: Absorptive capacity was measured through a scale previously validated and utilized by Murovec and Prodan (2009). We measured the use and importance of the different sources of information that are required to inspire new innovation projects or to contribute to the implantation of the existing ones. This measure is based on the assumption that firms must have a minimum of absorptive capacity in order to use certain sources of information to innovate. Thus, the more external sources of information the firm uses, and the more importance it grants them, the higher its absorptive capacity is. In contrast, the reason for a firm not to consider external sources of information is because it does not have absorptive capacity. This perspective goes beyond the measurement of absorptive capacity through patents and R&D expenditure.

The scale of Murovec and Prodan (2009) comprises six items determined by two factors: science-push absorptive capacity and demand-pull absorptive capacity. Science-push absorptive capacity is measured through the use of and importance given to information from universities and other higher education institutes, governments and private non-profit research institutes, and fairs and exhibitions. Demand-pull absorptive capacity is measured through the use of and importance given to information from customers and clients; competitors and other firms from the same industry; information from suppliers of equipment, materials, components or software; and information from fairs, congresses, curses, and workshops. Interviewees assessed each item according to a 5-point Likert scale.

The control variables of size and age were included in the model. Firm size was measured by the number of employees (Schoenecker and Cooper, 1998), and firm age was defined as the number of years since the firms were founded.

The Partial Least Squares technique was used to analyse the model. This technique has lax sample requirements especially regarding the sample size and the possibility to work with non-normally distributed variables (Cepeda and Roldan, 2004). We used the PLS-Graph software which is suitable for the analysis of mediator effects. Regarding the analysis process, we first analysed the validity of the measurement model. Subsequently, the hypotheses were tested by checking the validity of the structural model.

The evaluation of the measurement model (Table 1) shows a good reliability. All loading values exceeded the recommended threshold of 0.707, and therefore the model shows a good reliability of the items. The construct reliability of the scales is also above 0.7, as recommended by Carmines and Zeller (1979). The convergent validity was confirmed since the average variance extracted (AVE) from all the scales was above 0.5, as recommended by Fornell and Larcker (1981). Finally, the square root of the AVE of each construct was higher than the correlations amongst each other. Therefore, the discriminant validity of the model was also confirmed.

Table 1

Reliability and validity of the measurement model

Scale |

Item reliability |

Construct reliability |

Convergent validity |

Discriminant validity |

Structural social capital |

Yes |

Yes (0.857) |

Yes (0.553) |

Yes |

Demand-pull abs. capacity |

Yes |

Yes (0.772) |

Yes (0.629) |

Yes |

Science-push abs. capacity |

Yes |

Yes (0.753) |

Yes (0.618) |

Yes |

Innovation performance |

Yes |

Yes (0.841) |

Yes (0.572) |

Yes |

Hypotheses 1 and 2 propose the mediation effects of the structural social capital on the innovation performance through demand-pull absorptive capacity and science-push absorptive capacity respectively. In order to test the mediating effects of the two types of absorptive capacity we tested the four conditions set by Baron and Kenny (1986). The first condition requires a relationship between the independent variable and the dependent variable; the second condition requires a relationship between the independent variable and the mediating variable; the third condition requires a relationship between the mediating variable and the dependent variable; and finally, the fourth condition establishes that the relationship between the independent and the dependent variables should be eliminated or at least reduced when the mediating variable is included in the model.

Results show a significant positive effect of structural social capital (independent variable) on innovation performance (dependent variable) (Table 2), (β=0.478; p<0.10). These findings provide support for the first condition. The second condition is also fulfilled for demand-pull absorptive capacity, thus results show a positive relationship between structural social capital and this type of absorptive capacity (β=0.621; p<0.10). In contrast, structural social capital does not show a significant effect on science-push absorptive capacity. Therefore, the second condition is not fulfilled for science-push absorptive capacity.

Table 2

Direct effects of the variables

Construct |

Demand-pull abs. cap. |

Science-push abs. cap. |

Innovation performance |

Structural Social Capital |

0,621* |

-0,152ns |

0,271ns/(0,478)* |

Demand-pull abs. cap. |

|

|

0,561*** |

Science-push abs. Cap. |

|

|

0,272* |

Size |

|

|

0,404** |

Age |

|

|

-0,229ns |

R2 |

0,385 |

0,023 |

0,675/(0,506) |

ns not significant; *p<0.10; **p<0.05; ***p<0.01

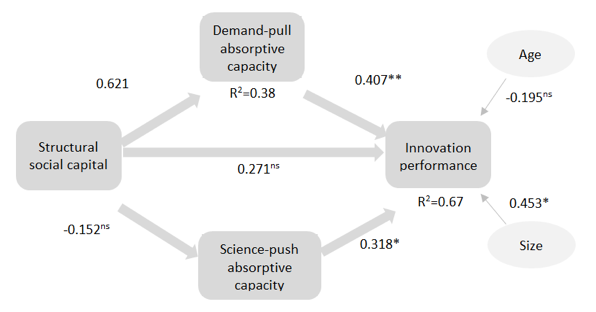

The results presented in Table 2 show a significant and positive effect of demand-pull absorptive capacity on innovation performance (β= 0.56; p<0.01), therefore the 3rd condition is fulfilled for demand-pull absorptive capacity. Likewise, a significant positive effect of science-pull absorptive capacity on innovation performance was observed (β= 0.272; p<0.1). Therefore it is also fulfilled for science-pull absorptive capacity.

Concerning the fourth condition, when we incorporate demand-pull absorptive capacity into the model along with structural social capital, innovation performance, and the control variables, the β coefficient significantly decreases, and the relationship between structural social capital and innovation performance becomes non-significant (β0=0.478 p<0.10 vs. β1= 0.271, not-significant). Therefore, the fourth condition is also verified for demand-pull absorptive capacity. Since all four conditions are supported, we can state that demand-pull absorptive capacity mediates the relationship between structural social capital and innovation performance. Thus, hypothesis 1 is supported.

In contrast, regarding science-push absorptive capacity, the second condition established by Baron and Kenny is not supported. Therefore, the mediating effect of science-push absorptive capacity was not verified, and thus hypothesis 2 is rejected.

Figure 2 illustrates the empirical results. The joint model includes structural social capital, innovation performance, demand-pull absorptive capacity and science-push absorptive capacity, and the control variables. The model explains 67.5% of the variance of the dependent variable. Regarding the relationship that both types of absorptive capacity have with the independent and the dependent variables, structural social capital does not show the same relationship with demand-pull absorptive capacity than with science-push absorptive capacity. Structural social capital showed a significant positive relationship with demand-pull absorptive capacity, whereas no significant relationship was found with science-push absorptive capacity. However, both types of absorptive capacity have a significant positive effect on innovation performance, notwithstanding that the effect of demand-pull absorptive capacity is stronger than the effect of science-push absorptive capacity.

Because our data do not show a relationship between structural social capital and science-push absorptive capacity, the mediating effect is restricted to demand-pull absorptive capacity according to Baron and Kenny´s conditions (1986). Furthermore, results show that the effect of structural social capital on innovation performance disappears (β1= 0.271, not-significant vs. β0= 0.478, significant). This shows a total mediating effect of demand-pull absorptive capacity on the relationship between structural social capital and innovation performance. Finally, according to Holmbeck (1997), the full model represents a significant improvement over the first model. In this respect, the R2=0.675 value for the full model indeed exceeds the initial R2=0.506 and, therefore, we verified that the adjustment improves the model when the mediating effect of absorptive capacity is incorporated.

Figure 2

Results

In this study the effect of structural social capital on innovation performance is analyzed and tested in a young science park. Thereby, we address a number of aspects that still need to be examined in detail. Firstly, we verified that the effect of structural social capital on innovation performance is not direct, it depends on the organization´s absorptive capacity. More specifically, demand-pull absorptive capacity is the mechanism that explains how firms located in a science park steer their structural social capital towards the improvement of innovation performance. Therefore, firms must focus their contact networks towards the identification, assimilation, and exploitation of market knowledge in order to leverage the environmental potentialities and innovate effectively.

Moreover, firms generally do not utilize their contacts to capture technological knowledge in order to innovate. Therefore, science-push absorptive capacity does not exert a mediating role between structural social capital and innovation performance. We draw attention to this result, particularly given the fact that the study was performed on a science park where firms are geared towards innovation. Nevertheless, it has to be emphasized that those firms able to identify, assimilate, and exploit technological knowledge from the environment do generate positive innovation results.

A number of reasons may lead firms to neglect the development of their science-push absorptive capacities. One of the antecedents of absorptive capacity is the stock of prior knowledge (Lichtenhaler, 2009). Firms must have a stock of scientific or technological knowledge to be able to develop their science-push absorptive capacity. However, it is very difficult for firms to generate a base of scientific or technological knowledge (Murovec and Prodan, 2009), and this is a barrier for the development of this kind of absorptive capacity. Moreover, the relationships between firms and knowledge-generating entities –i.e. the research institutes available in the science park- are normally of a formal nature. This hampers the contact between these entities and therefore the development of firms´ science-push absorptive capacity. Finally, the use of scientific and technological knowledge is normally articulated through R&D projects. Firms, especially technology-based firms, must face several challenges to perform R&D projects such as high costs, uncertainty, and lack of financial resources (Aernoudt, 2005).

Science parks favor the development of social networks because geographical proximity provides the chance to establish contacts with the closest agents (Athiyaman and Parkan, 2008). Nevertheless, not all of the firms are able to benefit from the potentialities generated by geographical proximity. By means of the empirical analysis performed through a case study, we verified that the development of absorptive capacities –especially demand-pull absorptive capacity– can drive these relationships towards higher innovation performance. Therefore, innovation results depend both on the firm´s degree of involvement with its contacts, and on the development of absorptive capacities oriented towards effective innovation, especially those generated by market demand.

Hence, we deepen understanding of the factors that explain innovation performance in a science park. We also delved into the debate on structural social capital, which refers to the implications of the strength of the ties and the network density for innovation (Zheng, 2010). To this end, we provide insights into the role of network ties in terms of strength, frequency and closeness. Regardless of their potential risks, networks with strong ties and frequent and close relationships improve innovation performance as long as firms focus their social capital on the development of demand-pull absorptive capacity. We also provide new insights into the role of absorptive capacity on the innovation process by analyzing its mediating effect on the relationship between structural social capital and innovation performance.

These findings have implications both for the managers of the science park and for the member firms. Member firms are mostly technology-based SMEs led by entrepreneurs who usually learn to manage their companies on the fly. Firms should broaden and strengthen their networks, focusing on the development of their demand-pull absorptive capacities because this will lead them to better innovation performance. They should also establish contacts beyond the boundaries of the science park as a way to avoid redundant information and lack of new knowledge (myopia). In this vein, science park managers should take into account the relevance of market knowledge for the member firms. They should also consider inviting entities able to provide this type of knowledge to join the science park´s network.

On the other hand, results show that firms are discouraged from establishing contacts with technological institutions. Surprisingly, results also show that despite being discouraged, firms that finally develop their capacity to utilize technological knowledge ultimately obtain better innovation performance. Hence, we recommend that science park managers incorporate technological institutions within firms´ networks, and promote informal contacts among firm managers and researchers from technological institutions.

We acknowledge a number of limitations in our study. The first one being derived from the sample size of our case study, which restricts the generalization of the findings. Furthermore, the science park studied began its activities in 2006. It is a relatively young science park, hosting relatively young and small firms. This can cause a bias in the results. At the moment of the study, entrepreneurs may still be in the early stages of their management learning processes, and their strategies may be affected by the shortage of financial resources that start-ups must face. This fact can also provide an explanation as to why firms do not tend to develop their science-push absorptive capacity. Both the age and the shortage of resources hamper the development of their technological knowledge bases, upon which science-push absorptive capacity is built.

We believe that it is important to expand the focus of this research to the two remaining dimensions of social capital in future studies. Regarding the debate on the structural dimension of social capital, future studies should explore the determinants of effective levels of structural social capital. Additional studies may also investigate and quantify the added value that each kind of knowledge brings to innovation. Finally, further investigation is also needed to test the model in other science parks or on a different kind of agglomeration of firms. This is necessary in order to verify whether results are similar throughout diverse agglomerations which would then shed light on the processes that drive innovation performance inside agglomerations of firms.

Aernoudt, R. (2005). Executive forum: Seven ways to stimulate business angels’ investments. Venture Capital, 7(4), 359 – 371.

Athiyaman, A., & Parkan, C. (2008). A functionalist framework for identifying business clusters: Applications in Far North Queensland. Australian Journal of Management, 33(1), 201-229.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

Cabanelas, P., Cabanelas-Omil, J. and Vázquez, X. H. (2013). A methodology for the construction of dynamic capabilities in industrial networks: The role of border agents. Industrial Marketing Management, 42(6), 992-1003.

Carmines, E. G., & Zeller, R. A. (1979). Reliability and validity assessment. Londres: Sage University Paper Series on Quantitative Applications in the Social Sciences.

Cepeda, G., & Roldan, J. L. (19-21 de septiembre de 2004). Aplicando en la práctica la técnica PLS en la Administración de Empresas. Conocimiento y Competitividad, XIV Congreso de ACEDE. Murcia: Asociación Científica de Economía y Dirección de la Empresa.

Cho, H. J., & Pucik, V. (2005). Relationship between innovativeness, quality, growth, profitability, and market value. Strategic Management Journal, 26, 555-575.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128-152.

Crossan, M. M. , & Apaydin, M. (2010). A multidimensional framework of organizational innovation: A systematic review of the literature. Journal of Management Studies, 47(6), 1154-1191.

Dyer, J., & Nobeoka, K. (2000). Creating and managing a high-performance knowledge-sharing network: The Toyota case. Strategic Management Journal, 21(3), 345-367.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18, 39-50.

Freeman, C. (1982). The economics of industrial innovation. London: Pinter.

Freeman, C. and Soete, L. (1997). The economics of industrial innovacion. Cambridge, MA.: MIT Press.

Friedrich, T. L., Mumford, M. D., Vessey, B., Beeler, C. K. and Eubanks, D. L. (2010). Leading for innovation. Reevaluating leader influences on innovation with regard to innovaton type and complexity. International Studies of Management and Organization, 40(2), 6-29.

García-Villaverde, P. M., Parra-Requena, G., & Ruiz-Ortega, M. J. (2010). Capital social y comportamiento pionero. El papel mediador de las capacidades tecnológicas y de marketing. Cuadernos de Economía y Dirección de Empresa(45), 9 - 42.

Garud, R., & Nayyar, P. R. (1994). Transformative capacity: Continual structuring by intertemporal technology transfer. Strategic Management Journal, 15, 365-385.

Gianiodis, P. T., Ettlie, J. E.; &Urbina, J. J. (2014). Open service innovation in the global banking industry: Inside-out versus outside-in strategies. Academy of Management Perspectives, 28(1), 76-91.

Gupta, A. K., Tesluk, P. E., & Taylor, M. S. (2007). Innovation at and across multiple levels of analysis. Organization Science, 18(6), 885–897.

Holmbeck, G. N. (1997). Toward Terminological, Conceptual, and Statistical Clarity in the Study of Mediators and Moderators: Examples From the Child-Clinical and Pediatric Psychology Literatures. Journal of Consulting and Clinical Psychology, 65(4), 599-610.

Inkpen, A., & Tsang, E. (2005). Social capital, networks, and knowledge transfer. Academy of Management Review, 30(1), 146-165.

Jantunen, A., Puumalainen, K., Saarenketo, S., & Kyläheiko, K. (2005). Entrepreneurial orientation, dynamic capabilities and international performance. Journal of International Entrepreneurship, 3(3), 223-243.

Koka, B. R., & Prescott, J. E. (2002). Strategic alliances as social capital: A multidimensional view. Strategic of Management Journal, 23(9), 795-816.

Korolev, V. I., Sekerin, V. D., Bank, S. V., Gorokhova, A. E., Arutyunyan, Y. I. (2017). Innovation potential of small-scale business: international experience. Revista Espacios, 38(49), 1-7. Retrieved from http://www.revistaespacios.com/a17v38n49/17384901.html.

Kyrgidou, L. P., & Spyropoulou, S. (2013). Drivers and performance outcomes of innovativeness: An empirical study. British Journal of Management, 24(3), 281-298.

Lane, P. J., Koka, B. R., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review, 31(4), 833–863.

Lichtenhaler, U. (2009). Absorptive Capacity, environmental turbulence, and the complementarity of organizational learning processes. Academy of Management Journal, 52(4), 822–846.

Malmberg, A. (2003). Beyond the cluster-local milieu and global economic connections. (J. Y. Peck, Ed.) Londres: SAGE Publications.

Maula, M., Autio, E., & Murray, G. (2003). Prerequisites for the creation of social capital and subsequent knowledge acquisition in corporate venture capital. Venture Capital, 5(2), 117-134.

Molina-Morales, F. X., Capó-Vicedo, J., Tomás-Miquel, J. V. and Expósito-Langa, M. (2012). Análisis de las redes de negocio y de conocimiento en un distrito industrial. Una aplicación al distrito industrial textil valenciano. Cuadernos de Economía y Dirección de la Empresa, 15, 94-102.

Murovec, N., & Prodan, I. (2009). Absorptive capacity, its determinants, and influence on innovation output: Cross-cultural validation of the structural model. Technovation, 29, 859-872.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital and the organizational advantage. Academy of Management Review, 23(2), 242 - 266.

Nascimento, E. R., Selig, P. M., & Pacheco, R. C., (2017). Dimensões do Capital Social: uma revisão integrativa. Revista Espacios, 38(4), 10-25. Retrieved from http://www.revistaespacios.com/a17v38n04/17380411.html.

Parra-Requena, G., Ruiz-Ortega, M., & García-Villaverde, P. (2013). Social capital and effective innovation in industrial districts: Dual effect of absorptive capacity. Industry and Innovation, 20(2), 157-179.

Roberts, P. W. (2001). Innovation and firm-level persistent profitability: A schumpeterian framework. Managerial and Decision Economics, 22, 239-250.

Rogers, E. M. (1995). Diffusion of Innovations, 4ª ed. Nueva York: Free Press.

Schoenecker, T. S., & Cooper, A. C. (1998). The role of firm resources and organizational attributes in learning entry time: A cross-industry study. Strategic Management Journal, 19, 1127-1143.

Simmie, J. (2005). Innovation and Space: A Critical Review of the Literature. Regional Studies, 39(6), 789-804.

Smith, K. G., Collins, C. J., & Clark, K. D. (2005). Existing knowledge, knowledge creation capability, and the rate of new product introduction in high-technology firms. Academy of Management Journal, 48(2), 346-357.

Tiwana, A. (2008). Do bridging ties complement strong ties? An empirical examination of alliance ambidexterity. Strategic Management Journal, 29(3), 251-272.

Tsai, W., & Goshal, S. (1998). Social capital, and value creation: The role of intrafirm networks. Academy of Management Journal, 41(4), 464-478.

Waarden, F. van (2001). Institutions and innovation: The legal environment of innovating firms. Organization Studies, 22(5), 765-795.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185-203.

Zhang, J., & Wu, W. P. (2013). Social capital and new product development outcomes: The mediating role of sensing capability in Chinese high-tech firms. Journal of World Business, 48(4), 539-548.

Zheng, W. (2010). A Social capital perspective of innovation from individuals to nations: Where is empirical literature directing us? International Journal of Management Reviews, 12(2), 151-183.

1. PhD in Business Strategy, research interest in innovation, social networks and education. Associate professor at the Business Department of the Catholic University of Murcia (Spain). ameseguer@ucam.com

2. PhD in Business Strategy, research interest in innovation, entry timing, agglomerations of firms and entrepreneurship. Professor at the Business Department of the University of Castilla-La Mancha (Spain). mariajose.ruiz@uclm.es

3. PhD in Business Strategy, research interest in innovation, social capital, agglomerations of firms and entrepreneurship. Professor at the Business Department of the University of Castilla-La Mancha (Spain). gloria.parra@uclm.es