Vol. 39 (Nº27) Year 2018. Page 12

Vol. 39 (Nº27) Year 2018. Page 12

Sergey Nikolaevich BOLSHAKOV 1; Alexey Vasilevich ABRAMOV 2; Mikhail Yurievich ALEKHIN 3; Mikhail Alexandrovich ZAGORODNIKOV 4; Sergey Alekseevich TKACHEV 5

Received: 20/05/2018 • Approved: 08/06/2018

ABSTRACT: The urgency of the study of investment policy in the Russian Federation is determined by the complexity of foreign economic and political conditions for the Russian economy. The socioeconomic differentiation of the subjects of the Russian Federation raises a particularly acute problem of encouraging the development-driven investment policy. The goal of this article is an economic assessment of changes in the investment processes in the regions, an analysis of conditions encouraging the growth of investment activity of the regions and their positive rating in the national investment rating. The article analyzes conditions and the regions development potential, provides an assessment of the investment activity and factors that encourage the positive investment image of the regions. The article reveals the methodological foundations for drawing up the investment rating and compares the movement of regions in the national investment rating. The national investment rating itself is reviewed as an instrument of regional social and economic policy that encourages the attention of regional authorities to solving the problems of improving the investment attractiveness of the territories. The importance of establishment of national rating systems, investment, innovation, socioeconomic policies, etc. allows to form a system of independent assessment of the authorities’ efforts to secure conditions for economic growth. The potential of the regions is largely differentiated and predetermined by natural resource and geographic factors, but the instruments for economic regulation and impact on the regional socioeconomic system that encourages sustainable development and economic growth based on positive investment dynamics are important. |

RESUMEN: La urgencia del estudio de la política de inversión en la Federación de Rusia está determinada por la complejidad de las condiciones económicas y políticas exteriores de la economía rusa. La diferenciación socioeconómica de los sujetos de la Federación de Rusia plantea un problema particularmente agudo para fomentar la política de inversión impulsada por el desarrollo. El objetivo de este artículo es una evaluación económica de los cambios en los procesos de inversión en las regiones, un análisis de las condiciones que fomenta el crecimiento de la actividad de inversión de las regiones y su calificación positiva en la calificación de inversión nacional. El artículo analiza las condiciones y el potencial de desarrollo de las regiones, proporciona una evaluación de la actividad de inversión y los factores que fomentan la imagen de inversión positiva de las regiones. El artículo revela los fundamentos metodológicos para elaborar la calificación de inversión y compara el movimiento de las regiones en la calificación de inversión nacional. La calificación de inversión nacional en sí es revisada como un instrumento de política social y económica regional que alienta la atención de las autoridades regionales para resolver los problemas de mejorar el atractivo de inversión de los territorios. La importancia del establecimiento de sistemas nacionales de calificación, inversión, innovación, políticas socioeconómicas, etc. permite formar un sistema de evaluación independiente de los esfuerzos de las autoridades para asegurar las condiciones para el crecimiento económico. El potencial de las regiones está ampliamente diferenciado y predeterminado por recursos naturales y factores geográficos, pero los instrumentos para la regulación económica y el impacto en el sistema socioeconómico regional que fomenta el desarrollo sostenible y el crecimiento económico basados en dinámicas de inversión positivas son importantes. |

Modern studies of the specifics of attracting investments in Russian regions and large infrastructure projects consider the formation of a spatial investment structure where investor expectations play a significant role. The problems of theoretical analysis of the spatial concentration of economic activity, as well as the agent expectations associated with it are investigated in many works that, inter alia, develop within the framework of economic geography (Krugman 1991; Krugman and Venables 1996). Theoretical models reveal that the expectations of economic agents under certain conditions can influence the investment attraction, the increase in spatial concentration of production, and the increase in employment, which ultimately brings the economy to a new equilibrium state (Akindinova and Yasin, 2015). The factor of socioeconomic differentiation of Russia's regional development, competition for investment flows and major investment projects are of particular importance.

Studies of factors in the development of the Russian economy indicate not just a significant correlation between the growth rates and the volume of foreign direct investment, but also the importance of sectoral specifics of raising investments in the regions. For example, the impact of investments concentration in the regions on value added has been proved, although dynamic aspects were not considered in the work (Baldwin, et. al. 2003). Part of the works aimed at revealing the determinants of Russia's economic growth pointed at the importance of the difference in regional growth rates, including the initial structure of the economy, labor and competitiveness (Miheeva 2010). As such, it is necessary to take into account not only regional characteristics, but also specific features of regional development when defining the main determinants of investment attractiveness (Bolshakov, et. al. 2015).

The methods of exploring changes in the investment processes extensively include the methods of analyzing interbranch balances as an efficient tool for analyzing interbranch relations, which can be used to build scenarios for the region development in the case of the dynamic recurrence model (Baldwin, et. al. 2001). This article uses econometric models that are most suitable for countries with a sustainably developing economy and a system for collecting and analyzing statistical information.

It must be said that international standards, ratings and indices help investors identify strategic areas for investment, monitor key trends and best investment practices and conduct benchmarking, while helping business define strategic priorities and areas that should be developed to reduce reputational risks and improve investment attractiveness of their assets.

In 2017, many Russian regions began to gradually recover from the crisis, which was described by a fall in the investment activity and a decrease in the average level of investment attractiveness (Kolomak 2010). National investment rating method consists of 54 indicators that are grouped into 19 factors, which, in turn, are combined into four areas: regulatory environment, business institutions, infrastructure and resources, and support to small businesses. The system of rating indicators has been developed by representatives of major business associations and experts and is aimed at assessing the efforts of regional authorities to improve the investment climate in the region (Kudrin and Gurvich 2014).

The national rating is the main tool for managing the investment climate development in the country. The goal of the national rating is to assess the results of efforts of authorities at all levels in the region to create favorable conditions for business. The national rating allows to solve problems on identifying best practices for arranging the work with investors, to create a system of incentives for authorities in the regions, to create a system to manage changes, and to develop project teams in the regions.

Factors of investment attractiveness considered by the investor when making an investment decision can be conditionally divided into the market and administrative ones.

Market factors are a part of the existing environment and cannot be changed in the short and medium term (assets, resources); the ability to exert influence on them is limited by labor force, scientific and technical basis, size of the available consumer goods market, size of the available manufactured goods market, infrastructure.

Administrative factors are the factors related to the efficiency of the administrative structures and processes, internal capacities of representatives of the relevant state organizations, legislation, etc.

From the investor's point of view, any of these factors can be qualified as a barrier to investing. There are several such factors:

Administrative factors are now regarded as a stronger driver in making an investment decision, since a low level of institutional development is unable to secure the implementation of market factors (Sinelnikov-Murylev, et. al. 2014).

The rating is important because it covers the entire country and most businesses. The rating itself is an important political tool of influence, it has been compiled for 4 consecutive years, including 21 regions in 2014, 76 regions in 2015, 81 regions in 2016, and 85 regions in 2017 (Vedev, et. al. 2014).

The rating expresses the positions of the business and is compiled under the direct methodological and practical auspices of the business. More than 400,000 business entities were included in the national rating in 2017, of which 47,000 entrepreneurs participated in general polls, 31,500 entrepreneurs participated in special polls, and 3,650 entrepreneurs participated in expert polls (Results in the annual rating of the investment attractiveness of the regions of Russia, n.d.).

The rating growth by 1.8 points was observed in 2017 (for example, the connection time to the electric grid is reduced from 108 to 86 days), which corresponded to an increase in private investments by 2% compared to 2015. Target models of encouraging the investment policy involve the emergence of the tools for managing changes. The important examples of target models are the following: obtaining construction permits within 129 days, property registration within 7 days, cadastral registration within 38 days, support of small and medium businesses through implementation of at least 15% of state procurements from small and medium businesses, technological connection to electric grid within 90 days.

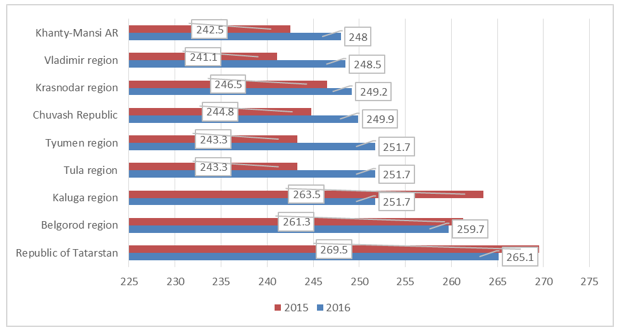

A substantial improvement in almost all indicators of the rating method should be noted in 2017: improvement of 10% on average was observed in area A – "regulatory environment"; a multidirectional trend was observed in area B – "institutes for business." A substantial improvement was observed in the field of the PPP (public-private partnership) mechanism activity (+51%) in 2017. The number of audits decreased by 5%, while the number of documents increased by 12%, which was more indicative of the negative component of the indicator. Overall, the assessment of the level of administrative pressure on business continued to worsen (-37%); an improvement was observed in area C – "infrastructure and resources" – for example, in the number of cadastral registration procedures (-3%), time terms (-8%), and tax privileges (+7%). There was also an improvement in the field of supporting small and medium businesses in 2017 – area D, and the key driver in this case was the improvement in the indicator “government procurement from small and medium businesses” (+157%) compared to 2016. The results of the 2017 rating indicated the improvement in the positions of 63% regions of the country (51 regions), while an average positive change in the rating of the regions was +5.3 p. or 2.6% (Materials of the Moscow Economic Forum, 2017) (Figure 1).

Figure 1

Changes in the index of the national rating of the investment

climate by regions of the Russian Federation in 2015-2016

The leaders in the growth of absolute values of the indicator are the following: the share of government procurement from small and medium businesses, procedural obtaining of construction permits, operation of the information portal for small and medium businesses, and the procedure for property registration. 61% of the method indicators in 2017 have grown and demonstrated positive changes. The leaders in the decline of the rating indicators are regional guarantees, administrative pressure on business, share of graduates in the total number of the employed, number of additionally requested documents, and jobs in business incubators and technology parks. The reduction in these components in the index demonstrates certain flaws of regional authorities and local government, which indicates a decrease in the function of governance control over the components of the rating indicators (Monitoring The Economic Situation In Russia. Trends And Challenges Of Socio-Economic Development, 2017).

The national rating of the investment climate state assesses the regional authorities’ efforts to create favorable conditions for running business and identifies the best practices, while its results encourage competition in the struggle for investments at the regional level. The top three rating leaders remained the same: in addition to Tatarstan, the Belgorod and the Kaluga regions were also there, but they switched positions: the Kaluga region had lost 11.8 points per year and dropped to the third line, while the Belgorod region ranked second, although it had lost 1.6 points as well.

Several regions at once saw a rapid increase in the national rating of the investment climate state. For example, the Tomsk region has moved from line 23 to line 12. The growth would have been impossible without the project-based approach to the regional development, which is consolidated in the federal project of the INO Tomsk Innovative Territorial Center. The project unites various projects and strategies and eliminates interdepartmental disunity.

The methods used to measure the investment and business climate play an important role in the relationship between the authorities and investors. The studies of the Expert RA Rating Agency point at the direct pattern: if the region's investment attractiveness grows, the probability of reelection of the regional leader is 75%.

The most recent rating clearly outlines centrifugal processes and differentiation of the Russian regions. The gap between the leaders and the outsiders of the rating grows.

The regions adjacent to Moscow and St. Petersburg, as well as the Tver and Vologda regions (with quite a high rating) establish a kind of "investment backup" for the implementation of the projects that for various reasons are inexpedient or difficult to implement in large cities and adjacent areas. The Novgorod region and the Yaroslavl region are part of some kind of the investment core of the federal transport infrastructure.

The 2017 rating of the regional socioeconomic development supports the above trend of the regions’ "polarization", which means a gradual growth of regional disproportions that lead to strengthening of the leading positions of successful regions and continuing worsening of outsiders’ positions. Most regions that improved their positions in the rating either moved within the group of leaders (the Belgorod and the Leningrad regions) or became the leaders among the closest pursuers (the Nizhny Novgorod, the Voronezh, the Tula regions and others). Low investment activity, weak development of the real sector of the economy and insufficient amount of fiscal revenues force many regions from the lower part of the rating to actively use public debt for the budget deficit funding (Distribution of Russian regions by the reintuition of the investment climate in 2017, n. d.).

According to the results of the comparative analysis of the National Investment Rating of the Regions with the Rating of Investment Attractiveness of Russian Regions by RAE Expert aimed at the identification of the qualitative characteristics of the investment climate in the regions and assessment of the investment potential of the Russian regions, 2017 is described by a substantial decline in all types of investment risks in the regions due to the organized crisis work of the Russian Ministry of Finance with the regional management teams (National rating of the investment climate in the constituent entities of the Russian Federation, n. d.).

The decline in the investment risks and threats was confirmed by the overall statistical data: the investments in fixed assets grew by 4.2% in 2017 compared to 2016; the industrial production grew from 72% to 85% in 2017. The rating of RAE Expert revealed some confusion of the management teams in the Russian regions (Table 1), as the regions had faced the need to change the paradigm of economic development: while the main driver before the 2014 crisis was sectoral priorities for various regions: the petrochemical and gas industry, agribusiness and implementation of complex federal programs, in 2017 and later it was a change in the strategy for the socioeconomic development, a multidirectional impact on the priorities of territorial development, and complication of managerial influence (Investment attractiveness of the regions – 2017: Growth contours, 2017).

Table 1

Distribution Of Russian Regions By The Investment

Climate Rating In 2017 (Selectively For Group A)

Highest potential – lowest risk (1A) |

Average potential – lowest risk (2A) |

Low potential – lowest risk (3A1) |

Moscow region |

Belgorod region |

Vladimir region |

Moscow |

Rostov region |

Voronezh region |

St. Petersburg |

Republic of Bashkortostan |

Kaluga region |

Krasnodar region |

Republic of Tatarstan |

Kursk region |

|

Nizhny Novgorod region |

Lipetsk region |

|

Samara region |

Ryazan region |

|

|

Tambov region |

|

|

Tula region |

|

|

Penza region |

|

|

Tyumen region |

Analysis of the rating data indicates the improvement in the positions of 12 regions in terms of the investment risk: the improvement is observed in the following regions: St. Petersburg (+3 positions), the Novosibirsk region (+6), the Volgograd region (+10 positions) and the Moscow region (+4). The influence of the agglomeration effect on economic trends can be seen in this rating – it is described by the revival and growth of consumer sentiments among the population.

The rating of the socioeconomic development of Russian regions reveals a drop in the positions of "oil and gas" regions of the Russian Federation that have been dependent on oil and gas revenues for a long time (20). This had an influence on the structure of the gross regional product: for example, the positions of the Khanty-Mansi Autonomous Region dropped in the rating (-8 positions by the investment risk indicator, -5 positions on investment potential), along with the Omsk region (-5 positions by investment potential indicator).

Researchers from RAE Expert note that against the background of the recovery of the Russian economy from the crisis, the motivational effect of federal programs on regional economies has noticeably decreased (the Crimea and Sevastopol, which is associated with poor quality of regional governance and program administration). An important positive trend is the rehabilitation of regional finances and decrease in the share of debt burden on the regional budgets, which influenced the decline in the components of the investment risk in general.

The authors conducted the assessment of the investment attractiveness of the regional economy sectors by a set of important indicators of the investment changes in economic processes, such as the sales volume, quality of human capital, fiscal capacity of the region, etc.

Let us calculate the Pearson correlation coefficients. Since there are no rank and binary variables in the analyzed data at this stage of the study, this method of the correlation calculation has been chosen (Lapo 2010; Lipkin 2012). The value of this coefficient for quantitative variables does not significantly differ from the values of the Spearman correlation coefficient (Kochkina 2016). The relationship among the factors of investment attractiveness without consideration for industry specifics is presented in Table 2.

Table 2

Interrelation Between The Investment Flows Of The

Region And The Factors Of Investment Attractiveness

|

Investment indicator |

Effect of agglomeration |

Fiscal capacity |

Investments in period t-2 |

Amount of investments in the nearest regions, with due regard to their remoteness |

Return on assets |

Quality of human capital |

Density of roads |

Sales volume per capita |

Investment indicator |

1 |

|

|

|

|

|

|

|

|

Effect of agglomeration |

-0.057 |

1 |

|

|

|

|

|

|

|

Fiscal capacity |

-0.048 |

-0.002 |

1 |

|

|

|

|

|

|

Investments in period t-2 |

0.062 |

0.210*** |

0.403*** |

1 |

|

|

|

|

|

Amount of investments in the nearest regions, with due regard to their remoteness |

0.188*** |

-0.075 |

-0.247*** |

-0.215*** |

1 |

|

|

|

|

Return on assets

|

0.584*** |

0.022 |

-0.217*** |

0.074 |

0.276*** |

1 |

|

|

|

Quality of human capital |

0.183*** |

-0.161** |

-0.253*** |

-0.031 |

0.294*** |

0.307*** |

1 |

|

|

Density of roads

|

0.027 |

0.237*** |

-0.002 |

0.430*** |

0.280*** |

0.304*** |

0.395*** |

1 |

|

Sales volume per capita |

-0.202*** |

0.187*** |

0.416 |

0.752*** |

-0.217*** |

-0.004 |

-0.140** |

0.336*** |

1 |

Note. 10% significance is marked *, 5% significance – **, 1% significance – ***.

The analysis revealed a positive linear relationship between the variable under study and the selected factors (except for the variables of fiscal capacity of the regions, effect of agglomeration and sales volume per capita); the statistical significance of the relationships under study is presented in the table.

The sectors of the economy under study demonstrate a negative correlation of investments in the region with the retail sales volume. The negative influence of the population’s expenditures in the region on investments in the processing industry may have various reasons, which are caused by a decrease in the share of savings in population’s incomes or by a decline in real incomes, for example. As such, the market effect, which had been caused by the growth of population’s incomes and had lead to an increase in the production concentration, was not reflected in econometric models for this sector. However, it must be noted that the market effect on the territory of Russian regions might be associated not with the retail sales volume but rather with the growth of intersectoral and intrasectoral trade among regional enterprises.

It must be concluded that the investment activity continues to decline, a number of investment projects are suspended, and previously adopted investment plans are abandoned in most Russian regions. The complexity of the changes in the investment processes is associated with the general negative economic situation in the Russian economy, reduction in revenue sources of the regional budgets, low living standards, and drop in effective demand.

A decrease in the investment capacity of the territory is observed in some Russian regions, while the natural resource and infrastructure potential is highly assessed. This emphasizes the importance of quantifying the investment potential of the regions and the need for further independent ranking of regions by the investment risk indicators once again. The sequence of the investment risk reduction and measures taken by the regional administration demonstrates positive changes in the investment processes in the Russian regions and positively influences the establishment of the entrepreneurial climate of the territory.

It is obvious that the development of the investment environment, business climate and the implementation of investment projects both on a budgetary basis and with the involvement of public-private partnership mechanisms in the priority areas of regional socioeconomic development contribute to the sustainable establishment and use of the economic potential. Indicators of the investment policy performance are an evaluation indicator of the regional government efficiency.

Akindinova, N.V. and E.G. Yasin, 2015. Novyy etap razvitiya ekonomiki v postsovetskoy Rossii [New Stage of Economic Development in Post-Soviet Russia]. In the Proceedings of the XVI April International Scientific Conference. Moscow: NRU HSE, pp: 35-37.

Baldwin R., Forslid R., Martin P., Ottaviano G., and Robert-Nicound F., 2003. Economic geography and public policy. Princeton University Press.

Baldwin R., Martin P., Ottaviano G., 2001 Global income divergence, trade and industrialization: The geography of growth takeoff, Journal of Economic Growth 6, 5–37.

Bolshakov, S.N., Yu.M. Bolshakova, N.A. Mokhalchenkova and M.D. Istikhovskay, 2015. The Mediatization of Socially Important Issues and the Dynamics of Civil Society. International Review of Management and Marketing, 5: 11-17.

Distribution of Russian regions by the reintuition of the investment climate in 2017. Extorters agency RA-EXSPERT (n. d.). Date View January 12, 2018 https://raexpert.ru/

Investment attractiveness of the regions – 2017: Growth contours. (2017). Moscow: IRAEX. Date View January 12, 2018 https://raexpert.ru/docbank/5e2/a5b/897/dd35c089e004153429d3569.pdf

Kochkina T.V. (2016). Determinants of the investment attractiveness of the regions analyzing the sectoral amenities. Final qualification work. HSE, Perm, pp. 72

Kolomak E. A. (2010). Spatial externalities as a resource of the economic region. Economics and Sociology, 4: 73-87

Krugman P. and Venables A., (1996). Integration, specialization, and adjustment. European Economics Review, 40, 959–967.

Krugman P., (1991). Increasing returns and economic geography. Journal of Political Economy, 99: 483 - 499.

Kudrin, A. and Gurvich, E. (2014). Novaya model rosta dlya rossiyskoy ekonomiki [New Model of Growth for the Russian Economy]. Issues of Economics, 12: 4-36.

Lapo V. F. (2010). The spatial concentration of production and the revival of investors' analytical selection tools to attract investment in the regions. Applied econometric, 2: 3-19

Lipkin, A.I. (2012). Rossiya mezhdu nesovremennymi "prikaznymi" institutami i sovremennoy demokraticheskoy kulturoy [Russia Between Old-fashioned "Mandative" Institutions and Modern Democratic Culture]. World of Russia, 4: 40-62.

Materials of the Moscow Economic Forum (2017). Moscow. Date View January 12, 2018 http://me-forum.ru/materials/Materials_2017_MEF.pdf

Miheeva N. N. (2010). Differentiation of the socio-economic situation of Russian regions and problems of regional policy. A series of scientific reports. Moscow: REEI

Monitoring The Economic Situation In Russia. Trends And Challenges Of Socio-Economic Development (2017). Date View January 12, 2018 http://iep.ru/files/RePEc/gai/monreo/monreo-2017-22-863.pdf

National rating of the investment climate in the constituent entities of the Russian Federation. Date View January 12, 2018 http://tpprf.ru/ru/investment_innovation/rating/

Results in the annual rating of the investment attractiveness of the regions of Russia. (n.d.). Date View January 12, 2018 http://www.ra-national.ru/

Sinelnikov-Murylev, S., Drobyshevskiy, S. and Kazakova, M. (2014). Dekompozitsiya tempov rosta VVP Rossii v 1999-2014 godakh [Decomposition of Russian GDP Growth Rates in 1999-2014]. Economic Policy, 5: 7-37.

Vedev, A., Drobyshevskiy, S., Sinelnikov-Murylev, S. and Khromov, M. (2014). Aktualnyye problemy razvitiya bankovskoy sistemy v Rossiyskoy Federatsii [Current Problems of the Banking System Development in the Russian Federation]. Economic Policy, 2: 7-24.

1. Syktyvkar State University named after Pitirim Sorokin, 167001, Russia, Republic of Komi, Syktyvkar, Octyabrsky Prospect, 55, E-mail: sn_bolshakov@mail.ru

2. St. Petersburg State Maritime Technical University, 198262, Russia, St. Petersburg, Leninsky Prospect, 101

3. St. Petersburg State Maritime Technical University, 198262, Russia, St. Petersburg, Leninsky Prospect, 101

4. FSUE Krylov State Research Center, 196158, Russia, St. Petersburg, Moskovskoe shosse, 44

5. Komi Republican Academy of State Service and Administration, 167001, Russia, Republic of Komi, Syktyvkar, Kommunisticheskaya str., 11