Vol. 39 (Nº27) Year 2018. Page 18

Vol. 39 (Nº27) Year 2018. Page 18

Irina Anatolievna KISELEVA 1; Mikhail Vladimirovich KARMANOV 2; Anatoly Vladimirovich KOROTKOV 3; Vladimir Ivanovich KUZNETSOV 4; Mikhail Samuilovich GASPARIAN 5

Received: 20/05/2018 • Approved: 08/06/2018

2. Concept and classification of risks in business

3. Methods of risk analysis and assessment

4. Importance of risk management in ensuring the economic security of an enterprise

5. Risk analysis of the economic activity of PJSC "Mobile TeleSystems"

ABSTRACT: This article describes an attempt to study the role of risk management from the standpoint of an entrepreneur. The main goal of this article is to identify the key patterns that determine the specifics of risk assessment in business as the main element contributing to achieving the economic security of the organization. The methods of cognition, retrospective and documentary analysis, as well as synthesis, generalization and systematization have been used in this paper. The object of research is public relations associated with the establishment of the risk management institution at the microlevel. The article reviews various types of economic risks, methods of risk analysis and assessment, as well as strategies for neutralizing risks. Features of risk management in Russia and abroad are reviewed. Various methods of risk management are used in the modern economic analysis. The most efficient way to reduce risk in the context of economic and political instability in Russia is diversification, i.e. distribution of risks between several business participants. |

RESUMEN: Este artículo describe un intento de estudiar el papel de la gestión de riesgos desde el punto de vista de un emprendedor. El objetivo principal de este artículo es identificar los patrones clave que determinan los detalles de la evaluación de riesgos en las empresas como el elemento principal que contribuye a lograr la seguridad económica de la organización. Los métodos de cognición, análisis retrospectivo y documental, así como la síntesis, generalización y sistematización se han utilizado en este documento. El objeto de la investigación son las relaciones públicas asociadas con el establecimiento de la institución de gestión de riesgos a nivel micro. El artículo revisa varios tipos de riesgos económicos, métodos de análisis y evaluación de riesgos, así como estrategias para neutralizar los riesgos. Se revisan las características de la gestión de riesgos en Rusia y en el extranjero. Varios métodos de gestión de riesgos se utilizan en el análisis económico moderno. La forma más eficiente de reducir el riesgo en el contexto de la inestabilidad económica y política en Rusia es la diversificación, es decir, la distribución de riesgos entre varios participantes comerciales. |

As market relations develop, the entrepreneurial activity is carried out in the face of growing uncertainty. The uncertainty of the external and internal environment forces the entrepreneur to take on a risk that can determine both gains and losses. Lack of the full information, existence of counteracting trends, elements of chance and other new economic conditions of management make it difficult to predict the management process, since most of the enterprise's management decisions are taken in the presence of risk.

Any entrepreneur is trying to conduct their business while minimizing the possible amount of losses and maximizing the amount of profit. To succeed in this desire within the enterprise, it is necessary to use the advances of science in the field of risk management and best practices of those who have successfully implemented a risk management system in the enterprise.

Availability of risk management toolkit enables the business entity to adequately respond to threats through the development and implementation of efficient behavioral strategies and implementation of appropriate crisis management measures to minimize risks in the face of uncertainty.

Any activity of an individual or an enterprise is directly related to unforeseen events that may arise in the course of their activities and result in losses. Besides, they must constantly make choices when taking certain decisions about their activities under conditions of incomplete information, which can also lead to losses or lost benefits. All this can be described with one word – "risk" (Shapkin and Shapkin 2014, p. 111).

Risk is integral to both people's lives and the activities of business entities. At the present stage, everyone understands that risks can’t be ignored in the course of activities. Entrepreneurship does not exist without risks. If the company understands them, it can build the optimal strategy for further development and choose the way out of adverse situations, the most important of which the entrepreneur can often insure. (Kiseleva and Simonovich 2014, p. 25).

The concept of risk is not a new category in economic science. It emerged and was identified back when the first civilizations of the Ancient East developed and when it primarily related to unforeseen events in agriculture, because natural production was the basis of social development (Khayrullina and Shagabutdinova 2013, p. 52).

The key risks, which stood out in this historical period and had a potential impact on shaping and development of the economic systems of the time, were:

1. natural risks (climatic conditions, natural disasters);

2. risks in the construction and maintenance of irrigation systems.

It can be said that the risks in the commodity-money sector of the society's activity were allocated in the same period. Since the rudiments of commodity-money relations were regulated at that time, there was a danger of social destabilization of the social order due to the alleged carrying out of voluminous trade and usurious operations, which could result in the mass impoverishment of the population. This is why back then, an important component of the trade regulation was the supervision of prices and the income received, monitoring of which was assigned to the relevant persons – market supervisors.

The approach to identifying risks in the economic thought of the Middle Ages was much more detailed and structured. (Chereshkin 2010, p. 50).

The following risks were identified in this period:

In the time of mercantilism, the economic theory was significantly enriched by new approaches to the definition of risks, which were further divided into:

For example, Russian economist Algin A.P. suggests the following definition of risk: "risk is the activities of economic entities associated with overcoming the uncertainty in the situation of inevitable choice, during which the possibility of desired result, failure and deviation from the goal contained in the alternatives can be assessed" (Algin 1991, p. 31).

According to the Russian scientist Balabanov I.T., risk is a possible danger of loss arising from the specifics of certain natural events and the types of the human society activities (Balabanov 2015, p. 52)

Risk is a threat that any event or action will adversely affect the possibility to achieve the desired result in business, implementation of the goal and strategic plans.

Risk is a subjectively objective economic category of a probabilistic nature and describes the uncertainty of the final result of the activity due to the possible impact of a number of objective and/or subjective factors on it that are not taken into account during its planning.

As such, all the above interpretations of the "risk" category can be divided into three main groups, where the authors focus on various aspects (Lavrenchuk and Mingaleva 2010, p. 462).

The first group includes interpretations that reveal risk as uncertainty; danger; a disaster that occurs unexpectedly, difficult to predict, and its consequences are difficult to evaluate. The following authors adhere to this concept: Ryndin A.G., Smirnova O.P., Shapkin A.S. The objective nature of risk is traced in the works of these authors (Ryndin and Shamayev 2014; Smirnova 2017; 25].

The second group includes definitions that underline the human factor, i.e. that reveal the subjective side of risk. It means that when carrying out economic activity, the entity faces alternatives and therefore a choice, and receives a positive or negative result depending on the chosen option. The works of the following authors within this concept can be noted (Vankovich I.M. (2014); Khayrullina and Shagabutdinova 2013; Shigaev 2012).

The third group includes interpretations where the emphasis is placed on both the subjective and objective side of risk. Risk is defined as a category that is probabilistic due to the uncertainty and the conflict nature of the economic activity and is measured by deviation (positive or negative) from the target indicators. Authors adhering to this concept are Arakelyan, K.S. (2014), Batova I.B. (2015).

Each enterprise chooses a strategy in practice in order to achieve the core goal of the enterprise, when the enterprise can take risks or, on the contrary, try to avoid risk.

Evaluation of the risk situation, formation of possible outcomes, definition of the probability of occurrence of certain events and the choice of solutions in many ways are individual for each enterprise.

Risks are difficult to classify due to their diversity.

There are certain types of economic risks, which all organizations are subject to, without exception, but along with general, there are specific types of risk associated with economic activity, risk associated with the entrepreneur’s personality, and risk associated with insufficient information about the external environment (Kleiner 2014, p. 85)

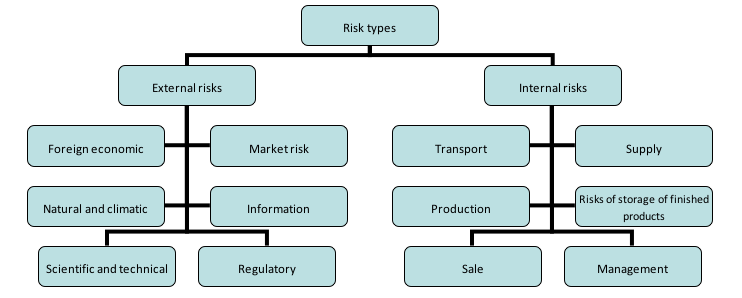

Figure 1 shows the risk classification that is used in economic practice.

Figure 1

Types of economic risks (Kleiner 2014, p. 87)

As such, there are external and internal causes of risk emergence arising from external conditions and internal factors of the enterprise activities.

A precondition for achieving success in the field of activity described by increased risk is the creation and improvement of risk management systems that allow identifying, assessing, localizing and controlling risk.

The decision-making mechanism should not just identify the risk but also allow to assess what risks and to what extent the enterprise can take on, and also determine whether the expected return will justify the corresponding risk.

Shaping the enterprise risk management model and ensuring its efficiency implies justification of the leading tasks and methods of risk neutralization.

Risk neutralization is a financial and mathematical technology for justifying, accepting, executing and monitoring the implementation of financial management decisions for the implementation of preventive financial, organizational or legal measures to ensure the efficiency of the business transaction and the levels of operational and financial leverage as components of the enterprise's integrated risk.

The system of the internal mechanism of enterprise risk neutralization includes (Korezin 2011, p. 50): avoidance of risk; limiting the risk concentration; hedging; diversification; distribution; self-insurance.

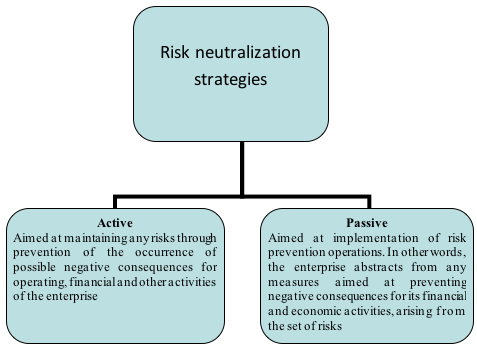

There are two main types of strategies for risk neutralization: active and passive (see Figure 2).

Figure 2

Risk neutralization strategies

Several major methods are distinguished in the set of methods to neutralize risks by active strategies:

The most efficient way to reduce risk in the context of economic and political instability in Russia is diversification, i.e. distribution of risks between several business participants. In order to increase economic security, enterprises should constantly try reducing risks and eliminating their sources.

The efficiency of risk management depends on the precise information provided by various departments, and therefore the risk manager needs to examine the following source documents: 1. technical documentation; 2. primary documents of management and financial reporting; 3. data of quarterly and annual financial statements; 4. financial statements; 5. results of inspections of the firm’s structural divisions.

Risk management covers a set of measures aimed at increasing the enterprise efficiency and minimizing possible losses in the course of its activities.

Particular attention should be paid to control issues: (Arakelyan 2014, p. 52) control of product quality; control of financial activities; control of human resources; control of pricing; preliminary control; ongoing control; final control; strategic control; management control; operational control.

As such, we can see that the modern economic analysis uses various methods of risk management. The optimal technique is the combination of elements of various practices for determining the risk ranking by the significance degree.

Risk management in Russia is very poorly developed both at the macro- and microlevels. This is due to the lack of sufficient theoretical and practical basis. This is mainly explained by the fact that risk management has simply been not required at the Russian enterprises for a long time, since the state took almost all risks of the enterprises in the Soviet period.

Formation of market relations has led to the fact that organizations should conduct economic activities at their own peril and risk, and therefore independently make management decisions. However, risk management, like any other science, cannot arise from nowhere: its establishment, development and subsequent implementation in practice take a long time. Besides, the established Soviet principles of management are not so easy to eradicate. As a result, risk management is still ignored in most Russian enterprises, especially small ones, because entrepreneurs believe that "it is not worth powder and shot", which means that it makes no sense to invest so much in the development and adoption of managerial decisions when it can be invested in expanding business. This makes sense, but given the current "risky" economic environment, in most cases, this disregard for risks leads the organizations to bankruptcy (Averyanova 2011, p. 222).

A completely different situation is observed abroad. Despite this science being relatively new, risk management has passed a much longer path of establishment and development there than in Russia. This is especially noticeable in European countries, where risk management has long been developed theoretically and is widely used in practice. At the same time, risk management is constantly developing and improving both at the expense of theoretical developments and through the increasingly enriching experience.

Practice of Roche can be an example of implementation of such a competent policy in the field of risk management abroad (Bystritskaya and Lavrentyeva 2016, p. 350).

F. Hoffmann-La Roche is a Swiss pharmaceutical company, one of the leading pharmaceutical companies worldwide and number one in the world in the field of in vitro diagnostic and histological diagnostic of oncological diseases.

It is one of the leading manufacturers of biotechnological drugs in oncology, virology, rheumatology and transplantology. It has representative offices in 150 countries and 88.5 thousand employees.

Revenue for 2014 is 47.46 bln Swiss francs (number three in profits among the pharmaceutical companies).

The core goal of Roche is production and promotion of unique products developed on the basis of innovative technologies that improve living standards, significantly prolong and sometimes save patients’ lives. The company's work in the healthcare market is conducted by its two independent divisions: pharmaceutical and diagnostic.

According to Roche experts, risk management is a well-arranged process. It is the central part of the company's strategic management. At its core, risk management should be a continuous process that analyzes the risks of each activity in order to achieve their maximum efficiency.

Risk managers structure risks by classes and types, identify the significance of these risks and responsible persons at the identification stage using a compiled catalog of risks.

Risk maps are drawn up at the assessment stage, reflecting the significance of certain risks and the likelihood of their occurrence.

The enterprise's predisposition to certain risks is determined at the analysis stage, and an action plan for mitigating consequences is developed.

Monitoring is carried out on the basis of information reports of structural subdivisions to external and internal audit. At this stage, risk profiles are drawn up, which contain information on the risk area, risk indicators and specific guidelines for risk minimization. This stage is perhaps the most important, since qualitative risk management depends on the ways and methods of control. Therefore, continuous monitoring allows analyzing the quality of risk reduction measures and provides the necessary information for further efficient managerial decision-making.

Let's proceed directly to risk management at Roche.

There is a constant process of identifying risks, their significance and likelihood of occurrence are determined in each division. In turn, the risk management department collects and analyzes information on risks, advising the units on reducing the risks occurrence probability and mitigating them.

For example, the risk management department constantly monitors the emergence and development of risks arising in various divisions of the company, updating the catalog of risks.

The Board reviews risk reports prepared by risk managers twice a year and determines the company's further actions in relation to the most probable and materially significant risks together with the Board of Directors once a year.

As such, the responsibility for risk management rests with all employees of this chain of structural relationships. Since the creation of a qualitative structure of risk management is possible only with full understanding of responsibility, wide awareness of workers is supported by the creation of risk maps for departments and a catalog of enterprise risks.

It should be borne in mind that the efficiency of risk management is determined not only by key elements such as risk identification, assessment and making decisions to reduce the likelihood of their occurrence and minimize damage if they occur, but also by automating the risk management process.

Such approach of the company ensures efficient risk management. However, despite the extensive experience and successful practice in risk management, Roche always strives to improve.

The risk management process does not develop in an accidental and chaotic manner but rather in a clear logical chain from theoretical aspects to practice.

For example, risk managers look at the past, analyzing which risk management methods have already been used in the enterprise in general or in a separate division; try to analyze the future (what can be improved), limiting themselves to the present (what is necessary, permissible). After this, based on the company’s goals and objectives, risk manager proceeds to the creation of specific risk management projects.

An extensive risk classification allows to conclude that risk has long been considered and analyzed as an economic category, and new approaches to the risk classification arise.

As such, the importance of the risk management process has been noted, which is seen as the process of making and executing managerial decisions aimed at reducing the likelihood of an adverse result and minimization of the possible losses caused by its implementation. From this it follows that management risks play a fundamental role in ensuring the economic security of the enterprise.

Public Joint Stock Company "Mobile TeleSystems" (PJSC "MTS") is a leading provider in Russia and CIS countries of mobile and landline services, Internet access, cable and satellite TV broadcasting, digital services and mobile apps, financial and e-commerce services, as well as convergent IT solutions in the field of system integration, the Internet of things, monitoring, data processing and cloud computing. MTS provides innovative services and solutions, thus making a significant contribution to economic growth and improving the living standards of tens of millions of people in the countries of operation.

Risk management in MTS Group corresponds to the generally accepted conceptual framework of management. The process of integrated risk management is efficiently in place in accordance with the needs of the Group of companies and international standards. The risk management policy is to minimize unforeseen losses from risks and capitalization maximization, given the ratio between risk and return on investments that is acceptable for shareholders and management of MTS Group.

The key principles of the risk management process are:

1. principle of integration. It provides a systemic approach to managing all types of risks inherent in MTS business, across the organizational structure and geography of the MTS Group operation;

2. principle of continuity. It consists in the implementation of a set of streamlined risk management procedures on a regular basis;

3. principle of validity. It provides an analysis of the ratio of costs to reduce the risk assessment to the potential damage from their implementation.

The most significant risk factors that have a potential impact on the PJSC "MTS" performance are presented below (see Table 1).

Table 1

Risk factors of PJSC MTS operation (PJSC “MTS”. 2007-2016)

Risk description |

Measures for risk mitigation |

Macroeconomic and country risks |

|

Macroeconomic and sociopolitical instability, possible downturns or slowdowns of economic growth in the countries of operation can lead to a decrease in demand for services provided, which may lead to a drop in revenues and performance indicators |

Monitoring the macroeconomic situation on the markets of the Group's operation, expansion of coverage and capacity of the existing network, ensuring the satisfaction of consumers with the quality of communication services |

Impact of the country and political risks, as well as risks associated with the legal status and the ability of uninterrupted service delivery in the countries of operation, which could affect our financial condition, asset safety and performance |

Monitoring of the situation on the markets of the Group operation, which allows to react promptly to changing conditions of the market operation |

Financial risks |

|

Crisis of financial markets, external restrictions and sanctions can affect the Company's ability to raise debt funding. |

Some measures are taken to structure the portfolio in order to reduce dependence on the exchange rate fluctuations, including a currency risk hedging program. |

Constant changes in tax legislation of the countries of operation, ambiguity in the interpretation of legislation in the field of activities |

Prompt response to any changes and monitoring of current trends in lawmaking and tax law in Russia and foreign jurisdictions, which allows to make timely comprehensive decisions in the field of tax planning and customs regulation. |

Regulatory risks |

|

Constant changes in the legislation regulating the provision of communication services. |

Regular monitoring of legislation with the purpose of meeting the requirements, participation in working groups on the base optimization in the communications industry. |

Technological risks |

|

Dependence of the network capacity and the possibility of its expansion on the used radio frequencies distributed by the state authorities of the countries of operation, which is important for maintaining the market share of subscribers and revenues |

Monitoring the expiry of licenses for the provision of telecommunications services and taking necessary measures for their timely extension, ensuring compliance with licensing conditions and other regulatory requirements |

Occurrence of technological failures in the network maintenance due to a system malfunction, failure or disruption of network security can adversely affect the ability to provide services to subscribers and the company reputation |

Use of backup telecommunications equipment, network management systems, operation and maintenance systems. |

Competition risks |

|

Dependence of business, operational indicators and financial position on the competitive environment in the countries of operation, demand for company’s services and efficiency of operations |

Investing in the development/modernization of communication networks, as well as in related businesses, creating synergies with the companies in the Group as part of the development of a technological base for expanding the range of services for all market segments, strengthening leadership in the telecommunications industry. |

Operating risks |

|

Dependence of operational indicators and competitive position on investment in expanding the portfolio of value added services, building the communication systems, developing wireless and landline services, etc. |

Balanced investment policy in order to expand the network infrastructure and the range of services provided. |

Dependence of the subscriber base, market share and revenues on the ability to develop a trading network, maintain relationships with regional dealers and the structure of the market of independent dealers. |

Expansion and improvement of the own trading network, preservation and development of the sales network through the national, regional and local dealers. |

To assess the performance and identify potential risks for PJSC "MTS" for 2007-2016, the following financial indicators were taken first: revenue; cost of sales; income (loss) from sales; other income; net income (loss).

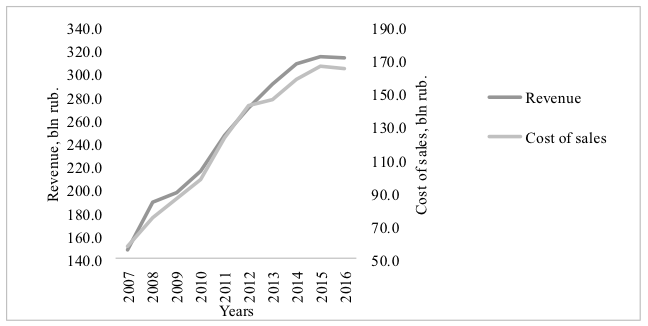

Figure 3

Dynamics of revenue and cost of sales of PJSC "MTS"

for 2007-2016, bln rub. (PJSC “MTS”. 2007-2016)

During the period under review, a clear growth trend in the revenue of PJSC "MTS" can be observed (see Figure 3). It grew from 147.3 bln rub. up to 314.3 bln rub. (approximately 2.7 times) in the period between 2007 and 2016. Besides, the simultaneous increase in the cost of sales cannot go unnoticed. It increased from 57.2 bln rub. up to 165.5 bln rub. (approximately 2.9 times) over the same period.

Analyzing the profit from sales, it is worth noting that it did not have a clearly defined trend during the period under study. It reached its maximum value (74.8 bln rub.) in 2008. However, its value fell sharply by 8.1 bln rub. (10.8%) after that. The main reason for this fall is the global financial crisis, which the company couldn’t circumvent and was adversely affected by. The growth in profit from sales began only after 2011. It increased by 49 bln rub. or 7.5% again in 2012, compared with the previous year. It was already at the level of 74.4 bln rub. as soon as in 2014, almost reaching the 2008 figures. But the currency crisis in Russia in 2014-2015 caused the profit from sales going into decline again. In other words, strong dependence of profit from sales on external factors should be noted. Its dynamics were negatively affected by macroeconomic instability and a decline in the country's economic growth. They are potential risks that can lead to a decrease in the company's revenues and indicators of its performance.

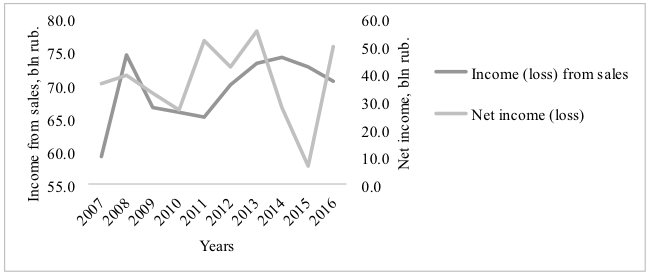

Figure 4

Dynamics of income from sales and net income of PJSC

"MTS" for 2007-2016, bln rub. (PJSC “MTS”. 2007-2016)

The dynamics of net income are more difficult to analyze (see Figure 4). Its values remain unstable from year to year. Its maximum value could be observed in 2013 (56 bln rub.), and minimum value was in 2015 (6.7 bln rub.). This indicator was also affected by the global financial and currency crises. This indicator fell by 12.4 bln rub. or 31.1% by 2010, compared to 2008. But the biggest decline was in 2015. Compared to the previous year, net income decreased by 21.7 bln rub. or 76.4%. In other words, there was also a general risk of decline in net income due to the volatile state of the Russian economy in the past few years.

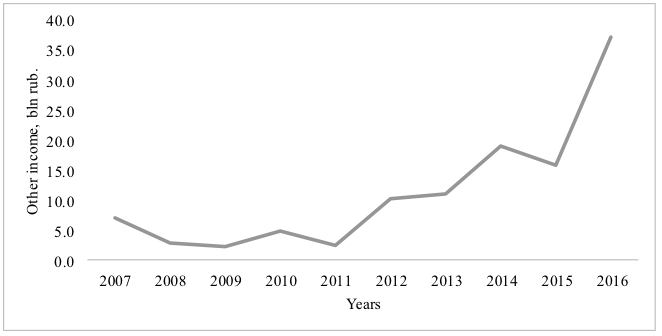

Figure 5

Dynamics of other income of PJSC "MTS" for

2007-2016, bln rub. (PJSC “MTS”. 2007-2016)

Speaking of other income, 2 periods can be defined (see Figure 5). There was a decrease in this indicator in the first period, between 2007 and 2011. Other revenues fell by 4.6 bln rub. or 64.8%. However, a positive trend could be seen as soon as in 2011-2016. During this time, revenues increased by 34.8 bln rub. or 15 times.

During the period under review, there were no significant changes in the balance structure of PJSC "MTS". The key characteristics of the company's assets and liabilities over 2007-2016 have been as follows:

1. Share of non-current assets is approximately 35-40%;

2. Share of current assets varies from 10 to 15% in the total balance sheet structure;

3. Share of equity is generally in the range between 10 and 15%;

4. Share of borrowed funds is approximately 35-40%.

The main features of the balance include:

1. Prevalence of borrowed funds over own funds;

2. Prevalence of non-current assets over current assets;

3. Relative stability in the balance sheet structure of the enterprise.

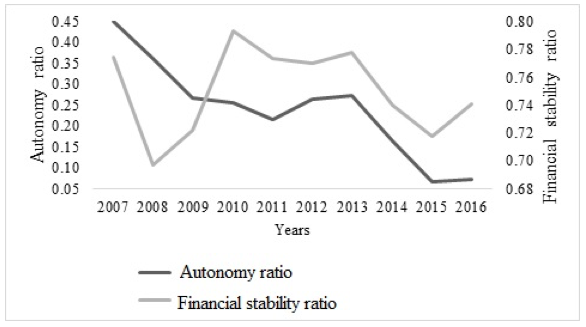

The level of financial stability of the organization can generally be described as stable. However, the autonomy ratio shows a low share of assets belonging to owners in the company's common property, and this share tends to fall. The conclusion follows that a further risk of decline in this indicator can be forecasted in subsequent years. However, the financial stability ratio indicates that long-term liabilities are secured by equity by 75% on average at little dynamics (see Figure 6).

Figure 6

Dynamics of the autonomy and financial stability ratios of

PJSC "MTS" for 2007-2016 (PJSC “MTS”. 2007-2016)

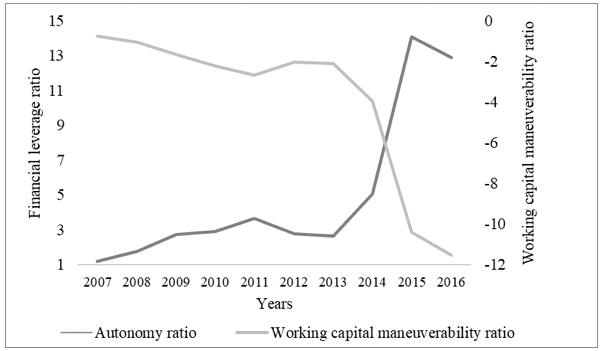

The financial leverage ratio, which has a growth trend, means that PJSC "MTS" is actively raising additional borrowed funds, which can be accompanied by a risk of non-fulfillment of its obligations. However, at the current level of the turnover ratio of current assets, borrowed funding drives the growth of the company's revenue (see Figure 7).

Figure 7

Dynamics of financial leverage and working capital maneuverability

ratios of PJSC "MTS" for 2007-2016 (PJSC “MTS”. 2007-2016)

The value of the working capital maneuverability ratio throughout the entire period under study is negative and tends to fall further. This means that the own funds are invested in fixed assets, while the working capital is formed from borrowed funds.

The study of the financial activities of the enterprise also involves examination of the probability of the firm’s bankruptcy (Bezuglaya 2013; Gubanov 2014; Dudin, Lyasnikov, Sekerin, Gorohova and Burlakov 2016; Semenova 2014). The following models of the organization bankruptcy were used for this purpose:

1. Foreign: E. Altman model; R. Lis model;

2. Domestic: Belikova-Davydova model.

Table 2

Calculation of E. Altman’s Z-account

Ratio |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

X1 |

0.21 |

0.25 |

0.29 |

0.17 |

0.21 |

0.20 |

0.15 |

0.18 |

0.24 |

0.10 |

Х2 |

0.37 |

0.34 |

0.09 |

0.23 |

0.20 |

0.25 |

0.26 |

0.15 |

0.05 |

0.07 |

Х3 |

0.24 |

0.19 |

0.10 |

0.09 |

0.13 |

0.13 |

0.16 |

0.07 |

0.03 |

0.13 |

Х4 |

0.82 |

0.57 |

0.36 |

0.34 |

0.27 |

0.36 |

0.37 |

0.20 |

0.07 |

0.08 |

Х5 |

0.67 |

0.67 |

0.51 |

0.55 |

0.52 |

0.60 |

0.67 |

0.63 |

0.59 |

0.65 |

Z |

2.22 |

1.97 |

1.26 |

1.30 |

1.37 |

1.50 |

1.64 |

1.19 |

0.91 |

1.20 |

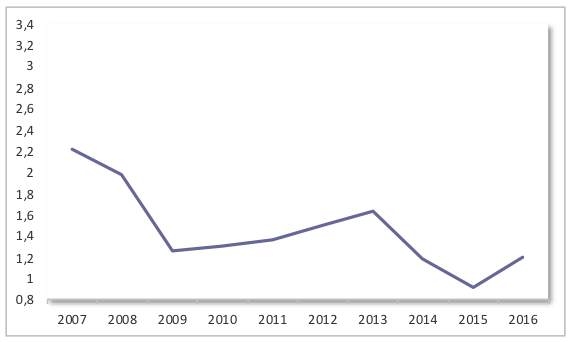

Examination of E. Altman bankruptcy model revealed (see Table 2) that PJSC "MTS" was in the "red zone". This indicates that the risk of the organization bankruptcy is from 80% to 100% (see Figure 8).

Figure 8

Dynamics of the Altman Z-account for PJSC

"MTS" for 2007-2016 (PJSC “MTS”. 2007-2016)

-----

Table 3

Calculation of R. Lis Z-account

Ratio |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

K1 |

0.212 |

0.248 |

0.291 |

0.170 |

0.209 |

0.199 |

0.148 |

0.184 |

0.242 |

0.097 |

K2 |

0.237 |

0.193 |

0.103 |

0.094 |

0.133 |

0.126 |

0.157 |

0.072 |

0.027 |

0.127 |

K3 |

0.371 |

0.339 |

0.086 |

0.228 |

0.199 |

0.248 |

0.255 |

0.149 |

0.052 |

0.071 |

K4 |

0.824 |

0.568 |

0.363 |

0.344 |

0.274 |

0.360 |

0.375 |

0.197 |

0.071 |

0.078 |

Z |

0.057 |

0.053 |

0.033 |

0.033 |

0.037 |

0.039 |

0.039 |

0.027 |

0.021 |

0.022 |

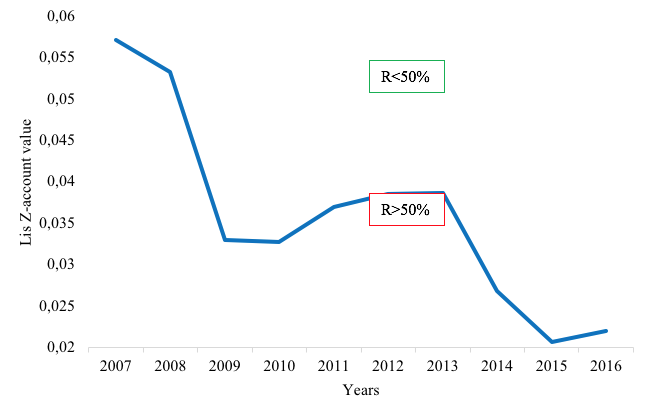

Similar results can also be observed in the construction of the R. Lis model (see Table 3). According to it, PJSC "MTS" has a similar negative tendency to increase the bankruptcy risk (see Figure 9).

Figure 9

Dynamics of the value of Lis Z-account of PJSC

"MTS" for 2007-2016 (PJSC “MTS”. 2007-2016)

------

Table 4

Calculation of Belikov-Davydova Z-account

Ratio |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

K1 |

-0.014 |

-0.055 |

0.013 |

-0.036 |

-0.018 |

-0.031 |

-0.075 |

-0.076 |

-0.040 |

-0.162 |

K2 |

0.373 |

0.391 |

0.323 |

0.274 |

0.518 |

0.362 |

0.473 |

0.350 |

0.187 |

1.446 |

K3 |

0.671 |

0.672 |

0.509 |

0.552 |

0.521 |

0.605 |

0.673 |

0.628 |

0.585 |

0.646 |

K4 |

0.647 |

0.530 |

0.387 |

0.280 |

0.427 |

0.301 |

0.382 |

0.179 |

0.040 |

0.306 |

Z |

0.806 |

0.715 |

0.606 |

0.450 |

0.800 |

0.558 |

0.688 |

0.433 |

0.210 |

1.540 |

-----

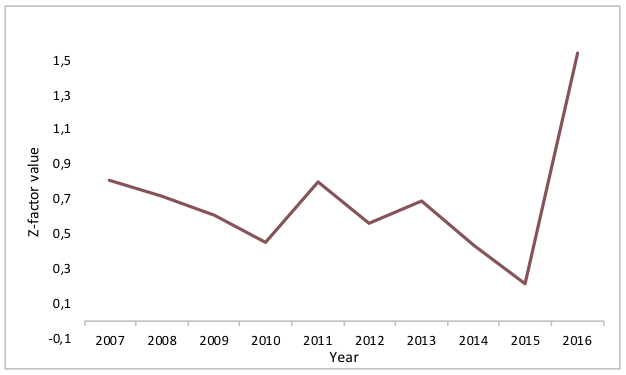

Figure 10

Dynamics of Belikov-Davydova Z-factor value of PJSC

"MTS" for 2007-2016 (PJSC “MTS”. 2007-2016)

The Belikov-Davydova model indicates the stability of the Russian organization. According to this model, the company bankruptcy risk is below 10% (see Table 4). An exception is the situation in 2015. However, it was caused by the currency crisis in the country, due to which the company's net income fell sharply that year, which provoked deterioration of financial stability (see Figure 10).

As such, the following types of PJSC "MTS" analyses for 2006-2017 were conducted as part of the research project:

In the course of horizontal analysis, the dynamics of such indicators as revenue, cost of sales, other income, income from sales, net income were examined. The first three indicators saw a positive upward trend for the period under study, while the latter two changed their value from year to year, being exposed to significant external factors, such as the global financial crisis, currency crisis in Russia, as well as the unstable situation in the Russian economy in general.

Vertical analysis was aimed at examining the structure of the company's balance sheet. It generally revealed the stability of assets and liabilities of the enterprise over the entire period under study.

Coefficient analysis revealed strong dependence of the company on borrowed sources of funding and attraction of long-term and short-term loans for the reserves formation. However, additional borrowed funds positively affect the company's revenue growth at the observed level of the working capital ratio. Therefore, it can be said that the level of financial stability is sustainable for a leading company in this industry.

Foreign models revealed a high level of the company bankruptcy, while domestic ones revealed the contrary. This disparity is explained by the fact that foreign models do not take the specifics of the Russian economy into account, which leads to inaccuracies in forecasts. However, organizations should pay attention to the data of foreign risk models of the enterprise bankruptcy, which make up more than 50%.

In other words, the analysis of PJSC "MTS" revealed the company's stability on the Russian market. It was proven that it was a well-deserved leader in the Russian mobile communications market and had all the necessary capabilities for its further development and extending of the influence area not only in Russia but also abroad. But despite this, some factors that potentially cause the risk of a decline in the organization’s profitability and performance should be identified: strong dependence on external environment (unstable situation in the Russian economy, slowdown in Russia's economic growth), high risk of the organization bankruptcy according to foreign models, risk of the organization’s insolvency to satisfy all its obligations, etc.

It must be noted that many entrepreneurs underestimate the importance of risk management, considering this to be unnecessary costs, while the detected problems are written off as errors of employees or management. Due to this type of thinking, many large and small companies lose lots of opportunities and sometimes fall into serious embarrassments that may even lead to bankruptcy.

This situation is largely explained by the late transition to market relations and, as a consequence, stiffened Soviet thinking, which does not accept any innovations. The lack of a solid scientific basis further exacerbates the situation, since even entrepreneurs who want to use risk management in their enterprises are not always able to do this.

In contrast to Russia, risk management abroad has come a long way of establishing and developing. This is particularly true for European countries, where risk management has become firmly embedded in the minds of entrepreneurs and has become an integral part of any organization striving to maximize its profits and minimize losses from making decisions under risk.

Economic entities should look for possible ways to introduce quality risk management under the pressure of the current situation in Russia (Lyakhovich 2006). Perhaps, the most realistic solution is to adopt the practice of foreign countries (Eisenhardt and Martin 2000; Foss 2007). At the same time, such adoption is seen not in thorough "copying", but in studying certain basic principles that could easily take root in Russian enterprises, with due regard to historical features of Russia's economic and political development.

In the course of a comprehensive risk analysis of the PJSC "MTS" operation for 2007-2016, the company's stable financial position was defined based on the following conclusions:

1. Analysis of the profit and loss statement revealed the growth of revenue, cost of sales and other income against the backdrop of volatile income from sales and net income, which was due to their strong dependence on external factors;

2. Analysis of financial statements revealed the stability of the organization's property structure. It has not undergone any significant changes over the past 10 years, which indicates a high degree of balance of assets and liabilities of the company;

3. Analysis of financial stability revealed high financial dependence on borrowed sources of funding. However, a large amount of borrowed capital has a positive effect on revenue growth at the current level of working capital;

4. Potential risks of the company: high bankruptcy level (according to foreign models) and strong dependence on the external environment (unstable situation in the Russian economy).

5. The positive trend for the company's revenue for 2017-2018 was forecasted against the backdrop of volatile profit dynamics.

Adamchuk N.G., Asabina S.N., Klochenko L.N., Sakharov V.S., Turbina K.E., Tsvetkova L.I. and Yuldashev R.T. (2013). Teoriya i praktika strakhovaniya [Theory and practice of insurance]. Study guide. Moscow: Ankil, pp. 703.

Algin A.P. (1991). Grani ekonomicheskogo riska [Edges of economic risk]. Moscow: Knowledge, pp. 187.

Ansoff, I. (1989). Strategicheskoye upravleniye [Strategic management]. Moscow: Economics, pp.358

Arakelyan, K.S. (2014). Ekonomicheskaya bezopasnost predpriyatiya kak instrument samostrakhovaniya v sisteme risk-menedzhmenta [Economic security of the enterprise as a self-insurance tool in the risk management system]. Young scientist, 6, 123-127.

Averyanova, Yu.G. (2011). Teoreticheskiye aspekty finansovoy bezopasnosti kommercheskogo banka [Theoretical aspects of financial security of a commercial bank]. Economic sciences, 77, 220-225.

Balabanov I.T. (2015). Risk-menedzhment [Risk management]. Moscow: Finance and statistics, pp. 192.

Batova I.B. (2015). Klassifikatsiya riskov i prichiny ikh vozniknoveniya [Classification of risks and causes of their emergence]. International Student Scientific Bulletin, 1, 25-27.

Bezuglaya, N.S. (2013). Ekonomicheskaya bezopasnost predpriyatiya. Sushchnost ekonomicheskoy bezopasnosti predpriyatiya [Economic security of the enterprise. Concept of economic security of the enterprise] / N.S. Bezuglaya. Russian entrepreneurship, 4-1, 63-67.

Bystritskaya A.Yu. and Lavrentyeva Ya.A. (2016). Ponyatiye i sovremennoye sostoyaniya strakhovogo rynka v Rossii [Concept and current state of the insurance market in Russia]. Economics and social medium, 5-1 (24), 349-351.

Chereshkin D.S. (2010). Upravleniye riskami i bezopasnostyu [Risk and security management]. Moscow: URSS Publishing Group, pp. 200.

Dudin M.N., Lyasnikov N.V., Sekerin V.D., Gorohova А.Е. and Burlakov V.V. (2016) Provision of energy security at the national level in the context of the global gas transportation industry development. International Journal of Energy Economics and Policy, 6(2), 234-242.

Eisenhardt, K.M., and Martin, J.A. (2000). Dynamic Capabilities: What Are They? Strategic Management Journal, 21, 1105-1121.

Foss, N.J. (2007). Scientific Progress in Strategic Management: The Case of the Resource-Based View. International Journal of Learning and Intellectual Capital (IJLIC), 4(1/2).

Gubanov R.S. (2014). Strakhovaniye finansovykh riskov kak metod risk-menedzhmenta [Insurance of financial risks as a risk management method]. Financial analytics: problems and solutions, 8, 31-35

Khayrullina A.D. and Shagabutdinova Z.V. (2013). Korporativnaya sistema upravleniya riskami [Corporate risk management system]. Kazan: RCYIPP, pp. 176.

Kiseleva I.A. and Simonovich N.E. (2014). Otsenka riskov s uchetom vliyaniya chelovecheskogo faktora [Risk assessment with due regard to the influence of the human error]. Economic analysis: theory and practice, 2 (353), 21-27.

Kleiner G.B. (2014). Riski malykh predpriyatiy [Risks of small enterprises] [Text]. Russian Economic Journal, 6, 85.

Korezin A.S. (2011). Menedzhment i kontrolling bezopasnosti predpriyatiya [Enterprise security management and control]. Moscow: ParkKom, pp. 27

Lavrenchuk E.N. and Mingaleva Zh.A. (2010). Risk-menedzhment i ekonomicheskaya bezopasnost predpriyatiya [Risk management and economic security of the enterprise]. Russian entrepreneurship, 4, 45-48.

Lyakhovich D.G. (2006). Otsenka effektivnosti i stepeni vliyaniya riska marketingovykh strategiy promyshlennogo predpriyatiya [Assessment of efficiency and degree of risk influence of the industrial enterprise marketing strategies]. Bulletin of universities. Machine building, 1, 74-79.

PJSC “MTS”. 2007-2016. http://www.company.mts.ru/comp/ir/control/data/annual_reports/ (access date: 13.12.2017)

Rykhtikova N.A. (2009). Analiz i upravleniye riskami organizatsii [Analysis and management of the organization’s risks]. Moscow: Economics, pp. 125.

Ryndin A.G. and Shamayev G.A. (2014). Organizatsiya finansovogo menedzhmenta na predpriyatii [Organization of financial management at the enterprise]. Moscow: Russian Business Literature, pp. 360.

Semenova, N.V. (2014). Primeneniye antikrizisnykh meropriyatiy kak mekhanizma povysheniya effektivnoy deyatelnosti turistskikh kompaniy v sovremennykh usloviyakh [Application of anti-crisis measures as a mechanism for improving the performance of tourist companies in modern conditions]. Service in Russia and abroadб 23(4), 127-131

Shapkin A.S. and Shapkin V.A. (2014). Teoriya riska i modelirovaniye riskovykh situatsiy: [Theory of risk and modeling of risk situations]: Study guide for bachelors. Moscow: Dashkov and Co., pp. 880.

Shigaev A.I. (2012). Kontrolling strategii razvitiya predpriyatiya [Controlling of the enterprise development strategy]: study guide for university students of the specialties "Accounting, Analysis and Audit", "Finance and Credit", "Taxes and Taxation". Moscow: UNITY-DANA, pp. 351.

Smirnova O.P. (2017). Osobennosti obespecheniya ekonomicheskoy bezopasnosti v tekhnologicheski sopryazhennykh vidakh deyatelnosti [Specifics of ensuring economic security in technologically related activities]. Science studies 1-2

Vankovich I.M. (2014). Finansovyye riski: teoreticheskiye i prakticheskiye aspekty [Financial risks: theoretical and practical aspects]. Russian entrepreneurship, 13 (259), 18-33.

1. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny lane, 36. Email: E-mail: kia1962@list.ru

2. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny lane, 36

3. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny lane, 36

4. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny lane, 36

5. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny lane, 36