Vol. 39 (Nº27) Year 2018. Page 20

Vol. 39 (Nº27) Year 2018. Page 20

Mikhail Gennadevich RUSETSKIY 1; Lyubov Vasilevna AGARKOVA 2; Lubov Konstantinovna ULIBINA 3; Olga Alekseevna OKOROKOVA 4; Timur Gadzhievich AYGUMOV 5

Received: 15/05/2018 • Approved: 08/06/2018

ABSTRACT: The problem of accident rate connected with the use of automobile transport has become especially relevant in the recent decade due to discrepancy between the road-transport infrastructure and the needs of the society in secure road traffic. It is also caused by inadequate efficiency of the functioning of the system of providing traffic safety as well as by extremely low discipline on the part of the participants of traffic. The regional economy suffers significant damage due to traffic accidents (TA). To ensure economic safety (ES) of the participants of traffic and mitigation of financial effects of road accidents the institute of insurance is widely and actively used in world practice. It allows providing compensation of personal and property damage done to both natural and legal persons that suffered on the road as well as to a third party that turned out to be victims of road accidents by chance. However, in Russia the given mechanism has not acquired proper development. |

RESUMEN: El problema de la tasa de accidentes relacionados con el uso del transporte de automóviles se ha vuelto especialmente relevante en la última década debido a la discrepancia entre la infraestructura de transporte por carretera y las necesidades de la sociedad en el tráfico vial seguro. También es causada por la eficiencia inadecuada del funcionamiento del sistema de suministro de seguridad del tráfico, así como por la disciplina extremadamente baja por parte de los participantes del tráfico. La economía regional sufre un daño significativo debido a los accidentes de tráfico (TA). Para garantizar la seguridad económica (ES) de los participantes en el tráfico y la mitigación de los efectos financieros de los accidentes de tránsito, el instituto de seguros se utiliza amplia y activamente en la práctica mundial. Permite compensar los daños personales y materiales causados tanto a las personas físicas y jurídicas que sufrieron en la carretera como a un tercero que resultó ser víctima de accidentes de tráfico por casualidad. Sin embargo, en Rusia el mecanismo dado no ha adquirido un desarrollo adecuado. |

According to the World Health Organization, up to 1.5 million people die from road accidents every year, more than 50 million who were able-bodied and economically active become disabled. The countries of the world community suffer economic losses alongside demographic ones, amounting to an average of 3% of GDP. Total losses from traffic accidents exceed $500 billion a year. Despite the efforts made, by 2030 road traffic injuries will occupy the fifth line in the list of main causes of death of the world population.

In the Decree of the Government of the Russian Federation "On the Federal Target Programme "Improving Road Safety in 2013-2020" the problem of road safety is characterized as one of the important socio-economic and demographic priorities of the Russian Federation. Automobile transport accident rate causes enormous material and moral damage to both society as a whole and to individual citizens. Road traffic injuries lead to the exclusion of people of working age from the sphere of production. Children are killed or disabled.

In the Russian Federation more than 275,000 people are killed or injured as a result of traffic accidents every year.

Ensuring road safety is an integral part of the tasks of ensuring personal security, solving demographic, social and economic problems, and improving the quality of life and promoting regional development (Proceedings of the meeting of the Collegium of the Ministry of Internal Affairs of the Russian Federation on the issue, n. d.; Federal Targeted Programme "Improving Road Safety in 2013-2020", 2013).

The analysis of risk situations in the road traffic system in the territory of the Russian Federation carried out by the authors in this study showed that significant material damage is done to participants of road traffic as a result of road accidents.

According to the Russian government, in 2004-2011 the amount of social and economic damage from traffic accidents and their consequences is estimated at 8188.3 billion rubles, which can be compared with the revenues of the consolidated budgets of the constituent entities of the Russian Federation in 2012 (8064.3 billion rubles). Despite the fact that the social and economic damage caused by traffic accidents and their consequences decreased to 862 billion rubles in 2011, its annual amount is nevertheless significant and equals approximately the expenditures on housing and communal services of the consolidated budget of the constituent entities of the Russian Federation in 2011 (881.25 billion rubles) (Federal Targeted Programme "Improving Road Safety in 2013-2020", 2013).

Material damage caused by traffic accidents cannot be compensated in most cases, primarily due to the owner’s (driver’s) of a vehicle lack of sufficient funds. In this respect, it is the vehicle insurance mechanism that will ensure the economic safety of traffic participants and create a social protection system for third parties – both victims and owners of vehicles.

Statistical and analytical materials of the Government of the Russian Federation and of the Russian Federal Service for Statistics, information and methodological documents of the Ministry of Economics of Russia, materials of official websites of insurance companies, data from Russian and foreign reference and scientific literature, and various production documentation served as the sources of the initial information for this research.

When solving the set tasks, methods of comparative analysis and rating evaluation, expert assessments, various economic-statistical and programme-target methods for solving economic problems were used.

The increase in traffic intensity accompanied by a quantitative increase in traffic accidents requires the objective development of a comprehensive insurance system.

According to statistics of the State Traffic Safety Inspectorate, in 2016 more than 173694 traffic accidents (TA) were registered in Russia, in which 20308 people died and more than 221140 people were injured.

The analysis of accident factors in the Russian Federation showed that the main factor contributing to the occurrence of a road accident is violation of road traffic rules by drivers. The main types of accidents are hitting pedestrians and vehicle crashes. The most common types of violations by drivers are inconsistency between speed and specific conditions and non-compliance with priority on the road; violations by pedestrians is crossing the roadways outside marked cross walks (Kapova 2016).

In Figure 1 the authors present a classification of risks for traffic participants:

1. Risks related to personal insurance:

1.1. the risk of temporary disability (for employed insured persons) or temporary health disorder (for unemployed insured persons) (risk "injury");

1.2. the risk of permanent disability (establishing I, II or III group of disability for insured persons aged 18 (inclusive)) or persistent health disorder (establishment the status of a disabled child for insured persons under the age of 18) (risk "disability");

1.3. the risk of death of insured persons (risk "death").

2. Risks related to property insurance:

2.1. the risk of damage – damage or destruction of a vehicle due to a traffic accident, fire or explosion, natural disasters (lightning, storm, storm, hurricane, hail, earthquake, mudflow, landslide and flood), unlawful actions of third parties (including theft of separate parts (vehicle parts and accessories), falling of foreign objects including snow or ice;

2.2. the risk of stealing - loss of a vehicle due to its stealing from storage or parking place or as a result of robbery or armed robbery.

3. Risks related to liability insurance:

3.1. the risk of liability of a vehicle owner for causing damage to life, health, employment ability of third parties as a result of using a vehicle belonging to him;

3.2. the risk of liability of a vehicle owner for causing damage to property of third parties as a result of using a vehicle belonging to him.

Figure 1

Classification of risks of participants of road traffic

ECONOMIC RISKS OF PARTICIPANTS OF ROAD TRAFFIC |

||||

Property |

Financial |

Social |

||

The risk of damaging livelihood of citizen (passengers, pedestrians) as a result of traffic accidents |

The risk of damaging property (vehicle and other property) as a result of traffic accidents |

The risk of value loss as a result of traffic accidents or due to stealing a vehicle that serves as collateral in a bank

|

The risk of death, establishing disability or loss of employment ability of recipients of a loan as a result of traffic accidents

|

The risk of death, establishing disability or loss of employment ability as a result of traffic accidents

|

It should be noted that most of the risks inherent in participants of road traffic can be insured in order to provide their economic safety.

However, the insurance mechanism in has not received proper development Russia yet which is confirmed by the results of the following studies.

The risks that cause concern among natural persons in Russia are considered in Table 1, from which we can see that Russian citizens express their primary concern about uninsurable risks. These, in particular, are concerns about high cost of medical care, fear for close people, fear of poverty. Classical insured risks presented in the table are of concern only for 5% of the population (Kapova 2016; (Rusetskaya, Rusetskiy, Rybina, Rybina and Sazhneva 2015).

Table 1

Risks that cause concern among natural persons in Russia

|

Risks |

Rate of sensitive to risks population, % |

1 |

High cost of medicine and medical care, hardships connected with loss of health |

16 |

2 |

Anxiety for close people |

15 |

3 |

Poverty, rising prices, non-payment of wages |

14 |

4 |

Unemployment |

12 |

5 |

Change for the worse |

5 |

6 |

Instability, uncertainty, hopelessness |

5 |

7 |

Banditry, theft, hooliganism |

3 |

8 |

Natural disasters, catastrophes, fires |

2 |

9 |

Injustice, lawlessness, arbitrariness |

2 |

Russian citizens assign the responsibility for solving various problems primarily to themselves (Table 2) whereas only 3% of respondents were ready to buy an insurance policy (Table 3) (Akinin 2004; Akinin 2006)

Table 2

Who the Russians assign the responsibility

for solving various everyday problems

Themselves only, % |

Problem |

Government, % |

64,8 |

Lack of money for basic necessities |

20,4 |

44,4 |

Lack of money for long-term necessities |

9,9 |

39,8 |

Diseases, health problems |

30,1 |

34,2 |

Employment |

18,7 |

30,8 |

Housing problems |

18,6 |

30,1 |

Care for children |

13,8 |

-----

Table 3

Guarantees of secured old age

In your opinion, what enables better security in old age? |

% |

Having a well-paid job |

46 |

Having savings |

40 |

Having income from property |

30 |

Giving education, the possibility of good earnings for children |

22 |

Buying an insurance policy, becoming a member of a non-government pension fund |

3 |

Analysis of socio-economic data confirms that most of Russia's population cannot ensure its economic security through an insurance mechanism due to the lack of funds to purchase insurance services. The significant factors in the decision of citizens about insurance are: distrust of citizens to the insurance institution, the price policy of insurers, the comprehensibility of insurance conditions, long terms of proceedings and incomplete payment of insurance compensation (Rusetskaja, Rusetskiy, Rybina and Chuvilova 2016).

In general, the system of vehicle insurance is hierarchical, dynamic and manageable. At the same time, it is influenced by many factors that determine the level of its condition and prospects for the development of the system. Of all the set of objective and subjective factors affecting the quality of the functioning and developing of the system under study, it seems reasonable to single out economic, social, legal ones (Table 4).

Table 4

Factors affecting the vehicle insurance system

Groups of factors |

Factors |

Economic |

- the amount of insurance tariffs for vehicle insurance services; - the income of the population; - the cost of automobiles; - the amount of road construction; - the number of insurance companies; - the level of competition on the vehicle insurance market |

Social |

- the level of prestige of driving a car; - the level of culture of drivers on the roads; - the level of corruption of the subjects of the vehicle insurance system that determine the economic parameters of rates of insurance tariffs and the damage caused as a result of a traffic accident |

Legal

|

- the legislative decisions on voluntary or compulsory vehicle insurance - the level of state support to the domestic automotive industry - the state regulation of the insurance services market |

The conducted research allows drawing the following conclusion: the due development of insurance in Russia is possible by creating a set of measures to popularize the insurance mechanism in the system of providing economic security of various subjects, including road traffic. To do this it is necessary:

In most cases automobile users who have been involved in traffic accidents or who have faced "abnormal" situations are forced to cope with difficulties on their own or to seek help from other drivers. The weak development of economy in Russia that specializes in helping car owners in "abnormal" situations on the road does not ensure the safety of their livelihoods. One of the main reasons for the increasing number of accidents on the road is the "human factor" that includes the poor quality of driver training and the possibility of a formalistic technical inspection of vehicles.

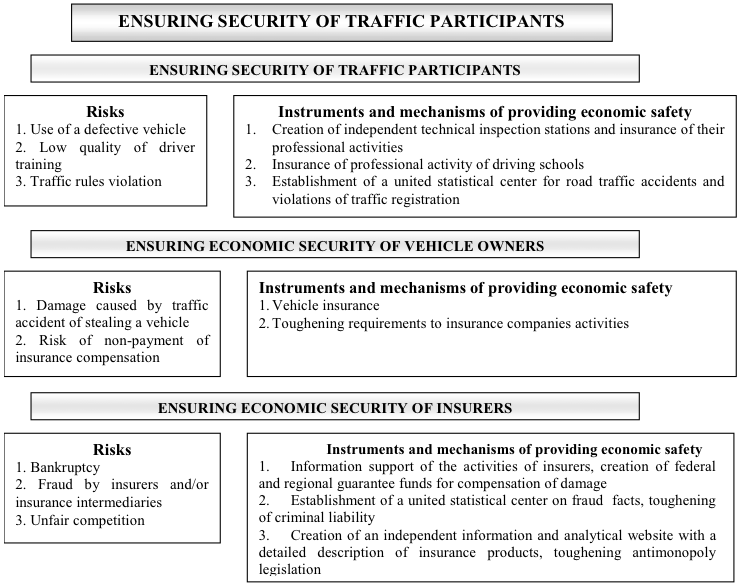

In order to ensure economic security and improve the insurance culture of traffic participants the authors developed a structural and logical model of the system for providing safety to road users (Figure 2).

Figure 2

Structural-logical model of the system of ensuring security of traffic participant

To ensure the implementation of the suggested model it is necessary to create an information system.

The goal of informatization of the process of ensuring the economic safety of traffic participants and road users is to improve the balance, efficiency and safety of the transport system functioning.

The functioning of the system proposed by the authors may involve the evaluation of information on the following parameters.

1. Inspection stations provide data on vehicles that have passed technical inspection successfully.

2. Driving schools submit data about their graduates.

3. The State Traffic Safety Inspectorate provide information about the facts of traffic accidents, their severity, and the facts of fraud on the roads.

4. The Ministry of Internal Affairs provides data on fraud in insurance.

5. Insurance companies submit data on fraud in insurance.

Federal and regional information centers are necessary for:

Based on the results of the analysis of information received the controlling bodies (the Ministry of Internal Affairs, the Investigative Committee, the Prosecutor's Office) conduct an investigation and bring the violators to justice.

The data of the federal information portal can be used:

The proposed mechanism will ensure the prompt receipt, processing and use of reliable data on the interaction of all traffic participants.

Based on the results of the study we came to the following conclusions.

The problem of accidents rate associated with the use of road transport has acquired a special urgency in the last decade due to discrepancy between the road-transport infrastructure and the needs of the society in secure road traffic, the inadequate efficiency of the functioning of the system of providing traffic safety as well as extremely low discipline on the part of the participants of traffic.

In order to ensure the economic safety of road users and mitigate the financial consequences of traffic accidents the world practice actively uses the institution of personal insurance, vehicle insurance and civil liability. However, in Russia this mechanism has not been properly developed yet.

The study of factors of low demand for the insurance mechanism in the system of ensuring economic safety of road users revealed a direct dependence of the development of insurance of natural persons on their income (Bondarenko, Vandina, Rusetskaya and Charakhchyan 2017; Mahdiyeva 2017a; Mahdiyeva 2016; Mahdiyeva 2017b; Yurgens and Tsyganov 2015; Tileubergenov, Pelevin, Vasiliev and Danilyanc 2016; Tsyganov 2017; Yuldashev and Logvinova 2017)

A proper development of insurance in Russia is possible by creating a set of measures to popularize the insurance mechanism in the system of ensuring economic security of various subjects, including road traffic.

The author's design of structural and logical model of ensuring safety of road users is presented. It classifies the risks for road users, car owners and insurers. A mechanism and tools to ensure economic security of traffic participants is suggested; it includes the creation of independent service stations and insurance of liability for their professional activities, insurance of professional liability of driving schools; the creation of federal and regional guarantee funds for compensation of damage.

In order to improve the system of economic security in the structure of the automobile insurance market the authors proposed an informatization system that provides the assessment of the effectiveness of vehicle technical inspection; the analysis of qualification requirements of drivers-graduates of driving schools; the characterization of traffic accidents taking into account the technical condition of vehicles and the qualifications of drivers; the analysis of fraud factors that allows monitoring, identifying and punishing violators of the traffic system and defining driving schools, maintenance stations and insurers rankings.

Information support will help to ensure the economic safety of traffic participants and to make the insurance mechanism more transparent and accessible to consumers.

The implementation of the proposed set of measures will enable to create a mechanism containing tools of preventing and reducing the amount of damage or its compensation in the event of an insured event, thereby ensuring the economic safety of the subjects of the road traffic system.

The authors confirm that the data do not contain any conflict of interest.

Akinin, P. V. (2004). Problems of development of the insurance services market in Russia and its regions. Moscow: Finance and Statistics, pp. 228.

Akinin, P. V. (2006). Development of civil liability insurance for vehicle owners. Moscow: Finances and Statistics

Bondarenko, I.A., Vandina, O.G., Rusetskaya, E.A. and Charakhchyan, K.K. (2017). Parametric characteristics of conflict of interests between owners and managers in corporations. Journal of Advanced Research in Law and Economics, 1(23), 18-22.

Federal Targeted Programme "Improving Road Safety in 2013-2020" (approved by Decree of the Government of the Russian Federation No. 864, October 3, 2013).

Kapova, Z.I. (2016). The role of insurance in the development of the Russian economy. Economics and management: problems, solutions, 4, 50-54.

Mahdiyeva, Yu.M. (2016). The current state of the voluntary liability insurance sector in Russia. Economics and management: problems, solutions, 11(1), 215-218.

Mahdiyeva, Yu.M. (2017a). The role of educational insurance in the formation and development of human potential. Economics and management: problems, solutions, 3(3), 109-112.

Makhdieva Yu.M. (2017b). Economic Preconditions and Prospects for the Development of Education Insurance in Russia. European Research Studies Journal, 20(4), 160 - 174.

Proceedings of the meeting of the Collegium of the Ministry of Internal Affairs of the Russian Federation on the issue "On the progress in the preparation of the Federal Target Programme for Road Safety in 2013-2020".

Rusetskaja, E.A., Rusetskiy, M.G., Rybina, G.K. and Chuvilova, O.N. (2016). Insurance fraud: Factors, identification problems, counteraction. The Social Sciences, 11(5), 579-584

Rusetskaya, E.A., Rusetskiy, M.G., Rybina, G.K., Rybina, Y.V. and Sazhneva, S.V. (2015). Problems and prospective lines of development of the liability insurance system. International International Business Management, 9 (6), 1079-1085.

Tileubergenov, E.M., Pelevin, S.I., Vasiliev, A.A. and Danilyanc, E.I. (2016). Political and legal defining the regulations of war in the hague convention of 1907. Journal of Advanced Research in Law and Economics, 7(3), 660-671.

Tsyganov, A.A. (2017). Development of the insurance market as a function of the development of the national economy. Insurance and risk management: problems and prospects. Pp. 140-152.

Yuldashev, R.T. and Logvinova I.L. (2017). The insurance market of the Russian Federation: organizational resources of development. The insurance business, 6(291), 3-9.

Yurgens, I.Yu. and Tsyganov, A.A. (2015). Insurance in the Russian Federation. Collection of statistical materials for 2015.

1. North Caucasus Federal University (NCFU), 355009, Russia, Stavropol, Pushkina str., 1, E-mail: elwirasgu@mail.ru

2. Stavropol State Agrarian University (StGAU), 355017, Russia, Stavropol, lane Zootechnical, 12

3. Kuban State Agrarian University (Kuban SAU), 350044, Russia, Krasnodar, Kalinina street, 13

4. Kuban State Agrarian University (Kuban SAU), 350044, Russia, Krasnodar, Kalinina street, 13

5. Dagestan state technical university (FSBEE HE DSTU), 367015, Russia, Republic of Daghestan, Makhachkala, I.Shamyl Ave., 70