Vol. 39 (Nº27) Year 2018. Page 29

Vol. 39 (Nº27) Year 2018. Page 29

Natalia Nikolaevna NATOCHEEVA 1; Yurii Aleksandrovich ROVENSKII 2; Tatiana Viktorovna BELYANCHIKOVA 3; Alexey Yevgenyevich FOSHKIN 4

Received: 15/05/2018 • Approved: 08/06/2018

ABSTRACT: The article offered the ratio of the volume of bank transactions in the market of mergers and acquisitions to the value of a bank’s equity capital; the factor analysis of return on capital was performed according to the DuPont formula. The dynamics of the market of mergers and acquisitions demonstrated a significant drop in their number during the last three years. The discrepancy of the price expectations of buyers and sellers did not clarify the problem of the contraction of the market of bank transactions of mergers and acquisitions. The authors suggested a hypothesis of the negative impact of factors on efficiency of capital use in the bank transactions in the market of mergers and acquisitions. The transaction analysis in this market showed that the availability of the equity capital did not provoke the bank management’s interest in making transactions. The authors proved that the efficiency of use of banks’ equity capital significantly influenced the market figures. In the article, the decomposition analysis of return on capital was performed taking into account the parameters of the banks’ activity. The results of the analysis revealed that return on equity was influenced by the margin of the banking profit. The article provided an example of profitability calculation of the equity capital and gave the assessment of the factors’ impact. |

RESUMEN: El artículo ofrece la relación entre el volumen de transacciones bancarias en el mercado de fusiones y adquisiciones y el valor del capital social de un banco; el análisis factorial del rendimiento del capital se realizó según la fórmula de DuPont. La dinámica del mercado de fusiones y adquisiciones demostró una caída significativa en su número durante los últimos tres años. La discrepancia de las expectativas de precios de los compradores y vendedores no clarificó el problema de la contracción del mercado de transacciones bancarias de fusiones y adquisiciones. Los autores sugirieron una hipótesis del impacto negativo de los factores en la eficiencia del uso de capital en las transacciones bancarias en el mercado de fusiones y adquisiciones. El análisis de las transacciones en este mercado mostró que la disponibilidad del capital social no provocó el interés de la administración del banco en realizar transacciones. Los autores demostraron que la eficiencia del uso del capital de los bancos influyó significativamente en las cifras del mercado. En el artículo, el análisis de descomposición del rendimiento del capital se realizó teniendo en cuenta los parámetros de la actividad de los bancos. Los resultados del análisis revelaron que el rendimiento sobre el capital estaba influenciado por el margen del beneficio bancario. El artículo proporcionó un ejemplo del cálculo de la rentabilidad del capital social y proporcionó la evaluación del impacto de los factores. |

In the financial sector of the market of mergers and acquisitions, bank transactions take the biggest part. Usually, transactions are made in the form of a merger (Chigiryova & Grekov 2017). Among the largest banking institutions, the leaders of bank transactions in the market are VTB, Vnesheconombank, and Gazprombank. Their share is 43% of all bank transactions (Gurieva, Ramonova, & Dzhioev, 2015). According to the statistical data of the bulletin "Market of Mergers and Acquisitions", the ratio of the volume of bank transactions to the value of bank equity capital in 2015 and the share of bank transactions was 65%; however, in 2016 the aggregate volume of transactions decreased quantitavely and significantly decreased in volumes to the lowest value of 2010 and was only 1.1. bln US dollars. (Bulletin "Market of Mergers and Acquisitions", n.d.). As experts mention, the reason for this situation in the market is the discrepancy of the price expectations of buyers and sellers because the first ones count upon the discounts to the cost of the net assets due to the forced financial asset of the "purchased" risks, and the second ones do not want to lower the price being afraid to lose the profit. However, in our opinion, these are "visible" reasons but the main reasons for closing up of bank transactions in the market of mergers and acquisitions are much deeper. Despite the fact that merger and acquisition transactions are aimed at the consolidation of capital and obtaining of new income resources, they are determined by the needs for additional resources and consolidation of the market participants, however, the efficient use of already available equity (bank capital), in our opinion, becomes fundamentally important. The use efficiency of the equity capital depends, to a large extent, upon its cost that is influenced by various factors changing this cost. Our task is to estimate, first of all, the impact of negative factors on the cost of the equity capital that is expressed in its depreciation.

In the market of mergers and acquisitions, bank transactions are the most widespread. However, they are characterized by the absolute indexes of the volume and number of transactions. The dynamics analysis does not give an objective idea of the use efficiency of banks’ equity capital and also of the factors’ impact in its size and cost. The relative parameters are necessary to increase the objectivity of the idea of bank transactions in the market of mergers and acquisitions and also the estimations of the factors’ impact on the cost and efficiency of use of the bank equity capital. To reveal the tendencies and dynamics of transactions with banks in the market of mergers and acquisitions we offer to introduce the additional ratio of volume of bank transactions to the value of the equity capital of banks:

where Kc – is the coefficient of bank transaction volume to the value of the bank equity capital;

Vtr – is the volume of bank transactions in the market of mergers and acquisitions;

Vc – is the value of bank equity capital;

We will analyze the dynamics of the indexes to reveal the interconnection of number, volume of bank transactions in the market of mergers and acquisitions with the values of the equity capital of credit institutions (Table 1).

Table 1

Dynamics of indexes of bank transactions in the market of mergers and acquisitions and bank equity capital

Indexes |

2010 |

2011 |

2011/ 2010 |

2012 |

2012/ 2011 |

2013 |

2013/ 2012 |

2014 |

2014/ 2013 |

2015 |

2015/ 2014 |

2016 |

2016/ 2015 |

Volume of bank transactions, bln US dollars |

2.3 |

9.6 |

4.2 |

14.9 |

1.6 |

5.5 |

0.7 |

3.8 |

0.69 |

2.1 |

0.55 |

1.1 |

0.52 |

Number of transactions, pcs. |

33 |

27 |

0.82 |

29 |

1.1 |

36 |

1.2 |

59 |

1,6 |

51 |

0.86 |

44 |

0.86 |

Bank equity capital × 103 (Top 30), mln roubles |

19. 6 |

22.4 |

1.1 |

26.0 |

1.2 |

28.4 |

1.1 |

35.2 |

1.,2 |

34.6 |

0.98 |

36.1 |

1.0 |

Return on equity, % |

1.9 |

17.6 |

9.3 |

18.2 |

1.9 |

15.2 |

0.83 |

7.9 |

0.52 |

2.3 |

0.29 |

10.3 |

4.5 |

Kc |

0.12 |

0.43 |

- |

0.57 |

- |

0.19 |

0- |

0.1 |

- |

0.06 |

- |

0.03 |

- |

Composed by the authors according to the data

(Official website of the Central Bank of the Russian Federation, n.d.).

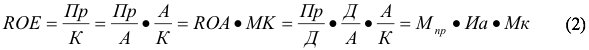

As Table 1 shows, the maximal volume of bank transactions in the market of mergers and acquisitions was reached in 2012 – 14.9 bln US dollars, and the return on equity during last 7 years reached the historical upper limit – 18.2%. The ratio of the volume of bank transactions in the market of mergers and acquisitions for the studied period was maximal – 0.57. The largest growth volume of such transactions reached its maximum in 2011 – 4.2 times. However, there were not many transactions in that period; the maximal number of transaction was registered in 2014, but the transactions were small and of insignificant volume. The bank equity capitals grew ambiguously but they reached its maximum – 36.1 mln roubles in 2016, and despite their use efficiency grew significantly up to the level of 10.3%, it was not, however, maximal. The availability of the considerable volume of bank equity capital does not motivate the bank management to the transactions of mergers and acquisitions. The bank capital shall be cost-efficient to provoke investors’ interest in the transactions of mergers and acquisitions. The index of bank return on equity allows estimating the share of bank capital for fast repayment or funding of earlier unaccounted or appearing losses of the credit institution related to the non-repayment of bank assets and can orient to the potential level of return of funds invested into the bank by its shareholders (Anti-Crisis Management: Enterprises and Banks: Work Book, 2001). To reveal the main sources of banks’ profit growth (return on equity), it is reasonable to perform the factor analysis of return specifying the elements of calculation and determining the impact of changes of each of them to the change of return in general. The formalized variant of solution of this problem is the model of decomposition analysis of return on equity (DuPont model), which makes it possible to reveal the connections and determine the main indexes of a bank’s capital efficiency:

where ROE – is the banks’ return on equity;

ROA – is the banks’ return on assets;

Pr – is the banking profit;

C – is the banks’ capital;

A – is the banks’ assets;

MC – is the capital multiplier;

R – is the banks’ revenue;

Mpr – is the margin of bank profit;

Ua – is the level of assets use.

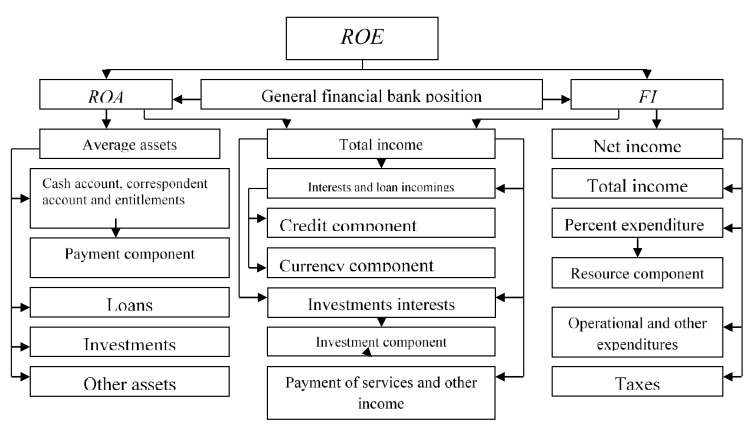

Fig. 1

Decomposition analysis of return on capital

taking into account the bank’s areas of activity

The value of the return on equity according to the DuPont model can be represented as the product of return on assets and capital multiplier that allows considering all structure elements of banks’ incomes and expenditures and also all elements of the bank return structure as the initial factors on the base of which the profit has been obtained or expenditures have been incurred. If we take into account the fact that the bank indexes including the composite indexes that are represented by the parameters of different areas of activity of the bank, are influenced by the bank risks that change the value of these indexes, "making" them deviate, then this can be represented by the decomposition analysis of the return on capital taking into account the parameters (Fig. 1).

The general financial position of a bank depends upon the return on assets and financial sustainability. The return on assets, in its turn, includes the medium assets and total revenue. The medium assets include a cash account, a correspondent account and entitlements. The payment position refers to the indexes of payment and settlement direction.

The total revenue is composed taking into account the interests and revenues on loans in roubles and foreign currency, interests of investments and from the revenue of service payment and other revenues. The value of interests on loans is determined to a large extent by the quality of assets and current liquidity and therefore, the credit component is important here. The exchange operations determine the currency component and the interest on investments depend also upon the special and general equity risk.

Financial sustainability is determined by the ratio of loans to deposits and is also divided into two components: total revenue and net income. The net income is made up algebraically by determining the difference between the total revenue and expenditures among which there is interest expenditure, operating and other expenditures and taxes. Interest expenditures depend, first of all, upon the stability of the resource base, and, therefore, the resource component is taken into account. All these components are elements of a general financial position of banks that perform the functions of bank parameters in the form of composite indexes. The connection of external components to the revenue and expenditures of banks with its return on capital is less evident and t is indirect, for example, the budget deficit of the country or risks in the world stock exchanges. The indirect influence can reveal itself through the special and/or general equity risk and also through the operations with foreign currency and/or payment transactions in the financial sector in the interbank market.

Let us consider Table 2 that illustrates the factors’ impact on the bank return on equity.

Table 2

Estimation of factors’ impact on the level of return on equity

Bank revenue margin – factor 1 |

Level of assets use– factor 2 |

Capital multiplier – factor 3 |

Return on equity |

7 |

9 |

10 |

630 |

5 |

11 |

5 |

275 |

10 |

16 |

9 |

1440 |

3 |

12 |

7 |

252 |

6 |

25 |

4 |

600 |

12 |

23 |

2 |

552 |

31 |

20 |

8 |

4960 |

22 |

7 |

11 |

1694 |

14 |

20 |

2 |

560 |

9 |

17 |

12 |

1836 |

24 |

6 |

1 |

144 |

15 |

13 |

18 |

3510 |

6 |

8 |

3 |

144 |

4 |

5 |

15 |

300 |

19 |

22 |

4 |

1672 |

16 |

7 |

14 |

1568 |

21 |

16 |

1 |

336 |

28 |

5 |

22 |

3080 |

18 |

9 |

2 |

324 |

13 |

12 |

17 |

2652 |

25 |

6 |

8 |

1200 |

17 |

14 |

15 |

3570 |

2 |

1 |

11 |

22 |

29 |

4 |

5 |

580 |

Composed by the authors according to the data

(Official website of the Central Bank of the Russian Federation, n.d.).

The data of Table 2 shows that return on equity influences the studied factors: the margin of bank revenue, the level of assets use and the capital multiplier. The maximal value of return on equity was reached at the value of margin bank revenue – 31, the level of assets use – 20, and the capital multiplier – 8. The level of assets use and the capital multiplier have an average value but the margin of bank revenue is maximal. Therefore, we can conclude: the return on equity to a large extent is influenced by the margin of bank revenue.

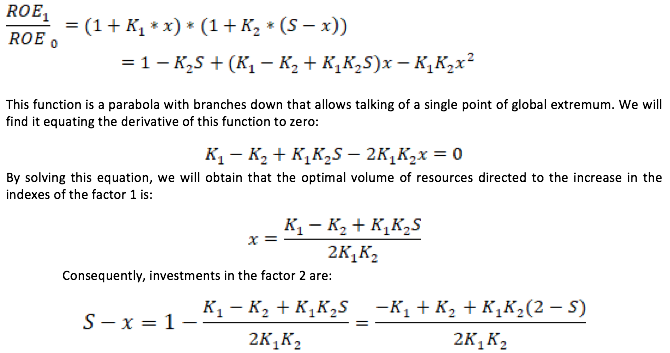

At the microlevel, to increase the return on equity, it is possible to influence only the factors 1 and 2. No particular bank can influence significantly the factor 3, the capital multiplier. To increase the return on equity, we will calculate the more efficient distribution of the internal resources of the bank according to these activities. For every factor, we will introduce the index Ki, characterizing the growth of the factor value i from the unit of invested resources. The higher the value of the index Ki, the fewer resources are required for the increase in the corresponding index by the particular percent. Solving the problem of optimization of distributing the bank resources with a size S, directed to the increase of the ROE index, we will presuppose that the resources provided for the increase in the factor 1 are x. Consequently, the resources directed to the factor 2 are S-x. We will obtain the following dependence of the growth rate of the return index from the invested funds:

It should be also mentioned that the negative values of the parameters x or S-x indicate that the optimal values of function are outside the economic sense of the indexes and these values shall be considered as equal to zero to obtain the maximum of the function of return on equity and all resources shall be directed to the increase in the second factor – the level of assets use of the credit institutions.

In the course of the scientific research, various opinions and debating points were revealed, the discussion of which will be useful for understanding and perception of the theoretical provision and practical recommendations during the implementation of the educational programs of the direction "Banking" and also for practical specialists of the credit institutions of Russia.

The discussion of the main issues related to bank transactions in the market of mergers and acquisitions took place during conferences, roundtable discussions, in the lecture halls and at credit institutions. This allowed elaborating the united platform of the categorical apparatus and obtaining the competent opinion of the problems of interest.

The adaptation of the expert opinion was performed on the scientific base by questionnaires. The use of the laboratory base of the university, library stock and modern computer technologies promoted obtaining exact and correct results of the research concerning bank transactions in the market of mergers and acquisitions.

The results of the analysis allow tracing the interconnection between the bank revenue and risks’ impact that change the general financial position of banks. Here, various indexes of a bank’s functioning are taken into account during its entering the market of mergers and acquisitions. The performed research and calculations allowed making a conclusion that:

– during the process of revealing the reasons for a decrease in the amount of bank transactions in the market of mergers and acquisitions during last six years, the multidirectional dynamics of the volume and quantity of such transactions were revealed in the market, as well as the value of the equity capital of the credit institutions and also the return of equity. The analysis of the reasons for such dynamics of transaction parameters does not guarantee the efficiency of its use and an increase in the number of bank transactions in the market of mergers and acquisitions. For more exact and reliable accounting of changes of the indexes of bank transactions in the market of mergers and acquisitions, it is reasonable to determine the ratio of the volume of such transactions to the value of a bank’s equity capital, the maximal value of which confirms the use efficiency of a bank’s funds;

– the results of the decomposition analysis of return on capital allowed estimating the impact of every factor on the efficiency of the bank equity and first of all on the margin of the bank revenue; and also the level of use of the bank assets and the capital multiplier;

– the results of calculations allowed making a conclusion that to increase the return on equity of credit institutions the growth of the factor of the level of bank assets use was necessary. This use shall be highly profitable taking into account the specific character of credit institutions;

– the obtained results did not contradict the main provisions and conclusions of scientists concerning the significance of the efficiency (return on equity) of a bank in bank transactions in the market of mergers and acquisitions.

1. During determination of the ratio of bank transactions to the value of a bank’s equity capital, it should be taken into account that a bank’s equity capital is, as a rule, a constant value during the long period of time and the volume of bank transactions in the market of mergers and acquisitions is quite unstable, which is confirmed by the results of research and does not always depend upon the bank. It is often determined by the conditions of the market of mergers and acquisitions and also by the factors of the globalization process of the world financial market.

2. The division of the formula of return of equity capital into components, on the one side, demonstrates perfectly the priority factor that influences to a large extent the profitability of equity capital of credit institutions. On the other side, this division does not show the reasons and sizes of deviations of the values of components and this narrows the possibilities for management to regulate them.

3. To calculate the return on equity of the bank and its components, the parameter values of revenue, expenditures and other indexes are taken from the balance sheet of the bank. However, it should be taken into account that the actual values of indexes depend significantly upon the accounting policy of credit institutions and can change at various conditions of the internal and external environment of the bank.

4. As the actual indexes of the bank activity represented in the balance sheet deviate under the impact of risks existing in the market of mergers and acquisitions, it should be taken into account that these values of indexes depend upon the efficiency of the risk management policy performed by the particular credit institution and also the sanation policy of the bank sector by the Bank of Russia during last several years. Here it is reasonable to take into account also the bank competition in the market of mergers and acquisitions; however, now in Russia this fact, in our opinion, has low impact because the number of banks in the Russian market of mergers and acquisitions decreased significantly, due to the purge of the bank sector, that is, its sanation by the banking regulator.

5. The results obtained by the authors do not contradict the main provisions of the theory of the factor analysis of the return on capital during the forecasting of profit and a bank’s return on capital and also by the risk management (Rusanov & Rusanova 2014; Bondarenko 2014; Kosterina & Bondarenko 2016); however, the conditions of functioning shall be taken into account as well as the specific character of the activity of credit institutions. The analysis of bank return on equity capital and its components allowed revealing the main directions of the further research, including:

– to extend the line of factors influencing not only the efficiency of use of the equity capital but also their cost, differentiating a bank’s equity capital into elements: authorized capital, additional capital, reserve capital, funds and profit of credit institutions determining the impact of factors on the cost of every element distinguishing the priorities in the estimation of such factor impact in correlation with the bank transactions in the market of mergers and acquisitions;

– to develop the minimal breakpoints of ratio of the volume of bank transactions in the market of mergers and acquisitions to the values of bank equity capital breaking which the bank transactions in the market of mergers and acquisitions can be inefficient and low profitable;

– to formulate and form the system of criteria of bank transaction classification in the market of mergers and acquisitions according to the ratio of the volume of such transactions to the value of equity capital of credit institutions;

– to reveal the tendencies of the main world trends in the bank transactions in the market of mergers and acquisitions to determine the moment of the most efficient making of bank transaction in the market of mergers and acquisitions taking into account the ratio of volume of such transactions to the value of the equity capital of credit institutions.

The performed research allowed obtaining the results and formulating some conclusions and proposals:

1. The objective necessity of extension of the line of factors influencing the efficiency of use and cost of equity capital of credit institutions making transactions in the market of mergers and acquisitions was revealed.

2. The ratio of the volume of bank transactions in the market of mergers and acquisitions to the value of the bank equity capital was developed and economically grounded; the maximal value of it demonstrated the efficient use of bank funds. The main tendencies of the change of such ratio were analyzed and the comparative analysis of dynamics of such value in the Russian banks during several years was performed. The analysis showed that the availability of the significant volume of equity capital did not guarantee its efficient use and the change of the cost of capital.

3. On the base of the results of the decomposition analysis of the return in equity, according to the DuPont formula, the estimation of the impact of the following factors was performed: the margin of bank revenue, the level of use of assets and the capital multiplier on bank return on equity. The estimation showed that the factor of the margin of bank revenue made the greatest impact on the bank return on equity.

4. The formalized variant of the problem of determining the dependence of the index growth rate of the bank return on equity (capital) om the use of the invested resources was proposed. The solution of the set problem allowed making the conclusion that the growth of such factor as the level of use of the bank assets was necessary to increase the efficiency of the equity (bank capital).

1. The authors are grateful to the scientific adviser of the Plekhanov Russian University of Economics, Doctor of Economic Sciences, Professor Valentey Sergey Dmitrievich for support in obtaining of the research information and organization of the article promotion.

2. The authors express gratitude to the Doctor of Economic Sciences, professor of Financial Markets Dean of the Plekhanov Russian University of Economics Rusanov Yury Yurievich for his competent opinion concerning the problems of management and cash flows of the credit institutions.

3. The authors express gratitude to the Candidate of Economic Sciences, senior professor of Financial Markets Dean of the Plekhanov Russian University of Economics Foshkin Aleksey Evgenievich for detailed consultations regarding the problems of use of the mathematical apparatus for solution of the formalized economic problems.

4. The authors express gratitude to the Assistant Financial Markets Dean, Candidate of Economic Sciences Badalov L.A. for assistance in preparation of the article materials.

Antikrizisnoe upravlenie: predpriyatiyami i bankami: Uchebno-prakticheskoe posobie [Anti-Crisis Management: Enterprises and Banks: Work Book]. (2001). Moscow: Delo. (p. 840).

Bondarenko, M.D. (2014). Osobennosti ispolzovaniya modeli DuPont pri analize protsessa formirovaniya rentabelnosti bankov [Peculiarities of Use of DuPont Model Analyzing the Process of Formation of Bank Return]. Ekonomika, statistika i informatika. Vestnik UMO, 4, 25‑29.

Byulleten "Rynok sliyanii i pogloshchenii" [Bulletin "Market of Mergers and Acquisitions"]. (n.d.). Retrieved October 13, 2017, from mergers.akm.ru

Chigiryova, E.V., & Grekov, I.E. (2017). Vliyanie uzhestocheniya denezhno-kreditnoi politiki TsB na sliyaniya i pogloshcheniya v bankovskom sektore [Impact of Tightening of Monetary Policy of the Central Bank on Mergers and Acquisitions in the Banking Sector]. Molodoi uchenyi, 20, 292‑295.

Gurieva, L.K., Ramonova, I.Z., & Dzhioev, Z.I. (2015). Osobennosti bankovskikh sdelok sliyanii i pogloshchenii v Rossii [Peculiarities of Bank Transactions of Mergers and Acquisitions in Russia]. In Sovremennye tendentsii razvitiya teorii i praktiki upravleniya v Rossii i za rubezhom: Sbornik dokladov i tezisov IV (IX) mezhdunarodnoi nauchno-prakticheskoi konferentsii [Current Trends in the Theory and Practice of Management in Russia and Abroad: Collected Works of the IV (IX)th International Scientific and Practical Conference] (pp. 17-19). Stavropol.

Kosterina, T.M., & Bondarenko, M.D. (2016). Razrabotka algoritma faktornogo analiza sinergeticheskogo effekta bankovskoi M&A sdelki [Development of an Algorithm of Factor Analysis of Synergetic Effect of M&A Bank Transaction]. In XXIX Mezhdunarodnye Plekhanovskie chteniya. Sbornik statei [XXIX Plekhanov International Reading. Collected works] (Vol. 2, pp. 201-204). Moscow.

Official website of the Central Bank of the Russian Federation. (n.d.). Retrieved October 13, 2017, from cbr.ru

Rusanov, Yu.Yu., & Rusanova, O.M. (2014). Chistye riski i shansy v realizatsii vnutrennei bankovskoi politiki. Monografiya [Pure Risks and Chances to Implement the Internal Bank Policy. Monography]. LAP Lambert Academic Publishing. (p. 128).

1. Plekhanov Russian University of Economics, 117997, Moscow, Russia, Stremyanny Lane, 36. E-mail: natocheeva12@yandex.ru

2. Plekhanov Russian University of Economics, 117997, Moscow, Russia, Stremyanny Lane, 36. E-mail: yury.rovensky@gmail.com

3. Plekhanov Russian University of Economics, 117997, Moscow, Russia, Stremyanny Lane, 36. E-mail: maestra_@mail.ru

4. Plekhanov Russian University of Economics, 117997, Moscow, Russia, Stremyanny Lane, 36