Vol. 39 (Number 28) Year 2018 • Page 30

Zhanat ALTAIBAYEVA 1; Ainagul KURMANOVA 2; Aibek SOLTANGAZINOV 3; Shynar MUTALLYAPOVA 4

Received: 16/02/2018 • Approved: 25/03/2018

ABSTRACT: The present paper considers the theoretical and practical aspects of local budgets as well as their role in financial support for the implementation of state tasks of the Republic of Kazakhstan. The essence of the local budget is revealed in the context of interbudgetary relations. The paper presents an analysis of the economic mechanism for the formation of local budgets, namely the dynamics of the formation of the local budget of Pavlodar city. The authors consider the development trends of interbudgetary relations based on greater independence of local authorities and analyze modern models and methods of local budget management. The paper addresses problems associated with assessing the efficiency of local budget management and shows how to solve them. |

RESUMEN: El presente artículo considera los aspectos teóricos y prácticos de los presupuestos locales, así como su papel en el apoyo financiero para la implementación de las tareas estatales de la República de Kazajstán. La esencia del presupuesto local se revela en el contexto de las relaciones intergubernamentales. El artículo presenta un análisis del mecanismo económico para la formación de presupuestos locales, a saber, la dinámica de la formación del presupuesto local de la ciudad de Pavlodar. Los autores consideran que las tendencias de desarrollo de las relaciones intergubernamentales se basan en una mayor independencia de las autoridades locales y analizan los modelos y métodos modernos de gestión del presupuesto local. El documento aborda los problemas asociados con la evaluación de la eficiencia de la gestión presupuestaria local y muestra cómo resolverlos. Palabras clave: presupuesto local, relaciones intergubernamentales, ingresos, irregularidades financieras. |

Production relations of a particular social system determine the content of state activity and the use of the budget as a distribution mechanism. The state accumulates a certain share of national and local (regional and territorial) income by means of the budget and directs it to the development of the economy, science, social sphere and for other purposes. This characterizes the essential side of the financial management of socio-economic processes, i.e. budgetary regulation implemented through the planning, formation and use of budget funds at all levels of the economic system.

In the Republic of Kazakhstan, budgets of the following levels are approved, fulfilled and self-administered: the national budget; the regional budget; the budget of the city of national significance, the budget of the capital; the district budget (of the city of regional importance) (Budget Code of the Republic of Kazakhstan of December 4, 2008).

The development of economic relations shifted the center of influence of the budgetary policy to the lower levels of the budgetary system – local budgets. In a broad sense, local budgets represent a special system of monetary relations that arise in the process of distributing and redistributing the value of gross domestic product and national income by accumulating its part at the disposal of local authorities for management and use in accordance with the functions assigned (Nurumov and Ismagulova 2012, p. 18).

The essence of the local budget as an economic category is realized through the distribution function. The distribution function consists in concentrating funds within local executive authorities and using them to meet socio-economic needs within their jurisdictional territory (Gryaznova 2012, p. 19).

Local budgets play an important role in the state budget as a financial base for the multifaceted activities of local authorities (Panteleev 2011). It is determined by the content and nature of functions and tasks entrusted to local authorities, as well as the administrative and territorial structure of the state and its political and economic orientation. Local budgets are significant in ensuring the integrated development of the territory and raising the standard of living of citizens. They are an important tool for influencing the development of the economy and the social sphere. They can help the state change the structure of social production, influence the results of management, and carry out social transformations (Vasilyeva 2007, p.20).

The main condition for the stability of local budgets is the ability of local authorities to ensure an appropriate balance between incoming revenues and incurred costs within a specific financial period and a specific territory. However, the main requirement for local budgets in the current context is that each monetary unit aimed at financing an object should be justified by the maintenance or improvement of the living conditions of citizens, the development of productive resources as well as the growth of capital.

The present tense condition of local budgets testifies to the need to improve the economic mechanism of budgetary processes based on the implementation of the following principles: realism, transparency, consistency, effectiveness, independence, continuity, validity, timeliness, efficiency, responsibility, target orientation (Yandiyev 2012).

The methodological basis of the research is formed by approaches to the study of interbudgetary relations and mechanisms of budgetary support of the financial base for reforming local authorities, developed in the evolutionary and institutional economic theory of economic budgetary relations, as well as methods for assessing the efficiency of budget management and budget planning.

The formation and development of local authorities in forms that meet general democratic standards and principles recognized in the civilized world is one of the most pressing issues for Kazakhstan. To fulfill the functions assigned to local representative and executive authorities, they are endowed with certain property and financial-budgetary rights (Kudrin 2010).

Local budgets function as an independent part of the budgetary system. The independence of the budget is understood as the situation when the local authority determines the amount of the budget as well as the specific structure and amount of revenues and expenditures by items on the basis of a fixed income base itself. However, the local budget is administered with regard to the national legislation defining the rights of local authorities in this area.

The share of local revenues in consolidated budget revenues by Kazakhstan’s regions is presented in Table 1.

Table 1

The share of local revenues in consolidated

budget revenues by Kazakhstan’s regions

Region |

Year |

|||||

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Akmola |

0,23 |

0,26 |

0,26 |

0,28 |

0,31 |

0,31 |

Aktobe |

0,53 |

0,51 |

0,51 |

0,52 |

0,60 |

0,53 |

Almaty |

0,29 |

0,32 |

0,33 |

0,34 |

0,41 |

0,36 |

Atyrau |

0,77 |

0,78 |

0,79 |

0,78 |

0,87 |

0,81 |

East Kazakhstan |

0,29 |

0,28 |

0,28 |

0,30 |

0,33 |

0,32 |

Zhambyl |

0,19 |

0,20 |

0,19 |

0,19 |

0,22 |

0,19 |

West Kazakhstan |

0,46 |

0,42 |

0,43 |

0,44 |

0,45 |

0,43 |

Karaganda |

0,44 |

0,48 |

0,47 |

0,49 |

0,56 |

0,52 |

Kostanay |

0,29 |

0,33 |

0,33 |

0,31 |

0,34 |

0,31 |

Kyzylorda |

0,21 |

0,20 |

0,22 |

0,31 |

0,22 |

0,19 |

Mangistau |

0,64 |

0,70 |

0,66 |

0,75 |

0,76 |

0,72 |

Pavlodar |

0,53 |

0,50 |

0,48 |

0,54 |

0,59 |

0,56 |

North Kazakhstan |

0,22 |

0,23 |

0,23 |

0,22 |

0,25 |

0,23 |

South Kazakhstan |

0,19 |

0,18 |

0,18 |

0,17 |

0,22 |

0,19 |

Almaty city |

0,59 |

0,67 |

0,68 |

0,71 |

0,68 |

0,71 |

Astana city |

0,29 |

0,28 |

0,36 |

0,44 |

0,53 |

0,53 |

Total |

0,38 |

0,39 |

0,40 |

0,73 |

0,68 |

0,69 |

Note. Compiled by the authors based on data of the Ministry of Finance of the Republic of Kazakhstan and the Agency of the Republic of Kazakhstan on Statistics |

||||||

In general, Kazakhstan’s regions tend to increase the share of their own revenues in consolidated budget revenues during the analyzed period. The lowest share of revenues is observed in the South-Kazakhstan and Kyzylorda regions. Positive dynamics of the growth of this indicator is observed in the Astana, Atyrau and Mangistau regions, i.e., in the capital and in the carbon-producing regions of the country. In the industrial and agricultural regions there is no noticeable change in the share of their own revenues.

The stable low share of revenues of many regions in consolidated budget revenues testifies to the lack of incentives for local authorities to rationally use municipal property as well as the insufficient reserves to increase this value. If this trend persists, the implementation of budgetary processes may deteriorate. The factors that affect the state, composition and structure of local budget revenues and expenditures are shown in Table 2.

Table 2

Factors affecting the local budget

Factors affecting the composition and structure of revenues and expenditures at the local level, determining the degree of socio-economic development of the administrative-territorial unit |

Factors affecting the state of local budgets |

Production facilities |

Economic potential of the corresponding territory |

Natural resources |

|

Social and household infrastructure objects |

|

Unit status |

|

Population density |

|

Natural and climatic conditions |

|

|

The country’s general economic situation |

|

Level of state legislation regulating the rights and responsibilities of local authorities |

|

Degree of competence of local authorities |

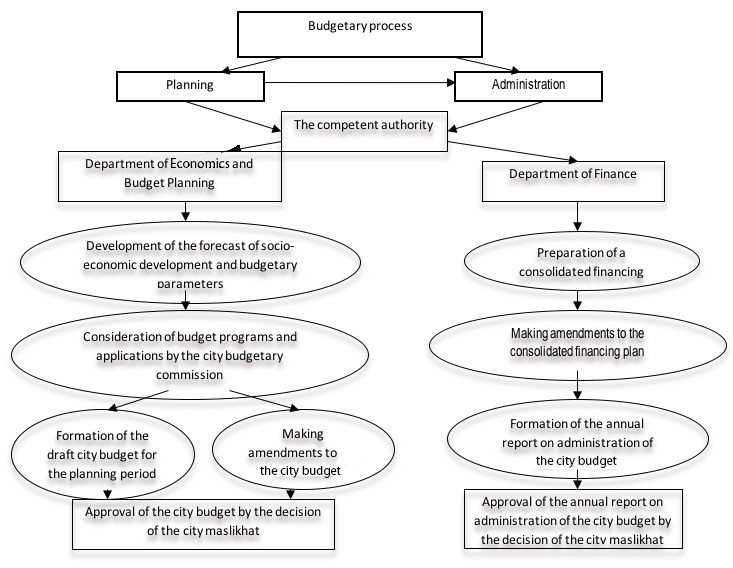

In Kazakhstan, the procedure for implementing budgetary processes and the sphere of responsibility for them have been formed in accordance with the scheme presented in Figure 1.

Figure 1

The scheme of the budgetary process

The budget planning policy developed several types (formats) of the budget: line-item; administration-based; program-based; balanced.

The line-item budget is a traditional way of drawing up an estimate of the planned document, on the basis of which local budget expenditures are formed by items. Estimates make it easy to control the use of funds, as they are compared to actual expenditures to identify variances.

The administration-based budget is very close to the program format in its essence and is closely related to the quality of administration. The data on the amount of work and its administration make it possible to judge the efficiency and effectiveness of this program (Shipilova 2012).

In the Republic of Kazakhstan, the program-based budget disclosed by cost items (specificities) has been adopted as the main format. The program-based budget is an expenditure of budget funds in the form of budget programs with their subsequent systematization into a single document.

The modern direction in budgetary practice is the balanced budgetary system. Its essence comes down to the fact that the assessment of future revenues is made first, which then is a restriction of budgetary allocations. The balanced distribution of revenues between regional budgets is achieved on the basis of reasonable calculations for each revenue source in the context of districts and cities, as well as the size of expenditures according to the budget classification. The main advantage is that it is possible to find the best option for the allocation of budget funds (Shah 2008).

In Kazakhstan, the method of integrated planning of the revenue and expenditure side of the budget is used. The financial base of local authorities is represented by local budget revenues, which consolidate their economic independence, activate economic activities, enable local authorities to develop infrastructure within the territory under their jurisdiction, and expand the economic potential of the region (Yashin and Yashina 2013).

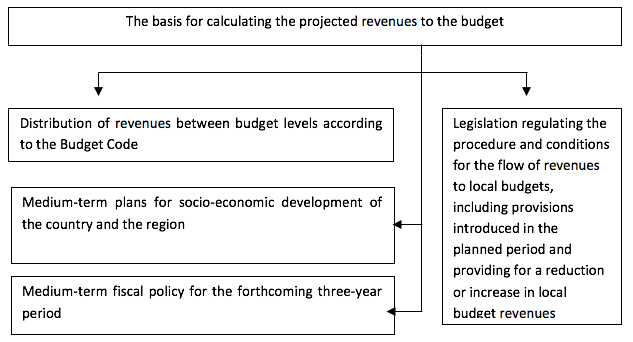

The formation of local budget projects is based on the parameters of the medium-term plan for the region’s socio-economic development, the forecast indicators of the Ministry of Finance of the Republic of Kazakhstan, stable rates of revenue distribution between the regional budget and the budgets of districts and cities, as well as the size of subventions transferred from the regional budget to lower budgets. The main documents for determining the projected value of local budget revenues are presented in Figure 2.

Figure 2

The main documents for determining the

projected value of local budget revenues

Local budget revenues are based on the forecast parameters of macroeconomic indicators for the medium-term period, taking into account the provisions of the Tax Code and other legal acts (Report of the Audit Commission for the Pavlodar region for 2012-2014). Over time, the forms and methods of budget work and budget planning are changing, but the budget always remains an objective necessity.

2.2. Analysis of the formation of the local budget of Pavlodar city

The budget of the Pavlodar region comprises 14 independent budgets. The budget of Pavlodar city accounts for the largest share of budget funds. The economic mechanism for ensuring the city's sustainable development includes the development of productive capacity, the effective replenishment of the budget, as well as the attraction of domestic and foreign investments in the regional economy.

The budgetary policy of local authorities is based on the budgetary policy of the Republic of Kazakhstan, as well as on the tax and price policies of the Government of the Republic of Kazakhstan. It is aimed at achieving the maximum provision of necessary budgetary resources for the authorities of the Pavlodar region and creating conditions for the region’s sustainable socio-economic development (Idimov 2012).

The formation and administration of the budget is one of the most important tasks of local authorities. The effectiveness of its implementation directly depends on the quality of all stages of the budgetary process, from approaches to its formation to the qualitative analysis and assessment of the results obtained. Kazakhstan experienced a gradual transition from the old system of financing of local budgets, which was mainly based on tax distribution, to a more transparent system of taxation at certain levels of budgets, as well as the use of equalization transfers, which are provided from the state budget to finance expenditure needs (Slepov and Shubov 2013).

According to the Budget Code, district budget revenues (of the city of regional significance) include:

- tax revenues;

- non-tax revenues;

- revenues from the sale of fixed capital;

- transfer revenues.

Consider the structure of local budget revenues using the example of the industrial city of Pavlodar in Table 3.

Table 3

Sources of the budget of Pavlodar city, 2012-2016 (million tenge)

Description of indicators |

2014 |

2015 |

2016 |

Actual, 2015/2014 |

Actual, 2016/2015 |

|||||||||

Plan |

Actual |

Actual share, % |

Fulfillment, % |

Plan |

Actual |

Actual share, % |

Fulfillment, % |

Plan |

Actual |

Actual share, % |

Fulfillment, % |

Variance, % |

Variance, % |

|

Tax revenues – Total |

27974 |

28333 |

90 |

101 |

28609 |

28655 |

92,5 |

100,2 |

33885 |

35087 |

96,5 |

103,5 |

101 |

122 |

Income tax |

14216 |

14474 |

46,0 |

101 |

14795 |

14659 |

47,3 |

99,1 |

12953 |

12745 |

35,1 |

98,4 |

101 |

87 |

Social tax |

- |

- |

- |

- |

- |

- |

|

|

|

|

||||

Property tax |

3166 |

3180 |

10,1 |

100 |

3461 |

3482 |

11,2 |

100,6 |

3645 |

3791 |

10,4 |

104,0 |

109 |

109 |

Land tax |

489 |

492 |

1,6 |

100 |

536 |

538 |

1,7 |

100,5 |

513 |

531 |

1,5 |

103,5 |

109 |

99 |

Vehicle tax |

862 |

881 |

2,8 |

102 |

1016 |

1094 |

3,5 |

107,7 |

1116 |

1184 |

3,3 |

106,1 |

124 |

108 |

Single tax |

- |

0,2 |

0,0 |

0,2 |

0,4 |

|

|

200 |

0 |

|||||

Domestic taxes on commodities, works and services |

8842 |

8887 |

28,2 |

100 |

8204 |

8218 |

26,5 |

100,2 |

15350 |

16491 |

45,4 |

107,4 |

92 |

201 |

Other taxes |

3 |

3 |

0,0 |

|

0,8 |

1,2 |

0,0 |

150,0 |

|

40 |

0 |

|||

State duty |

394 |

412 |

1,3 |

104 |

596 |

663 |

2,1 |

111,2 |

308 |

346 |

1,0 |

112,2 |

161 |

52 |

Non-tax revenues |

903 |

918 |

2,9 |

101 |

245 |

183 |

0,6 |

74,8 |

237 |

229 |

0,6 |

96,7 |

20 |

125 |

Total tax and non-tax revenues |

28877 |

29251 |

92,9 |

101 |

28853 |

28838 |

93,1 |

99,9 |

34122 |

35316 |

97,2 |

103,5 |

99 |

122 |

Revenues from sales of fixed capital |

2236 |

2232 |

7,1 |

99 |

2229 |

2146 |

6,9 |

96,3 |

1058 |

1035 |

2,8 |

97,8 |

96 |

48 |

Total revenues |

31114 |

31484 |

100 |

101 |

31082 |

30984 |

100 |

99,7 |

35179 |

36351 |

100 |

103,3 |

98 |

117 |

Note. Compiled by the authors based on the report of the Audit Commission for the Pavlodar region |

||||||||||||||

The share of tax revenues in the budget of Pavlodar city increased from 90% to 96.5% for three years. At the same time, the total amount of the budget increased from 31,484 million tenge to 36,351 million tenge. The most significant share of revenues in the local budget of Pavlodar is formed by an income tax. The budget source "Domestic taxes on commodities, works and services" is also one of the largest. However, its share does not tend to change over years. The share of non-tax revenues is not high. The budget source "Revenues from sales of fixed capital" decreased twice in 2016 compared to the previous year (Annual Surveys of State and Local Government Finances 2009).

The variance of actual and planned values by revenue sources during the considered period is insignificant, within 1-4 percent towards over fulfillment. The exception is "Non-tax revenues" and "Revenues from sales of fixed capital." A slight variance indicates a good level of organization and management of planning and budgetary processes. It should be noted that in Kazakhstan there is a strict fiscal policy regarding the discipline of fulfilling the budgetary obligations of taxpayers. This, on the whole, explains the fulfillment of planned targets for tax revenues.

The regulation of budgetary processes at the local level is largely determined by the established interbudgetary relations. The system of interbudgetary relations includes relations between the national and local budgets of the Republic of Kazakhstan, and within regions – between regional, city and district budgets. The interrelation of links of the budgetary system is realized through the mechanism of interbudgetary relations. The mechanism of budgetary regulation is based on the organization of an integrated system of economic relations aimed at a clear delineation of the functions and powers of public administration levels, as well as the unity and transparency of methods for allocating revenues and expenditures between budget levels.

Interbudgetary relations are often considered very narrow only at the level of the relationship between the national budget and local budgets. In practice, interbudgetary relations are the basis of budgetary regulation. The regulation of interbudgetary relations should take into account that the main principles of state budgetary policy are formed at the local level.

However, the methods of increasing budget revenues are mainly fiscal. The current methods of managing the fiscal system not only do not help, but often damage the efforts of enterprises and regions in developing their production, enhancing its efficiency and increasing the revenues of enterprises, industries and the budget. In addition, such indicators as the efficiency of the use of resources, the volume of production and sales of products and services, the cost, industry and regional structure of the economy, as well as the level of profitability and intensification of production and inflation are insufficiently taken into account . Therefore, there is an urgent need to improve the existing and develop new methods for analyzing, forecasting and planning the budgetary process at different levels of the economy.

The comparison of planned and actual targets indicates that forecasting needs to be improved. For certain types of non-tax revenues for the considered period, there are variances between actual and forecast values (up to 200% for annual indicators). The main reason for the discrepancy between the planned revenues and the actual ones lies in the nature of their planning, when the indicators are calculated based on the needs of the budget, rather than on the potential of taxation and the commercial potential of state assets.

Another problem regarding the accuracy of calculations of the revenue side of the budget is related to its methodology. The loss of control over the economy by the state, expressed in the absence of financial plans for non-state economic entities, as well as the destruction of the system of collecting economic information (previously carried out vertically through planning committees) makes it impossible to accurately calculate the expected revenues to the budget (Blochliger and Vammalle 2012).

General statistical methods (grouping, building series of dynamics, calculating average and relative indicators, etc.), the method of coefficients, normative and tax methods, the method of redistribution, subsidies, subventions, graphs and diagrams, analytical tables, etc. are widely used in the formation of budget revenues (The development program of Pavlodar city for 2011-2015). The repeated increase in prices for essential goods and other products as well as an increase in wages in budget institutions are regulated through coefficients; therefore, budget calculations are made with the help of coefficients. The main drawback of the method of coefficients is that it does not stimulate the identification of reserves and does not promote the introduction of the economic mode of funds.

Thus, the calculations of the revenue side of the budget are based on the methodology for using financial indicators that were actually formed over the previous year, taking into account inflation and trends observed in macroeconomics. This method of budget planning is inherent in a centralized form of budget regulation. A centralized form is a form carried out by the Ministry of Finance of the Republic of Kazakhstan with the aim of equalizing the possibilities of obtaining revenues and financing expenditures by all local authorities (Nesterenko 2001, p. 24).

It is impossible to improve the management of local budgets without the development of interbudgetary relations. The development of interbudgetary relations should primarily be manifested in providing them with greater flexibility and giving independence to local budgets. The independence of local budgets in the full sense of this concept would rather be provided by a decentralized form of budget regulation, which is based on the financial independence of local councils.

The most labor-intensive work that provides the development of the budget is the planning or drafting of the city's budget project. The number of amendments to the city budget in 2016 indicates the existence of problems in the organization of budgetary processes, and hence in the management of local budgets. Based on the findings of the Audit Commission and the inspection of financial control, one can identify the main factors contributing to violations in budgetary and financial spheres and the management system of state assets.

The most common types of financial irregularities allowed in budget planning are:

- poor strategic and budget planning, as well as a formal definition of strategic goals, objectives, direct and final results;

- violation of the principles of the budgetary system, namely, validity and timeliness in approving and clarifying tax revenues to the city budget, which leads to the attraction of advance payments;

- failure to adhere to the principles of efficiency, effectiveness and responsibility of the budgetary system by administrators of budget programs, which leads to the failure to draw budget funds and to fulfill their obligations.

The budget suffers certain losses due to the ineffective management of state assets and weak control by local authorities – founders over the activities of economic entities:

- Failure to comply with the terms of the concluded land use agreements by the authorized body results in a shortfall of payment for the lease of land plots;

- Violations of the procedure for granting the right to land plots related to the terms of concluding lease agreements lead to the untimeliness of budget revenues;

- Violations of the procedure for strengthening or transferring newly constructed engineering networks to the operating organizations lead to the loss of budget revenues;

- Untimely introduction of changes to the concluded agreements of hiring and trust management of municipal utilities in terms of increasing the value of the transferred property also leads to budget losses (Report of the Audit Commission for the Pavlodar region for 2012-2014).

These facts testify to the inefficient use of state budget funds and the lack of control by authorized bodies and administrators of budget programs.

To eliminate the above weaknesses of the management of budget funds, one should:

- ensure the full accounting and monitoring of budget revenues from the lease of communal property and property transferred to trust management, and from other sources of local budget replenishment;

- increase the responsibility of program administrators to take obligations only under the existing regulatory framework for the implementation of activities and to prevent the adoption of additional obligations without providing them with funding sources;

- increase the qualification level of financial workers of budget organizations financed from the city budget;

- strengthen the work to reduce receivables and payables, including overdue, preventing their growth and formation in the future;

- develop and administer the budget, focusing on the achievement of direct and final results, based on the need for the effective achievement of social and economic goals of the local budget;

- strengthen the control over the performance of contractual obligations, work and services by contractors;

- ensure the timely adoption of civil liability measures for the improper performance of contractual obligations and norms of the current legislation on public procurement.

In the world practice, it was impossible to create an optimal model of interbudgetary relations, and in fact there is no universal model for the distribution of revenues and expenditures by levels of power. The effectiveness of a particular model is determined by the adherence to the general provisions of the classical theory of budgetary federalism and the availability of institutional incentives for the authorities to conduct responsible fiscal policy. Under the influence of political, historical and national factors, a number of various budgetary systems have developed. Kazakhstan builds its own model of optimal interbudgetary relations, taking into account experience and critical rethinking. The study showed the following results.

It is impossible to improve the management of local budgets without the development of interbudgetary relations. The development of interbudgetary relations should primarily be manifested in providing them with greater flexibility and giving independence to local budgets. The independence of local budgets in the full sense of this concept would rather be provided by a decentralized form of budget regulation, which is based on the financial independence of local councils.

The proper self-management of local budgets is possible with the obligatory definition of responsibility for their formation and administration. In our opinion, responsibility for the self-management of local budgets can be provided by the monitoring and assessment of the effectiveness of local authorities. Until 2013, Kazakhstan assessed the effectiveness of measures to ensure the effectiveness and efficiency of using budget funds by administrators of budget programs according to the Methods for Assessing the Efficiency of Management of Budget Funds of a State Body, approved by the order of the Minister of Finance of the Republic of Kazakhstan (Methods for Assessing the Efficiency of Management of Budget Funds of a State Body).

We think that such an assessment should be renewed to improve the efficiency of local budget management. This will determine the personal responsibility of chief executive officers and process managers for the state of the local budget, as well as the strengths and weaknesses of managing budgetary resources. However, the assessment criteria are proposed to be revised, since some of them are duplicated. If a point assessment method is introduced, it will be possible to implement a rating system for assessing the performance of local authorities in managing local budgets.

Annual Surveys of State and Local Government Finances. (2009). U.S. Census Bureau. Retrieved from: http://www.census.gov/govs/estimate/

Blochliger, H., Vammalle, C. (2012). Reforming Fiscal Federalism and Local Government. Beyond the Zero-Sum Game. OECD Fiscal Federalism Studies. OECD Publishing.

Budget Code of the Republic of Kazakhstan of December 4. (2008). No. 95-IV ZRK.

Gryaznova, A.G. (2012). Finansy i Statistika. Мoscow.

Idimov, K.T. (2012). Actual issues on the development of local budgets, Bulletin of KazNU, Economic Series, 4(44), 18-24.

Kudrin, A.L. (2010). The three-year budget for economic diversification. Finance, 4, 36-40.

Methods for Assessing the Efficiency of Management of Budget Funds of a State Body, approved by Order No. 9 of the Minister of Finance of the Republic of Kazakhstan of January 10, 2012. (2012).

Nesterenko, T.G. (2001). Basic principles of interbudgetary relations. Finance, 11, 132.

Nurumov, A.A., Ismagulova, A.U. (2012). Local taxes of the Republic of Kazakhstan. Astana.

Panteleev, A.Yu. ((2011).Formation of a financial basis of local self-management. Finance, 11, 87-90.

Report of the Audit Commission for the Pavlodar region for 2012-2014.(2014).Pavlodar.

Shah, A. (2008). Macro federalism and Local Finance. Washington: The World Bank.

Shipilova, E.V. (2012). Priorities in assessing the effectiveness of budget expenditures. Budget, 12, 55-59.

Slepov, V.A., Shubov, V.B. (2013). Priority directions of the development of interbudgetary relations. Finance, 316, 69-72.

The development program of Pavlodar city for 2011-2015. (2015). Pavlodar.

Vasilyeva, M.V. (2007). Local budgets in modern conditions. Moscow: Finansy i Statistika.

Yandiyev, M.I. (2012). Finances of regions. Мoscow: Finansy i Statistika.

Yashin, S.N., Yashina, N.I. (2013). Some aspects of the analysis of the budget potential of municipalities. Finance and Credit, 5(119), 66-71.

1. L.N.Gumilyov Eurasian National University, Astana, Kazakhstan

2. GU “Audit Commission for Pavlodar Region", Pavlodar, Kazakhstan

3. L.N.Gumilyov Eurasian National University, Astana, Kazakhstan

4. S.Seifullin Kazakh Agrotechnical University, Astana, Kazakhstan