Vol. 39 (Nº31) Year 2018. Page 17

Vol. 39 (Nº31) Year 2018. Page 17

Oleg V. SAZANOV 1; Nadezhda K. MARTYNENKO 2; Vasiliy S. KIREEV 3; Elena A. SULIMOVA 4; Natalia E. SOKOLINSKAYA 5

Received: 18/03/2018 • Approved: 26/04/2018

ABSTRACT: The innovative way of development announced by the President of Russia in the current economic conditions requires new approaches to the realization of the scientific, technical and innovative potential of Russia’s regions. Projects associated with the introduction of innovative technologies, financing of research and development are characterized by a high degree of risk – the investment can bring significant profits, but may not pay off if the idea turns out to be erroneous or if it fails to be brought to the commercial implementation. |

RESUMEN: La forma innovadora de desarrollo anunciada por el Presidente de Rusia en las actuales condiciones económicas requiere nuevos enfoques para la realización del potencial científico, técnico e innovador de las regiones de Rusia. Los proyectos relacionados con la introducción de tecnologías innovadoras, la financiación de la investigación y el desarrollo se caracterizan por un alto grado de riesgo: la inversión puede generar importantes beneficios, pero puede que no rinda si la idea resulta errónea o si no se produce. |

In modern Russia, the term “venture” and the terms “venture capital” and “venture financing” often refers to any type of financing, different from a bank loan. Moreover, the boundaries of the term “venture” in the Russian language were expanded to such an extent that the word “venture” has entered everyday life, which denotes both the way and form of financing, as well as a newly formed company seeking financing its business from an external source.

Thus, the term “venture capital” is understood as an investment in companies in the early stages of development, as well as direct investment, i.e. investments in companies that are in the later stages of development. Such a classification makes it possible to get a fairly complete and objective view of the state of affairs, especially since in Russia almost all venture funds can be classified as Private Equity Investments (Gompers, 2007).

The development of venture capital and direct investment in Russia is one of the priority areas of the state innovation policy and a necessary condition for activating innovations and increasing the competitiveness of domestic industry.

Advantages of venture investment as a source of financing in the sphere of small and medium innovative business are obvious: a dynamically developing enterprise can receive venture investments when other financial sources avoid risky investments.

There is a number of problems in the Russian market, on which government agencies should focus their attention, and whose goal to create systemic elements of the national venture industry with the participation of the state, and the formation of a favorable economic and legal environment for the subsequent self-development.

The importance of venture financing for development projects is high, therefore, serious attention is paid to studying this source of financing investment projects, both theoretically and in the field of their practical application.

The questions of the theory and practice of investment are examined in the works of such foreign researchers as B. Black, B. Gilbert, R. Gilson, P. Gompers, M. Gruber, J. Lerner, S. Sommersby, and others.

Research of the essence of the investment process and analysis of the sources of its financing was carried out in the works of such Russian scientists as A.M. Babich, V.V. Kovalev, G.B. Polyak, V.V. Ivanov, V.A. Lyalin, B.I. Sokolov, and others.

Of particular scientific and practical interest are the works devoted to the analysis of problems related to the development of venture financing, such scientists as A.B. Vorontsovsky, A.B. Galitsky, V.I. Kotelnikov, O.V. Motovilov, V.K. Samokhin, and others.

The analysis of a wide range of works devoted to venture financing of territorial development projects showed that: (1) fundamentally new approaches, models and directions of research on the problems of the venture industry arise, as noted in a number of works (V.P. Yatsenko, I.I. Ivanov); (2) the problems of systematization of national models of the venture industry are being studied (Woolvvorth, T. Meyer, R. Mitchell, G. Nappier); (3) “new wave” studies are emerging that are oriented toward studying the interrelationships of the state and business when creating an ecosystem for venture investments (S. Noel, R. Durufle).

From the point of view of the American economist, the manager of NGC investment J. Nuechterlein, venture capital is the financing of the company at the early stages, as distinct from the acquisition of a controlling stake in the company or its diversification.

However, despite the considerable interest in the problem, some theoretical and practical issues related to venture financing of territorial development projects remain undeveloped in the Russian economic science. This circumstance determined the purpose and objectives of this study.

The modern practice of using venture capital in the innovative development of the Russian economy only makes its first steps. The efforts of entrepreneurs, authorities, public entities do not give tangible positive changes in the development of the “venture industry”.

One of the reasons for such situation is the inadequate depth and integrity of theoretical and methodological developments related to the nature, mechanisms and dynamics of the formation and use of national venture capital.

There is an acute need for a comprehensive concept of creating and developing a national venture system capable of meeting all the requirements for active innovation using venture capital.

Until now, no methodology, nor a convincing classification of innovative venture risks has been developed that could be used in practice, and no mechanism for their analysis and evaluation has been proposed.

The analysis of foreign practice of high-risk investment and recommendations for its use in our country is carried out without taking into account the features of the current stage of Russia’s economic transformations, the specifics of its national interests and the traditions of the development of Russian entrepreneurship.

Operating in Russia, venture funds are based on foreign capital and are often loosely associated with innovative activities in the sphere of material production (Gapsalamov, 2015). No effective institutional environment has been developed to create national venture capital.

In the process of research, both general scientific methods of research (analysis, synthesis, systemicity) and special methods were used: an integrated approach to the study of venture investment programs and models.

The principles of the system approach to studying venture-based innovation and investment processes in the world and domestic economy are applied in the work, as well as the interdisciplinary approach to economic analysis.

The scientific novelty of the work is that for the first time in the domestic and foreign literature an attempt has been made to conduct a comprehensive analysis of the problems and opportunities for building a venture industry in Russia using examples of projects for the development of territories taking into account the Russian specifics.

Financing of innovation activity of economic entities in the conditions of growing competition in the process of globalization and modernization of economic systems is increasingly optimized by venture capital.

Venture capital, as one of the sources of financing the development of companies with high value added, is an integral part of corporate finance management. Efficiently operating venture capital industry can provide dynamically developing innovative enterprises with investments, thereby contributing to the competitiveness of the national economy (Drachuk & Trushkina, 2014).

In the glossary of venture entrepreneurship published by the Russian Direct and Venture Investment Association (RDVIA), this definition is complemented by an note that venture is used for research, development, acquisition of new companies, increasing working capital, and improving the structure of the balance sheet.

The original meaning of the concept “venture capital” was closely related to the etymological meaning of the word “venture”, which, on the one hand, means an enterprise, and on the other, a risk. The study of the main theoretical and methodological approaches to the definition of the capital category, the identification of its main characteristics, the consideration of the types of capital and their interrelation showed the multifaceted and complex character of the concept of venture capital, which in principle excludes its generally accepted interpretation. The analysis of existing definitions of “venture capital” makes it possible to identify two main approaches: American and European ones.

The American interpretation of the concept of “venture capital” can be considered a narrow one. In the United States, venture capital means only what ats in the early stages of the formation of a high-tech company. The National Venture Capital Association of the United States (NVCA) defines “venture capital” as the capital provided by professionals in the field of management support to young, fast growing companies with significant competitive development potential (Bogoviz Alexei, Vukovic Galina & Stroiteleva Tamara, 2013). According to the American approach, transactions like MBO/MBI (management buy-out – redemption by external managers, management buy-in – redemption by internal managers) should not enter the venture capital structure. Venture capital is understood as a kind of direct investment.

The European interpretation of venture capital is an expanded one. In Europe, this concept includes all types and kinds of equity investments in all stages of development of small and medium-sized companies using high technology and not listed on the stock market.

In Europe, venture capital investments include non-traditional deals such as repurchase of shares using credit resources, investments in companies with unsatisfactory financial condition (referred to as problem companies), and initial public offering of securities (IPOs) (Zheng, Liu & George, 2006).

In line with such a broad definition, venture capital investments in Europe are sometimes equaled to private capital investments that represent any investment in private limited liability companies. In the US, transactions involving the use of credit, investments in problem companies and IPOs are generally classified as non-venture capital investments.

However, the conclusions of American experts that the interest of venture fund managers in working with developed companies is associated only with a reduction in the overall risk of investment is not entirely correct (Shkurkin et al., 2016). An element of increased risk is retained when working with developed companies, since in most cases it is associated with innovations in the organizational and management plan.

The formation of venture capital began in the postwar years in the United States, and its theory and practice in general terms was developed in the 1960s. The emergence and development of such a large hi-tech company as Hewlett-Packard (founded in 1938) amd the first company in the field of microelectronics - Intel (1964) became possible largely thanks to venture capital.

The very term “venture” (a risky undertaking) underscores the risky nature of investments, which are mainly connected with innovation activity. Later, the American model was borrowed and adapted by Western Europe and Asian countries. The beginning of development of the venture industry in Russia was promoted by the joint G7 and the European Union summit, held in Tokyo in 1993. The participants agreed to allocate funds to Russia for the development of venture projects under the auspices of the EBRD.

The difference between venture and other direct investments in the authorized capital is based on the presence or absence of strategic participation in the project implementation. In order to reduce the risk of misuse of investments as a mandatory condition for direct investment, a venture investor requires the entry of one or more of its representatives into the Board of Directors of the enterprise implementing the project (Akhmetshin et al., 2017).

Thus, a specific “niche” of venture financing is direct investment in the authorized capital with a risk level reduced as a result of the participation of representatives of the investor in the Board of Directors of the enterprise implementing the project.

The main feature of direct and venture investments in comparison with other investment sectors is that profit is generated due to the growth of the company’s capitalization during the time of a joint “affair” with an investor that provides not only the necessary funds but also assistance in the process of creation (Bogoviz, Vukovich, & Stroiteleva, 2013), development and management of the business, and product promotion. This is the so-called Smart Money principle. The investor can help in:

The venture capital market functions cyclically. Its high-risk nature is expressed very clearly both during the boom and during the crisis. Venture capital unites financial and intellectual resources, and also means that there is a mechanism for managing innovation risk. Its existence is caused by the objective requirements of society in the creation and commercialization of innovations.

Classical and modern economy distinguish constituting properties of the category of “capital”. This allows us to disclose the essence of venture capital in a broad sense (Rylov, Shkurkin & Borisova, 2016). This approach is not limited to the study of elements of investment, risk and profit. From this point of view, venture capital is a complex economic and organizational mechanism that allows creating new types of activities and products on the basis of mutual consideration of the economic interests of the participants in the process, which contributes to the effective development of the national economy.

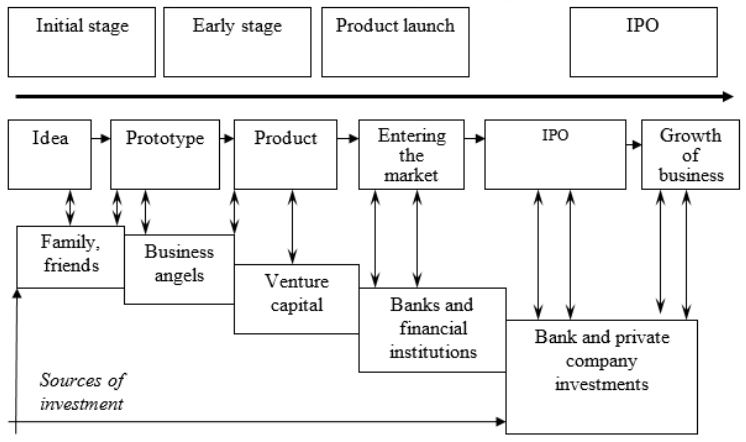

Figure 1

Sources of financing of innovation projects

depending on the stage of the company’s life cycle

Source: (Ivashov, 2014).

Venture capital has an important feature inherent in capital in general – self-increasing value. It can also be represented as a circle (Nyrov, 2009). At the same time, venture capital includes not only financial resources invested in an innovative company, but also intellectual “investments”: knowledge, experience, know-how in the field of marketing strategies, management and production. Today, intellectual capital plays a decisive role in achieving competitive advantages and ensuring qualitative parameters of economic growth (Nyrov, 2009). In the process of solving a particular problem, the forms of capital can be combined.

Innovation is a special function of venture investment, as it carries out a motivational impact on intellectual labor in the production process, despite the high degree of risk (Artemov., 2012). At the same time, the life cycle of venture capital at all stages requires a single information environment, management and control by the investor. This differentiates it from financial capital, since investment activity in this case is associated with intensive use of human capital, management activities and marketing. Depending on the stage of the life cycle of the innovation company, different sources of investment are distinguished (Figure 1), which differ depending on the implementation of stages from the seed stage to the stages of IPO (first public sale of shares) and business growth.

The essence of venture capital can thus be represented as an integration of financial and intellectual capitals. The purpose of such integration is to activate innovation activities that combine high risks with extremely high return on investment (Ugnich, 2013).

Thus, the most important function of venture capital is the integration of human and financial resources with a view to increasing efficiency and effectiveness in the operation of the economic system.

Considering venture capital, it is necessary to assess the dynamics of the contradictions of the innovation process. Venture capital develops, resolving contradictions in the relations of its subjects. The economic relations that accompany the financing of innovation activity are an environment of venture capital. The leading role belongs to the participants of venture financing: companies-recipients (venture firms), venture investors, venture professionals.

The development of markets for technological products is a long-term process. However, the speed of updating the ways of implementing innovations should be rather fast, where competence, experience and “way of thinking” of entrepreneurs are emphasized (Drachuk & Trushkina, 2014).

In the world practice, venture financing is targeted at both high-tech industries and the major industries and sectors of the economy. In most cases, the possibilities for financing innovations are sought from own funds, funds of individual large investors directly invested in production, funds from families, federal programs for financing innovations. Nevertheless, the main direction of venture capital is financing from special venture funds.

Corporate venture investments is one of the tools for the innovative development of corporations, products and markets associated with investments by corporations in external start-up projects (as opposed to corporate venturing when the company invests in internal projects). CVIs, in addition to profit, also pursue strategic goals that are important for the parent company, which should have a synergy effect in the future and promote leadership in the world market in terms of technological development.

Currently, Russia has launched such areas of support for innovative business, as the operation of specialized Russian and foreign funds; implementation of venture capital support programs; functioning of the state fund, which provides financial support to small innovative enterprises; the implementation of the program of the European Association of Venture Capital for the countries of the former Soviet Union; formation and functioning of the Russian Venture Investment Association; work on the territory of Russia of international institutions in the field of venture capital (Vranovich & Michurina, 2013).

High risks of venture investment lead to the need to provide a procedure for minimizing the financial losses of investors in case of a negative result when implementing an innovative project (Campbell, 2008). This process means the sale or liquidation of a company in order to repay the financial resources invested by the investor (disinvestment). Risks are characteristic for all investment activities, but venture capital investment is characterized by a higher risk at all stages of implementing innovative projects (Krotkova, Mullakhmetov, & Akhmetshin, 2016). At the same time, the predicted effect of innovations should have a high innovative and commercial result with a high profit of using venture capital investment (an increase by a factor of ten over five years).

The investor risks are compensated for by increasing the competitiveness of regional economic systems through the implementation of innovative projects in various types of economic activity. The life cycle of venture investment affects the volume of investment flows and the size of the expected profit received by the investor in the case of an innovative project.

Classification of venture capital risk types by phases of the investment project is presented in Table 1.

Table 1

Classification of venture capital risks by phases of the investment process.

# |

Venture Investment Phase |

Functionality of risk |

Type of risk |

1. |

Entry into the capital of the investee. Risk of unproduced investments |

Incompatibility with the economic, social and technological order |

Risk of unproduced investments |

Errors in the strategy of innovative development, ignoring traditions |

Isk of alternative capital investment opportunities |

||

2. |

Entry into capital and monitoring |

Industrial, technological, managerial risk |

The risk of future losses of the economic entity, its non-liquidity |

Untimely assessment of the transformation of innovation into a tradition |

Risk of depletion of investment resources |

||

3. |

Withdrawal from capital (realization of investments) |

Financial risk, lack of coordination of interests of participants |

Risk of financial insolvency of venture investments |

Updating the economic system |

Risk of the need for new investments and violation of the timeframes for withdrawal from the capital |

||

Source: Prepared by the authors.

The risk environment for investments of a venture investor is closely related to the specifics of venture capital and its profitability. This relationship is expressed by the principle of “risk-income”, which distinguishes it from bank financing or the financing by a strategic investor. These differences, as shown in Table 2, are manifested in the following features.

Table 2

Distinction of venture financing from other types of financing.

Sources of financing |

Banks |

Strategic Investors |

Venture financing |

Investments in equity |

– |

+ |

+ |

Loans |

+ |

– |

+ |

Long-term investments |

+ |

+ |

+ |

Risk business |

– |

– |

+ |

Investor participation in the management of the company |

– |

+ |

+ |

Source: Prepared by the authors.

Comparative analysis of the differences in methods and techniques of financing innovation presented in Table 2 showed that, firstly, venture financing is impossible without “approved risk.” This means that investors predict the possibility of losing funds at high risks of the financed enterprise in exchange for a high rate of profit in case of its success.

Secondly, a venture type of financing means a long-term investment of capital, in which the investor plans to invest on average 3 to 5 years to make sure the project is promising, and 5-10 years to make a profit on the capital invested.

For Russia, venture industry is a relatively new sector of the economy, and its mechanisms are not sufficiently developed. However, foreign and domestic investment institutions show a high interest in its development.

Russian entrepreneurs are ready to understand the conditions of the new game and adopt its rules. The system of venture fairs, the Venture Innovation Fund (Fund of Foundations), the emerging regional system for the search and training of company managers who attempt to attract venture financing for development projects, are a few of the elements of the relevant infrastructure that have appeared recently.

Venture financing of territorial development projects can bring a high profit or end in failure. The American and European economies to a significant extent owe their growth at the end of the twentieth century precisely to the flourishing of venture financing for development projects.

In our country, political and entrepreneurial climate is gradually being formed, favorable for venture and direct investment. A number of steps taken by the venture industry community and state structures at various levels contribute to the development of small and medium-sized businesses (in particular, high-tech), which, in turn, can give impetus to the development of the Russian economy as a whole. With the support of the state, the private sector and international organizations, the structures of the research sector of the market type were created, such as technology parks, innovation and technology centers, legal and consulting companies. New tools and mechanisms were also created related to the functioning of budgetary and extra-budgetary funds supporting fundamental and applied research and development, their competitive financing, protection of rights to intellectual property.

We would like to underscore the extremely necessary and active involvement of the Russian Ministry of Science, Russian Association of Venture Investment, the Assistance Fund, the Russian Fund for Technological Development, other structures and companies in promotion of venture financing for development projects, and creation of a favorable attitude towards this type of business, especially in Russian business circles. It is also very important to improve the legislation.

However, a qualitative change in the situation will only occur when the domestic capital actually comes to the venture business. Until this happened, all current activities tend to protect foreign capital. Recognizing the importance of foreign investment for the rise of the Russian economy, we consider the role of national capital to be strategically important in this task through implementation of full-scale projects on the formation of venture funds with Russian capital and Russian management.

The last few years have become a serious test for the industry of direct and venture investments, not only in Russia. As the economy stabilizes, the role of direct and venture investments as a source of long-term financing and support to companies in the innovative sector of the economy will become increasingly evident.

Akhmetshin, E. M., Vasilev, V. L., Puryaev, A. S., Sharipov, R. R., & Bochkareva, T. N. (2017). Exchange of property rights and control as a condition of the innovation process effectiveness at collaboration between university and enterprise. Academy of Strategic Management Journal, 16(Specialissue1), 1-9.

Artemov, S.V. (2012). Development of venture financing of innovative developments in Russian regions. Vestnik of the University (State University of Management), 4, 108-114.

Campbell, K. (2008). Venture business: new approaches. Moscow: Alpina.

Bogoviz Alexei, V., Vukovic Galina, G., & Stroiteleva Tamara, G. (2013). Study of regional labor market based on factor analysis. World Applied Sciences Journal, 25(5), 751-755. doi:10.5829/idosi.wasj.2013.25.05.13342

Bogoviz, A. V., Vukovich, G. G., & Stroiteleva, T. G. (2013). Motivation of staff in the corporate sector industry. World Applied Sciences Journal, 25(10), 1423-1428. doi:10.5829/idosi.wasj.2013.25.10.13390

Drachuk, Yu.Z. & Trushkina, N.V. (2014). Foreign Experience of Institutional Provision of Venture Financing for Innovative Development. Young Scientist, 8(11), 95.

Gapsalamov, A. R. (2015). Conditions of soviet economy development in the middle of XX century and factors of its crisis. International Business Management, 9(5), 862-867. doi:10.3923/ibm.2015.862.867

Gompers, P. (2007). Venture Capital. Handsbook of Corporate Finance. Empirical Corporate Finance, 1, 484.

Ivashov, R.M. (2014). Development of the system of venture investment of innovation activities of economic entities. St. Petersburg.

Krotkova, E. V., Mullakhmetov, K. S., & Akhmetshin, E. M. (2016). State control over small business development: Approaches to the organization and problems (experience of the Republic of Tatarstan, the Russian federation). Academy of Strategic Management Journal, 15(SpecialIssue1), 8-14.

Nyrov, A.A. (2009). The review of the venture capital market in Europe and its distinctive differences from the American model of venture capital. Collection of articles “Economics and Management”, 11. Moscow: MAX Press.

Rylov, D. V., Shkurkin, D. V., & Borisova, A. A. (2016). Estimation of the probability of default of corporate borrowers. International Journal of Economics and Financial Issues, 6(1), 63-67.

Shkurkin, D. V., Ryazantsev, S. V., Gusakov, N. P., Andronova, I. V., & Bolgova, V. V. (2016). The republic of Kazakhstan in the system of international regional integration associations. International Review of Management and Marketing, 6(6), 174-179.

Ugnich, E.A. (2013). Economic nature and the contradictions of the development of venture capital in the Russian economy. Bulletin of the Don State Technical University, 7-8(75), 148-155.

Vranovich, E.V. & Michurina, O.Yu. (2013). Venture Capital in Innovative Economic Development. Topical Issues of Economics and Law, 4 (28), 113-118.

Zheng, Y., Liu, J. & George, G. (2006). Dynamism in capabilities and networks: Implications for wealth creation in technology start-ups. Working Paper, Imperial College London.

1. Kazan Federal University, Elabuga Institute of Kazan Federal University, Elabuga, Russiaб E-mail: 9sov@bk.ru

2. Noyabrsk Institute of Oil and Gas (branch) of Tyumen Industrial University, Noyabrsk, Russia

3. National Research Nuclear University MEPhI (Moscow Engineering Physics Institute), Moscow, Russia

4. Plekhanov Russian University of Economics, Moscow,

5. Financial University under the Government of Russian Federation, Moscow, Russia