Vol. 39 (Nº31) Year 2018. Page 20

Vol. 39 (Nº31) Year 2018. Page 20

Satsita S. KHASANOVA 1; Sergey V. RYAZANTSEV 2; Ruzanna V. MIROSHNICHENKO 3; Igor Ya. BOGDANOV 4; Sergey V. MARTYNENKO 5

Received: 18/03/2018 • Approved: 28/04/2018

ABSTRACT: Investments today is the necessary conditions for resuming and sustaining economic growth, and therefore improve people's lives. The most important activity in the investment sector is the promotion of foreign investment in the regions. The volume of foreign investment in different regions of Russia depend on their investment climate and sequence of market reforms, the state of industrial, financial, and business infrastructure of the region. |

RESUMEN: Las inversiones actuales son las condiciones necesarias para reanudar y mantener el crecimiento económico y, por lo tanto, mejorar la vida de las personas. La actividad más importante en el sector de inversión es la promoción de la inversión extranjera en las regiones. El volumen de inversión extranjera en diferentes regiones de Rusia depende de su clima de inversión y la secuencia de las reformas de mercado, el estado de la infraestructura industrial, financiera y de negocios de la región. |

In the broadest sense, investments provide the mechanism needed to Finance the growth and development of the economy.

Investment is any instrument in which to put the money, hoping to retain or increase their value and (or) provide a positive amount of income. Free money – no investment, as the value of cash can be “eaten” by inflation, and they can't provide any income. If the same amount of money to put into a savings account in the Bank, they can be considered investments because the account guarantees a certain income.

There are various forms of investment, which differ on a number of factors: securities and real estate; debt securities; shares and options; with a lower or higher risk; for short or long term; direct and indirect.

In assessing the investment climate are usually applied output parameters – inflow and outflow of capital, inflation and interest rates, the share of savings in GDP, as well as input parameters that characterize the potential for the development of investment and risk of their implementation (Tikhonova, 2005).

Due to the large number of factors affecting the investment climate, you can rate it on various criteria (Karepova et al., 2015). The most important is: natural resources and the environment, the quality of labour resources, level of development and availability of infrastructure, political stability and predictability, the probability of occurrence of force majeure, macroeconomic stability, state budget, balance of payments, public debt, including external, the quality of governance, the policies of Central and local authorities, legislation, completeness and quality of regulation of economic life, the degree of liberalization, the rule of law and the rule of law, crime and corruption, protection of property rights, the level of corporate governance, the duty of performance by the partners of the contracts, the quality of the tax system and the level of tax burden, the quality of the banking system and other financial institutions, access to credit, openness, rules for trade with foreign countries, administrative, technical, informational and other entry barriers to the market, the level of monopolization of the economy.

In general, all factors of the investment climate can be divided into two large groups – is the potential and level of risk. To the potential can be attributed to factors such as: natural resources, infrastructure development, security of state etc. And to risk include: inflation, currency convertibility, level of corruption etc.

Investment decisions are among the most difficult according to the procedure of choice. They are based on a multivariate, multi-criteria evaluation of a number of factors and trends, often acting in different directions.

The territorial aspect of investments, their confinement to a certain country, region, territory is not in doubt, since it is the regional features that determine the nature, direction, and dynamics of investments. Obviously, an investor is interested in investing in regions with a low level of risk and high level of profitability. Regions with an unfavorable investment climate need to create such conditions that would allow to attract the required amount of investment.

Therefore, assessing the investment attractiveness of the territory is the most important aspect of making any investment decision. From its correctness, the consequences for both the investor and the economy of the region and the country as a whole depend.

Getting the volume of investments required by the economy is the main condition, without which it is impossible to achieve a dynamic and stable growth of this indicator. In order to attract investment, it is necessary to ensure favorable investment conditions. In this connection, the question arises of the formation and assessment of the investment climate of the regions, which is possible with effective management of the investment process.

A study of this problem is devoted to the work of many domestic scientists - economists: V.M. Anilin, I.A. Blank, T.G. Glushkova, N.D. Guskova, N.V. Igorshin, A.B. Idrisov, N.I. Klimova, V.V. Kosov, I. Roizman, A.G. Shakhnazarov, A.D. Sheremet, O.Yu. Shibalkin and others.

Journals “Expert” and “Komersant” pay special attention to the assessment of the investment climate in the regions of the Russian Federation, publishing respective ratings annually.

Various aspects of investment appraisal, investment attractiveness, potential, risk, activity are presented by the works of foreign scientists: Set B. Barnes, G. Birman., L.J. Gitman, J. Downes, M.D. Jonck, R.N. Holt, P.M. Havranek, S. Schmidt.

However, despite the increased interest in assessing the investment climate, demonstrated by the availability of various methods aimed at measuring the level of investment attractiveness, many aspects of this problem have not been sufficiently developed.

The constant development of the economic system determines the need for continuous improvement of assessment methods, requires consideration of new factors and the development of new methods for managing the investment climate in the regions. To the insufficiently studied questions of assessing the investment climate in the regions, one should include: approaches to the definition of the basic concepts used in the assessment system, methods for selecting factors that determine the attractiveness of the investment climate, sound methods for assessing the investment climate and other.

Object and subject of research. The object of the study are investment processes that take place both at the level of individual regions of the Russian Federation and in the Russian Federation as a whole.

The subject of the study are theoretical and methodological issues of assessing the investment climate in the regions in the process of making managerial decisions to regulate the flow of investment financial resources, as well as organizational and economic relations arising in investment activities.

Theoretical and methodological basis of the research are the results of research of domestic and foreign scientists in the field of theory and practice of investment activity, regulatory legal acts of federal and regional legislative and executive bodies.

Methodical - the base of the research includes methods of system theory, probability theory, concepts and principles of investment management and macroeconomics, methods of comparative technical and economic analysis, methods of correlation, regression analysis, methods of expert assessments,

Information base of the research. The data of the Federal State Statistics Service of the Russian Federation, as well as data presented in the works of domestic and foreign researchers, forecasts of economic development of Russia until 2020 by the Ministry of Economic Development and Trade of the Russian Federation were used as an information base:

As a primary source of information in analyzing the current state of the investment climate in the regions of the Russian Federation, the reports of the economic, financial, legal press, as well as analytical and statistical surveys of the development of the regions of the Russian Federation were considered.

The scientific novelty of the work is to develop methodological and practical recommendations for the formation and assessment of the investment climate, based on the dynamic interaction of investment attractiveness and investment activity in the regions.

The investment climate is a generalized characteristic of the aggregate of social, economic, organizational, legal, political, sociocultural prerequisites that predetermine the attractiveness and expediency of investing in one or another economic system (the economy of the country, region, corporation) (Gritsyna & Kurnysheva, 2016).

Most economists treat the content of this concept equally, but with a concretization of its structure, methods of assessing the opinions of scientists differ substantially. We can distinguish three most characteristic approaches to the assessment of the investment climate (Grokholinsky, 2016).

The first one is narrowed. It is based on an assessment of the dynamics of the gross domestic product, the national income and the output of industrial products; the dynamics of the distribution of national income, the proportions of accumulation and consumption; the course of privatization processes; the state of legislative regulation of investment activity; development of individual investment markets, including stock and money markets.

The second is advanced, factor. It is based on the assessment of a set of factors that affect the investment climate. Among them:

The third approach is risky. Supporters of this approach as components of the investment climate, consider two main options: investment potential and investment risks; investment risks and socio-economic potential. Sometimes it only takes into account the risks (of credit).

Evaluation of investment attractiveness of the territory is an important aspect of making any investment decision. The more complex the situation in the region, the more experience and intuition of an investor should be based on the results of expert assessment of the investment climate. While investment decisions are among the most complex. They are based on multivariate, multi-criteria assessment of factors and trends are often mixed.

The basis of comparison of investment attractiveness of territories was based on the expert scale, which included the following characteristics of each country: legislative conditions for foreign and national investors, the possibility of capital outflow, the stability of the national currency, political situation, inflation, the possibility of using the national capital (Gritsyn & Kornysheva, 2016).

This set of indicators was not sufficiently detailed to adequately reflect the whole complex of conditions taken into account by investors. Therefore, further development of techniques for comparative evaluation of investment attractiveness of different countries has gone the way of the extension and complexity of the system evaluated parameters and the introduction of quantitative (statistical) indicators. Often used the following parameters and indicators: the type of economic systems; macroeconomic indicators (GDP, structure of economy etc); natural resource endowments; the state of the infrastructure; the conditions for the development of foreign trade; state involvement in the economy (Kobersy et al., 2017).

The emergence in the late 80-ies of the group of countries with economies in transition and the specific terms of the investments required the development of special methodical approaches. In the early 90-ies in respect of these countries a number of expert groups (consulting firm “PlanEcon”, magazines “Fortune” and “Multinational Businesses”, etc.) independently from each other were prepared by simplified methods of comparative evaluation of investment attractiveness. They took into account not only the conditions but also the results of investment, the proximity of the country to global economic centers, the extent of institutional change, democratic tradition, the state and prospects of the reforms, the quality of labor resources. Currently, comprehensive rankings of investment attractiveness of countries is regularly published by the leading economic magazine “Euromoney”, “Fortune”, “The Economist’.

The most famous and frequently cited integrated assessment of investment attractiveness of countries is the ranking of the magazine “Euromoney” on which twice a year (March and September) the evaluation of investment risk and reliability of countries. Is used for this purpose, nine groups of indicators: economic performance; political risk; state indebtedness; ability to service debt; creditworthiness; availability of Bank lending; the availability of short-term financing; the availability of long-term loan capital; the probability of occurrence of force majeure.

As for the regions, the experts of the rating service EA-Ratings (strategic partner of Standard & Poor's), followed by analysts of the journal “Expert” all the factors credit risk on debt obligations of the constituent entities of the Russian Federation are divided into:

Russia is a country so sharp inter-regional economic, social and political contrasts that prospective investor with sufficient information about the investment climate can select the region with the best investment conditions. Such information must be contained in the regional rankings of investment attractiveness (investment climate). Unfortunately, despite the fact that in some regions the situation is better than in Russia as a whole, it is not accepted to the credit rating of the state was higher than national rating. Therefore, the international image of Russia heavily affected the ability of regions to attract investments (Royzman, Grishina & Shakhnazarov, 2003).

The significant growth of the Russian economy triggered the active development of the regional cities of the Russian Federation. And so today they have also become attractive not only for Russian investors and for foreign. The growth of regional markets has become commercial property. Actively carried out development of warehouse real estate. At a moderate pace develops office properties. The investment return of regional projects for a few basis points above the yield that can be obtained in Moscow and St. Petersburg, due to a higher level of risk (Gorokholinsky, 2016).

First, a foreign company may be hindered to the regional markets of real estate of Russia, absence of the so-called administrative resource, therefore, for a foreign investor it is advisable to have a Russian partner to enter into regional projects. Second, the high shortage of qualified personnel in the regions may hamper the implementation of the project. Thirdly, the capacity of regional markets is considerably lower capacity in Moscow and St. Petersburg markets.

All regions have the same economic, but different geographical space (Chub, 2014).

At different quantitative levels of resources, due to the geographical division of labour, the regions are in competition with each other for attracting mobile factors of production, which in the long run, specify the parameters and the scale of the investment potential of the territory (Makushkin et al., 2016). At the regional level the volume of attracted factors largely depends not on the comparative and absolute advantages, inherited like a “gift”.

From the point of view of the methodology of spatial theories of the basis of the absolute regional advantages are: the quantity and quality of labor resources, the production factor “land”, used for development, processing, and placement; geographical location on the global transport routes.

At the level of a particular region, the absolute benefits are available only to a very limited number of industries, resulting in local areas may not in the long term to attract and retain a large population and differentiated capital. The high mobility of capital creates for regions with absolute advantage, the possibility of a cumulative process of uneven development, which, on the one hand, may occur at a more rapid rate of accumulation of economic income, on the other – a deeper phase of depression, from which the territory cannot go out at all.

Usually the first sign of decline in investment capacity is the departure of highly qualified personnel due to the scope of work for remaining in their original locations. The departure of qualified personnel reduces the tax base of local budgets, which leads to a deterioration of the situation of several social groups that receive their incomes from the budget. The decrease in total welfare is almost always accompanied by a “flight” of capital, which gives a regressive process cumulative. We can draw one important conclusion: economic prosperity and decline of regions is self-developing process, reinforcing the uneven regional development.

Distribution of the regions in the overall rating of investment potential shows that the largest contribution to its formation are contributing factors accumulated from many years of economic activity: infrastructure-developed areas, innovative capacity and intellectual potential of the population. In addition to these generally accepted economic leaders like Sverdlovsk, Samara, Moscow, Kemerovo, Nizhny Novgorod region, Tatarstan, Moscow, Saint Petersburg, etc., in the top twenty included, maybe not so obvious economically powerful, but rather a region in Central Russia, Belgorod, Vladimir, Voronezh, Ryazan, Tula, involves the leaders of the Kaliningrad and Yaroslavl region.

Highlighted five potential poles of investment growth, concentrated in European Russia and the Urals, North-West, headed by the Saint Petersburg, Central Russia, led by Moscow and the Moscow region, Volga region (Samara and Saratov regions), Southern (Krasnodar region and Rostov region) and the Urals (Sverdlovsk and Chelyabinsk regions).

For foreign investors compared with domestic somewhat more attractive are Moscow, Ryazan, Vladimir, Volgograd, Voronezh, Saratov and Kemerovo region.

On the East potential hotbed of investment activity in the first place can become of the Novosibirsk region, the Altai, Krasnoyarsk and Khabarovsk region. Finally, in the North-West, the most favorable investment climate, have Leningrad, Kaliningrad region and Saint-Petersburg (Basenko, 2016).

The most important factor in the development of the investment process in the region is the activity of public authorities in creating investment attractiveness of the region.

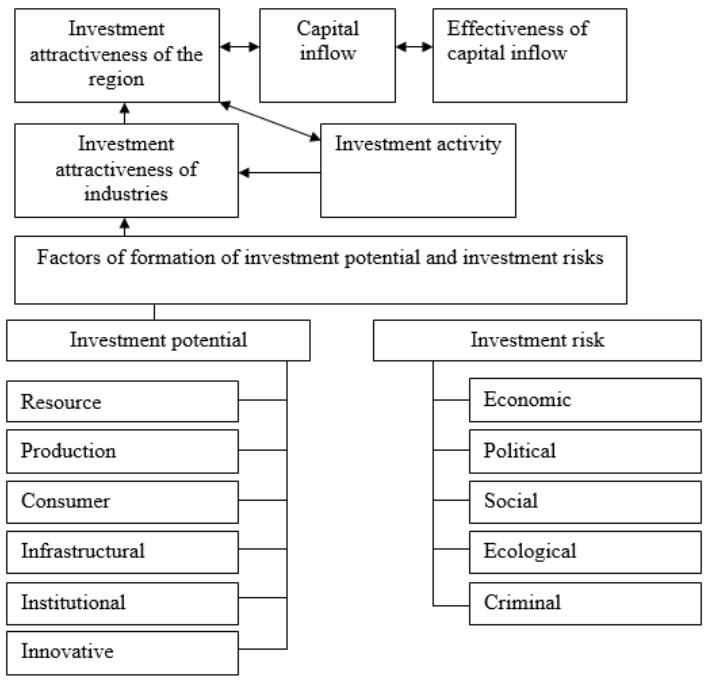

The investment attractiveness of the region it is understood the volume of investment that can be attracted to the region due to its inherent investment potential and level of investment risk in it. The higher the investment potential of the region and the lower the risk of investment activities in it, the higher the investment attractiveness of the as a consequence, higher investment activity in the region (Shkurkin et al., 2017).

Management of investment attractiveness of the region implies purposeful action of regional authorities on the criteria to increase reliability and efficiency of investments, ensuring transparency of activities at all levels, protectionism in relation to efficient investors.

After studying the components and mechanism of formation of the investment climate, we can display in the form of a schematic algorithm of forming of investment attractiveness of the region (Figure 1).

The purpose of state management of investment processes in the regions of the Russian Federation are: the increase in investment activity; reduction of risks in investing in the region's economy; improve the regulatory legal base of investment activity.

Actions of the regional administration aimed at improving the investment climate in the region and, as a consequence, increase its investment attractiveness, involve the solution of complex specific tasks (Chub, 2014).

Figure 1

Algorithm of forming of investment attractiveness of the region

Source: Prepared by the authors

The task of the administration of constituent entities of the Russian Federation, aimed at improving the investment climate in the region, include the following (Basenko, 2016):

To improve the efficiency of management of investment process at the regional level, the relevant issue is the creation and improvement of the organizational mechanism of management of investment process. Under an institutional framework understood as a set of principles and practices of management and organizational structures, coordinating the investment process and relevant legal provisions, taking into account the specifics of the region.

An institutional mechanism needs to define the principles, methods and order of planning of investment activity, as well as the structure and powers of the bodies responsible for coordinating investment processes on the territory of constituent entities of the Russian Federation.

The practical implementation of the outlined strategic and tactical tasks in the presence of the generated assumptions are obviously possible in case of regional investment policy will be based on the following principles:

State support investment activities should be based on the principles:

State support of investment activities carried out in the forms (Chub, 2014):

The system of state bodies of management of investment activity in the constituent entities of the Russian Federation includes Legislative Assembly of the region (province), the Governor, the administration, the Department of economic development and external relations, industry management departments and committees of the oblast information and analytical center.

Legislative Assembly of the region develops investment legislation that establishes the powers of the authorities of the region, and also performs overall control of the development of the investment process.

Information-analytical center. The main aim of the IAC is to participate in information and analytical support of activities of regional authorities and management, all regional authorities, the media and the scientific community of the region of prompt and reliable information on social, economic and political processes in the region.

To create an attractive image is required to inform potential investors about existing investment opportunities by conducting promotional campaigns in the media, the organization and participation in investment exhibitions, presentations and seminars at home and abroad.

Information support is a necessary element of working with international investors, especially in cases where the host country there is a change in General economic or regulatory conditions for investment activities. The quality of information plays an important role in economic development, as:

Information security management mechanism of regional investment strategy includes the following activities:

Widespread in the world practice of creation of the specialized public and semi-public agencies responsible for interaction with foreign investors. Such agencies operate in some 100 countries. Agencies perform three basic functions:

This Agency was created in Russia on the initiative of the Advisory Council on foreign investment - the Russian center of assistance to foreign investors.

At the same time, there are such organizations that with their own resources, not on government funding, perform the functions of attracting investment. So construction activities of the Interregional Fund for strategic initiatives and development Agencies and investment attraction. Target investment attraction is implemented by defining a range of companies, investments which are considered as the most important for the economic development of the region and establish direct contacts with them in order to interest prospects for investment. It is highly desirable the establishment of a regional information network with investors need information.

Informing potential investors about existing investment opportunities can only be done after proper identification of these opportunities, both at the level of the region and the entire state.

The creation of a favorable image of Russia is impossible without the development of a clear, consistent and transparent national economic policy and policies to stimulate investment activity. Relentless adherence to this policy will be the best advertising image of the Rostov region among potential investors.

The proposed institutional mechanism institutional role in the investment planning given the forecast plan (program), which must annually be approved by the administration. In the system of strategic program priorities, the most important place belongs to the policy of attracting investments as the main tool for regional economic development. The main objective of the investment policy is creating most favourable conditions for an active flow of investment capital into the economy.

Investment policy should be carried out in two directions:

1. The involvement of private, corporate, domestic capital and foreign direct investment, which have become the main source of modernization of the region's economy. Provides for the creation of attractive conditions for investors, administrative barriers. The basic principles of the investment policy is determined:

In order to overcome the administrative barriers for investors and entrepreneurs provides a system of support for the principle of “single window”, the simplification of procedures for obtaining permits for construction of facilities, including the rental and sale of land, to optimize the time of passage of documents on the harmonization of investment projects. Determined the formation of a single regional investment system involving regions and cities in the region, training of qualified personnel for work with investors.

2. Maximizing the effectiveness of investment budget funds, priority, transparency, careful assessment of support objects.

Public investment is envisaged on the basis of program-target mechanisms (mostly current expenditure), ensuring economic and social efficiency, and at the expense of the development budget of constituent entities of the Russian Federation in the form of: budget investments, state guarantees, budget loans on conditions of repayment, interest payment and urgency.

Proposed in this paper, the mechanism of management of investment processes in the region helps increase the economic efficiency of management of investment processes on the territory of constituent entities of the Russian Federation.

In order to maintain investment activity in the economy must be:

To stabilize the economy and improve the investment climate requires the adoption of a number of drastic measures aimed at solving the task of attracting foreign investment:

Proposals for the implementation of investment policy at the regional level. The analysis of scientific publications on the problem of formation of investment policy allows us to formulate a number of key directions of its implementation at the regional level:

Important value has an investment policy taking into account the specific conditions and the desire of regions to use their comparative advantages to attract domestic and foreign investors.

Using the above tools, in our opinion, will allow not only to form a favorable investment climate and implement investment policy, which needs to be directed at finding the most effective sources of funding and to support businesses and maximize production, natural and scientific potential.

Long-term recovery of the Russian economy on a modern technological level is only possible in one case – in case of emergency, the investment process, because truism says: without investment there is no economic growth.

The transition to regulated market relations will radically change the investment policy of the state to strengthen its influence on the investment process through financial and credit instruments, i.e. through taxes, tax incentives, accelerated depreciation norms and its index, accounting rate of Bank interest, subsidies from the budget of vital sectors of the economy.

An effective investment policy should cover both public investment and the creation of a favorable investment climate for private investors. Without investment it is impossible to implement the task of economic restructuring, improve the technical level of production and competitiveness of domestic products both on the domestic and world markets.

Basenko, A.M. (2016). Free economic zones in the world economy: methodological problems of organization and regulation mechanism. Rostov-on-Don.

Chub, B.A. (2014). Management of investment processes in the region. Moscow: Letter.

Gorokholinsky, A.B. (2016). Regional aspect of the investment process. Society and Economy, 6, 56-57.

Gritsyna, V. & Kurnysheva, I. (2016). Features of the investment process. Economist, 3, 78-80.

Karepova, S.G., Karabulatova, I.S., Klemovitsky, S.V., Novikov, V.S., Stratan, D.I. & Perova, A.E. (2015). New Approaches to the development of methodology of strategic community planning. Mediterranean Journal of Social Sciences, 6(36), 357-364.

Kobersy, I.S., Dzhamay, E.V., Novikov, V.S. & Shkurkin, D.V. (1017). Enterprise Finance: Essence, Composition and Structure. International Journal of Applied Business and Economic Research, 15(23), 297-304.

Makushkin, S.A., Kirillov, A.V., Novikov, V.S., Shaizhanov, M.K. & Seidina, M.Z. (2016). Role of Inclusion “Smart City” Concept as a Factor in Improving the Socio-economic Performance of the Territory. International Journal of Economics and Financial Issues, 6(S1), 152-156.

Novikov, V.S. (2013). Project management and optimization of company. In the: Socio-economic problems of development of southern macro-region: Collection of scientific works. Krasnodar, 181-184.

Royzman, I., Grishina, I. & Shakhnazarov A. (2003). Typology of investment climate of the regions on a new stage of development of the Russian economy. Investments in Russia, 3.

Shkurkin, D.V., Vikhrova, O.Yu., Sapozhnikova, E.U., Dzhamay, E.V. & Novikov, V.S. (2017). State Financial Market: Development Features. International Journal of Applied Business and Economic Research. Volume, 15(23), 365-373.

Tikhonova, V. (2005). Investment climate in Russia from the point of view of efficiency of foreign direct investment. Investment in Russia, 6.

1. Chechen State University, Grozny, Russia

2. Institute of Socio-Political Research under the Russian Academy of Sciences, Moscow, Russia; Moscow State Institute of International Relations, Moscow, Russia, E-mail: riazan@mail.ru

3. North-Caucasus Federal University, Stavropol, Russia

4. Institute of Socio-Political Research under the Russian Academy of Sciences, Moscow, Russia

5. Institute of Socio-Political Research under the Russian Academy of Sciences, Moscow, Russia