Vol. 39 (Number 33) Year 2018 • Page 21

Sankalp SRIVASTAVA 1; Charu BISARIA 2

Received: 20/03/2018 • Approved: 30/04/2018

2. Cumulative Impact of GST in The Real Estate Sector

4. Registration and Accountability of Businesses

5. Regulation and Development of RERA Act

6. Anti-Profiteering Measures (RERA benefits for the Builders)

7. The Triggering Effect of DeMo, RERA, and GST

ABSTRACT: Since the foundation of RERA (Real Estate Regulation and Development Act) and Goods and Service Tax (GST) there has been a noteworthy change in the land business in India, as purchasers are winding up more cognizant before contributing on the task. Under RERA, developers are limited from publicizing their under-development undertakings and need to get enrolled with all the information about the venture. RERA aims to direct the unregulated area and convey some train to check the task delays and unfulfilled guarantees from designers. GST intends to defend charge structure and acquire consistency costs, which is required to profit both the developers and the end clients, the home purchasers. The Real Estate developers need to pass on the advantage to the customers. While real estate specialists feel that costs will spike post-RERA, tax collection specialists feel that over the long haul GST will cut down costs of properties. On which side the prices will swing, it appears to be the truth will surface eventually. |

RESUMEN: Desde la fundación de RERA (Ley de Regulación y Desarrollo de Bienes Raíces) y del Impuesto sobre Bienes y Servicios (GST) ha habido un cambio notable en el negocio de tierras en India, ya que los compradores se están volviendo más conocedores antes de efectuar su inversión. Según RERA, los desarrolladores no pueden publicar sus proyectos subinformados y deben inscribirse la información completa sobre el desarrollo a emprender. RERA tiene como objetivo dirigir el área no reglamentada y revisar el desarrollo para verificar retrasos en las tareas y las ofertas incumplidas de los diseñadores. GST tiene la intención de defender la estructura de cargos y adquirir costos de consistencia, lo cual es necesario para beneficiar tanto a los desarrolladores como a los clientes finales: los compradores de viviendas. Los desarrolladores de bienes raíces deben transmitir la ventaja a los clientes. Si bien los especialistas en bienes raíces consideran que los costos aumentarán después de RERA, los especialistas en recaudación de impuestos consideran que a largo plazo GST reducirá los costos de las propiedades. De qué lado los precios oscilarán, parece ser que la verdad saldrá a la luz eventualmente. Palabras clave: RERA, GST, bienes raíces, economía, ingresos fiscales, derecho de la vivienda, REIT (Fideicomisos de inversión inmobiliaria) |

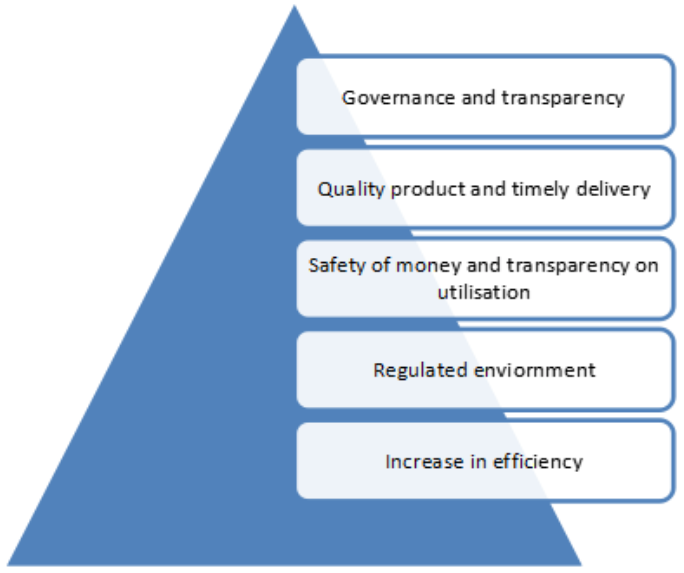

The Real Estate segment contributes very nearly 9% of the nation's GDP and is the second biggest boss after horticulture in India. With a large number of individuals moving and urbanization is going on around the land part is probably going to get a further lift from the administration with numerous plans and yojanas. The area which was up to this point scattered has been presently directed with RERA Act (Real Estate and Development Act) 2016 and GST (Good and Service Tax). From RERA the buyer will be more ensured and more prominent straightforwardness in the area which places responsibility in the designers as far as money related divulgence, convenient advancement of ventures and keeping up great corporate administration. As per specialists the private land segment post presentation of RERA it is on the way of change. RERA is forbidding the designers of pre-propelling the undertaking, raising the costs and uncover the task endorsement, venture format, enlistment compulsory and convey the venture on time. GST too is invited by the brotherhood and different partners. It will free them from twofold tax assessment affect.

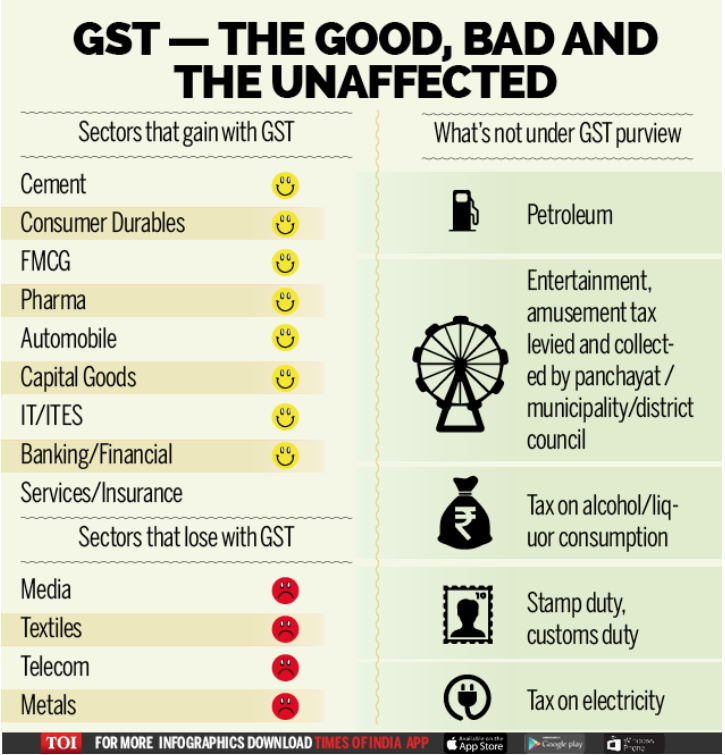

Both RERA and GST all things considered have a terrible and great impact and are relied upon to free home purchasers and financial specialists from a ton of problem. Under GST Act, a designer can assert most extreme credit; he should pay just differential assessment obligation to the administration body. GST is additionally anticipated that would support outside venture and advantage NRI financial specialists as well, it will likewise cost the development cost of creation, while at some point before the division is vigorously is saddled yet the single 12% GST is invited yet at the same time lucidity on the immaterialness or proceeded with exclusion for Affordable Housing. On the off chance that net revenue for designers is less a similar edge will be higher for the purchaser, the duties will be low the costs will naturally descend in addition the purchaser pay in a roundabout way to the engineers will likewise be killed. With all the charges descending and more leeway and straightforwardness, the RERA and GST will have a falling impact on the expanded rates for end clients. At the point when RERA gets completely utilitarian it greatly affects the land division, beginning there would be a year or taken to comprehend things appropriately. The Act will secure the enthusiasm of shoppers guaranteeing rapid redress question which will pick up certainty to the customer.

We have to comprehend that India has been searching for controls and statutory condition for very lengthy time-frame now. Both RERA and GST at first will see the ball rolling and all running forward and backward to comprehend the general ramifications Act. GST will diminish the numerous roundabout expenses and limit the degree for twofold tax collection and home purchaser to cheer.

The real estate sector, which till now was dis-sorted out, will be directed with the Real Estate Regulation and Development Act 2016 (RERA) and GST. The buyer will be more secured and more noteworthy straightforwardness in the division will be noticeable after the Government through enactment passed the RERA, which puts responsibility on the engineers as far as monetary exposure, opportune improvement of undertakings and keeping up great corporate administration hones. Home purchasers certainty is currently set to increment on the back of these conclusion building measures of the administration.

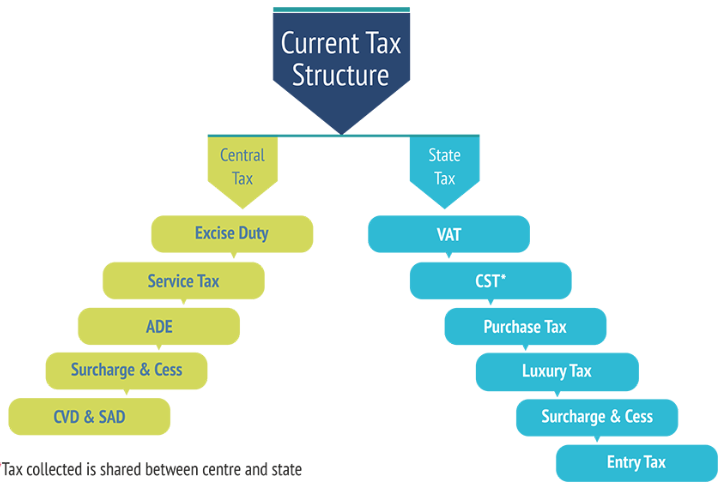

The change over to the GST administration is without a doubt one of the greatest duty changes in post-autonomy India. From today, GST adequately slices through a frustrating Gordian bunch of tax collection multifaceted nature in the nation. At the end of the day, it replaces the different duties collected by the focal and state governments and will move toward becoming subsumed of all the backhanded assessments, including focal extract obligation, business impose, octroi charge/charges, Value-Added Tax (VAT) and administration impose.

GST has been predominantly conceptualized around a 'One Nation, One Tax' theory and will help:

· kill the past falling expense structure

· Easy compliance

· Create uniform assessment rates and structure, and

· Help in lessening extra taxation rates on shoppers.

Be that as it may, the greatest distinct advantage in GST is the presentation of Input Tax Credit, whereby credits of information charges paid at each phase of creation or administration conveyance can be benefited in the succeeding phases of significant worth expansion. This makes GST on a very basic level an expense just on esteem expansion at each stage.

This implies the end buyer will accordingly just bear the GST charged by the last merchant in the store network, with set-off advantages at all the prior stages. To guarantee that makers, designers and specialist co-ops pass on the advantage to the last client, the Government has incorporated a hostile to profiteering condition in the GST charge under segment 171 of GST law. This condition plainly expresses that it is compulsory to pass on the advantage impose decrease because of info charge credit to the last client.

The Indian land area has been experiencing noteworthy changes as of late. The most recent Real Estate and Regulation Act (RERA) has just begun tending to the issue of non-straightforwardness and joins a level of responsibility on land developers and dealers which is phenomenal in the historical backdrop of the Indian property area. For the private segment, the usage of GST will be a positive assessment sponsor among property purchasers. GST may not be instrumental in cutting down the costs of private land over the here and now. It will, in any case, advantage every one of the partners of the private land division, as the impression of the segment will enhance the back of a streamlined expense structure and responsibility being settled at each stage.

A straightforward and straightforward duty connected on the price tag is the greatest take-away for property purchasers. Under the GST administration, all under-development properties will be charged at 12% (barring stamp obligation and enlistment charges). It won't have any significant bearing to finished and prepared to-move-in ventures, as there are no backhanded expenses relevant in the offer of such properties. VAT (with rates varying starting with one state then onto the next) and benefit assess together represented 7-9% of the ticket cost for a private property, which is 3-4% lower than the GST rate. Because of data asymmetry, be that as it may, customers were to a great extent ignorant of how VAT and administration charge are figured — unquestionably, the whole assessment computation was excessively mind boggling for laypeople, making it impossible to get it.

Any land item involves three cost parts, specifically land, material and work or administration costs. VAT is figured on material cost, and administration assess is computed on work and administration cost. It is extremely troublesome for purchasers to learn what parts were incorporated for count of VAT and administration charge. The usage of GST makes the count substantially easier, since the purchaser needs to pay just a solitary assessment. Likewise, the manufacturer must pass on the advantage of the value diminishment he appreciates because of info impose credit to the purchaser.

In the past expense administration, engineers likewise pondered the test of different tax collection. On different development materials acquired, the developer paid traditions obligation, focal deals assess, extract obligation, passage charge, and so forth., in this way making different occurrences of numerous tax collection. The combined weight in the end got passed on to the home purchaser.

GST will dispose of the various duties, and the advantage of having the capacity to guarantee enter charge credit can likewise enhance engineers' net revenues. Here are a couple of different advantages:

Major development materials have not seen a noteworthy change in charge rate.

Cement will be saddled at the rate of 28%, which is higher the present normal rate of expense around 20-24%

Iron bars and columns will be charged at the rate of 18%, which is like the normal rate of 20% under the old tax assessment administration

Paint, divider fittings, mortar, backdrop and artistic tiles will be saddled at 28%, which is additionally like the past normal rate of 20-25%

Sand lime blocks and fly cinder blocks will be burdened at 5%, which is lower than the past rate of 6%.

Be that as it may, the peripheral change in the level of these factors will have a tremendous effect as transportation and coordination costs decrease in the single tax assessment framework.

While there may be peripheral effect on the part in the close term, we are unquestionably taking a gander at a noteworthy change in purchaser estimation.

Designers too will discover the GST administration considerably less difficult to work with.

The Goods and Services Tax (GST) structure works on a modest bunch of key standards. The Centre will demand and gather the Central GST. States will demand and gather the State GST on supply of products and ventures inside a state. The Centre will require the Integrated GST (IGST) on between state supply of merchandise and ventures, and distribute the state's offer of assessment to the state where the great or administration is expended. The 2016 Act expects Parliament to repay states for any income misfortune attributable to the execution of GST.

The Central GST Bill, 2017 enables the focal government to advice rates at which CGST will be demanded, subject to a top of 20%. Further, organizations with turnover not as much as Rs 50 lakhs may pay charge at a level rate told by the administration (known as synthesis collect), which will be topped at 2.5%. This may prompt a couple of potential issues which are talked about underneath.

The Central GST Bill, 2017 enables the focal government to tell CGST rates, subject to a top. This suggests the administration may change rates subject to a top of 20%, without requiring the endorsement of Parliament. Under the Constitution, the ability to impose charges is vested in Parliament and state lawmaking bodies. Despite the fact that the proposition to set the rates through appointed enactment meets this necessity, the inquiry is whether it is suitable to do as such without earlier parliamentary examination and endorsement. The Constitution does not enable an expense to be demanded or gathered aside from by expert of law. Right now, most laws which exact duties, for example, salary expense, and administration assess determine charge rates in the important law, and any adjustments in these rates requires the endorsement of Parliament. While, laws, for example, the Central Excise Tariff Act, 1985 enable government to tell an adjustment in charge rates just if there should arise an occurrence of a crisis, these progressions are liable to the assessment rate, and certain confinements and tops determined in the 1985 Act.

The Central GST Bill, 2017 accommodates the middle to advise CGST rates, taking into account a different duty rate structure. The merchandise and enterprises to be exhausted at various rates will likewise be told by the legislature. It might be contended that such a structure might be against the possibility of a collecting GST at a solitary rate on all merchandise and enterprises. In December 2015, the Expert Committee on the Revenue Neutral Rate for GST had proposed a three rate structure for GST. In any case, while making this suggestion, the board of trustees had noticed that 90% of the nations which have received GST, have settled on a solitary rate structure, which takes into consideration less demanding duty organization. The thirteenth Finance Commission (2009) had suggested that GST ought to be required at a solitary rate of 12%. It had included that merchandise and enterprises, for example, training, wellbeing, and open administrations ought to be excluded from this duty. While a various assessment structure may take into consideration controlling the effect of GST on costs of fundamental things, arranging merchandise and enterprises under various pieces might be a perplexing activity. As of now, merchandise and enterprises might be exhausted at various rates crosswise over states inferable from geographic, financial and social reasons. For instance, coconut oil is exhausted in Kerala at 5%, while in Uttar Pradesh, it is burdened at 12.5%., Therefore, saddling every great and administration at a specific rate will be an intricate exercise as they can't just be moved to the closest section rate. A moment hindrance of a numerous rate structure is that it could prompt debate on grouping of merchandise and enterprises. .

At present, administrations are exhausted by the inside, and along these lines the state where they are at long last provided and devoured does not make a difference for imposing administration charge. Under GST, states will likewise have the ability to charge administrations, alongside the inside. This implies states will require SGST if there should arise an occurrence of intra-state supply of administrations, while the middle will demand IGST if there should arise an occurrence of between state supply of administrations and distribute an offer of the income to the state which is the beneficiary of the administration. The general administer to decide the area of the beneficiary is his area or address on record; there are particular tenets for different administrations, for example, telecom, property, transportation, and so on. This implies while an administration might be devoured over various states, the duty income would be ascribed to the state where the beneficiary is enlisted or his office is found. This could prompt higher duty ascribed to states that have more enrolled workplaces. For instance, an organization A situated in Mumbai promotes its items in the Patna release of a daily paper, which has its enrolled office in Delhi. For this situation, one may contend that the administration is by and large at long last devoured in Bihar. Be that as it may, as the beneficiary of administrations is in Mumbai, the duty would accumulate to Maharashtra.

The Central GST Bill enables the focal government to set up a hostile to profiteering specialist by law, or assign a current expert to complete the capacities. The expert will be in charge of guaranteeing that the decrease of duty rates by virtue of usage of GST brings about a comparable diminishment in costs. It might be contended this may enable the legislature to screen and control costs of all products and enterprises, which may meddle with the possibility of these costs being resolved in light of their request and supply in the market. Note that the value a decent or administration is reliant on a blend of variables, which include: (I) cost of information sources, (ii) innovation utilized for generation, (iii) impose rate, (iv) request and supply of item, (v) customer inclinations and regular varieties, (vi) rivalry in the market, and (vii) dissemination channels. Since costs related with these elements continue fluctuating, it might be hard to decide whether a lessening in charge rates has reflected in a proportionate reduction in cost of products or administrations. One concern could be that an organization or a gathering of organizations could conspire together to fix costs; notwithstanding, the Competition Commission of India has the ward to look at such cases and force punishments.

The method of reasoning behind sharing un-used cash in the GST Compensation Fund with the Centre and among states being not quite the same as Finance Commission equation is hazy [Section 10, GST (Compensation to States) Bill, 2017]. The Constitution (101st) Amendment Act, 2016 requires the inside to repay states for any income misfortune because of usage of GST for a five-year time frame. To repay states, an extra cess on specific products and ventures will be imposed under GST. In any case, toward the finish of the five-year time frame, the unutilised stores got by requiring the cess will be shared similarly between by focus and expresses; the offer of states will be allotted in the proportion of their SGST accumulations in the most recent year of change. This assessment is gathered from buyers by the focal government and the inquiry is the means by which to allocate it among the Center and each state. If there should arise an occurrence of direct expenses (and other focal duties, for example, traditions obligation), the equation depends on the proposals of the Finance Commission. Such recipe is utilized for partitioning the assets gathered through CGST and the inside's offer of IGST as well. The allocation of abundance stores gathered through the remuneration cess contrasts from such equation.

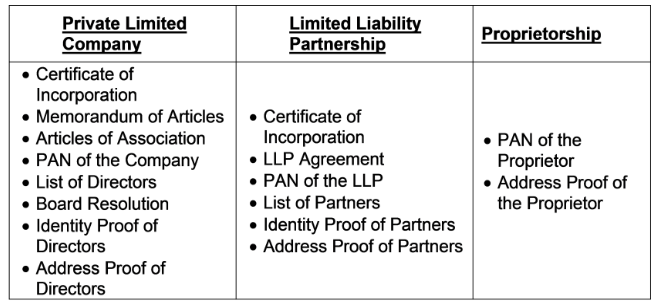

Any individual with an assessable supply turnover of over Rs.25 lakh is required to enrol for GST in India. There is additionally a system accessible for deliberate GST enrolment to enable claim to enter charge credit. The expression "individual" under GST law, who are required to pay it, incorporates proprietorship, association firms, Hindu Undivided Family, Company, LLP, Society and some other legitimate substance. GST enrolment must be acquired inside 30 days of surpassing the Rs.25 lakh turnover restrict. On account of people or elements with existing administration expense or VAT enlistment, the system for relocating the VAT or Service Tax enrolment as a GST enlistment will be declared at the appointed time.

Do you require a GST Registration Number?

It is normal that GST enrolment would be given in view of your PAN number. Another real favourable position of GST usage is that the same GST enrolment number can be utilized as a part of all states crosswise over India. Under the present VAT regimen represented by the State Governments, a VAT merchant must get VAT enrolment in each of the State, bringing about extra cost and consistence customs. Reports Required for GST Registration: The accompanying reports would be required to acquire GST enrolment:

Enrolments for GST should be possible online through an entryway (https://www.gst.gov.in/) kept up by the Central Government or State Government. The candidate should present an online application for GST enrolment utilizing Form GST-1 alongside detail of the great and administrations to be managed. Online instalment for the enrolment charge would be made accessible and impermanent GST enlistment number would be given on accommodation of use. On accommodation of the application, the candidate would need to print a duplicate of the application, append the reports specified above and messenger the same to the GST division. On check of the application, last GST declaration will be issued by the concerned officer. GST enrolment technique is relied upon to be a totally online process, like the administration imposes enlistment process. It's a basic, streamlined procedure to take after. Your assessments will be rearranged to a substantial degree and your business will encounter the simple stream of merchandise crosswise over state lines. The GST is an essential advance towards great administration and you don't need to stress over be exhausted various circumstances. It's a great opportunity to begin with your GST enlistment.

The promoter of land improvement firm needs to maintain a different escrow account each of their tasks. A base 70 for each penny of the cash from financial specialists and purchasers should be saved. This cash must be utilized for the development of the undertaking and the cost borne towards the land. To give clearness to purchasers, engineers should keep them educated of their other progressing ventures. RERA expects manufacturers to present the first endorsed plans for their progressing ventures and the modifications that they made later. They likewise need to outfit points of interest of income gathered from allottees, how the assets were used, the course of events for development, consummation, and conveyance that should be ensured by an Engineer/Architect/honing Chartered Accountant. It will be the duty of each state controller to enrol land undertakings and land operators working in their state under RERA. The points of interest of every single enlisted venture will be set up on a site for free.

RERA discusses the nature of development in ventures. In the course of the most recent couple of years, purchasers have challenged about poor of pads. The controller will guarantee assurance to purchasers in this issue for a long time from the date of ownership. On the off chance that any issue is featured by purchasers before the controller in this period incorporating into nature of development and the arrangement of administrations, the engineer should correct the same in a matter of 30 days. Developers can't welcome, promote, offer, offer, market or book any plot, loft, house, building, interest in ventures, without first enrolling it with the administrative expert. Moreover, after enlistment, all the promotion welcoming venture should bear the novel RERA enrolment number. The enlistment no. will be given task savvy. In the wake of enlisting the task, engineers should outfit subtle elements of their money related proclamations, lawful title deed and supporting archives. On the off chance that the promoter defaults on conveyance inside the concurred due date, they will be required to restore the whole cash contributed by the purchasers alongside the pre concurred loan cost specified in the agreement in view of the model contract given by RERA. In the event that the purchaser picks not to take the cash back, the manufacturer should pay month to month enthusiasm on each defer month to the purchaser till they get conveyance.

After developers enlist with the controller, a page will be made for the developer on the administrative specialist's site. The designer will be given login accreditations utilizing which it will transfer all the data with respect to the enrolled extends on the controller's site. The number, kind of flats, plots and extends and their fruition status will be refreshed at a most extreme quarterly premise. To add facilitate security to purchasers, RERA commands that designers can't solicit more than 10 for every penny from the property's cost as a propelled installment booking sum before really consenting to an enrolled deal arrangement. The controller will have the ability to fine and detain errant manufacturers in view of a case by case premise. The detainment can go up to a time of three years for a task.

While most land purchasers have been going back and forth with regards to speculations or buys of new houses post RERA and now GST, the last ensures that the Input Tax Credit (ITC) benefits got by the developer are passed on to the purchaser too. Developer is relied upon to finish this, in light of the counter profiteering arrangement in Section 171 of the GST Act. The goal of hostile to profiteering is to guarantee that the advantages inferred under GST, assuming any, ought to be passed on to the end client. Homebuyers however stay suspicious, even as the legislature is doing everything conceivable to guarantee that developers pass on ITC on development materials and administrations accessible under GST to homebuyers, with the would like to make lodging more moderate. The legislature has additionally cautioned manufacturers against charging more from purchasers put resources into progressing ventures as GST. However most purchaser bunches stay unconvinced that manufacturers will really take after these guidelines.

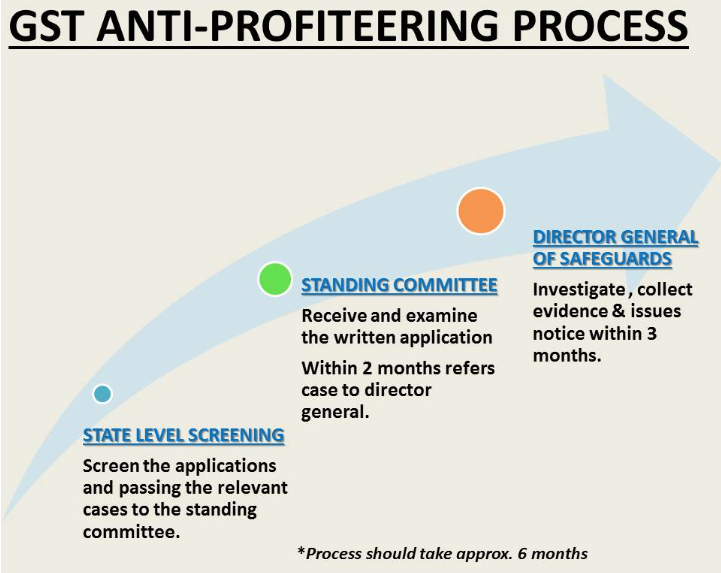

The Government to guarantee that organizations do pass on the whole advantage of lower charge rate, including ITC to the buyers, has set up a five-part Anti-Profiteering Authority for GST. The expert, to be going by a resigned secretary-level officer, can make suo motu move, other than following up on grievances of profiteering. The specialist will work for a long time before any progressions and will settle on the different punishments to be imposed. The essential obligation of the expert is influence organizations to discount the value diminishment on a proportionate premise to customers. Where the buyer can't be recognized, the sum would be credited to the shopper welfare finance. A hunt cum-determination board of trustees will be set up for settling the individuals from the counter profiteering expert which is probably going to take around two months to conclude. Other than the director, the four different individuals from the specialist will be joint secretary-level officers who have been officials in focal extract and administration charge either at the Centre or States. In any case, the legislature hopes that the Anti-Profiteering condition won't be utilized every now and again and will serve for the most part as a hindrance. One of the ways they want to accomplish this by giving solid teeth to the Anti-Profiteering Authority, particularly in managing land. An expansion in land costs is something the Centre is frantically attempting to stay away from, and thus the punishments forced will be steep.

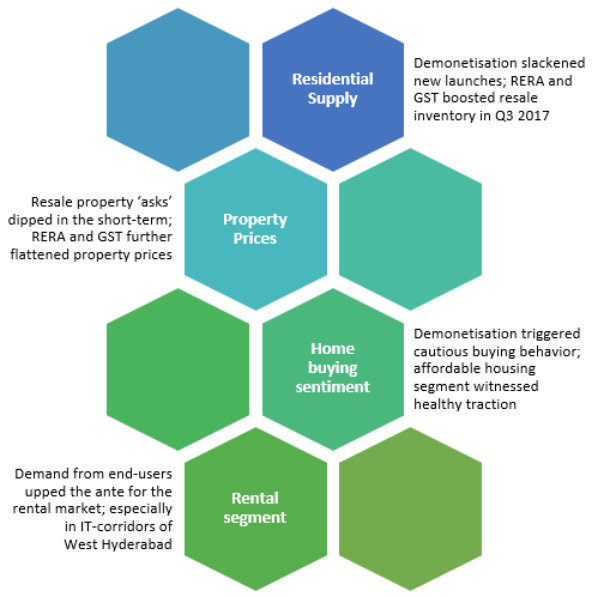

It is obviously apparent from the striking and daring strides of the present Indian government that some huge renewals are occurring in the Indian economy. In the event that you flip a few pages from the past, everything began with demonetisation in the period of November 2016 to annihilate the issue of dark cash. At that point, RERA was executed on May 1, 2017. The current one is GST, which was appropriate from July 1, 2017. Land is a standout amongst the most vital driving highlights for any economy. This reality isn't been escaped any of us that these three reconstructions will tremendously affect Indian land advertise. Along these lines, here are a few effects that Indian realty advertise has seen up until now and sooner rather than later. Initially demonetisation, at that point RERA and now GST, this is without a doubt a standout amongst the most progressive time in the historical backdrop of the Indian economy. The effect of these three variables has acquired extraordinary changes the business, impose and administrative condition in India. As these historic point advancements have been actualized inside a brief timeframe term, so clearly it will have a few issues till we and our economy ends up plainly acquainted with it. In any case, in the more drawn out run, it will acquire straightforwardness the framework and lift the certainty of speculators in India. In the midst of every one of these changes, Indian land division has begun seeing an expansion in both residential and remote speculations. Reports say that in the main portion of 2017, the realty advertise has figured out how to get $3.15 billion from various financial specialists. The starting of REITs (Real Estate Investment Trusts) and expanded in the straightforwardness are to give some examples reasons will effectively fill in as an impetus to pull in tricking more interests in the coming years. On the off chance that specialists are to be accepted, enormous players of the land market will touch new tallness in the coming years. Be that as it may, little players will discover it somewhat hard to support in this fluctuating business sector because of development in consistence cost.

This will get an ascent joint advancements as little land engineers won't ready to agree to the stringent RERA leads and should converge with the built up players. The individuals who are doing their business with straightforwardness will just get by in future. RERA in its initial 6 or 12 months will have some perplexity in the market, however in the more extended run; it will bring straightforwardness and streamline the things in the land world all through the nation. With the usage of GST, rather than paying different expenses, manufacturers and designers would now be able to pay single assessment. There are chances that there may have an expansion in the charges at the last stage, yet the simple accessibility of credits won't offer much weight of a little ascent in charges.

Under the prior law, purchasers were obligated to pay charges contingent upon the development status of the property, i.e., regardless of whether the property was under development or finish. When acquiring a property under development, a purchaser was subjected to the instalment of VAT, benefit assess, stamp obligation, and enrolment charges. Properties bought after consummation were excluded from VAT and administration impose, and just stamp obligation and enrolment charges were payable. In addition, the state where the property was found was likewise a pertinent thought since VAT, stamp obligation, and enrolment charges — all being state demands — differed from state to state. The greatest takeaway is that GST is a straightforward assessment that applies to the general price tag. All properties under development will be charged at 12 percent of the property estimation. This rejects stamp obligation and enrolment charges. For finished properties, the prior arrangements will proceed and purchasers will pay no backhanded expense at a bargain of prepared to-move-in properties.

Beforehand, engineers were subject to pay traditions obligation, focal extract obligation, VAT, section charges, and so on development material expenses. They likewise needed to pay a 15 percent assess on administrations like work, modeller expenses, endorsement charges, lawful charges, and so forth. Inevitably, this taxation rate was exchanged to the purchaser. Under the new administration, in any case, the adjustments in development costs are not as troublesome. For example, bond will now be burdened at the rate of 28 percent under GST. This is higher than the present normal duty rate of roughly 23-24 percent, yet a great deal of extra assessments charged over the normal rate will now be subsumed under GST. Press bars and columns utilized as a part of the development of structures are currently charged at the rate of 18 percent, which is not as much as the past normal rate of 19.5 percent. Moreover, the lessened cost of coordination will bring about a decrease of costs also. The information impose credits will likewise help in expanding net revenues. A designer will be qualified for take input credits on the offer of property under development against the assessments that are paid by the purchaser. This is relied upon to cut down the undertaking expense to the designers, and the engineers should pass on the advantage of the value decrease to the purchaser. Before GST, a tremendous level of every land venture use went unrecorded in the books. GST will chop down this rate because of distributed storage of invoicing. The land segment will likewise profit with the new expense law positively affecting every single auxiliary industry since this part has an animating interest for more than 250 subordinate enterprises.

Under GST, an ISD idea has been proposed for exchanging the expense credit of info benefits between at least two areas. Any provider of products or administrations can be viewed as an ISD. An ISD can exchange credit for a wide range of GST, including CSGT, SGST, or IGST. Further, an ISD can be any provider of merchandise or administrations. Thinking about different state enlistment, an ISD could be utilized as a device to guarantee ideal use of head office related credit, bringing about genuine cost decrease. Moreover, assessed of a sensible size having ISD office should document 61 returns in a year.

Consistence prerequisites will undoubtedly increment in the GST time, in any case, so organizations should outfit. All evaluates (counting composite merchant) will now be required to record yearly profits for or before 31st December following the important money related year. Additionally, surveys must record yearly returns for each enlisted branch and stockroom. There is a compulsory review prerequisite by Chartered Accountant or Cost Accountant where the enrolled substance's total turnover amid money related year crosses Rs 1 crore. In situations where a review is required, the yearly returns should be joined by a duplicate of the inspected yearly record and compromise articulation that accommodates yearly returns evaluated accounts.

Considering the new consistence challenges for the real estate business under GST, organizations should convey fitting changes to their IT frameworks keeping in mind the end goal to be GST consistence prepared. Moreover, the Real Estate (Regulation and Development) Act, 2016, will introduce an out and out new requirement for automation. Automation will give an immense exhibit of advantages, including convenient consistence, report age, examination of reports, basic leadership, cost-adequacy with lessened staff, specialized and online help, and that's only the tip of the iceberg. Organizations that receive Avalara's GST Cloud arrangement will be in the best position to effectively explore the difficulties ahead. Avalara is an accomplished application specialist co-op (ASP) and accomplice of approved GST Suvidha Providers (GSPs).

The impact of GST on real estate sector is expected to be neutral under GST. Though still, there is going to be a substantial benefit from GST as it will bring a lot of required transparency and accountability. Developers/Contractors would reap the benefit of many taxes which will be subsumed by GST.

“Real estate sector should be happy with GST even if the rate declared is higher than current rate”

Emil Malizia , (1992) "A Framework for Real Estate Feasibility Research", Journal of Property Valuation and Investment, Vol. 10 Issue: 3, pp.640-645.

James A. Graaskamp, (1992) "Fundamentals of Real Estate Development", Journal of Property Valuation and Investment, Vol. 10 Issue: 3, pp.619-639.

Surendra S. Yadav, Ravi Shankar, (2017) "Editorial", Journal of Advances in Management Research, Vol. 14 Issue: 2, pp.126-127, https://doi.org/10.1108/JAMR-02-2017-0021.

Bose S., Das A. (2013, March 19) Estimation of Counterfeit Currency Notes in India—Alternative Methodologies. Reserve Bank of India. URL(consulted 4 February 2017), from https://www.rbi.org.in/scripts/PublicationsView.aspx?id=14947 Google Scholar

Renhe Liu, Eddie Chi-man, HuiJiaqi LV, Yi Chen (2016, June 07), What Drives Housing Markets: Fundamentals or Bubbles?, The journal of real estate finance and economics, November 2017, Volume 55, Issue 4, pp 395–415.

Damodaran H. (2016, November 21) ‘Why Narendra Modi’s Demonetisation Move is Unprecedented’, The Indian Express. URL (consulted 4 February 2017), from http://indianexpress.com/article/explained/demonetisation-policy-black-money-narendra-modi-4386373/ Google Scholar.

Devasahayam M. (2016, December) ‘Dissecting “Demonetisation”’, gfiles, 10(9). URL (consulted 11 February2017), from http://www.gfilesindia.com/frmArticleDetails.aspx?id=1597&Name=GOVERNANCE Google Scholar.

Abhyankar R. (2016, December 1) ‘India Needs a ‘200 Note, not a ‘2,000 Note and the Science Behind It’, Moneylife. URL (consulted 13 February 2017), from http://www.moneylife.in/article/india-needs-a-rs200-note-not-a-rs2000-note-and-the-science-behind-it/49013.html Google Scholar

Kobad Ghandy, (2016, December 10) “demonetisation”, Economic and Political Weekly, Vol. 51, Issue no. 50, 10 December 2016.

Anantha Ramu M.R, K. Gayithri, (2017, July 17), “Fiscal Consolidation verses Infrastructural Obligation”, Journal of Infrastructural Development, Volume 9 Issue 1, 2017.

Marc K. Francke, Alex van de Minne (2017, August 29), The Hierarchical Repeat Sales Model for Granular Commercial Real Estate and Residential Price Indices, The journal of real estate finance and economics, November 2017, Volume 55, Issue 4, pp 511–532.

Martin Hoesli, Stanimira Milcheva, Alex Moss (2017,October12), Is Financial Regulation Good or Bad for Real Estate Companies? – An Event Study, The journal of real estate finance and economics, pp 1–39.

Thomas P. Boehm, Alan M. Schlottmann (2017, November), Mortgage Payment Problem Development and Recovery: A Joint Probability Model Approach, The journal of real estate finance and economics, November 2017, Volume 55, Issue 4, pp 476–510.

Web Sites

http://www.dnaindia.com/money/report-demonetisation-tohave-positive-impact-on-economy-godrej-2282372

http://marketrealist.com/2016/11/great-indian-demonetization/

Websites (accessed on 17-01-2018)

www.econoicstimes.indiatimes.com

1. Research Scholar at Amity Business School, Amity University. Contact email : sankalps95@gmail.com

2. Assistant Professor at Amity Business School, Amity University. Contact email : chrbisaria@yahoo.co.in