Vol. 39 (Number 33) Year 2018 • Page 27

Diana ALISHEVA 1; Dinara JARIKBAYEVA 2; Saltanat MASSAKOVA 3

Received: 17/04/2018 • Approved: 25/05/2018

ABSTRACT: Bank risk management becomes very important in the activity of banks in the presence of uncertainty of the external environment and the further development of crisis phenomena in the world economy. Risk development dynamics is considered based on analysis of statistical data of banking activities, which considers trends in the banking sector and assesses risk degree through management using analytical equalization coefficient. Risk management is an effective form of improving banking management. Using analytical methods for quantifying banking risks is an important tool for banking management aimed at improving it. |

RESUMEN: La gestión del riesgo bancario se vuelve muy importante en la actividad de los bancos en presencia de la incertidumbre del entorno externo y el desarrollo posterior de los fenómenos de crisis en la economía mundial. La dinámica del desarrollo de riesgos se considera en base al análisis de datos estadísticos de las actividades bancarias, que considera las tendencias en el sector bancario y evalúa el grado de riesgo a través de la gestión utilizando el coeficiente de ecualización analítica. La gestión de riesgos es una forma efectiva de mejorar la gestión bancaria. El uso de métodos analíticos para cuantificar los riesgos bancarios es una herramienta importante para la gestión bancaria destinada a mejorarla. |

Among different types of banking risks, there are different signs that are inherent in risk factors. Most often, these are market risks, interest and operating risks, credit, and liquidity. The classification of risks is discussed in the risk management standard. The most consistent approach to risk classification is presented in the risk management standard (). These principles are in use for banking institutions that can be designed to identify potential events that can affect the institution and create risks. The basic principles include the following: understandability - the language and format of risks should have a clear understanding for all units; reliability - the decision-making process depends on the financial statements and is of great importance for risk assessment; comparability - adjustment of risk parameters.

Professional risk management is one of the most important areas where financial institutions need to adapt to new conditions in order to understand the higher riskiness of banking activities in the stock market. A vivid example is the financial problems of Barings, when, in the opinion of the Supervisory Committee, there was no research on the level of high profitability of individual trader transactions (Rodriguez, 2015). Without adaptation to the risks of the stock market, it is impossible to build a system of bank risk management in a situation where banks are increasingly turning to high-risk transactions.

The efforts of financial institutions and the regulator are aimed at encouraging banks to create internal risk management systems that can identify and assess their risks from high-yield operations and carry out appropriate measures to prevent risks (Apostolik & Donohue, 2015).

In assessing risks, it is important to analyze the current state of banking activities related to risks, assess loan capital and identify risk areas. Increasingly, banking institutions are turning to integrated risk management systems that can assess quantitative and qualitative risk indicators.

For a financial institution, the risk is the uncertainty associated with the expected level of return on assets. Without the need to risk the need for the banking industry may cease to exist. Due to the fact that banks invest a significant part of their funds in assets that are sensitive to rewards, mainly credit, they face several types of risks that can be grouped into two broad categories: Market risk and Financial risk. The overall risk of the bank can be assessed by a combination of these two categories. When considering the financial risk, often companies do not take into account the market risk, which can lead to sharp fluctuations in profitability and in this respect it is important to assess the risk/return categories.

The managerial and organizational structure of banks is regulated primarily by the national laws of the Republic of Kazakhstan and regulators, has own peculiarities and differences. At the present stage, there is a harmonization of the relations between regulations of supervisory and control functions. The Basel Committee of Banking Supervision is a subdivision that is a supranational body leading the harmonization process, which is developing regulations in the field of banking supervision. The organization of the process of supervisory functions determines the system of many structures and relations (Basel Committee on Banking Supervision, 2014). In National Savings Bank of Kazakhstan Joint-Stock Company, it has a vertical component scheme that begins with the Board of Directors, becomes the Risk Management Committee of the Board of Directors, the Chief Executive Director for Risk Management, the Credit Committee, and the Assets and Liabilities Management Committee (JSC Halyk Bank, 2017).

The Board of Directors of National Savings Bank of Kazakhstan Joint-Stock Company should include a sufficient number of members with in-depth knowledge in the field of finance and risks that can assess and question the findings of top managers of the executive management body. Their level should allow assessing everything related to activities within the organization and assess external factors, that is, they should be well-oriented in matters of macroeconomics, financial markets, and the system.

The Board of National Savings Bank of Kazakhstan Joint-Stock Company is the body for the organization of an effective risk management system and the creation of structural entities for risk control. The main task of the Board is that it can create structural units for risk management. At the same time, the Board is accountable to the Board of Directors by the body that provides reporting data on approved regulatory documents, ensuring control in compliance with the existing provisions of the Risk Management Policy approved by the Board of Directors.

The studies of leading specialists in banking risk management point to different approaches in strengthening financial discipline and preventing risk situations. Papers by Heldman K., Halling M., Gestel T. V., Baesens B. devoted to programs of research and management of banking risks, including credit risks and liquidity risks. Damodaran A., Bansal A., Kauffman R. J. , Markand R. M. , Peters E., Birindelli G., Ferretti Р. consider issues of strategic risk management and the creation of an integrated risk management system (Bansal, Kauffman, Mark, & Peters, 1993; Damodaran, 2007; Heldman, 2010).

Bank risk research, like McKeynsey & Company, indicates that most of the prevention of bank risks comes from a public mood that is increasingly less tolerant of bank failures and the use of public money to save them (Rodriguez, 2015). Most parts of the prudential regulatory framework designed to prevent the recurrence of the financial crisis of 2008, now operate in financial markets in developed countries. But the future of internal risk management systems of banks is presented in the calculation of regulatory capital, as well as the potential use of a standardized approach as a minimum price level. The proposed changes can have significant consequences, especially for low-risk portfolios such as mortgages or high-quality corporate loans.

Other researchers draw attention to the need to perform supervisory functions of banking standards in risk management (Basel Committee on Banking Supervision, 2014). Commercial banking in almost all countries was exposed to a large quantitative risk. One of the rules is the minimum capital that commercial banks should have at their disposal if unexpected events occur. This type of capital requirements, in particular, is provided by the Basel Committee, whose purpose is to strengthen the key oversight issue and improve the quality of banking supervision (Birindelli & Ferretti, 2017). The history of banking crises indicates a low level of bank risk management, which occurred in different countries with an inadequate level of management of the banking systems of states. Therefore, the formation and development of banking risk management becomes an important aspect of the further development of banks in the system of international payments and the development of the economy in general. The emphasis is placed on the prevention of risks by calculating the necessary level of capital adequacy and the ratio of profitability, management of “bad loans” and participation in the investment of financial instruments.

The researches of such authors as Apostolic, Bouheni F.B., Ammi C., who faced problems of managing risks and the need to introduce risk management systems in banking are important for the practical application of experience in risk management of Kazakhstani banks (Apostolik & Donohue, 2015; Bank of Japan, 2005; Bouheni, Ammi, & Levy, 2016). An important aspect for our study is the study of credit risks. Credit risk is one of the significant risks of banks in the nature of their activities.

Due to effective credit risk management, banks not only support the viability and profitability of the banking business, but also contribute to system stability and efficient distribution of capital in the economy (Bessis, 2015). In the absence of control, small credit problems can lead to very large losses for the bank (Broad, 2013). Credit risk is the borrower's risk, which is estimated by the age of loans. One of the most common reasons is that the debtor is in a financially stressful situation (Broad, 2013). In addition, if a borrower with high credit quality worsens his reputation, he can also cause unsuccessful deals for banks. Banks invest in the debts of these customers. Then there are situations that having several such loans of poor quality, with forced to cover them at the expense of their reserves, which leads to a decrease in yield and even the emergence of a default. And good risk management helps avoiding high exposure to risk (Ghosh, 2012). In this assessment, it can be seen that credit risk continues to be most relevant in risk management. This has a significant impact on the nature of the risks and monitoring and supervision of the dynamics of loans overdue is the most important part of banking risk management.

The effectiveness of the banking industry is an important prerequisite for ensuring stability and economic growth (Van Gestel & Baesens, 2008). As a consequence, the assessment of the financial condition of banks is the main goal of regulators (Van Gestel & Baesens, 2008). Moreover, “the security of the banking system depends on the profitability and capital adequacy of banks. Profitability is a parameter that shows the approach to management and the competitive position of the bank in the banking sector. This parameter helps banks to have a certain level of risk and support it against short-term problems”.

In order to analyze the effect, it is necessary to find out whether there is a relationship between these two variables or not. The main problem is the indicators of credit risk management and profitability. The authors use the capital adequacy ratio (CAR) and the non-performing loan growth ratio (NPLR).

The hypothesis of the research can be formed as an increase in the effectiveness of banking risk management with the use of quantitative methods for estimating loans with overdue amount. Features of the development of the banking system of Kazakhstan are that the main operations of banks are related to lending to the consumer sector, which leads to a decrease in efficiency, due to the growth in non-payment of loans. This condition reduces the overall profitability of banks and affects the further development trends of the overall system of banks, causing threats to profitability and further development. The research sets out the following tasks:

- Defining the quantitative parameters of the dynamics of loans with overdue amount;

- Characterizing this dynamics on the basis of theoretical studies of banking trends;

- Formulating the parameters of the indicators of the minimum loan level, and this can negatively affect profitability.

In the study, the used methods involved statistical analysis based on measuring the growth ratio in the loan with overdue amount and the theoretical method of analytical equalization, which allow determining the dynamics of loan growth and the impact on the quality of capital. It is known that the quality of capital depends on the profitability of assets, so the level of sufficiency is significantly influenced by the level of riskiness of “bad loans”. In order to strengthen the bank's position, it is important to maintain financial discipline and strengthen supervisory functions.

The method of research can be attributed to quantitative and qualitative research. According to Green (2015), quantitative research emphasizes the quantitative evaluation of data collection and analysis. Usually quantitative research conducts a deductive approach to the relationship between theory and research, which focus on testing theory (Heldman, 2010). It combines the norms of the natural scientific model in a positivistic position and embodies social reality as an external, objective reality. On the contrary, qualitative research emphasizes words, rather than quantitative evaluation with data. It prefers to conduct an inductive approach to the relationship between theories and research, the purpose of which is the generation of theories. Qualitative research rejects the combination of practice and the norms of the natural scientific model (Hull, 2018). It emphasizes a variant of interpretation that relates to how people interpret the social world. This embodies the view of social reality as a constantly changing property of the creation of the individual.

According to Hull (2012), the purpose of the theory is to generate hypotheses that can be tested and thereby allow clarification of evaluation rules. Another principle, inductivism, means knowledge comes by gathering facts that provide the basis for the principle. Based on the above discussion, the verification of positivism can either be an analysis of those questions that can be internally verified (for example, mathematical equations) or by collecting data from those parameters that cannot be verified otherwise than “How does this relate to bank risks?”. Most likely, the psychological factor that characterizes the individual as striving to overdue payments, albeit for objective reasons, prevails in banking risks. The total bank capital supply is estimated by the capital adequacy ratio. It is important to consider the general condition of the bank when its revenues are classified by different types and it is necessary to determine the average level of dynamics of the aggregate of loan values of National Savings Bank of Kazakhstan Joint-Stock Company for 4 years.

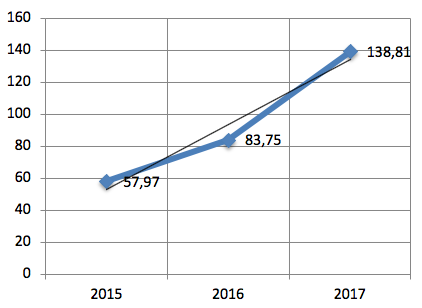

The average chronology of the interval series of loans is calculated based on the levels of the interval series and indicates how the values of the average loan growth allow determining how much the dynamics of such loans increase as the probability of risks increases with the continued growth of such loans, identifies loans as risky, determines their quantitative characteristics and possible scenarios for further development. In turn, this information is sent to the Asset Management and Liabilities Management Board of National Savings Bank of Kazakhstan Joint-Stock Company for further analysis and conducting preventive procedures in relation to the risks of this category. The peculiarities of risk assessment are that it is necessary to assess all types of risks that make up the aggregate risk, having in its characteristics the types of interest, currency, and credit risks. In total, the aggregate risk cannot be quantified, but has in its structure all kinds of risks. This is necessary to create elements of the risk management system for risk management and they have been evaluated. Risk management of risk control affects both quantitative and qualitative characteristics to have complete information about the risks.

The average volume of loans is calculated according to the formula of the average chronological value (2)

The results are presented in Table 1.

Table 1

Growth rates of loans with overdue amount of National Savings

Bank of Kazakhstan Joint-Stock Company, Republic of Kazakhstan

|

Loans with overdue amount over 90 days (KZT bln) |

Growth rate % |

Growth rate |

Average increase |

2014 |

2445.5 |

13.8 |

|

|

2015 |

12369 |

8.0 |

57.97 |

|

2016 |

1042.1 |

6.7 |

83.75 |

|

2017 |

1265.2 |

9.3 |

138.81 |

87.7 |

Note: Calculated by the author based on the data (30)

-----

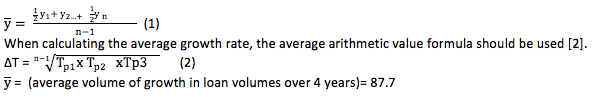

Figure 1

Dynamics of loans with overdue amount of National Savings Bank of Kazakhstan

Joint-Stock Company for 2015-2017, Republic of Kazakhstan

(The National Bank of the Republic of Kazakhstan, 2016)

Risk identification based on the calculation of the average chronological includes the creation of an integrated risk management system that incorporates risk management from all sides, while the quantitative assessment allows setting limits. The qualitative characteristic is aimed at expanding the powers of the risk management bodies and the concentration of individual committees in expanding their activities and reflecting changes in the structure of existing divisions in this activity. Although this approach has a significant cost, but allows using all the resources of a banking institution to prevent risks and save the bank's funds from future losses. Adoption of optimization management decisions reveals the strategic capabilities of the banking institution and strengthens financial discipline.

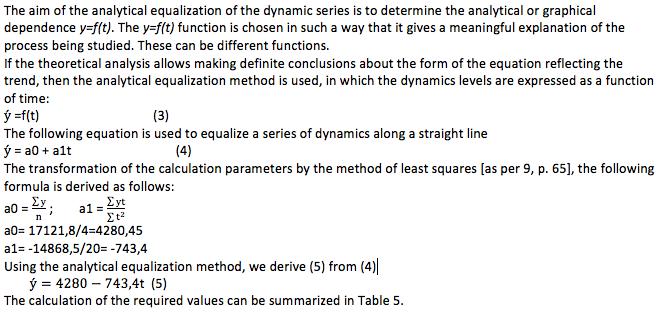

Analytical equalization is more versatile in the series of reduced values. When analyzing trends in the development of a certain activity, it is assumed that changes in the levels of variables at different time periods can be determined and expressed using mathematical formulas and in the form of functional dependencies. The form of the equation can be expressed by those characteristic numerical expressions that reflect the dynamics of the development of a particular phenomenon. In practice, the available time parameters are used to develop the form and determine the parameters of the function y=f(t), and then the level of deviations from the trend is estimated. Most often, when equalizing, different dependencies are used: linear, parabolic, and exponential. In many cases, creating models of variables series using polynomials or an exponential function does not give satisfactory results, since in the series of dynamics there are noticeable periodic oscillations around the trends of the variable series. Harmonic analysis should be used in such cases. The application of this method is well known, since it considers the law by which the values of the series levels can be predicted.

The aim of the analytical equalization of the dynamic series is to determine the analytical or graphical dependence y=f(t). The y=f(t) function is chosen in such a way that it gives a meaningful explanation of the process being studied. These can be different functions.

If the theoretical analysis allows making definite conclusions about the form of the equation reflecting the trend, then the analytical equalization method is used, in which the dynamics levels are expressed as a function of time:

Table 2

Indicators of analytical alignment of loans with overdue amount for 2014-2017

in National Savings Bank of Kazakhstan Joint-Stock Company, the Republic of Kazakhstan

|

у |

t |

t2 |

yt |

|

2014 |

2445.5 |

-3 |

9 |

-7336.5 |

6510.2 |

2015 |

12369 |

-1 |

1 |

-12369 |

5023.4 |

2016 |

1042.1 |

1 |

1 |

1042 |

3536.6 |

2017 |

1265.2 |

3 |

9 |

3795.6 |

2049.8 |

|

17121.8 |

0 |

20 |

-14868.5 |

17121 |

Note: calculated by the authors |

|||||

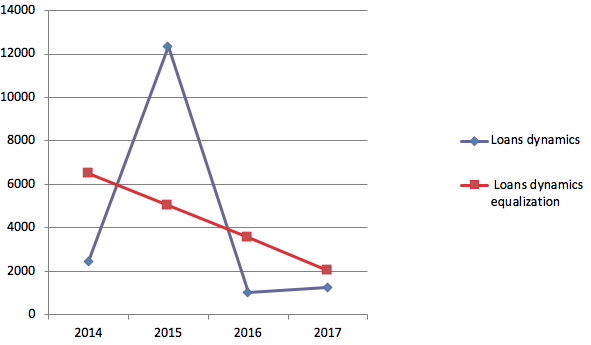

This equation can be used to calculate data for the future period. Figure 2 graphically shows the direct equalization of loan volumes. The future period will be formed using the equation of analytical equalization and the determination of numerical values equated to zero. Then the curve takes the form of a straight line, whose values represent optimal numerical values and reflect the credit policy of banks to achieve a balance.

Figure 2

Application of the equation of analytical equalization in the assessment of the

dynamics of loans of National Savings Bank of Kazakhstan Joint-Stock Company, Republic of Kazakhstan

(calculated by the authors)

As can be seen from Figure 2, when assessing the dynamics of loans, the curve is represented by values that are taken from the assessment of the current state of STBs. As can be seen in Figure 2, the dynamics of loans of National Savings Bank of Kazakhstan Joint-Stock Company looks like a sharp transition to growth, and further decline. This process is in a state of uncertainty. Uncertainty affects the credit structure of loans, reflects the return of risky lending. Therefore, the use of calculated indicators allows balancing and managing the processes in the formation of the loan portfolio. The main task becomes the possibility of using these values to determine equalization of a numerical series. The application of the equation of analytical equalization helps to determine those values of the numerical series that are necessary for the calculation of these values. Using the equation of analytical equalization allows managing the credit supply when planning the level of loans and the formation of a loan portfolio. Then the banking institution can use the values calculated using the equation of analytical equalization in order to determine a more even distribution of loan portfolio values and to plan the level of the credit supply. This method allows reducing risks of loans with overdue amount of banks of the Republic of Kazakhstan and regulates their volumes. The equation of analytical equalization allows considering the lending process as managed and to regulate risks on the basis of the calculated data presented in the reporting data of the banking sector of the Republic of Kazakhstan.

The conducted study of loans with overdue amount of National Savings Bank of Kazakhstan Joint-Stock Company, based on the application of statistical research methods, provides possible options for applying them in practice, while forming a loan portfolio. Formation of the loan portfolio considering the equation of analytical equalization enables managers to effectively use those types of loans that are the least risky in terms of numerical values obtained using the equation of analytical equalization.

From a practical point of view, the information presented in this study can be used in bank risk management. Bank managers could use credit risk management techniques to improve bank management and strive to maintain profitability of banking activities (Halling & Hayden, 2006; People’s Leasing & Finance PLC, 2013; Iverson, 2013; Harding, 2017). Thus, banks can better organize and allocate resources relative to the position of credit risks. In addition, private investors may have a better idea of how the profitability of loans will be considered in improving the effectiveness of bank lending policies. When assessing risk management from a risk report provided by banks, they may have more resources to make decisions in accordance with empirical results. Introduction of methods of analytical risk research allows banks to control risk levels and develop new approaches in risk management.

The definition of risk values determines the level of the organizational structure of the banking institution and the activities of the Asset and Liability Management Committee. The Committee can use various approaches to control critical risks and identify possible scenarios in the development of risk operations. Regulatory and supervisory functions of the Asset and Liability Management Committee contribute to the fact that risk management will be carried out using effective tools and at the proper level. The use of only the computation of the different risk levels by the Committee cannot facilitate their control, since such an assessment is made on the actual level and the analysis of past events, both for periods that are historical. Risk assessment process indicates their presence as a valid fact in the analyzed periods, but nothing more. Supervisory and control functions of the units, such as the Risk Management Board and the Assets and Liabilities Management Committee of National Savings Bank of Kazakhstan Joint-Stock, shall carry evaluation to identify hazardous zones of risk exceeding, and consider measures to prevent them (Psillaki, Tsolas, & Margaritis, 2010; Haerle, Havas, & Samandari, 2016; Analysis and evaluation of risks in business. Textbook and workshop., 2017; Volkov, 2015).

Bank products with new properties may have a high level of risk, as they have a high yield, so the ratio of profitability and risk should be taken into account when making strategic decisions taken by the Board of Directors of Kazakhstan banks. This approach improves the structure of portfolio investments and, above all, the loan portfolio (Bank of Japan, 2005; Bouheni, Ammi, & Levy, 2016; US Government Accountability Office, 2018). Risk management is a rather complex process of assessing both quantitative and qualitative aspects of banking management. This is especially complicated by the fact that new products and innovative valuation methods are used in banking. Specialists engaged in risk management should improve their skills and acquire new managerial experience. Banking institutions should encourage employees to master new types of management, improve their managerial level through social networking tools, professional growth through participation in conferences, workshops, trainings, training through professional literature and studying foreign experience (Vyatkin, Gamza, & Maievskiy, 2016).

The consumer lending mood is constantly changing, so the money supply is calculated only at a certain point in time, i.е. is a definite time indicator and gives an estimate in the amount of money in the economic space at a certain point in time - most often at the beginning of the period. Speaking about the size of the credit supply in a certain period of time, we need to know the average value of the value from the formulas of the average calculus in the time dynamic row of the average chronological or weighted average values for the period during which the credit supply would have an unchanged value (Polyakova & Shabrova, 2015; Risk management in a commercial bank, 2014; IFC).

There are several types of average values. The most known quantities, which reflect the average values, are the arithmetic mean value, and chronological value. The analysis of financial and economic activities most often uses the definition of profitability or credit dependence growth at different time intervals. This method allows for a broader review of the dynamics of credit debt and its use in planning risk management in the activities of Kazakhstan banks (Birindelli & Ferretti, 2017). Bank risk management involves the prevention of risks based on the analysis of loans of the Kazakhstani sector, which are characterized by instability and dependence on external factors (Kovalev, 2002; Financial risks. Scientific and practical manual, 2015).

It provides for an opportunity to identify all possible options for the riskiness of credit operations, allows monitoring the loan portfolio and its quality characteristics. Quantitative analysis allows displaying the quality of loans and direct efforts to structuring the money supply. The fact is that one of the main classifications of economic indicators implies their subdivision into interval and moment ones (Damodaran, 2007). Examples of the former are gross volume, profit, the volume of income for a certain period; examples of the second are data on stocks, fixed assets, and the number at a certain date. For averaging the interval indicators, the average arithmetic value formula is most often used, as for the averaging of the momentary indices, and then the average chronological value formula (Godlewski, 2015) is used. These indicators were calculated in our study and applied to the analysis of the calculation of the averaged amount of loans of National Savings Bank of Kazakhstan Joint-Stock Company. Uncertainty in assessing risks significantly affects the efficiency of banks and reflects general trends in calculating the level of risks. The importance of the research is aimed at improving risk management in banking institutions, based on the use of statistical methods for assessing loans and reducing risks.

The analysis has allowed establishing that the evaluation of loans of National Savings Bank of Kazakhstan Joint-Stock Company based on the use of methods of calculating the average chronological value and using the equation of analytical equalization gives certain results:

Quantitative assessment allows determining the average level of loans, which serves as a basis for creating reserves;

The equation of analytical equalization allows determining the numerical level of loans, which most uniformly determines the money supply in the loan portfolio;

This circumstance can regulate the process of granting loans and determine the qualitative nature of the loan portfolio, have numerical indicators to equalize the level of loans and thus reduce the level of risks.

The equation of analytical equalization can be used in the planning of numerical value of loans and in forming an effective level of the loan portfolio.

Analysis and evaluation of risks in business. Textbook and workshop. (2017).

APOSTOLIK, R., & DONOHUE, C. (2015). Foundations of Financial Risk: An Overview of Financial Risk and Risk-based Financial Regulation. n.a.: Wiley.

Bank of Japan. (2005, September). Advancing Integrated Risk Management. Retrieved March 30, 2018, from www.boj.or.jp: https://www.boj.or.jp/en/research/brp/ron_2005/data/fsk0509c.pdf

BANSAL, A., KAUFFMAN, R., MARK, R. M., & PETERS, E. Financial risk and financial risk management technology (RMT): Issues and advances. Information & Management. Vol 24, year 1993, number 5, page 267-281.

Basel Committee on Banking Supervision. (2014). Retrieved March 30, 2018, from www.bis.org: http://www.bis.org/bcbs/

BESSIS, J. (2015). Risk Management in Banking. Wiley.

BIRINDELLI, G., & FERRETTI, P. (2017). Operational Risk Management in Banks: Regulatory, Organizational and Strategic Issues (Palgrave Macmillan Studies in Banking and Financial Institutions). Palgrave Macmillan.

BOUHENI, F. B., AMMI, C., & LEVY, A. (2016). Banking Governance, Performance and Risk-Taking: Conventional Banks vs Islamic Banks. n.a.: Wiley.

BROAD, J. (2013). Risk Management Framework. Elsevier.

CISION PR Newswire. (2018, March 07). ABN AMRO chooses Wolters Kluwer and SAS to integrate finance, risk and reporting to meet regulatory compliance and improve business decisions. Retrieved March 30, 2018, from www.prnewswire.com: https://www.prnewswire.com/news-releases/abn-amro-chooses-wolters-kluwer-and-sas-to-integrate-finance-risk-and-reporting-to-meet-regulatory-compliance-and-improve-business-decisions-300609508.html

DAMODARAN, A. (2007). Strategic Risk Taking: A Framework for Risk Management. Upper Saddle River, New Jersey: Prentice Hall.

Financial risks. Scientific and practical manual. (2015).

GHOSH, A. (2012). Managing Risks in Commercial and Retail Banking. Wiley.

GODLEWSKI, C. Bank capital and credit risk taking in emerging market economies. Journal of Banking Regulation. Vol 6, year 2015, number 2, page 128-145.

GREEN, P. E. (2015). Enterprise Risk Management. Butterworth Heinemann.

HAERLE, P., HAVAS, A., & SAMANDARI, H. (2016, July). The future of bank risk management. Retrieved March 30, 2018, from www.mckinsey.com: https://www.mckinsey.com/business-functions/risk/our-insights/the-future-of-bank-risk-management

HALLING, M., & HAYDEN, E. (2006). Bank Failure Prediction: A Two-Step Survival Time Approach. SSRN, 33.

HARDING, A. (2017, July 24). Risk management in the banking sector: the role of management accountants. Retrieved March 30, 2018, from http://www.thebanker.com: http://www.thebanker.com/Comment-Profiles/Bracken/Risk-management-in-the-banking-sector-the-role-of-management-accountants?ct=true

HELDMAN, K. (2010). Project Managers Spotlight on Risk Management. Wiley.

HULL, H. (2018). Risk Management and financial institutions. Wiley.

HULL, J. (2012). Risk Management and Financial Institutions. Wiley.

IFC. (n.d.). Risk Management. Retrieved March 30, 2018, from www.ifc.org: https://www.ifc.org/wps/wcm/connect/Industry_EXT_Content/IFC_External_Corporate_Site/Industries/Financial+Markets/Risk+Management/

IVERSON, D. (2013). Strategic Risk Management: A Practical Guide to Portfolio Risk Management. Wiley.

JSC Halyk Bank. (2017, March 3). Consolidated Financial Statements and Independent Auditors’ Report For the Years Ended 31 December 2016, 2015 and 2014. Retrieved March 30, 2018, from www.kase.kz: http://kase.kz/files/emitters/HSBK/hsbkf6_2016_cons_eng.pdf

KOVALEV, V. V. (2002). Financial analysis: methods and procedures. Moscow.

People’s Leasing & Finance PLC. (2013). Annual Report 2012/13. Colombo: PLC.

POLYAKOVA, V. V., & Shabrova, N. V. (2015). Fundamentals of the theory of statistics. Yekaterinburg: Ural University.

PSILLAKI, M., TSOLAS, I. E., & MARGARITIS, D. Evaluation of credit risk based on firm performance. European Journal of Operational Research. Vol201, year 2010, number 3, page 873-881.

Risk management in a commercial bank. (2014). Moscow: KnoRus.

Risks and chances. Uncertainty, forecasting and evaluation. (2014).

RODRIGUEZ, J. (2015, February 24). Barings collapse at 20: How rogue trader Nick Leeson broke the bank. Retrieved March 30, 2018, from www.theguardian.com: https://www.theguardian.com/business/from-the-archive-blog/2015/feb/24/nick-leeson-barings-bank-1995-20-archive

The National Bank of the Republic of Kazakhstan. (2016, June 1). Current state of the banking sector of Kazakhstan. Retrieved March 30, 2017, from www.nationalbank.kz: http://m.nationalbank.kz/cont/%D0%A2%D0%B5%D0%BA%D1%83%D1%89%D0%B5%D0%B5%20%D0%91%D0%92%D0%A3_eng_01.06.2016.pdf

US Government Accountability Office. (2018, March 15). Banks Potentially Face Increased Risk; Regulators Generally Are Assessing Banks' Risk Management Practices. Retrieved March 30, 2018, from www.gao.gov: https://www.gao.gov/products/GAO-18-245

Van GESTEL, T., & BAESENS, B. (2008). Credit Risk Management. Oxford University Press.

VOLKOV, A. (2015). Risk management in a commercial bank. Practical guidebook. Moscow: Omega-L.

VYATKIN, V., GAMZA, V., & MAIEVSKIY, F. (2016). Risk management. Moscow: U-right.

1. 3rd year PhD student of JSC “Narxoz University”. di.alisheva@gmail.com

2. JSC “Narxoz University”. dinara.dzharikbaeva@narxoz.kz