Vol. 39 (Number 33) Year 2018 • Page 31

Yuliya Pavlovna SOBOLEVA 1; Andrey V. POLYANIN 2; Oksana Vyacheslavovna LEONOVA 3; Olga Aleksandrovna KORGINA 4; Aleksandr Vyacheslavovich MERKULOV 5

Received: 05/03/2018 • Approved: 17/04/2018

ABSTRACT: The purpose of the study is to form a mechanism for the effective performance evaluation of small business entities, combining a strategic approach to organizing activities with a resource, considering the development of potentials existing in the business structure. The practical significance of the results is the construction of a multifactorial model for evaluating the performance of entrepreneurial activities, allowing establishing achievable targets. |

RESUMEN: El propósito del estudio es formar un mecanismo para la evaluación efectiva del desempeño de las entidades de pequeñas empresas, combinando un enfoque estratégico para organizar actividades con un recurso, considerando el desarrollo de potenciales existentes en la estructura del negocio. La importancia práctica de los resultados es la construcción de un modelo multifactorial para evaluar el desempeño de las actividades empresariales, lo que permite establecer objetivos alcanzables. |

Making commercial decisions relates to the most complex tasks of enterprise management. One of the possible tools for regulating this process in the context of limited financial resources is to increase the performance of using the company's internal resources. Getting a loan for most commercial enterprises is quite a challenge. External sources of business financing are in most cases available to the network business. In this regard, the performance evaluation of activities is a significant strategic step in the process of achieving small business goals.

The purpose of this research is the development of theoretical and methodological provisions for the improvement of the system for performance evaluation of entrepreneurial activity in the current economic conditions. In accordance with the goal in the article, the following tasks are formulated:

– Consider approaches to performance evaluation of entrepreneurial activities;

– Formulate the criteria for performance evaluation of a small business entity based on its business potential;

– Develop a strategic model for performance evaluation of entrepreneurial activities;

– Offer a comprehensive model of business evaluation from the perspective of its business potential;

– Consider the mechanism for establishing the relationship between the target and benchmark indicators for making an effective management decision on an example of an element of the developed strategic human-potential model.

As noted in the Message of the President of the Russian Federation, the most real, requiring support and development sphere of activity of small and medium-sized enterprises is production. Providing the population with high-quality goods, the formation, and development of the commodity and logistics infrastructure can contribute to increasing the competitiveness of small and medium-sized business entities and create conditions for its entry into the foreign market.

Until now, the economy has not formed a single scientifically grounded approach to the essence of economic efficiency of economic activity, which does not allow developing a unified concept of the system of its criteria and indicators. Domestic and foreign literature notes that performance evaluation of economic entities activities is a central problem both in theory and in the practice of the functioning of companies (Heckl & Moormann, 2010; Neely, 2005; Richard et al., 2009; Sheremet, 2014; Savitskaya, 2012; Gorfinkel, 2015; Moiseeva, 2013).

Diana Heckl and Jürgen Moormann (2010), and P. Druecker (2004) evaluate business performance from the perspective of performance analysis. The enterprise must control production resources and use them as efficiently as possible. M. Porter (2005) assesses the performance of business through strategic analysis aimed at assessing competitiveness. The basis of competitiveness is productivity or “effective use of labor and capital”.

It is common knowledge that initially the performance of companies' activities was assessed using financial and economic indicators. Subsequently, it was recognized that the performance evaluation of the business entity should be linked to the objectives of its activities. In this regard, a system of balanced indicators has emerged that assesses the company's performance in four groups of indicators (Robert S. et.al, 2017). D. Keegan, et. al. (1989) argue that performance indicators determine the actions of management, so they must flow from the strategy. A number of studies assess the performance of the company from the position of a functional approach (Moiseeva, 2013), considering any indicator as a set of functions. Equally popular was the process approach, which notes that all functions performed in the organization are in a relationship (Guha, S. et. al., 1997). The so-called semantic approach (Manoj Thomas, Richard Redmond, Victoria Yoon, and Rahul Singh Thomas, 2005) deserves attention, according to which the profitability of organizations depends on the performance of their business processes. The performance analysis of these processes provides the basis for making important management decisions. The integrated approach assumes an assessment of the company's activities in interconnection and interdependence with the overall level of economic, organizational, technical, and technological development of production, the level of social development of the corporate team (Moiseeva, 2013).

Dobni and Luffman (2000) use the marketing concept based on customer satisfaction analysis, return on assets and sales, return on investment, profit, sales, and market share to evaluate business performance. Mihaela Filofteia Tutunea, Rozalia Veronica Rus (2012) consider business performance through the prism of the performance of using information resources.

In the practice of domestic companies, a systematic approach to activities performance evaluating has been widely adopted (Moiseeva, 2013, Saimina, 2016). It is based on a comparison of the results obtained and incurred costs and provides for the calculation of a number of coefficients. A systematic approach to evaluating management performance assumes that any economic system is a set of interrelated elements. The system has an input, a link to the external environment, feedback, and output. Sheremet A.D. (2014), Savitskaya G.V. (2012), Gilyarovskaya L.T. (2012), Lyubushin N.P. (2013) in their writings mainly emphasize on evaluating “internal performance” based on the calculation of financial ratios.

The work of one of the most famous domestic researchers in the field (Asaul, 2014, Bagiev, 2001) considers the system for entrepreneurial activity performance evaluation as an element of the model reflecting the interaction of the goal and the result. Such a variant approach involves analysis of the performance of the commodity, sales, price, and communication strategies in the organization's activities. Romanov and Gorfinkel (2015), Gryaznova A.G. (2003) offer to evaluate the performance of the company's activities from the position of its value. At the same time, the market uses cost-effective and profitable approaches.

The resource approach, founded by Michael Porter (2005, 2011), is a linkage of the resources available to a business entity with its strengths and market opportunities. From the standpoint of this approach, an economic category that reflects the performance of the use of financial, property, personnel, marketing, and information capacities of entrepreneurship should be used in the system of indicators for evaluating the performance of resource use. For each of these potentials, evaluation criteria have been developed in science and practice.

Analysis of the literature on the problem of evaluation and improving the performance of business structures led to the conclusion that foreign researchers often address these issues from the standpoint of analyzing business processes and productivity. The majority of domestic scientists see the set of the indicators characterizing concrete resources of commercial activity as the basis of performance evaluation of business.

During the implementation of the theoretical part of the study, it was found that there are no universal indicators to evaluate the performance of business. Organizations independently determine for themselves which key performance indicators to target. Unlike large companies, this issue is not thoroughly worked out in the segment of small business. The modern theory of commercial structures management, which is based on the principles of corporate finance (Gryaznova, 2003), examines the performance of activities from the perspective of increasing the value of the company, that is, from the standpoint of improving the welfare of the owners of the company. For small business entities, this approach is difficult to apply, since many of them have a small amount of equity and in most cases work with loans, subsidies and other forms of attracted capital. Moreover, for an owner of a small business, it is important not to increase the market value of his organization, but the revenue it brings. In view of this, it is required to determine the components that most clearly characterize the performance of the activities of small business entities.

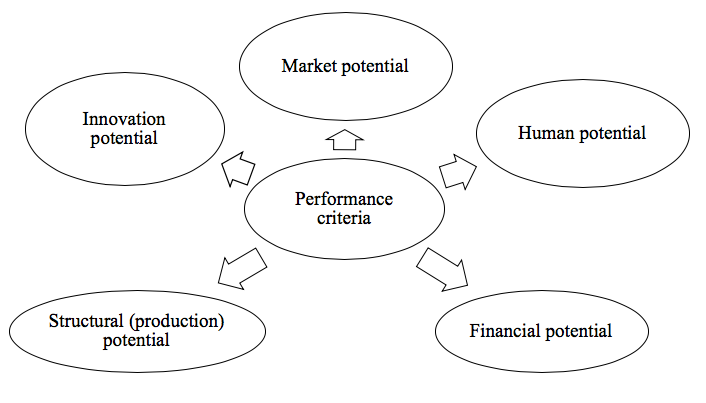

As applied to this research, considering the results of scientific research by domestic and foreign researchers (Sheremet, 2014; Savitskaya, 2012; Uskova, 2006; Kaplan, 2017; Heidari & Loucopoulos, 2014; Morris, Shirokova & Shatalov, 2013), the authors recommend to represent the whole set of performance criteria that could be the basis for evaluating the activities of small business entities in the form of several blocks (Figure 1):

Figure 1

Criteria for performance evaluation of small business entities in terms of existing potentials

(Source: developed by the authors)

Small business entities form simplified forms of accounting reporting, which makes it impossible to estimate many of the indicators that researchers suggest in the field of corporate finance and finance of organizations. It is necessary to develop such a system of indicators that would be available for the analysis of the activities of business entities, taking into account the specifics of their accounting and financial reporting. If the company calculates the performance indicators for the quarter, while not being financially stable due to the small amount of its own resources, it may be on the verge of bankruptcy within a short period. Each of the potentials presented in Figure 3 can be represented in the form of a target indicator and influencing factor criteria. The mechanism for evaluating one of the human potentials is discussed in this manuscript below.

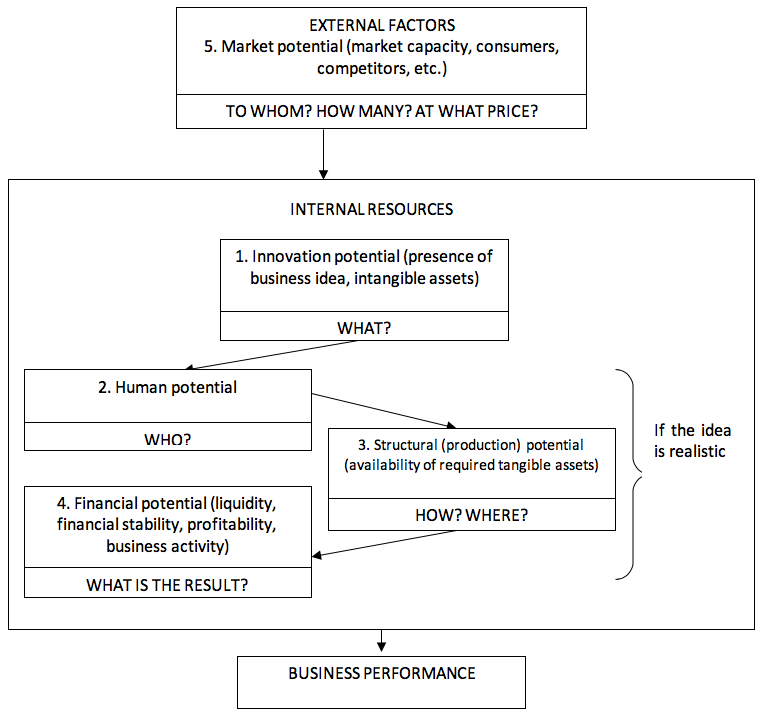

Considering the priority directions for assessing the performance of entrepreneurial activities (types of potential), the authors developed a comprehensive model for assessing business performance (see Figure 2).

Figure 2

Comprehensive model of entrepreneurship evaluation

from the position of evaluating its business potential

(Source: developed by the authors)

The presented model of cumulative research of various potentials represents a certain sequence of actions aimed at evaluating the performance of entrepreneurial activity. In the first place, the authors highlighted the evaluation of the business idea. In this case, the authors mean a systematic evaluation of product innovation that the company offers to the market. For a small business entity, the risk of losing competitiveness is very high, so certain intangible assets, R&D, the availability of scientific personnel or access to such must protect the company. Otherwise, business is doomed to a short-term existence.

Analysis of the company's innovative potential involves evaluating the entrepreneur's and their employees' abilities to develop and implement innovations related to both production and implementation of innovative solutions. However, the presence of a competitive innovative idea cannot guarantee the performance of the business process. It is necessary to have the work force available to realize this idea. In view of this, the personnel potential shall be placed second in the system of evaluating performance of entrepreneurial activity. It implies not only the provision of the organization with the necessary skills in the planned amount, but also the productivity of workers, the relationship between the number of employees, sales revenue, and performance. A peculiarity of human potential is that it is not reflected in the composition of the company's assets and is not the property of the company, but at the same time it plays a major role in the company's business potential, and as a result, in enhancing the performance of the business structure.

The structural potential includes all types of non-current assets of the organization. It can be quantitatively measured. Its evaluation implies an analysis of the available possibilities (rules and methods) of materializing the idea (product manufacturing) or an assessment of the technical feasibility of bringing the idea to the stage of the product's readiness for use or sale. A characteristic feature of many small enterprises is that they do not have own fixed assets. They own capacities either under a lease agreement or on an outsourcing basis. In this case, the structural potential implies the organization's performance of contractual terms, the quality of the services (works) provided, associated with these costs and their optimization.

Market potential characterizes the organization's position in the market, its relationship with business counterparts. Analysis of this component of the potential of the small business entity allows concluding whether the organization has a real chance of success, whether the goods it sells satisfy the market needs. This aspect involves the calculation of the capacity and market share, the assessment of consumers, competitors, and the image of the company. This information is available based on marketing research.

The financial potential can be attributed to the providing subsystems. The performance of entrepreneurial activity is based on consideration of all the listed potentials.

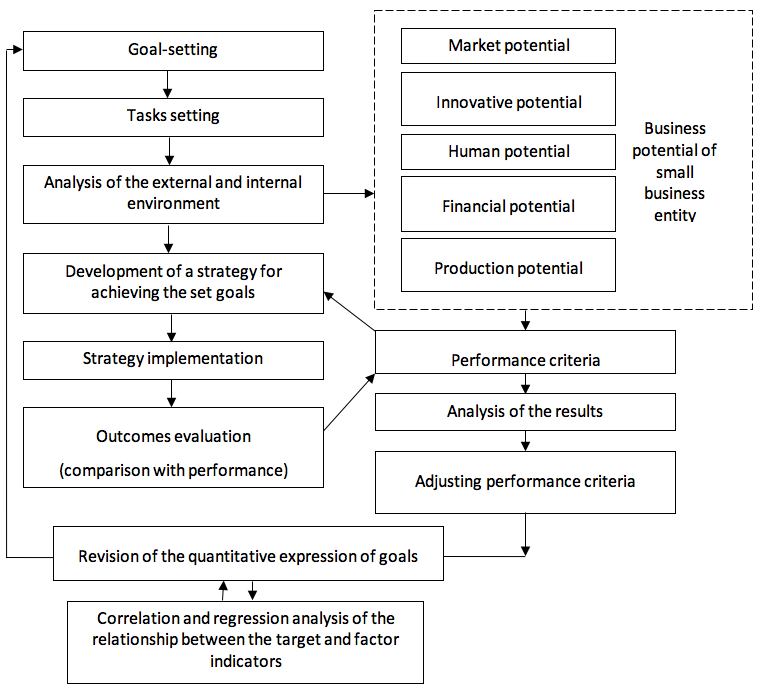

To date, the approaches to assessing the performance of companies' activities examined in the theoretical part of the research require clarification and optimization with respect to small business entities. Developing the studied variant approach to the evaluation of business performance and the approach based on the system of balanced indicators, the authors consider it appropriate to adapt them to the activities of small and medium-sized business entities, considering the specifics of these companies. The approach proposed by the authors is presented in the form of a strategic model (Figure 3).

The procedure for the strategic decision-making process is examined in detail in the studies by Papulova and Gazova (2016), Shugaepova and Ravzieva (2015), Zuzana Papulova and Andrea Gazova (2016). The model developed by the authors has the following features. As is known, the system of strategic planning of commercial activity implies, first, goal-setting (Soboleva & Parshutina, 2016).

The basic requirement for goals is that they must be measurable and clearly marked. The authors believe, the definition of profit as the main goal, which is typical for all domestic business entities, does not clearly specify their activities. Profitability of a small business depends, first, on the potential of the personnel. In this case, the authors mean the innovativeness of the employee, the suitability of the position, qualifications, etc. Only when these conditions are met, staff is able to work with maximum performance or productivity.

Figure 3

Strategic model for assessing the performance of entrepreneurial activities

(Source: developed by the authors)

The authors link small business performance with increased productivity (Haggège, Gauthier & Rüling, 2017; Pucci, Nosi & Zanni, 2017). In this case, the authors synthesize an integrated, systemic approach, and approach that considers the performance of an activity from a performance standpoint. In addition, since the goal of “increasing productivity” must have a numerical expression, the authors must predict the change in this performance indicator and determine the so-called “leverage points” or factors, affecting which it will be possible to achieve the goal. A significant issue is the choice of the criterion, influencing which the company will be able to achieve the goal. The authors recommend the use of correlation and regression analysis. It will allow making a factorial model of the dependence of the resulting indicator on the performance criteria.

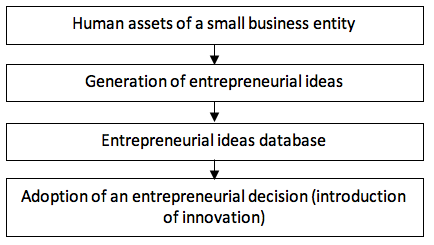

The performance of entrepreneurship is evaluated comprehensively from the standpoint of technical and economic, marketing and financial ratios and indicators. At the same time, currently available research does not give priority to any of the resources used in the process of entrepreneurial activity. Moreover, since the basis of entrepreneurial activity is innovative potential, it is possible to assert that its emergence and implementation are impossible without work force. In this manuscript, the authors consider the increase in labor productivity as a factor in increasing the innovative activity of a small business entity. From this position, small business employees are estimated as assets (Figure 4).

Figure 4

The process of realizing human assets

(Source: developed by the authors)

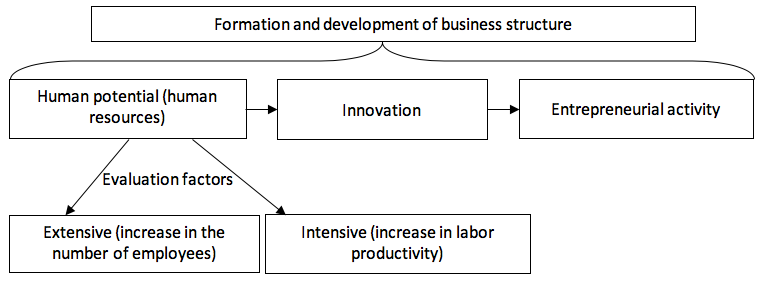

The development of human assets helps not only to generate new ideas, but also to use them effectively in the production process. Only qualified personnel can quickly adapt in changing market conditions, make competent management decisions, and work on complex equipment. That is why the authors consider it important to assess the labor potential as the basis for developing a model for evaluating entrepreneurial activity performance (Figure 5).

Figure 5

Human potential in the process of formation and development of entrepreneurial structure

(Source: developed by the authors)

Any company is, first, its employees and their performance. Financial reports, based on which the performance indicators of business activity are calculated, is already the result. If focusing solely on the financial report, rather than on the current activities of the organization in accordance with its life cycle and potential, then the organization may fail. Of course, revenue and related indicators are very important, but even more significant when the emphasis is on improving the performance of the use of resources, primarily labor.

For a well-founded formulation of the purpose of the organization's activities, a relationship must be established between the resulting (objective) and factor (criterial) indicators. The authors used the statistical method to solve this problem in the manuscript - correlation-regression analysis.

There are quantities called correlation coefficients to measure the strength of the relationship between variables. The task of the research at this stage is to establish a relationship between indicators that affect the entrepreneurial activity performance in terms of labor potential. The authors take the productivity of labor of employees of entrepreneurial structures as a resultant indicator. The number of employees, the number of companies on the market and their sales revenue is taken as a factor indicator. The initial data for performing the correlation analysis, which makes it possible to establish the relationship between the indicators, is presented in Table 1. The analysis was carried out in the whole of the Russian Federation on the materials of the survey of the activities of small enterprises, including microenterprises.

Table 1

Initial data for the correlation analysis of small enterprises of the Russian Federation

Period |

Average monthly wage, thousand RUB/people. |

Average number of employees, thousand people |

Turnover of enterprises, billion RUB. |

Number of enterprises, thousand units |

Labor performance, thousand RUB/person. |

2011 |

15743 |

11480 |

22610 |

1836 |

1969 |

2012 |

16711 |

11684 |

23464 |

2003 |

2008 |

2013 |

17948 |

11696 |

24782 |

2063 |

2119 |

2014 |

19201 |

11744 |

26392 |

2104 |

2247 |

2016 |

19796 |

11040 |

38877 |

2771 |

3521 |

(Source: Federal State Statistics Service of the Russian Federation)

Correlation analysis allowed concluding on the existence of an interrelation between the factor and the resultant index (Table 2).

Table 2

Matrix of interdependence of variables of correlation analysis

of activity of small enterprises of the Russian Federation

Variables |

Average monthly wage |

Number of enterprises |

Turnover of enterprises |

Average number of employees |

Labor performance |

Average monthly wage |

1 |

||||

Number of enterprises |

0.813 |

1 |

|||

Turnover of enterprises |

0.786 |

0.991 |

1 |

||

Average number of employees |

-0.366 |

-0.802 |

-0.855 |

1 |

|

Labor performance |

0.754 |

0.986 |

0.999 |

-0.880 |

1 |

(Source: developed by the authors)

For all pairs of variables, the value of the correlation coefficient is less than one. The relationship between the variables “average number of employees” and “turnover of enterprises”, “average number of employees” and “number of enterprises” and “average number of employees” and “labor productivity” is negative. This means there is a reverse link between the variables. The relationship between the variables “turnover of enterprises” and “number of enterprises” and “turnover of enterprises” and “labor productivity”, as well as “the number of enterprises” and “labor productivity” is positive. This means that there is a direct link between the indicators. The authors checked the significance of the calculated correlation coefficients (Table 3).

Table 3

Evaluation of the significance of correlation coefficients between variables that

reflect the activity of small enterprises of the Russian Federation (In units )

Group of indicators |

Correlation coefficient |

Check statistics, t |

Critical value t0,05;3 |

Comparing values |

Relationship between the indicators |

Performance/wage |

0.753545003 |

1.985375 |

2.571 |

t<t0,05;5 |

no connection |

Performance/amount of enterprises |

0.985810302 |

10.17181677 |

2.571 |

t>t0,05;5 |

there is a connection |

Performance/turnover |

0.998657998 |

33.39885898 |

2.571 |

t>t0,05;5 |

there is a connection |

Performance/number of employees |

-0.880317065 |

3.21416442 |

2.571 |

t>t0,05;5 |

there is a connection |

(Source: developed by the authors)

Based on the results of the comparison of the coefficient of the check statistics with the coefficient of the Student's distribution, the following conclusions are made: there is a direct relationship between the variables: “labor performance” and “number of enterprises”, “labor performance” and “turnover of enterprises”, “labor performance” and “number of employees”.

The authors conducted a regression analysis to determine the nature of the relationship between variables. The most acceptable dependent variable is the “labor performance” (“ym”) indicator. Independent variables: x1 – number of enterprises, х2 – turnover of small businesses, х3 – number of workers. The results of calculations are presented in Table 4.

Table 4

Regression statistics of the interrelation between factor and result indicators

of the activity of small enterprises of the Russian Federation (In units )

Indicator |

Value |

Explanations |

Multiple R |

0.999999213 |

The value of the correlation coefficient is close to 1, which indicates the existence of a connection between the variables |

R-square |

0.999998426 |

The coefficient of determination indicates that almost 100% of the value of the indicator “labor productivity” is due to the chosen variables. |

Observations |

5 |

Formed to review data for 5 years |

(Source: developed by the authors)

The authors use the results of the variance analysis to construct a model of the labor performance of employees of entrepreneurial structures of the Russian Federation from selected factors (Table 5).

Table 5

Summary data for building a two-factor model of labor productivity

of small businesses in the Russian Federation (In units)

Indicator |

Value |

Non-occupied member (Y-intersection) |

2671.357 |

The number of small businesses |

0.09179953499 |

Turnover of enterprises |

0.083619353 |

Average number of employees |

-0.240501318 |

(Source: developed by the authors)

The model of the dependence of labor productivity of factor indicators will have the following form:

Ypr RF=2671.357+0.091799*x1+0.0836*x2-0.2405*x3

The revealed mutual influence of economic indicators in the multifactor system obtained will allow small business entities and state authorities considering not only the trends of labor productivity changes, but also the main factors that have a primary impact on its change when planning their development. The formed function of dependence of labor productivity of workers of a small business entity on the chosen performance criteria will allow using the available resources most optimally and competently to build the development strategy. Small business structures of the Russian Federation need to concentrate resource support of their activities in the direction of increasing the growth rates of turnover.

A feature of the functioning of domestic small business entities is their clear focus on the result. However, ignoring the process of strategic planning, linking the needs and opportunities of the organization, leads to the fact that the assessment is short-lived and the results do not have any degree of stability. Based on the work of well-known domestic and foreign scientists in this field, the authors optimized the strategic approach to managing the performance of small business entities. This approach was based on the evaluation of the most significant and evaluated development potentials.

Evaluation of the entrepreneurship performance, determined based on a strategic approach to planning and analysis of its development potentials, will allow business entities, state and regional authorities to change the consumption of resources to achieve optimal economic performance. The established regression relationship between the resultant and factor indices will allow predicting the results of the activity and correct them in due time in the conditions of a lack of financial resources and other restrictions of business activity. The peculiarity and objectivity of the target model modeled in the article consist in the fact that in its development the authors used official statistical data reflecting the activities of small business entities. It is advisable to further expand the number of criteria, including in them not only the quantitative indicators considered, but also qualitative ones that reflect the level of the organization's social development, since this element also largely affects the performance of the business entity's functioning.

The proposed strategic model for evaluating entrepreneurial activities performance, linking the goal and results, as well as the approach to constructing factor models of the dependence of the effect on the criterial indicators affecting it, can be used in the practical activities of any organization related to small business entities, and can also be used by the authorities when developing forecasts and programs for small business development.

As of today, a small business entity cannot manage with a ready algorithm for managing assets and liabilities of an enterprise, since the decisions taken shall reflect not only the features of the enterprise, but also consider the state of the external environment. In this regard, there is a need for a common concept or ideology of enterprise resource management. The solution of this problem is possible when developing and implementing a performance management policy based on the enterprise development strategy.

The main factor of sustainable development of the country's economy is the increase in the performance of business entities. In the conditions of uncertainty of the external environment, lack of own financial resources and barriers to obtaining borrowed funds, improving the approach to evaluating the entrepreneurial activity performance is one of the ways to improve the performance of domestic companies and the economy of the country as a whole. A confirmation of the importance of this issue is also the fact that this problem has been systematically raised and actively discussed at the level of the country's leadership since 2015. The state authorities are attempting to reduce administrative barriers, tax burdens in the activities of small business entities. Nevertheless, no measures of external influence cannot be effective if firms themselves do not use scientifically based approaches to the organization of their business.

As of now, there is no single approach to evaluating performance of entrepreneurship. In practice, the diversity of the approaches proposed by the researchers is quite large. It is almost impossible to evaluate all aspects of entrepreneurial activity by applying the approach of one researcher or scientific school. Often, company's activity performance evaluation is reduced to an analysis of its financial and economic activities.

The article has developed a model for evaluating entrepreneurial activities performance, combining the following well-known theories and business practices approaches:

In this study, the authors listed the synthesis of these approaches in the form of a strategic model.

A scientifically sound goal-setting, linked to available resources, will yield the planned result and reduce the likelihood of adjustments to the strategic plan. For this purpose, the authors included statistical indicators characterizing the activity of small business entities in the model of forming the target indicator of labor productivity. The labor potential of small business entities is estimated by such indicators as the number of small business entities, the average number of personnel of organizations, and the turnover of business entities. Using them, the authors built a model linking the goal to the benchmarks, affecting which the business entity can effectively implement the development strategy.

The Decree of the Government of the Russian Federation as of June 02, 2016 No. 1083-r on the approval of the “Strategy for the Development of Small and Medium-sized Entrepreneurship in the Russian Federation for the period until 2030”. Retrieved from: http://government.ru/media/files/jFDd9wbAbApxgEiHNaXHveytq7hfPO96.pdf.

ASAUL, A.N., STARINSKY, V.N., STAROVOITOV, M.K., FALTINSKY, R.A. (2014). Evaluation of the organization (enterprise, business). St. Petersburg: ANPO “INSTITUTE OF ECONOMIC REVIVAL PROBLEMS”. Retrieved from: https://elibrary.ru/download/elibrary_25077215_73713509.pdf.

BAGIEV, G.L., ASAUL A.N. (2001). Organization of entrepreneurial activity: textbook. Saint Petersburg: Publishing House of Saint Petersburg State University of Economics. Retrieved from: http://www.aup.ru/books/m72/7_1.htm.

All-Russian Entrepreneurship Forum “Small Business – National Idea?”. Retrieved from: http://www.kremlin.ru/events/president/news/51186.

GILYAROVSKAYA, L.T. (2012). Analysis and evaluation of the financial stability of commercial organizations. Moscow: UNITY-DANA. Retrieved from: https://elibrary.ru/item.asp?id=20245034.

GRYAZNOVA, A.G. (2009). Evaluation of the cost of the enterprise (business). Moscow: INTERREKLAMA. Retrieved from: http://www.cons-s.ru/media/matherials/ocenka_bussines.pdf.

DRUECKER, Peter F. (2004). The Encyclopedia of management. Retrieved from: http://www.pqm-online.com/assets/files/lib/books/druker3.pdf

ZHURAVLEV, D.A. (2016). Formation and evaluation of the system of performance indicators of business structures: the dissertation author's abstract on competition for a scientific degree of the Candidate of Sciences (Economics). Saint Petersburg: Federal State Budgetary Educational Institution of Higher Education “Saint Petersburg State University of Economics”. Retrieved from: https://drive.google.com/file/d/0B0HkuB2lrZFKbVJTOERMZlJUZnc/view

Meeting of the State Council on the development of small and medium businesses. Retrieved from: http://www.kremlin.ru/events/president/news/49214.

MOISEEVA, I.I. (2013). Approaches to the evaluation of the performance of entrepreneurial activity // Socio-economic phenomena and processes. Retrieved from: https://elibrary.ru/item.asp?id=20617181.

List of instructions for the implementation of the President's Address to the Federal Assembly as of December 05, 2016. Retrieved from: http://www.kremlin.ru/acts/assignments/orders/53425.

PORTER, Michael E. (2005). Competitive strategy: Techniques for Analyzing Industries and Competitors. Retrieved from: http://www.klex.ru/7nf.

ROMANOV, A.N., GORFINKEL, V.Ya., POLYAK, G.B., SHVANDAT, V.A., ANTONOVA, O.V. (2015). ENTERPRENEURSHIP. Moscow: Unity-Dana. Retrieved from: http://biblioclub.ru/index.php?page=book_view_red&book_id=116987.

SAVITSKAYA, G.V. (2012). Indicators of financial performance of business: a substantiation and a method of calculation. Economic analysis: theory and practice. Retrieved from: https://elibrary.ru/download/elibrary_17990111_54492928.pdf

SAYMINA, D.K. (2016). Management of economic risks of business structures based on the portfolio approach: the dissertation on competition for a scientific degree of the Candidate of Sciences (Economics). Saint Petersburg: Federal State Budgetary Educational Institution of Higher Education “Saint Petersburg State University of Economics”.

USKOVA, S.I. (2006). The economic potential of an enterprise as a basis for entrepreneurial activity. Retrieved from: http://science-bsea.narod.ru/2006/ekonom_2006_2/uskova_ekonom.htm.

SHEREMET, A.D. Comprehensive analysis of sustainable enterprise development indicators: theory of economic analysis. Retrieved from: https://elibrary.ru/download/elibrary_22565408_75734994.pdf.

ANSOFF, Igor H. Conceptual underpinnings of systematic strategic management. European Journal of Operational Research. Vol 19, year 1985, number 1, page 2-19. Retrieved from: http://dx.doi.org/10.1016/0377-2217(85)90303-0.

TURTUNEA, Mihaela F., RUS, Rozalia V. Business Intelligence Solutions for SME's. Procedia Economics and Finance. Vol 3, year 2012, page 865-870. Retrieved from: http://dx.doi.org/10.1016/S2212-5671(12)00242-0.

MINTZBERG, Henry. Rethinking strategic planning part I: Pitfalls and fallacies. Long Range Planning. Vol 27, year 1994, number 3, page 12-21. Retrieved from: http://dx.doi.org/10.1016/0024-6301(94)90185-6.

DOBNI, Brook C., LUFFMAN, George. Market orientation and market strategy profiling: an empirical test of environment‐behavior‐action coalignment and its performance implications. Management Decision. Vol 38, year 2000, number 8, page 503-522. Retrieved from: https://doi.org/10.1108/00251740010378255

SOBOLEVA, Y.P., PARSHUTINA, I.G. Management of Investment Attractiveness of the Region by Improving Company Strategic Planning. Indian Journal of Science and Technology. Vol 9, year 2016, number 14. Retrieved from: http://www.indjst.org/index.php/indjst/article/view/91522/68706

GUHA, S., GROVER, V., KETTINGER, W. J., TENG, J.T.C. Business process change, and organizational performance: Exploring an antecedent model. Journal of Management Information Systems. Vol 14, year 1997, number 1, page 119-154.

KETTINGER, William J., TENG, James T. C., GUHA, Subashish. Business Process Change: A Study of Methodologies, Techniques, and Tools. Management Information Systems Research Center, University of Minnesota. Vol 21, year 1997, number 1, page 55-80. Retrieved from: http://www.jstor.org/stable/249742

HEIDARI, F., LOUCOPOULOS, P. Quality evaluation framework (QEF): Modeling and evaluating quality of business processes. International Journal of Accounting Information Systems. Vol 15, year 2014, number 3, page 193-223.

PAPULOVA, Zuzana, GAZOVA, Andrea. Role of Strategic Analysis in Strategic Decision-Making. Procedia Economics and Finance. Vol 39, year 2016, page 571-579.

HECKL, D., MOORMANN, J. (2010) Process Performance Management. In: vom Brocke J., Rosemann M. (eds): Handbook on Business Process Management 2. International Handbooks on Information Systems (pp 115-135). Berlin: Springer.

NEELY, Andy. The evolution of performance measurement research: Developments in the last decade and a research agenda for the next. International Journal of Operations & Production Management. Vol 25, year 2005, number 12, page 1264-1277.

KEEGAN, D. P., EILER, R. G., JONES, C. R. Are your performance measures obsolete? Strategic Finance. Vol 70, year 1989, number 12, page 45. Retrieved from: https://search.proquest.com/openview/39f63dbc833304f6fdccc9c4c42f26c9/1?pq-origsite=gscholar&cbl=48426

KAPLAN, Robert S., NORTON, David P. (2017). The balanced scorecard Translating. Strategy into Action. Moscow: Olimp-Business Publishing House. Retrieved from: https://www.olbuss.ru/upload/iblock/c79/ssp7.pdf

THOMAS, Manoj, REDMOND, Richard, YOON, Victoria, THOMAS, Rahul Singh. A Semantic approach to monitor business process performance. Communications of the ACM. Vol 48, year 2005, number 12, page 55-59. Retrieved from: http://libres.uncg.edu/ir/uncg/f/R_Singh_Semantic_2005.pdf.

MORRIS, M. H., SHIROKOVA, G., SHATALOV, A. The Business Model and Firm Performance: The Case of Russian Food Service Ventures. Journal of Small Business Management. Vol 51, year 2013, page 46–65.

HAGGÈGE, Meyer, GAUTHIER, Caroline, RÜLING, Charles-Clemens. Business model performance: five key drivers. Journal of Business Strategy. Vol 38, year 2017, number 2, page 6-15.

PUCCI, Tommaso, NOZI, Costanza, ZANNI, Lorenzo. Firm capabilities, business model design and performance of SMEs. Journal of Small Business and Enterprise Development. Vol 24, year 2017, number 2, page 222-241.

1. Russian Presidential Academy of National Economy and Public Administration, Moscow, Russian Federation

2. Russian Presidential Academy of National Economy and Public Administration, Moscow, Russian Federation

3. Russian Presidential Academy of National Economy and Public Administration, Moscow, Russian Federation

4. Russian Presidential Academy of National Economy and Public Administration, Moscow, Russian Federation

5. Russian Presidential Academy of National Economy and Public Administration, Moscow, Russian Federation