Vol. 39 (Number 34) Year 2018 • Page 14

Ekaterina BLINOVA 1; Kirill GERASIMOV 2

Received: 20/03/2018 • Approved: 30/04/2018

ABSTRACT: The diversity and significance of the methods for leasing payments calculation cannot be overestimated. Therefore, they obviously need to be investigated, adapted and applied. This work aims to present the results of a research of instruments for leasing payments calculation. In modern conditions, leasing has become the most suitable way for Russian enterprises to finance investments. Leasing, as a mechanism of alternative financing, plays a huge role in the implementation of strategic tasks for the technical re-equipment of enterprises. During the research we analysed contemporary methods of leasing payments management. We used different approaches for structuring and classifying the payments. Leasing payments were classified according to the forms and the frequency of payments, the methods of accrual, and the methods of payments contribution. We did the research for three methods of leasing payment contribution. They are annuity, regressive and progressive payments. According to the results of the research, it is justified that the amounts of payments for different methods of payment are different. The smallest amount of leasing payments and subsequently the fall in price of a leasing contract corresponds to the regressive payments. Contrary, the largest amount of leasing payments and the rise in price of a leasing contract correspond to the progressive schedule of payments. The trajectories of the unpaid property value are shown for the three methods of payment contribution. Thus, the comparative analysis allows us choose the exact methodological approach for determining the size of leasing payments. The research is valuable for scientists, managers and consultants who specialise in technical re-equipment, modernization and renewal of fixed assets of enterprises with various forms of ownership. |

RESUMEN: La diversidad y la importancia de los métodos para el cálculo de los pagos de leasing no pueden sobreestimarse. Por lo tanto, obviamente necesitan ser investigados, adaptados y aplicados. Este trabajo tiene como objetivo presentar los resultados de una investigación de instrumentos para el cálculo de pagos de arrendamiento. En las condiciones modernas, el arrendamiento se ha convertido en la forma más adecuada para que las empresas rusas financien sus inversiones. El arrendamiento, como mecanismo de financiación alternativa, desempeña un papel importante en la implementación de tareas estratégicas para el reequipamiento técnico de las empresas. Durante la investigación, analizamos métodos contemporáneos de administración de pagos de arrendamiento. Utilizamos diferentes enfoques para estructurar y clasificar los pagos. Los pagos de arrendamiento se clasificaron según las formas y la frecuencia de los pagos, los métodos de acumulación y los métodos de contribución de los pagos. Hicimos la investigación de tres métodos de arrendamiento de contribución de pago: estos son pago de anualidades, regresivos y progresivos. De acuerdo con los resultados de la investigación, se justifica que los montos de los pagos bajo diferentes métodos sean diferentes. El monto más pequeño de los pagos de arrendamiento y, posteriormente, la caída en el precio de un contrato de arrendamiento corresponde a los pagos regresivos. Por el contrario, la mayor cantidad de pagos de arrendamiento y el aumento en el precio de un contrato de arrendamiento corresponden al cronograma progresivo de pagos. Las trayectorias del valor de propiedad no pagado se muestran para los tres métodos de contribución de pago. Por lo tanto, el análisis comparativo nos permite elegir el enfoque metodológico exacto para determinar el tamaño de los pagos de arrendamiento. La investigación es valiosa para los científicos, gerentes y consultores que se especializan en el reequipamiento técnico, la modernización y la renovación de los activos fijos de las empresas con diversas formas de propiedad. |

To ensure competitiveness, industrial enterprises have to improve the quality of products and reduce costs. This cannot be achieved without modern means of production, therefore, firms need to timely change the morally and physically obsolete equipment. At present, many Russian enterprises need modernization. To solve long-term tasks of re-equipping enterprises with fixed assets, considerable financial resources are needed.

The technical re-equipment, modernization and renewal of the fixed as-sets of Russian enterprises was primarily financed from the profits of enterprises. The 1990s period and the subsequent regular financial crises in the Russian economy led to a complete lack of own funds for the enterprises, and as a result did not allow enterprises to update the worn out industrial machinery park and master new production technologies. Moreover, there was no reasonable credit system.

In these conditions, leasing has become the most appropriate way to finance investments for Russian enterprises. The main advantage of leasing is that it is not money that is provided, but the necessary equipment that can immediately be used in the production process. Leasing, as a mechanism for alternative financing, plays a huge role in the implementation of strategic tasks for the technical re-equipment of enterprises.

The total amount of leasing payments for the entire term of the leasing contract can be calculated as the sum of its constituent parts:

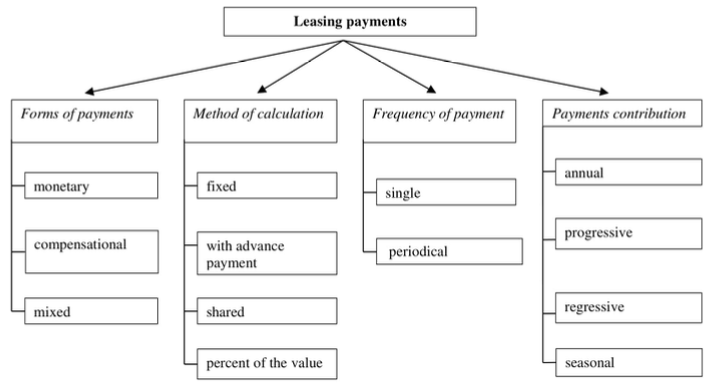

Figure 1

Classification of leasing payments

Addressing the economics authors (Dogan, 2016; Gazman, 2005; Giner, 2017; Goremykin, 2005; Keyhanian, 2015) we can classify the leasing payments according to the following characteristics:

- in monetary forms (most frequent in practise);

- compensational (if payments are made goods produced using the leased asset, or by rendering counter services to the lessor);

- in mixed form (in both monetary and compensational form).

- in the form of a fixed rate, established in the monetary (the most common option), in natural or mixed form, also in absolute form;

- with an advance payment (with partial prepayment at the time of signing the leasing contract, in the future the respective sums of money are deducted from the total amount of obligatory leasing payments, and the remaining sums are paid in the established order).

- in the form of share payments (the share of the amount of the sold products which were produced on the leased equipment) (Batkovskiy, 2016);

- as a percentage of the value of the object leased.

- one-time (are made after the property is delivered and the acceptance certificate is signed by the lessee and the supplier);

- periodic (monthly, quarterly or annual according to the schedule established by the parties). This method most corresponds to the essence of leasing. A one-time form of payment turns a leasing transaction into a simple purchase of property.

- linear (paid in proportionally equal parts);

- progressive (gradually increasing as the leased equipment is developed and the volume of output produced by the lessee is increased);

- regressive (gradually decreasing with relatively large payments in the initial stage of leasing) (Contino, 2016);

- seasonal (taking into account seasonality of cash flows of the lessee).

With the first two methods of calculation, the commission fee does not depend on the payment schedule for lease payments. In the third version of the calculation, used in the practice of leasing companies, the commission fee of the lessee, and, consequently, the total amount of leasing payments depends on the schedule of leasing payments. In leasing companies, the scheme used to calculate the commission fee is a percentage of the unpaid property value (Eisfeldt, 2009).

The most common ways of paying leasing payments are as follows:

- annuity payments (the amount of payments is constant),

- regressive payments (the amount of payments decreases during the term of the contract),

- progressive leasing payments (the amount of payments increases during the term of the contract),

- seasonal leasing payments (the amount of payments corresponds to the seasonal nature of the inflow of funds of the lessee).

The choice of the before mentioned methods of leasing payments is carried out as a result of negotiations between the lessor and the lessee (Belyakova, 2006; Bolshakov, 2006).

Each periodic leasing payment ut consists of two parts, the first part is to repay the value of the property, the second - to pay interest accrued on the unpaid property value:

Table 1

Terms of leasing contract

Equity price, monetary units |

1 000 000,00 |

Advance payment, monetary units |

300 000,00 |

Term of the contract, months |

24 |

Annual commission rate, % |

12 |

Commissions are charged on the unpaid value of the property. Calculation of the total amount of leasing payments using a regressive scheme (Kirkorov, 2006; Pavlov, 2006) is presented in the table 2.

Table 2

Calculation of leasing payments with a regressive scheme

Period, month |

Periodical leasing payment ut, monetary units. |

Commission payment part It, monetary units. |

Equity payment part Kt, monetary units. |

Unpaid cost of equity (Outstanding cost) xt, monetary units. |

0 |

– |

– |

– |

700 000,00 |

1 |

60 944,36 |

7000,00 |

53944,36 |

646 055,64 |

2 |

58 405,01 |

6460,56 |

51944,46 |

594 111,18 |

3 |

55 865,66 |

5941,11 |

49924,55 |

544 186,63 |

4 |

53 326,32 |

5441,87 |

47884,45 |

496 302,18 |

5 |

50 786,97 |

4963,02 |

45823,95 |

450 478,24 |

6 |

48 247,62 |

4504,78 |

43742,84 |

406 735,40 |

7 |

45 708,27 |

4067,35 |

41640,92 |

365 094,49 |

8 |

43 168,92 |

3650,94 |

39517,98 |

325 576,51 |

9 |

40 629,57 |

3255,77 |

37373,81 |

288 202,70 |

10 |

38 090,23 |

2882,03 |

35208,20 |

252 994,50 |

11 |

35 550,88 |

2529,95 |

33020,93 |

219 973,57 |

12 |

33 011,53 |

2199,74 |

30811,79 |

189 161,78 |

13 |

30 472,18 |

1891,62 |

28580,56 |

160 581,22 |

14 |

27 932,83 |

1605,81 |

26327,02 |

134 254,20 |

15 |

25 393,48 |

1342,54 |

24050,94 |

110 203,25 |

16 |

22 854,14 |

1102,03 |

21752,10 |

88 451,15 |

17 |

20 314,79 |

884,51 |

19430,28 |

69 020,88 |

18 |

17 775,44 |

690,21 |

17085,23 |

51 935,65 |

19 |

15 236,09 |

519,36 |

14716,73 |

37 218,91 |

20 |

12 696,74 |

372,19 |

12324,55 |

24 894,36 |

21 |

10 157,39 |

248,94 |

9908,45 |

14 985,91 |

22 |

7 618,05 |

149,86 |

7468,19 |

7 517,73 |

23 |

5 078,70 |

75,18 |

5003,52 |

2 514,21 |

24 |

2 539,35 |

25,14 |

2514,21 |

0,00 |

Total |

761 804,50 |

61 804,50 |

700 000,00 |

|

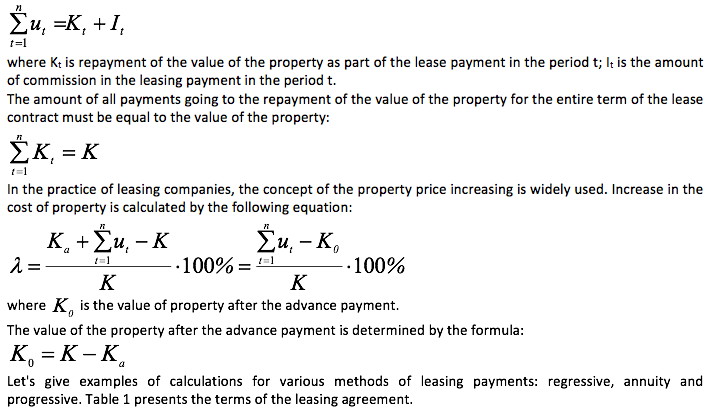

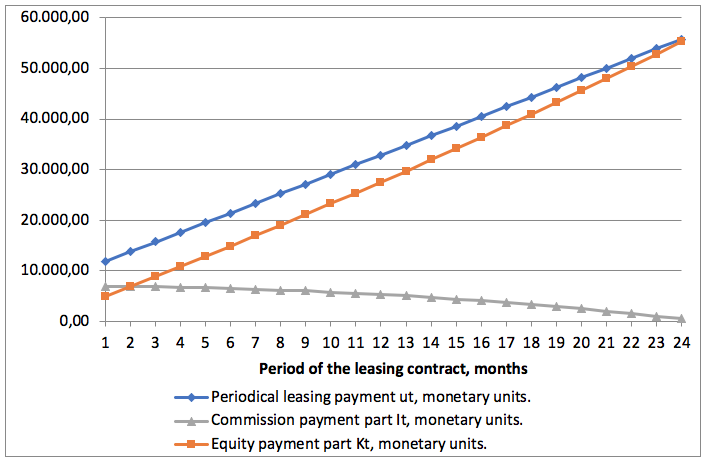

The amount of leasing payments using the regression scheme was 1061804,50 monetary units; rise in price of property - 6,18%. Graphs of regressive lease payments ut, commission payments It, payments for the repayment of the cost of property Kt are shown in the figure 2.

Figure 2

Regressive leasing payments graph

The calculation of the total amount of leasing payments using the annuity scheme is presented in the table 3.

Table 3

Calculation of leasing payments with an annuity scheme

Period, month |

Periodical leasing payment ut, monetary units. |

Commission payment part It, monetary units. |

Equity payment part Kt, monetary units. |

Unpaid cost of equity (Outstanding cost) xt, monetary units. |

0 |

– |

– |

– |

700000,00 |

1 |

32 951,43 |

7000,00 |

25951,43 |

674 048,57 |

2 |

32 951,43 |

6740,49 |

26210,94 |

647 837,62 |

3 |

32 951,43 |

6478,38 |

26473,05 |

621 364,57 |

4 |

32 951,43 |

6213,65 |

26737,78 |

594 626,79 |

5 |

32 951,43 |

5946,27 |

27005,16 |

567 621,62 |

6 |

32 951,43 |

5676,22 |

27275,21 |

540 346,41 |

7 |

32 951,43 |

5403,46 |

27547,97 |

512 798,44 |

8 |

32 951,43 |

5127,98 |

27823,45 |

484 975,00 |

9 |

32 951,43 |

4849,75 |

28101,68 |

456 873,32 |

10 |

32 951,43 |

4568,73 |

28382,70 |

428 490,62 |

11 |

32 951,43 |

4284,91 |

28666,52 |

399 824,09 |

12 |

32 951,43 |

3998,24 |

28953,19 |

370 870,90 |

13 |

32 951,43 |

3708,71 |

29242,72 |

341 628,18 |

14 |

32 951,43 |

3416,28 |

29535,15 |

312 093,03 |

15 |

32 951,43 |

3120,93 |

29830,50 |

282 262,53 |

16 |

32 951,43 |

2822,63 |

30128,81 |

252 133,73 |

17 |

32 951,43 |

2521,34 |

30430,09 |

221 703,63 |

18 |

32 951,43 |

2217,04 |

30734,39 |

190 969,24 |

19 |

32 951,43 |

1909,69 |

31041,74 |

159 927,50 |

20 |

32 951,43 |

1599,28 |

31352,16 |

128 575,35 |

21 |

32 951,43 |

1285,75 |

31665,68 |

96 909,67 |

22 |

32 951,43 |

969,10 |

31982,33 |

64 927,34 |

23 |

32 951,43 |

649,27 |

32302,16 |

32 625,18 |

24 |

32 951,43 |

326,25 |

32625,18 |

0,00 |

Total |

790 834,33 |

90 834,33 |

700 000,00 |

|

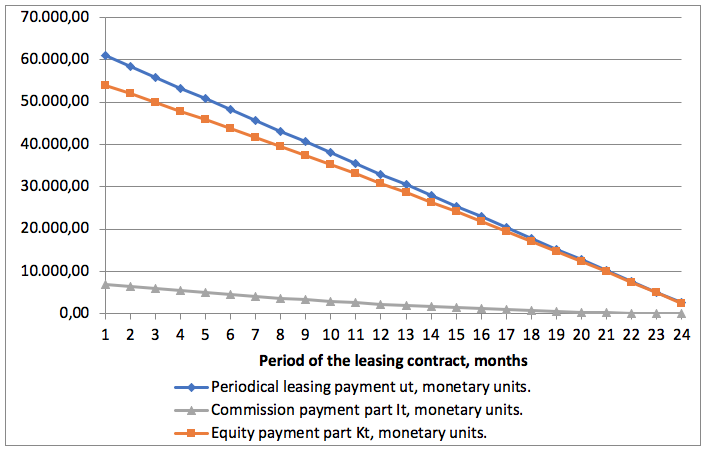

The amount of annuity leasing payments was 1090834,33 monetary units, rise in price - 9,08%. Charts of annuity leasing payments ut, commission payments It, payments for the repayment of the cost of property Kt are shown in the figure 3.

Figure 3

Annuity leasing payments graph

Calculation of the total amount of leasing payments using a progressive scheme is presented in the table 4.

Table 4

Calculation of leasing payments with a progressive scheme

Period, month |

Periodical leasing payment ut, monetary units. |

Commission payment part It, monetary units. |

Equity payment part Kt, monetary units. |

Unpaid cost of equity (Outstanding cost) xt, monetary units. |

0 |

– |

– |

– |

700000,00 |

1 |

11 908,85 |

7000,00 |

4908,85 |

695 091,15 |

2 |

13 817,71 |

6950,91 |

6866,80 |

688 224,35 |

3 |

15 726,56 |

6882,24 |

8844,32 |

679 380,03 |

4 |

17 635,42 |

6793,80 |

10841,62 |

668 538,41 |

5 |

19 544,27 |

6685,38 |

12858,89 |

655 679,52 |

6 |

21 453,13 |

6556,80 |

14896,33 |

640 783,19 |

7 |

23 361,98 |

6407,83 |

16954,15 |

623 829,04 |

8 |

25 270,84 |

6238,29 |

19032,55 |

604 796,49 |

9 |

27 179,69 |

6047,96 |

21131,73 |

583 664,77 |

10 |

29 088,55 |

5836,65 |

23251,90 |

560 412,87 |

11 |

30 997,40 |

5604,13 |

25393,27 |

535 019,60 |

12 |

32 906,25 |

5350,20 |

27556,06 |

507 463,54 |

13 |

34 815,11 |

5074,64 |

29740,47 |

477 723,07 |

14 |

36 723,96 |

4777,23 |

31946,73 |

445 776,33 |

15 |

38 632,82 |

4457,76 |

34175,05 |

411 601,28 |

16 |

40 541,67 |

4116,01 |

36425,66 |

375 175,62 |

17 |

42 450,53 |

3751,76 |

38698,77 |

336 476,85 |

18 |

44 359,38 |

3364,77 |

40994,61 |

295 482,23 |

19 |

46 268,24 |

2954,82 |

43313,41 |

252 168,82 |

20 |

48 177,09 |

2521,69 |

45655,40 |

206 513,42 |

21 |

50 085,95 |

2065,13 |

48020,81 |

158 492,61 |

22 |

51 994,80 |

1584,93 |

50409,87 |

108 082,73 |

23 |

53 903,65 |

1080,83 |

52822,83 |

55 259,91 |

24 |

55 812,51 |

552,60 |

55259,91 |

0,00 |

Total |

812 656,36 |

112 656,36 |

700 000,00 |

|

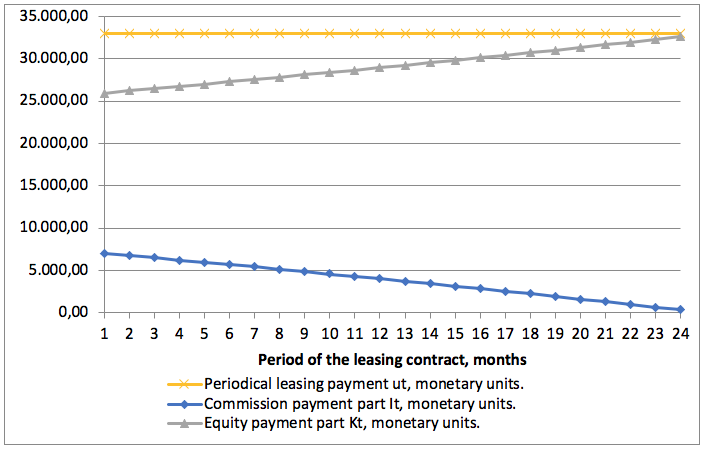

The amount of leasing payments using the progression scheme was 1112656,36 monetary units, rise in price of property - 11,27%. Graphs of regressive lease payments ut, commission payments It, payments for the repayment of the cost of property Kt are shown in the figure 4.

Figure 4

Progressive leasing payments graph

The amount of leasing payments, commission fees, property values and increase in the contract price for various payment schedules are presented in the table 5.

Table 5

The amount of payments for different payout schemes

|

Regressive payments |

Annuity payments |

Progressive payments |

Sum of periodical leasing payments , monetary units. |

761 804,50 |

790 834,33 |

812 656,36 |

Sum of leasing payments with advance payment, , monetary units. |

1 061 804,50 |

1 090 834,33 |

1 112 656,36 |

Sum of commission , monetary units. |

61 804,50 |

90 834,33 |

112 656,36 |

Sum of payments to repay the cost of property , without advance payment, monetary units. |

700 000,00 |

700 000,00 |

700 000,00 |

Rise in value of property λ, % |

6,18 |

9,08 |

11,27 |

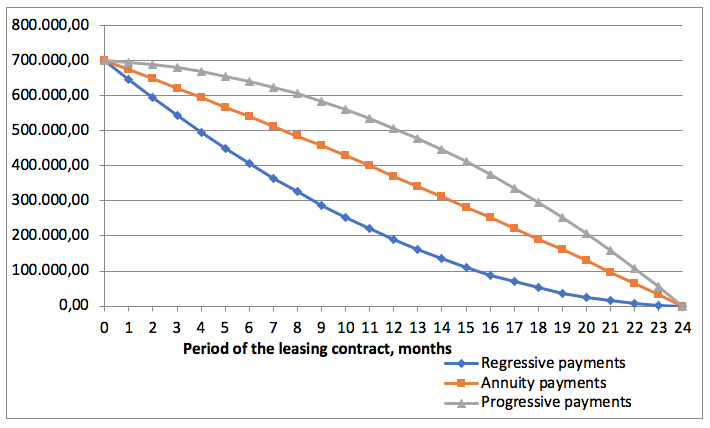

As you can see, the amounts of payments for different methods of payment are different. The smallest amount of leasing payments and of the rise in price corresponds to the regressive schedule, the largest amount of leasing payments and of the rise in price correspond to the progressive schedule. Leasing payment schedules affect the total price of leasing contract (Muftahova, 2015).

The trajectories of the unpaid value of the property for different methods of payment are shown in the figure 5.

Figure 5

Trajectories of unpaid equity cost for the 3 payments methods

Thus, the choice of how to pay leasing payments greatly affects the value of the entire leasing transaction. Comparative analysis allows us to make a specific choice of a particular methodological approach for determining the size of lease payments. In one case, the methodology is more advantageous for the lessor, in another case - for the lessee, but the agreement is reached by signing a specific contract.

From the lessee’s point of view, the application of any method for calculating leasing payments should pursue one goal: to use the leasing transaction as a resource-saving factor for conducting its own investments.

As a result of the analysis, the following conclusions can be drawn:

- the development of leasing as a form of entrepreneurial activity in Russia presupposes the existence of a certain group of prerequisites and factors;

- successful practice of leasing application and distribution in the Russian economy is related to the availability of a legal framework for the implementation of this form of entrepreneurial activity;

- in recent years we can notice a significant breakthrough in the development of leasing in Russia, a fairly large number of different leasing companies are being established;

- at the same time, the volume of leasing services provided in cash equivalent is insignificant against the background of traditional methods of investment and does not correspond to the opportunities of the created leasing market;

- the solution of problems in the leasing sphere will promote the leasing to the forefront among other types of investment activity in the real sector of the economy, which corresponds to its potential capabilities.

1. Attorneys, J.P., & Fred, S.S. (2005) Negotiate the Best Lease for Your Business, 2nd ed., NOLO Inc., USA.

2. Batkovskiy, A.M., Semenova, E.G., Trofimets, V.Y., Trofimets, E.N., & Fomina, A.V. (2016), Computer modeling of leasing operations. Indian Journal of Science and Technology, 9(28), p. 97661.

3. Belyakova, M.Yu. (2006). Formation of investment resources in the enterprise. Reference book of the economist, 2(32), pp. 21-30.

4. Bolshakov, S.V. (2006). Enterprise Finance: Theory and Practice. Moscow. Book World Publ.

5. Contino, R.M. (2002). The complete equipment-leasing handbook: A deal maker’s guide with forms, checklists, and worksheets. AMACOM.

6. Dogan, F.G. (2016) Non-cancellable Operating Leases and Operating Leverage. European Financial Management, 22(4), pp. 576-612.

7. Eisfeldt, A., & Rampini A. (2009). Leasing, Ability to Repossess, and Debt Capacity. Review of Financial Studies 22 (4), pp. 1621-1657.

8. Gazman, V.D. (2005). Financial leasing. Moscow: HSE Publ.

9. Giner, B., & Pardo, F. (2017), Operating lease decision and the impact of capitalization in a bank-oriented country. Applied Economics, 49(19), pp. 1886-1900.

10. Goremykin, V.A. (2005). Classification of leasing operations. Reference book of the economist, 7(25), pp. 90-102.

11. Keyhanian, S., & Rabbani, M. (2015), Revenue and turn-over based joint pricing and production planning for an integrated financial lease-sales system: A new mathematical model. International Journal of Operational Research, 22(3), pp. 310-341.

12. Kirkorov, A.N. (2006). Finance management of a leasing company. Moscow. Alfa-Press Publ.

13. Muftahova, O., Nechaev, A., & Antipina, O. (2015), The use of financial and credit tools to minimize the risks in the organization of production. International Journal of Economics and Financial Issues, 5(4), pp. 1060-1065.

14. Pavlov O.V. (2006). The dynamic task of coordinating the schedule of lease payments between the parties to the transaction. Izvestiya of the Samara Scientific Center of the Russian Academy of Sciences. 2006, Special Issue, pp. 82-85.

1. Samara National Research University, Samara, Russian Federation; E-mail: blinova@ssau.ru

2. Samara National Research University, Samara, Russian Federation; E-mail: kgerasimov@ssau.ru