Vol. 39 (Nº36) Year 2018. Page 7

Vol. 39 (Nº36) Year 2018. Page 7

Tatiana Grigorievna BONDARENKO 1; Sergey Aleksandrovich OREKHOV 2; Irina Vyacheslavovna SOKOLNIKOVA 3; Anzor Uvaysovich SOLTAKHANOV 4; Igor Borisovich KHMELEV 5

Received: 06/03/2018 • Approved: 01/05/2018

ABSTRACT: This paper examines the performance efficiency of the largest corporate structures of the Russian Federation. The selection of the performance by the largest corporations as the object of analysis is based on their system-forming role proven by the authors for the Russian economy. It was argued that the key role of the largest corporations in the Russian economy presupposed special requirements for the effectiveness of their operations and required constant optimization of appropriate methodological and methodological tools. For this purpose, it is necessary to conduct a permanent assessment of the relevance of individual methods and techniques of analysis, making conclusions about their practical applicability. In this paper, approbation of the DuPont formula as a tool for economic factor analysis of the performance of the largest corporations of the Russian Federation was carried out. Taking into account the logic of the retrospective analysis, the use of the DuPont formula for the Top 5 largest corporations of the Russian Federation made it possible to identify the impact of the factors of operational efficiency, asset utilization efficiency, and leverage efficiency on the integrated efficiency of corporations, expressed through return on equity. It was concluded that the DuPont formula could be used as an aggregated method for assessing the performance of the largest Russian corporations, which was disclosed through the application of its coefficients to the consolidated indicators of corporate balance sheets. |

RESUMEN: Este documento examina la eficiencia del rendimiento de las estructuras corporativas más grandes de la Federación Rusa. La selección del desempeño por parte de las empresas más grandes como objeto de análisis se basa en su papel de formación de sistemas probado por los autores para la economía rusa. Se argumentó que el papel clave de las empresas más grandes en la economía rusa presuponía requisitos especiales para la efectividad de sus operaciones y requería una optimización constante de las herramientas metodológicas y metodologías apropiadas. Para este propósito, es necesario realizar una evaluación permanente de la relevancia de los métodos individuales y las técnicas de análisis, haciendo conclusiones sobre su aplicabilidad práctica. En este trabajo, se llevó a cabo la aprobación de la fórmula de DuPont como una herramienta para el análisis económico de los factores del desempeño de las empresas más grandes de la Federación de Rusia. Teniendo en cuenta la lógica del análisis retrospectivo, el uso de la fórmula de DuPont para las 5 mayores corporaciones de la Federación Rusa permitió identificar el impacto de los factores de eficiencia operacional, eficiencia de utilización de activos y eficiencia de apalancamiento en el sistema integrado, eficiencia de las corporaciones, expresada a través del retorno de la equidad. Se concluyó que la fórmula de DuPont podría utilizarse como un método agregado para evaluar el desempeño de las mayores empresas rusas, que se reveló mediante la aplicación de sus coeficientes a los indicadores consolidados de los balances corporativos. |

The relevance of the research conducted in this paper is justified not only by the leading role of the corporate sector in the national economy, which is an internal factor, but also by external political and economic circumstances (economic sanctions, political pressure on the Russian Federation) that form an external negative background. The largest corporations of the Russian Federation, as the key driver of the economy, under these conditions, bear an increased responsibility for maintaining macroeconomic stability. Hence, the determining factor in the growth of the Russian economy can be considered the performance efficiency of the largest corporations, which, in turn, requires carrying out a related economic and statistical analysis.

Modern scientific literature, both domestic and foreign, mainly considers the problem of reducing the role of the corporate sector in the national economy through the development of the small and medium-sized businesses segment. Without diminishing the role of the largest corporations, the modern scientific doctrine avoids the importance of conducting a joint assessment of the effectiveness of corporate entities, receiving integral indicators of the direction of economic development. Moreover, the existence of various methods and methodologies for assessing the performance of enterprises requires regularly trying them to identify the relevance of the current economic situation: the application of a biased method to identify the efficiency of corporations can lead to the use of incorrect tools of macroeconomic regulation.

The methodology for researching the efficiency of large corporate entities in general is based on academic works in economic theory, corporate governance theory, strategic management, theory of system analysis, and statistics theory. Within the framework of this paper, the authors have applied:

- general scientific methods of analysis of structural elements of the efficiency of large corporate entities of the Russian Federation, synthesis in terms of combining the balance-sheet indicators of domestic corporations, systemic and situational approaches that reveal the specifics of the position of Russian corporate entities at the present time;

- specialized methodological provisions of the theory of corporate governance, economic theory and statistical theory, which allow rationalizing the use of methods of factorial economic analysis in order to obtain objective characteristics of the operations of the largest Russian corporations;

- practical tools that in the framework of this article have been the methods of factorial economic analysis, method of coefficients, economic modeling.

The information base of this paper was made up of indicators of the operations by the largest Russian corporate entities, academic studies by domestic and foreign scientists in corporate governance, educational and reference materials.

In the preamble to its Corporate Governance Principles, the OECD says: "Corporate governance is a key element in improving economic efficiency and growth as well as enhancing investor confidence… Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined. Good corporate governance should provide proper incentives for the board and management to pursue objectives that are in the interests of the company and its shareholders" (Price, 2014).

The basis that distinguishes modern corporate governance from other types of management is as follows:

- corporate governance is characterized by differentiation of property rights and management functions; non-corporate management implies the unification of the functions of property management and enterprise management.

It follows that the formation of the institution of corporate governance led to the formation of a new, independent party of economic relations – the institution of hired professional managers. This institution is a kind of layer between the owners of the corporation and the corporation itself. Therefore, with corporate governance, owners, besides management functions, lose touch with businesses. If in the system of unincorporated management the owners of capital are connected to each other via management relations (they are comrades), in the corporate governance system, the relations between the owners are missing and replaced by those of owners and the corporate structure.

These significant differences of corporate governance from non-corporate one form the following main advantages for corporation’s shareholders:

- independence of the corporation as a legal entity. A corporate entity as a legal entity has legal capacity, can acquire property and non-property rights, act in court on its own behalf and is liable for its debts to the full extent of its assets.

- limited liability of the corporation’s owners. In the authors’ opinion, this characteristic feature of corporate entities is one of the fundamental ones. For example, the federal legislature of the United States on taxation provides that limited liability is identified as the main feature of the corporation. Limited liability means that the owners of shares of the corporation do not bear personal property responsibility for the obligations of the corporation in which they invested their own funds.

- centralized management of the corporation. This feature of the corporation appears due to the transfer by shareholders to the corporate top management of the power to manage it. Thus, the corporate entity is managed not by the owners of the corporation, but by a centralized management body comprised of professional managers. This allows owners through the selection of highly qualified professionals to achieve effective management of the corporation.

Current practice shows that the problem of agency relations arises not only between top management and shareholders, but also within the enterprise, among its managers. This is particularly relevant in large corporations and groups of companies that have a hierarchical management structure. In such enterprises, most of the powers are distributed among the directors of strategic business units and further – among mid-level managers and the line management. The competitiveness of the corporation and its efficient performance largely depend on how efficient the delegation of authority and responsibility within the entire structure of management will be and how effectively the congruence of the goals of the interrelated parts of this system will be achieved.

The fact that the competitiveness of national economies in the context of globalization directly depends on the state of their corporate sector has been an economic axiom for many decades. Modern corporate entities can operate both in the form of a separate large company, and in the form of various associations involving financial and industrial enterprises in corporate communications. Such associations operate on the basis of the development and implementation of unified policy in differentiation and integration of production and capital, distribution of commodity flows among markets, cooperation in research and development.

The state of the national economy of our country is the result not only of market reforms over more than twenty years, but also of the comprehensive impact of external and internal economic and political factors. Meantime, despite the contradictory nature of this impact, one of the main objectives of the state policy of the Russian Federation is the formation and development of entrepreneurial activity in its most effective forms. As a result, a new model of corporate relations was formed in our economy, the improvement of which in the framework of the integration of business structures led to the emergence of large integrated associations in the form of joint-stock companies. Having taken a dominant position in the national economy, these joint-stock companies began to determine the level and intensity of the development of the Russian economy.

Corporate structures make up one tenth of all enterprises registered in the world, while they account for more than 50% of the world's gross domestic product (GDP) (Golikova, 2011). The share of corporations in the GDP of our country is even greater, as the development of small and medium-sized businesses does not have a significant effect yet.

In 2016, Russia's 400 largest companies received revenues of $967 billion, producing about 75% of our country's GDP (see Table 1). The top five largest corporations (Gazprom, LUKoil, Rosneft, Sberbank, RZD) sold products and services for $325 billion in 2016 – almost a quarter of GDP (Chepkemoi, 2017).

Table 1

Estimation of the contribution of the largest corporations to the Russian economy

(Gazprom, 2017; LUKoil, 2017; Rosneft, 2017; RZD, 2017; Sberbank, 2017)

Place |

Corporation |

Sales (million rubles) |

Profit before taxation (million rubles) |

Net profit (million rubles) |

1 |

Gazprom |

6,071,793 |

1,285,138 |

997,104 |

2 |

LUKoil |

4,743,732 |

272,515 |

207,642 |

3 |

Rosneft |

4,134,000 |

317,000 |

201,000 |

4 |

Sberbank |

2,835,300 |

677,500 |

541,900 |

5 |

RZD |

1,577,465 |

43,621 |

6,500 |

|

TOTAL Top 5 |

19,362,290 |

2,595,774 |

1,954,146 |

400 of the largest Russian corporations create almost 41% of the gross public product (this figure includes, in addition to GDP, intermediate consumption, that is, it is an exact analogue of the corporate earnings indicator for the whole economy) (Expert-400, 2017).

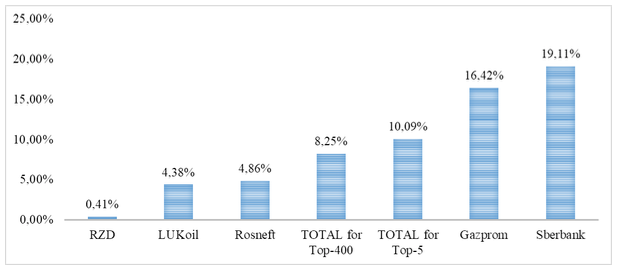

In 2016, 400 largest corporations jointly earned 5.36 trillion rubles of net profit, ensuring the profitability of sales of more than 8.00%. Of the Top 5, the best return on the ruble revenue was shown by Gazprom – 16.42%, the worst – by RZD (0.41%). In general, the Top 5 operates more efficiently than all the companies included in the Expert-400 rating. This is clearly seen in Figure 1.

Figure 1

Histogram of sales profitability of the largest

corporations of the Russian Federation

It should be noted that the average revenue per 1 employee of the Top 400 largest companies of the Russian Federation is about $118 thousand, the same figure for American corporations Fortune-500 being $428 thousand. Thus, by performance efficiency expressed in labor productivity, Russian corporations are almost 4 times behind American, and productivity gaps in the sectoral leaders of the United States and Russia reach 10 times or more (Expert-400, 2017). This fact, in the authors’ opinion, not only identifies the problems of evaluating the performance of corporations, but also highlights the potential for the development of the Russian corporate sector.

Thus, the statistics confirm the importance of the largest corporate entities for the Russian economy and demonstrate their significant contribution to the most important aggregated macroeconomic indicators of the Russian national economy, unlike developed economies and, primarily, the USA, where small and medium business is a backbone element. The contribution to GDP of small and medium-sized enterprises in the US, China, Japan is more than 60%, in the European Union – more than 50%; they are the largest employers in their countries, which contrasts sharply with the situation in our country (Robu, 2013).

The importance of the corporate sector for the Russian economy presupposes special requirements for the performance of these companies. Any large-scale problem arising in the operations of any largest corporate entity can lead to a slowdown in the economic growth of the entire country. Therefore, regular independent examination of the efficiency of these companies is necessary, which will make it possible to consider in advance and from different aspects the functioning of corporate governance mechanisms or the whole corporation and to proactively identify problems before they manifest themselves widely. At the same time, it is very important to use the relevant analysis tools, which would allow a qualitative, complex and intuitive assessment of the corporation's performance. One of these tools, included in the apparatus of economic and statistical analysis, is the so-called DuPont model.

The traditional role that the DuPont model plays in finance and in performance analysis is helping investors choose projects and investments that are most beneficial. Over the years, it has become a classic diagnostic tool for identifying strengths and weaknesses and potential improvements in the structure of corporate capital to maximize the well-being of shareholders (Brigham, & Ehrhardt, 2013).

Scholars note (Parrino et al., 2011) that the DuPont model in question is a diagnostic tool of a separate corporate entity, allowing one to analyze its "financial health" in a comprehensive way:

- corporate management evaluates the financial health of the company, using the DuPont coefficients;

- corporate management monitors the financial performance in this model for a long period of time, paying attention to their deviation from the targets;

- within the framework of the DuPont model, corporation management makes decisions that maximize the return on equity (ROE), as opposed to maximizing the value of shares of the shareholders.

Some researchers consider the use of the DuPont model as a tool to make operational marketing solutions in merchandising and retail trade, forming the basis of its integrated system of marketing performance (Levy, & Barton, 2011). In the authors’ opinion, this approach does not stand up to criticism, since the strategic essence of the DuPont model is obvious, which has been confirmed in the study by John Sterling and Charles Murray (Sterling, & Murray, 2007).

Thus, according to modern researchers, the DuPont model is primarily intended for use as a diagnostic and effective tool for the analysis of a single corporation. However, it seems appropriate to apply this model, which proved to be effective in the study of the efficiency of individual corporate entities, as a tool for analyzing the corporate sector as a whole or part of it. In defense of this proposal, the authors propose the following arguments:

- corporate entities in the modern economy use unified standards of accounting and financial reporting that allows freely aggregating comparable indicators without loss of quality for further analysis;

- reports of modern corporations are audited by leading auditors, which makes it possible not to question the reliability of the indicators presented therein;

- large corporations are the locomotive of the Russian economy, and the analysis of the consolidated balance sheet of the largest corporate structures using the DuPont model will make it possible to conclude that their corporate governance systems are effective, as well as their impact on the national economy through their activities.

Thus, one can assume that the DuPont model will be a good tool for economic and statistical analysis of the performance of the largest corporations of the Russian Federation, as presented in Table 2.

Table 2

Dynamic range of key performance indicators of the Top5 corporations of the Russian Federation

(Gazprom, 2017; LUKoil, 2017; Rosneft, 2017; RZD, 2017; Sberbank, 2017)

Company |

Year |

Assets |

Equity |

Revenue |

Net profit |

Gazprom |

2012 |

9,778 |

7,711 |

3,659 |

556 |

2013 |

10,442 |

8,127 |

3,933 |

628 |

|

2014 |

11,552 |

8,729 |

3,990 |

189 |

|

2015 |

12,615 |

9,206 |

4,334 |

404 |

|

2016 |

13,417 |

9,868 |

3,934 |

411 |

|

LUKoil |

2012 |

1,186 |

679 |

305 |

218 |

2013 |

1,242 |

801 |

260 |

210 |

|

2014 |

1,526 |

999 |

243 |

372 |

|

2015 |

1,889 |

1,218 |

259 |

302 |

|

2016 |

1,985 |

1,313 |

317 |

183 |

|

Rosneft |

2012 |

3,717 |

2,213 |

3,089 |

365 |

2013 |

5,751 |

2,746 |

4,694 |

555 |

|

2014 |

8,134 |

3,025 |

5,503 |

350 |

|

2015 |

9,189 |

2,905 |

5,150 |

356 |

|

2016 |

10,336 |

3,328 |

4,988 |

201 |

|

RZD |

2012 |

4,233 |

3,422 |

1,366 |

14 |

2013 |

4,454 |

3,511 |

1,377 |

1 |

|

2014 |

4,717 |

3,528 |

1,402 |

-44 |

|

2015 |

4,952 |

3,543 |

1,511 |

0 |

|

2016 |

5,370 |

3,900 |

1,577 |

7 |

|

Sberbank |

2012 |

12,966 |

1,446 |

899 |

348 |

2013 |

16,654 |

1,753 |

970 |

362 |

|

2014 |

21,706 |

1,951 |

939 |

290 |

|

2015 |

26,268 |

2,198 |

955 |

223 |

|

2016 |

26,352 |

2,595 |

1,355 |

542 |

For the analysis of the Top 5 largest corporations, the following necessary data were collected and systematized:

- assets and equity. According to the official accounts, average annual values were calculated.

- revenue and net profit. These data were taken from the official reports by the entities under review.

As part of the systematization of the data of the Top 5 largest corporations, statistical methods of summary and grouping were used. Calculation of the average annual values was carried out using the time average in time series of dynamics.

Further, the data were aggregated for each indicator and summarized in Table 3. Table 3 was used to calculate the performance of the DuPont model on aggregated assets, equity, revenue and net profit. Thus, the preparation for the economic and statistical analysis of the performance of the largest corporations of the Russian Federation was completed.

Table 3

Dynamic series of indicators for performance analysis

of the largest corporations of the Russian Federation

Parameter |

2012 |

2013 |

2014 |

2015 |

2016 |

Assets, billion rubles |

31,881 |

38,543 |

47,634 |

54,914 |

57,460 |

Equity, billion rubles |

15,471 |

16,937 |

18,232 |

19,069 |

21,005 |

Revenue, billion rubles |

9,319 |

11,234 |

12,077 |

12,209 |

12,172 |

Net profit, billion rubles |

1,501 |

1,756 |

1,157 |

1,285 |

1,343 |

ROE, % |

9.70 |

10.37 |

6.35 |

6.74 |

6.40 |

Return on sales, % |

16.11 |

15.63 |

9.58 |

10.53 |

11.04 |

Assets turnover ratio, % |

29.23 |

29.15 |

25.35 |

22.23 |

21.18 |

Financial leverage, % |

206.07 |

227.57 |

261.26 |

287.97 |

273.56 |

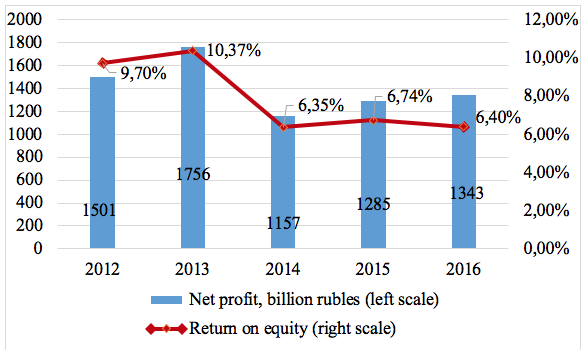

Now the authors will perform a preliminary analysis of the dynamic range of the indicator "ROE". The corporations in question jointly increased their efficiency for shareholders in 2012-2013; the return on capital in 2013 amounted to more than 10 kopecks of net profit per each ruble of equity.

However, in 2014 there was a sharp change in the dynamics of ROE – the figure was 6.35%, down from more than 4 pp in comparison with 2013. Then ROE was fixed in this area. The main impact on ROE was made by the decrease in the net profit of corporations – its fall in 2014 compared to 2013 was almost 600 billion rubles, or –34.10%, which is reflected in Figure 2.

Figure 2

ROE and net profit dynamics of the Top 5 largest

corporations of the Russian Federation

The reason for the revealed decline in the efficiency of the Top 5 corporate entities of our country in 2014 is the multiple crisis factors: volatility of the national currency, adoption of the sanctions by the West against our country, and an increase in the interest rate due to the CBR's key rate of 17.00% at the end of 2014 (The World Bank, 2017).

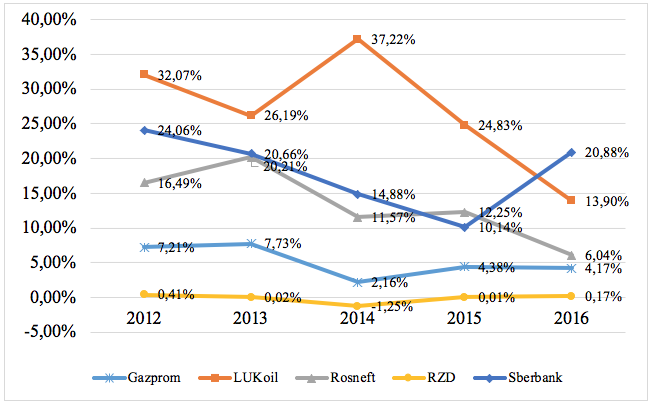

The economy of our country since 2014 has been in a stagnant state. However, a more detailed analysis of the contribution of each of the Top 5 corporations to their aggregate indicators provides an opportunity to assess the success of corporate management of each corporation in crisis and post-crisis conditions of economic stagnation. To do this, one needs to reduce the dynamic series of calculated ROE indicators of each company in question, as shown in Figure 3.

Figure 3

Dynamic series of ROE of the Top 5 largest

corporations of the Russian Federation

As is clearly seen in the chart above, LUKoil worked most effectively for its shareholders before the crisis of 2014; moreover, if all the corporations under consideration significantly lowered their profitability in 2014 (and RZD had a loss with negative ROE), LUKoil managed to significantly increase its return on capital to 37.22% from 26.19% in 2013.

In general, until 2016, LUKoil worked more efficiently than other Top 5 corporations, but in 2016 Sberbank outperformed it by ROE: if LUKoil cut the figure almost 2-fold, Sberbank almost doubled it. It is interesting to note that RZD is managed extremely inefficiently compared to other corporations, and this does not depend on the crisis phenomena in the economy.

Now let us carry out further factor analysis of the impact of each indicator on the change in the efficiency of the Top 5 corporations. To do this, the chain method was used in the framework of the DuPont model.

Having done the calculations by the method of chain substitutions, the authors reduced them to a single analytical Table 4 and interpreted the obtained results.

Table 4

Analytical table with calculations of the influence of factors on the change

in ROE of the Top 5 largest corporations of the Russian Federation

Parameter |

2012 |

2013 |

2014 |

2015 |

2016 |

ROE |

9.70% |

10.37% |

6.35% |

6.74% |

6.40% |

Profitability of sales |

16.11% |

15.63% |

9.58% |

10.53% |

11.04% |

Asset turnover ratio |

29.23% |

29.15% |

25.35% |

22.23% |

21.18% |

Financial leverage |

206.07% |

227.57% |

261.26% |

287.97% |

273.56% |

Growth of ROE, pp |

- |

0.66% |

-4.02% |

0.39% |

-0.34% |

Growth of ROE from changes in profitability of sales, pp |

- |

-0.29% |

-4.01% |

0.63% |

0.33% |

Growth of ROE from changes in asset turnover, pp |

- |

-0.03% |

-0.83% |

-0.86% |

-0.33% |

Growth of ROE from changes in financial leverage, pp |

- |

0.98% |

0.82% |

0.62% |

-0.34% |

Increase in profitability of sales, pp |

- |

-0.48% |

-6.05% |

0.94% |

0.51% |

Increase in turnover of assets, pp |

- |

-0.08% |

-3.79% |

-3.12% |

-1.05% |

Increase in financial leverage, pp |

- |

21.50% |

33.69% |

26.71% |

-14.41% |

In 2013 and 2014, the decrease in the profitability of sales was the main negative impact on changes in ROE of the corporations under review by 0.48 and 6.05 pp, respectively. ROE under the influence of this factor decreased by 0.29 pp in 2013 and by 4.01 pp in 2014.

Negative operational efficiency was due to the fact that corporate management could not effectively manage the cost of production, which led to a decrease in net profit with the growth in sales volumes.

It should be noted that the decrease in operational efficiency began before the crisis of 2014, but immediately after the crisis, corporate governance mechanisms were redirected to improve this indicator. Therefore, in 2015 and 2016, the profitability of sales showed an increase of 0.94 pp and 0.51 pp, respectively. The contribution of this factor to ROE was 0.63 pp in 2015 and 0.33 pp in 2016.

Throughout the whole period under review, the efficiency of using the assets of the Top 5 corporations of the Russian Federation has been constantly decreasing: the growth in the asset turnover ratio in 2013-2016 was negative. The greatest negative impact on ROE was provided by the factor in 2014-2015, when under its influence the ROE decreased by 0.83 pp and 0.86 pp, respectively. Corporate management inefficiently manages assets, which is manifested in the disproportionate growth of business (total assets) and the return on them in the form of revenue.

The analysis of the third factor – the ratio of financial leverage – showed that in 2013-2015, the corporations under review significantly increased borrowed funds. During this period, the increase in this ratio did not fall below 20 pp. Due to the attraction of financing to corporate management, it was possible in 2013 and 2015 to obtain a positive increase in ROE, offsetting the low efficiency of operating activities and the use of assets. In 2016, on the contrary, the increase in financial leverage was negative (-14.41 pp), which, combined with the negative impact of return on assets, blocked the positive contribution to ROE of profitability of sales. Releasing in 2016 from the debt burden, the largest Russian corporations increased the involvement of their own funds in operating activities, which reduced the return in the form of net profit per ruble of shareholder investments.

Thus, the authors tested the DuPont model using the example of the Top 5 Russian corporate structures. The practical significance of the research is the development of methodological tools for analyzing the effectiveness of the corporate sector through the use of factorial economic statistics to aggregate corporate balance-sheets.

In addition to existing approaches, the tool proposed by the authors allows obtaining an integral assessment of the state of corporate governance systems in the Russian economy through an analysis of key indicators characterizing the activity of corporate structures – profitability of sales, ROE, asset turnover, financial leverage.

As a scientific novelty, the authors of this paper propose to consider the conclusion reached about the relevance of the DuPont model as an algorithm for factorial economic statistical analysis for application as a tool for aggregating the performance of the largest corporations of the Russian Federation. Unlike existing approaches that develop the application of the DuPont model to assess the effectiveness of a particular corporation, the authors applied this model to the aggregate balance sheets of the largest corporate entities in the Russian Federation and concluded that the use of this model was relevant as a method of economic and statistical analysis of the aggregate activity of large national corporations.

The conclusions and results of this article are focused on the application of methods for assessing the effectiveness of the corporate sector of the Russian economy in order to improve the instruments of macroeconomic management and decision-making at the leadership level of the country.

This economic and statistical analysis of the performance of the largest corporations of the Russian Federation has revealed certain problems. First of all, the low efficiency of asset management should be noted: corporate management increased the total capitalization of business, but did not involve it in production, which led to a permanent decline in asset turnover. This decline was especially strong in the crisis conditions of 2014-2015. Secondly, attention to the efficiency of operations rose in corporate executives only after the crisis, and in 2013-2014, the contribution of profitability of sales to the overall performance of companies was negative. Third, the effect of financial leverage became the determining factor that positively supported the ROE of the Top 5 largest corporations within 3 years (2013-2015). Due to the borrowings, the management increased ROE, but in 2014 this did not help to block the sharp drop in operating efficiency.

One can assume that corporate governance systems of the largest, backbone companies in our country do not respond flexibly to changes in the external environment. The main attention is paid to work in the loan capital market, while the operational efficiency and related efficiency of asset management decrease. The impact of Western sanctions on the Russian economy is certainly large, but it is the largest corporations that must become the driver that can support the national economy in a difficult situation. So far, only the flagship of the banking sector – Sberbank – has shown signs of a way out of the crisis, having increased its ROE in 2016. The corporate sector of the Russian Federation, in the person of its leaders, must overcome the inertia of corporate governance mechanisms, increasing the efficiency of operations and return on capital.

Brigham, E., & Ehrhardt, M. (2016). Financial Management: Theory and Practice (15th ed.). South-Western College Pub. (p. 1180).

Chepkemoi, J. (2017). The Largest Companies in Russia by Revenue. Retrieved February 4, 2018, from https://www.worldatlas.com/articles/the-largest-companies-in-russia-by-revenue.html

Expert-400. (2017). Retrieved February 4, 2018, from http://expert.ru/dossier/rating/expert-400/

Gazprom. (2017). Presentations. Retrieved February 4, 2018, from http://www.gazprom.com/investors/presentations/2017/

Golikova, Yu.A. (2011). Korporatsii Rossii: sostoyanie i perspektivy razvitiya [Corporations of Russia: State and Development Prospects]. Rossiiskoe predprinimatelstvo, 5(1), 46-51.

Levy, M., & Barton, W. (2011). Retailing Management (8th ed.). McGraw-Hill Education. (p. 704).

Lukoil. (2017). Reports and Presentations. Retrieved February 4, 2018, from http://www.lukoil.com/InvestorAndShareholderCenter/ReportsAndPresentations/FinancialReports

Parrino, R., Kidwell, D., & Bates, T. (2011). Fundamentals of Corporate Finance (3rd ed.). John Wiley & Sons, Inc. (p. 784).

Price, J. (2014). The Directors Role in Corporate Governance. Australian Securities and Investments Commission. Retrieved February 4, 2018, from http://asic.gov.au/regulatory-resources/corporate-governance/corporate-governance-articles/the-directors-role-in-corporate-governance/

Robu, M. (2013). The Dynamic and Importance of SME’s in Economy. The USV Annals of Economics and Public Administration, 13(1(17)), 84-89.

Rosneft. (2017). Financial Statements. Retrieved February 4, 2018, from https://www.rosneft.com/Investors/Reports_and_presentations/Consolidated_financial_statements/

RZD. (2017). Results and Reporting. Retrieved February 4, 2018, from URL:http://eng.rzd.ru/statice/public/en?STRUCTURE_ID=4224

Sberbank. (2017). IFRS Reports. Retrieved February 4, 2018, fromhttp://www.sberbank.com/investor-relations/financial-results-and-presentations/ifrs

Sterling, J., & Murray, C.D. (2007). Reaping Value from Intellectual Property: DuPont's Strategic Approach Achieves Global Growth. Strategy & Leadership, 35(1), 36-42.

The World Bank. (2017). Russian Federation. Retrieved February 4, 2018, from https://data.worldbank.org/country/russian-federation

1. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per., 36, E-mail: t.g.bondarenko@gmail.com

2. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per., 36

3. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per., 36

4. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per., 36

5. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per., 36