Vol. 39 (Nº36) Year 2018. Page 20

Vol. 39 (Nº36) Year 2018. Page 20

Daniil DREMOV 1; Aleksandr PENKIN 2

Received: 18/05/2018 • Approved: 30/05/2018

ABSTRACT: The recommendations can be used to develop strategic directions for the development of credit institutions and banking system. The directions of future research are related to the fact that the growing geopolitical instability entails significant risks and threats to the security of the banking system and the national security of Russia as a whole, which predetermines the need for constant study of the changes taking place and the choice of the most effective counteraction methods considering the prevailing conditions. |

RESUMEN: Las recomendaciones se pueden utilizar para desarrollar direcciones estratégicas para el desarrollo de las instituciones de crédito y el sistema bancario. Las direcciones de futuras investigaciones están relacionadas con el hecho de que la creciente inestabilidad geopolítica implica riesgos y amenazas considerables para la seguridad del sistema bancario y la seguridad nacional de Rusia en su conjunto, lo que predetermina la necesidad de un estudio constante de los cambios que se están produciendo y la elección de los métodos de neutralización más eficaces teniendo en cuenta las condiciones imperantes. |

Russia has faced a number of economic problems in recent years, including capital flight, the rapid depreciation of the ruble, exclusion from international capital markets, inflation and internal budgetary pressure (Dipasha et.al., 2013). One of the steps aimed at achieving stable growth rates of the national economy in the long term was the Russian Economic Security Strategy until 2030, approved by the President of Russia (Decree No. 208, 2017).

The document focuses on the problems and threats to the economic security of the country, as well as the goals and directions of the state policy in the field of ensuring economic security. The strategy formulates key challenges and threats to economic security: the desire of developed countries to use their advantages in the level of development of the economy and high technologies as a tool for global competition; strengthening structural imbalances in the world economy and the financial system; use of discriminatory measures against key sectors of the Russian Federation's economy; change in the structure of global energy demand; exhaustion of the raw material model of export of economic development; insufficient volume of investments in the real sector of the economy; limitation of Russian non-market exports; insufficiently effective public administration; uneven spatial development of the Russian Federation.

Analysis of these challenges and threats allows us to conclude that in the context of geopolitical instability, the banking system of Russia plays an important role in ensuring economic security, and this, in turn, predetermines the purpose of this study, which consists in studying and theoretically substantiating the most promising areas for raising the level economic security of the banking system of Russia in conditions of geopolitical instability.

After the global financial crisis of 2008-2009, the problem of financial stability in the banking systems of states has increasingly become central to the scientific discussions of researchers from different countries, including: N. Apergis, I. Fafaliou, M. Polemis (2016), L. Bargigli et.al. (2015), L. Deepasha , K. Anil, K. Mukesh (2013), F. Fiorelisi, D. Mare (2014), M. Fleming, A. Sarkar (2014), C. Lee, M. Hsieh (2014), A. Simplice (2013), S.Yu. Glaziev (2016), D.D. Kirton (2017), and D.V. Smirnov (2017) et.al.

Globalization and liberalization in the 21st century led to the emergence of financial conglomerates that crossed not only different financial sectors, such as banking and insurance, but also a number of countries and led to massive cross-border capital flows (Minina and Klimenko, 2017). Such flows often mediate speculative activities in such areas as real estate and stock markets, and periods of excessive capital inflow lead to asset price bubbles, which creates serious risks for balances of credit institutions, as well as for non-financial institutions.

At the same time, according to N. Mock, a compromise is needed between aggressive and conservative reaction to potential bubbles (9, p.2910). The former is more likely to prevent bubbles, but can also cause instability and distortion in financial markets as a result of excessive intervention. Moreover, one can agree with D. Anginer and others that the volatility of capital flows is manifested in sharp changes in exchange rates, which adversely affect the balance sheets of residents because of the large devaluation (Anginer and Demirguc-Kunt, 2014). A large devaluation can lead to serious currency losses (for example, during the Asian financial crisis), which leads to high costs in terms of output and employment losses (Dudin and Nevmyvako, 2017). By reason of this argument, maintaining financial stability becomes the main task, especially in the case of emerging economies, as they are often forced to borrow in foreign currency. All of the above is exacerbated by the limitation of the Russian banking system in the world financial markets, which further reduces the level of economic security.

That is, the stability and security of the banking system can be vulnerable, even if there is price stability and macroeconomic stability. Moreover, individual researchers also note that the threat of financial stability of large subjects of the banking sector (systemically important financial institutions) threatens financial stability in the country as a whole (T. Beck et al. (2013), K. Fu (2014), E.I. Meshkov (2016), Z.I. Rakhmatov and others (2017), A.M. Ekmalyan (2017)). Understanding the dynamism of the economic security of the banking system and better control over such dynamics requires understanding the behavior of banks at the micro level regarding macro-financial events.

In addition, according to L. Tan et al., it is necessary to correctly assess the probability of financial instability (potential shocks), its virulence and its occurrence rate (Tan et.al., 2017). The authors consider it very important to focus on the development of appropriate analytical models for understanding and measuring financial stability. Financial instability is connected with the problems of financial illiquidity in the markets, which leads to a discrepancy between assets and liabilities and, consequently, to symptoms of financial insolvency.

At the same time, it should be borne in mind that currently there is no unequivocally acceptable list of financial sustainability indicators. Both at the level of international organizations and financial regulators of individual countries, work is under way to identify the most appropriate and important indicators for the implementation of the Financial System Assessment Program (FSAP). This program is a joint initiative of the IMF and the World Bank and is designed to help create systems for early diagnosis of the vulnerabilities of financial markets and to develop effective measures to deal with the development of possible problems in the financial sector.

This question was considered in the works of A. Ellull (2015), S. Langfield et.al. (2014), E.V. Altukhova et al. (2016), E.V. Baturina and A.N. Litvinenko (2018), S.N. Silvestrov (2014). As a rule, the basic set (capital adequacy of credit institutions and the quality of their assets, profit and profitability, liquidity, sensitivity to market risks) and an additional set of financial stability indicators are usually among the indicators considered. The latter may include indicators that characterize the state of depository institutions, non-bank financial institutions, corporate sector (enterprises), household sector, and real estate markets - more than 20 indicators (BIS, 2013). The Bank of Russia uses its dashboard in assessing the stability of the country's financial market (see, for example, Financial Stability Review (CBR, 2018).

The authors agree that financial stability with a bank-oriented economy should, first of all, be measured in terms of the ability of the banking system to provide liquidity in the economy and ensure the financial solvency of the system in order to ensure a stable continuous smooth and sustainable financial development (Panova, 2016). Thus, the authors talk about the relationship between the stability of the banking sector and security in the real economy.

It can be argued that the stability of the banking sector in the financial system of emerging market countries is of great importance for ensuring the economic security of the banking system, which requires the stability of institutions, market stability, the absence of turbulence and low volatility. This can be also found in the works by foreign researchers:

The possibilities of ensuring the economic security of banks and the banking system were considered by many scientists (Azarskaya and Pozdeev, 2016; Grafova and Emelyanov, 2016; Korobova, 2017; Maslennikov, 2014).

M.E. Lebedeva and others analyze the development trends of banking systems, the transition to a multi-level banking system, in particular. The authors try to analyze possible changes in the structure of the banking sector and make details in the actions of the regulator to ensure financial stability and, as a consequence, the state's economic security (Lebedeva et.al., 2017). L.N. Mamayeva and N.A. Shmarygo are considering the possibility of reducing credit risks in the banking sector, suggesting measures to reduce credit risks. They showed that the magnitude of credit risks is influenced by macro- and microeconomic factors. The research is based on institutional, systemic and structural-functional methods (Mamaeva and Shmarygo, 2017). Despite the proposed activities, it can be noted that they do not sufficiently analyze the impact on the economic security of the banking system.

The methods of systematization and generalization of theoretical concepts in this field were used as the methodological basis for investigating the possibility of increasing the level of economic security of the banking system. The synthesis of foreign experience was used to identify the most priority, effective and widely used methods in the process of ensuring the economic security of the banking system.

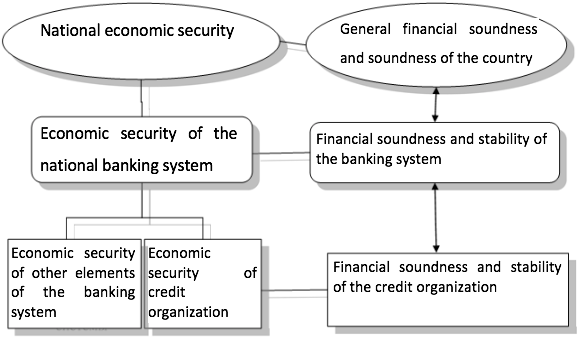

The conducted research allows for concluding that ensuring the sustainability of each individual credit institution is related to the stability of the national economic system, and the sustainability of the economic system is related to the stability of credit institutions. Naturally, the smaller the scale of a credit institution, the less impact the results of its activities have on the stability of a higher level. On the other hand, the impact of the sustainability of the national economic system on the activities of small-scale credit institutions is higher than that of larger banks.

Figure 1

The ratio of economic security and financial sustainability at different levels

A similar principle of determining the stability of the banking system of the country was described by J. Keynes, who described the relationship and the correlation of the stability of financial institutions with the activities of the real sector. Expanding this principle, the authors suggest including in it the economic security of the state.

At the same time, the early warning models characteristic of the banking sector are of paramount importance. Since commercial banks receive financing in international financial markets and are oriented towards international activity, therefore they depend heavily on international events, while regional factors play only a secondary role. However, regional side effects are becoming a significant determinant of the stability of the banking system, in particular for small regional banks. The authors believe that a continuous and promising indicator of the stability of the banking system can serve to identify macroprudential indicators of early warning and international and regional side effects. The indicator should include not only the main systemically important institutions, but also small banks, which are especially important for regional lending. The stability indicator is intended to provide a macroprudential analysis tool for banking supervisors and policy makers. It may consist of three components: probability of default, credit spread and the stock market index for the banking sector.

The probability of default is based on the risk model for small banks; for large financial organizations, one can use the financial stability ratings of Moody's Bank. It is possible to form an estimate of the control risk profile as a reference for assigning weights to the components of the indicator. This emphasizes the need to monitor macroprudential indicators in banking supervision and supports regulators developing regulatory requirements that include the business cycle.

Another possibility to improve the economic security of the banking system is the use of macroprudential tools that are more flexible and can be targeted at specific points in the financial system that create distortions. In particular, the Central Bank of Russia may use capital adequacy ratios, loan loss ratios and lending ratios to assets to discourage speculation in the markets where a potential bubble is forming. It is also possible to increase the level of security by reducing systemic risk by improving payment settlement systems and creating incentives for certain derivative transactions that can be resolved.

Another way is to develop procedures aimed at maintaining the stability of systemically important institutions. It would be possible to use authorization procedures similar to those of the Federal Deposit Insurance Corporation, so that systemically important institutions could not become too large to be in a crisis situation. Increase the level of economic security of the banking system is possible through the development of intervention procedures to avoid significant distortions in the real exchange rate, the change of which can be too costly and affect the stability of the financial system.

The main goal of the central bank in the context of geopolitical instability is deterring damage and limiting the impact on the real economy. The first imperative is to ensure tranquility in the financial markets. The panic of the market creates the equivalent of a financial attack, interrupting the flow of loans. This increases the damage in the banking system and is one of the main transmission channels through which the crisis affects the real economy. Therefore, it is necessary to reduce uncertainty, ensure the proper functioning of short-term credit markets and prevent the collapse of credit institutions due to liquidity constraints.

Another unconventional measure is direct intervention in financial markets: direct purchase of financial instruments to influence the yield curve or stimulate a systemically important credit market. If necessary, flexibility can be used as an additional tool. It is possible to reduce collateral requirements and offer a wider range of tools: to organize inter-currency swaps with foreign central banks to provide liquidity, expressed in foreign currency.

An important point is the liquidation of debt on loans. Overdue loans are a burden on the balance sheets of banks and worsen the profitability of banks, causing loss of revenue. They also block part of the banks 'capital, thereby reducing the banks' ability to provide new loans. Ensuring the economic security of the banking system requires progress in cleaning the balance sheets of banks and restoring sufficient capital buffers. It is necessary to achieve real restructuring of the loan or the repurchase of unused assets, which should be supported by the current legal framework to ensure the debt burden and the repurchase of assets.

Many countries are working to improve the framework of insolvency and the functioning of the judiciary to ensure a more rapid debt restructuring. For example, Greece introduced electronic auctions to sell collateral. Another way is decisions of out-of-court restructuring, based on the voluntary cooperation of banks and debtors. If loan restructuring fails, banks may consider getting rid of impaired assets. Overdue loans can be traded on specialized secondary markets, possibly as securitized products.

In order to cope with the legacy of troubled loans, some countries have established asset management companies (AMCs), also known as “bad banks”, so that banks could transfer portfolios of bad debts to them. Support for the sale of such debts can also be organized by the banking sector itself (through government guarantees, for example, using the Atlante scheme in Italy). The role of national supervisory authorities and regulators is fundamental when it comes to resolving the problem. Such bodies regularly check the quality of bank assets, control the repayment of debts and impose adequate reserves for losses on loans and capital buffers.

In addition, it seems expedient to develop alternative sources of financing for companies. In order to improve access to financing through non-bank sources, various actions should be taken to develop capital markets: stock markets and bonds, private equity and venture capital funds and modern approaches to securitization. It is also important to implement specific measures to support the development of regional capital markets.

Thus, when considering ways to improve the banking system's economic security, the following is required:

1. The key financial markets and the financial institutional system are resilient to economic shocks and fulfill their basic functions smoothly and continuously.

2. The ability of the banking system to facilitate and strengthen economic processes, manage risks and absorb shocks, and the stability of all elements of the system to stress.

3. There are no system-wide situations in which the banking system does not function.

4. Public confidence in financial institutions, markets, infrastructure and the whole system is broadened.

Summarizing the above-said, it can be concluded that the banking system of Russia is an important element of economic security, allowing for formulating and implementing monetary and supervisory policies, promote the creation of a sound economic and financial environment, and exercise the functional responsibility for ensuring a reliable and stable financial system.

ANGINER, D., DEMIRGUC-KUNT, A., ZHU. M. How does competition affect bank systemic risk? Journal of Financial Intermediation. Vol 23, year 2014, issue 1, page 1–26.

APERGIS, N., FAFALIOU, I., POLEMIS, M.L. New evidence on assessing the level of competition in the European Union banking sector: A panel data approach. International Business Review. Vol 25, year 2016, issue 1, page 395–407.

BARGIGLI, L., DiIASIO, G., INFANTE, L., LILLO. F., PIEROBON. F. The multiplex structure of interbank networks. Quantitative Finance. Vol 15, year 2015, page 673–691.

BECK, T., DeJONGHE, O., SCHEPENS, G. Bank competition and stability: Cross-country heterogeneity. Journal of Financial Intermediation. Vol 22, year 2013, issue 2, page 218–244.

DIPASHA, S., ANIL, K.S., MUKESH, K.B. Efficiency and productivity of banking sector: A critical analysis of literature and design of conceptual model. Qualitative Research in Financial Markets. Vol 5, year 2013, issue 2, page 195-224.

ELLUL, A., JOTIKASTHIRA, C., LUNDBLAD, C.T., WANG, Y. Is historical cost accounting a panacea? Market stress, incentive distortions, and gains trading. Journal of Finance. Vol 70, year 2015, issue 6, page 2489-2538.

FIORDELISI, F., MARE, D.S. Competition and financial stability in European cooperative banks. Journal of International Money and Finance. Vol 45, year 2014, page 1–16.

FLEMING, M.J., SARKAR, A. The Failure Resolution of Lehman Brothers. Economic Policy Review, Forthcoming. Year 2014.

FU, X., LIN, Y., MOLYNEUX, P. Bank competition and financial stability in Asia Pacific. Journal of Banking & Finance. Vol 38, year 2014, page 64–77.

LANGFIELD, S., LIU, Z., OTA, T. Mapping the UK interbank system. Journal of Banking and Finance. Vol 45, year 2014, page 288–303.

LEE, C.C., HSIEH, M.F. Bank reforms, foreign ownership, and financial stability. Journal of International Money and Finance. Vol 40, year 2014, page 204–24.

Bank for International Settlements (BIS). (2013). Liquidity coverage ratio disclosure standards. Consultative Document.

MOCH, N. Competition in fragmented markets: New evidence from the German banking industry in the light of the subprime crisis. Journal of Banking & Finance. Vol 37, year 2013, issue 8, page 2908–2919.

SIMPLICE, A.A. Post‐crisis bank liquidity risk management disclosure. Qualitative Research in Financial Markets. Vol 5, year 2013, issue 1, page 65-84.

TAN, L.H., CHEW, B.C., Hamid S.R. Service quality implementation in shaping sustainable banking operating system: A case study of Maybank Group. Qualitative Research in Financial Markets. Vol 9, year 2017, issue 4, page 359-381.

AZARSKAYA, M.A., POZDEEV, V.L. Principles of economic security of commercial banks. Bulletin of the Moscow University of the Ministry of Internal Affairs of Russia. Year 2016, issue 6, page 149-152.

ALTUKHOVA, E.V., ZOTOV, V.A., MARKOV, M.A. Methodical approaches to risk management in a regional commercial bank. The Economy of the Region. Year 2016, issue 1, page 267-282.

BATURINA, E.V., LITVINENKO, A.N. Monitoring of shadow cash flows by computer modeling tools. Economics of the region. Year 2018, issue 1, page 326-338.

GLAZIEV, S.Yu. Stabilization of the currency and financial market as a necessary condition for the transition to sustainable development. The Economy of the Region. Year 2016, issue 1, page 28-36.

GRAFOVA, I.L., EMELYANOV, R.A. Economic security of a commercial bank as an element of the banking system of the country. Economic Journal. Year 2016, issue 42, page 73-78.

DUDIN, M.N., NEVMYVAKO, V.P. Mechanisms of imbalance of the economic system, worsening its security, and ways to overcome them. Economy and society: modern development models. Year 2017, issue 16, page 5-14.

KIRTON, D.D. Ensuring stability and inclusiveness: the success of the “Group of Twenty” in containing financial crises. Bulletin of International Organizations: education, science, new economy. Year 2017, issue 2, page 2-10.

KOROBOVA, G.G. Problems of development of the Russian banking system at the present stage. Bulletin of the Saratov State Social and Economic University. Vol 2, year 2017, issue 66, page 55-58.

LEBEDEVA, M.E., VASILIEV, S.A., UKHOVA, A.A. Creation of a multilevel banking system in Russia. Proceedings of Saint Petersburg State University of Economics. Vol 4, year 2017, issue 106, page 7-12.

LEONOVA, O.V. Financial problems of the banking sector of the economy, which arose because of the imposition of anti-Russian sanctions. Russian Foreign Economic Journal. Year 2017, issue 1, page 56-62.

MAMAEVA, L.N., SHMARYGO, N.A. Reduction of credit risks as a way to ensure economic security of the bank. Information security of regions. Vol 3-4, year 2017, issue 28-29, page 39-41.

MASLENNIKOV, M.I. Regional tendencies of business capitalization in conditions of growth of financial instability. Economy of the region. Year 2014, issue 2, page 141-150.

MESHKOVA, E.I. The capital agreement Basel III: how to combine the stability of the banking sector and the challenges of economic growth? Finance and credit. Vol 40, year 2016, issue 712, page 17-32.

MININA, T.I., KLIMENKO, N.A. Main Problems and Directions of Russia's Monetary Policy in the Conditions of the Introduction of International Sanctions. Economics. Taxes. Law. Year 2017, issue 3, page 52-59.

Decree of the President of the Russian Federation No. 208. (2017). On the Strategy of Economic Security of the Russian Federation for the period up to 2030.

CBR. (2018). Review of financial stability. Q4 2017-Q1 2018. Retrieved from: http://www.cbr.ru/publ/Stability/OFS_17-03.pdf

PANOVA, G.S. Banks in the conditions of international sanctions: strategy and tactics. Bulletin of MGIMO. Vol 1, year 2016, issue 46, page 154-168.

RAKHMATOVA, Z.I., ZOIDOV, Z.K., ABDUKHAMIDOV, G.M. Providing economic security of the banking system from threats and challenges of globalization transformations. RPEE. Vol 6, year 2017, issue 80, page 78-90.

SILVESTROV, S.N. The Financial Stability Board is the fourth pillar of the global financial system. Finance: Theory and practice. Year 2014, issue 6, page 84-91.

SMIRNOV, D.V. Economic Security in the Sphere of Banking Activity. The Symbol of Science. Year 2017, issue 5, page 109-111.

EKMALYAN, A.M. Banking system and national security issues of the Russian Federation. Proceedings of the Institute of State and Law, RAS. Vol 5, year 2017, issue 63, page 127-148.

1. JSC “AlfaBank”, Vice-President. Contact email: dandremov@yandex.ru

2. Russian Presidential Academy of National Economy and Public Administration