Vol. 39 (Nº36) Year 2018. Page 21

Vol. 39 (Nº36) Year 2018. Page 21

Alexandr Lvovich ELYAKOV 1; Isabella Damdinovna ELYAKOVA 2; TAleksandr Andreyevich KHRISTOFOROV 3; Pavel Nikolaevich EGOROV 4; Nadezhda Sergeevna BURYANINA 5; Elena Egorovna TOTONOVA 6; Afanasiy Afanasievich FEDOROV 7

Received: 18/05/2018 • Approved: 18/06/2018

ABSTRACT: The article assesses the influence of factors influencing the formation of world oil prices and the development of short-term forecasted price level scenarios. For this, the study involved the following activities: classification of factors affecting the price of oil; assessment of the impact of factors on world oil prices; forecasted scenarios of oil prices based on the use of trend analysis methods, triple exponential smoothing models and empirical analysis. |

RESUMEN: El artículo evalúa la influencia de los factores que influyen en los precios mundiales del petróleo y el desarrollo de pronósticos de escenarios de precios a corto plazo. Para esto, el estudio involucró las siguientes actividades: clasificación de los factores que afectan el precio del petróleo; evaluación del impacto de los factores en los precios mundiales del petróleo; escenarios pronosticados de los precios del petróleo basados en el uso de métodos de análisis de tendencias, modelos de suavizado exponencial triple y análisis empírico. |

Oil historically is the main energy resource in the world, which is the basis for the existence of modern society, so its price rate is a reflection of what is happening all over the world. Currently, oil is one of the most used energy sources in the world energy economy and a strategic resource for many countries, thus causing a direct interest in its value. In addition, the economy of some countries with a commodity economy directly depends on the oil price (British Petroleum, 2017).

There is a need to predict oil prices for short and medium terms in order to avoid instability in the national and world economy to let the economy work effectively. Oil price has a great influence on the political and economic processes and macroeconomic indicators of the countries of the world, which in one way or another are connected with the consumption of oil and their derivatives or its extraction, which makes it necessary to predict its price level.

Russia is one of the main countries-exporters of oil. Almost half of the state budget revenue consists of oil and gas revenues. Therefore, it is very important for the country to accurately assess the prospects for price changes in the world oil market (Plenkina et al., 2018). In 2018, the ESPO pipeline reached its designed capacity and began to expand oil supplies to China. This allowed expanding the market for the sale of Russian oil (Bibylev et.al., 2006). However, given the changes in oil prices in recent years, the world oil market has undergone major changes. This makes it necessary to compile various forecasts of changes in oil prices to ensure the most effective economic policy of the country.

In the course of the study, the correlation-regression analysis method was used to identify the relationships between variables through point and interval estimation of paired (private) correlations, calculation and verification of the significance of multiple correlation and determination coefficients; selection of the factors that have the most significant effect on the outcome, based on measuring the degree of communication between them.

Using the paired correlation coefficients, the density and strength of the relationship between the main factors influencing the change in oil prices for each period of development of the world oil market are established.

Paired correlation coefficients served as a basis for determining the priority factors that most strongly influence the change in oil prices. The method of least squares determined the quantitative level of priority of the influence of factors on the oil prices level, which made it possible to assess the tightness of the relationship between the modulated variables and to assess the effect of the outcome factor. Priority of the influence of factors is represented by the regression model.

A model for calculating future values is used to compute forecast values of production and consumption volumes based on the analysis of historical data based on exponential smoothing with the definition of confidence ranges (the ETS AAA algorithm). Thus, the forecast values are based on existing data and continue the timeline.

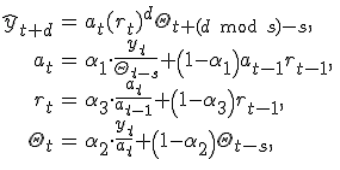

The Holt-Winters triple exponential smoothing algorithm is used for calculations (Mandelbrot, 1963; Goodwin, 2010).

Time sequence is denoted as Yt:

where s is the seasonal period, s-1 is the season profile, rt is the trend parameter, at is the forecast parameter cleared from the influences of the trend and season.

World oil prices are formed under the influence of many factors, which causes their high variability. Significant impact on the change in oil prices have such factors as: change in the macroeconomic situation in the country, the development of the world economy, changes in the geopolitical situation, oil reserves, changes in exchange rates, etc. These factors can be divided into external and internal. Economic factors, as a rule, are of greatest importance among external factors. The greatest impact among economic factors is the ratio of supply and demand. The following is distinguished among other economic factors: aggregate supply and demand for oil, GDP growth rates, exchange rates and investment in the industry (Bushuev et.al., 2013). It is also possible to single out geopolitical factors that imply a significant impact on the oil market in the short and long term and natural and climatic factors of influence that are associated with the variability of weather conditions. The following is distinguished among the internal factors of oil price formation: development of technology and scientific and technological progress, analysis of price volatility, current legislation and others. The scientific and technological progress is especially important for pricing oil - it reduces the cost price of oil production, which helps to reduce its prices (Bushuev et.al., 2013).

Table 1

External and internal factors affecting the oil market.

External factors |

Internal factors |

Oil market conditions |

Oil production and consumption volumes |

Geopolitical situation |

Oil production costs |

Development of alternative energy sources |

Taxation of oil companies |

Weather conditions |

Customs duty |

World economy development pace |

Oil reserves volume |

Scientific and technological progress in the energy sector |

Development of the oil industry of the country |

Potential oil reserves volume |

|

Economic and financial crises |

Also, when analyzing the factors influencing the formation of oil prices, researchers use a different approach. They identify factors that affect supply or demand. A certain impact on world oil prices has a level of global demand. It is affected by a number of factors, such as: natural and climatic conditions in places of oil production, energy consumption of the world economy, tax rates in countries and geopolitical situation (the likelihood of military actions in the oil production regions). World oil production level, as a rule, is determined by the demand for oil and oil products. At the same time, in addition to demand, the following range of factors has a significant impact on the oil supply level: geological characteristics of the field, field development technology, the number of developed and explored deposits and their estimated size, the state policy of the oil and gas sector, world oil price levels, natural and climatic conditions and the geopolitical situation in the oil-producing countries (Bibylev, 2006).

Table 2

Factors affecting supply and demand in the world oil market.

Factors affecting demand |

Factors affecting supply |

Energy intensity of the world economy |

Quantitative and qualitative characteristics of the available geological oil reserves |

The level of economic development of the country |

Technical progress |

Social standard of living |

Oil production costs |

Oil world market price level |

Oil world market price level |

Climatic conditions |

Climatic conditions |

The volume of commercial oil reserves |

Tax policy |

Tax policy |

Geopolitical situation |

Geopolitical situation |

The factors determining the formation of oil prices were systematized and the author's approach to the classification of factors influencing the oil price and the market situation was developed in the course of the research. It is proposed to divide the factors into the two categories: factors affecting demand, and factors affecting the supply of oil. Each of the categories includes two sub-categories of factors - internal and external.

Table 3

Authors' classification of factors affecting the oil market.

Factors affecting demand |

Factors affecting supply |

||

External |

Internal |

External |

Internal |

Energy intensity of the world economy |

Oil world market price level |

Scientific and technical progress |

Oil consumption volume |

Economic development level of the countries in the world |

The volume of commercial oil reserves |

Energy intensity of the world economy |

Oil production costs |

Social standard of living |

Tax policy |

Oil market conditions |

Tax policy |

Climatic conditions |

Customs duty |

Available and potential oil reserves |

Customs duty |

Development of alternative energy sources |

Geopolitical situation |

Development of the oil industry of the country |

|

Geopolitical situation |

Climatic conditions |

Oil world market price level |

|

Policy regulation of production volumes |

|||

World oil production and consumption analysis was conducted for the analysis of the market.

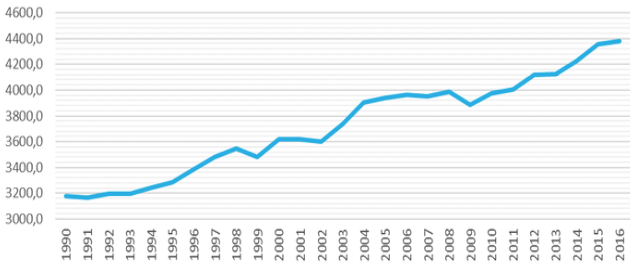

Almost stable growth of oil production is observed for the whole analyzed period, although in some years (1999, 2002, 2007, 2009) there was a drop in oil production (Fig. 1).

Fig. 1

World oil production volume, 1990-2016,

million tons/year (British Petroleum, 2017).

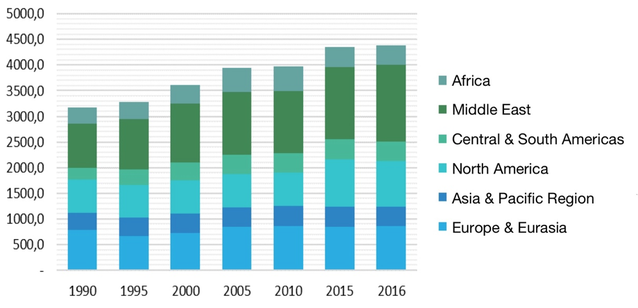

As can be seen from Fig. 2., the main oil producing region is the Middle East. Extraction volume of the region grows throughout the period under review. Europe and Eurasia have been maintaining their production volumes since 2005 at approximately the same level of about 850 million tons per year. North America significantly increased its production after 2010 and exceeded 900 million tons in 2015, but in 2016 there is a slight decrease.

Fig. 2

World oil production volume by region, 1990-2016,

million tons/year (British Petroleum, 2017).

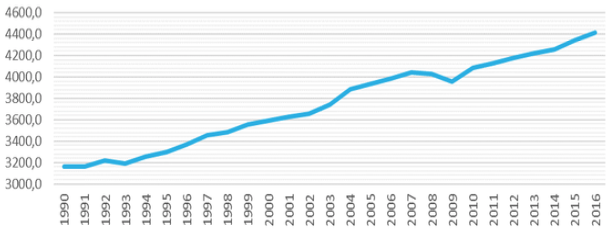

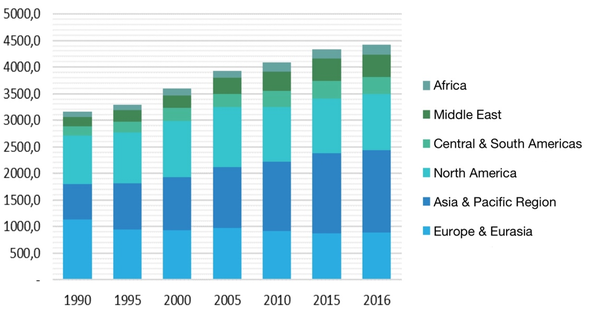

Further, oil consumption dynamics was analyzed. As can be seen from Fig. 3, oil consumption almost constantly increases over the period under review. At the same time, consumption volumes have decreased in recent years in Europe and Eurasia, but have significantly increased in the Asia-Pacific region (Fig. 4). In other regions, consumption levels show weak growth since 2005.

Fig. 3

World oil consumption volume, 1990-2016,

million tons/year (British Petroleum, 2017).

-----

Fig. 4

World oil consumption volume by region, 1990-2016,

million tons/year (British Petroleum, 2017).

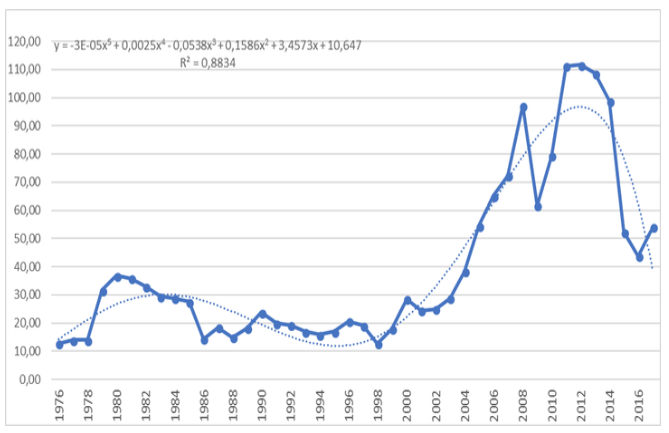

Figure 5 shows the dynamics of Brent oil prices since 1976. Oil price level has more than tripled over the last 30 years. In 2012, the average annual oil price exceeded the USD120 per barrel, which allows for estimating oil price volatility as very high. For three years, the average annual oil price increased from USD60 to USD120 per barrel, which leads to difficulties in constructing forecast values using trend historical analysis. As can be seen, the oil price is highly volatile and trend analysis in the analysis of such a time series cannot be carried out, since the forecast reaches zero in 2018.

Fig. 5

Dynamics of prices for Brent oil, 1976-2017,

USD/bbl (British Petroleum, 2017).

Impact analysis of the factors influencing on world oil prices was made by correlation-regression method. This allowed for assessing the strength of the dependence of oil prices on the factors affecting it. The authors have chosen the main factors that affect the price of oil volumes of world demand and supply in the oil market and the volume of world oil trade. Evaluation of the strength of price dependence on factors will allow developing a more accurate model of world oil prices, built on the basis of empirical analysis. The dependence of oil prices on the annual volumes of world trade, consumption and oil production in the world was established to calculate the correlation coefficients.

The following correlation coefficients values have been received:

Of the world oil production r = 71.72%;

Of the world oil consumption r = 74.03%;

Of the world trade volume r = 70.46%.

The analysis results indicate a strong influence of all analyzed factors, but the demand level has the greatest impact on price. Thus, it can be argued that, in the main, oil prices are formed precisely by the world demand level.

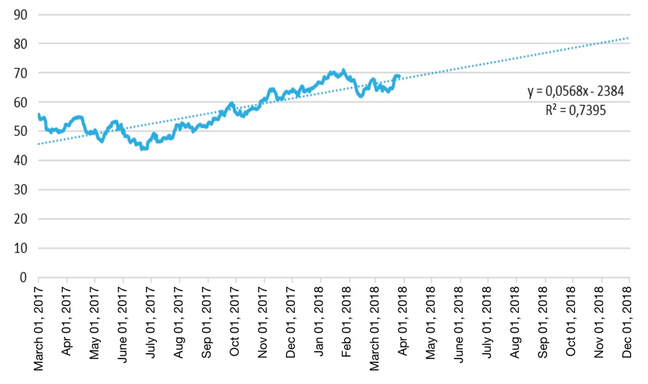

The evaluation of price dependence on factors, supply and demand allowed the development of three forecast scenarios for changes in oil prices. The first forecast is based on the trend analysis and assumes the establishment of prices for Brent oil within USD80 per barrel by the end of the year (Fig. 6.). This is confirmed by the relatively stable price increase since June 2017.

Fig. 6

Estimation of short-term forecast scenarios of world prices

for Brent oil by the trend analysis method, USD / bbl.

The second forecast was made by creating a triple exponential smoothing model (the ETS AAA algorithm - the modified Holt-Winters model) (Mandelbrot, 1963; Goodwin, 2010). The result of this model is more conservative and assumes the establishment of oil prices by the end of the year in the region of USD70-72 per barrel, but allow fluctuations in prices in the corridor from USD53 to USD90 per barrel (Table 4).

Table 4

Estimation of short-term forecast scenarios

of oil prices by the Holt-Winters method

Date |

Forecast |

Upper confidence range |

Lower confidence range |

April 01, 2018 |

69.69 |

72.15 |

67.78 |

May 01, 2018 |

69.89 |

75.80 |

63.97 |

June 01, 2018 |

70.08 |

78.32 |

61.84 |

July 01, 2018 |

70.27 |

80.39 |

60.15 |

August 01, 2018 |

70.46 |

82.24 |

58.69 |

September 01, 2018 |

70.66 |

83.94 |

57.37 |

October 01, 2018 |

70.85 |

85.55 |

56.15 |

November 01, 2018 |

71.04 |

87.09 |

55.00 |

December 01, 2018 |

71.23 |

88.57 |

53.90 |

January 01, 2019 |

71.43 |

90.01 |

52.84 |

The third model is based on the empirical analysis and assumes the establishment of prices within 70 USD per barrel and considers the cyclicality of prices and changes in market conditions. This is a more moderate forecast and it is based on the analysis of the current dynamics of changes in oil prices, which, although they show a smooth growth for 2017 - early 2018, but suggest different fluctuations. Price fluctuations that reduce the growth rates of oil prices were observed in 2016 and in summer 2017. Thus, a similar low price decline is expected in the summer of 2018, which corrects the analysis results obtained by the trend method and the Holt-Winters method, which leads to a price around 70USD/bbl.

Also, the authors made a medium-term forecast of oil prices. The data of this forecast are less accurate, since they have longer time horizons. The forecast of medium-term oil prices was made by the Holt-Winters method. The dynamics of prices for Brent crude oil from June 2017 to March 2018 was taken as the basis. The following results were obtained:

In 2018, the average annual price is expected to reach USD55/bbl (and the average annual price in 2017 was USD54.25/bbl) and further growth to 2023, where it will be 63USD/bbl. At the same time, various price fluctuations in corridors are allowed, established by confidence intervals. Moreover, the forecast has greater accuracy in the closer forecast horizons, so the further the forecast is made, the wider the price corridors determined by the confidence ranges (Table 5).

Table 5

Year |

Forecast |

Upper confidence range |

Lower confidence range |

2018 |

55.16 |

77.91 |

32.42 |

2019 |

56.81 |

84.19 |

29.43 |

2020 |

58.46 |

89.80 |

27.12 |

2021 |

60.11 |

94.98 |

25.24 |

2022 |

61.76 |

99.83 |

23.68 |

2023 |

63.41 |

104.44 |

22.37 |

In the course of the study, the following main results were obtained:

1. The existing classifications of factors influencing world oil prices were analyzed and own approach to the classification of these factors was proposed;

2. The analysis of dynamics of indicators of the world market of oil, such as world volumes of extraction and consumption and the prices (on an example of Brent) has been carried out.

3. The authors estimated the impact of the supply and demand of the world oil market on the oil price level and, based on the results of the correlation-regression analysis; found that oil prices have a higher interrelation with the demand level.

4. Three forecasts were made for the development of world oil prices based on the Holt-Winters method, historical trend and empirical analyses.

5. Mid-term oil price levels were also calculated using the Holt-Winters method.

The results of this study, which includes identifying factors that affect oil prices, assessing their impact on world oil prices and developing forecasts, can be applied in the area of budget planning in Russia, as well as in planning and forecasting in oil and gas organizations.

BIBYLEV, Yu.N., PRIKHODKO, S.V., DROBYSHEVSKIY, S.M., TAGOR, S.V. (2006). Factors for oil prices. Moscow: Institute for the Economy in Transition.

British Petroleum. (2017). BP Statistical Review of world energy 2017. Retrieved from: https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review-2017/bp-statistical-review-of-world-energy-2017-full-report.pdf

BUSHUEV, V.V., KONOPLYANIK, A.A., et.al. (2013). Oil prices: analysis, trends, forecast. Moscow: Energy Publishing House.

GOODWIN, Paul. The holt-winters approach to exponential smoothing: 50 years old and going strong. FORESIGHT Fall. Year 2010, page 30-33.

MANDELBROT, B. New Methods in Statistical Economics. Journal of Political Economy. Vol 61, year 1963, page 421–440.

PLENKINA, V., ANDRONOVA, I., DEBERDIEVA, E., LENKOVA, O., OSINOVSKAYA, I. (2018). Specifics of strategic managerial decisions-making in Russian oil companies. Entrepreneurship and Sustainability Issues, 5(4), 858-874.

1. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation

2. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation, izabella.elyakova@yandex.ru

3. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation.

4. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation.

5. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation.

6. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation. Institute of Foreign Languages and Regional Studies of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation.

7. Financial and Economic Institute of the Ammosov North-Eastern Federal University, Yakutsk, Russian Federation.