Vol. 39 (Nº36) Year 2018. Page 23

Vol. 39 (Nº36) Year 2018. Page 23

Irina GOLAIDO 1; Inna PARSHUTINA 2; Olga SHAPOROVA 3; Elena KIRPICHENKO 4; Irina VORONKOVA 5

Received: 18/05/2018 • Approved: 26/06/2018

ABSTRACT: The article deals with the theoretical-methodological and practical consideration of the problem of building a model of the management forecast system of enterprise reserves in respect of risk factors. The authors analyzed and structured the main provisions of significant research in the field of reserves and enterprises reserve system and their use at the micro level; the definitions of the basic concepts were clarified, the aggregates of the enterprise reserve system were featured, and the possibilities of using accounting engineering tools were investigated. The authors defined a set of protective mechanisms of different orientation and level, which allows the enterprise to function under conditions of risk and uncertainty. |

RESUMEN: El artículo aborda la consideración teórico-metodológica y práctica del problema de construir un modelo del sistema de previsión de gestión de las reservas empresariales con respecto a los factores de riesgo. Los autores analizaron y estructuraron las principales disposiciones de investigación significativa en el campo del sistema de reserva de reservas y empresas y su uso a nivel micro; se aclararon las definiciones de los conceptos básicos, se presentaron los agregados del sistema de reserva empresarial y se investigaron las posibilidades de utilizar herramientas de ingeniería contable. Los autores definieron un conjunto de mecanismos de protección de diferente orientación y nivel, lo que permite a la empresa funcionar en condiciones de riesgo e incertidumbre. |

Risk is an integral part of business, which can influence the achievement of strategic, operational and financial goals. Accordingly, each enterprise is aimed at protecting and managing risks. In addition, different approaches to forecasting risks and protection against them have been developed: ignoring risks, pursuit of mitigating risks, partial or complete hedging, etc.

Thus, the reserve system currently plays a significant role in the enterprise activity as an insurance mechanism against risks. Leveraging reserves allows not only minimizing the negative consequences of economic events, but also avoiding bankruptcy in some cases. Consequently, the formation of an accounting and analytical system of the company’s reserves is one of the sources of uncertainty and risk insurance. For this purpose, the management accounting and analytical system of valuation indicators should be considered as management of assets and liabilities, risks, etc.

When losses occur, companies cover them from previously created reserves, which allows them to gain time and avoid panic among investors. Therefore, the creation of the enterprise reserve system permits to provide an appropriate level of security in the current economic conditions, which poses a pressing challenge.

Despite a large number of studies of the enterprise reserve system, more precisely, the specifics of its formation and use, the reserve system aggregates within the management accounting and analytical system, currently there are differences in the interpretation of terms. Issues concerning the classification of reserves and interpretations of the reserve system and their use at the micro level remain somewhat debatable.

Within the framework of this research, various approaches to interpretation of the concepts of the reserve system as a set of enterprise reserve aggregates aimed at the continuation of its activities and currently existing were analyzed. As a result, terminological discrepancies found in various works distorting the semantic load of the categories “reserve system”, “the reserve system aggregates” and limiting the possibilities of their application for the formation of an effective reserve system of the enterprise, which allows ensuring the minimization of risks and stable activity, were noted. The authors developed the proprietary model of the managerial accounting and analytical system of the company’s reserves, as well as presented practical aspects of the formation of some aggregates of the reserve system within the framework of the management accounting and analytical system of evaluation indicators. Grounded on the developed accounting and analytical system of reserves and the management mechanism of the reserve system, it is possible to forecast actual threats, quickly identify them, develop ways to reduce risks and calculate the impact of negative consequences on the firm’s state, which will result in a combination of maximum profit and long-term business stability.

In the course of the study, we considered various interpretations of reserves and the reserve system, and their use at the micro level.

The first interpretation considers the reserve, hedge and other factors as a particular opportunity to eliminate the risk in the cash market. This interpretation represents in fact only certain hedging processes, its supporters are: L. Gitman, M. Joehnk, D. Downes, G.J. Alexander, J.V. Bailey, W. F. Sharpe and others.

W. F. Sharp, G.J. Alexander and J.V. Bailey reduce reserve processes only to hedging as buying and selling futures to exclude risks in the spot market.

Representatives of this direction are characterized by a restriction of the reservation by micro- and macro hedging processes, hedging as loss insurance and hedging as risk management.

Representatives of the second direction limit the reserve system by insurance against a wide variety of losses, simultaneously expanding the concept of reservation. Representatives of this area include D. Blake, R. Merton, Z. Bodie, I. Bishek, J. Marshall, and others.

The third interpretation considers the enterprise reserve system in connection with the obligating event (the economic situation, the adoption of which requires the calculation of the appropriate amount of risk assets), the adoption of which, on the one hand, involves certain risk-generating assets and, on the other hand, can bring significant profits.

Therefore, the obligating event is estimated from two ways:

- the value of risk assets with a certain degree of probability, reflected using the derivative financial statements of the integrated risk;

- the reserve system reliability, which is confirmed by a hedged derivative financial statement.

Obligating events are characterized by risk and uncertainty, the event size, the time of the event occurrence and the capabilities of the reserve system in solving them. In order to substantiate the decisions made, the representatives of this interpretation use the basic provision of the theory of marginal values. The representatives of this direction are: J. Harris, T.N. Malkova, L.T. Gilyarovskaya, R. Merton, B. Butler, M.S. Scholes, B. Hunt, R. Shulvu, S. Tyke, and others.

The fourth interpretation views the enterprise reserve system as risk management based on the use of the reserve system aggregates as an integrated status compensating for the risk. The supporters of this interpretation of the reserve system are: A.G. Gryaznova, D. Kidwell, G.E. Krokhicheva, J. Laurent, P. Samuelson, V.I. Tkach, F. Jornon and others.

The basis of this interpretation are the works of the Group of Thirty (G30) – a private non-profit international body that developed rules for working with risk. Among other recommendations, G30 proposed to use an indicator known as risk value as the only means of risk measurement.

From the point of view of V.I. Tkach, G.E. Krokhicheva and I.M. Ageev, the enterprise reserve system is considered as a complex of protective aggregates, each of which includes several risk-compensating positions: asset and liability management; micro- and macro-hedging; reservation based on the use of reserves accounts and subaccounts; immunization of assets and liabilities; insurance and guarantees and pools.

The effect of the reserve system aggregates on property is provided by using the system of zero derivative balance sheets: organic, actuarial, virtual, strategic, immunization, hedged, of integrated risk, synergetic, etc.

S.V. Romanova investigated more than 50 reserve accounts, combining them into 11 groups, and developed a general model of the enterprise reserve system.

I.M. Ageev developed a model of management accounting of the enterprise reserve system in terms of risk and uncertainty, in which he presented 14 accounting aggregates of the reserve system and proposed 8 blocks describing them: generally accepted principles of the reserve system, situational accounting model of the reserve system, the reserve system foundation, financial accounting of reserves, accounting for liabilities, decision-making, assumptions and consolidated accounting mechanism.

D.V. Bondar developed and tested a hedged balance sheet as a tool for management accounting of the enterprise reserve system. In this interpretation, the model of the hedged derivative balance sheet includes hedged accounting entries, balance hedge, relevant valuations (balance, market, fair, etc.), hypothetical asset realization processes and hypothetical satisfaction of obligations, which ensures the receipt of net assets and net liabilities and determining variance as regards reserve protection standards, as well as the development of appropriate measures to ensure the survival of the investment company.

The research of the organization of accounting for a reserve system in an enterprise-type networked system is of particular interest.

G.E. Krokhicheva developed a technique for accounting for a reserve system in virtual networks, in which 13 aggregates of the reserve system are presented: asset and liability management, hedging, insurance, reservation based reserves accounts, gross savings growth, increase in net assets, employees’ participation in profit, capital adequacy, warranty liabilities, forecasting, regulation of relevant items, freeze and hidden reserves. The mentioned aggregates are characterized by seven blocks: the essence of the method, the object of management, the basis of the reserve system, the result of protection, the reflection of the results of the reserve system in accounting, the methods of managing the risk and reserves, the result of reserve protection: net assets.

The concept of the reserve system as a set of organization’s reserve aggregates, ensuring the continuation of its activities belongs to G.E. Krokhicheva, which combined the reserve aggregates into three groups: the reserves of own sources of funds, included directly into net assets; reserves that protect active balance sheet items (active reserves); reserves protecting passive balance sheet items (passive reserves).

In the late 20th - early 21st centuries there were works exploring reserve accounts, ways of property protection, representation in accounting of evaluation of guarantees issued and received, the formation of a reserve organization system and its management, analysis and control of the reserve system: J. Betge, U. Brigham, E. Helfert.

A. Upchurch emphasizes that engineering assessments are built on a special methodology. Almost the opposite, from the point of view of methodological accuracy, is the method of estimation based on the analysis of accounts, since the engineering method is created on the basis of an appropriate system of tools: zero, actuarial, hedged, immunization, fractal, strategic, reorganizational and other derivative balance sheets that allow obtaining and use highly analytical information and in market, fair, replacement, collateral, residual and other assessments depending on the issues of strategic orientation to be resolved.

Many economists (K. Drury, V.I. Tkach, F. Lefebro and others) note that the use of accounting engineering tools, derivative financial instruments and strategic hedging can transform our ideas about the formation of the shareholder value of large companies. At the beginning of the 21st century, more than 400 tools of financial engineering and more than 50 instruments of accounting engineering operated. G.E. Krokhicheva investigated the accounting and analytical aspects of the network information system, proposed and put to an evaluation test the system of fractal derivatives of balance reports: strategic, hedged, immunization, enabling to organize the economic information management in fractals of time and space.

T.O. Kubasova developed a model of the net asset value based on the concept of determining an organization’s net worth of as a property complex: balance sheet, zero, organic, reproductive, actuarial, static, forecasting and virtual value of net liabilities. All these concepts were first systematized from two points of view.

J. Richard wrote that the existence of multiple concepts of property (liquid, paid-in, static, actuarial, fiscal, etc.) makes all attempts vague which try to restrain the development of accounting in the strict uniformity framework, that naturally led to the emergence of the concept of net liabilities approximately 40 years ago in Germany.

The theory of net liabilities, developed by I.N. Bogataya, is formalized as follows: Cash = Net liabilities.

The significance of this indicator follows from the theory of maximizing shareholders’ wealth. The use of indicators of earnings per share, cash flow per share or net asset value per share to assess the company’s performance does not allow shareholders to obtain relevant information about the organization’s functioning.

In its turn, the indicator “net liabilities per share” allows estimating the return of own capital by the level of profitability to the greatest extent, as well as the increase in property in value terms and the amount of funds to be distributed among owners. In other words, the value of this indicator is that net liabilities “characterize the amount of liabilities to owners, taking into account future expenses, as well as taking into consideration the repayment of all obligations associated with the use of property.”

The indicator of net liabilities reflects the organization’s real market value. This item is important in the sense that 20% of Russian enterprises have a real cost of capital in the form of a negative value.

In this regard, it is appropriate to note that the largest representative of accounting in Europe, I.F. Cher (1846-1924), drew attention to the fact that the capital account can have a debit balance, as a result of the “using up” of property and the lack of adequate reserves.

The dictionary of Macmillan’s modern economic theory defines uncertainty as a situation in which the probability of occurrence of events is completely unknown, i.e. outcomes cannot be related to any probability distribution. If the considered event is an investment in the project, then the uncertainty of revenue is understood as such a situation in which the possible revenue is known, but the probability of its receipt is unknown.

In such circumstances, it is necessary to turn to a certain rule based on the investor’s attitude to the profit and loss balance. The rule is that in certain situations, a particular choice is made, for which hedged entries and entries to reflect risk situations are applied.

For the first time an accounting model for determining the level of the organization’s reserve protection was proposed by I.M. Ageev (Table 1).

The hedged derivative balance sheet is a balance sheet showing the required level of reserve protection in the form of the value of net assets. D.S. Kidwell, L.R. Peterson, D.W. Blackwell put forward the idea of immunizing the balance as a whole in the form of hedging revenue against equity by implementing the idea of calculating the gap in the recovery period by comparing the market value and the percentage sensitivity of own assets with the market value and the percentage sensitivity of their liabilities, i.e. balancing of assets and liabilities by many factors, including the price component.

Table 1

Accounting model of determining the level of an enterprise’s reserve protection based on derivative balance sheets

Accounting balance-sheet |

Model blocks |

||||||||||||||||

Accounting balance sheet after adjustment |

Accounting reserve system aggregates |

Register of reserve system aggregates |

Derived balance sheets |

Forecasting balancesheets |

Reserve system sufficiency limit |

||||||||||||

At the beginning of period |

At the end of period |

Reserve accounts |

Asset-liability management |

Hedging |

Insurance |

Warrants and others |

Debit of accounts |

Credit of accounts |

Zero |

Organic |

Actuarial |

Budgetary |

Strategic |

Balance net assets |

Adjustment of accounting reserve system aggregates системы |

Reserve тet assets or liabilities |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

1. Fixed Assets |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

|

|

|

|

|

2. Current Assets |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

3. Capital and reserves |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

4. Long-term liabilities |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

5. Short-term liabilities |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

Statement of financial position |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

Balance net assets |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

|

Reserve system net assets |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

|

Reserve system net liabilities |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

+ |

In the Russian economy, the use of net liabilities was developed by V.I. Tkach and I.N.Bogataya to determine the disaggregated property index in conjunction with the aggregated indicator The idea of immunization based on the definition of the indicator of net liabilities was first published by V.I. Tkach and J. Laurent in 1997, F.T. Teuwazhukova, which defined net liabilities as net sources remained at the enterprise after the deemed sale of assets and meeting obligations.

R.K. Merton and Z. Bodie define the process of risk management as systematic work as regards the analysis in a particular field of activity, developing and taking appropriate measures to minimize it, and defining a risk zone: active, passive and neutral.

But despite numerous works, the method of monitoring the organization’s reserve system has not been adequately covered in the literature, especially in the context of timely prevention of economic disasters.

In the process of developing a model of the managerial accounting and analytical system of the enterprise reserves, the authors applied the following postulates.

First, the model will enable solving any organizational problem (seizure of a new market niche, reorganization of the organization, use of venture capital, change of innovation policy, etc.). Three items are taken into account: high level of uncertainty; probability of wrong decision and low confidence.

Secondly, it is very often necessary to carry out the analysis, since the enterprise operates in conditions of uncertainty, which leads to the fact that the enterprise is surrounded by two zones:

- tolerance (characterizes the zone providing active counteraction to uncertainty factors)

- imbalance.

The zone of tolerance is considered as an effective activity zone, which, as a rule, corresponds to an active financial condition, and the zone of imbalance leads to inefficient activity and a passive financial state.

Third, the model should be based on the use of accounting engineering tools: hedged, strategic and derivative balance sheet of integrated risk.

Fourth, the tools of accounting engineering require the use of hypothetical entries for the deemed sale of assets and meeting obligations at appropriate prices (market-based, fair, etc.).

Against this background, the authors offer a model of management accounting and analysis system of the enterprise reserves, which consists of an initial operator (reserve system aggregates and reserve system indicators) and eight elements.

The enlarged aggregates of the reserve system include: fixed assets; current assets; capital and reserves; short-term liabilities and long-term liabilities.

The reserve system indicators comprise: net assets; net liabilities; price component; areas of financial state (active, passive, zero).

The concept of organization’s reserve system indicators is built on two basic conceptual approaches:

determination of the aggregated indicator of ownership in the form of net assets.

2) determination of a disaggregated indicator of ownership in the form of net liabilities: the theory of net liabilities.

Generally, 14 units of the organization’s reserve system are distinguished: reserve accounts; asset and liability management; hedging; insurance; guarantees issued and received; losses forecast; conjuncture fluctuations forecast; regulation of financial results; blocking of property; hidden reserves; standby solvency; individual investment; government guarantees; guarantees received from municipal authorities.

Hedged entries are used to register the organization’s reserve system aggregates, which is a set of protective measures of different levels and focus, ensuring the organization functioning in terms of risk and uncertainty, based on the calculation and use of hedged net assets in management.

The representation of entries as regards risk situations is aimed at ensuring the implementation of four items: a systematic identification of risks with a probability of up to 95%; expert evaluation of the cost of risks; determination of integrated risk amount; specification of the financial status zone: active, passive, zero. Risk impact assessment can be carried out related to four items: zero, low, medium, high (Table 2).

Table 2

Risk Impact Assessment (Lebedev, 1996)

Impact on project characteristics |

Zero |

Low |

Medium |

High |

Business advantages |

<2% profit reduction <2% increase in operating costs |

3-5% profit reduction 3-5% increase in operating costs |

6-10% profit reduction 6-10% increase in operating costs |

>11% profit reduction >11% increase in operating costs |

Sale / quality |

Imperceptible impact on implementation of business functions / services |

Degradation of business functionality in non-key functions or degradation of the level of services |

Abrupt degradation of business key functions or degradation of the level of services, resulting in complaints |

Loss of business key functions or abrupt degradation of the level of services, resulting in complaints |

Project cost |

<2% increase in project cost |

3-5% increase in project cost |

6-10% increase in project cost |

>11% increase in project cost |

Project schedule |

Additional work does not require the key guidance shift |

Key guidance shift slightly, but the general schedule is followed |

The implementation is carried out beyond the deadline, but this does not result in serious political consequences |

The system is implemented four months after the deadline, and this leads causes serious political consequences |

Based on the undertaken study, the authors concluded that the reserve system should be understood as the set of standard and organizational and methodological subsystems for the formation of reserve stocks, on the one hand, and the unused possibilities of reducing the current and advancing costs of the economic entity, on the other, performing functions to maintain a balance between the users’ interests, ensuring the stability of the accounting and analytical system and monitoring the systemic risks of conducting business operations.

According to the authors’ point of view, the accounting and analytical system of the economic entity’s reserves is a multifunctional complex of elements for collecting, summarizing and analyzing the multifaceted financial information that meets the various users’ interests, functioning with the possibility of ensuring the safety of activities and compensation of risks (tax, financial, investment, etc.) and applying the theory of limit values related to the analytical indicators of assets and liabilities of economic entities.

In modern economic realities, two concepts of reserves are distinguished. The first category includes reserve supplies, including raw materials, supplies, the availability of which is a prerequisite for the continuous systematic development of an enterprise.

The second category implies reserves, as previously unused opportunities to improve the quality indicators and production growth. The company’s reserves represent previously unused opportunities to reduce the current and forthcoming costs of the enterprise. One way to use available reserves is to eliminate various losses and unreasonable costs. Another area of reserves usage is represented by ensuring the possibility of increase in intensification and production efficiency.

The reserve amount is the gap between the existing and possible level of the enterprise resources usage.

In this case, reserves are classified according to various characteristics. Based on the source of the reserve formation and from the point of view of the enterprise, they are internal and external.

External reserves are represented by sectoral and regional reserves. Internal reserves are the main source of savings at enterprises.

The enterprise’s activities are influenced by internal and external factors that create situations of uncertainty and risk. To assess the internal environment – its strength and weakness, as well as external opportunities and threats, SWOT analysis is carried out.

SWOT analysis is one of the most common methods in management practice, connecting external and internal factors that determine the development of a managed enterprise. It is necessary to accurately identify the goal, the tasks of building a matrix of strategic SWOT analysis of the company, as well as to determine the sequence of the analysis stages.

The significance of SWOT analysis is that it enables to see the most likely risks, identifying and structuring the company’s strengths and weaknesses, as well as potential opportunities and threats.

Financial and production resources of the enterprise can be used in an intensive or extensive way.

With the extensive use of resources, their additional involvement in the production process is performed. With the intensification of production, the results should grow faster than costs with less involvement of resources.

In modern conditions of enterprises’ functioning for a considerable time there cannot be a definitely intensive or extensive way of development, therefore it is advisable to talk about the preferred variant of a certain type.

The predominantly extensive type of production allows for a certain increase in efficiency, but higher growth is possible only due to the predominantly intensive type of development.

Classification of reserves, depending on the factors and conditions for intensification and improving the efficiency of economic activity is relevant for the search for reserves.

In particular, the reserves for increasing the progressiveness of production, the equipment used, and the scale of mechanization are directly related to the scientific and technological level of industrial production.

In the organizational structure of production, reserves of specialization, co-operation, reduction of the production cycle duration and other similar reserves are distinguished.

Substantial reserves are available in improving the social conditions of the labor group work and life, the state of production culture, careful attitude to nature and rational use of natural resources, and in improving the enterprise’s foreign economic relations.

Reserves may include: reserve capital; reserves to reduce the value of tangible assets; future expenses and payments; reserve for the pending payment for holidays; payment of annual remuneration for the length of service; reserves created by enterprises taking into account the specifics of activities.

A reserve system is created by hedging each component of the enterprise’s aggregate of indicators. In other words, each element of the asset and liability is checked for risk, and adjustments are made. Grounded on the adjustments made, a hedged derivative balance sheet is prepared. The main criterion for the enterprise’s reserve system capacity is the disintegrated indicator – the value of the company’s net liabilities.

The difference between hedged and balance sheet net assets shows the status of the reserve system:

- standard protection NAh = NAb

- excessive reserve protection NAb > NAh

- lack of reserve system NAh < NAb

where NAh – hedged net assets,

NAb – balance sheet net assets (Arkhipov, 2006).

While forming the hedging potential of the enterprise, a risk insurance system is created in two directions:

1) registering the reserve system aggregates;

2) calculation of the hedging potential.

The significance of creating a reserve system led to the conclusion that it is necessary to develop a model of the managerial accounting and analytical system of the company’s reserves in order to ensure the safety of activities.

The developed model of the managerial accounting and analytical system of the enterprise reserves in case of risk events should be built taking into account the specific features of the enterprise’s activity, with the purpose of timely risk detection and prevention.

The model of the management accounting and analytical system of the company’s reserves enables to predict future events, because it is based on the intended changes in indicators that directly affect the enterprise’s property and financial position.

The accounting and analytical reserve system of the enterprise is a multifunctional system of elements for collecting, summarizing and analyzing various financial information that meets the interests of various users, acting with the possibility of ensuring the safety of activities and neutralizing various types of risks and applying the theory of limit values with regard to the analytical indicators of assets and liabilities of the enterprise.

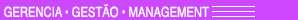

Generally speaking, the system of accounting and analytical support for reserve formation (Figure 1), includes four sections directly related to each other: the enterprise’s obligations, elements of accounting and analytical provision of reserves, a mechanism per se providing the company’s reserves management by the accounting and analytical system, the enterprise capital.

Figure 1

Model of accounting and analytical support for the enterprise reserves formation

The process of risk management through the system of accounting and analytical provision of reserves implies finding the optimal relationship between balance liabilities and balance assets.

In the first section of the model, the main events and operations of the enterprise’s economic activities and their features are presented: identification of the uncertainty of an economic operation; determining risk indicators; cost estimate and possible consequences of an economic operation; maturity period and possible temporary fluctuations.

The complex of the enterprise reserve system elements (the reserve system aggregates) as a complex position compensating for the risk is presented in the second section. When forming elements of accounting and analytical support, the following should be considered:

- features of accounts and subaccounts usage for the accounting of reserves: accounts and subaccounts of reserves do not ensure the property safety; out of accounts of reserves, account 82 Reserve Capital is created at the expense of net profit, accounts 14 Reserves for the Reduction of the Value of Tangible Assets, 59 Provisions for the Financial Investments Devaluation and 63 Doubtful Debts Provisions are created at the expense of other costs (relate to account 91 Other Incomes and Expenses), and account 96 Reserves for Future Expenses performs the role of a self-cost controller for assigning a wide variety of costs (vacation allowance, maintenance work, etc.).

- complexity in the evaluation of each element of the reserve system;

- formation of the enterprise reserves in accordance with the requirements of the legislation and the prevailing economic conditions (reserves for warranty repair, the reserve for future expenses and payments, the reserve for the devaluation of financial investments, reserves for the termination of a particular type of activity or the enterprise as a whole are created in the amount occurred at the termination of costs functioning in respect to dismissal of employees, payment of fines, penalties, penalties for violation of contracts, payment of regress suits, etc.).

The reserve system aggregates, which are subject to representation in accounting, are recognized in international practice in accordance with the specifics of the national accounting system: the insurance cost recognition; revaluation of assets, if not performed, a reserve may be created to reduce (increase) the value of assets; creation of a reserve for doubtful debts; accounting for changes in the value of money over time; creation of reserves in case of depreciation of investments in securities; creation of a reserve fund; hedging and obtaining guarantees (recognition of the value of operations for hedging and obtaining guarantees), etc.

The legislation of the Russian Federation provides for the creation of reserves for future expenses and estimated reserves.

In order to present reliable data in financial statements, the enterprise’s estimated reserves are created, which are used to adjust certain balance sheet items.

When the reserve is created, the profit of the reporting period is reduced by the amount of the created reserve due to the increase in expenses at the current period; this implies a decrease in the asset and liabilities of the balance by the corresponding amounts.

When insuring financial risks, the risk of each asset and liability element is assessed and adjustments are made, which makes it possible to make a hedged derivative balance sheet.

The information about the guarantees issued is represented on the off-balance sheet accounts of the enterprise.

The mechanism providing enterprise reserves management through the accounting and analytical system is presented in the third section and includes: methodological support for the accounting process; accounting information and quality criteria for this information, which allows providing information to various stakeholder groups, with minimum costs and risks for the enterprise; reporting both financial and managerial, enterprise infrastructure elements forming the processes of enterprise development and management processes; the theory of marginal values, etc.

In the context of determining the level of adequacy of enterprise reserve protection, the theory of marginal values can be interpreted as limit states that cannot be overcome or circumvented, without changing the nature of the reserve protection.

In this case, the following relations are to be considered: the benchmark for the alteration can be presented by two relations:

1. SP – WP > U = SR,

where

SP – strong points;

WP – weak points;

U – uncertainty;

SR – standard risk.

If the uncertainty is less than the difference between strengths and weaknesses, then this provides an acceptable risk and property retention.

2. SP – WP < U = ZT,

where

SP – strong points;

WP – weak points;

U – uncertainty;

ZT – zero tolerance.

In the case where uncertainty exceeds the difference between strong points and weak points, it means unacceptable risk and loss of ownership.

In the fourth section of the model under consideration, the enterprise’s capital is presented:

- property complex – land plots, buildings and facilities, equipment, inventory, raw materials and products; liabilities related to the implementation of business activities (claims and debts); other non-material objects (intellectual property in the form of firm name, trademarks, service marks);

- net assets – the difference between the value of the assets (property) of the economic entity and the amount of liabilities subject to execution at the expense of this property, at the time of their identification;

- net liabilities – the structure of net property (authorized capital stock, additional capital, capital reserves, net profit, goodwill, accreted value); in another interpretation – monetary funds.

In the enterprise practice, the reserve system provides opportunities to reduce negative results, including bankruptcy, at the expense of previously created reserves.

Elements of the reserve system are: reserve accounts; asset and liability management; hedging and insurance; stand-by solvency; guarantees issued and received, including government guarantees; forecast of losses and negative changes; optimization of the amount of income and expenses; enterprise’s hidden reserves; individual investment.

When the entrepreneurial potential was formed, the reserve capital of Orel region enterprises of various organizational and legal forms of ownership and sectors was considered (Table 2).

Table 2

Assessment of the availability of reserve capital of enterprises in the Orel region

Business name |

Data |

2016 |

2015 |

2014 |

2013 |

2012 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

PJSC ORLESTROY |

Amount of share capital |

111 |

115 |

125 |

125 |

125 |

Capital reserves |

19 |

19 |

19 |

19 |

19 |

|

Retained net surplus (unrecovered loss) |

2,162,830 |

2,056,184 |

1,986,424 |

1,464,799 |

1,174,344 |

|

OOO ORPLAST |

Amount of share capital |

10 |

10 |

10 |

10 |

10 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

3,105 |

2,407 |

251 |

28 |

(3,062) |

|

CJSC AGRONOVA-LIVNY |

Amount of share capital |

84 |

84 |

84 |

84 |

84 |

Capital reserves |

4 |

4 |

4 |

4 |

4 |

|

Retained net surplus (unrecovered loss) |

45,340 |

41,566 |

39,967 |

34,358 |

32,767 |

|

ООО LIVNY -ELECTRO

|

Amount of share capital |

2,581 |

2,581 |

2,581 |

2,581 |

2,581 |

Capital reserves |

529 |

529 |

529 |

529 |

529 |

|

Retained net surplus (unrecovered loss) |

36,548 |

37,415 |

37,198 |

34,029 |

31,082 |

|

ООО LIVNY-KHLEB

|

Amount of share capital |

- |

10 |

10 |

10 |

10 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

- |

18,413 |

12,944 |

10,458 |

5,727 |

|

ООО Mtsensk Bakery |

Amount of share capital |

10 |

10 |

10 |

10 |

10 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

(3,480) |

(1,697) |

(518) |

1,744 |

2,551 |

|

ООО Mtsensk Confectionery |

Amount of share capital |

10 |

10 |

10 |

10 |

10 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

9 |

2,485 |

2,785 |

2,927 |

3,134 |

|

JSC HMS LIVGIDROMASH

|

Amount of share capital |

42,145 |

42,145 |

42,145 |

35,145 |

35,145 |

Capital reserves |

18,959 |

18,959 |

18,959 |

18,959 |

18,959 |

|

Retained net surplus (unrecovered loss) |

1,020,065 |

989,918 |

925,607 |

935,209 |

961,875 |

|

OJSC MTSENSK FOUNDRY PLANT

|

Amount of share capital |

166,600 |

166,600 |

166,600 |

166,600 |

166,,00 |

Capital reserves |

8 330 |

8,330 |

8,330 |

8,330 |

8,330 |

|

Retained net surplus (unrecovered loss) |

(192,257) |

(171,307) |

(154,565) |

102,699 |

47,558 |

|

OJSC OREL SILICATE BRICK PLANT

|

Amount of share capital |

19,007 |

19,007 |

19,007 |

19,007 |

19,007 |

Capital reserves |

6,078 |

6,078 |

5,127 |

4,177 |

3,27 |

|

Retained net surplus (unrecovered loss) |

73,664 |

103,911 |

78,399 |

74,079 |

60,821 |

|

ООО ORLOV FURNITURE COMPANY |

Amount of share capital |

- |

11 |

10 |

10 |

10 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

- |

3,084 |

694 |

230 |

8 |

|

ООО VERKHNEOKSK CABLE PLANT |

Amount of share capital |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

2,430 |

1,526 |

1,499 |

1,490 |

1,436 |

|

LLC KROMSKY FODDER FACTORY |

Amount of share capital |

10 |

10 |

10 |

10 |

10 |

Capital reserves |

- |

- |

- |

- |

|

|

Retained net surplus (unrecovered loss) |

53,027 |

42,517 |

42,036 |

39,199 |

37,065 |

|

CJSC VERKHOVSKY MILK CANNING PLANT |

Amount of share capital |

164,441 |

164,441 |

164,441 |

164,441 |

164,441 |

Capital reserves |

- |

- |

- |

- |

- |

|

Retained net surplus (unrecovered loss) |

290,008 |

173,261 |

59,959 |

36,817 |

31,08 |

The table data show that the reserve capital is created by enterprises for which its creation is provided for by legislation (joint-stock companies). Organizations of other organizational and legal forms are not obliged to form it, however, they have the right to do so.

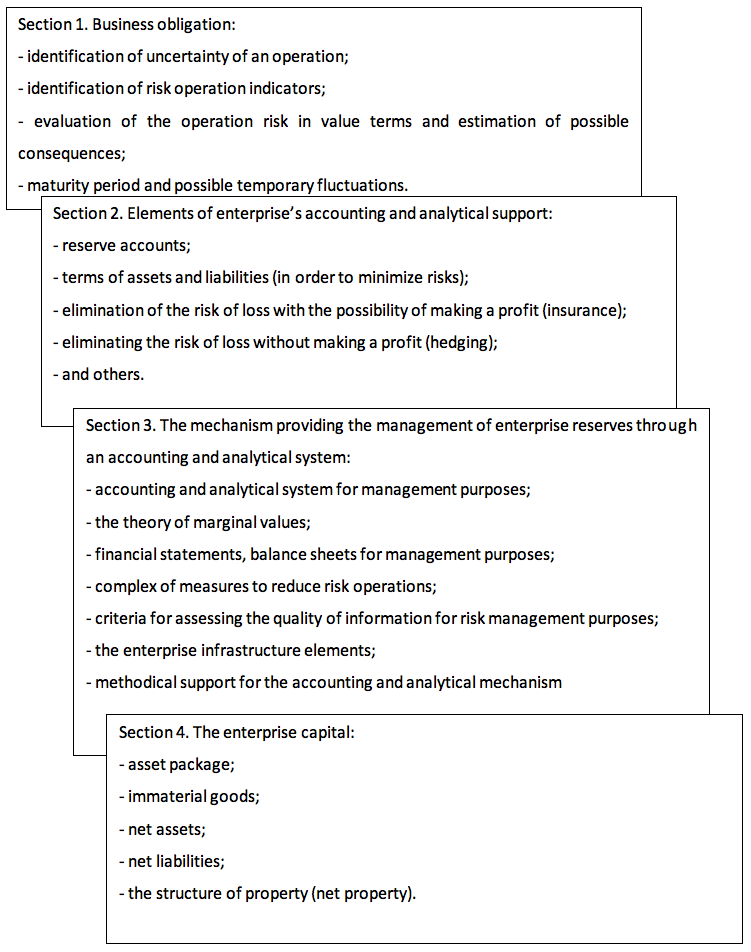

The dynamics of the reserve capital of enterprises in the Orel region is shown in Figure 2.

Figure 2

The dynamics of the reserve capital of enterprises in the Orel region

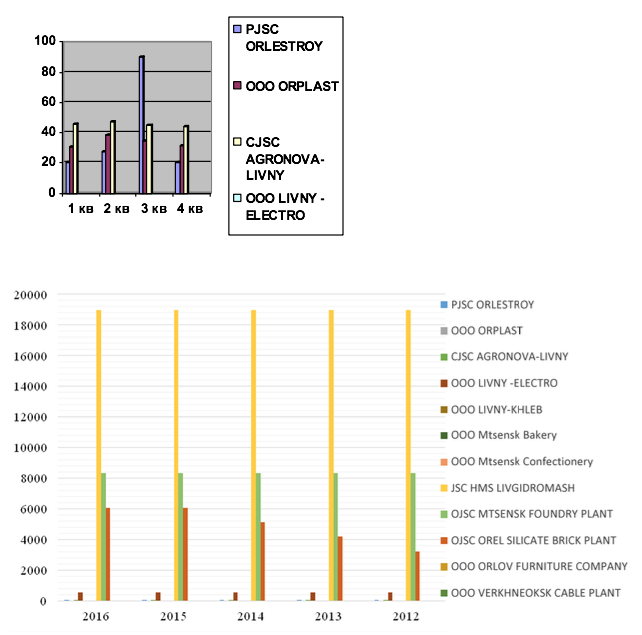

The general state of the reserve system is analyzed applying the SWOT-analysis mechanism (Figure 3).

Figure 3

Results of SWOT analysis

As a result of the SWOT analysis, the total impact amounted to +1,075 – 1,060 = +15.

Consequently, the forecasted state of the potential with the consideration of the basic potential is: 120 + 1,075 – 1,060 = 135

Based on the data obtained, it can be concluded that to improve the efficiency of the company’s functioning, it is necessary to make maximum use of “opportunities” and “strength”.

The model of the management accounting and analytical system of the company reserves includes balance aggregates and the reserve system indicators (the header statement), hedged risk situations, strategic directions and hypothetical records that allow determining and using hedged, integrated risk, strategic and hypothetical derivative balance reports in management, and monitoring the reserve system based on the use of net assets and net liabilities in the market or fair assessment.

When making managerial decisions, a certain ratio of risk and profitability is taken into account. To manage the reserve system, it is necessary to create a security system, i.e. creation of reserves and hedging.

The derivative balance sheet of the integrated risk allows determining the organization’s net assets taking into account the risk and compare them with hedged net assets. The balance showing the required level of reserve protection in the form of net assets value is a hedged derivative balance sheet.

In addition, there is a strategic derivative balance sheet that allows determining the enterprise’s strategic potential analyzed in comparison with risk situations according to the derivative balance sheet of the integrated risk based on net assets. In such a case, in order to avoid risk situations, strategic entries are made.

When analyzing the reserve system to determine the price influence, hypothetical entries are made, followed by a hypothetical derivative balance sheet.

The methodology for building a managerial forecast system of enterprise reserves is presented in Table 3.

The opening balance sheet includes: assets in the amount of 30,660 thousand rubles, managed assets in the amount of 34,530 thousand rubles.

Table 3

Model of the managerial forecasting system of enterprise reserves

Aggregates and the reserve system indicators |

Opening balance |

Hedged internal transactions |

Hedged derivative balance sheet |

Internal transactions adjusted for risk situations |

Derivative balance sheet of integrated risk |

Strategic internal transactions |

Strategic derivative balance sheet |

Hypothetical internal transactions |

Hypothetical derivative balance sheet |

||||

Debit |

Credit |

Debit |

Credit |

Debit |

Credit |

Debit |

Credit |

||||||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

1. Fixed assets |

131,200 |

|

|

131,200 |

6)23,000 |

5)18,000 |

136,200 |

7) 20,000 |

|

156,200 |

|

156,200 |

- |

2. Current assets |

214,100 |

2)70,000 |

3)5,000 |

279,100 |

6)80,000 |

5)70,000 |

289,100 |

7) 52,000 |

|

341,100 |

651,100 |

708,900 |

283,300 |

3. Capital and reserves |

306,600 |

1)20,000 3)5,000 4)13,000 |

2)70,000 |

338,600 |

5)88,000 |

6)103,000 |

353,600 |

|

7) 72,000 |

425,600 |

142,300 |

|

283,300 |

4. Long-term liabilities |

- |

|

4)13,000 |

13,000 |

|

|

13,000 |

|

|

13,000 |

13,000 |

|

- |

5. Short-term liabilities |

38,700 |

|

1)20,000 |

58,700 |

|

|

58,700 |

|

|

58,700 |

58,700 |

|

- |

Balance |

345,300 |

108,000 |

108,000 |

410,300 |

191,000 |

191,000 |

425,300 |

72,000 |

72,000 |

497,300 |

|

|

283,300 |

Net assets |

306,600 |

|

|

338,600 |

|

|

353,600 |

|

|

425,600 |

|

|

|

Net liabilities |

- |

|

|

|

|

|

|

|

|

|

|

|

283,300 |

Price component |

- |

|

|

|

|

|

|

|

|

|

|

|

23,300 |

Areas of financial state: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Active |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Passive |

- |

|

|

-32,000 |

|

|

-15,000 |

|

|

+72,000 |

|

|

|

Zero |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Management accounting and analytical system of the organization’s reserves includes the following components: hedged entries; a hedged derivative balance sheet; entries with respect to risk situations; a derivative balance sheet of the integrated risk; strategic entries; a strategic derivative balance sheet; hypothetical entries; a hypothetical derivative balance sheet.

The complex of protective mechanisms of various directions and levels that allows an enterprise to function under conditions of risk and uncertainty is presented by hedged entries, the purpose of which is to use the aggregates of the organization reserve system for registration.

The formation of adjustment entries is presented in Table 3.

Table 3

The process of adjustment entries formation

Business transactions |

Correspondence of the balance sheet sections |

Amount, thousand rubles |

|

Debit |

Credit |

||

1 |

2 |

3 |

4 |

1. Economic situations of self-insurance (accounts for accounting reserves, the enterprise’s hidden reserves, stand-by solvency, individual risk capital investments) in the amount of 20,000 thousand rubles. |

III |

V |

20000 |

2. Economic situations of risk prevention (asset and liability management, optimization of revenues and expenses, forecast losses and negative changes) in the amount of 70,000 thousand rubles. |

II |

III |

70000 |

3. Economic situations of avoiding risk (hedging, use of new financial instruments) in the amount of 5,000 thousand rubles. |

III |

II |

5000 |

4. Economic situations of risk transfer (insurance, guarantees issued and received, including government ones) in the amount of 13,000 thousand rubles. |

III |

IV |

13000 |

Representation of risk situations in accounting |

|||

5) 17 potential risk situations that could lead to losses in the amount of 88,000 thousand rubles. |

III |

I II |

88000 18000 70000 |

6) 21 potential risk situations that could lead to economic benefits in the amount of 103,000 thousand rubles. |

I II |

III |

23000 80000 103000 |

Net assets in the hedged derivative balance sheet calculated by this method amounted to 338,600 thousand rubles, while the passive area of financial situation is 32,000 (30,6600-33,8600) thousand rubles.

The derivative balance sheet of the integrated risk was obtained as a result of the formation of entries for the representation of risk situations. Passive area of financial situation in this case is 15,000 thousand rubles, the size of net assets constitutes 353,600 thousand rubles.

The general lack of resources (passive area of financial situation) amounts to 47,000 (32,000 + 15,000) thousand rubles.

The next stage of this model involves preparing a strategic derivative balance sheet. As a result of the represantation of operations and activities in order to avoid risk situations, strategic entries were made, as a result of which net assets were determined in the amount of 425,600 thousand rubles, and the financial stability area became active (425,600 – 306,600 – 32,000 – 15,000) = + 72,000 thous. rub.

To determine the price component, hypothetical entries and a hypothetical derivative balance sheet were compiled.

As a result, net liabilities amounted to 283,300 thousand rubles, the price component is 23,300 (283,300 – 306,600) thousand rubles.

At present, the organization reserve system is designed to insure the owners’ risk, to compensate for the risk of assets and liabilities, to ensure the organization’s financial stability, to regulate financial results under the negative influence of external and internal factors.

In the conditions of economic instability, enterprises do not possess the size of reserves that will ensure stable functioning in case of receiving losses and other unfavorable situations. The reserve system of most enterprises is at a low level, as evidenced by an analysis of the size of the balance sheet currency and the size of the enterprises reserves. Therefore, the enterprise management should take managerial decisions targeted at the final financial result. That is, reserves serve as an information base for various types of users about the amount of future expenses and existing obligations, which is relevant under the conditions of uncertain economic events.

ACKOFF, R.L. (2002). A concept of corporate planning. Moscow: Sirin.

AGEEV, I.M. (2001). Financial and managerial accounting of the enterprise reserve system under conditions of risk and uncertainty. Synopsis of thesis… PhD (Econ. Sciences). Rostov-on-Don.

ANSOFF, I. (1999). The new corporate strategy. St. Petersburg: Peter Publishing House.

ARKHIPOV, E.L. (2006). Model of the derivative balance sheet of the integrated risk in the network management accounting. Accounting. Analysis and audit in a market economy: problems and solutions: Collection of scientific articles. Rostov-on-Don: Rostov State Building University.

BAKAEV, A.S, SHNAIDMAN, L.Z. (1994). The enterprise accounting policy. Moscow: Bukhgaltersky Uchet.

BODIE, Z., MERTON. R. (2000). Finance. Moscow: Williams Publishing House.

BOGATAYA, I.N. (2001). Accounting models of firm valuation. Rostov-on-Don: Publishing house SKNTSVSH.

BONDAR, D.V. (2004). Financial, tax and management accounting of investment activities: monograph. Rostov-on-Don: RSEU RINH.

BUNIN, A.P. (1994). Risks in the modern business. Moscow: Alliance.

COASE, R. (1991). The firm, the market and the law. New York: Telex.

GILYAROVSKAYA, L.T., ENDOVITSKY, D.A. (1997). Financial and investment analysis and audit of commercial organizations. Voronezh: VSU Publishing House.

GORNON, F. (2004). Cost, risk and control: a dynamic process that needs integration. Moscow: Vershina.

GRYAZNOVA, A.G., FEDOTOVA, M.A. (1999). Business evaluation: Manual. Moscow: Finance and Statistics.

JARY, D., JARY, J. (1999). Sociology (Collins Dictionary). Moscow: Veche.

KERIMOV, V.E., KERIMOV, E.E. Functional-cost analysis of costs as an effective method of management accounting. I am an Accountant. Year 1999, issue 10, page 153-157.

KROKHICHEVA, G.E. (2002). Accounting and analytical support for virtual accounting. Rostov-on-Don: RGSU, 2002.

KROKHICHEVA, G.E. (2002). Virtual accounting: concept, modeling, accounting and analytical support. Rostov-on-Don: RGSU.

KROKHICHEVA, G.E. (2003). Virtual accounting: concept, theory and practice. Moscow: Finance and Statistics.

KROKHICHEVA, G.E. (2004). Corporate network accounting and reporting: concept, methodology and organization: synopsis of thesis… Doctor of Economics. Moscow: Moscow State University.

KUBASOVA, T.O. (2001). Accounting for the sale of the enterprise property complex. Rostov-on-Don: OOO Tera Publishing House.

LEBEDEV, А. Electronic money: myth or reality. The World of Cards/ Year 1996, issue 10, page 36-37.

MALKOVA, T.N. (2001). Theory and practice of international accounting: manual. SPb .: Business Press Publishing House.

RICHARD, J. (2000). Accounting: theory and practice. Moscow: Finance and Statistics.

ROMANOVA, S.V. (2000). Organization of accounting and analysis of the enterprise reserve system. synopsis of thesis… PhD (econ. sciences). Voronezh.

SAMUELSON, P., NORDHAUS, V. (2000). Economics. Textbook. Moscow: Williams.

SHAPOROVA, O.A. (2010). Paradigms of the managerial accounting and analytical system of evaluation indicators. dis. doc. econ. sciences. Rostov-on-Don.

TKACH, V.I., AGEEV, I.M., ILCHENKO, E.V., KROKHICHEVA, G.E., SEFEROVA, I.F. (2001). Financial and management accounting of the enterprise reserve system. Rostov-on-Don: RSSU Publishing house.

TKACH, V.I., KROKHICHEVA, G.E., ANIKEEV, M.Yu., ARKHIPOV, E.L. (2004). Accounting for hedging transactions. Rostov-on-Don: RGSU.

WEATHERFORD, J. (2001). The history of money: the struggle over money from sandstone to cyberspace. Moscow: TERRA.

1. Department of Finance and Credit, FSBEI of Higher Education Orel State University of Economics and Trade, Orel, Russia. Email: igolaido@yandex.ru

2. Rector, FSBEI of Higher Education Orel State University of Economics and Trade, Orel, Russia

3. Department of Accounting, Analysis and Audit, FSBEI of Higher Education Orel State University of Economics and Trade, Orel, Russia

4. Department of Accounting, Analysis and Audit, FSBEI of Higher Education Orel State University of Economics and Trade, Orel, Russia

5. Department of History, Philosophy, Advertising and Public Relations, FSBEI of Higher Education Orel State University of Economics and Trade, Orel, Russia