Vol. 39 (Number 37) Year 2018 • Page 06

Oksana V. TAKHUMOVA 1; Elena V. KASATKINA 2; Elena A. MASLIHOVA 3; Alexey V. YUMASHEV 4; Maria V. YUMASHEVA 5

Received: 04/04/2018 • Approved: 20/05/2018

ABSTRACT: The changes in the structure of the Russian economy are reflected at the level of attracting foreign investments into local systems. This situation affected almost all territorial units of our country. As the main goal in the work, the clarification and expansion of the theoretical base, the development of practical recommendations for increasing the investment attractiveness of the regional systems of the Russian Federation, in particular with a difficult economic and geopolitical situation, were chosen. The work presents an overview of the theoretical scientists on the problem under study; a critical analysis of the opinions of some representatives on the issue under study was carried out. As elements of scientific novelty, a justified identification of a group of factors that determine the current investment attractiveness and reduce the investment activity of the region can be noted. The methodical approach to an estimation of investment appeal of region, on the basis of a complex of the interconnected parameters was specified and expanded. The point of view that in order to successfully implement the region’s investment development strategy, it is necessary to develop institutions on the basis of an innovative approach was argued; proposals to improve the mechanism for attracting investment in the region’s economy were formulated. From a practical point of view, the model of the process of managing the investment attractiveness of the region is of interest, which will make it possible to intensify activities to attract foreign financial sources to the region. The obtained results allow to objectively evaluate the investment orientation of the region under study, and the factors considered and substantiated can be taken into account when developing investment policy in the regional systems of Russia. The author made an attempt to expand existing ideas on increasing the investment attractiveness in the region. The theoretical generalizations contained in the work can be used as materials for dispute in a scientific discussion. In addition, they may be of interest to scientific and educational activities. |

RESUMEN: Los cambios en la estructura de la economía rusa se reflejan en el nivel de atraer inversiones extranjeras a los sistemas locales. Esta situación afectó a casi todas las unidades territoriales de nuestro país. Como objetivo principal en el trabajo, la aclaración y la ampliación de la base teórica, se eligió el desarrollo de recomendaciones prácticas para aumentar el atractivo de inversión de los sistemas regionales de la Federación de Rusia, en particular con una situación económica y geopolítica difícil. El trabajo presenta una visión general de los científicos teóricos sobre el problema en estudio; se llevó a cabo un análisis crítico de las opiniones de algunos representantes sobre el tema en estudio. Como elementos de novedad científica, se puede observar una identificación justificada de un grupo de factores que determinan el atractivo de la inversión actual y reducen la actividad inversora de la región. Se especificó y amplió el enfoque metódico para una estimación del atractivo de inversión de la región, sobre la base de un complejo de parámetros interconectados. El punto de vista de que para implementar con éxito la estrategia de desarrollo de inversión de la región, es necesario desarrollar instituciones sobre la base de un enfoque innovador; se formularon propuestas para mejorar el mecanismo de atracción de inversiones en la economía de la región. Desde un punto de vista práctico, el modelo del proceso de gestión del atractivo de inversión de la región es de interés, lo que permitirá intensificar las actividades para atraer fuentes financieras extranjeras a la región. Los resultados obtenidos permiten evaluar objetivamente la orientación de inversión de la región en estudio, y los factores considerados y fundamentados se pueden tener en cuenta al desarrollar la política de inversión en los sistemas regionales de Rusia. El autor hizo un intento de ampliar las ideas existentes sobre el aumento del atractivo de la inversión en la región. Las generalizaciones teóricas contenidas en el trabajo pueden usarse como materiales para disputas en una discusión científica. Además, pueden ser de interés para actividades científicas y educativas. |

The problem of attracting foreign investment has always been the focus of attention. Especially this issue is being updated in the conditions of unstable economic growth of the regions of the country, which was a consequence of the global financial crisis, imposed sanctions. All this involves identifying regions that could at least partially meet the needs of foreign investors (Burtseva). The relevance of the research topic is conditioned by the need for the development of regional systems, the formation of which takes place under conditions of a complicated geopolitical situation, under the influence of negative effects of the processes of the global financial crisis. The problem of attracting foreign investments is always important for expanding international relations, increasing the sustainability of the development of world regional systems. This problem is also topical for Russia, whose economic indicators have been growing very slowly over the past few years.

Investment attractiveness is a set of financial and economic indicators that determine the assessment in the external environment, including political, economic, social, legal, and modify the final result (Fyodorova, 2015; Fisher, 1999).

All this significantly increases the need for scientific study and understanding of the problems of regulating investment processes at the regional and sub-regional levels related to the increasing attractiveness of the investment climate (Adamenko et al., 2017; Kryukova et al., 2016).

The formation of theoretical bases for the management of the investment process is connected with the works of J.M. Keynes, P. Samuelson, M. Friedman and several other scientists. Issues of attracting and effective use of additional sources of funding are devoted to the work of such domestic and foreign researchers, including: L. Abalkin, V. Andrianov, V. Artyukhov, A. Biryukov, L. Gitman, M. Jonk. And the scientific approach to evaluation of investment attractiveness can be traced in the works of: V. Bard, I. Grishin, D. Denison, N. Markov, O. Machulskaya, N. Mashegov, I. Roizman, V. Savchuk, I. Tikhomirov, Ye. Fyodorova, D. Chernev, J. Bailey J., G. Birman, D.J., R. Holt., W. Sharp and others.

The concept of "investment attractiveness" in modern economic and management literature is treated ambiguously. As evidenced by recent research, it is quite often identified with the concept of "investment climate". Some scientists, such as V. Lapo (Lapo and Blinov, 2001), believe that investment attractiveness, along with investment activity, determines the investment climate. Ye. Fyodorova, on the contrary, believes that this economic category includes investment attractiveness and investment activity (Fyodorova, 2010). Bakiyeva A.A. reveals the main content as the likelihood of timely achievement of the economic desires of the investor on the basis of the performance of the proposed investment object (Bakiyeva, 2008). Another researcher, Bay E.I., defines investment attractiveness as "a certain state of household and economic development of the investment object, in which, with a high probability and within an acceptable investment time, investments can yield a satisfactory level of profitability or a different positive effect" (Bay, 2008). Further, in formulating the definition of the region’s investment attractiveness, the author writes that it is a system of socio-economic, natural-geographical conditions, opportunities and some restrictions that make the investment attractiveness (Bay, 2008). Svetovtsev M.N. gives a very similar definition: "investment attractiveness is a system or combination of various objective attributes, means, limitations for the maximum possible attraction of investment resources in the regional socio-economic system" (Svetovtsev, 2006).

Investment attractiveness is also seen as an integral characteristic of individual enterprises and industries in terms of development prospects, possible income and risk level (Birman and Shmidt, 1997). Finally, the investment attractiveness of the region is defined as a system of certain conditions that affect the inflow of capital and are estimated by investment activity.

The variety of approaches to the definition of the concept of "investment attractiveness" indicates an insufficient theoretical study of both it and interrelated concepts "investment climate" "investment potential" and "investment risk." In this regard, it is useful to clarify how they differ from each other and what they have in common.

The original definition was proposed by G. Marchenko (Svetovtsev, 2006), who considers the investment climate as a system consisting of three elements: investment potential, investment risk and legislative conditions.

Turning to clarifying the content of the concept of "investment attractiveness", we note that a number of researchers argue that, unlike the investment climate, which is objective in nature, investment attractiveness has a subjective component related to preferences, subjective views, life and entrepreneurial priorities and values of investors (Avdeyeva, 2006). Biryukova A.P. writes that "investment attractiveness is the view of a particular investor on the investment object, and the investment climate is a concept that excludes subjective opinions and does not depend on the characteristics of the investee" (Biryukova, 2004). According to Olshanskaya M.V., investment attractiveness includes two categories. The first is based on the study of external factors that determine the profitability for external investors. The second content part describes the system of preferences, which is determined by the investor, setting the degree of the importance of various factors (Krylovsky, 2004).

The authors do not agree with this interpretation. In the opinion of the authors, the investment attractiveness really differs from the investment climate, but on other grounds. First, the concept of the investment climate describes the state of a particular socio-economic system from within, the concept of "investment attractiveness" describes the state of the same socio-economic system, but from the outside. In fact, investment attractiveness is an external manifestation of internal content. Second, the investment climate is the entire set of conditions in which investment activity is or may be carried out, i.e., a certain combination of conditions, both positive and negative. Depending on what conditions prevail over the content, the author makes a conclusion about favorability, or about the unfavorability of the investment climate. Investment attractiveness, in turn, - are conditions only with a plus sign, i.e. those that have positive content, since only positive can attract. Accordingly, the greater the socio-economic system of conditions with the plus sign, the higher its investment attractiveness. Under conditions with a plus sign, we understand, first of all, the conditions that make up the investment potential of the regional economy, other non-economic conditions and the least possible investment risks.

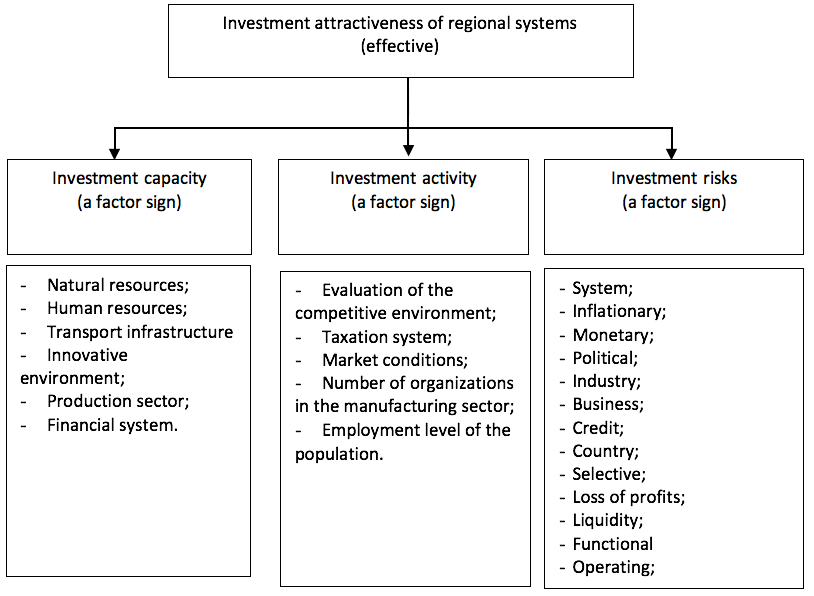

The analysis of special literary sources made it possible to propose the following variant of an assessment of the investment attractiveness of a regional system, based on three interrelated elements (Figure 1).

Figure 1

Methodology for assessing the investment attractiveness of the region

This approach was used by the authors as key criteria for assessing the investment

attractiveness of regions and the rating of the territorial unit among the

subjects of the Russian Federation (Folomiyev, 1999).

The authors, in turn, also share the position according to which the methodology for analyzing the investment attractiveness of the region includes three stages:

1) an assessment of the socio-economic status of the region and the definition of its rating in Russia; 2) analysis of the dynamics and structure of investments in fixed assets; 3) identifying the benefits that provide investment incentives for external investors in the regional system and constraining the conditions for the development of investment activities.

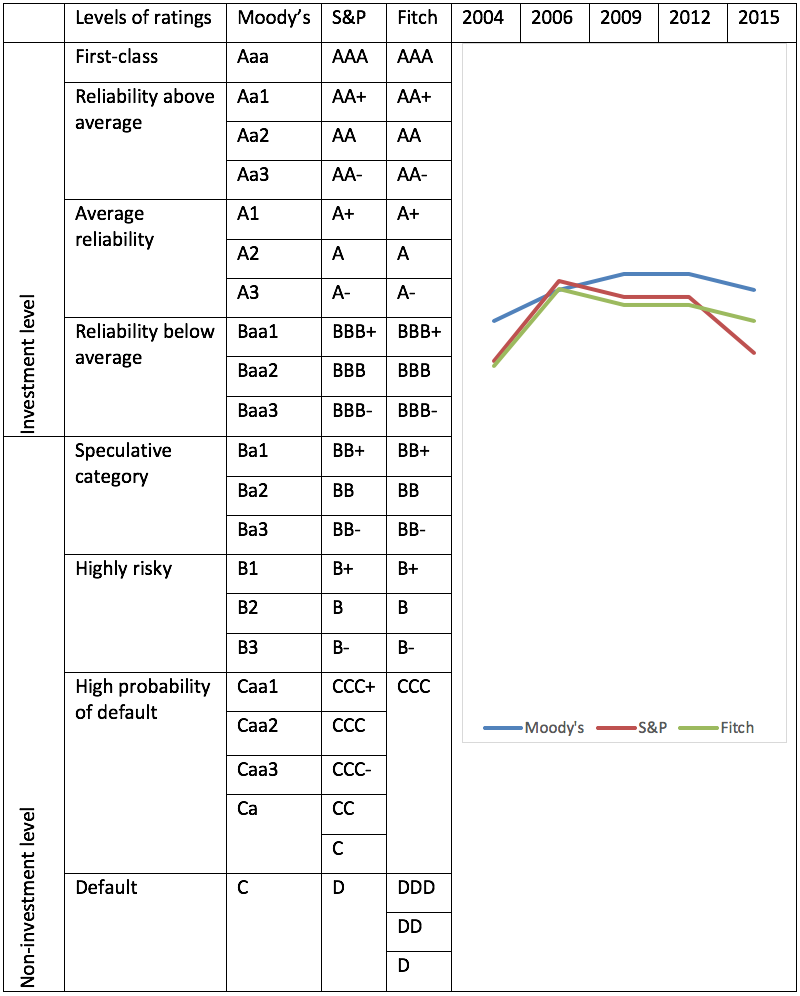

Analyzing past periods, it can be noted that March 2014 is considered a point of change in the country’s current investment climate. The next step is the imposition of sanctions by the European Union and the response of the Russian Federation have significantly affected the evaluation of international rating agencies that have distributed the regions of the country in terms of investment attractiveness, thereby changing the attitude of potential investors to the country’s economy. In general, this position can be reflected as follows (Table 1).

Based on the data, it can be seen that by 2012, investors could consider the economic situation of the country relatively reliable. These data are reflected in the reports of the Ministry of Economic Development, which indicates that the volume of raised funds for the period from 2007-2012 was close to $ 263 billion. Considering the present time, it should be noted that arguments about the possibility of attracting a significant amount of investment are not possible (Dunning, 1993).

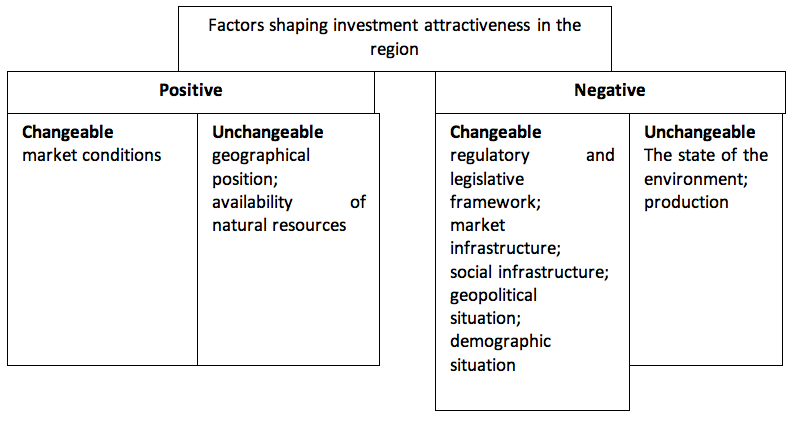

The analysis allows to draw a conclusion that, in general, there is an unstable dynamics of attracting investments by regions in Russia, which is connected, undoubtedly, with the instability of economic growth in most regions (Dunning, 1988). In this regard, we suggest in the work to identify groups of factors that form investment attractiveness and different nature of influence, the result is shown in Figure 2.

Comparison of the places among the subjects of the Russian Federation occupied by the region according to certain "paired" criteria for social and economic development testifies to a significant discrepancy between the position in the rating of indicators characterizing the level of the economy of the province development and the position of indices calculated per capita (Hymer, 1988). The main reasons for this discrepancy are related to the following factors:

- discrepancy between the volumes of production of goods, works, services and a comparatively high population. In comparison with other subjects of the Russian Federation, the economy of the region experiences a great demographic burden;

Table 1

Dynamics of investment confidence in the economy

of the Russian Federation for 2004-2015

- low level of industrial processing and use of available raw materials and natural resources in business. In trade relations with other regions of Russia and foreign countries, the region is predominantly a supplier of agricultural raw materials and products of chemical production;

- relatively high share of the shadow economy.

Figure 2.

Factors shaping investment

attractiveness in the region

Hence – the low level of incomes of the population, low level of budgetary provision. So, for money incomes per capita, the region is on the 57th place, on the average nominal accrued salary ranks 65th, on real money incomes – 53rd place. In 1998, the Stavropol Region was ranked 46th among the constituent entities of the Russian Federation by the GRP criterion per capita, and in 2007 it was already 67th.

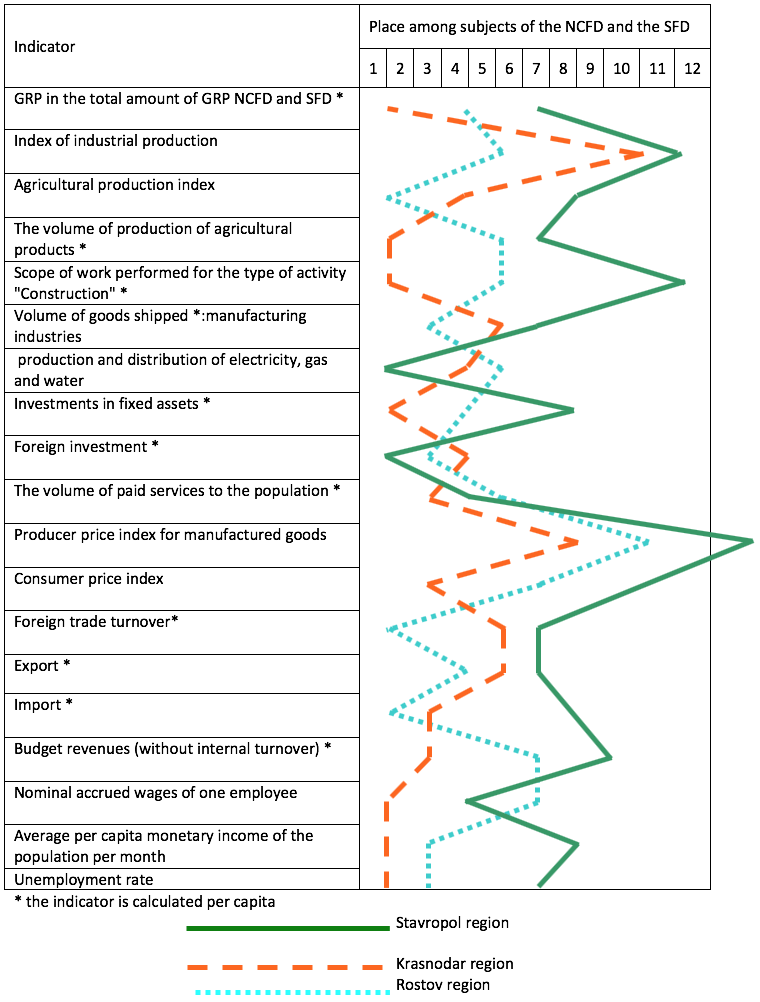

Inside the two districts of the North Caucasus Federal District and the Southern Federal District, there is a sharp lag of the district behind other regions in terms of such indicators as the share of GRP, the index of industrial production, the share of innovative products, etc. (Figure3).

The Stavropol Territory attracts with the availability of natural resources. The Caucasian Mineral Waters, as a recreational complex, although it does not yet meet international standards, is of particular interest. This is due to the deterioration of fixed assets, which certainly speaks of the need to upgrade this type of infrastructure.

Figure 3

"Profile of the region" in accordance with the places occupied by the subject in

the North Caucasus Federal District and the Southern Federal District for the

main socio-economic criteria in 2015

-----

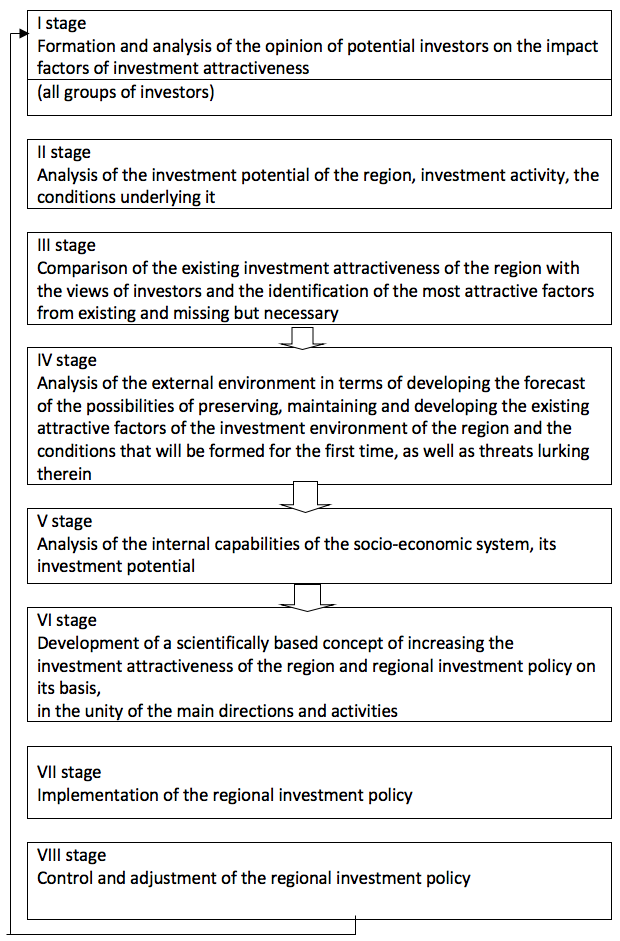

Figure 4

Model of the process of managing the

investment attractiveness of the region

The proportion of foreigners who chose this region as a holiday is very small and reaches less than 10 percent of all visitors, and without the CIS countries – less than 1%. Further, based on the results of the SWOT analysis of the socio-economic development of the region, we will determine the factors that determine the current investment attractiveness of the region and conditions that lower it.

The Stavropol region holds leading positions in the Russian Federation in providing sanatorium and health services.

In 2015, the region’s share in the national volume of sanatorium and health services was 16.8 percent. The analysis made it possible to propose the following structure for activating investment activity (Coase, 1988). In general, the analysis showed that the region has a number of conditions that reduce the investment attractiveness in the region. One of them is an inefficient system for managing innovation and investment activities. In this regard, the model proposes to work out the main components of investment activity management in the regional aspect (Figure 4).

As it seems to us, the presented model has a number of advantages. Firstly, in accordance with the logic, the sequence of the initial stages of managing the investment attractiveness of the region is clarified, secondly, it does not terminate at the stage of implementing the program of concrete measures, but ends with a stage of monitoring, control and adjustment, the implementation of which allows the entire management process to be closed in a cycle and provide feedback in it (Cairncross and Was, 1988, Matieson, 1988).

Finally, the proposed model takes into account the fact that the transformation occurring at higher levels directly affects the investment attractiveness of the structures of the lower levels and vice versa.

Analysis of international experience makes it possible to identify several options for organizing processes for enhancing investment activities:

creation of an independent structure in the government system that is not subordinate to other agencies and is fully responsible for the development and implementation of investment policy;

transfer of basic functions to a specialized unit, assigning to it tasks on coordination of directions of regulating investment activity.

As organizational structures for supporting investment activities, we can name the following:

- Investment development agency;

- Investment guarantee agency;

- Banks and development funds.

Based on the experience of a number of subjects of the Russian Federation, it is also advisable to propose the creation of an investment fund of the CMW region.

The objectives of the Foundation may be:

attraction of foreign sources of financing to successfully developing companies of regional systems;

improving the investment position of the regional system;

capital formation of the fund for reinvestment in new projects in the region.

Based on the study of theoretical and practical aspects of investment attractiveness, the following generalizations and conclusions can be made.

The concepts of "investment attractiveness" and "investment climate" are not identical. If the investment climate is the state of a particular socio-economic system from within (for example, the investment climate in the region), then the investment attractiveness is a description of the state of the same social and economic system from the outside (the investment attractiveness of the region). In addition, the investment climate is the entire set of conditions in which investment activity is or may be carried out, i.e., a certain combination of conditions, both positive and negative, while investment attractiveness is only those conditions that attract the investor, i.e., with a plus sign.

The investment attractiveness of the region along with such factors as the values, experience and vital priorities of investors is determined by their economic interests, which consist in preserving their financial capital, as well as its growth at a level not lower than the average profit on advanced capital. An important role in the investment attractiveness of the region is provided by such factors as the status, investment objectives and membership in the regional socio-economic system.

The content of the process of managing investment attractiveness can be disclosed from the positions of the goal, the subject and the management method. In the most general terms, the process of managing investment attractiveness is an activity connected with the creation of a consistent system of general conditions that interest foreign and domestic investors in investing the necessary investment resources in a particular investment object. Being internally differentiated, management of investment attractiveness involves the passage of the following stages: analysis of investors’ views on the most important factors of the investment attractiveness of the socio-economic system; analysis of the existing investment attractiveness of the socio-economic system; comparison of the existing investment attractiveness of the socio-economic system with the views of investors and the identification of the most attractive factors; analysis of the external environment and internal capabilities of the socio-economic system; development of a scientifically based concept of increasing the investment attractiveness of the social and economic system and investment policy; implementation of investment policy; control and adjustment of investment policy.

The conducted researches allowed revealing several methodical approaches to the evaluation of investment attractiveness, differing in the objectives of the research, the number of criteria used, the field of research. Several methods are used to determine the investment attractiveness of the region today: the methodology for assessing the investment attractiveness of the region of the economic weekly "Expert", the methodology for assessing the investment attractiveness of the region of the CSPF team of the RF Ministry of Economic Development and RAS, the methodology of N.I. Klimova and the methodology of the research associate of the Institute of Economics of the Russian Academy of Sciences K. Guseva. The method is well-founded, according to which the analysis of the investment attractiveness of the region includes three stages: 1. Assessment of the socio-economic status of the region and the definition of its rating in Russia; 2. Analysis of the dynamics and structure of investment in fixed assets in the region; 3. Identifying the advantages that ensure the investment attractiveness of the region and the constraints of investment development.

Analysis of indicators of socio-economic development of the region shows that among the subjects of the Russian Federation, it occupies no leading position: 17th position by population, 45th by direct foreign investment. Investigation of the investment climate in the region indicates that the factors determining current investment attractiveness include: complex recreational resources; unique medical and improving technologies; advantageous geographical position and developed transport communications; diversified regional economy; availability of financial support from the state for ongoing investment projects, as well as communication, information and telecommunication technologies, consumer potential, energy security and energy supply (according to the strategy for attracting investments in the economy of the Stavropol Territory for the period up to 2020).

Investigation of investment activity in the region made it possible to identify a number of positive trends: positive dynamics of investment in fixed assets from all sources of financing, as well as an increase in the share of non-state investments. At the same time, compared to other regions of the country, the achieved results can be estimated as very modest: the dynamics of the places occupied in the rating of the constituent entities of the Russian Federation in terms of the volume of investments in fixed capital tend to worsen the positions of the region, and the rate of their growth is also unsatisfactory.

Taking into account that the documents determining the directions of activity of the administration of the region and public authorities of the Stavropol Territory in the sphere of increasing the investment attractiveness of the region at present are of a strategic nature, it seems logical to propose the development of a regional investment program. In order to ensure its effectiveness, we propose to create a regional investment council, whose functions can include analysis and selection for the implementation of investment projects, analysis and evaluation of the structure of the investment market and the real estate market, development of recommendations for creating a region of new market institutions. To help this council on the basis of the administration, it is necessary to create a special structural unit for managing investment risks in the region to provide more favorable conditions for the activity of potential investors.

To stimulate investment activity and ensure investment attractiveness of the region, as evidenced by the experience of foreign countries, it seems expedient to initiate the creation of so-called development institutions, in which the Region Development Bank, the regional investment fund and the Agency for Investments and Development of the Region can act.

As a result of the research, a classification of factors that allows to broaden the field of studying investment processes, from the theoretical point of view, is offered, and methodological support is offered on the basis of an integrated approach that can be used by managers and specialists of territorial bodies of the national economic complex when developing investment policy and improving the management mechanism of investment processes.

Adamenko, A.A., Zolotukhina, E.B., Ulanov, V.A., Samoylova, E.S., Chizhankova, I.V., Mamatelashvilli, O.V. (2017). Investment management activities of commercial enterprises. International Journal of Applied Business and Economic Research, 15(12): 11-21.

Avdeyeva I.L. (2006). Management of the process of formation of a favorable investment climate in municipalities: the author’s abstract of the.... Cand. econ. sciences. Oryol.

Bakiyeva A.A. (2008). Theoretical and methodical bases of an estimation of investment appeal of region: the author’s abstract of the ... Cand. econ. sciences. St. Petersburg.

Bei E.I. (2008). Investment attractiveness of regions as a factor in the development of Russia’s national economy: the author’s abstract of the ... Cand. econ. sciences. Moscow.

Birman G., Shmidt S. (1988). Economic analysis of investment projects. Unity.

Biryukova A.I. (2004). Evaluation of the investment attractiveness of the industrial sector of the region: the author’s abstract of the ... Cand. econ. sciences. Irkutsk.

Burtseva T. Characteristics of the city’s investment attractiveness Available at: http://emsu.ru/me/default.asp?c=1039&p=1 (Access date 27.08.17)

Cairncross A.A., Was D.C. (1988). Control of Long-Term International Capital Movements. The Brooking Institution.

Coase, R.H. (1988). The Nature of the Firm (1937) in: The Firm, the Market and the Law. Chicago and London: University of Chicago Press.

Dunning, J. (1993). Explaining International Production. London: Unwun Hymati.

Dunning, J.H. (1993). The Liberalization of Business. The Challenge of the 90 s.London, New York: Аnn. Routledge.

Fisher, P. (1999). Foreign direct investment for Russia: a strategy for the revival of industry. Finance and statistics, 2, 512-513.

Folomiyev, S. (1999). Investment climate of Russian regions and ways to improve it. Issues of Economics, 9, 57-59.

Fyodorova N. (2005). Foreigners are frightened by corruption. Economy and life, 11, 30-37.

Fyodorova Ye.A. (2003). Formation of a mechanism for attracting investment in the regions: the author’s abstract of the. ... Cand. econ. sciences. St. Petersburg.

Hymer, S. (1988). Internatinal Operations of National Firms. A Study of Foreign Direct and Investment. Cambridge: Mass.

Krylovsky, A.B. (2004). Economic interests and incentives in the system of investment relations. the author’s abstract of the ... Cand. econ. sciences. Pyatigorsk.

Kryukova, E., Vetrova, E., Urzha, O., Alieva, Z., Konovalova, E., Bondaletova, N. (2016). Problems of attracting foreign investment in Russia. Journal of Applied Economic Sciences, 11(2): 239-346.

Lapo V.F., Blinov V.F. (2001). Estimates of the investment climate in the region: the example of cities and districts of the Krasnoyarsk region. Region: Economics and Sociology, 1, 167-169.

Matieson D.J. (1988). Liberalization of the Capital Accounts. Experiencies and Issues. Wash, 103, 6-7.

Svetovtsev, M.N. (2006). Formation and implementation of the regional investment strategy. Modern aspects of the economy, 11, 6-7.

1. PhD of Economics, Assoc. Prof. Department of Economic Analysis. Kuban State Agrarian University named after I.T. Krasnodar. Russian Federation. E-mail: takhumova@rambler.ru

2. PhD of Economics, Assoc. Prof. Department of Oil and Gas. Branch of the Tyumen Industrial University in Nizhnevartovsk. Nizhnevartovsk. Russian Federation. E-mail:kasatkina61@mail.ru

3. PhD of Economics, Assoc. Prof. Department of Humanitarian, Economic and Natural Science Disciplines. Branch of the Tyumen Industrial University in Nizhnevartovsk. Nizhnevartovsk. Russian Federation. E-mail:maslihova777@mail.ru

4. PhD., Prof. Department of Prosthetic Dentistry. I.M. Sechenov First Moscow State Medical University (Sechenov University). Moscow, Russian Federation. E-mail: umalex99@gmail.com

5. Student. Haskayne School of Business. University of Calgary. NW Calgary. Canada. E-mail:razmgp@gmail.com