Vol. 39 (Number 39) Year 2018 • Page 30

Natalia V. TRUSOVA 1; Serhii V. KARMAN 2; Maksym A. TERESHCHENKO 3; Yurii O. PRUS 4

Received: 04/04/2018 • Approved: 05/05/2018

ABSTRACT: The article considers the regulating the debt burden of the financial system with the allowable level of risk of revaluation pressure on the balance the payments of the Ukraine and countries the Eurozone. The purpose of research is to substantiate the scenarios for easing the pressure of the debt burden of the financial system of Ukraine taking into account the elements management of public debt in countries the Eurozone. The methodology used in the research is based on the principles of the relationship between the indicators of economic growth and the indicators of the debt burden of the financial system within the framework of the "Laffer debt curve" model. Construction of "Laffer debt curve" shows the dependence of GDP changes on the level of debt burden of the financial system for countries what form economic core of the Eurozone and of new EU members with another level of secure debt pressure for period 2012-2017. The financial instruments have been analyzed, which allowed providing these countries with the effective management of debt risks guaranteed by the state debt taking into account national characteristics. It is determined that the critical level of permissible pressure of the debt burden of the financial system for the Ukrainian economy is within the limit of 51.2%. Based on the dynamics of payments for Ukraine public debt, the scenarios of a probable increase the debt burden in the medium-term perspective over external debt. Efficient directions of effective borrowing of financial resources and their allocation allowed to form risk-oriented scenarios of management of guaranteed government liabilities in terms of adjusting debt ratios to the limited boundaries. |

RESUMEN: En el artículo se considera la regulación de la carga de la deuda del sistema financiero con el nivel permisible de riesgo y la presión de revaluación sobre el saldo de los pagos de Ucrania y los países de la Eurozona. El propósito de la investigación es corroborar los escenarios para aliviar la presión de la carga de la deuda del sistema financiero de Ucrania teniendo en cuenta los elementos de gestión de la deuda pública en los países de la Eurozona. La metodología utilizada en la investigación se basa en los principios de la relación entre los indicadores de crecimiento económico y los indicadores de la carga de la deuda del sistema financiero en el marco del modelo de la "curva de endeudamiento de Laffer". Esta curva muestra la dependencia de los cambios del PIB en el nivel de carga de la deuda del sistema financiero para los países que forman el núcleo económico de la zona euro y de nuevos miembros de la UE con otro nivel de presión de la deuda segura para el período 2012-2017. Los instrumentos financieros han sido analizados, lo que permitió brindar a estos países la gestión efectiva de los riesgos de la deuda garantizados por la deuda estatal teniendo en cuenta las características nacionales. Se determina que el nivel crítico de presión permisible de la carga de la deuda del sistema financiero para la economía ucraniana se encuentra dentro del límite del 51,2%. Con base en la dinámica de los pagos de la deuda pública de Ucrania, los escenarios de un probable aumento de la carga de la deuda en la perspectiva de mediano plazo sobre la deuda externa. Las direcciones eficientes del endeudamiento efectivo de los recursos financieros y su asignación permitieron formar escenarios de gestión del riesgo de pasivos gubernamentales garantizados en términos de ajuste de los coeficientes de deuda a los límites limitados. |

The tendency to increase the debt burden of the financial system of Ukraine has been traced over the past few years. It is determined by the high foreign exchange risk of external debt, the unstable situation with the refinancing of debts of previous years, as well as the pressure of debt payments on public finances. Unfortunately, domestic methodological provisions and recommendations that were supposed to suspend the increase of the debt burden of the financial system of Ukraine through effective forecasting, analysis and assessment of changes in the financial market conditions did not ensure active management of the market share of budget debt at an acceptable level. In the context of the crisis, the European Union member states demonstrated their willingness to support financial institutions - banks, insurance and investment companies that were in a state of bankruptcy, through the injection of budgetary funds. The modernization of their debt burden policy, which strengthened the financial system and economic growth, should become the main reference point for Ukraine to adjust the debt service cost ratio to the permissible level of risk of revaluation pressure on the national currency, the level of the balance of payments, and internal price competitiveness. The purpose of research is to substantiate the scenarios for easing the pressure of the debt burden of the financial system of Ukraine taking into account the elements management of public debt in the Eurozone member States.

The assessment of the critical state of the financial system, the growth of the threatening parameters of the debt burden and the excessive attraction of disadvantageous financial resources, along with inefficient use of them, is studied in the works of many foreign scholars: T. Holmes (Holmes, 1998), G. Refet, B. Sack and J. Wright (Refet et al., 2007), G. Pengjie and Y. Qi (Pengjie and Qi, 2013), S. Ardagna and F. Caselli (Ardagna and Caselli, 2014), W. Grabowski and E. Stawasz (Grabowski and Stawasz, 2017). At the national level domestic scientists pay considerable attention to the study of government-guaranteed debt in the context of financial policy and public finances – S. Londar (Londar, 2013), О. Oliinyk and I. Sidelnikova (Oliinyk and Sidelnikova, 2011); definition of the system of indicators of debt risks and thresholds of debt stability – O. Serhiienko (Serhiienko, 2014), О. Vlasiuk and L. Shemaieva (Vlasiuk and Shemaieva, 2016); improvement of Ukraine debt policy – V. Danyliuk (Danyliuk, 2013) and О. Londar (Londar, 2015). However, the problem of the debt burden of the financial system of Ukraine needs a comprehensive analysis taking into account its origin, the causes of appearance and deepening, the current state and risks.

The current stage in the development of global economics is characterized by a significant increase in public debt in many countries of the world (Medvedeva, 2012). Specialists of international organizations, in particular the IMF (World economic Outlook, 2012), considering the debt policy of the state in a set of actions, believe that it is implemented through a set of measures and is aimed at rational and effective mobilization, distribution, use and return of borrowed financial resources by the state. The ultimate goal of debt policy is to reduce the debt burden that will not be excessive in keeping the permissible level of currency interest rates, that is, it will be considered financially secured by the external and guaranteed state debt and will not interfere with the growth of the balance of payments, as well as intra-price competitiveness.

The theoretical and methodological approach of identifying the relationship between economic growth and the debt burden of the financial system is the so-called "Laffer debt curve" (Laffer, 1979), which allows to estimate the level of relative increase in the volume of borrowing to GDP growth rates. So, increasing government debt and increasing debt burden enlarges the risks of the financial system. Lenders in the financial markets react to this fact by increasing borrowing rates, which causes an increase in public debt servicing costs compared with the rate of GDP growth. This leads to the formation of a so-called debt overhang, when the cost of attracting additional financial resources for the borrowing state significantly increases compared to the rate of its economic development. Further borrowing leads to the rollout of the debt spiral (that is, to serve the debt, it is necessary to lend again at an increasingly unfavorable conditions), which forces to build a debt pyramid (IMF Country Report for Ukraine).

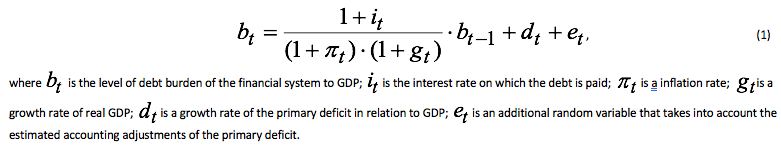

IMF experts evaluate the model of the debt burden of the financial system (bt) in the form of an empirical ratio in the long run. At the same time, measures for attracting, accounting, servicing and repaying public debt should be coordinated. They timely co-ordinate the changes in the rates of growth of real GDP from the growth rate of inflation and budget surplus (World economic Outlook, 2012):

The functionality of this model results in the government decision to create a non-standard situation – the simultaneous presence of rather high inflation and relatively low nominal interest rates for commercial loans and government borrowings. This is accompanied by a small but continuous economic growth, which gradually leads to a balanced budget (Trusova et al., 2017).

Within the framework of the all-European approach (fiscal consolidation policies), the Eurozone member States developed a series of "fiscal rules of a new generation" (Numerical fiscal rules in the EU Member States; Kilponen et al., 2015), which were implemented according to target indicators (structural deficit, budget expenditures, debt burden of the financial system), and their algorithm of calculation was introduced at the legislative level. Thus, the general and individual fiscal rules for rating the pressure of debt burden of the financial system of the Eurozone member States are aimed at bringing the indicator in a range not exceeding 60% of GDP. If the range is exceeded, countries must develop individual measures to reach the threshold level of this indicator, through annual adjustments of certain segments of public finances.

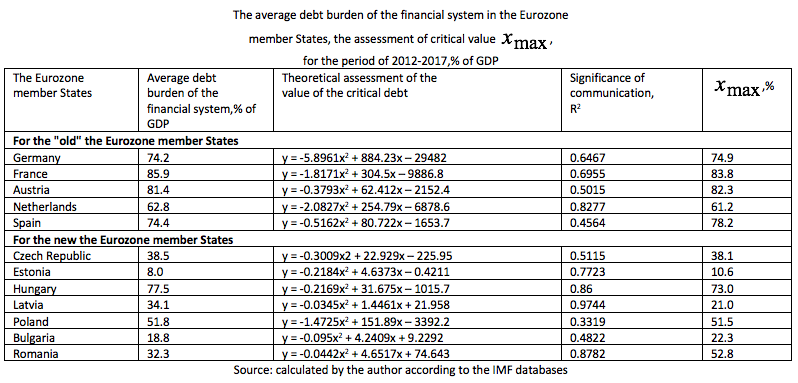

Within the "Laffer debt curve" model, the dependence of GDP changes on the level of debt burden of the financial system for the countries that form the economic core of the Eurozone (Germany, France, Spain, the Netherlands, and Austria) is developed. These countries monitor the level of the indicator. This dependence is developed also for the new EU member States (Estonia, Latvia, Romania, Bulgaria, Lithuania, Slovenia, Czech Republic, Slovakia, Poland, Hungary), which have a different level of safe debt burden (Table 1).

Table 1

The calculations for the economies of the countries show that for France this value is 83.8% of GDP, Germany – 74.9%, Spain - 78.2%, Netherlands – 61.2%, Austria – 82.3%. The average value of the critical debt burden for a given group of "old" EU member States can be estimated at 76.1% of GDP. The dynamics of the debt burden of the financial system for the group of new member states in comparison with the "old" EU member States has the following range: in Estonia – 9.7% of GDP, Latvia – 37.8%, Romania – 40.4%, Bulgaria – 26.9%, Lithuania – 37.7%, Slovenia – 82.9%, Czech Republic – 41.6%, Slovakia – 54.0%, Poland – 48.8%, Hungary – up to 79.6% of GDP. That is, in the two countries of this group (Hungary and Slovenia), the value of the debt burden of the financial system significantly exceeded the threshold of 60%, while in countries such as Poland and Slovakia, this threshold was closer.

Within the framework of the "Laffer debt curve" model, the new Eurozone member States, during 2012-2017, had a significant relationship of "GDP – debt burden of the financial system". At the same time, the maximum of this curve for Bulgaria is at the level of 22.3% of GDP, Latvia – 21.0%, Estonia – 10.6%, Romania – 52.8%, the Czech Republic – 38.1%, Poland – 51.5 %, Hungary – 73.0% of GDP. The average value of this indicator for this group of countries is 38.5% of GDP.

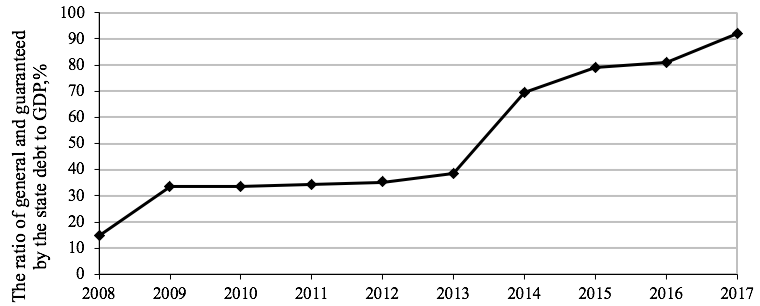

According to the forecasts of international financial organizations, in particular of the World Bank, by 2018 the economic growth of the global economy will slow down to 2.9% versus 3.5% in 2017 (The World Bank, 2017). As a result of such forecasts, the crisis situation in Ukraine, which is in a state of reorientation from one market to another, may deepen further, due to a decline in demand for commodities, a reduction in foreign exchange flows and a reduction in exports. The calculations of the critical debt burden of the financial system of Ukraine within the framework of the "Laffer debt curve" model have shown that during 2008-2017 the average maximum allowable pressure of the debt burden for the Ukrainian economy, above which the situation of the "debt overhang" may occur, is 51.2%.

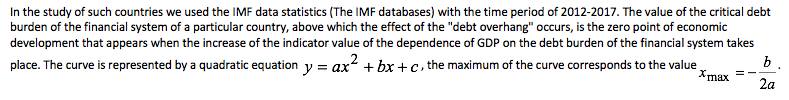

The dynamics of changes in the debt burden of the financial system (the ratio of the total and guaranteed debt to GDP) in Ukraine during 2008-2017 shows Figure 1. Thus, the state of public finances of Ukraine for the period of 2009-2013 was characterized by a lack of systematic implementation of borrowings. For the most part, the government used to issue emission loans from the National Bank of Ukraine, while the pressure of debt burden of the financial system was within the range of 33-39% of GDP.

Figure 1

Dynamics of changes in the debt burden of the financial system of Ukraine in 2008-2017

Source: calculated by the author according to the Ministry of Finance of Ukraine databases

Since 2014 the debt burden of the financial system of Ukraine has grown rapidly as a result of a reduction in GDP, due to significant devaluation of the national currency (from almost UAH 24.00/$1 to about UAH 27.19/$1), and also due to an increase in the volume of foreign currency external debt. The aggregate state and state-guaranteed debt of Ukraine in 2017 amounted to about 92% of GDP. During 2014-2017 debt burden indicator increased more than three times. That is, the annual rate of growth in 2017 was 123%, against 188% in 2014. It should be noted that the Law of Ukraine "On the State Budget of Ukraine for 2017" provided for the maximum amount of state and state-guaranteed debt at the level of UAH 2295.9 billion, which is 18.9% more than the amount of debt in 2016 (UAH 1929.8 billion). Over the past two years (2016-2017), the consolidated deficit of the state budget increased from UAH 54.7 billion to UAH 78.7 billion, or 2.3% of GDP to 2.9% of GDP and the deficit of the general government sector – from to UAH 55 billion to 81 billion, or 2.3% of GDP to 3% of GDP. According to estimates of the National Bank of Ukraine in 2018, deficits may decrease to 2.8% of GDP and 2.9% of GDP respectively (Databases the Ministry of Finance of Ukraine on the general and guaranteed debt, 2017; About the State Budget of Ukraine, 2017).

We consider the debt burden of the financial system of Ukraine in the context of raising the level of its risk-taking concerning the structure of debt at rates of repayment. Thus, in the structure of the currency debt in 2014 the volume of state and state-guaranteed debt amounted to 61.7%, in 2015 – 70.2%, in 2016 – 69.7%, in 2017 – 71.1%. Such a trend contributes to the growth of currency costs for servicing debt and increases the threat of reduction in currency supply on the domestic financial market.

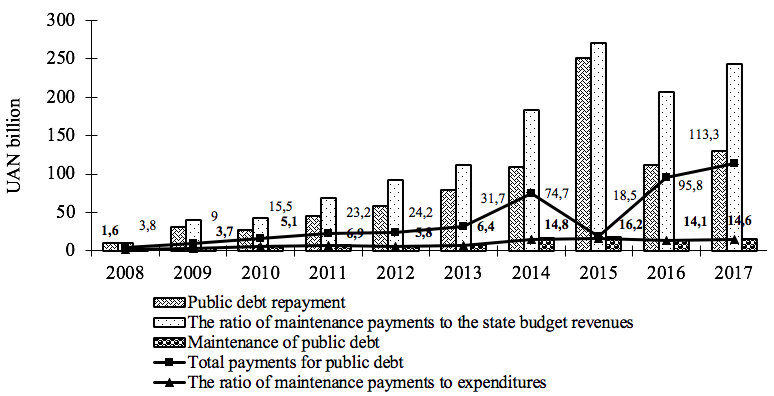

A dangerous challenge to financial security during 2014-2017 was a growing debt burden on the state budget due to increased payments for debt (Figure 2). So, if in 2014 their total volume amounted to UAH 183.86 billion, then in 2017 – UAH 242.9 billion (including UAH 168.7 billion in domestic debt and UAH 74.2 billion in external debt). In the structure of aggregate debt payments, there is a tendency of increasing the cost of repayment of public debt. Their total amount in 2014 was UAH 109.20 billion, in 2015 – UAH 251.60 billion, in 2016 – UAH 111.4 billion, in 2017 – UAH 129.56 billion.

The projected payments for state debt in 2018 are estimated at UAH 305.9 billion, of which UAH 193.36 billion are the payment of internal debt and UAH 112.54 billion are the payment of external one.

The growth of aggregate debt payments in the medium term is particularly critical for Ukraine, which can largely provoke a state insolvency crisis (on the condition of uncertainty about further IMF lending and slowdown of economic growth). According to the forecast for 2019, their total volume will exceed UAH 339 billion, in 2020 – UAH 341 billion.

Payments of Ukraine for debt obligations during 2018-2022 are estimated at USD 64.2 billion, including USD 35.5 billion for domestic and USD 28.7 billion for external debt. In 2018, Ukraine debt payments will be USD 10.9 billion, in 2019 – USD 11.6 billion, in 2020 – USD 13.7 billion, in 2021 – USD 14.1 billion, in 2022 – USD 13.9 billion (NBU and the Ministry of Finance of Ukraine made on the exchange of bonds of domestic government loans portfolio owned by the NBU, 2017).

Figure 2

Dynamics of payments for the state debt of Ukraine in 2008-2017

Source: calculated by the author according to the Ministry of Finance of Ukraine databases

In order to reduce the debt burden of Ukraine financial system in the third quarter of 2017, the exchange of bonds of domestic government loans that were owned by the NBU on new government bonds was carried out. The total volume of the bonds portfolio owned by the NBU in 2017 amounted to UAH 360.6 billion, of which bonds with a nominal value of UAH 219.6 billion were specified for refinancing. Approximately UAH 145.2 billion of the general government bonds portfolio are converted into long-term bonds in the national currency of different maturity with anchoring of profitability to the level of inflation and about UAH 74.4 billion into long-term bonds in the national currency of different maturity with fixed interest rates. The redemption of the bonds will be carried out in equal parts (approximately UAH 12 billion annually) until 2047 (NBU and the Ministry of Finance of Ukraine made on the exchange of bonds of domestic government loans portfolio owned by the NBU, 2017).

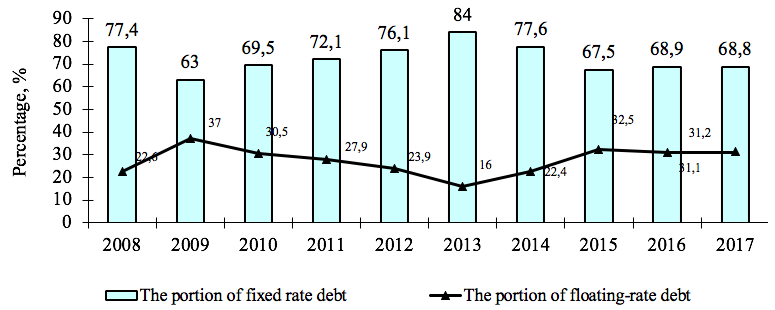

It should be emphasized that the presence of simultaneously fixed and floating rate bonds will ensure the diversification of interest rate risk. But the tendency to hold interest risk as an indicator of increasing the value of debt in national and foreign currency with a fixed and floating rate will be maintained. The dynamics of interest rate risk in the debt sector (Figure 3) showed an increase in the share of floating rate financial instruments, the volatility of which in the financial market is increasing.

Figure 3

Dynamics of interest rate risk in the debt area of Ukraine 2008-2017

Source: calculated by the author according to the Ministry of Finance of Ukraine databases

Under the influence of political and economic upheavals in 2009 their level was 37.0%, in 2010 – 30.5%. During 2016-2017, the share of floating-rate debt was kept at the level of 31.1-31.2%, due to IMF loans. The use of significant volumes of floating rate implies the need to choose weighed approaches to the type of debt instruments that reflects the level of risk of growth in future maintenance costs.

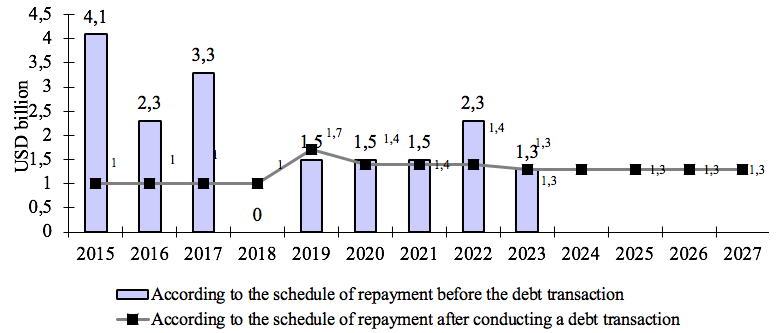

The probability of increasing the debt burden in the medium term as a result of the realization of potential risks and debt restructuring is completed with virtually all external debt obligations, in particular: 20% of the principal debt of USD 3.6 billion was cancelled and a portion of the debt of USD 15 billion was restructured (the exchange of current series for 9 new ones of Eurobonds was carried out) with the postponement of maturity dates from 2015-2023 to 2019-2027. This allowed reducing the burden of debt payments in the most difficult period for public finances (Figure 4).

The increase in the value of restructured financial instruments for debt operations to 7.75% and their attachment to GDP growth rates instead of write-offs of USD 3.6 billion will oblige the state to pay lenders 15% or 40% of nominal GDP growth over 20 years. According to UIF estimates, in the years of 2022-2027 additional payments for restructured bonds, with annual growth of real GDP by 4.0-4.5%, will amount to USD 2.5 billion in compensation payments to creditors. But this will pose an additional threat to the financial system of the country as a whole (Ukraine's default risks become critical, 2017).

Figure 4

Comparative assessment of government debt repayment before and after debt transaction of 2015, USD billion

Source: calculated by the author according to the Ministry of Finance of Ukraine databases

Thus, the state of the financial system during 2014-2017 is unstable and too sensitive to the effects of risks.

The restructuring of external and guaranteed State debt with a moratorium on individual debt payments is a compulsory step for Ukraine to control the critical pressure on the debt burden of the economy.

Harmonization of the development of the financial system of Ukraine and adjustment of debt indicators to the limit boundaries should be ensured on the conditions of increasing the effectiveness of such measures:

the implementation of medium-term debt management of the financial system for 2018-2020 in accordance with the Strategy of Public Finances Management for 2017-2021 (approved by the Resolution of the Cabinet of Ministers of Ukraine dated May 24, 2017 № 415-R);

the establishment of restrictions on foreign currency borrowings in the domestic financial market, as well as the general level of external debt not exceeding 50% in order to reduce currency risk;

interest rate risk bias in the formation of the medium-term debt burden of the financial system and the development of an additional scenario for responding to rising costs of servicing debt at an increase in floating rate loans;

improvement of legislative regulation in relation to consolidating the level of debt burden of the financial system with GDP – 40%.

The directions of effective borrowing and distribution of financial resources at the level of formation of a stable financial system should be as follows:

legislative provision of fiscal rules for optimizing state borrowing through maintaining the balance in emission activities and collecting taxes at increasing debt and increasing the cost of its servicing;

provision of measures on the formation of price guidelines for the placement of domestic government debt securities in national currency;

provision of legislative support for the issuance of long-term (at least for 20-30 year old) government securities (for example, Argentina has successfully placed 100 year old Eurobonds with a yield of 7.5% per annum among private investors);

providing monitoring and evaluation of fiscal risks associated with contingent liabilities and a period of reduction of the general and guaranteed state debt to a safe limit – 60%;

reduction of expenditures to cover the amount of state-guaranteed credit granted to small and medium-sized enterprises to a value not exceeding the equivalent of EUR 2.5 million (similar restrictions exist in the Eurozone member States);

enhancement of protective mechanisms in providing state guarantees in compliance with the Public Finance Management Strategy for 2017-2021.

Accelerating the pace of reforming the financial system and implementing measures to improve the government debt burden will ensure further economic growth and a high level of social security in the country.

About the State Budget of Ukraine (2017). URL: http://zakon3.rada.gov.ua/laws/show/1801-19 (data accessed: 30.03.2017).

Ardagna, S., Caselli, F. (2014). The political economy of the Greek debt crisis: A tale of two bailouts. American Economic Journal: Macroeconomics, 6, pp. 291-323.

Danyliuk, V. (2013). Debt policy of the state: concept, types, peculiarities of realization. Bulletin of Odessa National University. Economy, 3, pp. 115-118.

Databases the Ministry of Finance of Ukraine on the general and guaranteed debt (2017). URL: http://195.78.68.18/minfin/control/uk/publish (data accessed: 29.03.2017).

Grabowski, W., Stawasz, E. (2017). Sovereign bond spreads in the emu peripheral countries: the role of the outright monetary transactions. Prague Economic Papers, 26, pp. 360-373.

Holmes, T. (1998). The effect of state policies on the location of manufacturing: Evidence from state borders. Journal of Political Economy, 106, pp. 667-705.

IMF Country Report for Ukraine. Second review under the extended fund facility and requests for waivers of non-observance of performance criteria, rephrasing of access and financing assurances review-press release; staff report; and statement by the executive director for Ukraine. URL: https://www.imf.org/external/pubs/ft/scr/2016/cr16319.pdf (data accessed: 28.03.2017).

Kilponen, J., Laakkonen, H., Vilmunen, J. (2015). Sovereign risk, European crisis-resolution policies, and bond spreads. International Journal of Central Banking, 11, pp. 285–323.

Laffer, A. (1979). The Economics of the Tax Revolt. New York: Harcourt, Brace.

Londar, S. (2013). Level of debt burden of public finances in Ukraine. Finance of Ukraine, 1, pp. 22-31.

Londar, О. (2015). Improvement of the debt management system of Ukraine in the process of integration into the EU. Scientific works of NDFI, 2, pp. 57-69.

Medvedeva, N.V. (2012). Modern educational policy in the context of budget reform. Materials of the Afanasiev Readings, 1(10):188-192.

NBU and the Ministry of Finance of Ukraine made on the exchange of bonds of domestic government loans portfolio owned by the NBU (2017). URL: https://www.minfin.gov.ua/news/view/natsionalnyi-bank-ta-ministerstvo-finansiv-zdiisnyly-reprofailinh-ovdp-z-portfeliu-nbu?category=novini-ta-media (data accessed: 30.03.2017).

Numerical fiscal rules in the EU Member States. URL: http://ec.europa.eu/economy_finance/db_indicators/fiscal_governance/fiscal_rules/index_en.htm (data accessed: 29.03.2017).

Oliinyk, O., Sidelnikova, I. (2011). Debt security of Ukraine: state, problems, prospects. Herald of the National Law Academy of Ukraine named Yaroslav the Wise, 5, pp. 41-48.

Pengjie, G., Qi, Y. (2013). Political Uncertainty and Public Financing Costs: Evidence from U.S. Municipal Bond Markets, 145, pp. 25-36.

Refet, G., Sack, B., Wright, J. (2007). The U.S. Treasury yield curve: 1961 to the present. Journal of Monetary Economics, 54(8), pp. 2291-2304.

Serhiienko, O. (2014). The construction of the concept determine the specific indicators that point to the critical state of the public debt for the economy of Ukraine. Young scientist, 12, pp. 59-65.

The IMF databases. URL: http://www.imf.org/data/imf-finances (data accessed: 28.03.2017).

The World Bank (2017). The rate of decline in the global economy to 2.9% in 2018. URL: http://iee.org.ua/ru/prognoz/5101/(data accessed: 29.03.2017).

Trusova, N., Kalchenko, S., Tsap, V., Ternovsky, V. (2017). Restrictions of Financing the Budget Deficit of Ukraine. International Journal of Economic Research, 14, pp. 353-364.

Ukraine's default risks become critical (2017). URL: https://uifuture.org/uk/post/ekonomika-ukrainy-riski-defolta-ukrainy-stanovatsa-kriticeskimi_448 (data accessed: 29.03.2017).

Vlasiuk, O., Shemaieva, L. (2016). Debt sustainability as a strategic direction to improve the level of financial security. Kyiv: NISD.

World economic Outlook. (2012). Coping with high debt and slugging growth. URL: https://www.imf.org/external/pubs/ft/weo/2012/02/pdf/text.pdf (data accessed: 29.03.2017).

1. Tavria State Agrotechnological University, Melitopol, Ukraine. e-mail:trusova_natalya5@rambler.ru

2. Tavria State Agrotechnological University, Melitopol, Ukraine

3. Tavria State Agrotechnological University, Melitopol, Ukraine

4. Tavria State Agrotechnological University, Melitopol, Ukraine