Vol. 39 (Number 41) Year 2018 • Page 13

Olga Vasilievna VORONKOVA 1 Anna Alexandrovna KUROCHKINA 2; Irina Pavlovna FIROVA 3; Tatiana Vasilievna BIKEZINA 4

Received: 17/04/2018 • Approved: 11/05/2018

ABSTRACT: The purpose of this article is to explore development trends and identify ways of creating a more efficient and sustainable sector of small business and individual entrepreneurship in the Russian Federation. As research methods, the comparative analysis of quantitative indicators of official statistics of the countries represented by the Organisation for Economic Cooperation and Development, World Development Bank, etc. was used. The results of the performed research show that the contribution to the economy of the sector of small and medium-sized enterprises (SMEs) and individual entrepreneurship (IE) in Russia remains relatively low compared to developed countries and some countries with emerging economies. A characteristic feature of SMEs and IE in Russia is a small number of micro- and small enterprises and low employment in the small business sector. Based on the study of international experts' opinions, the authors conclude that currently there is a huge underused potential in the activities of Russian SMEs and IE. There are a number of areas, in which further improvement would be able to significantly stimulate SMEs and IE development. These include targeted and specialized state support for IE and SMEs; development of programs on innovation development, export and investment for SMEs in the manufacturing industry; a national campaign to raise awareness of entrepreneurship; optimization of the tax system for formal businesses; support for measures to broaden the spectrum of alternative financing for SMEs and IE. |

RESUMEN: El propósito de este artículo es explorar las tendencias de desarrollo e identificar formas de crear un sector más eficiente y sostenible de pequeñas empresas y emprendimiento individual en la Federación Rusa. Como métodos de investigación, se utilizó el análisis comparativo de los indicadores cuantitativos de las estadísticas oficiales de los países representados por la Organización para la Cooperación y el Desarrollo Económico, el Banco Mundial de Desarrollo, etc. Los resultados de la investigación realizada muestran que la contribución a la economía del sector de las pequeñas y medianas empresas (PyMEs) y el emprendimiento individual (EI) en Rusia sigue siendo relativamente baja en comparación con los países desarrollados y algunos países con economías emergentes. Un rasgo característico de las PYME e IE en Rusia es un pequeño número de micro y pequeñas empresas y un bajo nivel de empleo en el sector de las pequeñas empresas. Sobre la base del estudio de las opiniones de expertos internacionales, los autores concluyen que actualmente existe un enorme potencial subutilizado en las actividades de las PYME rusas y de IE. Hay una serie de áreas en las que una mejora adicional podría estimular significativamente el desarrollo de las PYMES y los IE. Estos incluyen apoyo estatal dirigido y especializado para IE y PYMES; desarrollo de programas sobre desarrollo de innovación, exportación e inversión para PYME en la industria manufacturera; una campaña nacional para concienciar sobre el emprendimiento; optimización del sistema tributario para negocios formales; Apoyo a medidas para ampliar el espectro de financiamiento alternativo para PYMES e IE. Palabras clave: emprendimiento individual, pequeñas y medianas empresas, pequeñas empresas, microempresas, pymes y sector de IE, problemas de desarrollo. |

Back in the early 1990s, when Russia embarked on the path of economic and political reforms, the development of a sustainable sector of micro- and individual entrepreneurship became one of the most important factors of socio-economic transformation in the country. This was clear from the pursued state policy of supporting entrepreneurship and rhetoric, which publicly propagated its importance for the development of the modern economy and social life of the population.

In recent years, the Russian Government has paid special attention to the development of small and medium-sized enterprises (SMEs) and individual entrepreneurship (IE) and taken active steps to create more competitive business environment and implement state programs aimed at removing barriers in such areas as the development of the competences, finance and innovation.

In the Federal Law on SMEs of 2007, a stable and favorable policy framework in the field of SMEs and IE, clear guidelines concerning the policy objectives, types of actions and commitments by various public entities were introduced.

The federal budget for the measures of "SMEs and IE" Program was significantly increased from 3.9 billion rubles in 2008 to 11.33 billion rubles in 2016 (Federal Treasury of the Russian Federation 2017). The large-scale programs of competition development were deployed, the process of simplification of administrative and regulatory procedures was rapidly advancing and the infrastructure of support for services for enterprise development began to form. Vnesheconombank (VEB), the state development bank, also made a major contribution to improving the access of subjects of SMEs and entrepreneurs to credit by providing significant public credit lines for SMEs lending to partner banks, and a new Federal Credit Guarantee Agency was established in 2014.

However, despite the efforts made to create a legislative framework and an impressive amount of resources allocated to support entrepreneurship, the development performance of small and medium-sized businesses in Russia remains very modest.

In most Russian regions there is negative dynamics of business demography, i.e. the number of "dead" SMEs exceeds the number of created new businesses. In the largest sector, in the country for 2012-2016 the number of existing IEs reduced to 78.7 thousand people (-3%) (Federal State Statistics Service of the Russian Federation 2017). Of 85 constituent entities of the Russian Federation, only 10 regions, including two capital ones, show small growth, which is mainly due to the concentration of capital and the volume of the trade and services market.

The officially declared now support of the entrepreneurial sector does not fully correspond to the tendencies of IE development on the ground, and its potential remains largely unused. Currently, less than 30% of the labor force is employed in the SME sector, while in most countries of OECD this figure exceeds 50% (OECD 2015). Only 5% of adults in Russia are currently starting or participating in the creation of new business. For comparison: in China, this figure stands at 16%, and in Brazil – at 18%. Only 5% of SMEs in Russia carry out any of the types of innovation compared to the typical level of 50% in OECD countries.

In 2015, at the State Council meeting, the Russian President set ambitious goals to increase the contribution of SMEs to the Russian economy, including an increase in the share of GDP produced by SMEs from 25% in 2012 to 50% in 2020 (Putin 2015).

In June 2016, the Russian Government approved the Strategy of Development of Small Business up to 2030 (The Decree of the RF Government No. 1083-r 2016), which provided for the release of separate market niches for small businesses, increasing the availability of financing, amending the tax laws, etc.

This research aims to determine the role of small and medium-sized businesses in the overall development of the Russian economy and search for ways to create a more efficient and sustainable IE sector.

Thus, this research is important because of its potential in the development of the small business sector, which has become a carrier of development and an engine of social and economic growth. The research results will identify which issues require priority attention, thereby encouraging the government to allocate properly financial resources and incentives to improve existing enterprises.

A literature review has been conducted to identify definitions of key concepts, research methods, theoretical frameworks available to explain the behavior of SMEs and IE, and the challenges they face.

Theoretical studies on the role of small business in global economic development were contradictory and ambiguous. Earlier, it was argued that small enterprises impede economic growth by attracting scarce resources from their larger partners (Audretsch and Thurik 2004). Subsequently, more and more studies indicating that economic activity has shifted from large firms to the small ones, predominantly young firms (Brock and Evans 1989; Kurochkina et al. 2006), began to emerge.

Most modern scholars agree that small business is an engine of economic development of countries (Ratten 2014). One of the main advantages of small business is its ability to respond quickly to the economic pressure and meet the needs of local communities (Kiseleva and Pinkovetskaia 2016; Voronkova 2014; Voronkova 2011; Voronkova 2006a; Voronkova 2006b).

There is currently no universally accepted definition of SMEs (Ratten 2014). For example, Pobobsky cites a study by the International Labour Organization that identifies over 50 definitions in 75 countries with considerable ambiguity in the terminology used (Berisha and Shiroka Pula 2015). Lack of a universal definition of SMEs is a major challenge in the cross-country analysis of SMEs data (Ardic et al. 2011).

The term "small business and entrepreneurship" (SBE) is a recent introduction to the literature on small business management (Fairlie 2013). Only a few studies used SBE as a term in the last few years. For example, Zhuplev and Shtykhno (2009) used it in their report on the done work on the results of a longitudinal study, in which small business entrepreneurs had taken part.

There is one of the first attempts to define SMEs in the report of Bolton of 1971 (Carter and Jones‐Evans 2006), which proposed to use two approaches to defining SMEs: a quantitative and qualitative approach.

Despite the fact that this is the most common criterion in determining, the number of employees has a lot of differences in equivalent sources of SMEs statistical reporting. The greatest number of sources defines that SMEs have a cut-off range of 0-250 employees (Ayyagari et al. 2003; Firova and Bikezina 2016). Among all definitions of SMEs, the European Union's definition is most commonly used in SMEs studies. Although this definition is recommended by the EU, it is mandatory for institutions and enterprises striving to get its funding (Carter and Jones-Evans 2006). The European Commission through the leadership defines the criteria for determining a small enterprise: the number of employees, annual turnover and annual balance (European Commission 2005).

Currently, most countries use quantitative indicators as key criteria for classifying firms by size categories as shown in Table 1 (Pickernell et al. 2013).

Table 1

The key criteria for classifying small enterprises

Country |

Type |

A specified number of employees |

EU |

Medium-sized enterprises |

<250 employees and annual turnover ≤50 million euro or total balance <43 million euro |

Small enterprises |

<50 employees and annual turnover ≤10 million euro or total balance ≤10 million euro |

|

Microenterprises |

<10 employees and annual turnover ≤2 million euro or total balance ≤2 million euro |

|

USA |

Microenterprises |

5 employees |

Small enterprises |

<500 employees |

|

Russia |

Medium-sized enterprises Small enterprises Microenterprises |

101‑250 people; income 2 billion rubles 100 people; income 800 million rubles 15 people; income 120 million rubles |

A critical issue in the literature is the terminology used for the category of enterprises that do not fall within the scope of activities of large enterprises. One part of researchers refers to them only small enterprises, others use the concept of SMEs, while some distinguish micro-, small and medium-sized enterprises (Komarek and Loveridge 2015; Voronkova et al. 2016).

Quite a large number of modern studies are devoted to specific issues of SMEs development, including the problems of financing small businesses and IE (Botrić and Božić 2015; Qi et al. 2017), entrepreneurial motivation (Eijdenberg et al. 2015; Yousaf et al. 2015; Voronkova et al. 2017; Vetrenko et al. 2017), the formation of competencies and teaching the basics of business (Gross et al. 2013; Bhardwaj 2014), innovative development, etc.

At the same time, the complexity of the macroeconomic situation in the Russian Federation dictates the need to further study the problems, to determine the perspective vector of development and state support for IE at the present stage.

The methodological work is based on the qualitative and quantitative analysis of documentary sources, such as official statistics, the media and other publications.

A method of comparative analysis of the SMEs and IE sector development of the following indicators of Russia and foreign countries has been used to assess trends:

• The number of existing SMEs;

• Density of small and medium-sized businesses (SMBs) – reflects the number of registered small and medium-sized businesses per 1,000 people of the population;

• Employment in SMBs – shows the proportion of the able-bodied population employed at SMEs, %;

• The proportion of SMBs and IE in the total turnover of Russian enterprises.

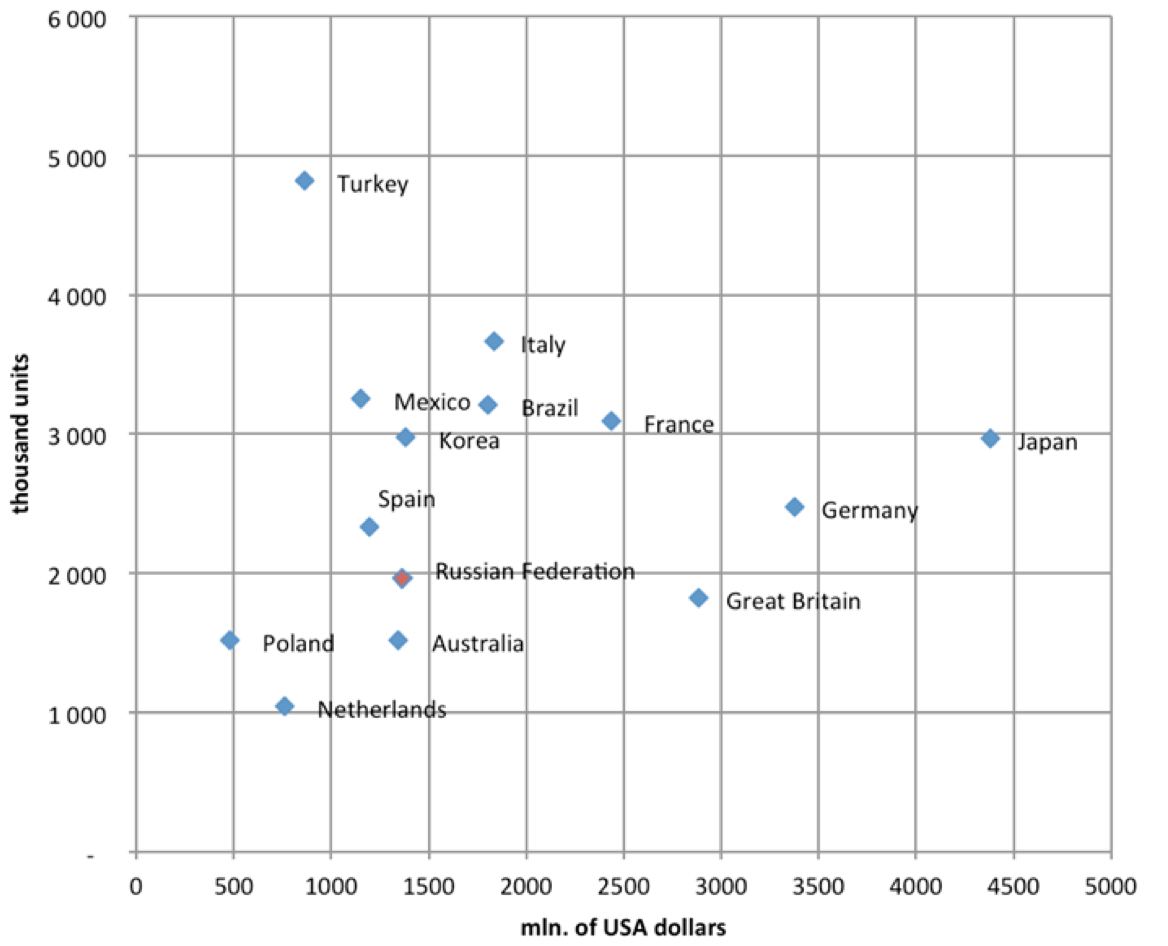

According to the OECD estimates, there were 1,958.7 thousand active SMEs in the Russian Federation in 2014 (OECD 2017). As shown in Figure 1, this is a small number relative to the size of the Russian economy. A few small countries, such as Turkey, Mexico, Spain and Korea, have more enterprises than the Russian Federation.

Figure 1

The number of enterprises and GDP in 2014

In Table 1, the indicators of SMEs are presented from the point of view of density of small and medium-sized businesses as a proportion of the working age population. The indicator of 26 registered enterprises per 1,000 people of the population in the Russian Federation is significantly lower than in OECD countries (Table 2).

Table 1

The number of enterprises per the working age population, 2014

Countries |

Number of enterprises (thousand) |

Number of the able-bodied age population, thousand people (OECD 2018) |

Number of small enterprises per 1,000 people of the population |

Australia |

1,520 |

12,278 |

124 |

Brazil |

3,209 |

105,537 |

30 |

France |

3,095 |

29,296.79 |

106 |

Germany |

2,476 |

41,779 |

59 |

Italy |

3,668 |

25,278 |

145 |

Japan |

2,969 |

65,870 |

45 |

Korea |

2,976 |

26,536 |

112 |

Mexico |

3,254 |

51,837 |

63 |

Netherlands |

1,042 |

8,896 |

117 |

Poland |

1,517 |

17,428 |

87 |

Russian Federation |

1,959 |

75,428 |

26 |

Spain |

2,331 |

22,858 |

102 |

Turkey |

4,817 |

28,786 |

167 |

Great Britain |

1,823 |

32,513 |

56 |

By size, in 2014 about 80.8% of enterprises in the Russian Federation were microenterprises (1-9 employees), 15.4% were enterprises with 10-49 employees, 3.3% – with 50-249 employees, and 0.5% – large firms with at least 250 employees. In comparison with other countries, there is a shortage in the number of micro- and small enterprises.

It is estimated that in 2014 in the Russian Federation in the small and medium-sized businesses just over 18 million people were employed, which was only 24.5% of the able-bodied population (Table 2).

Table 2

Employment at SMEs as a proportion of the working age population

Number of the employed at SMEs, thousand people |

Number of the working age population, thousand people |

Proportion of the working age population employed at SMEs (in percent) |

|

Australia |

7,926 |

12,278 |

64.6% |

Brazil |

34,190 |

105,537 |

32.4% |

France |

15,457 |

29,296.79 |

52.8% |

Germany |

27,739 |

41,779 |

66.4% |

Italy |

14,109 |

25,278 |

55.8% |

Japan |

35,228 |

65,870 |

53.5% |

Korea |

15,036 |

26,536 |

56.7% |

Mexico |

18,518 |

51,837 |

35.7% |

Netherlands |

5,286 |

8,896 |

59.4% |

Poland |

8,381 |

17,428 |

48.1% |

Russian Federation |

18,466 |

75,428 |

24.5% |

Spain |

10,603 |

22,858 |

46.4% |

Turkey |

12,482 |

28,786 |

43.4% |

Great Britain |

8,655 |

32,513 |

26.6% |

These figures show that there is a great potential for job creation through the creation and development of the SME sector in the Russian Federation.

Table 3 presents information on sales of SMEs and IE in Russia for 2014-2016.

Table 3

The turnover of the SMEs and IE sector in the total turnover

of the enterprises of the Russian Federation (Rosstat 2017)

Indicator |

2014 |

2015 |

2016 |

Turnover of SMBs, billion rubles |

26,392.2 |

44,124.3 |

38,877 |

Total revenue of IE, billion rubles |

10,447.5 |

7,894 |

12,369.2 |

Turnover of the organizations in total in the Russian Federation, billion rubles |

129,195 |

141,547.3 |

149,320.2 |

Proportion of the SMBs and IE sector in the total turnover of the Russian Federation, % |

28.5% |

36.7% |

34.3% |

In 2014, SMEs accounted for 28.5% of enterprise sales in terms of total volume of economic activity. Even though this figure is not strictly comparable with international data, this proportion is much lower than the average typical figure in OECD countries constituting about two thirds of SMEs generated by business units. These figures highlight the need to improve the quality of existing SMEs activities in the Russian Federation, as well as to increase the number of enterprises and their employment.

Table 4 shows that the business and employment indicators in SMBs and IE in the Russian Federation are significantly related to wholesale and retail trade.

Table 4

The sectoral composition of SMEs and individual entrepreneurs

Economic activity |

SMEs |

IE |

||||

|

Number of small enterprises, thousand units |

Share in total number of SMEs, % |

Average number of employees |

Share of employment at SMEs |

Number of IEs |

Share in the number of IEs |

agriculture, hunting and forestry |

61.3 |

2.2% |

474.5 |

4.3% |

112.2 |

4.4% |

fishery, fish farming |

4.8 |

0.2% |

25.7 |

0.2% |

2.3 |

0.1% |

extraction of minerals |

10.3 |

0.4% |

57.7 |

0.5% |

0.4 |

0.0% |

manufacturing activity |

245.8 |

8.9% |

1,609.6 |

14.6% |

127 |

5.0% |

construction |

335.9 |

12.1% |

1,403.1 |

12.7% |

92 |

3.6% |

wholesale and retail trade, consumer services |

1,032.1 |

37.3% |

3,183.7 |

28.8% |

1,231.7 |

48.8% |

hotels and restaurants |

79.4 |

2.9% |

444.5 |

4.0% |

55.6 |

2.2% |

transport and communications |

215.4 |

7.8% |

690.4 |

6.3% |

307.8 |

12.2% |

operations with real estate, rent and provision of services |

600.7 |

21.7% |

2,322.1 |

21.0% |

370.9 |

14.7% |

health care and provision of social services |

42.6 |

1.5% |

276.8 |

2.5% |

17 |

0.7% |

provision of other public, social and personal services |

75 |

2.7% |

287.1 |

2.6% |

161.6 |

6.4% |

The retail trade and consumer services sector represented almost half of all IEs and more than one third of SMEs. One third of SMEs and IEs are engaged in the sectors focused on domestic consumption, such as hotels and restaurants, transport and communications, construction and real estate, rent and business services.

Manufacturing accounted for only 7% of the total number and only 14.6% of the employed. These data indicate a decline in the manufacturing sector within SMEs activities in the Russian Federation and a shift towards trade and services.

It is necessary to achieve a significant increase in the scale of SMEs manufacturing activities in the Russian Federation in order to use relatively good prospects for maintaining long-term productivity growth, providing export earnings and diversification of the Russian export through the use of natural resources, and for supporting growth in the rest of the economy by the creation of supply chains.

There have been some significant improvements in several aspects of the framework conditions affecting SMEs and entrepreneurship in the Russian Federation. These include increased openness to trade since the accession of the Russian Federation to the World Trade Organization, the introduction of significant programs for the development of competition and privatization, considerable reduction of administrative and regulatory burden on business and the introduction of federal anti-corruption initiative. For example, the time needed to start a business has been reduced to the time of the world's leading countries. It is important to continue developing these reform programs in these areas and to ensure their effective implementation on the ground.

International experts agree that there is a huge underutilized potential of SMEs and entrepreneurship activities in the Russian Federation. This is evidenced by significant weaknesses regarding other developed and developing countries in the number of SMEs per capita, the employment rate in small businesses, the rate of new business start-ups and the level of investment and innovation by SMEs.

Overcoming these shortcomings will have a significant impact on the Russian economy in terms of significant job creation and income generation, increased investment, competition and productivity, and diversifying the economic base from its current dependence on commodity exports (OECD 2015).

One of the tasks will be to improve attitude towards entrepreneurship in the Russian society. The share of the adult population indicating the intention to start a business in the Russian Federation is only 3% of the population and is one of the lowest in the world. In addition, many entrepreneurs doubt that they have sufficient knowledge and experience to do business and have a relatively intense fear of failure.

Changing entrenched attitudes is a difficult perspective for the Russian Government, but necessary for entrepreneurship to gain the legitimacy needed to become an integral part of the Russian society and the economy.

Another issue that needs to be addressed is the dependence of many Russian households on the large informal sector. A large scale of informality reflects a number of institutional weaknesses, and the reduction of the informal economy scale will require not only a systematic approach to management, but also measures to eliminate its causes.

Efforts should also be gradual and cautious, since it must be recognized that informal activities currently provide jobs and contribute to reducing social and economic exclusion, at least in the short term.

In the Russian Federation, the innovation activity performance of SMEs, measured by the rate of product/process innovation and the rate of marketing/organizational innovation, as well as the novelty of products and services provided by Russian enterprises to their customers, is also relatively low. Improving innovation activity of SMEs is one of the most important priorities of the Russian Federation's current policy, which is crucial for future competitiveness. In addition, there is some evidence that growth-oriented entrepreneurs find it more difficult to achieve their aspirations in the Russian Federation than in other BRICS countries. The development of a more substantial sector of high growth rates in the Russian Federation is another key policy priority.

The government of the Russian Federation should strengthen the work aimed at the elimination of existing cyclical limitations and structural barriers. One of the major obstacles to the development of entrepreneurship and SMEs in Russia is the complexity of financing, which is exacerbated by the restriction of access of Russian banks to global financial markets due to anti-Russian sanctions. Bank lending to SMEs and lending conditions are still not recovered to the precrisis levels, and evidence suggests that credit constraints for SMEs are likely to remain in the foreseeable future.

In this context, a two-pronged approach is needed to improve the access and financing conditions of SMEs. On the one hand, it is important to restore the health of banks in order to improve lending, since bank financing will continue to be crucial for SMEs. On the other hand, it is necessary that SMEs diversify their sources of financing towards non-bank tools and support private investment. Currently, however, financing instruments, alternative to traditional loans, still represent only a small source of funding for SMEs. Alternative methods of external financing for SMEs and IE are:

• asset-based financing – asset-based lending; factoring; purchase order financing; warehouse receipts, leasing;

• corporate bonds – securitized debt; covered bonds; private placement; crowdfunding;

• "hybrid" instruments – subordinated loans/bonds; participation in loans;

• rights of participation in profits; convertible bonds; bonds with warrants, mezzanine finance;

• equity instruments – direct investment; venture capital; business angels; specialized platforms for public placement of SMEs.

To solve the above challenges, the following key recommendations for sector development policy are proposed:

• to increase the number of SMEs and their employment by combining extensive measures aimed at increasing the level of entrepreneurship among the population and more targeted and specialized support for growth-oriented entrepreneurs and enterprises;

• to promote the growth of manufacturing SMEs, inter alia, by strengthening attention to SMEs innovation, export and investment programs and setting targets for the participation of manufacturing SMEs in these programs;

• to promote positive attitude towards entrepreneurship by conducting national campaigns to raise awareness of entrepreneurship with the participation of the media and the comprehensive integration of training to teach entrepreneurship throughout the education system;

• to facilitate the transfer of business activities from the informal to the formal economy by removing unnecessary barriers to formal entrepreneurship in the taxation system, as well as regulation and support for informal entrepreneurs in upgrading their businesses and use of new sources of demand;

• to take actions that enable SMEs and IE to access a wider range of financial instruments, as well as the formation and the development of civilized private capital markets and collective investments.

The results of the conducted research allow drawing the following conclusions:

• A characteristic feature of SMEs and IE in the Russian Federation is a shortage in the number of micro- and small enterprises, low employment and a fairly modest contribution of the SME and IE sector to the country's economy compared not only to the developed countries but also to the countries with emerging economies.

• Within the framework of SMEs and IE activities in the Russian Federation, the scope of activities of manufacturing enterprises is decreasing; the emphasis is shifted towards trade and services.

• Experts converge in opinion that there is a huge underutilized potential of SMEs and entrepreneurship activities in the Russian Federation. There are several areas, in which further improvement could significantly stimulate SMEs and entrepreneurship development. They include opening the economy to more vigorous activities of the private sector by further reducing state control, promoting foreign direct investments’ (FDI) inflows, strengthening vocational and entrepreneurial skills, increasing investment in research and development and the commercialization of public research, strengthening of the rule of law, including entrepreneurs' property protection and outside investors' rights in SMEs, and the increase in bank lending to SMEs.

• Further efforts should be directed to realization of a complex of measures on targeted and specialized state support for growth-oriented IE and SMEs; strengthening attention to programs for innovation, export and investment for manufacturing SMEs; a national campaign to raise awareness of entrepreneurship; eliminating barriers to formal entrepreneurship by means of tax optimization; improving the access of SMEs and IE to financing by broadening the range of financial instruments.

Ardic O.P, Mylenko N. and Saltane, V. (2011). Small and Medium Enterprises: A Cross-Country Analysis with a New Date Set. World Bank Policy Research Working Paper Series. World Bank.

Audretsch D. and Thurik R. (2004). A Model of the Entrepreneurial Economy. Max Planck Institute for Research into Economic Systems Group Entrepreneurship, Growth and Public Policy.

Ayyagari M., Beck T. and Demirgüç-Kunt A. (2003). Small and Medium Enterprises across the Globe: A New Database. Working Paper 3127. World Bank.

Berisha G. and Shiroka Pula J. (2015). Defining Small and Medium Enterprises: A Critical Review. Academic Journal of Business, Administration, Law and Social Sciences, 1(1), 17-28.

Bhardwaj R.B. (2014). Impact of Education and Training on Performance of Women Entrepreneurs: A Study in Emerging Market Context. Journal of Entrepreneurship in Emerging Economies, 6(1), 38-52.

Botrić V. and Božić L. (2017). Access to Finance: Innovative Firms’ Perceptions in Post-Transition EU Members. EaM: Ekonomie a Management, 20(1), 129-143.

Brock W.A. and Evans D.S. (1989). Small Business Economics. Small Business Economics, 1(1), 7-20.

Carter S. and Jones-Evans D. (2006). Enterprise and Small Business: Principles, Practice and Policy (2nd ed.). Harlow: Pearson Education.

Eijdenberg E.L., Paas L.J. and Masurel E. (2015). Entrepreneurial Motivation and Small Business Growth in Rwanda. Journal of Entrepreneurship in Emerging Economies, 7(3), 212-240.

OECD. (2017). Entrepreneurship at a Glance 2017. Paris: OECD Publishing. Retrieved from http://dx.doi.org/10.1787/entrepreneur_aag-2017-en

European Commission. (2005). The New SME Definition: User Guide and Model Declaration Section. Brussels: Office for Official Publications of the European Communities.

Fairlie R.W. (2013). Entrepreneurship, Economic Conditions, and the Great Recession. Journal of Economics and Management Strategy, 22(2), 207-231.

Gross A.C., Holtzblatt M., Javalgi R., Poor J. and Solymossy E. (2013). Professional Occupations, Knowledge-Driven Firms, and Entrepreneurship: A National and Regional Analysis. Business Economics, 48(4), 246-259.

Kiseleva O.V. and Pinkovetskaia I.S. (2016). Analysis on Investment of Small and Medium Entrepreneurship. International Journal of Economics and Financial Issues, 6(8 Special Issue), 315-320.

Komarek T. and Loveridge S. (2015). Firm Sizes and Economic Development: Estimating Long-Term Effects on U.S. County growth, 1990-2000. Journal of Regional Science, 55(2), 262-279.

OECD. (2015). Russian Federation: Key Issues and Policies. OECD Studies on SMEs and Entrepreneurship. Paris: OECD Publishing. Retrieved from http://dx.doi.org/10.1787/9789264232907-en

OECD. (2018). Working Age Population. Retrieved from http://dx.doi.org/10.1787/d339918b-en

Pickernell D., Senyard J., Jones P., Packham G. and Ramsey E. (2013). New and Young Firms: Entrepreneurship Policy and the Role of Government – Evidence from the Federation of Small Businesses Survey. Journal of Small Business and Enterprise Development, 20(2), 358-382.

Qi Y., Roth L., and Wald J. (2017). Creditor Protection Laws, Debt Financing, and Corporate Investment over the Business Cycle. Journal of International Business Studies, 48(4), 477-497.

Ratten V. (2014a). Encouraging Collaborative Entrepreneurship in Developing Countries: The Current Challenges and a Research Agenda. Journal of Entrepreneurship in Emerging Economies, 6(3), 298-308.

Ratten V. (2014b). Future Research Directions for Collective Entrepreneurship in Developing Countries: A Small and Medium-Sized Enterprise Perspective. International Journal of Entrepreneurship and Small Business, 22(2), 266-274.

Voronkova O.V., Kurochkina A.A., Firova I.P., and Bikezina T.V. (2017). Implementation of an Information Management System for Industrial Enterprise Resource Planning. Espacios, 38(49), 23.

Voronkova O.V., Kurochkina A.A., Firova I.P. and Yaluner E.V. (2016). Innovative Managerial Aspects of the Potential of Material-Technical Base and the Formation of Controlling Mechanism in the Management of the Enterprise Potential Development. Journal of Internet Banking and Commerce, 21(S6), 14.

Yousaf U., Shamim A., Siddiqui H. and Raina M. (2015). Studying the Influence of Entrepreneurial Attributes, Subjective Norms and Perceived Desirability on Entrepreneurial Intentions. Journal of Entrepreneurship in Emerging Economies, 7(1), 23-34.

Zhuplev A. and Shtykhno D. (2009). Motivations and Obstacles for Small Business Entrepreneurship in Russia: Fifteen Years in Transition. Journal of East-West Business, 15(1), 25.

Voronkova O.V. (2006a). Metodologiya formirovaniya integrirovannoi regional'noi programmy upravleniya kachestvom. Referat dissertatsii na soiskanie uchenoi stepeni doktora ekonomicheskikh nauk [Methodology for the Formation of an Integrated Regional Quality Management Program (Doctoral Thesis Abstract)]. Tambov: Tambov State Technical University.

Voronkova O.V. (2006b). Formirovanie regionalnoi kontseptsii upravleniya kachestvom produktsii i uslug: ucheb. posobie dlya studentov ochnogo i zaochnogo otd-nii spetsialnostei [Formation of the Regional Concept of Quality Management of Products and Services: Manual for Full-Time and Part-Time Students of Branches]. Tambov: Ministry of Education and Science of the Russian Federation, State Educational Institution of Higher Professional Education "Tambov State Technical University".

Voronkova O.V. (2011). O finansovykh aspektakh nauchnogo potentsial [On the Financial Aspects of Scientific Potential]. Nauka i biznes: puti razvitiya, 4, 109-112.

Voronkova O.V. (2014). Klyuchevye napravleniya issledovanii v Rossiiskoi Federatsii [Key Areas of Research in the Russian Federation]. Nauka i biznes: puti razvitiya, 5(35), 87-90.

Putin V.V. (2015). Vystuplenie na Zasedanii Gosudarstvennogo soveta po voprosam razvitiya malogo i srednego biznesa [Vladimir Putin's speech at the State Council Meeting for the Development of Small and Medium-Sized Businesses]. Retrieved from http://kremlin.ru/events/president/news/49214

Kurochkina A.A., Pankov A.V. and Petrov A.N. (2006). Strategiya sotsialno-ekonomicheskogo razvitiya natsionalnoi ekonomiki v usloviyakh ekonomicheskogo rosta [Strategy of Social and Economic Development of National Economy in Conditions of Economic Growth]. St. Petersburg: Publishing House SPbGuEf.

Rasporyazhenie Pravitelstva RF ot 02.06.2016 No. 1083-r Ob utverzhdenii Strategii razvitiya malogo i srednego predprinimatelstva v Rossiiskoi Federatsii na period do 2030 goda [The decree of the RF Government No. 1083-r "On Approval of the Strategy of Development of Small and Medium Enterprises in the Russian Federation for the Period up to 2030"]. (2016, June 2). Retrieved from http://www.consultant.ru/document/cons_doc_LAW_199462/

Federal Treasury of the Russian Federation. (2017). Raskhody federalnogo byudzheta: GRBS PO TsSR I VR [Federal Budget Expenditures: By Chief Managers of Federal Budget Resources According to Target-Oriented Items and Expenditure Types]. Retrieved from http://datamarts.roskazna.ru/razdely/rashody/rashody-po-grbs/rashody-grbs-po-csr-i-vr/?paramPeriod=2016

Rosstat. (2017). Rossiiskii statisticheskii ezhegodnik [Russian Statistical Yearbook]. Retrieved from http://www.gks.ru/bgd/regl/b17_13/Main.htm

Federal State Statistics Service of the Russian Federation. (2017). Chislennost fakticheski deistvuyushchikh individualnykh predprinimatelei po subektam Rossiiskoi Federatsii. Institutsionalnye preobrazovaniya v ekonomike [The Number of Active Individual Entrepreneurs by Constituent Entities of the Russian Federation. Institutional Changes in the Economy]. Retrieved from http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/enterprise/reform/#

Firova I.P. and Bikezina T.V. (2016). Sovremennye problemy vnedreniya integrirovannogo risk-menedzhmenta v tselyakh snizheniya finansovykh riskov khozyaistvuyushchikh subektov [Modern Problems of Integrated Risk Management Implementation in Order to Reduce the Financial Risks of Economic Entities]. Nauka i biznes: puti razvitiya, 11, 35-37.

Vetrenko P.P., Chernysheva E.A., Levitina I.Yu. Voronkova O.V. and Mikheeva D.G. (2017). Encouraging Employees to Increase the Labor Intellectualization Level as a Factor of Evolution of the Intellectual Capital at an Enterprise. European Research Studies Journal, XX(4B), 637-646.

1. Russian State Hydrometeorological University. 98 Malookhtinsky Ave., Saint Petersburg 195196, Russia. E-mail: olga_v_voronkova@bk.ru

2. Russian State Hydrometeorological University. 98 Malookhtinsky Ave., Saint Petersburg 195196, Russia

3. Russian State Hydrometeorological University. 98 Malookhtinsky Ave., Saint Petersburg 195196, Russia

4. Russian State Hydrometeorological University. 98 Malookhtinsky Ave., Saint Petersburg 195196, Russia