Vol. 39 (Number 41) Year 2018 • Page 37

Sergei Bulatovich ZAINULLIN 1; Elena Aleksandrovna EGORYCHEVA 2; Natalia Vitalievna BONDARCHUK 3; Anna Andreevna KURASHOVA 4

Received: 20/04/2018 • Approved: 12/06/2018

ABSTRACT: The relevance of researching the main problems of corporate governance is determined by the necessity of identifying scientific methods of solving the practical task to increase the efficiency of Russian enterprises and Russian economy in general. Researchers both in Russia and other countries of the world as well as respectable international institutions such as Organization for Economic Cooperation and Development, stock market regulators, stock exchanges, rating and auditing agencies and large security holders attach special importance to corporate governance problems. The authors of this article are trying to figure out the crucial problems of corporate governance in Russian companies, which in the future can form the basis for elaborating a set of measures to improve corporate governance in Russia. In their study the authors rest upon researches conducted by other scientists and both state and non-state active stock market participants, as well as on their own investigations. The novelty of the research results consists in consolidation of corporate governance studies for 2015-2017 period, and also in the authors’ independent investigations and finding out the main corporate governance problems in Russia as of 2017-2018 years. The content of this article represent theoretical value for academic specialists studying corporate governance as well as for practitioners effecting state and non-state regulation of corporate governance, which will allow them to modernize their policies of administering corporate processes in Russia. The researches and conclusions outlined in this article can be beneficial in practical terms for investors interested in putting their capital into Russian businesses as well as for the executive bodies, members of Boards of directors, corporate secretaries and other people effecting corporate governance in Russian companies and seeking improvement of corporate governance quality. |

RESUMEN: La relevancia de investigar los principales problemas del gobierno corporativo está determinada por la necesidad de identificar métodos científicos para resolver la tarea práctica de aumentar la eficiencia de las empresas rusas y de la economía rusa en general. Los investigadores tanto en Rusia como en otros países del mundo, así como las instituciones internacionales respetables como la Organización para la Cooperación y el Desarrollo Económico, los reguladores del mercado de valores, las bolsas de valores, las agencias de calificación y auditoría y los grandes titulares de valores otorgan especial importancia a los problemas de gobierno corporativo. Los autores de este artículo están tratando de resolver los problemas cruciales del gobierno corporativo en las empresas rusas, que en el futuro pueden constituir la base para elaborar un conjunto de medidas para mejorar el gobierno corporativo en Rusia. En su estudio, los autores se basan en investigaciones realizadas por otros científicos y participantes activos en el mercado bursátil tanto estatales como no estatales, así como en sus propias investigaciones. La novedad de los resultados de la investigación consiste en la consolidación de los estudios de gobierno corporativo para el período 2015-2017, y también en las investigaciones independientes de los autores y el descubrimiento de los principales problemas de gobierno corporativo en Rusia a partir de los años 2017-2018. El contenido de este artículo representa un valor teórico para los especialistas académicos que estudian el gobierno corporativo, así como para los profesionales que aplican la regulación estatal y no estatal del gobierno corporativo, lo que les permitirá modernizar sus políticas de administración de procesos corporativos en Rusia. Las investigaciones y conclusiones resumidas en este artículo pueden ser beneficiosas en términos prácticos para los inversores interesados en invertir su capital en las empresas rusas, así como para los órganos ejecutivos, los miembros de las juntas directivas, las secretarias corporativas y otras personas que realizan el gobierno corporativo en las empresas rusas. Buscando la mejora de la calidad del gobierno corporativo. |

Modern economy goes through hard times: cyclical economic crises, sanctional confrontation between the major global powers, demographic imbalances, political instability on the one hand create good opportunities for investments but on the other hand significantly increase investment risks. One of the main factors which reduce these risks is the quality of corporate governance, protection of all investors’ rights, regardless of the position – major or minor – which they hold in the corporations which are the objects of investment.

The authors focused their attention on the special features of corporate governance development in Russia, observance of obligatory provisions of law and advisory norms of the best practices.

The article first gives a theoretical review of American, European, Asian and Russian researchers’ positions regarding the influence of observing norms of the best practices of corporate governance in Russia and abroad. Then the authors analyzed the studies of the Central Bank of the Russian Federation, companies Economist Intelligence Unit, Ernst & Young, Deloitte Touche Tohmatsu Limited in 2015 which investigate the actual state of affairs in the area of corporations’ compliance with the provisions of the best practices. Finally, the authors presented their own studies conducted in 2017-2018 years.

The authors see the main purpose of their research in identifying the degree of observing the advisory norms and the best practices of corporate governance in Russia and of the impact of corporate governance quality on Russian companies’ investment appeal.

Scenarios are possible variants of the future development of events. They help the company management to perform the strategic vision. It is important to take into account that it is necessary to base the scenario on many objective factors the company management and state governmental structures cannot influence (Bretsman 2011).

Scenario planning includes not only the formation of scenarios but also a complex of management solutions, actions and measures within strategic planning (Lindgren 2011).

According to G. Kahn, a general strategic long-term tendency that describes the development of the external environment is an important notion in scenario planning (Kahn 1967). The extrapolation of tendencies within the logics of “general tendency” causes the development scenario. Besides, several variations based on realistic opportunities of the system development and forming strategic alternatives are substantiated. Under scenario planning, G. Kahn is based on the dynamics of qualitative indicators and uses the retrospective approach to functioning and development of systems. This is how scenarios move from a hypothesis to facts. Thus, according to G. Kahn, scenarios are a hypothetic succession of events used to study causal relationships and resulting in taking strategic decisions (Kahn 1967).

In economy scenario planning started being used after the Royal Dutch Shell Dutch and British Gas and Oil Company applied multivariate strategies of development in 1960. The development of strategies by the Shell Company allowed to avoid many consequences of the oil crisis. The company managed to earn profit from the crisis and to form a new competitive advantage in the management system. As a matter of fact, since this moment they have started using methods of scenario planning applied to estimate the degree of business independence on various factors.

Scenario planning, similarly to traditional planning, starts from defining what can and cannot be forecasted. At the same time the scenario goes beyond the predictability and possibility to form clear areas of actions and models. The task of scenario planning is to understand general tendencies that can form the general structure for scenarios. Then it will be possible to offer several variants of the future development within such structure.

Scenario planning is related to the idea of developing and supporting sustainable functioning of the company under ambiguous, changing conditions. It can be applied on various levels. In their researches J. Ogilvy, P. Schwartz, G. Michel, L. Fahey, R. Randall, R. Miller, K. Heijen described basic principles and rules of forming scenarios, peculiarities of organizing a process of strategic planning, as well as revealed the most frequent mistakes.

Table 1 shows comparative characteristics of traditional and scenarios approaches to the strategic planning.

Methodological framework of this research is formed by the works of such scientists as Aman and Nguyen (2015), Fama and Jensen (1983), Klein (1998), Piot and Missionier-Piera (2007) and others, who studied the influence of observing the best practices of corporate governance on investment attractiveness of businesses in the USA, Europe and Asia.

For example, Fama and Jensen (1983) and Piot and Missionier-Piera (2007) analyzed the factor of independent directors as an effective tool for controlling corporate management as the impartiality of inside directors is affected by their connections with the management and suppliers.

Exploring the best corporate governance practices the authors took as a basis Russian Corporate governance code and European practices.

When assessing the implementation of the best corporate governance practices in Russia the authors studied the analysis conducted by the Central Bank of the Russian Federation (2017), Capital Confidence Barometer prepared by Economist Intelligence Unit and Ernst & Young (2015), the research done by Deloitte Center of corporate governance in the CIS “Corporate governance structures in Russian public companies” (Deloitte Touche Tohmatsu Limited, 2015) as well as the studies of Russian corporate governance conducted by I.S. Rumyantsev (2010), A.A.Semenov (2013), S.N. Markov (2015). Besides, the issues of corporate governance in energy sector were considered in works by modern scientists (Chernyaev 2014).

The main research method chosen was a comparative analysis juxtaposing the special features of the most common models of corporate governance and Russian corporate governance using the following criteria (Letter of Bank of Russia from 10th of April, 2014. N 06-52/2463 “On Corporate governance Code”):

For the comparative analysis one company corresponding to each model of corporate governance was selected. The selection of the companies was based on the following criteria:

In order to verify the authors’ conclusions, the article also examines the analysis conducted by state and non-state organizations independent from the authors.

The authors have made an attempt to make a comparative analysis of Russian corporate structures and those of other countries. Among the whole spectrum of corporate governance models the following ones which most demonstrably characterize fundamentally different approaches can be distinguished (see Figure 1).

Figure 1

Corporate governance models

An example of the Anglo-American model implementation in corporate governance is the Boeing Company.

The Boeing Company is one of the largest aircraft corporations with a turnover of more than 95 million dollars (according to the annual report for 2016 year) (Boeing 2016b).

Its main subsidiaries are: Boeing Canada, Boeing India, Boeing Defense UK, Boeing Helicopters, Boeing Capital, Boeing Commercial Airplanes, Boeing Phantom Works, Boeing Australia, Boeing Defense, Space & Security, McDonnell Douglas and Boeing Spain.

In Russia the following subsidiaries are actively represented: Jeppesen company which is a provider of information and information services for navigation on air, sea and land transport and Ural Boeing Manufacturing which produces titanium forgings (Boeing 2018).

The framework of corporate governance is outlined in the Principles of corporate governance of the Boeing Company as of 27 June 2016 Boeing (2016a).

Let’s overview the key principles:

1. The Boeing business is runned by its employees, managers and officers headed by the CEO subject to supervision by the Board of directors.

2. The directors’ main responsibility is to exercise their business judgment and to act according to what they consider to be the best for the interests of the Company and its shareholders.

3. The Board and managers acknowledge that long-term interests of the Company and its shareholders are promoted when they take into consideration concerns of the employees, customers, suppliers and communities.

4. Committee of the Board of Directors annually checks skills and characteristics necessary for the directors (international business, production, risk management, finances, government, marketing, technologies and state policy as well as other factors such as independence, absence of conflict of interests, diversity and age).

5. At least 75% of the Board of Directors members should comply with the independence criteria of New York stock exchange.

6. The directors should have reputation of professional integrity, honesty and adherence to the highest ethical standards and be committed to acting in all shareholders’ long-term interests (Boeing 2018).

From the above cited principles we can see the determining role of the Nomination Committee in the Board of Directors formation, strict requirements for the independence of a member of the Board, his or her professional competencies and reputation. Along with this the influence of the majority shareholders on the Board of Directors formation is artificially reduced.

Besides the Nomination Committee, the Boeing Company formed an Audit Committee, a Finance Committee, a Remuneration Committee, and a Special Programs Committee, and also subcommittees.

The main advantages and disadvantages of the Anglo-American model of corporate governance are outlined in Table 1.

Table 1

The main advantages and disadvantages of the

Anglo-American model of corporate governance

Main benefits |

Main drawbacks |

High return on equity in the short term |

Cost of capital is too high in comparison with Japan and Germany |

High liquidity |

The accountancy practice is such that it leads to overestimating investment projects return |

Corporate governance transparency |

The stock market is focused on short term benefit. Institutional investors make decisions considering short term goals and do not assess the situation in the long run. |

Strict control of the Securities and Exchange Commission over respecting shareholders’ rights |

Stock market does not reflect the real value of assets as it is susceptible to fads and to whims of major individual players |

|

Actual absence of control of shareholders over the Board of Directors encourages rising salaries, remunerations, options and golden parachutes for members of the Board of Directors and Executive Board |

|

Mass phenomena of hostile acquisitions, raider takeovers, greenmail |

The German model of corporate governance bases on a principle of social interaction – all stakeholders have a right to participate in the decision-making process (German Corporate Governance Code 2015).

The German model of corporate governance includes the following main elements:

An example of a multinational corporation acting within the framework of the German model is one of the biggest industrial corporations in Germany ThyssenKrupp AG which was formed as a result of a merger between two companies: Thyssen AG and Friedrich Krupp AG Hoesch-Krupp which had existed in Germany since the middle of the 19th century.

The company’s main subsidiaries are: Thyssenkrupp Steel Europe AG, ThyssenKrupp Steel, ThyssenKrupp Materials Services GmbH, ThyssenKrupp System Engineering, ThyssenKrupp Airport, ThyssenKrupp Automotive, Berco ThyssenKrupp Bilstein Blohm + Voss, ThyssenKrupp Drauz, ThyssenKrupp Elevator, ThyssenKrupp Fördertechnik, ThyssenKrupp Mannex, ThyssenKrupp Materials International, ThyssenKrupp Nirosta, Nordseewerke, Polysius , ThyssenKrupp Industrial Solutions Rasselstein GmbH , Rothe Erde ThyssenKrupp Schulte, ThyssenKrupp Stahl Baulemente

According to the Annual report for 2015/2016 the turnover of ThyssenKrupp AG for 2015/16 fiscal year amounted to 39 billion euros (Thyssenkrupp 2018).

ThyssenKrupp group has more than 2000 enterprises/divisions and is present in 78 countries.

The Board of Directors consists of two levels – Supervisory Board and Executive Board.

The Annual report reflects the following approaches to forming the Supervisory Board (Thyssenkrupp 2017):

Under the Supervisory Board the following committees are formed:

The main advantages and disadvantages of the German model of corporate governance are outlined in Table 2.

Table 2

The main advantages and disadvantages of the German model of corporate governance

Main benefits |

Main drawbacks |

Stability of corporate governance system |

Low liquidity |

Rare phenomena of hostile acquisitions, raider takeovers, greenmail |

Low corporate governance transparency |

Realization of the social interaction principle |

Disregard of minority shareholders’ rights |

Maintenance of the balance of interests of majority shareholders, partners and employees |

Small influence of independent directors |

Tight control over the Supervisory Board and Management/Executive Board |

|

The Japanese model of corporate governance is based on family approach to corporate governance (Kester 1997). An example of the Japanese model of corporate governance in a multinational is a Mitsubishi Heavy Industries group consisting of 312 companies in aircraft industry, space technologies, car industry, ship building, defence industry which are situated in Japan, China, North and South America, Europe, Middle East and Oceania. The annual turnover of the group is 1.2 billion of yen (MHI 2018b).

According to the Guidance on Corporate Governance Mitsubishi Heavy Industries, Ltd., the company is runned by the President, the CEO and the Board of Directors.

Requirements to the members of the Board of Directors include qualification and expertise in the Company’s businesses. The share of independent directors should be not less than 1/3 (MHI 2018a).

Before new members of the Board of Directors are appointed, they should pass a filter of the CEO and the President’s assertion about the candidates’ qualification and competence, after which the Board Directors takes a vote.

The procedure of appointment of outside directors and directors – members of Audit and Supervision is stipulated separately. The main advantages and disadvantages of the Japanese model of corporate governance are outlined in Table 3.

Table 3

The main advantages and disadvantages of the

Japanese model of corporate governance

Main benefits |

Main drawbacks |

Stability of corporate governance system |

Nepotism in owning and managing companies |

Rare phenomena of hostile acquisitions, raider takeovers, greenmail |

Lack of corporate governance transparency |

Family approach to corporate governance |

Disregard of minority shareholders’ rights |

Maintenance of the balance of interests of companies included in the keiretsu |

Small influence of independent directors |

Existence of informal, club agreements |

Low liquidity of the stock market |

Special features of Russian corporate governance are outlined in the analytical survey of the Central Bank of the Russian Federation “Corporate governance: history and practice”:

“Insufficient level of corporate culture and governance in Russia often provokes various conflicts in interaction between managers and shareholders” (Bank of Russia 2016).

This threat expressed in diluting minority shareholdings, obstacles to minority shareholders’ participation in shareholders’ meetings, additional stock issues, withdrawal of assets from joint-stock companies to affiliated structures is the most typical for Russia and one of the main factors that worsen the investment climate.

Another threat is the desire of majority shareholders to take control over a joint-stock company, even to the detriment of profits, which impedes long-term planning and hence the implementation of real, non-nominal, long-term development programs.

This threat creates obstacles to the participation of all shareholders in corporate governance, which leads to a clash of interests and permanent conflicts between different groups of shareholders (Bank of Russia 2016).

Among the most common violations of shareholders ' rights are:

-deliberate bankruptcy;

- creation of parallel management bodies;

- abuse of the dominant position of the majority shareholders;

-avoidance of informing shareholders and proper disclosure of information;

- evasion from approving of large deals and related party transactions;

-avoidance of approval of shares issues;

- understatement of share repurchase price.

The violations mentioned above are systemic and create threats for a number of corporate security elements such as:

Some domestic joint-stock companies are already elaborating their own corporate governance codes based on the Bank of Russia Corporate governance code.

As an example of a Russian holding, we can consider PAO Objedinennie Mashinostroitelnie Zavody (the holding’s name is translated as Public joint-stock company United Machine Building Plants) belonging to Uralmash – Izhora group with consolidated revenues for 2016 year of more than 37 billion roubles (OMZ 2018).

More than 98% of shares are hidden under management of close-end mutual fund (D.U. ZPIF of long-term direct investments Gazprombank – Promyshlennye Investizii).

The Board of Directors is elected by the General meeting of shareholders.

The Members of the Board of Directors elected to the Board of Directors in 2017 are not independent (in terms of conformity of a member of the Board of Directors with the independence criteria as defined in the Corporate governance code).

PAO Objedinennie Mashinostroitelnie Zavody (hereinafter PAO OMZ) consists of (according to the annual report of PAO OMZ for 2016) enterprises of nuclear, chemical and metallurgy industry, machine building, mining and industrial equipment, namely PAO Izhora plants, AO Uralkhimmash, Škoda JS a.s., PAO Cryogenmash, PAO “IZ-KARTEKS imeni P.G. Korobkova”.

The following committees of the Board of Directors have been formed:

The Annual report states only partial compliance with the provisions of the Corporate governance code.

We can make a conclusion that OMZ group with ZPIF (close-end mutual fund) being the majority shareholder with the share of more than 98% meets the smallest possible level of requirements and recommendations to the corporate governance and doesn’t pursue transparency and independence of the governing bodies which is a common situation for Russian corporate structures.

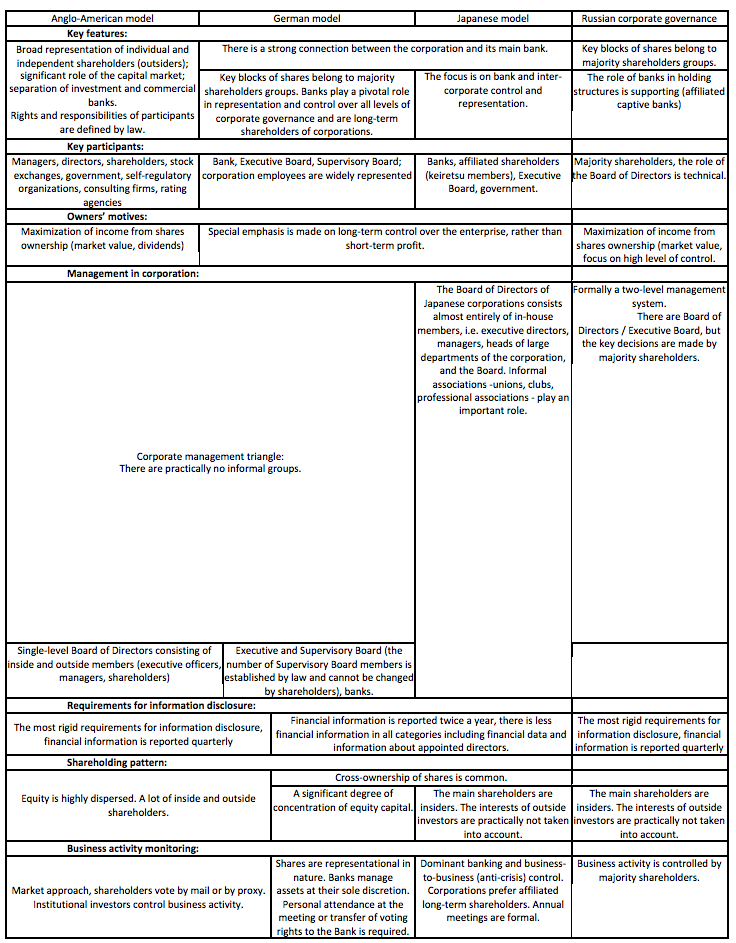

Characteristics of corporate governance models are given in Table 4.

Table 4

Comparative characteristics of corporate governance models

The main problem of Russian corporate governance which has not formed a separate model yet is that regulation and hence management structure are taken from the Anglo-American model and actual ownership structure mainly resembles the German one.

The conclusions and results of the authors ' research are confirmed by a number of other studies. Corporate governance review of the Central Bank of the Russian Federation dated April 2017 provides an analysis of meeting the requirements of the Corporate governance code (Bank of Russia 2017).

The review is based on data obtained from 84 public joint stock companies, shares of 56 of which are included in QL 1 (Quotation list of the Moscow interbank currency exchange, the authors ' note), and shares of 28 of them - in QL 2 as for 1.07.2016 (sampling companies).

“18 companies (21.4% of the sampling) declared in general full compliance with at least 75% principles of the Code. Another 36 companies (42.9 per cent of the sampling) stated that they observe 50 to 75 per cent of the Code principles. This is the most numerous category. 30 joint-stock companies (35.7% of the sampling) observe less than 50% of the principles of the Code, while the minimum percentage of compliance for all reports prepared according to the Form recommended by the Bank of Russia was 16.5%” (Bank of Russia 2016). Percentage of the sampling companies that reported 100% compliance with the principles of a particular Chapter of the Code are outlined in Table 5.

Table 5

Percentage of the sampling companies that reported 100% compliance with the

principles of a particular Chapter of the Code “Corporate governance: history and

practice” (Bank of Russia 2016).

Chapter of the Code |

Number of principles |

All companies, % |

QL1, % |

QL2, % |

I. Rights of the shareholders |

13 |

5 |

7 |

0 |

II. The Board of Directors |

36 |

0 |

0 |

0 |

III. Corporate secretary |

2 |

45 |

54 |

29 |

IV. Remuneration system |

10 |

6 |

7 |

4 |

V. Internal control system |

6 |

42 |

46 |

32 |

VI. Information disclosure |

7 |

15 |

20 |

7 |

VII. Major corporate actions |

5 |

7 |

7 |

7 |

The Central Bank of the Russian Federation is the securities market regulator therefore its researches are official and serve as a base for elaboration and implementation of state policy in the field of corporate governance. In particular the Central Bank of the Russian Federation is a developer of the Corporate governance code which is in force on the Russian territory.

As an independent research the authors studied the Research of Deloitte Center of Corporate Governance in the CIS conducted in 2015 year: “Corporate governance structures of public Russian companies” (Deloitte Touche Tohmatsu Limited).

The research covers 120 Russian companies common shares of which are included in the first or the second level list of the Moscow Stock Exchange or listed on such leading international stock exchanges as the London Stock Exchange (LSE; listing of shares and depositary receipts), the New-York Stock Exchange (NYSE) and NASDAQ. The analysis performed embraces almost all Russian companies with listed shares with only a small number of exceptions relating to Russian companies listed on other stock exchanges (for example on other Russian stock exchanges and also in Hong-Kong, Stockholm, Frankfurt etc.). The research also includes companies for which Russia is the main location of operating activity regardless of the country of foundation of these companies or whether they have national listing or not.

The research found out that:

- As for the ownership structure, there is a tendency to higher concentration. “73% of the companies had majority blocks of shares, along with it the study noted a high level of concentration of ownership with an average size of a large shareholding of 57,4%, which confirms the authors’ conclusions about the dominance of majority shareholders in Russian corporations." (Malkov, Shevchuk and Derisheva 2015) - “no more than 41% of the sampling companies comply with the Code (no more than 38% for companies with Russian listing). Outside Chairman existed only in 13% of Boards of Directors and senior independent Director existed only in 18% of them” (Malkov, Shevchuk and Derisheva 2015)

“- the average size of the Board of Directors in Russian public companies amounted to 9.6 people, while the same figure in Europe was 12.1” (Malkov, Shevchuk and Derisheva 2015)

“- The share of inside Directors was 73%, while the share of outside Directors was 27%, with the share of companies where external Directors constituted the majority of the Board of Directors being only 8%.” (Malkov, Shevchuk and Derisheva 2015)

Most of the companies had the following committees of the Board of Directors:

“Audit committee (95%) (Malkov, Shevchuk and Derisheva 2015)

Remuneration and nomination committee (64%)

Strategy committee (53%)” (Malkov, Shevchuk and Derisheva 2015)

This set of committees coincides completely with the example analyzed by the authors before – PAO “Obyedinennye mashinostroitelnye zavody”.

In March-April 2017 companies Economist Intelligence Unit and Ernst & Young published Capital Confidence Barometer which measures the degree of companies’ confidence in economic development prospects, gives an idea about priority tasks of managers and also allows to identify the main trends in the field of capital management.

The companies surveyed more than 2300 top managers from 45 countries, including about 50% of CEOs, CFOs and other top managers.

The survey revealed positive attitude connected with expectations regarding the future of corporate transactions market, “another reason for the resumption of activity was the increase in portfolio investment due to greater confidence of players in the prospect of economic recovery against the background of achieving relative stability. In addition, implementation of the plan of privatization of companies partially owned by the state will also contribute to growth in Russian mergers and acquisitions market” (EY 2015).

Along with this the Capital Confidence Barometer indicates that “about 60% of the respondents noted a special need for a comprehensive audit of mergers and acquisitions deals in the Russian market as there are doubts about observing the requirements of regulatory acts or antimonopoly legislation” (EY 2015). This, in the authors’ opinion, is directly connected with a low level of transparency of Russian corporate governance.

So, the brief ideas are:

1. Nowadays active transformation of Russian corporate governance is taking place. The Central Bank of the Russian Federation in 2014 introduced a new Corporate governance code and actively monitors execution of the norms of this Code among companies listed on the Moscow Interbank Stock Exchange.

2. Introduction of the requirements of the Corporate governance code in Russian companies is perfunctory in nature: imperative legislative norms are observed – in particular, public companies release quarterly and annual reports about their activity, form Board of Directors as an obligatory body with a minimal number of members, however, they avoid forming committees of Boards of Directors except for the necessarily required – Audit, Strategy and Nomination committees.

3. The independence of the Board of Directors remains a problem, most of the members are still insiders, with many Russian companies trying to minimize the participation of independent directors in the Boards of Directors and even totally exclude their presence.

4. Also there is still a high level of ownership concentration, even in public companies, major shareholders own blocks of shares of more than 50%, which gives them an opportunity to make decisions on most issues automatically, besides, even public companies still hide the final beneficiaries under nominal ownership.

5. This practice to avoid compliance with corporate governance standards certainly reduces the investment appeal of Russian companies and the whole Russian economy.

The government and active professional participants of the securities market, as well as scientists and experts are actively engaged in studying the issues of corporate governance.

The history of corporate governance regulation dates back to the early days of Roman law.

The law of the XII tables (5th century BC), table VIII, allowed members of communities to make agreements which do not violate public order (Leges duodecim tabularum epy the law of 12 tables). Thus, the dualism of state interference in corporate governance was defined, on the one hand, the freedom of a corporation itself in regulating corporate relations is assumed, on the other hand, certain standards of public order in this governance are formed. This approach of the state is still maintained in all corporate governance models. The problems of corporate governance considered in the article are not unique. Shleifer and Vischny as early as in 1997 put forward a hypothesis of “private benefits”, considering the conflict of interests between majority shareholders and other shareholders and stakeholders (Shleifer and Vischny 1997). Aman and Nguyen (2015) argued that in Japanese companies institutional investors have an advantage over private investors due to their more profound professional expertise (Aman and Nguyen 2015). Fama and Jensen (1983) suggested a hypothesis that it is independent directors who act as an effective tool for controlling management of a corporation, as the impartiality of inside directors is biased by their relationship with the management, suppliers, etc. (Fama and Jensen 1983). Piot and Missionier-Piera (2007) in the late 1990s and early 2000s in France explored the direct dependence of the cost of servicing a company’s debts on the proportion of independent directors and concluded that the higher this proportion is, the more transparent corporate governance is considered, the less risks are and the smaller interest rates are at which the company can raise funds. Piot and Missionier-Piera (2007) noted the positive effect of the predominance of independent directors in the Remuneration Committee of the Board of Directors (Piot and Missioner-Piera 2007), and Klein (1998), basing on a study of the Boards of Directors in the United States, hypothesized that inside directors are more effective in Finance and Strategy Committees (Klein 1998). Both statements can be recognized to be true since both inside and outside Directors have their strengths, and weaknesses. In-house directors know better the specifics of the company, especially regarding planning and implementation of the plans, so they are more successful in that part of the work of the Board of Directors and Committees, which is aimed at developing strategies, plans, regulations of companies, but are less effective in performing control functions, as they are deeply involved in the connections inside and outside of the corporation; independent Directors are less biased and more effective in exercising the supervisory functions of the Board of Directors as they are not so much involved in the in-house relationships.

In 2014, the European Commission issued a Recommendation on the quality of disclosure of information about corporate governance where the “comply or explain” approach was used. According to the European Commission’s recommendations the corporate governance codes should state the difference between provisions implemented on a “comply or explain” basis and provisions implemented solely on a voluntary basis. This document also provides guidance on adequate explanations of non-compliance with the Code.

In July 2015, the Basel Committee on banking supervision published revised Corporate governance principles for banks, which form the basis of a corporate governance system that promotes reliable and efficient banking operations. In the new document the emphasis is made on the importance of establishing risk management system, as well as compliance mechanisms.

During the period from 2014 to 2016 in several European countries, in particular Norway, Portugal, UK, France, Sweden, Finland and Romania corporate governance codes based on the principle “comply or explain” were revised and improved. In the same period the codes were revised in Kenya and New Zealand.

On the one hand, the Russian Сode of corporate governance states that the provisions of the Code are advisory in nature, on the other hand, the state regulator - the Central Bank of the Russian Federation analyzes the implementation of the Code and requires disclosure of information about compliance / non-compliance with the Code provisions in corporate reports.

In particular, I.S. Rumyantsev (2010) notes that there has been a change in Russian corporate governance towards the Japanese model as a more closed and secluded model of corporate governance, as well as the “merger” of majority shareholders and key managers (Rumyancev 2010). The authors agree with this position in the part that indeed the majority shareholders of Russian companies really seek to maintain maximum control and secrecy of information, but the introduction of new mandatory rules in Russian corporate legislation and the new requirements of the Russian Сode of corporate governance as well as the introduction of the principle “comply or explain” by the securities market regulator increasingly force Russian companies to enhance transparency and respect the rights of minority shareholders.

A.A. Semenov (2013) makes a more optimistic conclusion that Russian companies are implementing corporate governance standards and improving their professional level of management (Semenov 2013). The authors only partly agree with this position, as companies do disclose information, apply in their practice codes of corporate governance, provisions about governing bodies and policy in the field of corporate governance (dividend policy, resolution of conflicts of interest and corporate conflicts, etc.), but as shown by the comparative analysis results, the application of these practices is often perfunctory by nature.

According to S.N. Markov (2015) only general meeting of shareholders and the executive bodies are mandatory, (Markov 2015) but in the authors’ opinion, such a two-level structure is applicable only to joint-stock companies with a single shareholder or a small number of shareholders affiliated with each other, which allows them to neglect procedural requirements to hold general meetings of shareholders without the risk of appeal.

The position of foreign and domestic authors discussed in the article may differ in particular questions such as the role of independent directors, which is determined both by national peculiarity of the country where the research was conducted, and by multifunctionality of the tasks of the Board of Directors, but scientists and the regulator as well as reputable stock market participants agree that the implementation of the best practices of corporate governance, enhancing the independence of the members of the Board of Directors and increasing the transparency of corporate management as well as observance of the shareholders’ rights improves the quality of corporate governance.

Let’s summarize the results of our research. The state's position on corporate governance regulation remains unchanged from ancient times to the present day - corporations have the right to establish only such rules of corporate governance that are consistent with public order, public interest, fairness, respect for the rights of both owners and other stakeholders. At the same time, both in Europe and in Russia, both legislation and advisory norms are actively developing. Indeed, the period of 2014-2016 was marked by the adoption of new codes of corporate governance and the introduction of a completely new principle of compliance with the recommendatory provisions - “comply or explain”.

Along with this, as the authors’ research as well as other cited studies show, the situation with corporate governance quality is far from being perfect. Russian corporations, even at the level of public joint-stock companies seek to observe only baseline minimum of the legislative requirements in order to avoid the regulator’s sanctions or delisting from the stock exchange. The studies revealed that majority shareholders are still, as of 2017, retain control over Russian corporations, try not to allow minority shareholders to make decisions, to minimize the number of independent directors and corporate governance transparency, which, in its turn, negatively affects the investment attractiveness of Russian corporations.

The publication was prepared with the support of the “RUDN University Program “5-100”.

Aman H and Nguyen P. (2015). Does good governance matter to debtholders? Evidence of the credit rating of Japanese firms. Research in International Business and Finance. 12: 14-34.

Bank of Russia (2017). Bank of Russia review of corporate governance.

Bank of Russia. (2016). Corporate governance: history and practice.

Boeing. (2016a). Boeing Principles of corporate governance from the 27th of June 2016. Retrieved from https://www.boeing.com/resources/boeingdotcom/company/general_info/pdf/corporate-governance-principles.pdf

Boeing. (2016b). Boeing Annual Report 2016.

Boeing. (2018). Official web-site of company group “Boeing”. Retrieved from http://www.boeing.com/company/key-orgs/boeing-international/

Chernyaev М.V. (2014). Directions to increase the functioning efficiency of the oil and gas industry as the basis for ensuring energy security. The author's dissertation of candidate economic sciences: 08.00.05 / Peoples' Friendship University of Russia (RUDN). Moscow, 25.

EY. (2015). Capital Confidence Barometer. Economist Intelligence Unit Ernst & Young.

Fama E.F. and Jensen M.C. (1983) Separation of ownership and control. Journal of law and economics, 301-325.

German Corporate Governance Code (2015). The Deutscher Corporate Governance Codex, 19.

Kester K. (1997). Governance, contracting, and investment horizons: a look at Japan and Germany. Studies in International Corporate Finance and Governance Systems. A Comparison of the U.S., Japan & Europe. Edited by Donald H. Chew. Oxford University Press, NY-Oxford, 227-242.

Klein A. (1998). Firm Performance and Board Committee Structures. Journal of law and economics 41(1): 275-304

Leges duodecim tabularum epy the law of 12 tables. Retrieved from https://en.wikipedia.org/wiki/Twelve_Tables

Letter of Bank of Russia from 10th of April, 2014. N 06-52/2463 “On Corporate governance Code”

Malkov A., Shevchuk A. and Derisheva O. (2015). Center of corporate governance research Deloitte Touche Tohmatsu Limited “Corporate governance structures of the Russian public companies”, 20.

Markov S.N. (2015). Features of corporate governance in Russian practice. Vestnik of Siberian Institute of business and information technology, 3(15): 50-54.

MHI. (2018a). Corporate Governance Guidelines of Mitsubishi Heavy Industries, Ltd.

MHI. (2018b). Official web-site of Mitsubishi Heavy Industries, Ltd. Retrieved from https://www.mhi.com/company/aboutmhi/governance

OMZ. (2016). PJSC OMZ Annual report 2016.

OMZ. (2018). Official web-site of PJSC OMZ. Retrieved from http://omz.ru/share/

Piot C. and Missioner-Piera F. (2007). Corporate governance, audit quality and the cost of debt financing of French listed companies. 28th Congress of Francophone association, 22.

Rumyancev I.S. (2010) Features of corporate governance in Russia in transforming economy Vestnik of Chelyabinsk state university. 35: 130-134.

Semenov A.A. (2013). Specific features of corporate governance security as a macroeconomic factor in modern conditions. Vestnik of Tambov University. 4. Joe Studwell. How Asia Works: Success and Failure in the World's Most Dynamic Region". Alpina Publisher, 2016.

Shleifer A. and Vischny R.W. (1997) A survey of corporate governance. The journal of finance. 52(2): 737-783

Thyssenkrupp. (2017). Thyssenkrupp Annual Report 2016.

Thyssenkrupp. (2018). Official web-site of Thyssenkrupp Retrieved from https://www.thyssenkrupp.com/en/investors

1. Federal State Independent Educational Institution of Higher Education “Peoples' Friendship University of Russia" (RUDN University), Russia, 117198, Moscow, Miklukho-Maklaya Street, 6. E-mail: Law_union@mail.ru

2. Federal State Independent Educational Institution of Higher Education “Peoples' Friendship University of Russia" (RUDN University), Russia, 117198, Moscow, Miklukho-Maklaya Street, 6

3. Federal State Budgetary Educational Institution of Higher Education "Russian State Social University". Russia, 129226, Moscow, Wilhelm Pieck Street, 4/1

4. Federal State Budgetary Educational Institution of Higher Education “Moscow Technological University”. Russia,119454 Moscow, Prospect Vernadskogo, 78